Global Sodium Bromide Market Size, Share, And Business Benefit By Grade (Medical Grade, Agriculture Grade, Cosmetic Grade, Others), By Form (Powder, Liquid, Others), By End-Use (Oil and Gas, Water and Wastewater, Food and Nutrition, Construction, Pharmaceutical, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161604

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

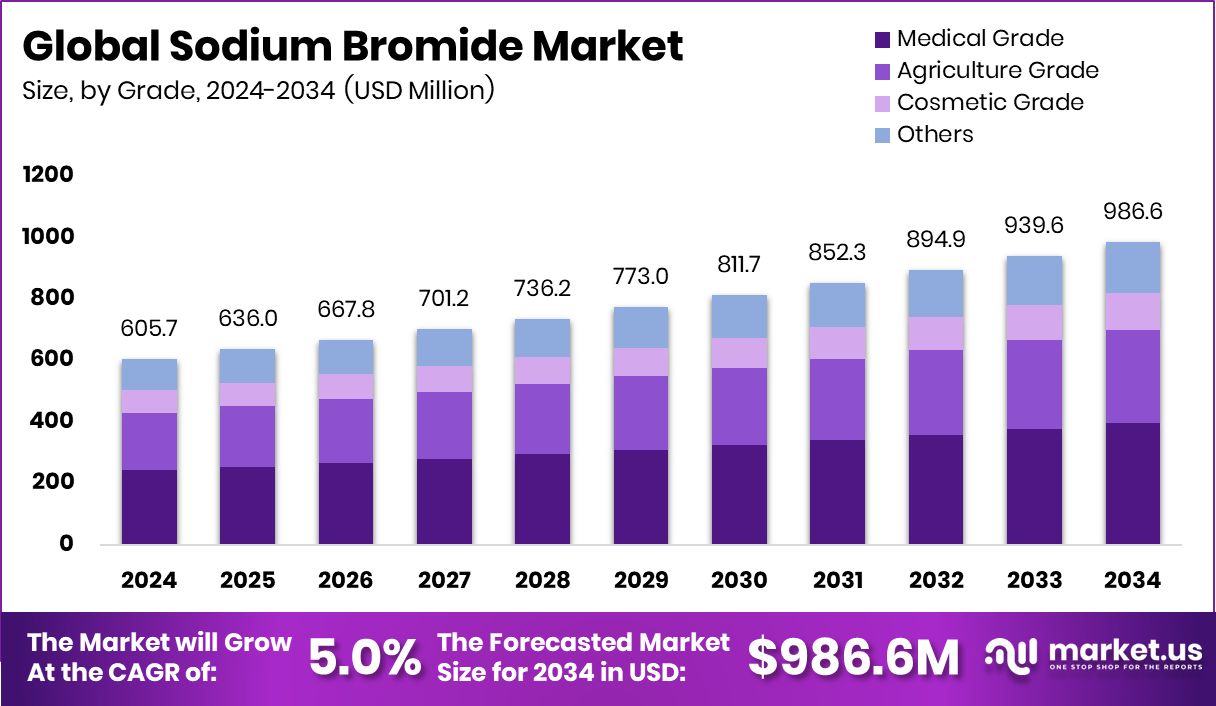

The Global Sodium Bromide Market is expected to be worth around USD 986.6 million by 2034, up from USD 605.7 million in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. Growing oilfield and water treatment activities continue driving Asia Pacific’s 52.3% share. Sodium Bromide demand is higher.

Sodium bromide (NaBr) is a crystalline ionic compound composed of sodium and bromide ions. It readily dissolves in water to give bromide ions, which can participate in chemical synthesis, disinfection, and specialty formulations. In industrial applications, it serves as a precursor in bromine chemistry, a component in photographic and flame-retardant uses, and as part of dense brine fluids in oil and gas well operations. While its medical uses (e.g., sedatives) have declined over time, its chemical and industrial roles remain significant.

The sodium bromide market comprises global production, distribution, pricing, and consumption across sectors such as chemicals, oil & gas, water treatment, electronics, and pharmaceuticals. Its trajectory is shaped by the growth or contraction of these downstream sectors, feedstock (bromine/salt) availability, regulatory limits, and capital investment patterns. Regions undergoing rapid industrialization or heavy energy investment tend to drive stronger demand. The market also reacts to shifts in environmental policies, synthesis cost pressures, and logistical constraints in shipping dense brines.

