Global Solid Oxide Fuel Cells Market Size, Share Analysis Report By Type (Planar, Tubular), By Component (Stack, Balance of Plant), By Solution (ЕРС, Components), By Application (Portable, Stationary, Transport), By End User (Residential, Commercial And Industrial, Data Centre, Military And Defense, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168759

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

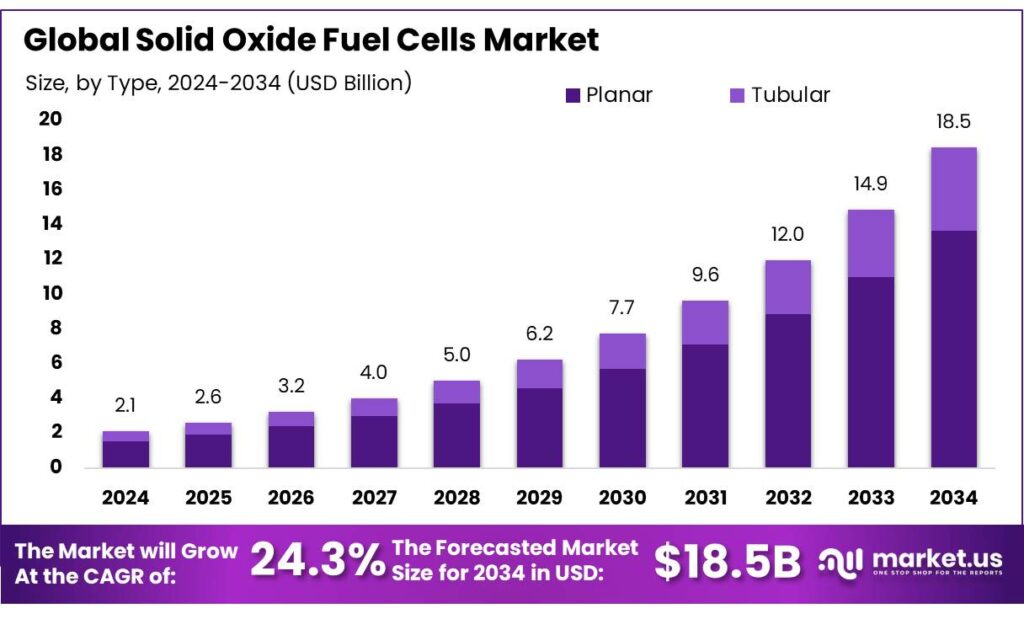

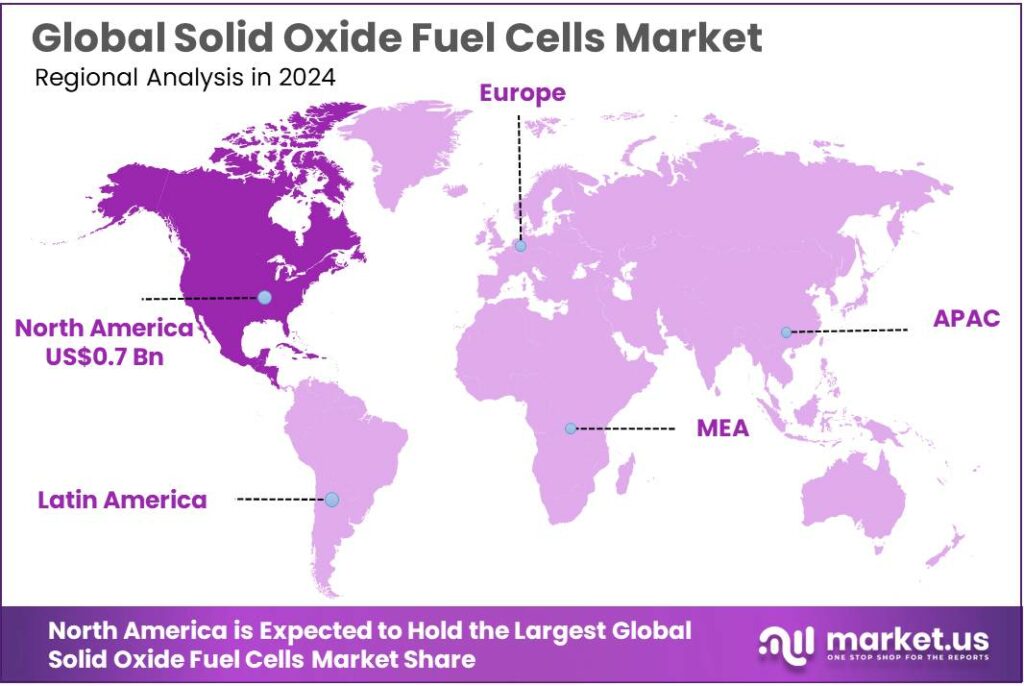

The Global Solid Oxide Fuel Cells Market size is expected to be worth around USD 18.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 24.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.2% share, holding USD 6.9 Billion revenue.

Solid oxide fuel cells (SOFCs) are high-temperature electrochemical devices that convert hydrogen, natural gas, biogas, or synthetic fuels directly into electricity and heat with electrical efficiencies above conventional gas engines. Recent U.S. Department of Energy (DOE) demonstrations report overall system efficiencies up to 89% for small SOFC units like BlueGen, producing around 13,000 kWh of electricity and 7,400 kWh of heat per year from a single module, highlighting the technology’s potential for highly efficient distributed generation.

The International Energy Agency’s fuel cell technology reports note that for larger stationary applications, the United States leads with around 500 MW of cumulative installed stationary fuel cell capacity, a significant share of which uses high-temperature technologies such as SOFC and molten carbonate fuel cells.

- OEMs report total fuel cell manufacturing capacity of about 12 GW per year across all technologies as of 2023, underlining that industrial scale production has moved beyond pilot phase. In Japan and Europe, thousands of micro-CHP units—including SOFC-based systems—are being deployed to supply building-scale heat and power, with Japan alone having installed over 300,000 residential fuel cell CHP systems under the ENE-FARM program by the early 2020.

