Global Silo Bags Market By Material Type (Polyethylene (PE), Polypropylene (PP)), By Capacity of Bags (Up to 2000 Mt, Above 2000 Mt), By Application (Grains and Oilseeds Storage, Dried Fruits Storage, Forage Storage, Fertilizer Storage, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158832

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

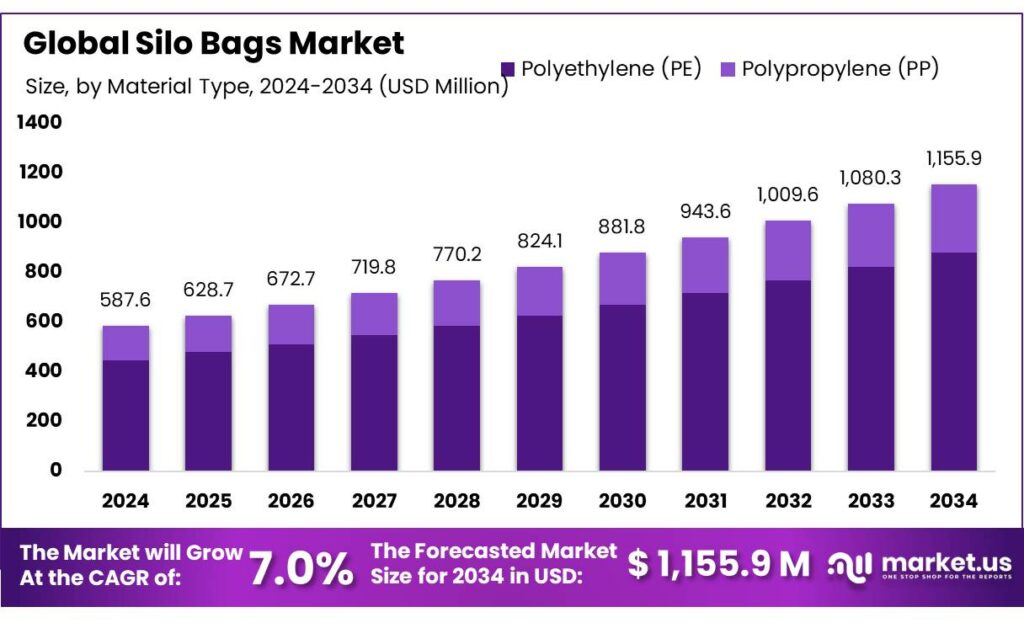

The Global Silo Bags Market size is expected to be worth around USD 1155.9 Million by 2034, from USD 587.6 Million in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 43.9% share, holding USD 257.9 Million in revenue.

Silo bags have become an integral component of modern agricultural storage solutions, particularly in regions like India, where efficient grain storage is crucial to minimizing post-harvest losses and ensuring food security. These large, flexible polyethylene bags are designed to store bulk grains such as wheat, maize, and rice, offering a cost-effective alternative to traditional storage methods like steel silos.

Government initiatives play a pivotal role in promoting the use of silo bags. The Indian government has pledged a $15 billion investment to enhance grain storage capacity, aiming to store 100% of the nation’s grain production. This initiative underscores the commitment to improving agricultural infrastructure and reducing food wastage. Additionally, the Food Corporation of India (FCI) has been actively involved in establishing modern grain silo warehouses across the country.

For instance, a state-of-the-art silo warehouse with a storage capacity of 50,000 metric tonnes was inaugurated in Pasraha village, Bihar, at an estimated cost of ₹150 crore. Such projects are instrumental in modernizing the agricultural logistics framework and supporting small and marginal farmers.

Several factors are driving the adoption of silo bags in India. Firstly, the government’s commitment to enhancing food security is evident through initiatives like the National Food Security Mission, which aims to increase food grain production and improve storage capacities.

Additionally, the introduction of the Pradhan Mantri Kisan Sampada Yojana (PMKSY) has provided financial support for the establishment of cold chain and post-harvest infrastructure, indirectly benefiting the silo bag industry. Moreover, the Maharashtra government’s Package Scheme of Incentives 2019 offers subsidies up to 60% for warehousing projects, including silo bag storage, in designated areas.

Key Takeaways

- Silo Bags Market size is expected to be worth around USD 1155.9 Million by 2034, from USD 587.6 Million in 2024, growing at a CAGR of 7.0%.

- Polyethylene (PE) silo bags held a dominant market position, capturing more than a 92.8% share of the North American silo bags market.

- Up to 2000 metric tons (MT) held a dominant market position, capturing more than a 67.4% share.

