Global Sodium Lignosulphonate Market Size, Share, And Business Benefit By Type (Dry, Liquid), By Application (Animal Feed Binder, Concrete Admixture, Oil Well Additives, Agriculture Chemicals, Dust Suppressants, Lead Batteries, Gypsum Plasterboards, Others), By End-user (Construction, Animal Feed, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162298

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

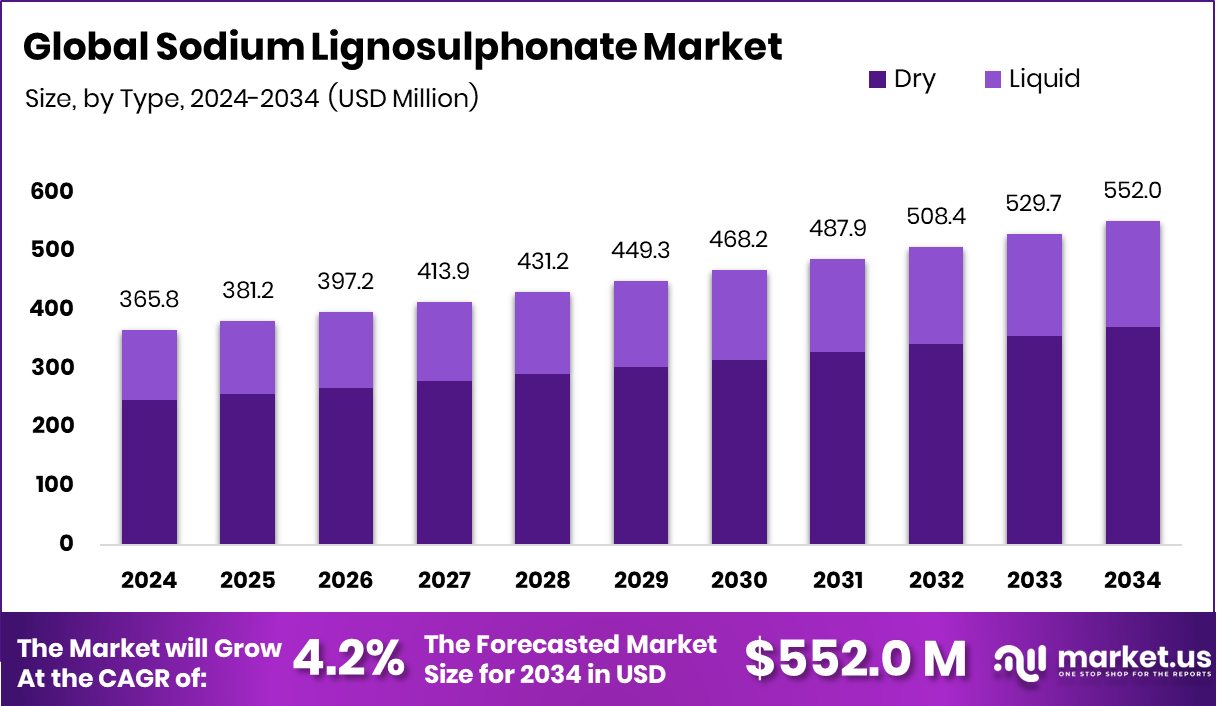

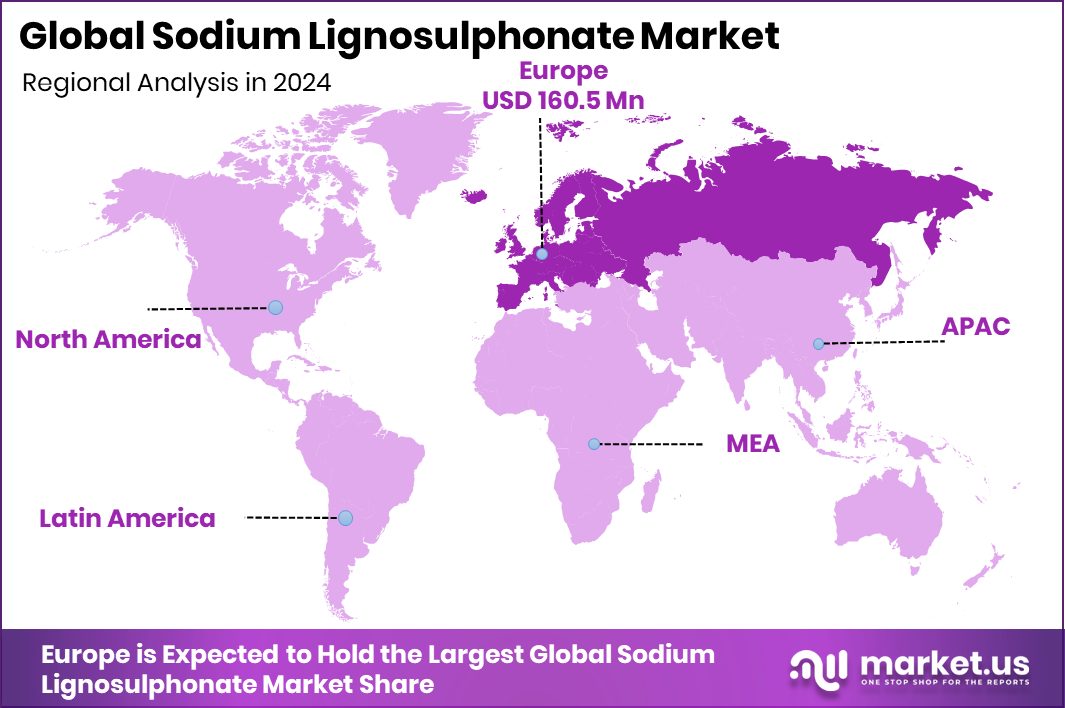

The Global Sodium Lignosulphonate Market is expected to be worth around USD 552.0 million by 2034, up from USD 365.8 million in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. Growing eco-friendly construction practices strengthened Europe’s 43.90% share, valued at USD 160.5 million.

Sodium Lignosulphonate is a natural polymer obtained from the sulfite pulping process of wood. It acts as a dispersant, binder, and emulsifier across several industries such as construction, animal feed, ceramics, and agriculture. The market is growing as industries increasingly favor bio-based and low-cost alternatives to synthetic chemicals. The rise in global investments in sustainable and biotechnological innovation supports this shift—Canada funds $7.2 million for a microbial protein aquafeed project, Binder Park Zoo secures $4.6K for a giraffe health project, and Enifer raises $39 million to expand a mycoprotein plant in Finland.

Similarly, Rival Foods attracts $11.6 million Series B for plant-based whole cuts, Shiru raises $16 million Series B to expand an AI ingredient platform, and Onego Bio nets $15.2 million to advance animal-free egg protein. These signals of sustainable innovation strengthen the ecosystem that sodium lignosulphonate supports, especially in green materials and feed applications.

