Global Spinal Cord Stimulation Devices Market By Product Type (Rechargeable SCS Devices, Non-Rechargeable SCS Devices) By Application (Failed Back Surgery Syndrome (FBSS), Peripheral Neuropathies, Degenerative Disc Disease (DDD), Complex Regional Pain Syndrome (CRPS), Arachnoiditis, Others) By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160860

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

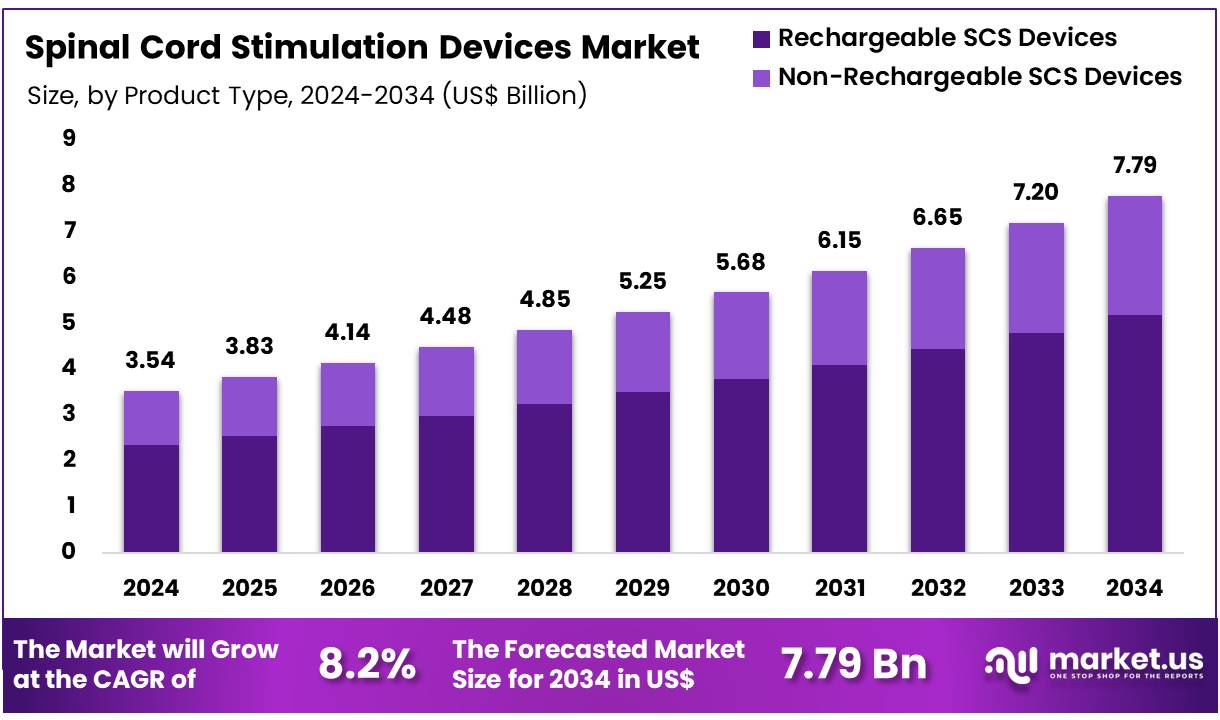

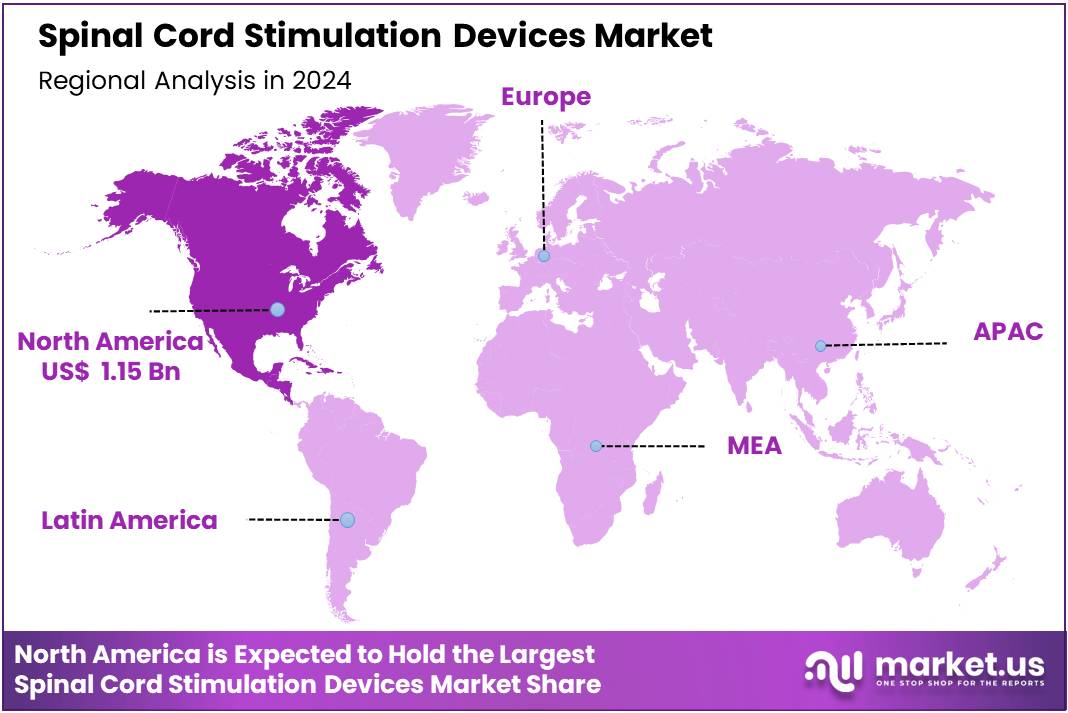

Global Spinal Cord Stimulation Devices Market size is expected to be worth around US$ 7.79 Billion by 2034 from US$ 3.54 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 32.5% share with a revenue of US$ 1.15 Billion.

The spinal cord stimulation (SCS) devices sector is expanding steadily due to multiple health and policy factors. Chronic pain remains one of the most significant public health burdens worldwide. According to the World Health Organization (WHO), low back pain affected about 619 million people in 2020, and this figure is expected to reach 843 million by 2050. As conventional therapies often provide limited relief, the demand for advanced, non-opioid interventions such as SCS continues to grow.

The ageing global population further drives this demand. By 2030, one in six people will be over the age of 60, and by 2050, the 60+ group is expected to reach 2.1 billion. Older adults are more likely to suffer from musculoskeletal and neuropathic conditions, which are key indications for SCS. As longevity increases, the need for interventional pain solutions is expected to rise, creating steady demand for implantation procedures and long-term device management.

The increasing prevalence of diabetes also contributes to market growth. Painful diabetic neuropathy is a major indication for SCS, and WHO data shows that the number of people with diabetes rose to around 830 million in 2022, with the largest increases occurring in low- and middle-income regions. As medical therapies often fail to fully address neuropathic pain, more patients are being considered for neuromodulation, expanding the potential patient base for SCS devices.

