Global Small Scale LNG Market Size, Share, And Business Benefit By Type (Liquefaction, Regasification), By Mode of Supply (Trucks, Trans-shipment and Bunkering, Others), By Application (Heavy-duty Vehicles, Marine Transport, Industrial and Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165842

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

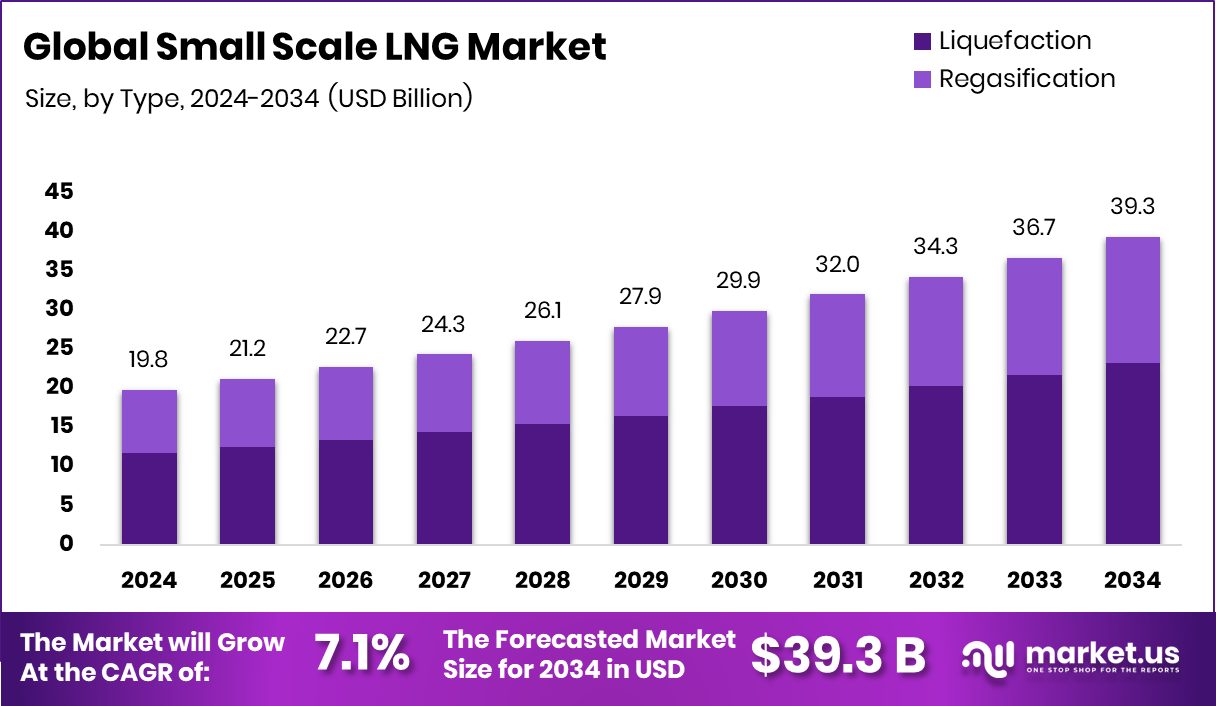

The Global Small Scale LNG Market is expected to be worth around USD 39.3 billion by 2034, up from USD 19.8 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034. Asia-Pacific’s 43.90% share reflects expanding energy needs and rising small-scale LNG use.

Small-scale LNG refers to the production, storage, and distribution of liquefied natural gas in smaller volumes than traditional large LNG terminals. It is designed to serve regions or industries that cannot access major pipeline networks, offering a flexible and cleaner fuel option for transportation, remote power generation, and industrial use. Its appeal comes from easier deployment, lower upfront capital needs, and the ability to reach niche or off-grid markets.

The Small-scale LNG market focuses on compact liquefaction units, micro-LNG plants, satellite storage facilities, and short-distance distribution by trucks, ISO containers, or small carriers. Demand continues rising as industries look for affordable, low-carbon fuels and countries invest in diversified energy systems. The market also benefits from broader decarbonization efforts and the growing need to replace diesel and heavy fuel oil in marine and off-grid applications.

