Global Silicon Thin Film Solar Cell Market Size, Share, And Enhanced Productivity By Type (Amorphous Silicon, Microcrystalline Silicon, Others), By Application (Residential, Commercial, Industrial, Utility-Scale), By Installation (Rooftop, Ground-Mounted), By End-User (Energy, Electronics, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168189

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

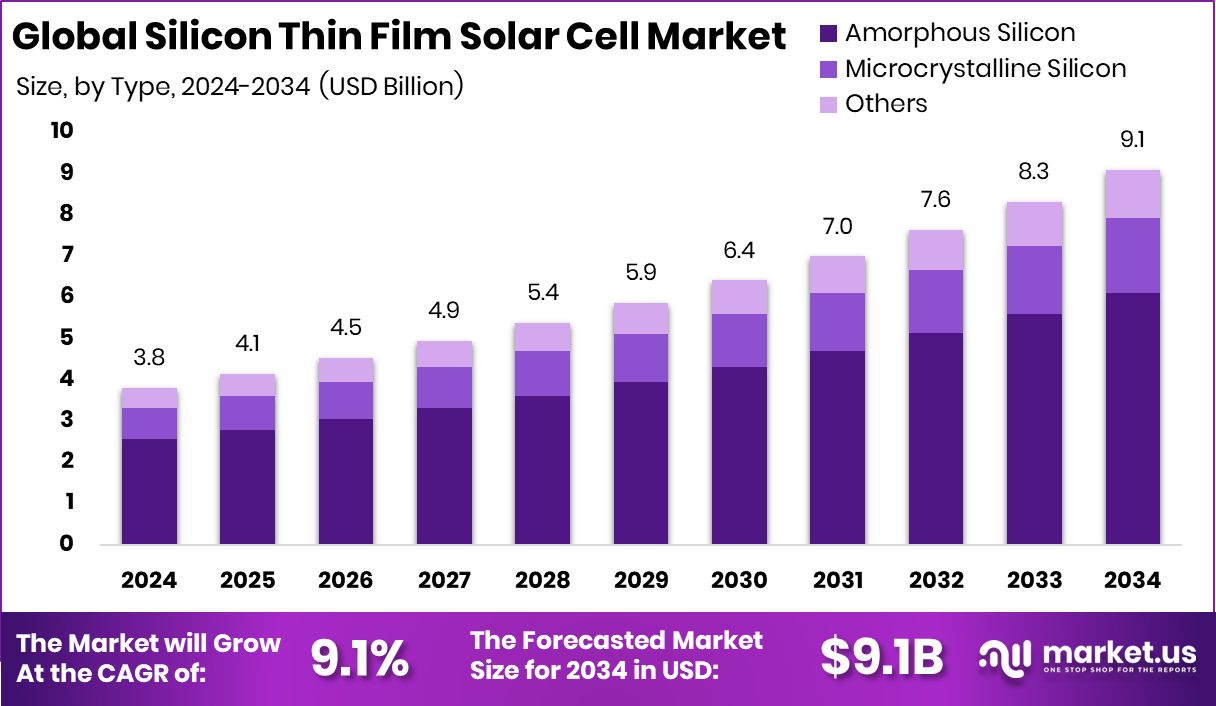

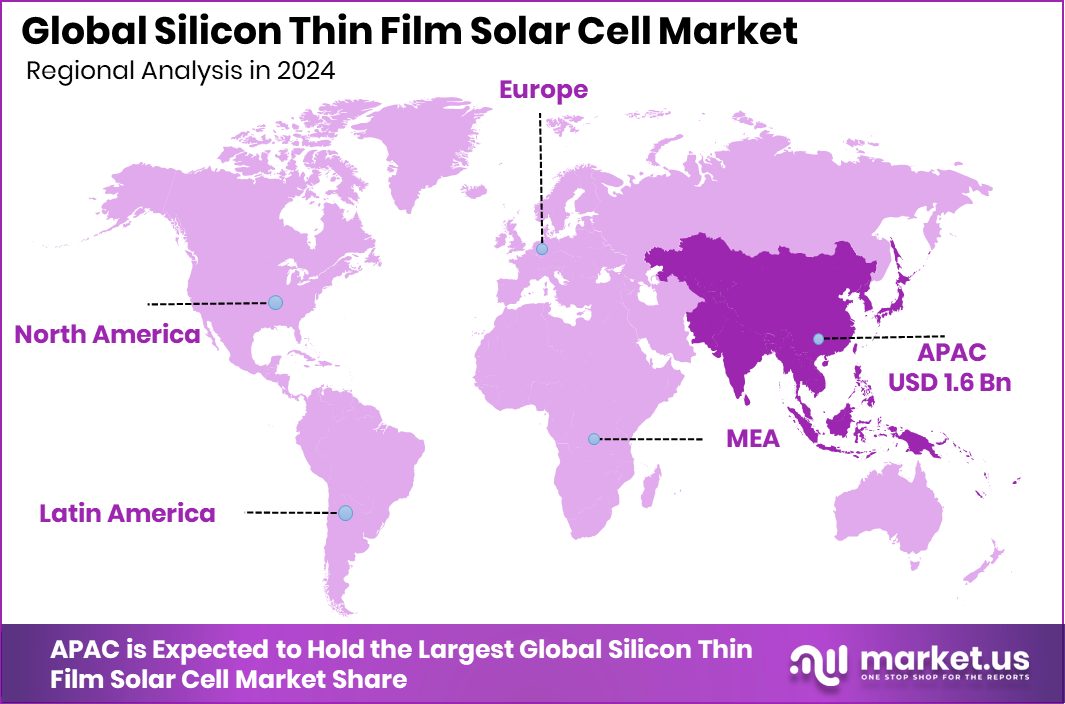

The Global Silicon Thin Film Solar Cell Market is expected to be worth around USD 9.1 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034. Asia Pacific dominance reflects 43.9% Silicon Thin Film Solar Cell Market share, USD1.6Bn.

Silicon Thin Film Solar Cell is a photovoltaic technology where very thin layers of silicon are deposited on glass, metal, or plastic surfaces to convert sunlight into electricity. Unlike crystalline panels, it uses less silicon, performs better in low light, and allows flexible or lightweight designs.

Silicon Thin Film Solar Cell Market refers to the production, use, and deployment of these cells across residential, commercial, and utility-scale applications. The market benefits from growing rooftop installations, building-integrated solar designs, and policy support focused on affordable and space-efficient solar solutions.

Growth factors include continuous public funding and research backing. The amorphous silicon program funded by the Commission of European Communities at around $2.4 million per year supports efficiency improvements and cost optimisation. Such long-term research funding helps strengthen manufacturing know-how and application diversity.

Demand is rising due to easier financing and rooftop programs. Rooftop solar-focused NBFC Dugar Finance raised $3 Mn in debt, while Fibe launched a rooftop solar financing solution partnering with 100 solar EPC firms. These steps reduce upfront costs and speed up rooftop adoption.

Opportunities are expanding through government initiatives. The government rolled out a Rs 2.3 Crore startup challenge to boost rooftop solar energy solutions, while Haryana announced a Rs 200 crore fund with battery storage backing. These moves create strong openings for thin-film adoption in decentralised energy systems.

Key Takeaways

- The Global Silicon Thin Film Solar Cell Market is expected to be worth around USD 9.1 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034.

- Amorphous silicon dominates the Silicon Thin Film Solar Cell Market with 67.2% share due to efficiency.

- Utility-scale applications hold 41.5% in the Silicon Thin Film Solar Cell Market, driven by solar projects.

- Rooftop installations lead the Silicon Thin Film Solar Cell Market with 69.8% supporting decentralised power needs.