Demand-side drivers are closely tied to the wider hydrogen economy. The IEA estimates global hydrogen demand at almost 100 million tonnes in 2024, up about 2% from 2023, with clean hydrogen expected to grow rapidly under net-zero scenarios. The EU’s REPowerEU plan aims for 10 million tonnes of domestic renewable hydrogen production and 10 million tonnes of imports by 2030, supported by at least 40 GW of electrolyser capacity. Germany’s National Hydrogen Strategy alone projects hydrogen demand of 95–130 TWh by 2030.

- Policy and R&D support are directly pushing SOFC technology up the learning curve. The U.S. Department of Energy’s National Energy Technology Laboratory runs a dedicated SOFC program focusing on low-cost, efficient systems for grid and distributed power. In November 2024, NETL installed and began testing a 1.5 kW SOFC system at its Morgantown site to evaluate real-world performance and durability.

- In October 2024, DOE’s Office of Fossil Energy and Carbon Management announced up to USD 4 million in funding for reversible SOFC projects targeting low-cost clean hydrogen production, building on earlier grants such as a USD 2.6 million award to Cummins in 2020 for a 20 kW SOFC system at the University of Connecticut.

Key Takeaways

- Solid Oxide Fuel Cells Market size is expected to be worth around USD 18.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 24.3%.

- Planar held a dominant market position, capturing more than a 73.9% share.

- Stack held a dominant market position, capturing more than a 67.1% share.

- EPC held a dominant market position, capturing more than a 59.2% share.

- Stationary held a dominant market position, capturing more than a 68.8% share.