Growth is supported by steady investments that expand LNG and clean-fuel infrastructure. Recent commitments, such as NextDecade securing $1.8 billion for the Rio Grande LNG project and Canada’s $49 million investment into hydrogen liquefaction, show strong confidence in new-age gas technologies. These fund flows help scale downstream networks that indirectly push small-scale LNG adoption.

Demand is also lifted by the rising appeal of renewable gases. The €11.5 million secured by SUBLIME Energie to deploy biogas liquefaction highlights how low-carbon molecules are entering small-scale LNG systems, blending conventional LNG with greener alternatives and creating long-term supply opportunities.

Further opportunities emerge from strategic export initiatives. The federal commitment of up to $200 million to support a project shipping LNG to Asia signals stronger trade corridors, opening pathways for small-scale hubs, micro-liquefaction units, and feeder terminals that serve niche energy users across expanding regional markets.

Key Takeaways

- The Global Small Scale LNG Market is expected to be worth around USD 39.3 billion by 2034, up from USD 19.8 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- Small-scale LNG market sees strong momentum as liquefaction technologies capture 59.2% share today.

- Trucks dominate the small-scale LNG market supply modes, securing a significant 57.6% global share.

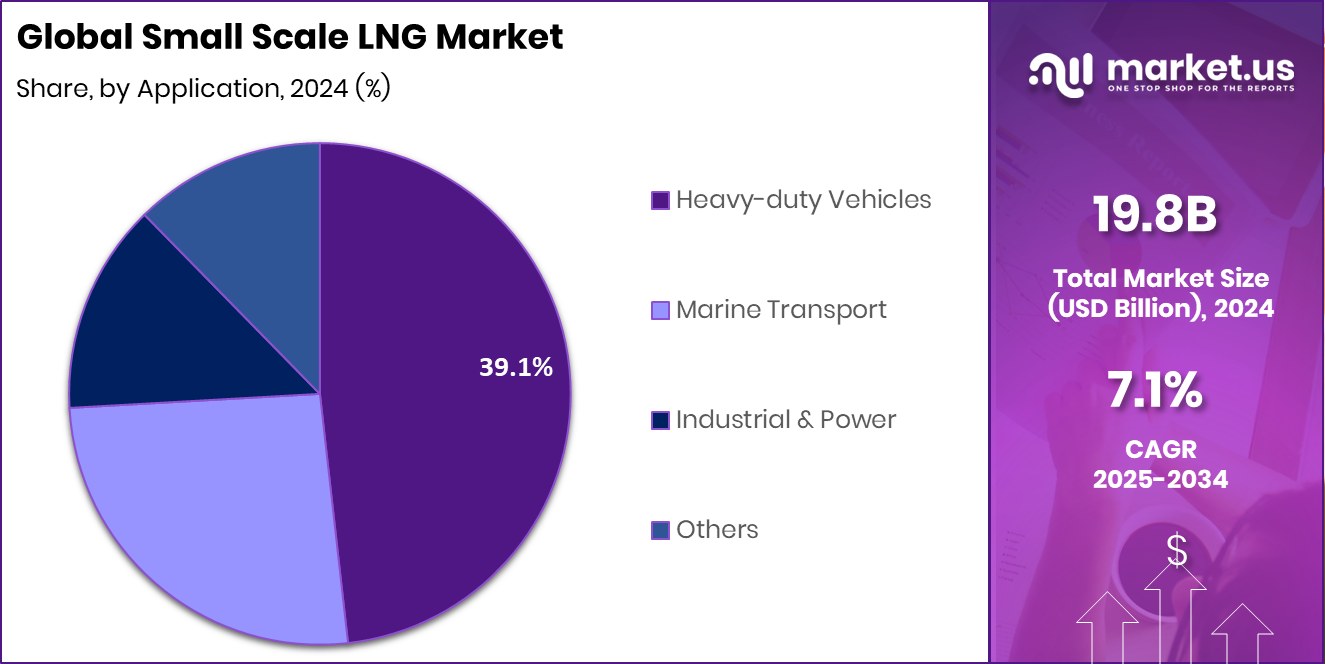

- Heavy-duty vehicles drive substantial fuel demand, holding 39.1% in the small-scale LNG market.

