Global Sodium Bicarbonate Market Size, Share, And Business Benefit By Grade Type (Pharmaceutical Grade, Technical Grade, Food Grade, Feed Grade), By Form (Powder, Pellets, Slurry, Liquid), By End Use (Processed Food, Pharmaceuticals, Personal Care Products, Chemicals, Detergent, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166206

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

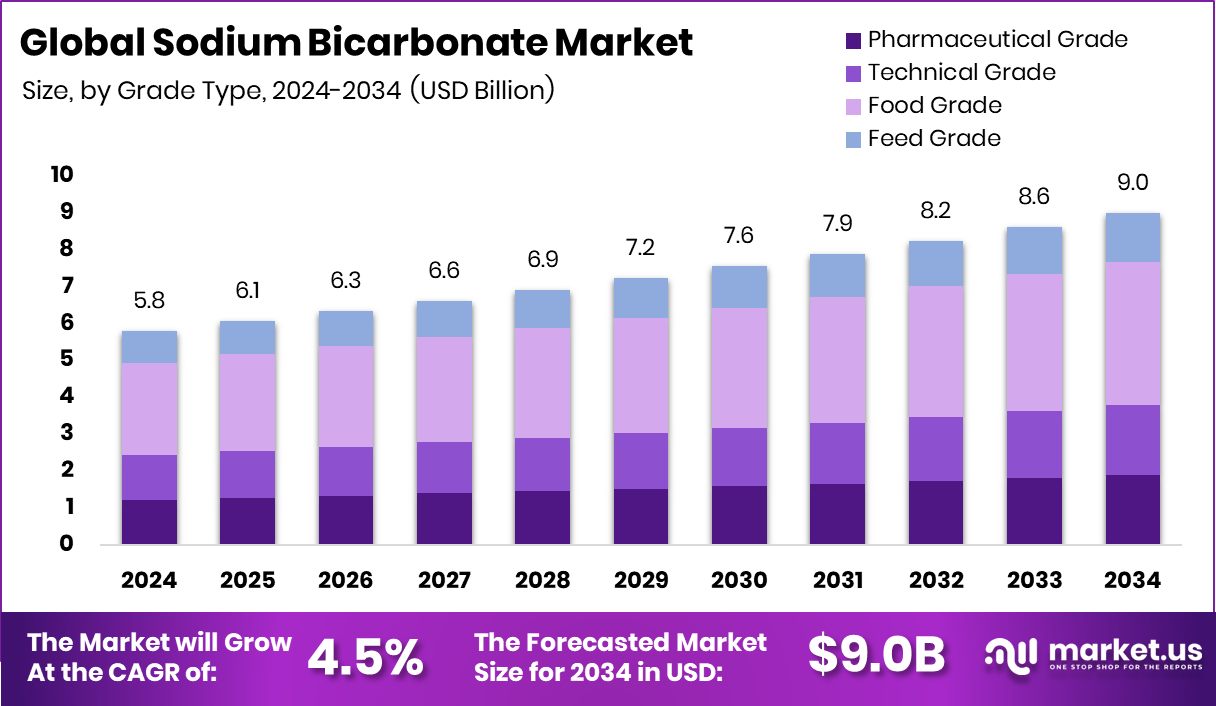

The Global Sodium Bicarbonate Market is expected to be worth around USD 9.0 billion by 2034, up from USD 5.8 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Rapid consumption growth in the Asia Pacific, 45.9% supports rising clean-label functional ingredient adoption.

Sodium bicarbonate is a white, crystalline, alkaline compound commonly known as baking soda. It dissolves easily in water, neutralizes acids, releases carbon dioxide when heated, and is widely used in foods, pharmaceuticals, water treatment, flue gas desulfurization, and everyday household cleaning. Its mild pH-buffering properties make it suitable for personal care, animal feed, and agriculture, where safe and non-toxic materials are required.

The sodium bicarbonate market is supported by food-grade, technical-grade, and pharmaceutical-grade applications, with demand rising due to clean-label preferences, digestive health usage, and industrial emission control solutions. Energy-intensive industries are increasingly adopting sodium bicarbonate for gas scrubbing and effluent management, while food and personal care brands use it for low-chemical, preservative-free formulations.

