Global Silicone Surfactants Market Size, Share, And Business Benefit By Type (Water-Soluble, Oil-Soluble), By Application (Emulsifiers, Foaming Agents, Defoaming Agents, Wetting Agents, Dispersants, Others), By End Use (Personal Care, Construction, Textile, Paints and Coatings, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166367

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

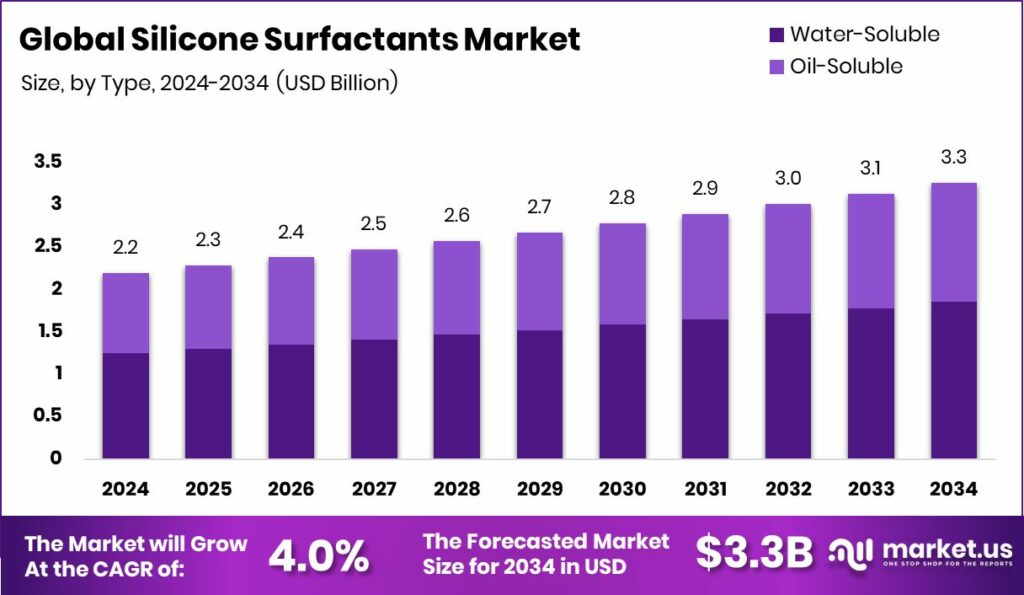

The Global Silicone Surfactants Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.2 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034. Rising sustainable formulations strengthen Asia Pacific leadership, maintaining 37.4% regional market value.

Silicone surfactants are hybrid surface-active molecules that contain both silicone and organic components, enabling them to reduce surface tension, improve spreading, wetting, and foam control across coatings, personal care, agrochemicals, polyurethane foams, and textile formulations. Their unique structure helps stabilize emulsions and offers better slip, softness, and durability compared to conventional surfactants, especially in harsh chemical or high-temperature environments.

The Silicone Surfactants Market reflects increasing use across high-value applications such as sustainable paints, high-performance coatings, advanced personal care emulsions, agricultural spray efficiency boosters, and flexible/rigid foam systems for insulation. Demand is also shaped by the shift toward low-VOC, water-borne, and bio-based formulations where silicone surfactants provide cleaner processing, higher operational efficiency, and longer-lasting performance.

A key growth factor comes from sustainable and green coating ecosystems. Recent capital flows, such as JSW Paints securing INR 3,300 crore financing for a strategic expansion move, and Ecoat raising €21 million to reinvent next-generation eco-friendly paint systems, indirectly create opportunities for silicone surfactants suppliers to position themselves as enablers of low-emission and high-functionality coatings.

Rising innovation in specialty chemicals also supports market momentum. Startups such as Distil raising $7.7 million in Series A funding signal growing attention toward advanced formulation ingredients, where silicone surfactants can fit as premium performance additives delivering better stability, reduced dosage, and improved sustainability metrics.