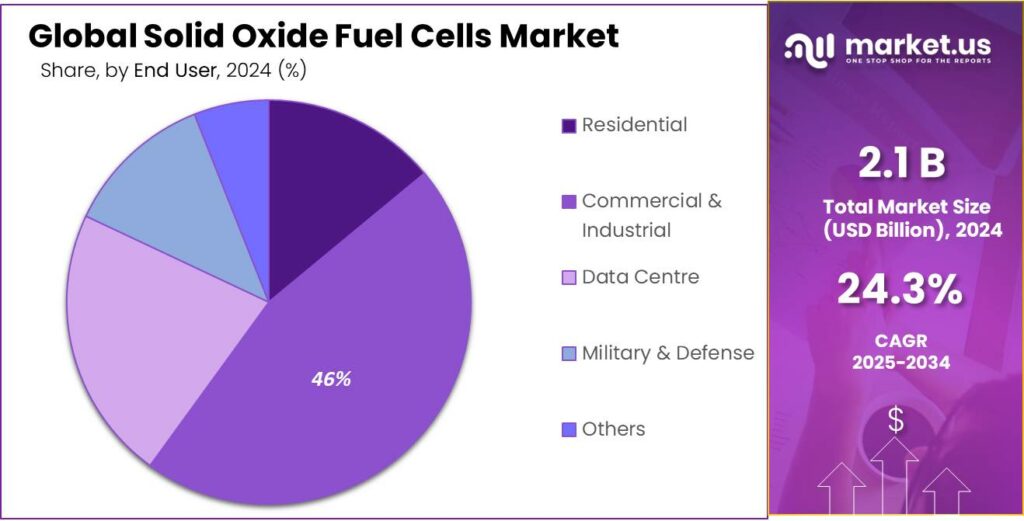

- Commercial & Industrial held a dominant market position, capturing more than a 46.5% share.

- North America accounted for 36.30% of the global solid oxide fuel cell market, representing approximately USD 0.7 billion.

By Type Analysis

Planar leads with 73.9% — chosen for its compact design and proven manufacturing readiness.

In 2024, Planar held a dominant market position, capturing more than a 73.9% share; this position is explained by the planar architecture’s ease of scale-up, lower manufacturing complexity compared with tubular designs, and suitability for compact, high-power-density applications such as distributed generation and backup power. Product developers and system integrators have preferred planar units because they allow tighter control of cell thickness and seal interfaces, which in turn improves performance consistency and reduces per-unit production variability.

As a result, investment in planar production lines and process optimisation has been prioritised by suppliers, and incremental improvements in stack assembly and interconnect materials have been targeted to extend cycle life while keeping system costs predictable. Overall, the market has been shaped by the maturity and manufacturability of the planar type, which explains its pronounced share in 2024.

By Component Analysis

Stack leads with 67.1% — driven by its central role in power generation and system efficiency.

In 2024, Stack held a dominant market position, capturing more than a 67.1% share, as the stack remains the core component responsible for actual electricity generation and overall conversion efficiency in solid oxide fuel cell systems. Most suppliers continued to invest in stack design improvements through advanced electrolytes, optimized interconnects and higher-temperature stability materials, which supported stronger performance in both stationary and industrial applications.

The period of 2024–2025 saw steady deployment of stack-focused upgrades aimed at extending operating life and reducing degradation rates, allowing manufacturers to deliver more reliable output with predictable performance curves. This emphasis on stack durability and energy density explains why the component maintained its clear lead in the market, as end users prioritized systems with robust stack assemblies to secure long-term operational value and lower maintenance requirements.

By Solution Analysis

EPC leads with 59.2% — supported by integrated delivery and lower project risks.

In 2024, EPC held a dominant market position, capturing more than a 59.2% share, as end users continued to favor turnkey, engineering–procurement–construction solutions that simplify solid oxide fuel cell deployment and reduce project uncertainties. The EPC model was preferred in 2024–2025 because it centralizes responsibility for design, component sourcing, installation and commissioning, allowing project owners to avoid fragmented contracting and potential delays.

This integrated approach also supported smoother grid integration for stationary SOFC units and reduced overall implementation costs by standardizing workflows across different sites. As a result, companies investing in distributed power systems, industrial backup units and micro-generation applications consistently selected EPC packages to secure predictable timelines, performance guarantees and long-term service support, reinforcing the segment’s strong share position.

By Application Analysis

Stationary leads with 68.8% — driven by reliable demand from power generation and backup systems.

In 2024, Stationary held a dominant market position, capturing more than a 68.8% share, as solid oxide fuel cells continued to be adopted for on-site power generation, combined heat and power units and long-duration backup systems. The stationary segment maintained its lead in 2024–2025 because users valued the high electrical efficiency and stable output that SOFC systems deliver when operated at steady loads, making them suitable for commercial buildings, data centers, small industrial units and utility-supported microgrids.