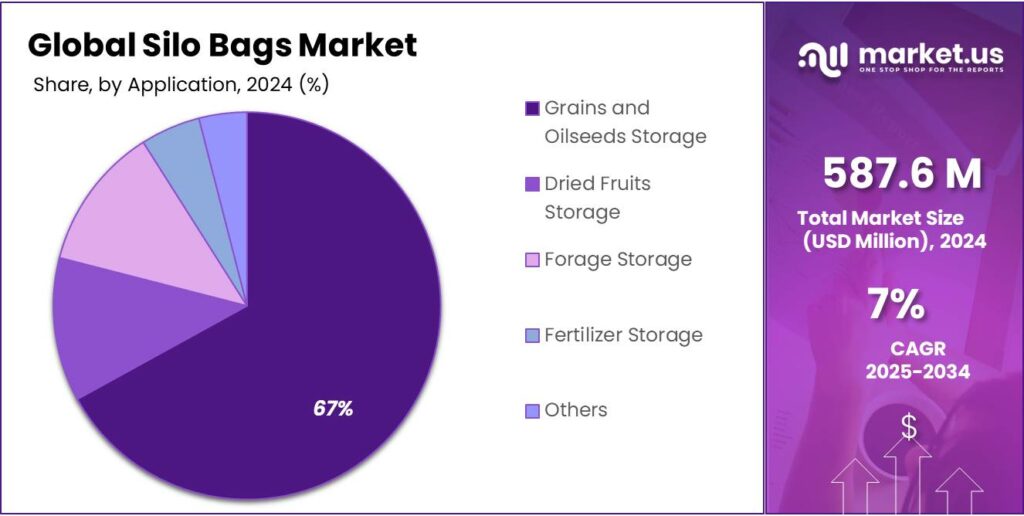

- Grains and oilseeds storage application held a dominant market position, capturing more than a 67.9% share.

- Europe led the global silo bags market, capturing a dominant share of 43.90%, equating to approximately USD 257.9 million.

By Material Type Analysis

Polyethylene (PE) Silo Bags Lead with 92.8% Market Share in 2024

In 2024, Polyethylene (PE) silo bags held a dominant market position, capturing more than a 92.8% share of the North American silo bags market. This significant share underscores PE’s preference due to its durability, cost-effectiveness, and recyclability. Farmers favor PE bags for their resilience and affordability, aligning with rising sustainability goals across North America.

The widespread adoption of PE silo bags is attributed to their suitability for various agricultural applications, particularly grain storage. Their ability to protect stored grains from environmental factors such as moisture and pests contributes to their popularity among farmers seeking reliable and efficient storage solutions.

By Capacity of Bags Analysis

Up to 2000 MT Capacity Silo Bags Capture 67.4% Market Share in 2024

In 2024, silo bags with a capacity of up to 2000 metric tons (MT) held a dominant market position, capturing more than a 67.4% share. This segment’s prominence is attributed to its suitability for medium-scale farms and agricultural cooperatives, offering a balance between storage capacity and cost-effectiveness. These bags are particularly advantageous for storing grains, silage, and other agricultural products, providing flexibility and scalability in storage solutions.

The preference for up to 2000 MT capacity silo bags is also influenced by their ease of handling and transportation, making them ideal for regions with limited infrastructure. Their widespread adoption underscores the demand for efficient and affordable storage options in the agricultural sector.

By Application Analysis

Grains and Oilseeds Storage Dominates Silo Bags Market with 67.9% Share in 2024

In 2024, the grains and oilseeds storage application held a dominant market position, capturing more than a 67.9% share. This segment’s prominence is attributed to the increasing demand for efficient storage solutions to manage the growing production of grains and oilseeds. Silo bags offer a cost-effective and flexible alternative to traditional storage methods, addressing challenges related to space and infrastructure. Their ability to protect stored commodities from environmental factors contributes to their widespread adoption in the agricultural sector.

The preference for silo bags in grains and oilseeds storage is also influenced by their scalability and ease of use. Farmers and agribusinesses can adjust storage capacities based on seasonal production variations, enhancing operational efficiency. Furthermore, the growing emphasis on reducing post-harvest losses aligns with the benefits offered by silo bags, such as extended storage periods and protection against pests and moisture.