The opportunity landscape includes bio-derived silicone surfactants, REACH-aligned clean chemistry, circular-ready production, and customized grades for smart textiles, e-mobility insulation foams, and next-generation cosmetics, positioning the segment toward long-term value creation.

Key Takeaways

- The Global Silicone Surfactants Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.2 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- In the Silicone Surfactants Market, the water-soluble type holds a 56.9% share due to versatile formulation benefits.

- Emulsifiers account for 34.1% of the Silicone Surfactants Market, driven by stable dispersion needs globally.

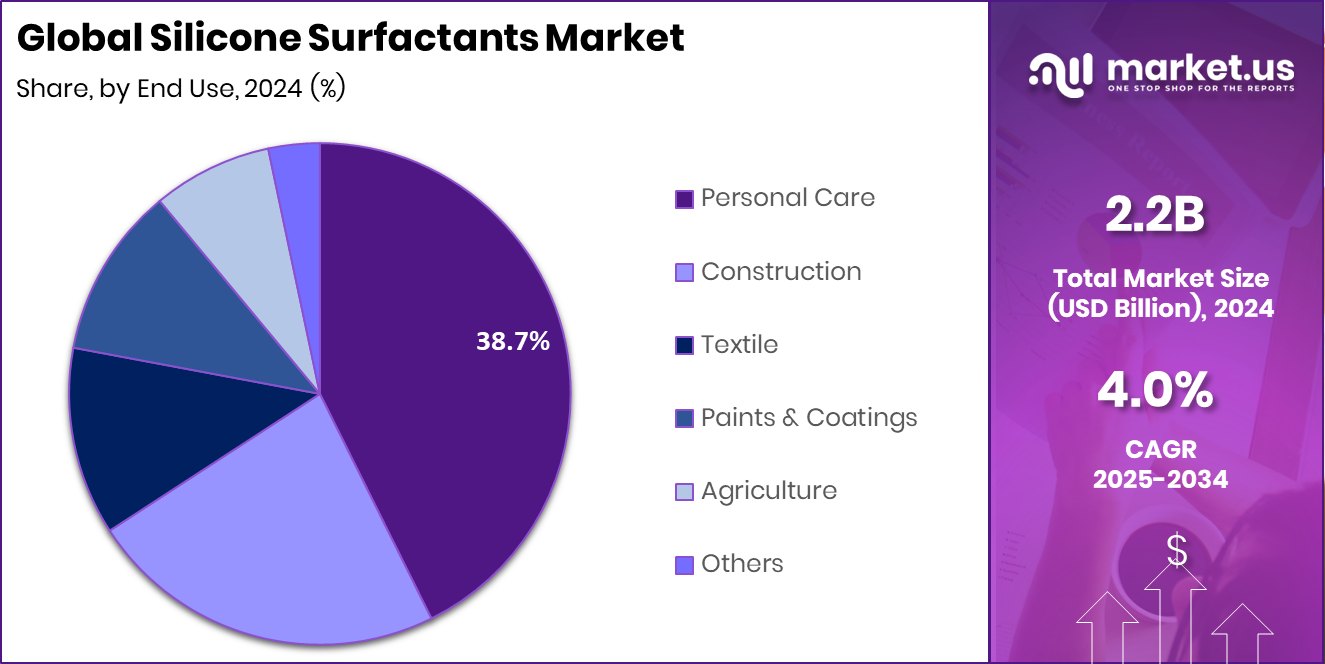

- Personal care end use leads with 38.7% in the Silicone Surfactants Market with premium sensorial performance.

