Global Solar Wind Hybrid Systems Market Size, Share, And Enhanced Productivity Component(Solar Panels, Wind Turbine, Battery Storage, Controllers, Inverters, Others), By Power Rating (Up To 10 kW, 11-100 kW, Above 100 kW), By Application (Residential, Commercial, Industrial, Utility), By Location (On-Grid, Off-Grid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171739

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

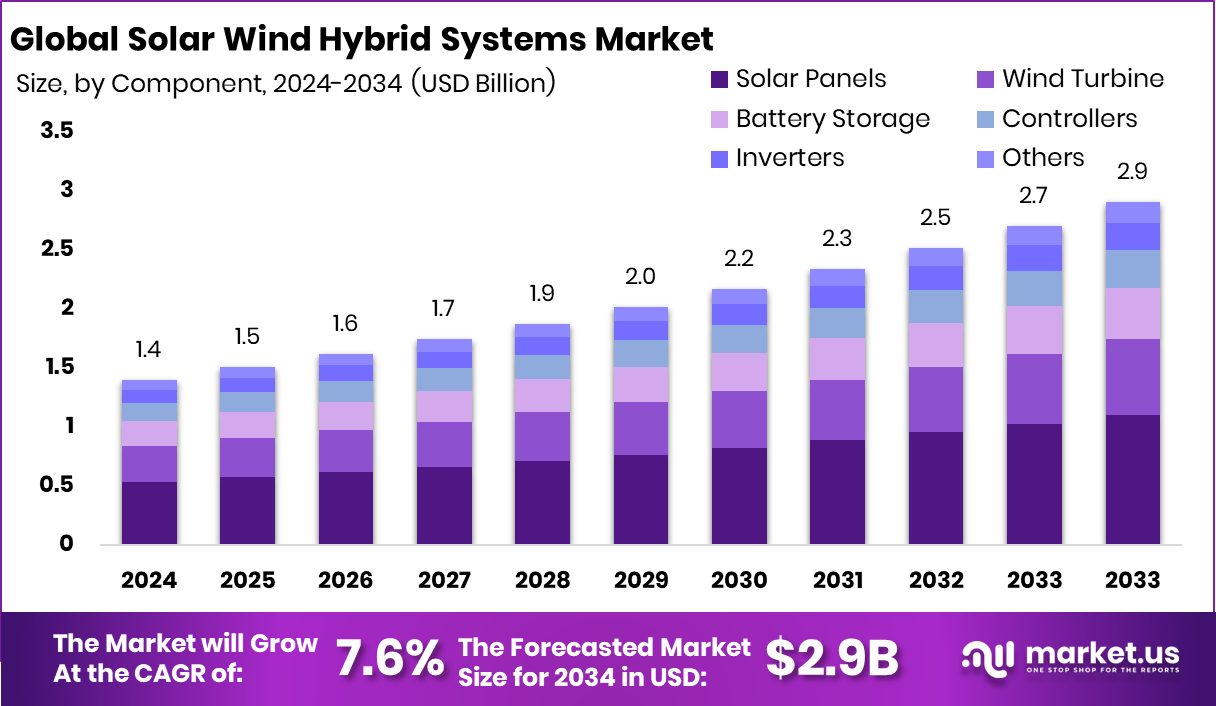

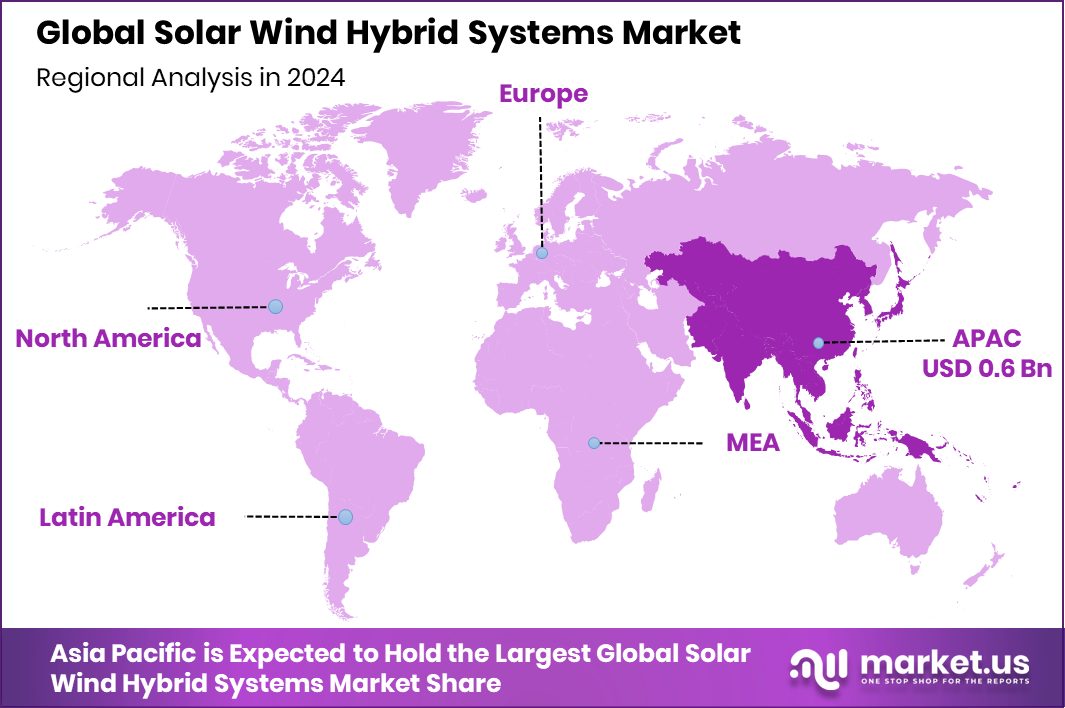

The Global Solar Wind Hybrid Systems Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034. In Solar Wind Hybrid Systems, Asia Pacific achieved 46.70%, totaling USD 0.6 Bn.

Solar wind hybrid systems combine solar panels and wind turbines into a single energy-generation setup that can supply power more consistently than using either source alone. When sunlight falls short, wind often compensates, creating a stable and reliable flow of electricity for homes, industries, and community facilities. This mixed approach reduces dependence on diesel generators and helps users shift toward cleaner energy.

The Solar Wind Hybrid Systems Market refers to the growing ecosystem of technologies, installations, and services built around integrating both solar and wind resources. The market is shaped by rising renewable targets, falling equipment costs, and strong government interest in stable, low-carbon power. As countries expand clean-energy infrastructure, hybrid systems naturally gain attention for their reliability and ease of operation.

Growth factors are strongly influenced by continuous investment into solar manufacturing and panel innovation. For example, ACME Solar securing ₹4,725 crore for renewable projects encourages larger utility-scale hybrid deployments. At the household level, programs like Sardinia’s €100 million green solar scheme support hybrid-ready rooftop installations and create long-term adoption momentum.

Market demand also benefits from circular-economy initiatives. India’s shift toward responsible reuse and recycling is strengthened by Beyond Renewables & Recycling raising ₹5 crore, enabling better lifecycle management for hybrid-linked solar components. Such moves help reduce waste while improving supply availability.

Opportunities continue to expand as new solar technologies mature. High-efficiency materials advance with support like Tandem PV’s $4 million CEC grant and SunDrive Solar’s AU$25.3 million ARENA funding, while the $45.5 million boost for Australian solar manufacturing strengthens future hybrid adoption. Even policy disputes—such as states challenging the halt of a $7bn solar grant program—highlight how central renewables have become in shaping future hybrid market growth.

Key Takeaways

- The Global Solar Wind Hybrid Systems Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034.

- The Solar Wind Hybrid Systems Market sees Solar Panels leading with a strong 37.9% share.