Growing interest in cleaner distributed energy solutions further supported demand, with many operators choosing stationary SOFCs to reduce local emissions while securing continuous power availability. This sustained preference for dependable, grid-supportive installations reinforced the segment’s strong share and ensured its ongoing priority in system deployment strategies.

By End User Analysis

Commercial & Industrial leads with 46.5% — supported by consistent demand for reliable on-site power.

In 2024, Commercial & Industrial held a dominant market position, capturing more than a 46.5% share, as businesses continued to adopt solid oxide fuel cell systems to secure stable, efficient and low-emission power for daily operations. The segment’s strength in 2024–2025 was driven by rising energy-reliability requirements in facilities such as manufacturing units, data centers, logistics hubs and large commercial buildings, where uninterrupted electricity is critical for productivity and equipment protection.

Operators favored SOFC installations because they offer high electrical efficiency, long operating life and the ability to run on natural gas or hydrogen, helping firms reduce carbon intensity without compromising performance. This steady shift toward cleaner on-site generation positioned the Commercial & Industrial segment as the leading end-user group, reinforcing its strong share across new deployments.

Key Market Segments

By Type

- Planar

- Tubular

By Component

- Stack

- Balance of Plant

By Solution

- ЕРС

- Components

By Application

- Portable

- Stationary

- Transport

By End User

- Residential

- Commercial & Industrial

- Data Centre

- Military & Defense

- Others

Emerging Trends

Reversible SOFCs Turn Power Plants into Hydrogen “Two-Way Streets

One of the most interesting new trends in solid oxide fuel cells (SOFCs) is the move toward reversible SOFC (rSOFC) systems. These units can work as a normal fuel cell, making electricity from hydrogen or natural gas, and then switch to electrolysis mode to make hydrogen from electricity and steam. In late 2024, the U.S. Department of Energy (DOE) announced up to USD 4 million in federal funding to advance reversible SOFC technology for clean, low-cost hydrogen production and energy storage.

This trend is tightly linked to the wider hydrogen transition. The International Energy Agency (IEA) reports that global hydrogen demand rose to almost 100 million tonnes in 2024, about 2% higher than 2023, and most of it is still “grey” hydrogen from fossil fuels. At the same time, IRENA’s roadmap for green hydrogen foresees about 5 terawatts (TW) of electrolyser capacity by 2050, up from only a few hundred megawatts today.

On the technical side, new studies show that rSOFC systems are already reaching interesting performance levels. A detailed analysis of a 1 MW reversible SOFC plant reported hydrogen production efficiency of about 54.1% and a levelised hydrogen cost near USD 3.19 per kg, with the possibility of going below USD 2 per kg under favourable electricity-price conditions.

Governments are starting to plan for trade in hydrogen derivatives, not just local projects. IRENA and the WTO estimate that hydrogen and its derivatives could meet around 14% of global final energy consumption by 2050 in a 1.5°C pathway, backed by roughly 4–5 TW of electrolysis capacity and massive solar and wind build-out.

Drivers

Surging Clean Hydrogen Demand and Net-Zero Targets Drive SOFC Adoption

A major driving factor for solid oxide fuel cells (SOFCs) is the push to decarbonise industries that cannot easily switch to direct electrification. Global hydrogen demand reached more than 97 million tonnes in 2023 and could approach 100 million tonnes in 2024, mostly for refining and chemicals and still largely fossil-based. This huge “grey” hydrogen baseline creates a very real market pull for cleaner conversion technologies such as SOFCs that can turn low-carbon hydrogen or other fuels into power and heat with very high efficiency.

Policy roadmaps now assume clean hydrogen will become a core pillar of the energy system. In its 1.5°C scenario, IRENA suggests that clean hydrogen could supply up to 12% of global final energy consumption by 2050. To reach that level, electrolysis capacity for green hydrogen must expand from roughly 1 GW today to more than 5,700 GW by 2050. As this low-carbon hydrogen becomes available, SOFCs are a natural conversion technology because they can achieve high electrical efficiency and also deliver useful heat for industry.