A key growth factor for sodium lignosulphonate is its expanding role in the construction sector as a water-reducing and plasticizing agent. It enhances concrete fluidity, lowers water demand, and improves strength—all while being derived from renewable wood sources. As infrastructure development continues globally and the construction industry embraces eco-friendly materials, demand for such lignin-based additives continues to accelerate.

Rising demand in the animal feed, dyes, and ceramics industries also drives the sodium lignosulphonate market. Its use as a binder in feed pellets improves durability and minimizes nutrient loss. In dye and pigment manufacturing, it acts as a dispersant, ensuring consistent color and texture. These versatile industrial applications sustain steady global consumption and diversify revenue streams.

The greatest opportunity lies in circular economy advancement and biomass valorization. As global industries transition toward renewable feedstocks, sodium lignosulphonate stands out as a sustainable additive replacing petrochemical-based dispersants and binders. Continued funding in biotechnology and sustainable proteins underlines a broader trend that aligns perfectly with the growth trajectory of lignin-derived chemicals, creating pathways for innovation in green manufacturing and sustainable product design.

Key Takeaways

- The Global Sodium Lignosulphonate Market is expected to be worth around USD 552.0 million by 2034, up from USD 365.8 million in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- In 2024, dry sodium lignosulphonate held a 67.3% market share due to easy handling and long shelf life.

- Concrete admixture dominated the application segment with a 37.2% share due to its water-reducing and plasticizing benefits.