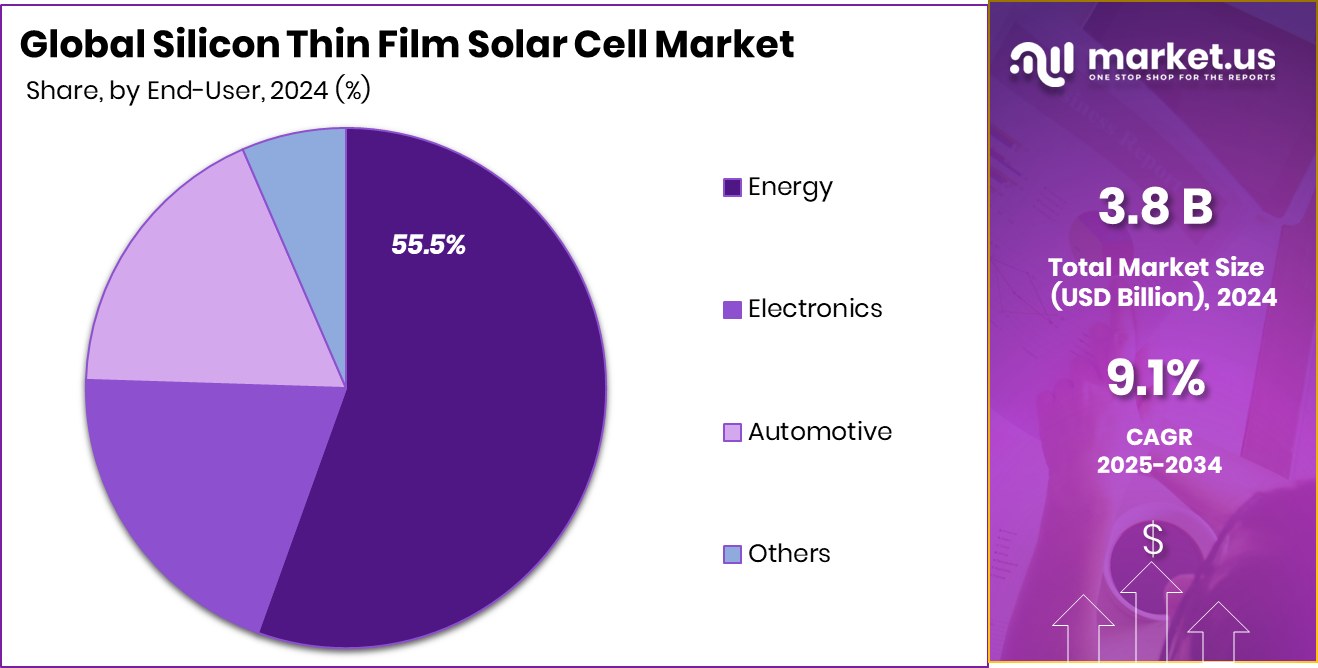

- Energy end-users account for 55.5% of the Silicon Thin Film Solar Cell Market consumption globally today.

- In the Asia Pacific, the Silicon Thin Film Solar Cell Market reached a 43.9% share of USD1.6Bn

By Type Analysis

Amorphous silicon leads the Silicon Thin Film Solar Cell Market with 67.2% share, driven by low-light performance.

In 2024, Amorphous Silicon held a dominant market position in the By Type segment of the Silicon Thin Film Solar Cell Market, with a 67.2% share. This leadership reflects its strong acceptance across rooftop and distributed solar installations, where lightweight structure and flexibility are key requirements.

Amorphous silicon cells perform reliably under low-light and high-temperature conditions, making them suitable for urban environments and varied climates. Their lower material usage and simpler manufacturing process support cost-efficient production, which encourages wider deployment in residential and commercial applications.

The technology’s ability to be integrated into thin, compact designs also strengthens its relevance in space-constrained settings. As solar adoption continues to move toward rooftops and building-integrated solutions, amorphous silicon maintains a clear advantage within the thin film category, reinforcing its dominant position in the market during 2024.

By Application Analysis

Utility-scale projects account for 41.5% of the Silicon Thin Film Solar Cell Market, supported by large installations.

In 2024, Utility-Scale held a dominant market position in the By Application segment of the Silicon Thin Film Solar Cell Market, with a 41.5% share. This dominance is closely linked to the suitability of thin film technology for large solar installations that require consistent output and efficient land utilisation.

Utility-scale projects benefit from the stable performance of silicon thin film modules under varying light conditions, supporting reliable energy generation across extended areas. Their uniform appearance and ease of installation also align well with large-scale solar park requirements.

As grid-connected solar capacity continues to expand, utility-scale deployments remain a key application area, allowing silicon thin-film solar cells to achieve significant penetration and sustain their leading role within this segment during 2024.

By Installation Analysis

Rooftop installations dominate the Silicon Thin Film Solar Cell Market with 69.8% share globally.

In 2024, Rooftop held a dominant market position in the By Installation segment of the Silicon Thin Film Solar Cell Market, with a 69.8% share. This strong position reflects the growing use of silicon thin film technology in space-constrained urban and semi-urban settings, where rooftop installations are preferred.

Thin-film solar cells are well-suited for rooftops due to their lightweight structure and adaptability to varied building designs. Their ability to deliver stable output under diffused sunlight supports consistent performance in densely populated areas.

Rooftop installations also allow property owners to utilise existing surfaces efficiently, encouraging wider adoption. As decentralised solar generation continues to gain importance, rooftop installations remain the primary channel supporting the dominant presence of silicon thin-film solar cells within this segment in 2024.

By End-User Analysis

Energy end-users represent 55.5% of the Silicon Thin Film Solar Cell Market, driven by sustainability goals.

In 2024, Energy held a dominant market position in the By End-User segment of the Silicon Thin Film Solar Cell Market, with a 55.5% share. This dominance is driven by the extensive use of silicon thin-film solar cells in power generation activities focused on stable and scalable electricity output.

The energy sector benefits from the technology’s ability to perform consistently under diverse environmental conditions, supporting a steady energy supply across different project sizes. Thin film solutions also align well with long operating lifecycles, which is essential for energy-focused applications.