Emerging markets with rising infrastructure, energy, and chemical sectors represent expanding demand zones. Regions investing in water reuse, desalination, or advanced disinfection will lean on bromide chemistry. There’s an opportunity in producing high-purity grades tailored for electronics or pharmaceutical intermediates, as well as placing plants closer to demand hubs to cut transport costs. Novel uses—for instance, in energy storage systems, specialty materials, or next-generation electronics—offer further potential for sodium bromide producers to diversify and capture value.

Large infrastructure funding announcements indicate stronger backing for sectors that use sodium bromide indirectly (e.g., water, wastewater, and industrial systems). For example: Idaho states it needs $1 billion for water and wastewater infrastructure upgrades; New York State has allocated $36 million across 48 projects for infrastructure; Canada is committing over CAD 369.5 million (more than $50 million specifically in New Brunswick) to water and wastewater infrastructure; a sustainable water recycling project in the UK received £2 million in Ofwat funding; and in California $150 million was pledged for solid waste and wastewater infrastructure upgrades (alongside larger funds for water systems). These funding flows reduce capital risk, accelerate project pipelines, and thus support stronger demand for specialty chemicals like NaBr used in treatment and process systems.

Key Takeaways

- The Global Sodium Bromide Market is expected to be worth around USD 986.6 million by 2034, up from USD 605.7 million in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- In 2024, medical-grade sodium bromide captured 31.3%, driven by pharmaceutical formulations and diagnostic reagents.

- Liquid sodium bromide held a 52.5% market share owing to its easy solubility and fast application.

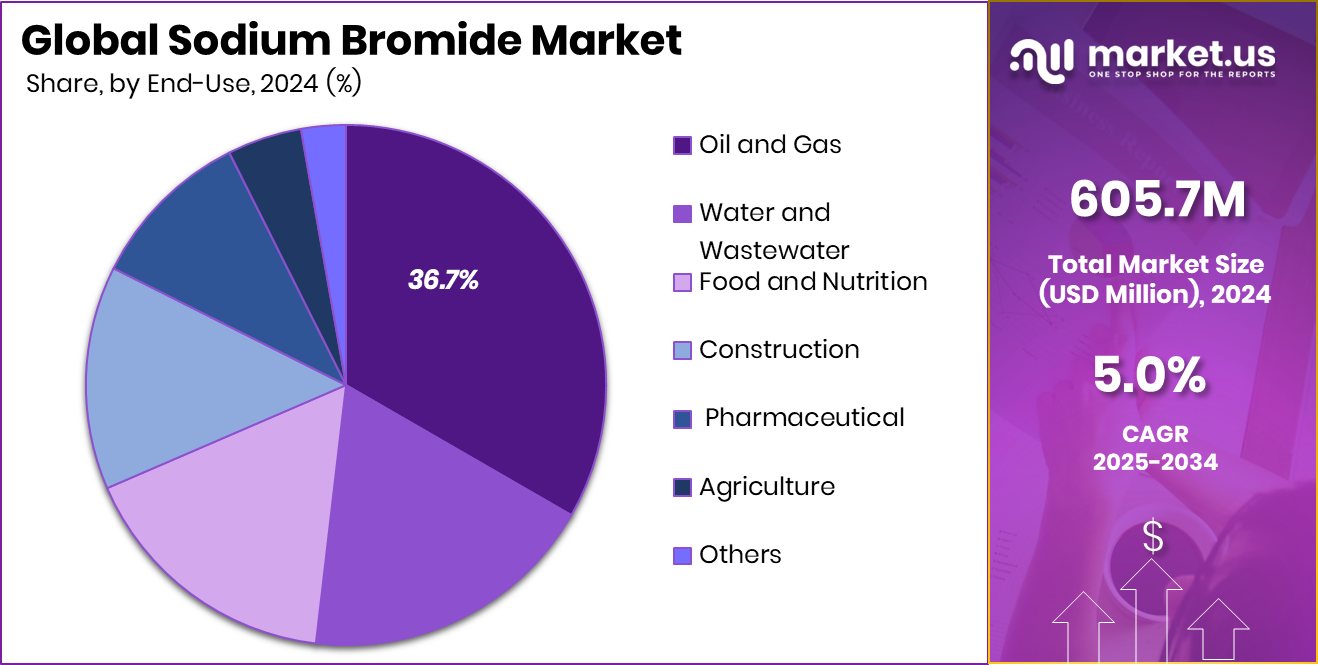

- The oil and gas sector dominated with 36.7% due to its use in clear brine fluids.

