Global Sodium Hypochlorite Market Size, Share Analysis Report By Function (Disinfection, Oxidizing, Bleaching, Odor, Removal, Others), By Application (Water Treatment, Agriculture, Chemical, Textile, Household, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162025

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

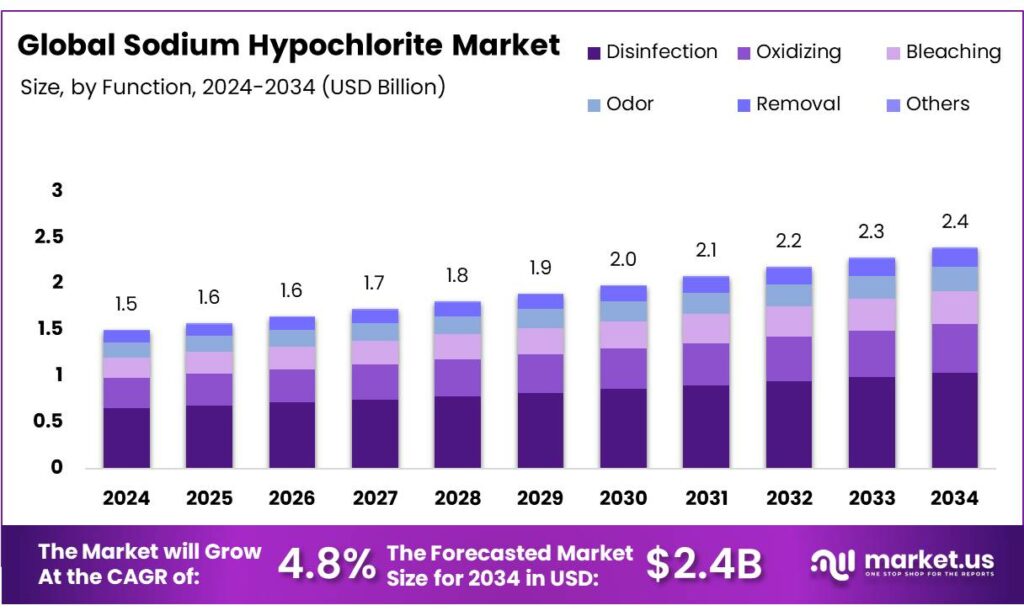

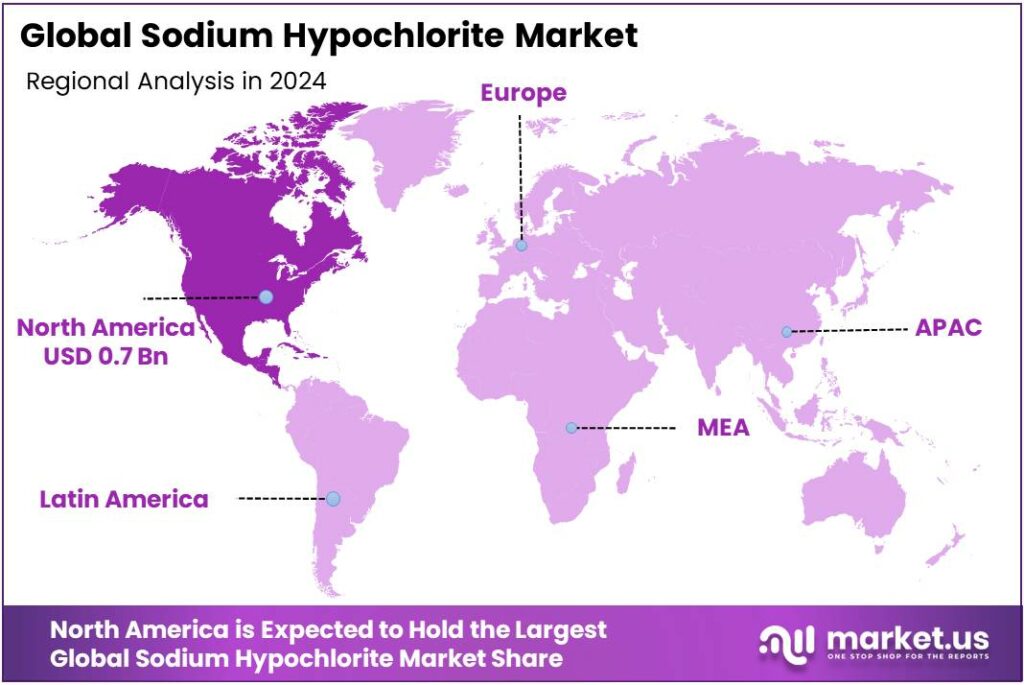

The Global Sodium Hypochlorite Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 52.8% share, holding USD 0.7 Billion in revenue.