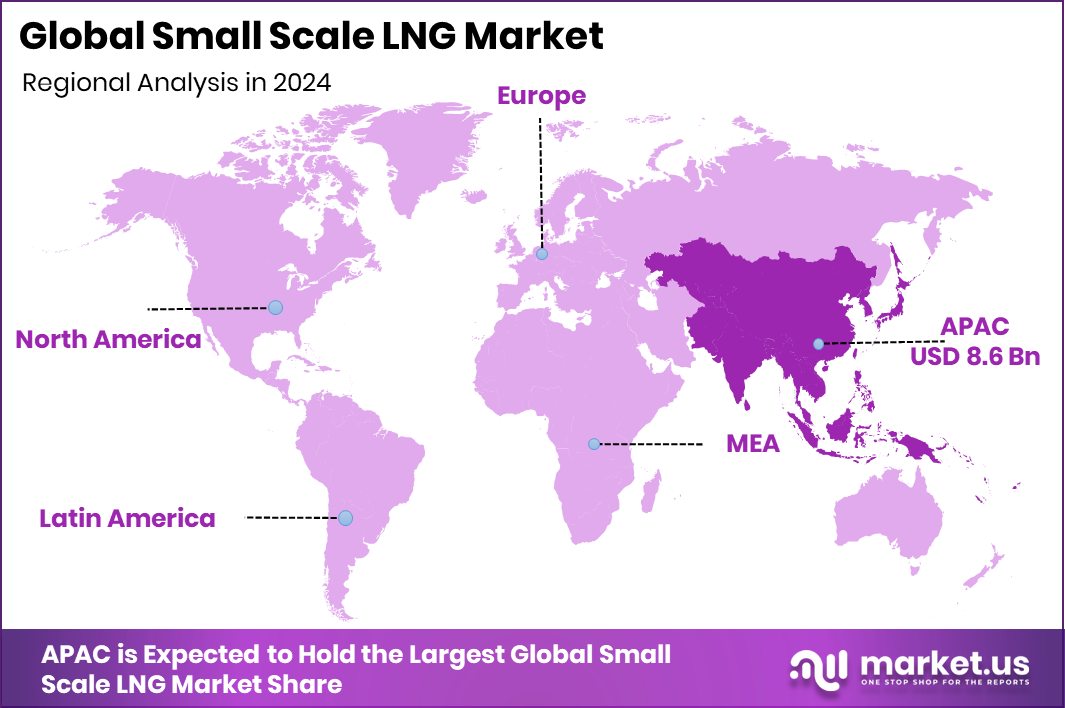

- The Asia-Pacific’s maintained strong LNG demand, supporting stable growth toward USD 8.6 Bn.

By Type Analysis

Liquefaction leads the Small Scale LNG Market with a strong 59.2% share.

In 2024, Liquefaction held a dominant market position in the By Type segment of the small-scale LNG Market, with a 59.2% share. This leadership reflects the strong push toward flexible LNG production systems that support regional energy access and cleaner fuel adoption. Liquefaction units play a central role in enabling small, distributed LNG supply chains by converting natural gas into a transportable form for remote industries and off-grid locations. Their importance increased further as new funding flowed into LNG and related low-carbon fuel projects, strengthening upstream and midstream capabilities.

With rising investments in cleaner energy infrastructure and growing interest in micro-LNG solutions, the Liquefaction segment continued to anchor overall market expansion in 2024.

By Mode of Supply Analysis

Trucks dominate the Small Scale LNG Market logistics with a 57.6% share.

In 2024, Trucks held a dominant market position in the By Mode of Supply segment of the Small-Scale LNG Market, with a 57.6% share, reflecting their role as the most flexible and accessible delivery option for regional and off-grid consumers. Truck-based distribution supports industries, small power units, and transportation fleets that require a reliable LNG supply without depending on pipeline networks. This mode benefits from quick deployment, easier routing, and lower initial infrastructure needs, making it suitable for emerging LNG demand points.