- The Asia Pacific valuation reached around USD 316.7 million, reflecting its strong industrial expansion.

By Grade Analysis

In 2024, Medical Grade led the Sodium Bromide Market at 31.3%.

In 2024, Medical Grade held a dominant market position in the By Grade segment of the Sodium Bromide Market, with a 31.3% share. This dominance was primarily driven by its extensive use in pharmaceutical formulations and medical imaging applications, where high-purity bromide compounds are essential for safety and efficacy. The medical-grade quality ensures consistent composition, making it suitable for use in sedative preparations and as a reagent in diagnostic solutions.

With growing healthcare infrastructure investment and stricter purity regulations worldwide, demand for medical-grade sodium bromide continued to rise. The segment benefited from improved production standards and reliable distribution networks supporting its steady presence in global pharmaceutical and healthcare supply chains.

By Form Analysis

In 2024, Liquid form dominated the sodium bromide market with 52.5%.

In 2024, Liquid held a dominant market position in the By Form segment of the Sodium Bromide Market, with a 52.5% share. The dominance of the liquid form was largely due to its easy solubility and immediate applicability across water treatment and drilling fluid formulations. Liquid sodium bromide is widely preferred in oilfield operations for its convenience in preparing dense brine solutions used during well completion and workover processes.

Its uniform concentration reduces handling risks and improves operational efficiency compared to solid forms. The segment’s growth also aligned with rising industrial and municipal water treatment initiatives, where liquid formulations offered faster dosing and better control, strengthening their demand across large-scale chemical and energy applications.

By End-Use Analysis

Oil and Gas held a 36.7% share of the sodium bromide market.

In 2024, Oil and Gas held a dominant market position in the By End-Use segment of the Sodium Bromide Market, with a 36.7% share. This dominance stemmed from the compound’s essential role in oilfield operations, particularly as a key component in clear brine fluids used during drilling, completion, and workover activities. Sodium bromide provides the required density and stability for maintaining wellbore pressure while preventing formation damage.

The sector’s steady drilling recovery and investment in deeper exploration projects further supported this share. Additionally, rising global infrastructure funding in wastewater and water management indirectly strengthened demand, as integrated energy projects increasingly adopted bromide-based fluids for efficient and safer resource extraction operations.

Key Market Segments

By Grade

- Medical Grade

- Agriculture Grade

- Cosmetic Grade

- Others

By Form

- Powder

- Liquid

- Others

By End-Use

- Oil and Gas

- Water and Wastewater

- Food and Nutrition

- Construction

- Pharmaceutical

- Agriculture

- Others

Driving Factors

Rising Oil & Gas Brine Demand — Backed by New Investments

One big factor pushing the sodium bromide market is how much it’s used in oil and gas operations as a dense, stable fluid for drilling and well completion. As companies go deeper and explore tougher geological conditions, they need reliable brine systems—sodium bromide is ideal for that. Its use helps maintain pressure, reduce formation damage, and improve operational safety.

On top of that, growing infrastructure and water management funding create positive spillover effects: for instance, the Rockefeller Foundation has invested $3.5 million to support U.S. farmers, improve nutrition, and address chronic disease, which in turn stimulates agricultural and rural water projects that may require advanced chemical treatment—ultimately boosting demand for specialty chemicals like sodium bromide.

Restraining Factors

Restrained by Rising Environmental and Disposal Concerns

One major factor holding back the Sodium Bromide Market is increasing environmental and waste disposal concerns. The compound, while effective in drilling fluids and water treatment, can release bromine compounds that pose risks to aquatic ecosystems if not properly managed. Governments across several regions have tightened regulations on chemical discharge and wastewater handling, increasing compliance costs for industries using sodium bromide.

