Global Sports Nutrition Supplements Market Size, Share, And Business Benefit By Form (Powder, Capsules, Bars), By Product (Amino Acids / Derivatives, Herbal Products, Vitamins / Minerals, Others), By Consumer Group (Athletes, Bodybuilders, Recreational Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165338

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

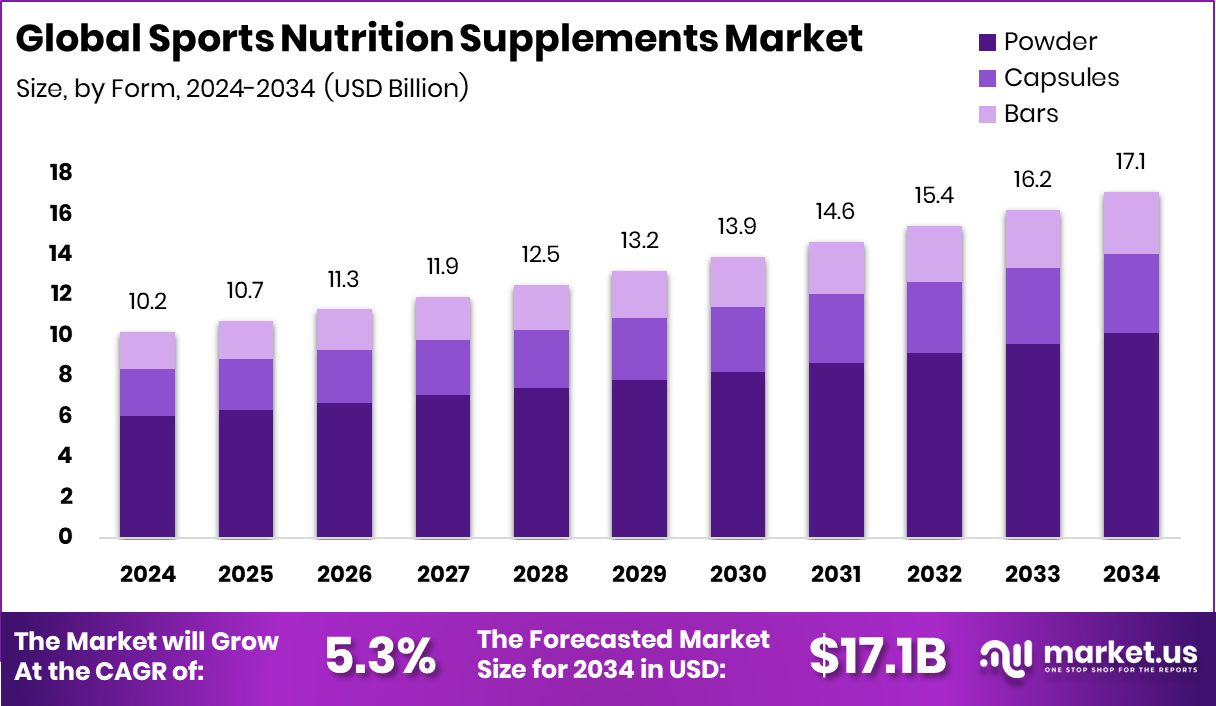

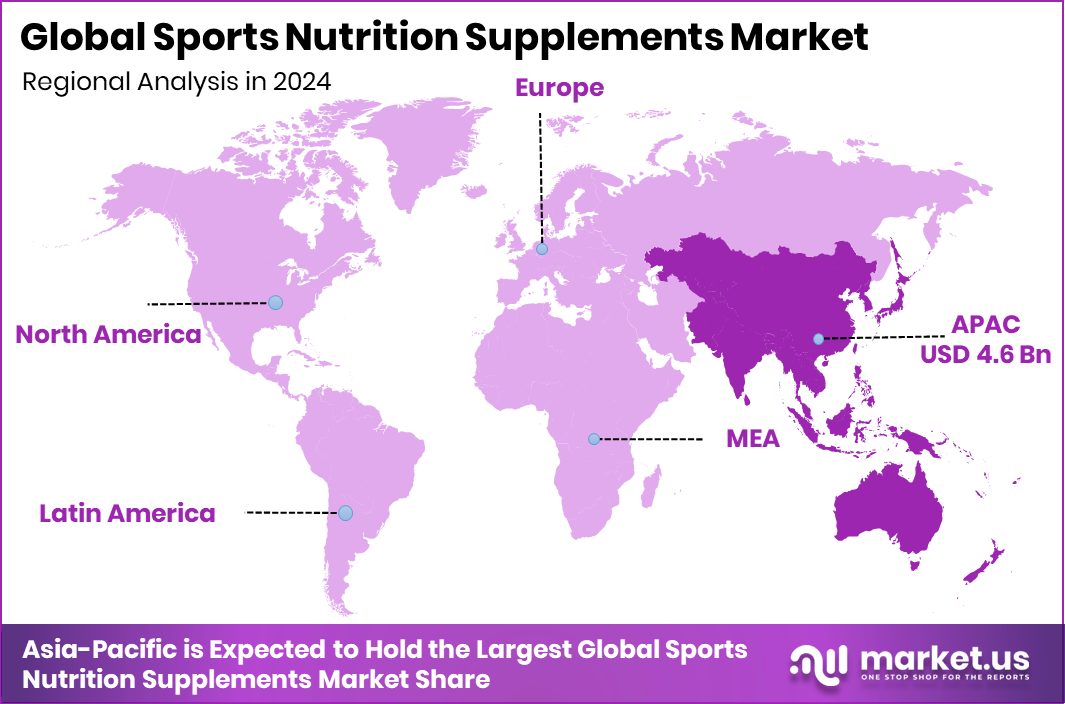

The Global Sports Nutrition Supplements Market is expected to be worth around USD 17.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Asia-Pacific’s 45.20% dominance is driven by rising fitness awareness and expanding health infrastructure.

Sports nutrition supplements are specialized products designed to support athletic performance, endurance, recovery, and overall fitness goals. They typically include proteins, amino acids, vitamins, minerals, energy boosters, and hydration formulas that help optimize muscle repair and metabolic function. These supplements are used by athletes, gym-goers, and health-conscious individuals to enhance strength, stamina, and muscle development. Increasing awareness of physical fitness and active lifestyles has made these supplements an essential part of modern nutrition routines across the globe.

The sports nutrition supplements market is witnessing strong growth due to the rising focus on wellness, performance, and preventive health. Consumers are prioritizing protein-based and plant-derived formulations for sustainable energy. Innovative companies are investing heavily in biotech-based ingredients — for instance, GRObio recently secured $60.3 million in Series B funding to advance protein therapeutics. This growing interest in natural, functional ingredients is driving new product formulations and broader consumer adoption.

Demand is being fueled by changing lifestyles and higher participation in sports, fitness clubs, and endurance events. The popularity of fitness influencers and digital health platforms has accelerated supplement use among young adults. Moreover, brands are innovating with clean-label and bio-based products. For example, Biosyntia raised €11.5 million to launch the world’s first bio-based vitamin B7, signaling a strong shift toward sustainable nutraceutical ingredients.

The market holds vast opportunities in personalized and gender-focused nutrition. Companies are tailoring supplements to meet specific hormonal and metabolic needs, attracting new user segments. In this context, Unilever Ventures’ $6 million investment in Perelel Health and Indonesia’s YOUVIT $6 million Series B round show the industry’s confidence in targeted vitamin and wellness solutions. Similarly, Just Herbs’ $1.5 million funding aims to expand holistic nutrition offerings, reinforcing the move toward clean, functional, and inclusive health products.

Key Takeaways

- The Global Sports Nutrition Supplements Market is expected to be worth around USD 17.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- Powder form dominates the sports nutrition supplements market with 59.3%, offering easy mixing and fast absorption.

- Amino acids and derivatives hold a 38.4% share in the sports nutrition supplements market, enhancing muscle performance.