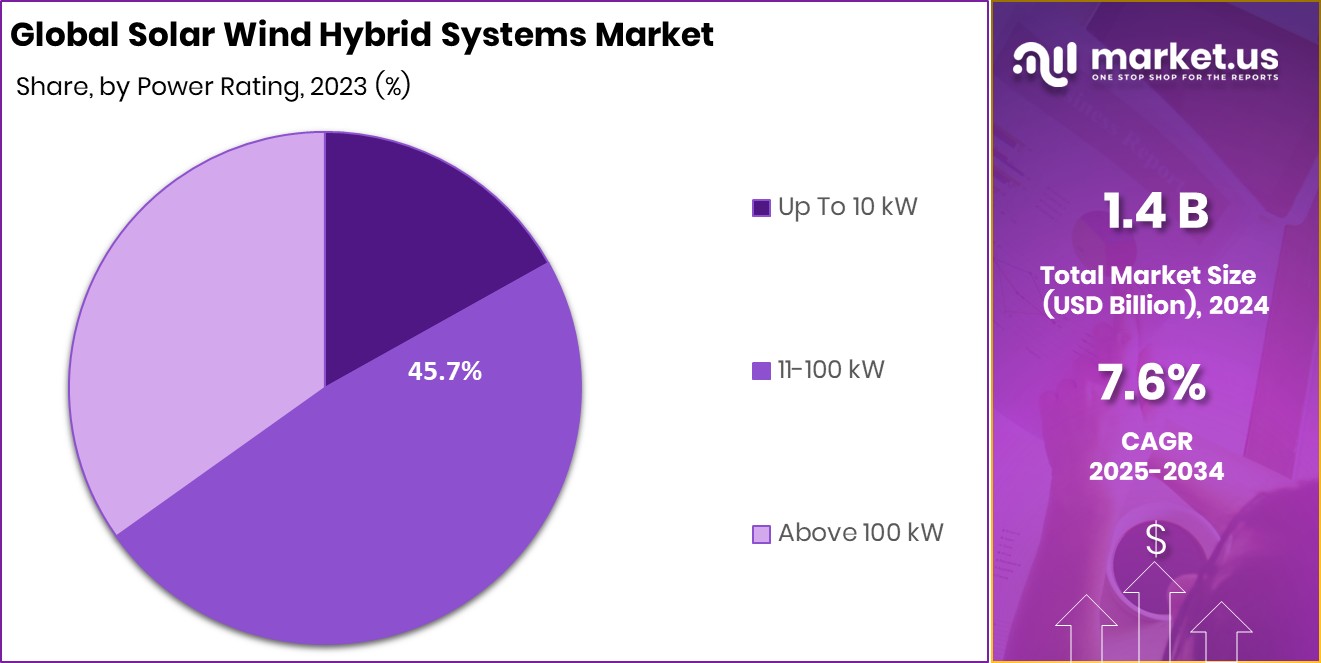

- Within the Solar Wind Hybrid Systems Market, the 11–100 kW segment dominates with 45.7% share.

- The Solar Wind Hybrid Systems Market shows Commercial applications holding a notable 38.5% share globally.

- In the Solar Wind Hybrid Systems Market, On-Grid installations remain dominant, capturing a major 71.4% share.

- The region Asia Pacific captured 46.70%, valued at USD 0.6 Bn overall.

By Component Analysis

The Solar Wind Hybrid Systems Market sees Solar Panels leading with 37.9% share.

In 2024, Solar Panels held a dominant market position in the By Component segment of the Solar Wind Hybrid Systems Market, capturing a 37.9% share. This lead reflects their strong ability to deliver consistent and predictable power output within hybrid setups. Their efficiency in converting sunlight into electricity makes them a stable backbone component in integrated renewable systems.

Their dominance also stems from improved panel durability and widespread compatibility with hybrid controllers and storage units. As more users seek reliable and low-maintenance energy solutions, solar panels continue to be the preferred choice. The 2024 share highlights how essential photovoltaic modules have become for balanced hybrid energy generation.

By Power Rating Analysis

Power rating of 11–100 kW holds 45.7% in Solar Wind Hybrid Systems Market.

In 2024, 11–100 kW held a dominant market position in the By Power Rating segment of the Solar Wind Hybrid Systems Market, accounting for a 45.7% share. This capacity range is widely favored due to its suitability for medium-scale facilities that require stable power without oversizing system investments.

Its strong presence reflects rising adoption among institutions, mid-sized commercial units, and community energy users who seek dependable hybrid performance. The 11–100 kW range offers flexibility, balanced generation, and easier installation, which supports its leadership. The segment’s 2024 share indicates that this capacity band continues to meet practical on-site energy needs effectively.

By Application Analysis

Commercial use dominates the Solar Wind Hybrid Systems Market with a 38.5% contribution.

In 2024, Commercial held a dominant market position in the By Application segment of the Solar Wind Hybrid Systems Market, securing a 38.5% share. Commercial users increasingly prioritize hybrid systems to reduce operational energy costs and maintain more stable power availability.