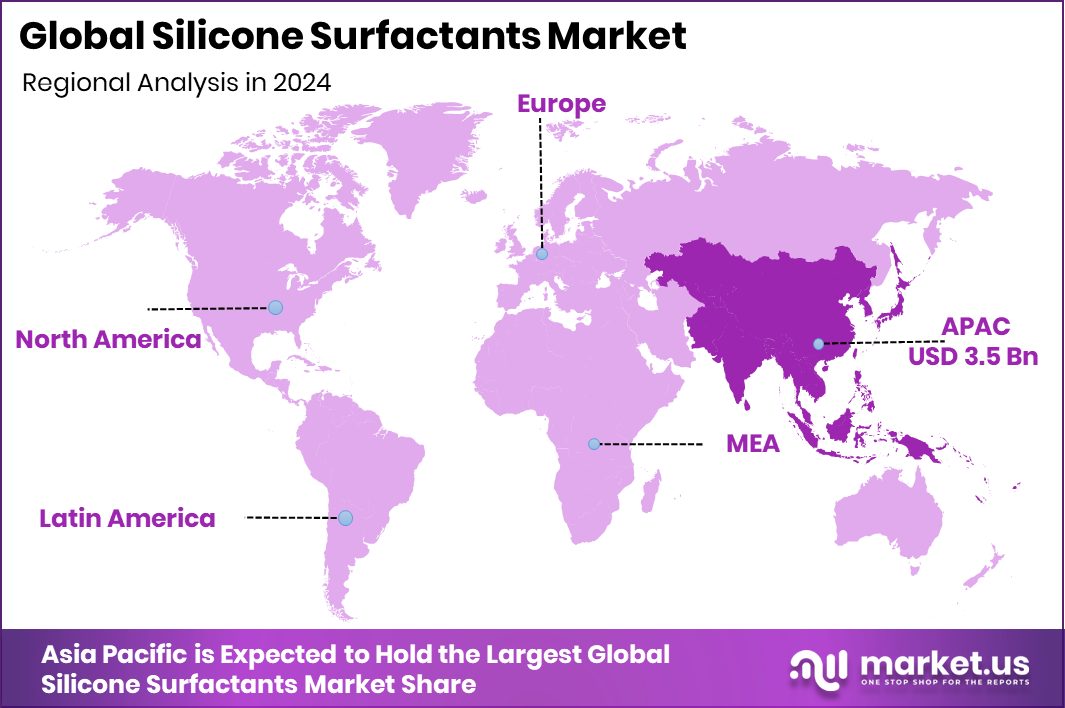

- Asia Pacific demand grows with coatings, beauty, and insulation applications worth USD 3.5 Bn.

By Type Analysis

The Silicone Surfactants Market sees the water-soluble type leading with 56.9%, enabling superior formulation compatibility.

In 2024, Water-Soluble held a dominant market position in the By Type segment of the Silicone Surfactants Market. Its leading position reflects strong suitability in modern formulation systems where quick dissolving, smooth wetting, and higher compatibility with water-based solutions are preferred. Industries focusing on eco-aligned and low-VOC products benefit from water-soluble grades because they disperse easily without extra processing, helping reduce formulation time, wastage, and energy consumption.

Their dominance also stems from wide usage in personal care emulsions, agricultural spray enhancement, and coating formulations where clean application, lower residue, and controlled foam behavior are required. The high share indicates a shift toward sustainable and safer chemistry aligned with global formulation standards.

By Application Analysis

The Silicone Surfactants Market records emulsifiers holding 34.1%, supporting stable multi-phase formulations.

In 2024, Emulsifiers held a dominant market position in the By Application segment of the Silicone Surfactants Market, with a 34.1% share. This leadership is tied to its essential role in stabilizing mixtures where oil and water must remain uniform, especially in modern formulations requiring fine texture, smooth spreadability, and enhanced durability.

Emulsifier-based silicone surfactants support efficient dispersion, reduced surface tension, and controlled droplet size, which helps achieve long-lasting stability without phase separation. Their dominance also reflects consistent usage in coating systems, personal care blends, and chemical formulations where product appearance, feel, and functional reliability are critical for performance and shelf life.

By End Use Analysis

The Silicone Surfactants Market shows personal care leading with 38.7%, driven by premium textures.