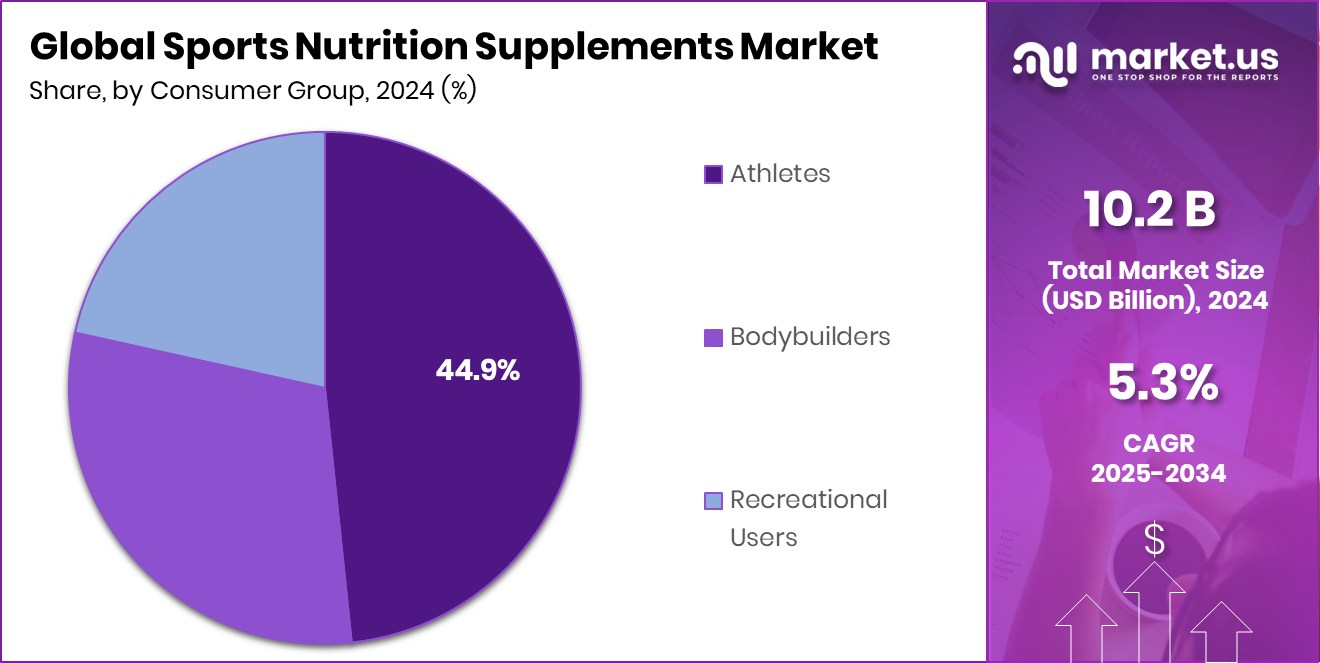

- Athletes represent 44.9% of the sports nutrition supplements market, reflecting their growing reliance on performance-boosting nutrition.

- The Asia-Pacific market value reached USD 4.6 Bn, reflecting strong consumer adoption.

By Form Analysis

Powdered sports nutrition supplements hold a 59.3% share, dominating due to convenience.

In 2024, Powder held a dominant market position in the By Form segment of the Sports Nutrition Supplements Market, with a 59.3% share. The powder form continues to lead due to its higher bioavailability, convenient mixing options, and suitability for diverse fitness goals such as muscle recovery and endurance. Athletes and fitness enthusiasts prefer powdered supplements for their faster absorption and customizable dosage.

Growing awareness of clean-label, nutrient-dense formulations has further reinforced consumer trust in powder-based nutrition products. The segment’s dominance also reflects innovation in flavors and plant-based protein blends, aligning with evolving health preferences. Its consistent market leadership underscores powder’s role as the preferred and versatile form in sports nutrition supplements.

