Global Silicone Rubber Waterproof Coating Market Size, Share, And Business Benefit By Product Type (Single-component Silicone Coatings, Two-component Silicone Coatings, Modified Silicone Coatings, Heat-cured Silicone Coatings, Room Temperature Vulcanizing (RTV) Silicone Coatings), By Application (Construction and Building, Aerospace and Defense, Automotive, Electronics, Marine, Medical Devices, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166308

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

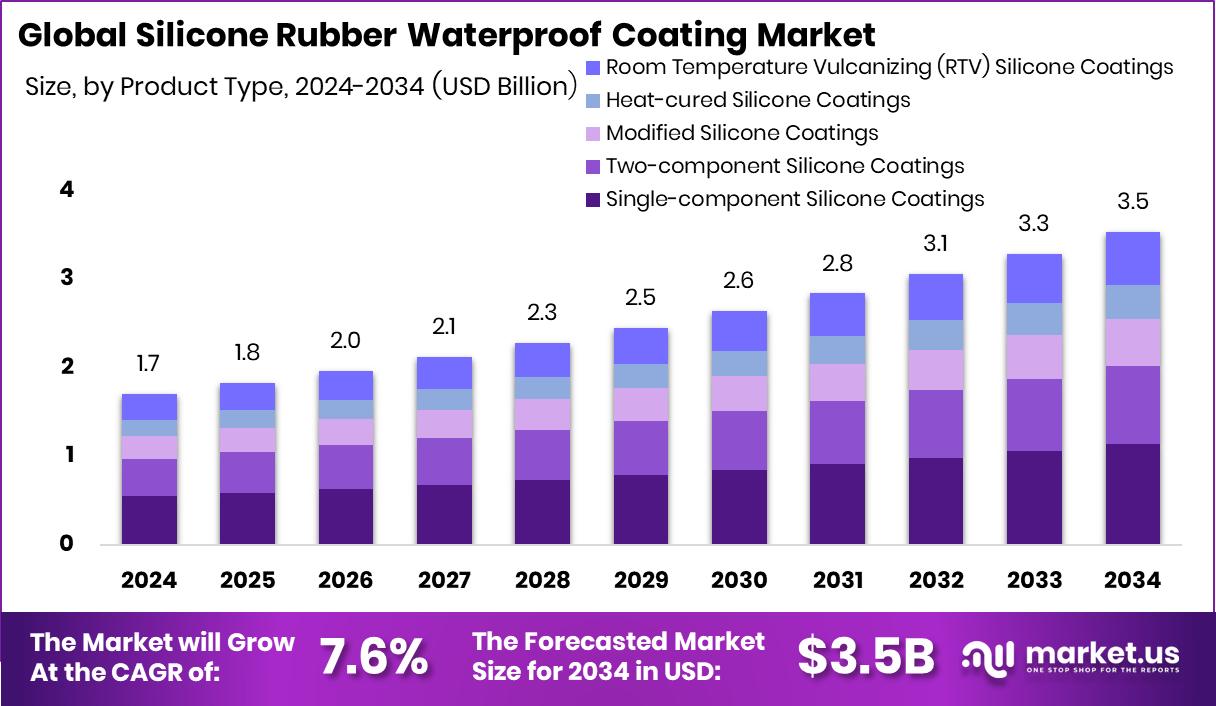

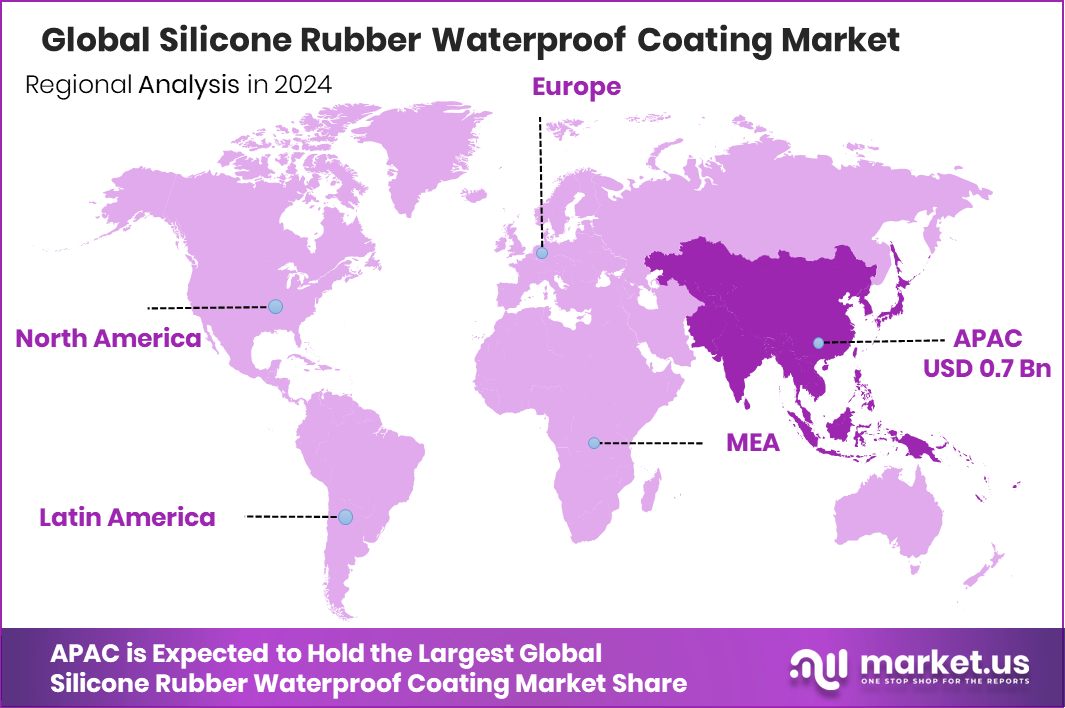

The Global Silicone Rubber Waterproof Coating Market is expected to be worth around USD 3.5 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034. Asia-Pacific maintains 45.9% dominance, driving revenue near USD 0.7 Bn in construction-led performance.

Silicone rubber waterproof coating is a flexible, heat-resistant, and moisture-repelling protective layer made from silicone elastomers. It forms a seamless film that can stretch, resist UV rays, tolerate harsh temperatures, and block water penetration on roofs, walls, metals, insulation boards, and prefab structures. Its long service life and resistance to cracking make it ideal for modern and large-scale construction environments where durability and energy efficiency are priorities.

The Silicone Rubber Waterproof Coating market represents the commercial demand and supply ecosystem for these coatings across infrastructure, housing, industrial, and prefab construction applications. Growth is shaped by climate-resilient architecture, faster project delivery cycles, and a rising focus on leak-proof, maintenance-free surfaces, especially for prefab and modular buildings.

Stronger demand is influenced by public and private investments in construction digitization and workforce development. Europe is seeing technology-driven upgrades, where €38 million in funding for a German SaaS platform and $1.2M in seed capital for an AI-based construction data backbone reflect a shift towards precision, lifecycle optimization, and advanced building materials.

The government plans to train new-age workers to build 1.5 million homes, along with prefab expansion, such as a $20 million investment in modular development, and create opportunities for wider coating usage in faster, cleaner, and waterproof construction systems.

Key Takeaways

- The Global Silicone Rubber Waterproof Coating Market is expected to be worth around USD 3.5 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034.

- Single-component products lead the silicone rubber waterproof coating market with a 32.1% share, driven by easy use.