Their demand is driven by the need for dependable onsite electricity, especially for operations experiencing fluctuating grid conditions. Hybrid systems provide commercial facilities with balanced energy generation, making them an attractive investment. The 2024 dominance shows that businesses view hybrid solutions as an efficient way to enhance energy reliability and long-term cost control.

By Location Analysis

On-grid installations capture 71.4%, strengthening the Solar Wind Hybrid Systems Market globally.

In 2024, On-Grid held a dominant market position in the By Location segment of the Solar Wind Hybrid Systems Market, commanding a strong 71.4% share. This leadership highlights the growing preference for systems that can feed excess electricity into the grid while drawing stable backup power when needed.

On-grid setups offer flexibility, lower system costs, and simplified integration, making them highly attractive for both small and large users. Their 2024 share underscores their strategic value in enabling hybrid systems to support broader network stability while ensuring users maintain reliable energy access.

Key Market Segments

By Component

- Solar Panels

- Wind Turbine

- Battery Storage

- Controllers

- Inverters

- Others

By Power Rating

- Up To 10 kW

- 11-100 kW

- Above 100 kW

By Application

- Residential

- Commercial

- Industrial

- Utility

By Location

- On-Grid

- Off-Grid

Driving Factors

Rising Clean-Energy Support Accelerates Hybrid Adoption

The Solar Wind Hybrid Systems Market is growing quickly because countries and communities want steadier and cleaner power. A major driver is the strong push from public programs that encourage both rooftop solar and community-scale clean-energy projects. For example, Great British Energy awarded £10 million to expand rooftop solar, which helps households shift toward systems that can later integrate wind support for more dependable power. This type of funding increases confidence in hybrid-ready environments.

Another key push comes from community-focused grants. In the U.S., the $41.1 million Clean Energy Community Grant awards help local projects include hybrid-compatible infrastructure that balances solar and wind output. At the same time, Virginia’s loss of $156 million in Solar for All funding shows how crucial continuous support is, making existing programs even more valued and accelerating hybrid adoption where funding remains strong.

Restraining Factors

High Capital Needs Slow Hybrid Deployment Growth

One major restraint for the Solar Wind Hybrid Systems Market is the high upfront cost required to combine two renewable sources into one system. Even though wind and solar technologies have become more affordable, the combined setup, storage needs, and grid integration still demand large investments that many regions struggle to meet. This challenge becomes clearer when looking at funding patterns. For instance, the EBRD offering $200 million for a wind project in Türkiye shows how substantial the required capital can be, especially when building capacities as large as 250 MW.

Early-stage companies also face hurdles in scaling hybrid-compatible technologies. The £865,000 seed funding secured by Myriad Wind helps innovation but remains limited compared to the size of the infrastructure needed for full hybrid systems. At the same time, experts note that Ed Miliband’s £1.1 billion allocation is “not enough” for offshore wind highlights how even billion-level support may fall short. These gaps in available funding slow down large-scale hybrid adoption and make many developers cautious about investing in combined solar-wind setups.

Growth Opportunity

Growing Storage Investments Boost Hybrid Expansion

A major growth opportunity for the Solar Wind Hybrid Systems Market comes from the rapid expansion of energy-storage projects that make hybrid systems more stable and useful. When storage grows, solar and wind can work together more smoothly, helping users rely on clean power even when weather conditions change. This opportunity becomes stronger as large renewable projects secure major funding.

For example, Ørsted achieving full funding for its 632 MW offshore wind farm in Taiwan strengthens the foundation for future hybrid-ready infrastructure by adding more wind capacity that can later be paired with solar and storage.

Storage-led development also opens new doors for hybrid adoption. The 100-MW Victorian battery project funded by Flow Power shows how battery capacity helps balance fluctuating resources, making hybrid systems more practical for businesses and communities. At the same time, Europe’s strong push toward storage—highlighted by €2.14 billion in ESS funding for Li-ion and mechanical systems—creates long-term room for hybrid projects that depend on strong storage backbones.

Latest Trends

Advanced Storage Technologies Transform Hybrid Energy Systems

One of the latest trends in the Solar Wind Hybrid Systems Market is the fast shift toward advanced energy-storage technologies that make hybrid setups far more stable and efficient. Users now want systems that can store energy when both solar and wind peak, and release it when either source drops. This shift is strongly supported by major regional investments that push storage adoption forward. A key example is Europe’s strong momentum, where Li-ion and mechanical storage projects lead a large €2.14 billion ESS funding initiative, creating the ideal conditions for hybrid systems to operate with smoother output.