Sodium hypochlorite (NaOCl) is a cornerstone oxidant and disinfectant used across municipal water treatment, hygiene products, and a wide set of industrial processes. In public-health guidance, regulators specify the typical bleach strengths used for emergency water disinfection: the US EPA notes labels commonly indicate 6% or 8.25% sodium hypochlorite in household bleach, a critical parameter for dose calculations during boil-water notices and disasters. The CDC likewise frames practical dosing around 5–9% sodium hypochlorite solutions to make water safe in emergencies, underscoring NaOCl’s role at point-of-use.

Industrial production is tightly linked to the chlor-alkali value chain. In Europe, about 86% of chlorine is produced via membrane electrolysis (2023), the dominant, lower-energy route that also co-produces caustic soda—the immediate precursor with chlorine for NaOCl. The chlor-alkali sector is energy-intensive: Euro Chlor reports ~35 TWh/year of electricity consumption, and energy can represent up to ~28% of industry turnover, making power costs central to competitiveness.

Best-available-tech (BAT) benchmarks in the EU BREF target <3,000 kWh per tonne of chlorine (excluding liquefaction), providing a quantitative yardstick for continuous efficiency upgrades. At the process level, OxyChem’s design stoichiometry illustrates inputs: 1.00 lb chlorine + 1.13 lb caustic soda → 1.05 lb sodium hypochlorite (ideal basis), informing feed planning and yield expectations.

Demand is anchored in water safety. The EPA’s Sodium Hypochlorite Supply Chain Profile (2023) documents NaOCl’s roles in primary and residual disinfection, algal control, and on-site generation schemes, reflecting its ubiquity in drinking-water and wastewater operations. In humanitarian WASH response, sodium hypochlorite volumes scale rapidly: during Syria’s cholera outbreak response, 408 tons of NaOCl were distributed over two weeks, enabling 10 million people to access safer water—evidence of surge utility in epidemics.

Several forces will continue to drive sodium hypochlorite consumption. First, the chemical sector remains the largest industrial energy consumer globally, according to the IEA, ensuring that efficiency-led membrane retrofits (and power-price hedging) remain strategic priorities in chlor-alkali—and by extension NaOCl—supply. Parallelly, the IEA highlights that industrial electrolyser capacity exceeds 20 GW (widely used in chlor-alkali), indicating a sizable installed base that can benefit from grid decarbonization and modern controls to reduce emissions intensity of NaOCl inputs.

Key Takeaways

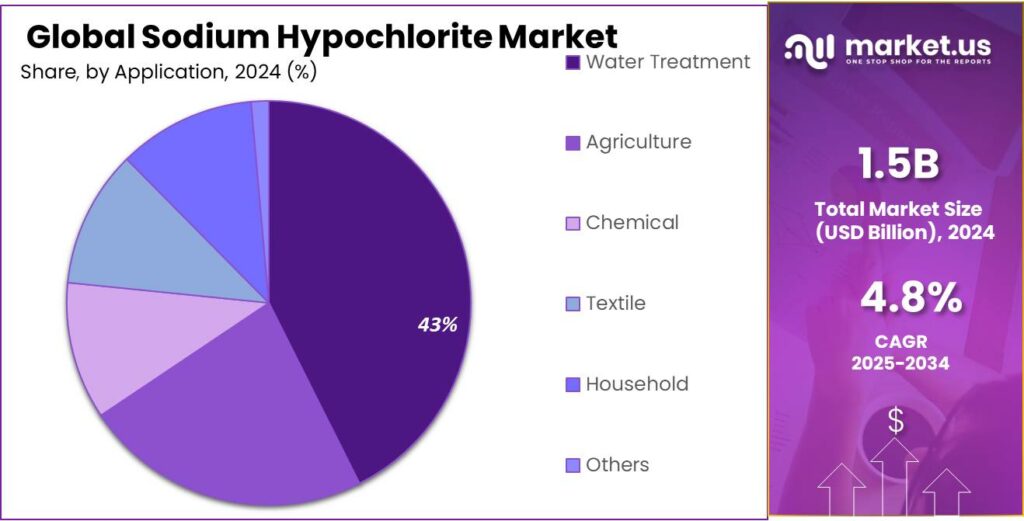

- Water treatment held a dominant market position, capturing more than a 42.6% share of the overall sodium hypochlorite market.