Key Market Segments

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

By Capacity of Bags

- Up to 2000 Mt

- Above 2000 Mt

By Application

- Grains and Oilseeds Storage

- Dried Fruits Storage

- Forage Storage

- Fertilizer Storage

- Others

Emerging Trends

Rising Adoption of Silo Bags for Sustainable Agriculture Practices

One of the latest trends in the silo bags market is the increasing adoption of these storage solutions as part of sustainable agriculture practices. As the world faces growing environmental concerns and food security challenges, sustainable farming practices are becoming more important. Silo bags, with their ability to reduce food waste, preserve the quality of grains, and minimize the need for large, resource-heavy storage facilities, are being recognized as a key solution in this transition.

Silo bags help farmers store harvested crops like wheat, maize, and rice for longer periods without the need for energy-intensive refrigeration or large warehouses. This reduction in energy use contributes to the growing trend of sustainable farming, which aims to lower the carbon footprint of food production.

- According to the United Nations Environment Programme (UNEP), the global food sector is responsible for about 30% of total greenhouse gas emissions. By reducing the reliance on traditional storage methods, which often involve fossil fuel-powered infrastructure, silo bags are contributing to a more sustainable food system.

According to the World Bank, about 30% of harvested crops are lost in sub-Saharan Africa due to poor storage practices. Organizations like the International Fund for Agricultural Development (IFAD) are supporting the use of silo bags in the region to improve food security and reduce waste. These efforts are aligned with the African Union’s Comprehensive Africa Agriculture Development Programme (CAADP), which emphasizes sustainable agricultural practices to combat hunger and poverty.

Drivers

Government Initiatives Drive Silo Bag Adoption for Enhanced Grain Storage

One of the primary factors propelling the adoption of silo bags in India is the government’s concerted effort to bolster food security through infrastructure development. Recognizing the critical need for efficient grain storage solutions, the Indian government has committed to a substantial investment aimed at modernizing the nation’s storage capacity.

In 2025, India announced plans to invest $15 billion to establish an additional 70 million tonnes of grain storage capacity over the next five years. This ambitious initiative includes the construction of thousands of warehouses and bins across the country, with the ultimate goal of accommodating 100% of the nation’s grain production.

- For instance, the Food Corporation of India (FCI) is planning to add 150 lakh metric tonnes (15 million tonnes) of storage capacity under the Hub & Spoke model and scientific silo-based systems. These modern silos are designed to reduce post-harvest losses and improve the efficiency of grain handling and storage.

Additionally, the government has implemented schemes like the Gramin Bhandaran Yojana (Rural Godown Scheme), which offers subsidies to individuals or organizations for the construction or renovation of rural warehouses. This initiative aims to enhance the storage capacity for small farmers, enabling them to sell their produce at favorable prices rather than during periods of glut

Restraints

Environmental Concerns and Regulatory Challenges Impacting Silo Bag Adoption

While silo bags offer a cost-effective and flexible solution for grain storage, their widespread adoption faces significant environmental and regulatory hurdles. One of the primary concerns is the environmental impact associated with the use of polyethylene (PE) materials in silo bags. PE is a non-biodegradable plastic, and improper disposal can lead to long-term environmental pollution. In India, where plastic waste management is a growing issue, the increased use of PE-based silo bags could exacerbate the plastic pollution problem.

The Indian government has recognized the environmental challenges posed by plastic and has implemented measures to address plastic waste. For instance, the Ministry of Environment, Forest and Climate Change has passed regulations to ban all polythene bags less than 50 microns in thickness. However, enforcement remains a challenge, and regional authorities have had to implement their own regulations.

In 2016, Sikkim became the first fully organic state in India to ban the use of not only packaged drinking water bottles in any government meetings or functions but also food containers made from polystyrene foam all over the state. Other states like Himachal Pradesh and Karnataka have also taken steps to ban plastic bags of certain thicknesses.

These regulatory measures indicate a growing trend towards reducing plastic usage in the country. As such, the continued use and disposal of PE-based silo bags could face stricter regulations, potentially leading to increased costs for farmers and agribusinesses. This could hinder the adoption of silo bags, especially among smallholder farmers who may not have access to alternative storage solutions or the resources to comply with new regulations.

Opportunity

Increasing Demand for Efficient Grain Storage in Emerging Markets

A key growth opportunity for the silo bags market is the increasing demand for efficient grain storage solutions, particularly in emerging markets where agricultural production is expanding rapidly. Silo bags, which are flexible, durable bags used to store grains, offer a cost-effective and space-efficient alternative to traditional silos, making them particularly appealing to small and medium-sized farmers in countries with growing agricultural sectors.