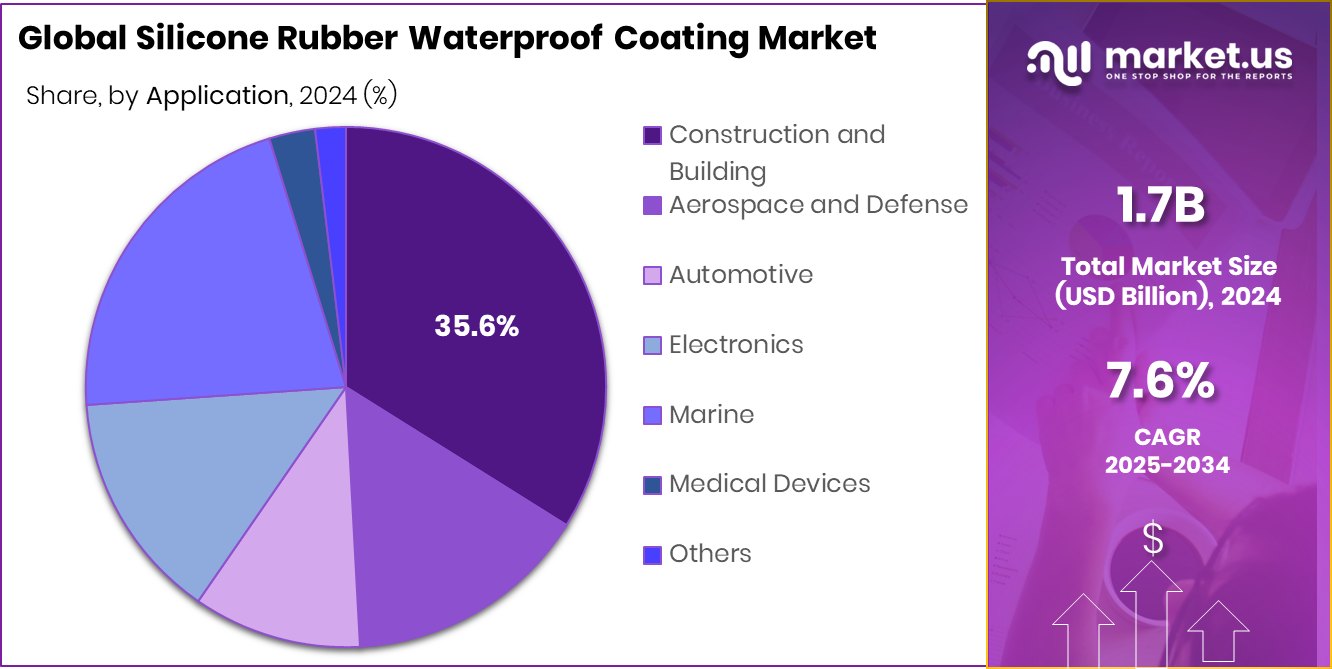

- The construction and building segment dominates the silicone rubber waterproof coating market with a 35.6% demand share.

- Asia-Pacific demand strengthens due to infrastructure growth worth USD 0.7 Bn, 45.9% of the segment.

By Product Type Analysis

Single-component dominates the silicone rubber waterproof coating market with a 32.1% share.

In 2024, single-component silicone coatings held a dominant market position in the by-product type segment of the silicone rubber waterproof coating market, with a 32.1% share. This type gained preference because it is easy to apply, cures without complex mixing, and reduces labor effort at construction sites.

The demand was further supported by the growing shift toward fast-application waterproofing solutions in both residential and industrial structures, especially in large-scale projects and modular building environments.

Its seamless finishing ability, flexibility under temperature fluctuations, and compatibility with concrete, metal, insulation boards, and prefabricated panels helped it remain the leading choice. The preference for durable, long-life coatings strengthened its dominance and continued acceptance across modern construction developments.

By Application Analysis

Construction and building lead the Silicone Rubber Waterproof Coating Market with a 35.6% share.

In 2024, Construction and Building held a dominant market position in the By Application segment of the Silicone Rubber Waterproof Coating Market, with a 35.6% share. This leadership was primarily driven by its use across rooftops, exterior walls, insulation layers, joints, and prefab structures where long-term waterproofing is essential.

The segment benefited from material advantages such as flexibility, UV resistance, and high-temperature stability, making it suitable for new developments and renovation projects.

Growing focus on moisture-free, energy-efficient, and low-maintenance structures encouraged wider application in housing, commercial buildings, and infrastructure works. Easy surface compatibility and long service life supported continued preference, allowing this segment to maintain a steady demand outlook.

Key Market Segments

By Product Type

- Single-component Silicone Coatings

- Two-component Silicone Coatings

- Modified Silicone Coatings

- Heat-cured Silicone Coatings

- Room Temperature Vulcanizing (RTV) Silicone Coatings

By Application

- Construction and Building

- Aerospace and Defense

- Automotive

- Electronics

- Marine

- Medical Devices

- Others

Driving Factors

Government-backed housing expansion fuels waterproof coating demand

One major driving factor for the silicone rubber waterproof coating market is the strong rise in housing and infrastructure development supported by fresh public and private funding commitments. Construction confidence increased when Carney announced Build Canada Homes with $13B funding to accelerate new home construction, which directly boosts demand for long-life waterproofing materials in foundations, roofs, façades, and modular projects.

At the same time, modern construction methods also gained support as an MMC firm secured £8M funding for an Oxfordshire housing scheme, showing that fast-build and prefab structures need durable waterproof coatings that perform well under varied climates. These investments create strong future opportunities across new builds, refurbishments, and moisture-risk construction zones.

Restraining Factors

High project cost pressure slows product adoption

One key restraining factor for the silicone rubber waterproof coating market is the cost sensitivity seen across many construction and housing projects, especially when developers look for budget-friendly waterproofing alternatives. Silicone-based coatings deliver long service life and strong weather resistance, but the upfront pricing, specialized surface preparation, and skilled labor requirements can limit adoption in price-controlled projects.

This situation becomes more visible when governments announce temporary or stop-gap financial measures rather than full-scale capital release, such as the £2bn stop-gap funding for 18,000 homes, which may prioritize basic completion instead of premium material upgrades. As a result, cost-efficient or quick-apply substitutes may delay faster penetration of silicone waterproof systems.

Growth Opportunity

Advanced and futuristic construction unlocks new coating demand

A strong growth opportunity for the silicone rubber waterproof coating market comes from next-generation construction models that require long-lasting, flexible, and weather-resistant surface protection. Digital-first project management is gaining pace as a construction build tracking startup raised $6.6 million, supporting faster, accurate, and defect-free execution, where high-performance waterproofing fits well with modern quality benchmarks.