As small-scale LNG adoption grew across remote industrial sites and localized energy projects, trucks remained the preferred choice for last-mile delivery, ensuring steady movement of LNG from liquefaction facilities to end-use locations throughout 2024.

By Application Analysis

Heavy-duty vehicles (39.1%) drive major demand in the Small Scale LNG Market dynamics.

In 2024, Heavy-duty Vehicles held a dominant market position in the by-application segment of the Small-Scale LNG Market, with a 39.1% share, driven by the growing shift toward cleaner and more cost-efficient transport fuels. LNG continued to attract fleet operators looking to reduce emissions, cut diesel dependence, and meet tightening environmental norms. Heavy trucks, long-haul carriers, and large commercial fleets increasingly adopted LNG engines because they offer longer driving ranges and stable fuel availability through small-scale LNG distribution networks.

The segment’s strong position reflects rising interest from logistics and industrial transport users who require high-performance fuel solutions. As adoption expanded across regional freight corridors, heavy-duty vehicles remained the leading demand center for small-scale LNG in 2024.

Key Market Segments

By Type

- Liquefaction

- Regasification

By Mode of Supply

- Trucks

- Trans-shipment and Bunkering

- Others

By Application

- Heavy-duty Vehicles

- Marine Transport

- Industrial and Power

- Others

Driving Factors

Growing Investment in Clean Fuel Infrastructure Expansion

A key driving factor for the Small-Scale LNG market is the strong rise in public funding that supports cleaner fuel systems and flexible energy logistics. The US Department of Transportation disbursing over $35 million in maritime infrastructure funds is an important push, as it helps improve small ports, LNG-ready terminals, and coastal logistics.

Better maritime infrastructure allows small-scale LNG carriers and bunkering trucks to move fuel more safely and efficiently. This funding also encourages ports to handle cleaner fuels, reducing diesel dependence in coastal transport.

As shipping routes, small terminals, and dockside facilities receive upgrades, industries gain easier access to LNG for vehicles, equipment, and power needs. This creates steady long-term momentum for small-scale LNG adoption across transport and industrial users.

Restraining Factors

High Infrastructure Costs Slow Wider LNG Adoption

A major restraining factor for the small-scale LNG market is the high cost of setting up storage, transportation, and handling systems, especially in regions with limited existing gas networks. Even though there is a strong interest in cleaner fuels, many small industries and local transport operators struggle with the upfront expenses needed to adopt LNG-compatible equipment. The situation becomes more complex when coastal regions require specialized terminals or upgraded docking points.

Although more than £1.1 billion in investment is being directed to boost growth, jobs, and skills in the UK’s coastal towns and cities, such funding often aims at broad regional development rather than fully covering LNG-specific infrastructure needs. This gap keeps initial adoption slow, particularly for smaller businesses.

Growth Opportunity

Rising Clean Marine Transport Creates Strong Opportunity

A key growth opportunity for the Small-Scale LNG market comes from the fast-growing push to clean up marine transportation. Ports, coastal industries, and shipping operators are looking for practical low-emission fuels that can be supplied in flexible amounts, making small-scale LNG an attractive choice. This opportunity expands further as new technologies enter the maritime sector.

For example, Candela’s flying boat, which grabbed $14 million to decarbonise maritime transport, shows how quickly the marine industry is shifting toward cleaner energy solutions. As ports and operators invest in greener vessels and new fueling options, demand for reliable LNG bunkering in smaller volumes increases. Small-scale LNG systems can serve ferries, coastal crafts, and emerging clean-marine technologies, opening a strong long-term growth pathway.

Latest Trends

Shift Toward Multi-Fuel and Hybrid Marine Solutions

A leading trend in the Small-Scale LNG market is the shift toward marine systems that can handle multiple clean fuels, including LNG, bio-LNG, and emerging low-carbon gases. Ports and vessel designers are moving toward flexible fuel options to meet future emission standards and operate efficiently across different routes. This trend strengthens as new funding supports cleaner maritime innovation.