A strong growth factor comes from the shift toward natural, simple, and recognizable ingredients used in bakery, beverages, snacks, and personal care. This movement aligns with new food-tech innovation, where Lasso, launched by the team behind Tender Food, secured $6.5 million to advance clean-ingredient product development. Such funding strengthens the value of chemical-safe additives like sodium bicarbonate.

Market demand is also influenced by rising investor activity around minimally processed foods. Actual Veggies attracted $7 million as revenues doubled, and India-based Khetika raised $18 million to grow preservative-free processed food lines, validating interest in safer formulation agents, including sodium bicarbonate.

A notable opportunity emerges from healthier bakery alternatives supported by Modern Baker, which secured a £2.5 million Series A investment to develop better ultra-processed food substitutes. This aligns with emerging prospects for sodium bicarbonate in artisanal bakery, sports nutrition, pet foods, and functional digestive-friendly formulations.

Key Takeaways

- The Global Sodium Bicarbonate Market is expected to be worth around USD 9.0 billion by 2034, up from USD 5.8 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- The Sodium Bicarbonate Market sees strong growth from 43.2% food-grade demand.

- Powder form holds a 32.7% share due to easy handling and versatility.

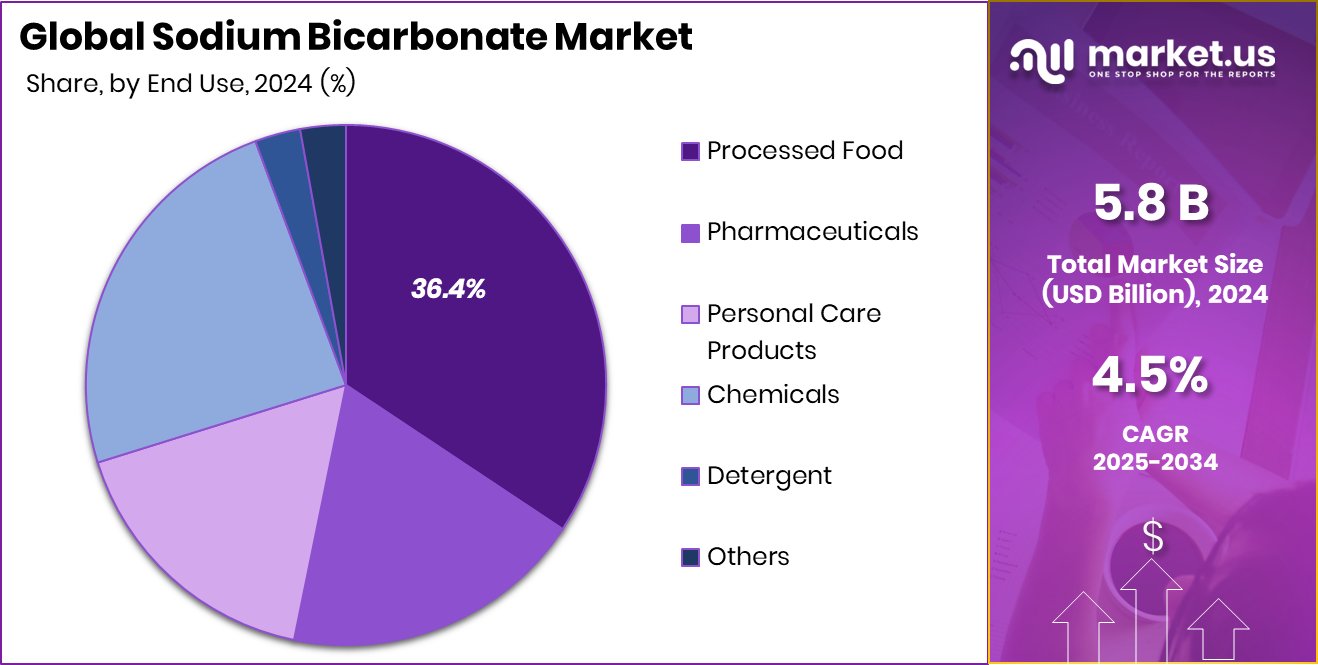

- Processed food applications lead with 36.4% market share growth globally.