At the same time, innovation is expanding beyond Earth, with USD 57.2 million in funding from NASA for construction in space, signaling long-term research into extreme-condition building materials. Silicone coatings already perform well under temperature shifts, radiation, and moisture exposure, which positions them as a promising candidate for advanced habitats, off-planet modules, and high-risk engineering environments.

Latest Trends

Rise of extreme-condition waterproofing innovation trend

A major latest trend in the Silicone Rubber Waterproof Coating Market is the growing interest in high-performance waterproofing materials built for conditions beyond traditional residential and industrial use. Construction scientists and material engineers are testing coatings for extreme environments such as high altitude, deep sea, defense shelters, and outer-space structures. This direction became more visible when USD 57.2 million in funding was announced by NASA for construction in space, encouraging research toward materials that can survive radiation, vacuum pressure, thermal shock, and moisture-free durability.

Silicone-based waterproof coatings already show strong temperature flexibility and UV stability, making them a suitable base for future protective chemistry, long-life smart coatings, and hybrid insulation-barrier technologies.

Regional Analysis

Asia-Pacific leads with a 45.9% share valued at USD 0.7 Bn in the 2024 market.

Asia-Pacific held the leading position in the Silicone Rubber Waterproof Coating Market with a 45.9% share valued at USD 0.7 Bn, supported by active construction activity, prefabricated infrastructure usage, and wider acceptance of long-life waterproofing layers across residential, commercial, and industrial structures. The region also benefits from large-scale housing targets, rising waterproofing awareness, and the adoption of advanced surface protection materials aligned with long-term lifecycle durability needs.

North America maintained steady market interest driven by renovation cycles, roofing upgrades, climate-resilient building standards, and property maintenance spending. Europe continued to record preference for durable waterproof systems due to strict energy and building protection norms, especially in moisture-sensitive and cold-weather zones.

The Middle East & Africa showed increasing usage across industrial, logistics, and infrastructure developments, where heat endurance, UV resistance, and protective membrane durability remained key selection factors. Latin America reflected growing demand across urban housing expansion, repair-based waterproofing applications, and long-term building preservation requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AkzoNobel continued to be viewed as a strong participant in silicone-based waterproof construction materials due to its background in protective and performance coatings. The company’s focus on long-life exterior solutions, colour-stable formulations, and weather-resistant finishes aligned well with demand for premium waterproof layers used on walls, façades, and large-scale infrastructure surfaces. Its emphasis on technical consistency, material reliability, and improved sustainability narratives kept it relevant in modern construction needs.

Sika Mortars maintained a strategic position through its focus on building-grade materials, repair systems, and moisture-control overlays suited for residential and commercial construction. Its domain understanding in bonding, sealing, and leak-prevention systems provides synergy with silicone waterproof coatings used for roofing joints, wall gaps, expansion sections, and prefabricated panels. The company’s experience in site-ready construction materials supports adoption in quick-completion projects and modular structures where waterproofing quality is critical.

PPG sustained market relevance through its presence in advanced coatings and protective chemistry used across construction, industrial, and infrastructure environments. Its expertise in surface technologies and weather-tolerant formulations strengthens alignment with silicone waterproof coatings that demand durability across temperature changes and long service cycles.

Top Key Players in the Market

- AkzoNobel

- Sika Mortars

- PPG

- Sherwin-Williams

- Grupo Puma

- Koster

- BASF

- Weber Building Solutions

- Davco

- Henkel

Recent Developments

- In October 2024, AkzoNobel’s Coil & Extrusion Coatings team announced that at the METALCON show, they would highlight new applications of their “CERAM-A-STAR®” silicone-modified coating for metal building envelopes and cladding.

- In January 2024, Sherwin-Williams launched a new water-based wood coating under the “SHER-WOOD® EA” brand, designed for improved environmental adaptability without performance drawbacks in tougher weather conditions.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.5 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single-component Silicone Coatings, Two-component Silicone Coatings, Modified Silicone Coatings, Heat-cured Silicone Coatings, Room Temperature Vulcanizing (RTV) Silicone Coatings), By Application (Construction and Building, Aerospace and Defense, Automotive, Electronics, Marine, Medical Devices, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel, Sika Mortars, PPG, Sherwin-Williams, Grupo Puma, Koster, BASF, Weber Building Solutions, Davco, Henkel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silicone Rubber Waterproof Coating MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Silicone Rubber Waterproof Coating MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AkzoNobel

- Sika Mortars

- PPG

- Sherwin-Williams

- Grupo Puma

- Koster

- BASF

- Weber Building Solutions

- Davco

- Henkel