Another growing trend is the move toward hybrid solutions designed for flexible grid support. With better storage, hybrid systems can offer voltage control, backup power, and load management, making them useful not only for homes and businesses but also for local grids looking for reliability. As more regions upgrade their storage capabilities, hybrid systems are evolving from simple dual-source setups into smart energy assets.

Regional Analysis

Asia Pacific held 46.70%, reaching USD 0.6 Bn in Solar Wind Hybrid Systems.

Asia Pacific dominated the Solar Wind Hybrid Systems Market with a 46.70% share, valued at USD 0.6 Bn, reflecting the region’s strong adoption of integrated renewable solutions and its expanding base of hybrid energy projects. This leadership highlights the region’s focus on stabilizing electricity supply through combined solar-wind generation, especially in countries with large industrial and commercial energy demands.

North America continued to show steady interest in hybrid systems as users sought improved grid stability and greater resilience. Europe maintained consistent deployment driven by energy diversification goals and favorable hybrid system integration across mixed-resource locations.

The Middle East & Africa displayed rising potential supported by vast solar exposure and emerging hybrid installations aimed at reducing grid dependence. Latin America also demonstrated growing utilization of hybrid systems as users explored cost-effective generation models suitable for remote and semi-urban locations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Vestas Wind Systems A/S strengthened its position in the Solar Wind Hybrid Systems Market by leveraging its long-standing expertise in wind technology and applying it to hybrid configurations that balance variable resources more efficiently. The company’s focus on dependable turbine performance and system-level integration helped it maintain relevance as hybrid projects increased across regions seeking stable mixed-generation solutions. Vestas continued positioning itself as a strong partner for large-scale users looking for reliability and operational continuity within hybrid networks.

Suzlon Energy Ltd. played a strategic role by aligning its wind engineering capabilities with hybrid system development, especially in markets where distributed energy demand is rising. The company’s emphasis on accessible and modular hybrid-compatible solutions made it appealing for users seeking cost-effective renewable setups. Suzlon’s familiarity with resource-diverse landscapes enabled it to support energy users transitioning to combined solar-wind models without adding system complexity.

SMA Solar Technology AG contributed significant value through its inverter and control technologies, which form the operational backbone of hybrid systems. Its strength in power electronics allowed users to manage variable generation smoothly and ensure reliable grid interaction. SMA’s hybrid-ready solutions continued to support streamlined integration for commercial and utility users that required stable, responsive control platforms.

Top Key Players in the Market

- Vestas Wind Systems A/S

- Suzlon Energy Ltd.

- SMA Solar Technology AG

- GE Vernova

- NextEra Energy

- Iberdrola SA

- Jinko Solar Holding Co., Ltd.

- Canadian Solar Inc.

- Brookfield Renewable Partners

- Algonquin Power & Utilities Corp.

Recent Developments

- In June 2024, SMA Solar Technology AG’s renewable energy platform called Sunny Central FLEX won the smarter E Award 2024 for innovation. This platform supports solar, battery, and hydrogen applications and was recognized at Europe’s largest solar energy trade fair, highlighting SMA’s strength in modular, flexible systems.

- In April 2024, GE Vernova started trading independently on the New York Stock Exchange after spinning off from GE. This marked the company’s fresh start, focused on energy transition and electrification technologies.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.9 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Solar Panels, Wind Turbine, Battery Storage, Controllers, Inverters, Others), By Power Rating (Up To 10 kW, 11-100 kW, Above 100 kW), By Application (Residential, Commercial, Industrial, Utility), By Location (On-Grid, Off-Grid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Vestas Wind Systems A/S, Suzlon Energy Ltd., SMA Solar Technology AG, GE Vernova, NextEra Energy, Iberdrola SA, Jinko Solar Holding Co., Ltd., Canadian Solar Inc., Brookfield Renewable Partners, Algonquin Power & Utilities Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Wind Hybrid Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Solar Wind Hybrid Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vestas Wind Systems A/S

- Suzlon Energy Ltd.

- SMA Solar Technology AG

- GE Vernova

- NextEra Energy

- Iberdrola SA

- Jinko Solar Holding Co., Ltd.

- Canadian Solar Inc.

- Brookfield Renewable Partners

- Algonquin Power & Utilities Corp.