Government health agencies are also playing a key role. The U.S. Centers for Disease Control and Prevention (CDC) reported that nearly a quarter of U.S. adults experienced chronic pain in 2023. With rising awareness of opioid misuse risks, health policies are encouraging alternatives like SCS, which can reduce dependence on long-term pain medication. Similarly, regulatory and reimbursement frameworks are supporting adoption.

The UK’s National Institute for Health and Care Excellence (NICE) recommends SCS for chronic neuropathic pain, while Medicare in the United States provides defined coverage under Local Coverage Determinations. In Australia, neurostimulation procedures are included in the Medicare Benefits Schedule, highlighting international recognition of SCS as standard care.

Regulatory approvals also contribute to growth. The U.S. Food and Drug Administration (FDA) continues to approve new devices and expanded indications, while Health Canada and other agencies ensure steady product availability. Advances in device technology, including improved battery life and software features, strengthen clinician confidence and broaden use.

In addition, formalized care pathways such as those commissioned by NHS England help streamline referrals and improve access to treatment. Broader epidemiological trends, such as the global rise in obesity, further add to the pool of patients suffering from chronic pain conditions.

Key Takeaways

- Market Size: Global Spinal Cord Stimulation Devices Market size is expected to be worth around US$ 7.79 Billion by 2034 from US$ 3.54 Billion in 2024.

- Market Growth: The market growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

- Product Analysis: In 2024, rechargeable SCS devices dominate the market, accounting for 66.7% of the total market share.