By Product Analysis

Amino acids and derivatives capture 38.4% of the market demand.

In 2024, Amino Acids / Derivatives held a dominant market position in the By Product segment of the Sports Nutrition Supplements Market, with a 59.3% share. This dominance is driven by their critical role in muscle growth, repair, and energy metabolism, making them a staple among athletes and fitness enthusiasts.

Amino acid supplements such as BCAAs and glutamine support endurance and reduce fatigue, leading to higher adoption in both professional and recreational sports. The segment’s strong presence also reflects the increasing preference for targeted nutrition that enhances performance and recovery. Its leadership underscores the growing consumer awareness of amino acid benefits in maintaining muscle health and optimizing athletic performance.

By Consumer Group Analysis

Athletes represent a 44.9% share, reflecting growing professional and amateur participation.

In 2024, Athletes held a dominant market position in the By Consumer Group segment of the Sports Nutrition Supplements Market, with a 44.9% share. This dominance reflects the consistent demand from professional and competitive athletes who rely heavily on nutritional supplements to enhance performance, stamina, and recovery. Athletes often incorporate protein powders, amino acids, and energy boosters into their daily routines to meet rigorous training and competition requirements.

The segment’s strength also stems from increasing participation in organized sports and fitness events worldwide. Growing awareness about muscle maintenance, hydration, and endurance has further fueled the preference for sports supplements among athletes, reinforcing their position as the key driving consumer group in this market.

Key Market Segments

By Form

- Powder

- Capsules

- Bars

By Product

- Amino Acids / Derivatives

- Herbal Products

- Vitamins / Minerals

- Others

By Consumer Group

- Athletes

- Bodybuilders

- Recreational Users

Driving Factors

Rising Focus on Health and Performance Nutrition

A major driving factor for the Sports Nutrition Supplements Market is the growing awareness of health, fitness, and performance optimization. People are becoming more conscious about muscle recovery, strength building, and balanced nutrition, leading to a rise in supplement consumption across all age groups. The market is supported by the increasing adoption of active lifestyles and participation in sports and gym activities.

Nutritional supplements are now being used not only by professional athletes but also by fitness enthusiasts aiming to enhance endurance and immunity. The trend is further strengthened by targeted innovations such as women-focused formulations. For example, female-led Ritual raised $25 million to expand vitamins designed specifically for women, signaling broader demand for personalized nutrition.

Restraining Factors

Concerns Over Product Authenticity and Safety Standards

A key restraining factor for the Sports Nutrition Supplements Market is the growing concern about product authenticity and safety. Many consumers are becoming cautious due to the rising number of counterfeit or adulterated supplements available both online and offline. These low-quality products may contain banned substances, undeclared ingredients, or improper labeling, leading to potential health risks.

The absence of uniform global regulations and inconsistent quality control further complicates consumer trust. Misleading claims and a lack of transparency in ingredient sourcing also discourage some buyers from regular use. As a result, despite growing awareness about fitness and nutrition, skepticism regarding product safety continues to limit the full market potential and consumer confidence in supplements.

Growth Opportunity

Expansion of Functional and Personalized Nutrition Products

A major growth opportunity in the Sports Nutrition Supplements Market lies in the rise of functional and personalized nutrition products. Consumers are now seeking supplements tailored to their unique health goals, lifestyles, and dietary needs. This shift is driving innovation in formulations enriched with vitamins, minerals, and natural ingredients that target specific outcomes like muscle recovery, mental focus, or immunity.

Companies are exploring plant-based, sugar-free, and allergen-friendly options to attract wider audiences. The growing adoption of digital health tools and DNA-based nutrition plans is further supporting this trend. Reflecting this momentum, Dutch vitamin startup Yummygums secured €1.2 million to expand across Europe, highlighting the rising investor interest in personalized and functional nutrition products.