Disposal of brominated waste also requires advanced treatment systems, which adds to operational expenses. These stricter rules and higher treatment costs make some companies shift toward alternative, eco-friendly options. As a result, environmental scrutiny and disposal issues continue to limit market expansion despite strong industrial demand.

Growth Opportunity

Expanding Opportunities in Advanced Water Treatment Systems

A key growth opportunity for the Sodium Bromide Market lies in its increasing use in advanced water treatment and recycling systems. As industries and municipalities focus on reusing water and maintaining quality under stricter environmental norms, sodium bromide serves as a reliable source for bromine-based disinfectants and oxidants. It effectively controls microbial growth in cooling towers, desalination plants, and wastewater facilities, even under high organic load conditions.

Growing urbanization and industrialization are pushing the need for large-scale water purification, which directly supports sodium bromide demand. The trend toward sustainable and efficient treatment technologies gives manufacturers a strong chance to expand supply networks and develop specialized formulations suited for next-generation water reuse projects.

Latest Trends

Rising Adoption of Bromide Solutions in Sustainable Treatment

A key trend shaping the Sodium Bromide Market is the growing shift toward sustainable water and wastewater treatment technologies. Industries and municipalities are now prioritizing eco-friendly disinfectants and safer oxidation systems, where sodium bromide plays a vital role as a source for bromine-based solutions. These applications help control microbial growth efficiently while reducing harmful by-products.

The push for cleaner industrial operations and safer reuse of treated water is accelerating its adoption. Meanwhile, funding initiatives are helping innovation flourish — for example, Better Nutrition secured Rs 10 crore from investors across Google and Meta to promote healthier and sustainable practices. Such funding indirectly supports chemical innovations linked to cleaner production and improved environmental management.

Regional Analysis

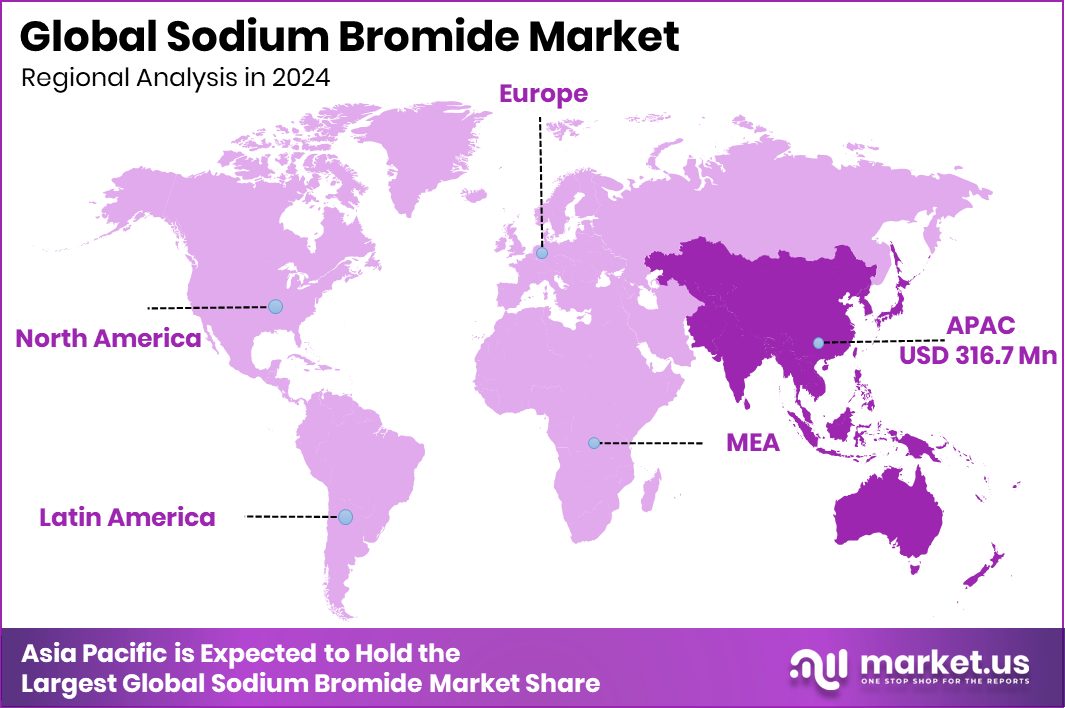

In 2024, the Asia Pacific dominated the Sodium Bromide Market with a 52.3% share.