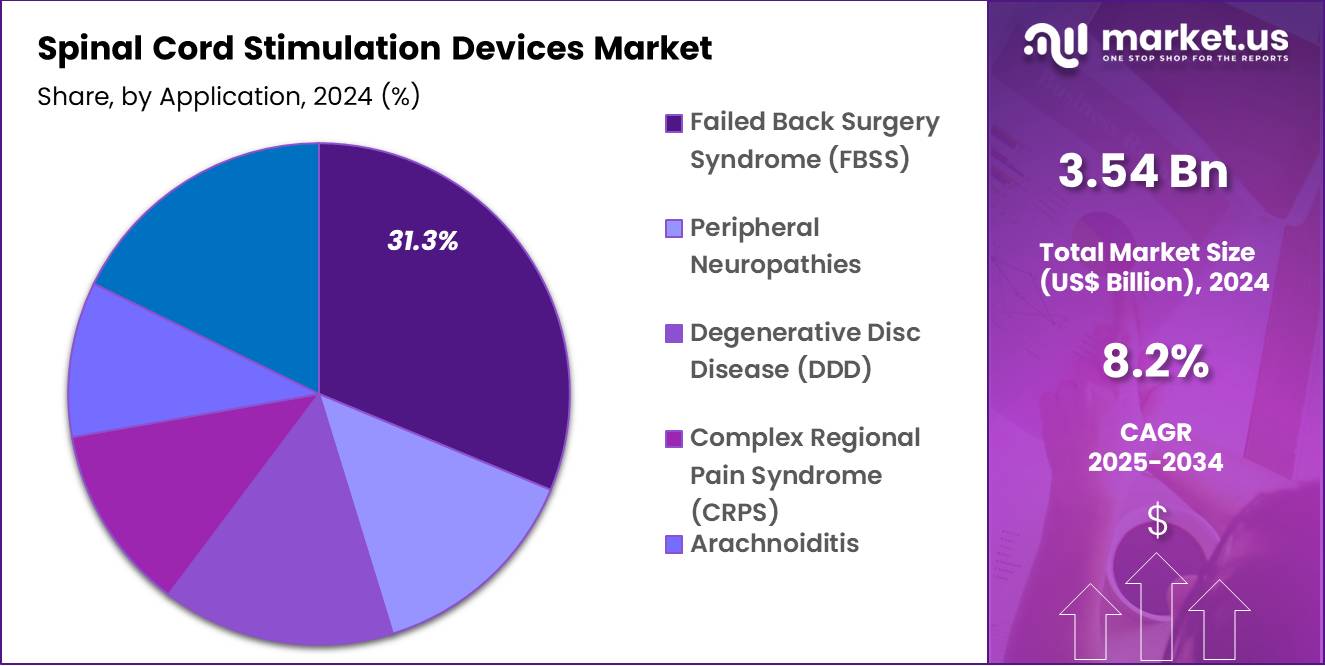

- Application Analysis: The Failed Back Surgery Syndrome (FBSS) dominates with a 31.3% market share in 2024.

- End-Use Analysis: In 2024, hospitals dominate the market with a 55.6% share, reflecting their critical role in advanced pain management and complex spinal procedures.

- Regional Analysis: In 2024, North America led the market, achieving over 32.5% share with a revenue of US$ 1.15 Billion.

Product Type Analysis

The spinal cord stimulation (SCS) devices market is segmented into rechargeable SCS devices and non-rechargeable SCS devices. In 2024, rechargeable SCS devices dominate the market, accounting for 66.7% of the total market share. The strong preference for rechargeable systems can be attributed to their longer device lifespan, reduced need for surgical replacements, and improved patient convenience.

These devices allow repeated recharging of the implanted pulse generator, thereby lowering long-term costs and enhancing patient compliance. Additionally, advancements in miniaturized batteries and wireless charging technologies have further supported their widespread adoption.

Non-rechargeable SCS devices, although less dominant, continue to serve a significant segment of the market. These systems are often preferred by elderly patients or individuals with limited ability to manage frequent recharging. Their appeal lies in the simplicity of use and ease of implantation, making them suitable for patients seeking low-maintenance options. However, shorter battery life and the need for replacement procedures remain key limitations affecting their uptake.

Overall, the dominance of rechargeable devices reflects a shift towards long-term cost efficiency and patient-centric features, while non-rechargeable devices retain relevance in specific patient populations.

Application Analysis

The spinal cord stimulation (SCS) devices market is segmented by application into Failed Back Surgery Syndrome (FBSS), Peripheral Neuropathies, Degenerative Disc Disease (DDD), Arachnoiditis, and Others. Among these, Failed Back Surgery Syndrome (FBSS) dominates with a 31.3% market share in 2024.