Governments are backing this shift with targeted hydrogen and fuel-cell programmes. The U.S. Department of Energy’s Hydrogen Shot aims to cut the cost of clean hydrogen by 80%, from about USD 5/kg today to USD 1/kg within a decade, effectively by 2030. If this cost goal is met, using hydrogen in SOFCs for power, combined heat and power, and industrial backup becomes far more attractive than running gas turbines or diesel gensets.

At the same time, governments are tightening expectations on SOFC performance and cost, which helps de-risk adoption for utilities and industrial users. A U.S. SOFC programme, reported under the IEA Advanced Fuel Cells Technology Collaboration Programme, targets electrical efficiency above 60% without carbon capture, a stack cost of USD 225/kW, a system cost of USD 900/kW, and performance degradation of less than 0.2% per 1,000 hours over 40,000 hours of operation. These benchmarks give project developers confidence that SOFCs can meet long-term reliability and cost expectations in commercial plants.

IRENA’s green-hydrogen policy roadmap calls for total electrolyser capacity of 5 TW by 2050, up from about 300 MW when the roadmap was first drafted, supported by national hydrogen strategies across dozens of countries. As governments channel billions of dollars into hydrogen production, storage, and transport, SOFC projects become a logical downstream use case, turning that hydrogen into steady, efficient, low-carbon power for grids, data centres, and industrial sites.

Restraints

High Capital Cost and Durability Problems Slow Down SOFC Adoption

A big restraining factor for solid oxide fuel cells (SOFCs) is still their high upfront cost and the way performance slowly drops over time. A study supported by the U.S. Department of Energy (DOE) points out that, even with technology progress, current SOFC systems are still above the DOE capital-cost goal of USD 900 per kW set for the 2025–2030 period. This means many utilities, data centers, and industrial plants see SOFCs as technically attractive, but financially hard to justify compared with gas engines or turbines.

Detailed cost work from Lawrence Berkeley National Laboratory for stationary SOFC combined-heat-and-power units found that a 10 kW system could cost about USD 2,380 per kW at 1,000 units/year and still around USD 1,660 per kW even at 50,000 units/year (including markup).That is close to, or above, DOE’s earlier USD 1,700 per kW target for small fuel-cell CHP systems. For many building owners, this gap is large enough to delay investment, especially when competing technologies can be financed through standard bank products with well-known risk profiles.

European data tell a similar story. A comprehensive review of fuel cells reports that micro-CHP fuel-cell systems in Europe can cost around EUR 10,000 per kW, with over 2,000 such units already installed and about 2,800 more planned by 2021.These numbers show that the technology works in the field, but the cost level keeps it in a niche, supported by subsidies and pilot schemes rather than pure market economics.

Governments and public labs are trying to tackle these barriers, which shows how serious they are. A recent U.S. FOA dedicated about USD 34 million of DOE funding specifically to SOFC systems and hybrid concepts to improve materials, architectures, and lifetime. The IEA’s Advanced Fuel Cells Technology Collaboration Programme is also pushing R&D on low-cost materials and longer-life stacks, aiming to bring cell and stack costs down towards the DOE goals of USD 225 per kW for the stack and USD 900 per kW for the full system.

Opportunity

Power-Hungry Data Centres and Microgrids Open a Big Door for SOFCs

A powerful growth opportunity for solid oxide fuel cells (SOFCs) is the fast-rising demand for clean, reliable on-site power in data centres and critical microgrids. The International Energy Agency (IEA) estimates that data centres used about 415 TWh of electricity in 2024, roughly 1.5% of global consumption, and their electricity use has been growing around 12% per year.

Governments see this pressure clearly. The European Commission links this data-centre boom with its broader efficiency and climate agenda, backing an EU energy-efficiency target to cut final energy use by 11.7% by 2030 compared with 2020 projections, and supporting a global pledge to double the rate of energy-efficiency improvement to over 4% per year by 2030. These goals make it harder for large power users to rely on simple, fossil-only backup; they need higher-efficiency solutions like SOFCs that can pair with renewables and waste-heat recovery.

The same IEA assessment shows data-centre electricity demand is on track to more than double to about 945 TWh by 2030, nearly the current use of an entire major economy. In the EU alone, data-centre electricity consumption is estimated at 70 TWh in 2024, rising towards 115 TWh by 2030. This kind of growth is forcing operators to look for on-site, low-carbon generation that can run 24/7 without depending only on constrained grids.