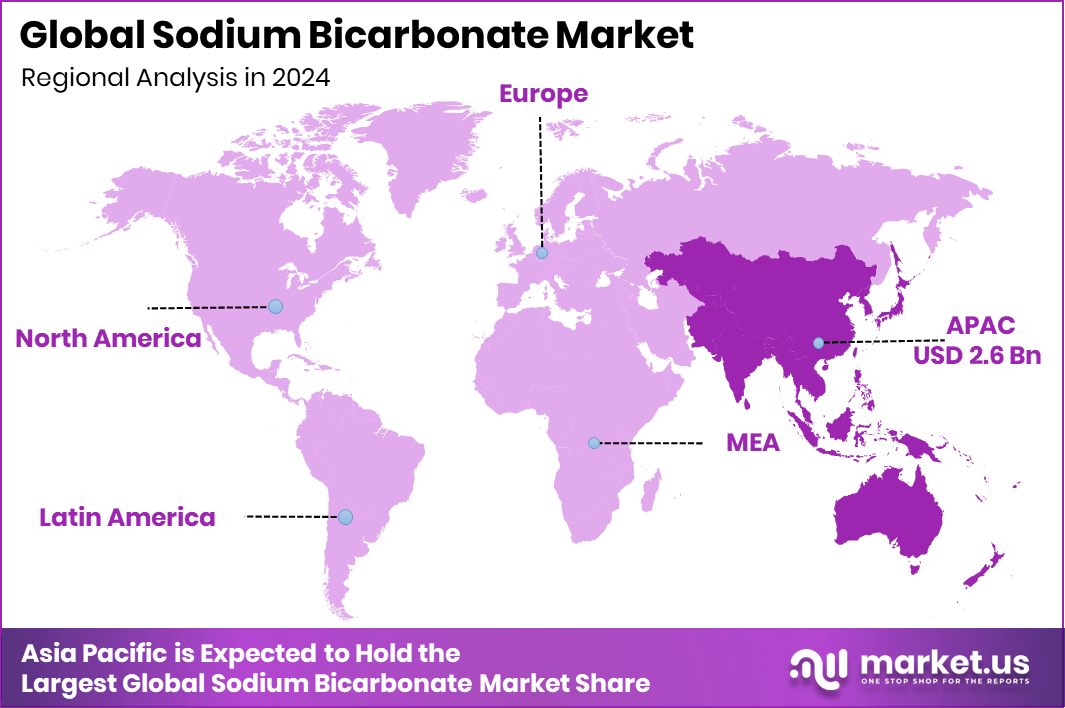

- The Asia Pacific market value reached USD 2.6 Bn, showing strong commercial potential.

By Grade Type Analysis

The Sodium Bicarbonate Market sees strong adoption of Food Grade (43.2%) due to expanding bakery, healthy snacks, and preservative-free product launches.

In 2024, Food Grade held a dominant market position in the By Grade Type segment of the Sodium Bicarbonate Market, with a 43.2% share. This grade is widely used in food and beverage applications due to its safe composition, neutralizing ability, and suitability in bakery, confectionery, beverages, and processed foods.

Growing preference for clean-label ingredients and consumer awareness towards reduced chemical additives strengthened its use in processed food categories. Its buffering, leavening, and pH-balancing properties support both commercial and household applications, making it preferred where safety, taste, and regulatory alignment are important.

The rising shift toward simple and familiar ingredients also contributed to its higher adoption in ready-to-cook mixes, artisanal bakery formats, and preservative-free packaged food offerings.

By Form Analysis

Powder form holds 32.7% share in the Sodium Bicarbonate Market due to easy solubility and storage.

In 2024, Powder held a dominant market position in By Form segment of the Sodium Bicarbonate Market, with a 32.7% share. Powder form remained widely preferred due to its easy solubility, long storage life, and convenient handling in food, pharmaceutical, and household applications.

It is commonly used for pH adjustment, leavening, deodorizing, and mild cleansing, making it suitable for daily consumer and industrial use. The fine and uniform texture enables efficient blending in dry mixes, bakery formulations, and health-focused packaged preparations.