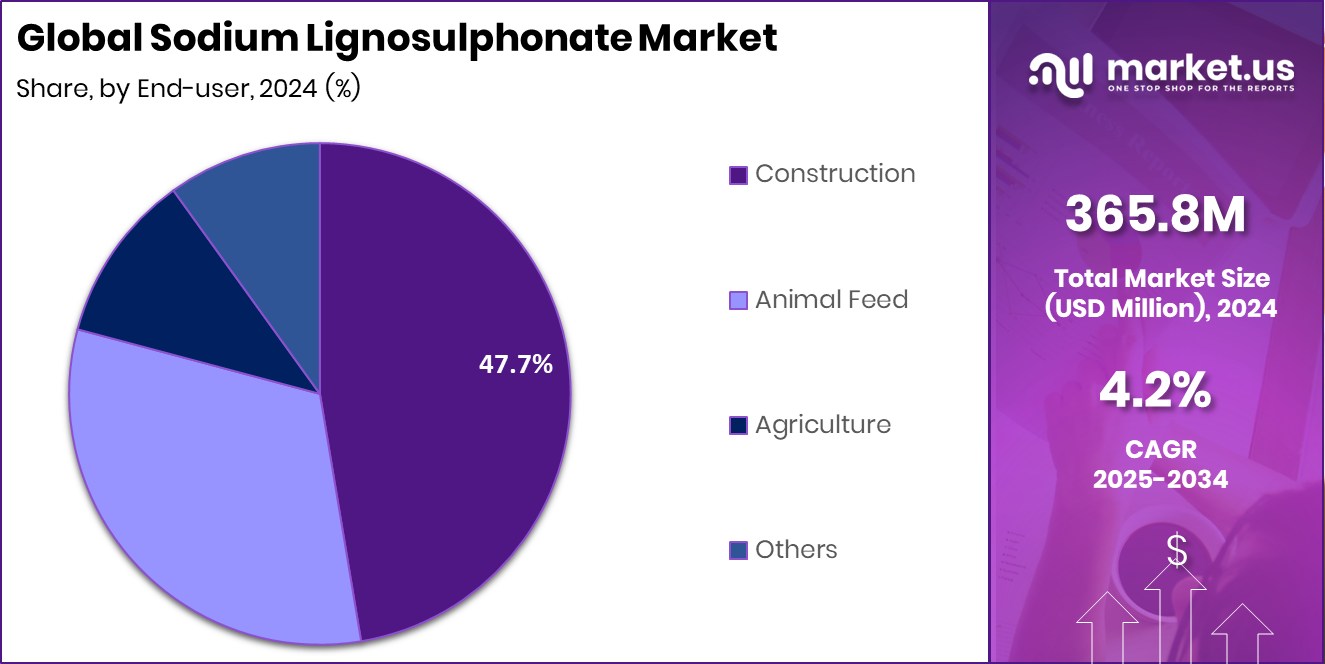

- The construction sector led the end-user segment with a 47.7% market share in 2024.

- The regional market in Europe reached a value of USD 160.5 million in 2024.

By Type Analysis

In 2024, the Sodium Lignosulphonate Market saw the dry form dominate with a 67.3% share.

In 2024, Dry held a dominant market position in the By Type segment of the Sodium Lignosulphonate Market, with a 67.3% share. The dry form gained strong traction due to its easy handling, longer shelf life, and cost efficiency in transport and storage.

It is widely used in construction additives, ceramics, and feed binders, where uniform dispersion and low moisture content are critical. The dry variant’s compatibility with various industrial processes and its high solubility have made it the preferred choice among manufacturers.

Meanwhile, the liquid form continues to serve niche applications in dye formulations and agricultural sprays but accounts for a smaller share due to higher logistics costs and storage limitations. The overall preference for dry sodium lignosulphonate highlights the industry’s inclination toward efficient, stable, and versatile material forms that support scalable production and global trade in industrial-grade lignosulphonate solutions.

By Application Analysis

Concrete admixture held a strong 37.2% share in the sodium lignosulphonate market.

In 2024, Concrete Admixture held a dominant market position in the By Application segment of the Sodium Lignosulphonate Market, with a 37.2% share. The dominance of this segment is attributed to the compound’s excellent water-reducing, dispersing, and plasticizing properties that enhance concrete strength and durability.

Its ability to improve workability and reduce cement consumption has made it indispensable in large-scale infrastructure and commercial construction projects. The eco-friendly nature of sodium lignosulphonate, derived from renewable lignin sources, further supports its adoption as industries pursue sustainable building materials.