In 2024, Personal Care held a dominant market position in the By End Use segment of the Silicone Surfactants Market, with a 38.7% share. This leadership is supported by strong adoption in skincare, haircare, and cosmetic formulations, where smooth texture, improved spreadability, and long-lasting sensory benefits are essential.

Personal care manufacturers prefer silicone surfactants because they help create lightweight, non-greasy, and stable emulsions suitable for creams, serums, conditioners, and sun protection products. Their ability to enhance softness, slip, and moisture balance without compromising product feel plays a key role in premium and daily-use formulations. The dominant share highlights continuous demand for performance-driven beauty and hygiene products in global retail and personal grooming segments.

Key Market Segments

By Type

- Water-Soluble

- Oil-Soluble

By Application

- Emulsifiers

- Foaming Agents

- Defoaming Agents

- Wetting Agents

- Dispersants

- Others

By End Use

- Personal Care

- Construction

- Textile

- Paints and Coatings

- Agriculture

- Others

Driving Factors

Government-Backed Infrastructure and Performance Material Expansion

A major driving factor for the Silicone Surfactants Market comes from increasing demand for high-performance materials in government-funded construction, insulation, protective coatings, and long-term facility projects.

Recent public investment activities, such as Kentucky military facilities receiving $147 million in federal construction funding, indirectly support markets linked to durable coating systems, foam insulation, sealants, waterproofing, and advanced chemical formulations where silicone surfactants are used to improve wetting, stability, and long-term weather resistance. These projects encourage the adoption of efficient, long-lasting, and environmentally safer material technologies that reduce maintenance and improve operational reliability.

As public infrastructure and institutional construction standards shift toward energy efficiency and high-quality finishing, silicone surfactants gain higher relevance due to their ability to provide smoother application and improved compatibility with modern, water-based systems.

Restraining Factors

High Product Cost Limits Wider Adoption

A key restraining factor for the Silicone Surfactants Market is the comparatively high production and formulation cost when measured against conventional organic surfactants. Silicone-based chemistry requires specialized raw materials, controlled processing, and higher purity levels, which increases final pricing for manufacturers and end users. This becomes challenging in cost-sensitive sectors such as basic detergents, commodity coatings, agricultural formulations, and mass-market personal care products, where pricing plays a major role in purchasing decisions.

Small and mid-scale manufacturers may avoid switching to silicone surfactants even when performance benefits are strong, simply because the initial procurement and formulation costs are difficult to absorb. As a result, adoption remains more concentrated in premium, technical, or regulated applications rather than mainstream, high-volume markets.

Growth Opportunity

New Skilled Workforce Boosting Advanced Material Demand

A major growth opportunity for the Silicone Surfactants Market comes from the rising need for advanced and durable materials in modern construction, coating, insulation, and finishing systems. As training expands, product awareness and technical usage improve, helping advanced chemicals gain acceptance.

The recent announcement that Thunder Bay College is getting over $2 million to train more construction workers supports a larger labor pool familiar with next-generation building products, efficient application methods, and sustainability-focused formulations where silicone surfactants are used for smoother spreadability, better adhesion, and long-term performance.

When new technicians learn modern standards rather than traditional methods, they tend to prefer safer, water-based, long-lasting, and low-waste materials, creating a supportive environment for silicone surfactants to expand across institutional, residential, and industrial construction applications.

Latest Trends

Shift Toward Smart and High-Tech Formulations

A key latest trend in the Silicone Surfactants Market is the rising shift toward smart, multi-functional, and high-tech formulations that deliver both performance and sustainability. Industries are looking for ingredients that can do more than just stabilize or improve spreadability; they want additives that support longer shelf life, lower dosage, and compatibility with digital manufacturing and automated production systems.

Innovation energy in the specialty materials space is growing, supported by new technology-focused funding movements such as ConCntric, raising $10 million in Series A funding, which reflects stronger confidence in data-driven and advanced material-driven solutions. This mindset pushes formulators toward silicone surfactants because they can support controlled wetting, self-leveling, anti-smudge performance, and improved stability across next-generation coatings, foams, agriculture blends, and beauty formulations.