- Disinfection held a dominant market position, capturing more than a 43.3% share of the overall sodium hypochlorite market.

- North America held a commanding position in the global sodium hypochlorite market, capturing 52.8% of total market share, equivalent to a market value of around USD 0.7 billion.

By Function Analysis

Disinfection leads the Sodium Hypochlorite Market with 43.3% share in 2024 due to its extensive use in water treatment and sanitation.

In 2024, disinfection held a dominant market position, capturing more than a 43.3% share of the overall sodium hypochlorite market. The dominance of this segment was mainly attributed to its essential role in municipal water purification, wastewater treatment, and public sanitation systems.

Sodium hypochlorite continues to be one of the most widely used disinfectants due to its strong oxidizing properties and cost-effectiveness, making it indispensable for both residential and industrial hygiene applications. The product’s proven efficiency in eliminating bacteria, viruses, and organic contaminants has positioned it as a preferred choice for maintaining safe water quality across communities and industries.

By Application Analysis

Water Treatment dominates the Sodium Hypochlorite Market with 42.6% share in 2024 driven by rising demand for clean and safe water supply.

In 2024, water treatment held a dominant market position, capturing more than a 42.6% share of the overall sodium hypochlorite market. This strong share reflected the compound’s critical role in ensuring clean, safe, and disinfected water for both municipal and industrial uses.

Sodium hypochlorite remained the preferred chemical for water purification due to its strong oxidizing ability, ease of handling, and proven efficiency in eliminating harmful microorganisms and organic matter from water systems. Its use in municipal treatment plants, industrial cooling towers, and residential water purification units continued to expand across developed and developing economies alike.

Key Market Segments

By Function

- Disinfection

- Oxidizing

- Bleaching

- Odor

- Removal

- Others

By Application

- Water Treatment

- Agriculture

- Chemical

- Textile

- Household

- Others

Emerging Trends

Cleaner chlorination—on-site generation and stricter chlorate control are reshaping sodium hypochlorite use

A clear trend is taking hold across food plants and water utilities: sodium hypochlorite is being produced and dosed more carefully, with tighter control of by-products and a shift toward on-site generation (OSG). The public-health rationale is strong. The World Health Organization (WHO) estimates 600 million people fall ill and 420,000 die each year from unsafe food—pressure that keeps disinfection central to both processing lines and wash-water systems.

The most visible operational change is OSG. Utilities are deploying small electrolyzers that convert salt and water into low-strength hypochlorite on site, reducing transport hazards and letting operators make fresher solutions with fewer chlorate buildup issues. U.S. EPA technical support notes low-strength generators typically produce 0.4–0.8% hypochlorite, which is then fed directly or stored briefly—an approach popularized in AWWA’s M65 guidance as an alternative to bulk deliveries.

At the same time, regulators are tightening expectations for chlorate and chlorite—by-products that can rise in aged hypochlorite or poorly managed systems. WHO’s chemical fact sheet sets 0.7 mg/L (700 µg/L) provisional guideline values for chlorate and chlorite in drinking water, urging utilities to meet these limits while never compromising microbiological safety. In food, the European Commission applies a default Maximum Residue Level (MRL) of 0.01 mg/kg for chlorate across commodities, spurring processors to monitor residues and review sanitation steps that rely on hypochlorite.

Food-safety practice itself is becoming more standardized and numeric. FAO guidance describes starting produce-wash operations at 100–150 ppm free chlorine, then adjusting as organic load rises—helping plants codify targets for real-world conditions. Land-grant extension guidance in the U.S. recommends 50–200 ppm in fresh-produce wash water with attention to pH and contact time, giving line operators practical bands that can be audited.

Drivers

Ensuring Food Safety through Wide-Use of Sodium Hypochlorite

One of the major driving factors behind the demand for Sodium Hypochlorite in the industrial and processing world is the imperative of food safety. In simple terms: producers and regulators must keep microbes out of our food, and sodium hypochlorite plays a vital role in doing that. In fresh-produce washing, equipment sanitation, and wash-water treatment within food plants, this chemical offers a reliable line of defence—and its effectiveness is backed by global food-safety bodies.