For example, OSG winning a $3 million US DOE grant to design a vessel for LCO₂ transport highlights how quickly marine technology is evolving toward low-carbon operations. As vessels become capable of handling different clean fuels, demand for small-scale LNG bunkering, modular storage, and compact liquefaction grows. This multi-fuel direction positions small-scale LNG as a key transitional fuel in next-generation maritime energy systems.

Regional Analysis

Asia-Pacific dominated the Small Scale LNG Market with 43.90%, reaching USD 8.6 Bn.

Asia-Pacific led the Small-Scale LNG Market in 2024, holding 43.90% of the total share and reaching USD 8.6 Bn, supported by strong energy demand, growing industrial needs, and wider LNG adoption in transportation and remote power. This region’s leadership is reinforced by expanding small liquefaction units and flexible supply networks that cater to diverse end users across developing economies.

North America followed with steady growth driven by rising uptake of cleaner fuels and increasing reliance on truck-based LNG distribution for industries located away from pipelines. Europe showed consistent progress as countries moved toward lower-emission fuel options for heavy vehicles and small-scale marine applications.

The Middle East & Africa displayed emerging potential as LNG gained traction in remote industrial operations and isolated grid systems. Latin America continued developing small-scale LNG infrastructure to support regional transport corridors and local energy needs, gradually increasing its presence in the overall market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

LINDE PLC continued to influence the sector through its expertise in gas processing and liquefaction systems, supporting compact LNG solutions that fit remote industries and off-grid regions. Its long engineering experience positions the company well in a market that values efficiency, reliability, and adaptability in smaller LNG units.

WÄRTSILÄ CORPORATION contributed through its focus on clean-energy engines and integrated LNG systems that help industries and transport operators shift toward low-emission fuels. The company’s work in modular energy solutions aligns closely with the rising demand for flexible LNG supply options, especially in marine and power applications.

HONEYWELL INTERNATIONAL INC. strengthened the market through advanced control systems and automation technologies, helping improve operational safety, fuel optimization, and system performance across small-scale LNG facilities. Together, these companies shaped a more mature, technology-driven market landscape, where efficiency, flexible deployment, and lower emissions remain central priorities.

Top Key Players in the Market

- LINDE PLC

- WÄRTSILÄ CORPORATION

- HONEYWELL INTERNATIONAL INC.

- ENGIE SA

- SHELL PLC

- GASUM OY

- CHART INDUSTRIES, INC.

- TOTALENERGIES

- EXCELERATE ENERGY, INC.

- SOFREGAZ

Recent Developments

- In February 2025, Linde announced that in 2024 it secured 59 new long-term agreements to build, own, and operate 64 customer-site plants, reinforcing its distributed gas, liquefaction, and on-site production business.

- In October 2024, Wärtsilä introduced its “NextDF” dual-fuel engine technology for the Wärtsilä 25DF LNG engine, designed to cut methane emissions to as low as 1.1 % and strengthen LNG as a sustainable marine fuel.

Report Scope

Report Features Description Market Value (2024) USD 19.8 Billion Forecast Revenue (2034) USD 39.3 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquefaction, Regasification), By Mode of Supply (Trucks, Trans-shipment and Bunkering, Others), By Application (Heavy-duty Vehicles, Marine Transport, Industrial and Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LINDE PLC, WÄRTSILÄ CORPORATION, HONEYWELL INTERNATIONAL INC., ENGIE SA, SHELL PLC, GASUM OY, CHART INDUSTRIES, INC., TOTALENERGIES, EXCELERATE ENERGY, INC., SOFREGAZ Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Small Scale LNG MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Small Scale LNG MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LINDE PLC

- WÄRTSILÄ CORPORATION

- HONEYWELL INTERNATIONAL INC.

- ENGIE SA

- SHELL PLC

- GASUM OY

- CHART INDUSTRIES, INC.

- TOTALENERGIES

- EXCELERATE ENERGY, INC.

- SOFREGAZ