Regional Analysis

Asia Pacific holds a 37.4% share in the silicone surfactants market, valued at USD 3.5 Bn.

In 2024, Asia Pacific emerged as the dominant region in the Silicone Surfactants Market, holding a 37.4% share valued at USD 3.5 Bn, supported by rising usage across personal care, construction coatings, and agricultural formulations. The region benefits from increasing product penetration in water-based systems, consumer beauty products, and insulation materials, which strengthens long-term consumption patterns across developing and advanced manufacturing economies. Growing adoption of low-VOC and high-performance additives also supports steady industrial demand.

North America shows stable uptake driven by preference for efficient formulations used in premium personal care emulsions, modern building materials, and advanced polyurethane systems. Rising acceptance of surface-enhancing technologies continues to support market use across multiple end-use segments.

Europe reflects consistent interest in sustainable formulation chemistry, creating favorable usage across eco-aligned coatings and controlled-performance emulsions suited for regulated industries. Manufacturers are also shifting toward long-lasting and application-efficient surfactants.

Middle East & Africa demonstrate gradual utilization, supported by growing infrastructure-linked demand for durable material performance and surface-improving additives.

Latin America shows progressive interest in performance-driven surfactants for consumer and industrial needs, supported by rising formulation awareness and product diversification.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Zotefoams Plc is viewed through the lens of material-driven innovation, where its long-term focus on engineered and performance-oriented products can align well with end-use sectors that prefer stable, lightweight, and durable material integration. From an analyst standpoint, any association with modern formulation-compatible materials could indirectly support future interest areas linked to performance additives such as silicone-based surface-enhancing agents, particularly where long-term efficiency and high-quality finishing outcomes are required.

Owens Corning can be assessed from a market positioning perspective where performance, durability, and advanced application benefits remain important. Analyst sentiment suggests that markets connected to efficiency-focused building and material systems increasingly evaluate complementary technologies, including surface modifiers and formulation-enhancing ingredients that assist in uniformity, application quality, and durability improvement opportunities.

Kingspan Group Plc similarly shows alignment with sectors where thermal, structural, moisture, and finishing performance are consistently evaluated. From an analytical viewpoint, any long-term market shifts toward advanced chemical inputs, enhanced coatings, and optimized surface-behavior solutions may offer conceptual relevance to silicone surfactants, especially in application-critical projects.

Top Key Players in the Market

- Zotefoams Plc

- Owens Corning

- Kingspan Group Plc

- Rockwool International A/S

- Recticel NV/SA

- Morgan Advanced Materials plc

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Knauf Insulation

- Saint-Gobain

- Palziv Inc.

Recent Developments

- In January 2025, the company announced its full-year trading update for the year ended 31 December 2024: revenue reached £147.8 million (up ~16% vs prior year), and adjusted profit before tax grew ~19% to ~£15.6 million.

- In February 2024, Owens Corning announced the acquisition of Masonite International for approximately US $3.9 billion to strengthen its position in residential building materials (doors and systems).

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Water-Soluble, Oil-Soluble), By Application (Emulsifiers, Foaming Agents, Defoaming Agents, Wetting Agents, Dispersants, Others), By End Use (Personal Care, Construction, Textile, Paints and Coatings, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Zotefoams Plc, Owens Corning, Kingspan Group Plc, Rockwool International A/S, Recticel NV/SA, Morgan Advanced Materials plc, Armacell International S.A., Aspen Aerogels, Inc., Knauf Insulation, Saint-Gobain, Palziv Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silicone Surfactants MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Silicone Surfactants MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zotefoams Plc

- Owens Corning

- Kingspan Group Plc

- Rockwool International A/S

- Recticel NV/SA

- Morgan Advanced Materials plc

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Knauf Insulation

- Saint-Gobain

- Palziv Inc.