Additionally, its cost-effectiveness and compatibility with modern admixture formulations reinforce its wide usage in ready-mix and precast concrete. While other applications, such as animal feed binders, ceramics, and dyes, continue to grow steadily, the construction industry remains the largest consumer base, solidifying the leading role of concrete admixtures in driving consistent demand for sodium lignosulphonate worldwide.

By End-user Analysis

Construction accounted for 47.7% of the overall sodium lignosulfonate market.

In 2024, Construction held a dominant market position in the end-user segment of the Sodium Lignosulphonate Market, with a 47.7% share. The segment’s dominance is driven by the compound’s wide application in concrete admixtures, mortars, and cement formulations. Its ability to enhance fluidity, reduce water usage, and improve the overall strength and durability of concrete structures makes it indispensable for infrastructure development.

The ongoing global expansion of residential, commercial, and transportation projects further strengthens its demand. Additionally, the shift toward sustainable and cost-efficient materials aligns with the adoption of sodium lignosulphonate, derived from renewable lignin sources.

While other end-users, such as agriculture, animal feed, and ceramics, are gaining traction, the construction sector remains the primary consumer, supported by rapid urbanization, government-funded building programs, and industrial expansion across emerging economies, consolidating its leading role in the market.

Key Market Segments

By Type

- Dry

- Liquid

By Application

- Animal Feed Binder

- Concrete Admixture

- Oil Well Additives

- Agricultural Chemicals

- Dust Suppressants

- Lead Batteries

- Gypsum Plasterboards

- Others

By End-user

- Construction

- Animal Feed

- Agriculture

- Others

Driving Factors

Surging Construction Activity Drives Sodium Lignosulphonate Demand

Rapid growth in construction globally has significantly boosted demand for sodium lignosulphonate, thanks to its role as a water-reducing and plasticizing additive that improves concrete workability and durability. As urbanization intensifies and governments invest heavily in infrastructure, the need for cost-efficient and high-performance construction materials rises. This trend has encouraged investment into advanced building technologies, such as the fact that Concretene raised €3.5 million for its carbon-saving graphene-enhanced concrete admixture and the backing of Black Swan Graphene, which highlighted the closing of Concretene’s £3 million strategic financing.

These developments signal strong confidence in upgrading construction materials, ultimately driving increased use of sodium lignosulphonate in concrete mixes to achieve better efficiency, reduced cement consumption, and lower environmental impact.

Restraining Factors

High Volatility in Raw-Material Prices Hinders Uptake

One of the primary hindering factors for the sodium lignosulphonate market is the high volatility and unpredictability of its raw-material inputs, particularly lignin sourced from pulp and paper operations. When prices or the supply of pulp-derived lignin fluctuate, additives such as sodium lignosulphonate become more expensive or harder to procure reliably. This increases costs for downstream manufacturers and may limit adoption in cost-sensitive industries.

Compounding this, the concreting and construction ecosystem is undergoing its own investment surge — a CO₂-negative concrete start-up recently secured US$1 million from an Intel co-founder, and a graphene-concrete decarbonisation initiative obtained £400,000 to push advanced admixtures. These investments steer focus toward novel, greener alternatives, meaning that, unless sodium lignosulphonate maintains cost-competitiveness and supply stability, it risks being edged out by next-generation materials.

Growth Opportunity

Rising Green Construction Unlocks New Market Opportunities

A major growth opportunity for the sodium lignosulphonate market lies in the global shift toward sustainable and low-carbon construction materials. As governments and industries invest heavily in cleaner infrastructure, demand for eco-friendly concrete additives is increasing rapidly.

Sodium lignosulphonate, being a natural, biodegradable polymer derived from wood lignin, aligns perfectly with this green transition. It helps reduce cement usage, improves concrete strength, and minimizes the environmental footprint of construction activities.

Supporting this momentum, Nano business Concretene raised £3 million in a fresh venture round to advance sustainable concrete innovation, while the ‘clean cement’ projects are receiving $1.5 billion under the Biden administration’s funding initiative. These investments highlight a growing ecosystem where lignin-based materials like sodium lignosulphonate can thrive as key enablers of climate-friendly construction.