In 2024, the Asia Pacific held a dominant position in the Sodium Bromide Market, accounting for 52.3% of the total share, valued at USD 316.7 million. The region’s leadership was driven by strong demand from oilfield operations, chemical synthesis, and growing investment in water and wastewater treatment facilities. Expanding industrial infrastructure in China, India, and Southeast Asia further supported consistent consumption levels.

North America followed, benefiting from steady oil and gas activities and stricter water management regulations. Europe showed moderate growth, supported by increasing adoption of bromine-based solutions in industrial water treatment.

The Middle East & Africa saw notable potential with ongoing drilling projects and desalination plant developments. Latin America, meanwhile, experienced gradual growth as regional industries invested in cleaner chemical solutions and infrastructure modernization. Overall, Asia Pacific remained the key revenue generator due to its expanding manufacturing base and continued industrialization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, leading producers such as ICL, Albemarle Corporation, and Shandong Tianxin Pharma-Tech Co. played crucial roles in shaping the global Sodium Bromide Market.

ICL continued to strengthen its position through efficient bromine extraction and value-added bromide formulations. The company’s integrated production model and focus on downstream chemical solutions supported stable supply and competitive pricing in global markets.

Albemarle Corporation leveraged its extensive bromine production expertise to expand sodium bromide output for oilfield and water treatment applications. Its investments in advanced chemical processing and product innovation reinforced its reputation for reliability and quality across multiple regions.

Meanwhile, Shandong Tianxin Pharma-Tech Co. maintained a strong foothold in Asia through cost-effective production and high-purity grades catering to pharmaceutical and industrial needs. The company’s focus on product consistency and export growth helped it build long-term partnerships with chemical distributors and industrial clients.

Collectively, these firms contributed to maintaining market balance by ensuring secure supply chains, investing in sustainable operations, and aligning production with global industrial and environmental demands. Their continued technological improvements and operational efficiency positioned them as dependable suppliers meeting the growing need for sodium bromide across energy, water treatment, and specialty chemical applications worldwide.

Top Key Players in the Market

- ICL

- Albemarle Corporation

- Shandong Tianxin Pharma-Tech Co.,

- LANXESS

- Jordan Bromine Company

- Tosoh Corporation

- TETRA Technologies, Inc.

- Shandong Haiwang Chemical Co., Ltd.

- Tata Chemicals Ltd.

- Jordan Bromine Company Ltd.

- Others

Recent Developments

- In November 2024, Albemarle proactively extended liquidity support, maintaining approximately USD 3.4 billion in estimated liquidity (cash, revolver lines, credit) to navigate market volatility.

- In July 2024, ICL acquired Custom Ag Formulators (CAF), a U.S. company that specializes in customized liquid and dry agricultural formulations. This gives ICL enhanced capacity in specialty liquid products and localized distribution in the U.S. market.

Report Scope

Report Features Description Market Value (2024) USD 605.7 Million Forecast Revenue (2034) USD 986.6 Million CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Medical Grade, Agriculture Grade, Cosmetic Grade, Others), By Form (Powder, Liquid, Others), By End-Use (Oil and Gas, Water and Wastewater, Food and Nutrition, Construction, Pharmaceutical, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ICL, Albemarle Corporation, Shandong Tianxin Pharma-Tech Co.,, LANXESS, Jordan Bromine Company, Tosoh Corporation, TETRA Technologies, Inc., Shandong Haiwang Chemical Co., Ltd., Tata Chemicals Ltd., Jordan Bromine Company Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ICL

- Albemarle Corporation

- Shandong Tianxin Pharma-Tech Co.,

- LANXESS

- Jordan Bromine Company

- Tosoh Corporation

- TETRA Technologies, Inc.

- Shandong Haiwang Chemical Co., Ltd.

- Tata Chemicals Ltd.

- Jordan Bromine Company Ltd.

- Others