Recent U.S. policy moves underline how seriously governments treat this growth path. In September 2024, the U.S. Department of Energy announced up to USD 4 million in federal funding specifically “to advance solid oxide fuel cell technology for clean, low-cost hydrogen production,” with a focus on reversible SOFC systems that can switch between power generation and hydrogen production.

Regional Insights

North America commands 36.30% with USD 0.7 Bn — supported by strong policy support and early commercial deployment.

In 2024, North America accounted for 36.30% of the global solid oxide fuel cell market, representing approximately USD 0.7 billion, a position that can be attributed to active federal research programs, targeted demonstration projects and early commercial adoption in critical applications. Investment and grant initiatives from the U.S. Department of Energy have accelerated R&D for reversible and high-temperature SOFC systems, supporting cost-reduction targets and pilot installations.

National laboratories and programme activity led by the DOE’s NETL have supplied technical roadmaps and testing infrastructure that de-risk stack and system scale-up for manufacturers and integrators. Adoption has been concentrated in stationary applications — notably data centers, microgrids and combined heat-and-power projects — where operators prioritise high efficiency, fuel flexibility and resilience; several recent commercial demonstrations and utility partnerships in the region have validated performance under continuous operation.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bloom Energy’s commercial SOFC activity has been scaled through large project wins and factory expansion, with product and service revenue recorded at $1.47 billion in 2024; the company’s modular server approach has been applied to data centers and industrial sites to deliver low-carbon, on-site power. Ongoing factory investments and tax-credit support were pursued to raise stack capacity and lower unit costs, while partnerships and project finance structures were used to accelerate deployments and customer rollouts.

Mitsubishi Power’s SOFC effort has been advanced as part of the group’s power-technology roadmap, with research focused on high-efficiency ceramic cells and integrated combined-cycle configurations; the broader Mitsubishi Heavy Industries group reported consolidated revenue of ¥5,027.1 billion for FY2024, reflecting strong investment capacity. Development has been directed at scalable stack modules, system integration and fuel flexibility for industrial and utility applications, with pilot and demonstration programmes used to de-risk the pathway to commercial SOFC deployments.

Ceres Power’s business model is based on licensing its solid oxide cell and system IP to manufacturing partners, enabling rapid scale via third-party production; the company reported £51.9 million revenue in 2024. The technology has been positioned for distributed power and hydrogen production, with partners integrating Ceres’ stacks into commercial modules. Emphasis has been placed on reducing stack cost through factory design and on delivering reliable power-module efficiencies that support applications from commercial CHP to industrial hydrogen generation.

Top Key Players Outlook

- Bloom Energy

- Mitsubishi Power Ltd.

- Ceres

- General Electric

- FuelCell Energy Inc.

- Ningbo SOFCMAN Energy

- KYOCERA Corporation

- AVL

- NGK SPARK PLUG CO., LTD.

Recent Industry Developments

In 2024, General Electric Vernova recorded Revenue =USD 34,900 million and Net Income =USD 1,600 million as part of its consolidated performance.

In 2025, FuelCell Energy reported quarter revenue of US$ 46.7 million, nearly double the prior-year quarter’s US$ 23.7 million — showing a strong rebound in top-line sales.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 18.5 Bn CAGR (2025-2034) 24.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Planar, Tubular), By Component (Stack, Balance of Plant), By Solution (ЕРС, Components), By Application (Portable, Stationary, Transport), By End User (Residential, Commercial And Industrial, Data Centre, Military And Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bloom Energy, Mitsubishi Power Ltd., Ceres, General Electric, FuelCell Energy Inc., Ningbo SOFCMAN Energy, KYOCERA Corporation, AVL, NGK SPARK PLUG CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solid Oxide Fuel Cells MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Solid Oxide Fuel Cells MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bloom Energy

- Mitsubishi Power Ltd.

- Ceres

- General Electric

- FuelCell Energy Inc.

- Ningbo SOFCMAN Energy

- KYOCERA Corporation

- AVL

- NGK SPARK PLUG CO., LTD.