Latest Trends

Smart and Sustainable Concrete Solutions Shaping Future

A key trend in the sodium lignosulphonate market is the growing fusion of sustainability and smart construction technologies. Industries are increasingly combining bio-based additives like sodium lignosulphonate with digital innovations to achieve stronger, greener, and more intelligent building materials. This trend reflects the global push to decarbonize construction while improving quality monitoring and material efficiency.

Recent funding highlights this shift—Concrete sensor manufacturer Wavelogix received a $1 million grant from the National Science Foundation to advance real-time concrete monitoring, and carbon storage startup Paebbl raised €8 million in a seed round to scale CO₂-mineralizing materials.

Such investments indicate a deepening commitment to sustainable infrastructure, where lignin-derived products like sodium lignosulphonate integrate with emerging technologies for a cleaner and smarter construction future.

Regional Analysis

In 2024, Europe dominated the Sodium Lignosulphonate Market with a 43.90% share.

In 2024, Europe held a dominant position in the global Sodium Lignosulphonate Market, capturing a 43.90% share with a market value of USD 160.5 million. The region’s strong foothold is driven by robust demand from the construction and infrastructure sectors, where sodium lignosulphonate serves as a key water-reducing and dispersing agent in concrete formulations. European countries are actively embracing sustainable and bio-based materials, supporting the use of lignin-derived chemicals as part of their green building initiatives.

North America follows closely, supported by steady growth in industrial and agricultural applications. Asia Pacific continues to emerge as a fast-growing region due to rapid urbanization, expanding construction activities, and increasing adoption of renewable additives in China and India.

Meanwhile, the Middle East & Africa benefit from infrastructure expansion projects, and Latin America shows gradual growth with rising use in feed and dye applications. Europe remains the clear leader, supported by advanced construction standards and sustainability-focused policies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Borregaard LignoTech has maintained its leadership by leveraging advanced biorefining capabilities to produce high-purity lignin-based chemicals. Its strong focus on sustainable innovation and environmental performance supports the rising global demand for bio-based dispersants and binders. The company continues to invest in improving production efficiency and product customization for diverse industrial uses, including concrete admixtures, feed, and ceramics.

Tembec, with its integrated pulp and chemical operations, remains an influential supplier by efficiently converting wood by-products into value-added lignosulphonate derivatives. Its strategy emphasizes resource optimization and consistent supply to the construction and agricultural sectors. By aligning its portfolio with green industry standards, Tembec enhances its competitiveness in North America and Europe.

Nippon Paper Industries contributes through advanced lignin extraction and conversion technologies, aligning with Japan’s sustainability and circular economy goals. The company’s strong R&D foundation enables it to produce sodium lignosulphonate for high-performance concrete and specialty applications. Collectively, these players exemplify the industry’s transition toward renewable chemical solutions, efficiency-driven production, and environmentally conscious growth—ensuring the sodium lignosulphonate market remains resilient and innovation-oriented in the years ahead.

Top Key Players in the Market

- Borregaard LignoTech

- Tembec

- Nippon Paper Industries

- Burgo Group

- Domsjo Fabriker

- Ingevity Corporation

- Shenyang Xingzhenghe Chemical Co., Ltd.

- Others

Recent Developments

- In October 2024, Borregaard announced its decision to invest NOK 490 million to debottleneck and increase capacity at its Sarpsborg site, targeting a production capacity increase of 5-10% for lignin-based biopolymers, speciality cellulose, and related materials.

- In April 2024, Nippon Paper Industries obtained a patent for a liquid composition containing a lignin-sulfonic acid‐based compound and a water-soluble compound (which relates to lignosulphonate chemistry).

Report Scope

Report Features Description Market Value (2024) USD 365.8 Million Forecast Revenue (2034) USD 552.0 Million CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dry, Liquid), By Application (Animal Feed Binder, Concrete Admixture, Oil Well Additives, Agriculture Chemicals, Dust Suppressants, Lead Batteries, Gypsum Plasterboards, Others), By End-user (Construction, Animal Feed, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Borregaard LignoTech, Tembec, Nippon Paper Industries, Burgo Group, Domsjo Fabriker, Ingevity Corporation, Shenyang Xingzhenghe Chemical Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sodium Lignosulphonate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Lignosulphonate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Borregaard LignoTech

- Tembec

- Nippon Paper Industries

- Burgo Group

- Domsjo Fabriker

- Ingevity Corporation

- Shenyang Xingzhenghe Chemical Co., Ltd.

- Others