Its extended usability across multiple end-use categories supported steady demand, while familiarity, cost-effectiveness, and stable physical properties strengthened its position as the most utilized form in commercial and consumer product development.

By End Use Analysis

Processed food dominates 36.4% of the Sodium Bicarbonate Market, driven by bakery and snack expansion.

In 2024, Processed Food held a dominant market position in the by-end-use segment of the Sodium Bicarbonate Market, with a 36.4% share. The segment benefited from its continuous role in bakery, snacks, confectionery, and ready-to-cook formulations, where leavening, stabilization, and pH management are essential.

Its clean-label suitability and mild taste profile made it a preferred choice for preservative-conscious brands seeking familiar and safe functional additives. The rising acceptance of minimally processed and simple-ingredient packaged foods further strengthened its usage across both commercial and retail channels.

Its multifunctional performance, ease of blending with dry mixes, and compatibility with preservative-free innovation continued to support strong demand in this category.

Key Market Segments

By Grade Type

- Pharmaceutical Grade

- Technical Grade

- Food Grade

- Feed Grade

By Form

- Powder

- Pellets

- Slurry

- Liquid

By End Use

- Processed Food

- Pharmaceuticals

- Personal Care Products

- Chemicals

- Detergent

- Others

Driving Factors

Growing Shift Toward Clean And Safer Ingredients

One of the key driving factors for the Sodium Bicarbonate market is the strong global movement toward safe, natural, and clean-label ingredients across food, personal care, and household categories.

Consumers increasingly look for familiar, non-toxic, and multi-functional components, and sodium bicarbonate fits well due to its mild chemical nature and wide use in bakery, beverages, oral hygiene, baby-safe cleaning, and eco-friendly laundry care. This trend gained more commercial strength as natural cleaning and detergent concepts continued attracting investors and retail interest.

A recent example includes Amazon awarding €100,000 “Startup of the Year” funding to a natural laundry detergent company, highlighting how non-hazardous, environmentally gentle components such as sodium bicarbonate are gaining commercial space, product launches, and brand value.

Restraining Factors

Limited Performance Against Stronger Chemical Alternatives

A major restraint for the Sodium Bicarbonate market is its limited performance when compared to stronger and more specialized chemical agents used in industrial, medical, and advanced formulation applications.

While it is safe, economical, and adaptable, its effectiveness as a cleaning, buffering, or neutralizing compound can be lower in complex environments where stronger corrosion control, rapid reactivity, or long-term stabilization is required.

In heavy-duty sectors like advanced pharmaceuticals, water treatment, petroleum processing, and large-scale industrial cleaning, more concentrated or tailored chemical solutions are often chosen. This performance gap may restrict sodium bicarbonate’s growth opportunities in highly technical areas where faster action, a stronger solubility response, or optimized chemical bonding is mandatory for efficiency, consistency, and durability.

Growth Opportunity

Rising Opportunity In Natural Home Care Products

A strong growth opportunity for the Sodium Bicarbonate market lies in the fast-expanding natural and non-toxic home care solutions category, where consumers actively prefer eco-friendly, fragrance-safe, pet-safe, and skin-friendly alternatives to harsh chemical cleaners.

Sodium bicarbonate already has a household image as a gentle yet effective cleaning and deodorizing ingredient, making it suitable for surface cleaners, detergents, bathroom care, fabric care, and kitchen hygiene products. This demand is further strengthened by funding interest in clean-home startups, as seen when D2C home-cleaning brand Koparo raised Rs 14.5 crore to expand natural and child-safe cleaning products.

Such developments indicate deeper consumer readiness for safer formulations, boosting new product launches, subscription models, and global brand partnerships centered around sodium-based natural cleaning.

Latest Trends

Growing Shift Toward Bio-Based and Upcycled Ingredients

One of the latest trends in the Sodium Bicarbonate Market is the move toward bio-based, circular, and upcycled ingredient sourcing, driven by sustainability goals and consumer preference for low-carbon everyday products.