For instance, the Food and Agriculture Organization of the United Nations (FAO) notes that “sodium hypochlorite is the most widely used disinfectant, in particular in the production and processing of poultry meat, leafy greens, sprouts, hydroponics and seafood.” In real numeric terms, facilities processing leafy greens may use solutions in the range of 50 mg/L (ppm) free available chlorine from hypochlorite to treat wash-water, as documented in FAO-assessed practices. This shows just how integral NaOCl is: we’re talking dozens of milligrams per litre of active agent used to reduce micro-organisms before produce reaches our tables.

In pack-houses dealing with fresh produce, a U.S. technical guidance document on post-harvest washing of produce notes that many liquid bleach solutions used contain concentrations from 8.3% to 12.75% sodium hypochlorite as starting mainstream strength. This high-strength stock then gets diluted to appropriate levels for washing or sanitizing surfaces. The reason is straightforward: you need a strong starting point to reliably reach target ppm levels when water and organic load dilute or consume available chlorine. So food-processors rely on sodium hypochlorite not only as a chemical disinfectant, but as a scalable tool in their hygiene systems.

Government and regulatory frameworks back this up. For example, the United States Department of Agriculture (USDA) provides a technical bulletin which states that sodium hypochlorite is approved for final sanitizing rinse of food-processing equipment, and may be used in washing and lye-peeling of fruits and vegetables under U.S. Food & Drug Administration rules. This regulatory acceptance means food firms feel confident integrating sodium hypochlorite into their sanitation protocols—and that creates stable demand for it.

Restraints

Formation of Disinfection By-Products and Quality Risks

While Sodium hypochlorite (NaOCl) is widely used as a sanitizer in food processing and water treatment, one of the biggest restraints on its use is the risk of disinfection by-products (DBPs) formation and related quality issues, especially when organic matter, surface residues or high concentrations are involved.

In practical food-industry settings, when sodium hypochlorite reacts with organic materials (such as vegetable wash-water, peelings or residual soil), it can form by-products like chlorinated organics (e.g., haloacetic acids or trihalomethanes). A joint report from Food and Agriculture Organization of the United Nations (FAO) and World Health Organization (WHO) notes that although sodium hypochlorite is effective, it also “may produce undesirable by-products when high organic loads or uncontrolled conditions exist.” For example: in one study of fresh produce washing using NaOCl, when the free chlorine level was about 25 mg/L, and the organic load high (600-700 mg/L organic matter), the measured concentration of trihalomethanes reached 710 µg/L in the wash water.

These by-products not only pose potential food-safety issues (or regulatory attention) but can also impact flavour and quality of the final product. According to a fact sheet by Oklahoma State University, sanitizing wash solutions using bleach may cause “highly objectionable flavours and odours” if residual chlorine remains in the product or syrup; they emphasise that solutions used on food-contact surfaces should not exceed 200 ppm available chlorine unless followed by potable rinse.

Corrosion and equipment damage are also indirect restraining factors. Sodium hypochlorite, especially at higher concentrations or in the presence of acids, can degrade metals and plastics. The same Oklahoma State guidance says that when concentrations go above 400 ppm “you’re entering a risk zone” (they list 1 fluid ounce of standard 5.25% bleach in a gallon of water yields approx. 400 ppm). In food-processing plants, corrosion or damage to conveyers, tanks, and wash equipment can raise maintenance costs or require more frequent equipment replacement — which reduces the attractiveness of NaOCl for processors especially in emerging economies or smaller facilities.

Opportunity

Food-safety upgrades and resilient water sanitation are expanding sodium hypochlorite use

A powerful, durable growth opportunity for sodium hypochlorite is the rising investment in food-safety and water-sanitation systems—both routine, in plants and pack-houses, and surge-capacity, during outbreaks. The need is clear. The World Health Organization estimates 600 million people fall ill and 420,000 die each year from unsafe food, a burden of 33 million healthy life years lost. As regulators, food brands, and retailers tighten controls, plants are standardizing proven sanitizers to cut microbial risks—keeping sodium hypochlorite central to wash-water and surface-sanitation programs.

On factory floors, practical, codified limits guide everyday use. U.S. food-safety guidance long used by processors specifies that hypochlorite solutions for raw produce washing may be used at up to 2,000 ppm in the wash water when followed by a potable rinse; food-contact equipment sanitizing typically caps at 200 ppm available chlorine before draining. These numeric controls support consistent adoption at scale across fruit, vegetable, and ready-to-eat lines.