In many emerging economies, such as India, Brazil, and several African nations, agriculture plays a critical role in the economy. As these nations continue to grow, both in terms of population and agricultural output, the need for efficient grain storage has never been greater. The United Nations Food and Agriculture Organization (FAO) reports that global food production must increase by 70% to meet the needs of the world’s population by 2050. In emerging economies, silo bags are increasingly seen as a practical solution to prevent post-harvest losses, which are often significant in these regions due to inadequate storage facilities.

In India, for example, where agriculture accounts for about 17% of GDP, post-harvest losses in grains are estimated to be around 10-15% annually due to inadequate storage infrastructure. According to the Ministry of Agriculture and Farmers Welfare, the Indian government is investing in modernizing storage facilities and encouraging the use of technologies like silo bags to reduce these losses. The National Mission on Food Processing (NMFP) in India has supported various programs aimed at enhancing post-harvest management and storage, including grants and subsidies for farmers to adopt new technologies.

- According to the World Bank, around 30% of harvested grains are lost due to inadequate storage. To address this, international organizations such as the International Fund for Agricultural Development (IFAD) have been promoting the use of silo bags in the region as part of broader food security initiatives.

Regional Insights

Europe Dominates Silo Bags Market with 43.90% Share in 2024

In 2024, Europe led the global silo bags market, capturing a dominant share of 43.90%, equating to approximately USD 257.9 million in market value. This leadership is attributed to the region’s robust agricultural sector, which emphasizes efficient grain storage solutions to mitigate post-harvest losses and ensure food security.

The European market’s growth is further supported by government initiatives aimed at enhancing agricultural infrastructure. For instance, the European Union’s Common Agricultural Policy (CAP) provides funding for rural development projects, including investments in modern storage facilities. Such policies facilitate the adoption of innovative storage solutions like silo bags.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

RKW Group is a leading German manufacturer specializing in polyolefin-based film solutions. With over 65 years of experience, the company produces agricultural films, including silo bags, known for their durability and UV resistance. RKW operates 17 sites across Europe, Asia, and North America, employing approximately 2,700 people. Their products are widely used in agriculture, hygiene, and industrial applications.

Founded in 1992, GrainPro Inc. is a global leader in hermetic post-harvest solutions, offering innovative storage technologies to preserve the quality of agricultural commodities. Their products, such as the SuperGrainbag®, are designed to protect grains from pests, moisture, and spoilage without the need for chemicals. GrainPro operates in over 115 locations worldwide, aiming to positively impact the lives of smallholder farmers.

ALC Corp is a global leader in bulk liquid packaging and cargo moisture control solutions. Through its JB Anderson division, ALC provides advanced cargo desiccant bags, customized container liners, and other moisture control products. These solutions are designed to protect agricultural products during storage and transportation, ensuring quality preservation.

Top Key Players Outlook

- RKW Group

- GrainPro Inc.

- Silo Bag India Pvt. Ltd.

- Canadian Tarpaulin Manufacturers Ltd.

- Alccorp

- Hangzhou Xinguang Plastic Co. Ltd.

- Tama

- KSI Supply Inc.

- Global-Pak Inc.

- BAG Supplies Canada Ltd

Recent Industry Developments

In 2024, RKW Group employs approximately 2,800 individuals across its global operations, which include facilities in Europe, Vietnam, and the United States. The company’s strategic expansions, such as the acquisition of Hyplast NV in 2014, have strengthened its position in the agricultural film sector.

In 2024, GrainPro’s impact was significant, with over 191,000 farmers served across various regions, including Africa, Asia, and Latin America. The company’s products helped save over 11 million kilograms of crops, translating to a value of approximately $3.3 million.

Report Scope

Report Features Description Market Value (2024) USD 587.6 Mn Forecast Revenue (2034) USD 1155.9 Mn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polyethylene (PE), Polypropylene (PP)), By Capacity of Bags (Up to 2000 Mt, Above 2000 Mt), By Application (Grains and Oilseeds Storage, Dried Fruits Storage, Forage Storage, Fertilizer Storage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape RKW Group, GrainPro Inc., Silo Bag India Pvt. Ltd., Canadian Tarpaulin Manufacturers Ltd., Alccorp, Hangzhou Xinguang Plastic Co. Ltd., Tama, KSI Supply Inc., Global-Pak Inc., BAG Supplies Canada Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- RKW Group

- GrainPro Inc.

- Silo Bag India Pvt. Ltd.

- Canadian Tarpaulin Manufacturers Ltd.

- Alccorp

- Hangzhou Xinguang Plastic Co. Ltd.

- Tama

- KSI Supply Inc.

- Global-Pak Inc.

- BAG Supplies Canada Ltd