Manufacturers and start-ups are exploring ways to integrate natural, waste-derived, or biodegradable inputs in home care, food, and personal care formulations, creating space where sodium bicarbonate aligns well due to its simple composition, minimal toxicity, and eco-friendly perception.

This trend is strengthened by growing investor attention in circular chemistry, highlighted when Dispersa closed $5.8 million to turn food waste into chemicals for everyday products, showing strong interest in replacing synthetic, petroleum-based, and high-emission alternatives with cleaner, waste-valorized solutions that complement sodium bicarbonate-based applications.

Regional Analysis

Asia Pacific leads the Sodium Bicarbonate Market with 45.9% share dominance.

Asia Pacific dominated the Sodium Bicarbonate Market with a 45.9% share valued at USD 2.6 Bn, supported by strong consumption in food, home-care, and daily-use household applications across fast-expanding population clusters and manufacturing economies. Growing demand for safer, multifunctional ingredients in baking, packaged food, and natural home-cleaning categories, along with increasing awareness toward mild and eco-friendly formulations, helped the region maintain a leading position.

North America continued to show stable usage supported by product adoption in food, healthcare, pet-care, and household products, driven by familiarity and comfort of daily use. The region also maintains a strong preference for clean-ingredient labeling and reduced harsh-chemical exposure across multiple lifestyle categories.

Europe reflected demand through increasing use in bakery products, personal-care formulations, and home-cleaning products, aligned with regulated chemical-use standards and consumer inclination toward simpler ingredients. Latin America demonstrated gradual usage through retail expansion and baking culture, while the Middle East & Africa reflected steady adoption across home-care and packaged food categories, influenced by demographic growth and evolving branded product availability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Solvay continued to demonstrate a long-standing presence in the sodium bicarbonate value chain, supported by experience in large-scale production, diversified industrial applications, and a strong focus on chemistry-driven solutions. The company’s recognition in multiple end-use sectors such as food, environmental applications, and healthcare has helped maintain a steady market position. Its heritage in chemical innovation and process optimization supports reliability, consistency, and quality compliance, which remain essential in regulated applications.

Tata Chemicals plays an important role, backed by a well-established inorganic chemicals portfolio and wide market access across consumer, industrial, and agricultural segments. Its ability to serve both volume-driven and value-based markets supports balanced growth. The company benefits from experience in natural soda ash and downstream products, which contribute to continuous sodium bicarbonate availability. Tata Chemicals’ integrated operations support long-term business sustainability, efficiency, and cost competitiveness.

Church & Dwight is widely known for its strong association with consumer-oriented household products, which helps maintain steady demand visibility for sodium bicarbonate in daily-use applications. The company’s consumer-facing approach, brand familiarity, and household positioning support continued product relevance and trust, especially in personal care and home-care usage scenarios.

Top Key Players in the Market

- Solvay

- Tata Chemicals

- Church & Dwight

- Novacap

- Genesis Energy

- Nirma Limited

- Tosoh Corporation

- AGC Inc.

- Others

Recent Developments

- In July 2025, Solvay announced that its Dombasle (France) soda ash & bicarbonate plant will now use biogenic CO₂ supplied by Air Products. This change is expected to reduce about 4,000 tonnes of CO₂ emissions annually, improving the sustainability of their bicarbonate/soda-ash line.

- In November 2024, Tata Chemicals Europe (UK) approved a capital investment of £60 million (≈ Rs 655 crore) to build a new pharmaceutical-grade sodium bicarbonate plant in Northwich, UK. The new plant is expected to triple production capacity and will begin construction in 2025, with first production targeted in 2027.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade Type (Pharmaceutical Grade, Technical Grade, Food Grade, Feed Grade), By Form (Powder, Pellets, Slurry, Liquid), By End Use (Processed Food, Pharmaceuticals, Personal Care Products, Chemicals, Detergent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Solvay, Tata Chemicals, Church & Dwight, Novacap, Genesis Energy, Nirma Limited, Tosoh Corporation, AGC Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sodium Bicarbonate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Bicarbonate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Solvay

- Tata Chemicals

- Church & Dwight

- Novacap

- Genesis Energy

- Nirma Limited

- Tosoh Corporation

- AGC Inc.

- Others