Latest Trends

Growing Shift Toward Science-Backed Nutrition Solutions

One of the latest trends in the Sports Nutrition Supplements Market is the growing shift toward science-backed and clinically tested nutrition solutions. Consumers today prefer supplements supported by medical research and biotechnology, ensuring proven safety and measurable results. This shift has encouraged collaborations between supplement manufacturers, healthcare experts, and biotech startups to develop precise formulations that enhance energy, metabolism, and recovery.

Modern consumers value transparency and scientific validation over marketing claims, leading to a new generation of data-driven nutritional products. Reflecting this movement, Finnish biotech company NADMED raised €3.5 million in Series A funding to advance vitamin B3 deficiency testing, reinforcing how scientific innovation is shaping the future of sports and performance nutrition.

Regional Analysis

In 2024, the Asia-Pacific dominated the Sports Nutrition Supplements Market with a 45.20% share.

In 2024, Asia-Pacific held a dominant position in the global Sports Nutrition Supplements Market, accounting for 45.20% share, valued at USD 4.6 billion. The region’s growth is supported by a rapidly expanding fitness industry, increasing gym memberships, and growing awareness about nutrition and muscle health among younger populations. Rising disposable incomes and a shift toward preventive healthcare have further strengthened supplement consumption across major countries in the region.

North America continues to show steady demand driven by a well-established sports culture and widespread acceptance of protein and amino acid-based products. Europe follows with the increasing adoption of clean-label and plant-based supplements. Meanwhile, the Middle East & Africa and Latin America are gradually emerging markets, witnessing growing interest in health-oriented nutrition and fitness supplements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abbott Nutrition in 2024 continues to maintain a strong presence in the global Sports Nutrition Supplements Market through its advanced nutrition formulations that support endurance, recovery, and muscle performance. The company’s focus on scientifically backed products and precise nutrient delivery systems aligns with the global shift toward evidence-based sports nutrition.

Bio-Synergy Ltd. has strengthened its market visibility by emphasizing innovation in clean, effective, and performance-driven supplements. Its approach toward quality assurance, transparent labeling, and customer-centric product development reflects evolving consumer preferences for trusted, sustainable brands in fitness and performance enhancement.

Champion Performance, known for its focus on athletes and active consumers, continues to leverage its heritage in sports nutrition to deliver high-protein, energy-supporting formulations. The company’s consistent innovation and attention to taste, formulation quality, and athletic efficacy position it well in a competitive environment. Together, these companies reflect a maturing market emphasizing scientific validation, quality assurance, and consumer trust.

Top Key Players in the Market

- Abbott Nutrition

- Bio-Synergy Ltd.

- Champion Performance

- Clif Bar & Company

- Future Nutrition

- Glanbia Plc

- GlaxoSmithKline Plc

- GNC Holdings, Inc.

- Herbalife International of America, Inc.

- Maximum Human Performance, LLC

Recent Developments

- In September 2024, Bio-Synergy entered a strategic partnership with Pace Partnership London to expand its brand into the Japanese and South Korean markets. The UK-based sports nutrition company aims to bring its product range and DNA testing kits for athletic performance into these two key Asian markets.

- In January 2024, Abbott introduced the PROTALITY™ brand, a high-protein shake designed for adults pursuing weight loss while preserving muscle mass. The product blends fast- and slow-digesting protein to support muscle health even as caloric intake decreases.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 17.1 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Capsules, Bars), By Product (Amino Acids / Derivatives, Herbal Products, Vitamins / Minerals, Others), By Consumer Group (Athletes, Bodybuilders, Recreational Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abbott Nutrition, Bio-Synergy Ltd., Champion Performance, Clif Bar & Company, Future Nutrition, Glanbia Plc, GlaxoSmithKline Plc, GNC Holdings, Inc., Herbalife International of America, Inc., Maximum Human Performance, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sports Nutrition Supplements MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Sports Nutrition Supplements MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Nutrition

- Bio-Synergy Ltd.

- Champion Performance

- Clif Bar & Company

- Future Nutrition

- Glanbia Plc

- GlaxoSmithKline Plc

- GNC Holdings, Inc.

- Herbalife International of America, Inc.

- Maximum Human Performance, LLC