The prevalence of FBSS has been rising due to the growing number of spinal surgeries globally, many of which do not fully resolve chronic pain. SCS devices have emerged as a highly effective therapy for FBSS patients, offering significant improvements in pain management, quality of life, and functional recovery.

Peripheral neuropathies represent another important segment, driven by the increasing incidence of diabetes and related nerve damage. SCS therapy provides notable relief from neuropathic pain, thereby fueling adoption. Degenerative Disc Disease (DDD) is also a significant application area, supported by the rising geriatric population and age-related spinal degeneration.

Arachnoiditis, though less common, contributes steadily to market demand due to the chronic pain associated with the condition. The others category, which includes conditions such as complex regional pain syndrome, continues to expand with growing clinical evidence supporting broader SCS use.

End User Analysis

The spinal cord stimulation (SCS) devices market is segmented by end user into Hospitals, Ambulatory Surgical Centers (ASCs), and Others. In 2024, hospitals dominate the market with a 55.6% share, reflecting their critical role in advanced pain management and complex spinal procedures.

Hospitals benefit from well-established infrastructure, availability of skilled neurosurgeons, and access to advanced technologies, which position them as the primary centers for SCS device implantation and post-operative care. The increasing prevalence of chronic pain disorders, combined with higher patient preference for comprehensive treatment facilities, continues to strengthen hospital dominance.

Ambulatory Surgical Centers (ASCs) represent a growing segment, supported by the rising trend toward outpatient procedures and cost-effective care delivery. ASCs offer shorter recovery times, lower procedure costs, and enhanced convenience, making them an attractive option for eligible patients. Their adoption of minimally invasive procedures has also contributed to market expansion.

The others category, which includes specialized pain clinics and rehabilitation centers, plays a supplementary role, providing targeted pain management services. Although their share remains smaller, these facilities contribute to expanding accessibility and specialized treatment options. Overall, hospitals remain the cornerstone of market growth, while ASCs are steadily gaining traction.

Key Market Segments

By Product Type

- Rechargeable SCS Devices

- Non-Rechargeable SCS Devices

By Application

- Failed Back Surgery Syndrome (FBSS)

- Peripheral Neuropathies

- Degenerative Disc Disease (DDD)

- Complex Regional Pain Syndrome (CRPS)

- Arachnoiditis

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Others

Driving Factors

A primary driver for the SCS devices market is the rising prevalence of chronic pain. In the U.S., about 20.9 % of adults reported chronic pain in 2021, and 6.9 % experienced high-impact chronic pain limiting daily life. As pain remains a leading cause of disability and health care utilization, demand for nonpharmacologic interventions increases.

Additionally, demographic shifts such as population aging and increased incidence of spine degenerative disorders further drive demand. Advances in reimbursement policies for neuromodulation therapies, along with growing awareness among clinicians and patients of alternatives to long-term opioid use, reinforce this growth impetus.

Trending Factors

A notable trend is the technological evolution toward closed-loop systems, miniaturization, and rechargeable devices. Research literature highlights increasing adoption of systems that adjust stimulation in real time based on feedback signals.

The shift from fixed-output implants to AI-enabled, closed-loop neuromodulation is gaining momentum, improving therapy precision and reducing side effects. Moreover, integration with wireless connectivity, remote monitoring, and patient programming through external interfaces is becoming more common, aligning with digital health trends and improving patient convenience.

Restraining Factors

Regulatory complexity and device maintenance burden represent key restraints. Medical device regulatory frameworks require rigorous design validation, quality control, and post-market surveillance. The U.S. Food and Drug Administration mandates compliance with Quality System Regulations to ensure device safety and reliability.

Novel neuromodulation products often face prolonged review cycles. In addition, the ongoing maintenance demands of SCS implants battery replacement, firmware updates, lead integrity checks, and patient reprogramming impose cost and logistic burdens on providers and patients alike, potentially limiting adoption rates in resource-constrained settings.

Opportunity

A significant opportunity lies in expansion into underserved and emerging markets coupled with value-based care models. Many low- and middle-income regions still lack access to advanced neuromodulation therapies. As healthcare infrastructure strengthens and governments emphasize nonopioid pain strategies, adoption of SCS devices may accelerate.