Public programs are pulling demand forward too. The U.S. Environmental Protection Agency’s implementation memo for the Bipartisan Infrastructure Law details US$43 billion in water-infrastructure funding through State Revolving Funds—resources that utilities can use to modernize treatment trains, bolster disinfection capacity, and improve residual management. Those upgrades typically require reliable disinfectant supply and monitoring, a positive signal for municipal-grade sodium hypochlorite.

Crisis response underscores the role of sodium hypochlorite as a fast, scalable tool. During cholera response operations in Syria, UNICEF reported distributing 408 tons of sodium hypochlorite in two weeks to raise chlorine dosages and curb transmission. Emergency logistics teams depend on hypochlorite because it can be transported, diluted, and dosed quickly across fragmented water points—turning a single commodity into population-level health protection. The same logistics model repeats in floods, cyclones, and conflict-affected settings worldwide, creating a recurrent, mission-critical demand stream.

Regional Insights

North America dominates the Sodium Hypochlorite Market with 52.8% share valued at USD 0.7 billion in 2024, driven by strong water treatment and sanitation demand.

In 2024, North America held a commanding position in the global sodium hypochlorite market, capturing 52.8% of total market share, equivalent to a market value of around USD 0.7 billion. This dominance was primarily attributed to the region’s advanced water treatment infrastructure, strict environmental regulations, and consistent demand across industrial, municipal, and residential applications. Sodium hypochlorite remains a key disinfectant chemical in North America, where its use is integral to maintaining safe drinking water standards and effective wastewater treatment processes.

The United States accounted for the majority of sodium hypochlorite consumption within the region, supported by extensive municipal water networks and industrial sectors such as food processing, chemical manufacturing, and healthcare. According to the U.S. Geological Survey (USGS), the country’s annual chlorine production exceeded 11 million metric tons in 2024, ensuring a stable domestic supply of feedstock for sodium hypochlorite manufacturing. Additionally, Canada and Mexico have witnessed increasing investments in water treatment facilities under national clean-water initiatives, expanding sodium hypochlorite use across both urban and rural communities.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Unilever remains a prominent global consumer goods company actively utilizing and sourcing sodium hypochlorite in its home care and hygiene products. The company’s “Domestos” brand, distributed in over 45 countries, is a leading bleach containing sodium hypochlorite as its key ingredient. Unilever focuses on sustainability, promoting safe sanitation access for communities, aligning with its Clean Future program that invests €1 billion to cut fossil-based chemicals from cleaning products by 2030, boosting greener NaOCl supply and responsible chlorination practices.

AkzoNobel N.V., headquartered in the Netherlands, is among the largest producers of chlor-alkali derivatives in Europe, supplying sodium hypochlorite for industrial and municipal disinfection. Through its subsidiary Nouryon, the company operates large-scale chlor-alkali facilities that ensure a reliable feedstock chain for NaOCl. AkzoNobel’s focus on energy-efficient membrane electrolysis has reduced energy consumption per ton of chlorine by nearly 25%, supporting sustainability and reinforcing its leadership in safe, low-carbon chemical production.

Westlake Chemical, a major U.S. chlor-alkali and PVC producer, plays a central role in sodium hypochlorite manufacturing. The company’s Gulf Coast operations produce chlorine and caustic soda—the primary reactants for NaOCl—ensuring vertical integration. Westlake’s Chlor-Alkali & Derivatives segment generated over US $4.2 billion in revenue in 2024, with significant volumes supplying municipal water-treatment and cleaning product sectors. Its focus on energy recovery and emission control supports efficient, sustainable sodium hypochlorite production for global markets.

Top Key Players Outlook

- Unilever

- AkzoNobel

- PPG Industries

- Westlake Chemical Corporation

- Mitsui Chemical Corporation

- LANXESS

- Others

Recent Industry Developments

Mitsui Chemicals reports for FY 2024 that it achieved ¥1,809.2 billion in sales revenue and an operating income before special items of ¥101.0 billion.

In 2024 Westlake Chemical Corporation, reported net sales of US $12.1 billion, net income of US $677 million, and EBITDA of US $2.3 billion.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Disinfection, Oxidizing, Bleaching, Odor, Removal, Others), By Application (Water Treatment, Agriculture, Chemical, Textile, Household, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Unilever, AkzoNobel, PPG Industries, Westlake Chemical Corporation, Mitsui Chemical Corporation, LANXESS, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unilever

- AkzoNobel

- PPG Industries

- Westlake Chemical Corporation

- Mitsui Chemical Corporation

- LANXESS

- Others