In parallel, payers and governments are seeking cost-effective interventions; neuromodulation may present long-term economic value by reducing expensive chronic pain management, hospitalizations, and disability. Clinical research demonstrating health economic benefits could bolster reimbursement, further catalyzing adoption across broader populations.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 32.5% share and holding US$ 1.15 billion market value for the year. The region’s leadership is driven by the rising burden of chronic pain disorders and the strong adoption of advanced neuromodulation therapies. A high number of spinal surgeries and an increasing rate of failed back surgery cases have created strong demand for spinal cord stimulation devices.

The presence of advanced healthcare infrastructure supports higher procedural volumes. Hospitals and specialty clinics in the United States and Canada are well equipped for device implantation, boosting patient access. Favorable reimbursement frameworks further strengthen market uptake, making SCS devices more accessible to a wider patient base.

Technological advancements in rechargeable and MRI-compatible devices have also accelerated regional growth. Continuous innovation by key manufacturers and early availability of new technologies keep North America ahead of other regions.

While North America dominates, Europe follows closely with significant adoption in countries like Germany and the U.K. Emerging economies in Asia-Pacific are expected to grow faster due to increasing healthcare investments and rising awareness of chronic pain therapies.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The spinal cord stimulation devices market is characterized by the presence of several well-established players competing on innovation, product portfolio expansion, and strategic collaborations. Companies are focusing on the development of minimally invasive and technologically advanced stimulation systems, including rechargeable and MRI-compatible devices, to enhance patient outcomes and extend device longevity.

Continuous investment in research and development is driving the introduction of next-generation devices with improved programmability, wireless connectivity, and personalized pain management capabilities. Strategic partnerships with healthcare providers and distribution networks are being leveraged to expand market reach, particularly in emerging economies.

Mergers, acquisitions, and product approvals are frequently pursued to strengthen competitive positioning and consolidate market share. The competitive landscape is also shaped by ongoing clinical trials and regulatory approvals, which serve as critical differentiators in influencing adoption rates. Collectively, these strategies highlight an industry dynamic that is highly innovation-driven and patient-centered.

Market Key Players

- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Nevro Corp.

- Saluda Medical Pty Ltd.

- Nalu Medical

- Mainstay Medical Limited

- Stimwave Technologies, Inc.

- Cirtec Medical Corporation

- Synapse Biomedical Inc.

- Beijing PINS Medical Co., Ltd.

- Gimer Medical

- Other key players

Recent Developments

- Medtronic: In April 2024, Medtronic received U.S. FDA approval for its Inceptiv™ closed-loop spinal cord stimulator, marking its first SCS device capable of sensing biological signals and automatically adjusting stimulation in real time. In January 2025, 12-month clinical data were reported showing that 91 % of patients experienced no uncomfortable stimulation during daily activities, and over 80 % achieved ≥ 50 % low-back pain relief.

- Abbott Laboratories: In January 2025, Abbott unveiled four-year follow-up data from its BurstDR™ spinal cord stimulation technology, reinforcing sustained pain relief and high patient satisfaction.

- Nevro Corp.: In April 2025, Globus Medical finalized its acquisition of Nevro, positioning Nevro as a wholly owned subsidiary and integrating Nevro’s high-frequency SCS technologies into Globus’s broader musculoskeletal portfolio.

- Saluda Medical Pty Ltd.: In January 2025, Saluda obtained U.S. FDA approval for an automated programming platform in spinal cord stimulation, aiming to optimize treatment personalization and reduce clinician burden.

Report Scope

Report Features Description Market Value (2024) US$ 3.54 Billion Forecast Revenue (2034) US$ 7.79 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rechargeable SCS Devices, Non-Rechargeable SCS Devices) By Application (Failed Back Surgery Syndrome (FBSS), Peripheral Neuropathies, Degenerative Disc Disease (DDD), Complex Regional Pain Syndrome (CRPS), Arachnoiditis, Others) By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Medtronic, Abbott Laboratories, Boston Scientific Corporation, Nevro Corp., Saluda Medical Pty Ltd., Nalu Medical, Mainstay Medical Limited, Stimwave Technologies, Inc., Cirtec Medical Corporation, Synapse Biomedical Inc., Beijing PINS Medical Co., Ltd., Gimer Medical, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Spinal Cord Stimulation Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Spinal Cord Stimulation Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Nevro Corp.

- Saluda Medical Pty Ltd.

- Nalu Medical

- Mainstay Medical Limited

- Stimwave Technologies, Inc.

- Cirtec Medical Corporation

- Synapse Biomedical Inc.

- Beijing PINS Medical Co., Ltd.

- Gimer Medical

- Other key players