As energy demand continues to rise alongside the transition toward cleaner power sources, the energy end-user segment maintains a leading role, reinforcing its dominant position within the silicon thin-film solar cell market in 2024.

Key Market Segments

By Type

- Amorphous Silicon

- Microcrystalline Silicon

- Others

By Application

- Residential

- Commercial

- Industrial

- Utility-Scale

By Installation

- Rooftop

- Ground-Mounted

By End-User

- Energy

- Electronics

- Automotive

- Others

Driving Factors

Affordable Rooftop Financing Accelerates Thin Film Adoption

A major driving factor for the Silicon Thin Film Solar Cell Market is the growing affordability created by flexible rooftop financing models. When monthly payment options reduce the upfront burden, more households and small businesses find solar adoption practical and low risk.

Thin film solar cells benefit directly from this shift because they are lightweight, adaptable to varied roof types, and suitable for quick installations. The launch of rooftop solar financing plans offering systems at ₹2,449 per month in Rajasthan has strengthened consumer confidence and widened access to solar ownership.

Such schemes encourage long-term adoption by aligning energy savings with predictable monthly costs. As affordability improves, demand naturally rises, pushing silicon thin film solutions deeper into residential markets and reinforcing steady market expansion through broader participation.

Restraining Factors

High Capital Intensity Slows Widespread Market Penetration

A key restraining factor for the Silicon Thin Film Solar Cell Market is the high capital requirement needed for large-scale manufacturing and deployment. While the technology offers clear long-term benefits, the initial investment in production facilities, installation infrastructure, and network expansion remains significant.

Even though Solar Landscape secured $175 million from PGIM Private Capital to expand distributed rooftop solar installations, such large funding rounds highlight how capital-heavy the sector is. Smaller developers and new entrants often struggle to access similar financial strength, which limits faster market expansion.

Funding tends to concentrate projects among well-funded players, slowing equal adoption across regions. As a result, despite strong interest, high upfront capital needs continue to act as a restraint on broader and faster growth of silicon thin film solar cell deployment.

Growth Opportunity

Mass Rooftop Deployment Creates Strong Expansion Opportunity

A major growth opportunity for the Silicon Thin Film Solar Cell Market comes from large-scale rooftop solar deployment. When adoption reaches scale, thin-film technology gains wider visibility and trust due to its lightweight structure and suitability for rooftops.

The installation of 1 million units under a rooftop solar scheme shows how quickly demand can rise when supportive programs are in place. Such wide deployment creates repeat demand for efficient, space-saving solar solutions that work well in residential and small commercial buildings.

As rooftops become key energy assets, thin-film solar cells can benefit from steady replacement cycles and new installations. This large installed base also helps improve supply chains and installation skills, creating long-term growth momentum across both urban and semi-urban regions.

Latest Trends

Large-Scale Rooftop Electrification Driving Thin Film Demand

A key latest trend in the Silicon Thin Film Solar Cell Market is the rapid expansion of rooftop electrification programs aimed at households. Silicon thin-film solar cells are increasingly preferred for such schemes because they are lightweight, perform well in diffused sunlight, and can be installed on different roof structures.

The plan by SBI to support a rooftop solar scheme targeting 40 lakh homes highlights how solar adoption is moving directly into residential areas. This scale of rollout creates steady demand for rooftop-suitable technologies rather than only utility projects.

As homes become direct energy producers, thin-film solutions gain attention for ease of installation and stable output. This trend signals a strong shift toward decentralised solar generation, shaping current market dynamics.

Regional Analysis

Asia Pacific leads the Silicon Thin Film Solar Cell Market at 43.9% share, USD 1.6 Bn

Asia Pacific dominates the Silicon Thin Film Solar Cell Market, accounting for 43.9% of the market and valued at USD 1.6 Bn. This leadership is driven by a strong regional focus on solar deployment across residential, commercial, and utility-scale applications. Dense urban development and limited rooftop load capacity have supported the adoption of lightweight thin-film solutions. The region’s emphasis on expanding solar access across cities and semi-urban areas continues to reinforce its leading position, making the Asia Pacific the most influential contributor to overall market activity.

North America represents a steady market landscape shaped by consistent solar adoption across distributed and grid-connected systems. The region shows strong alignment with thin film usage in applications where flexible design and stable performance are required, particularly in rooftop and large installation formats.

Europe maintains a structured market presence supported by long-standing experience with thin film technologies. The region emphasises efficiency, architectural integration, and long operational life, making silicon thin-film solar cells relevant for diverse installations.

Middle East & Africa show growing interest in solar technologies suited for challenging climatic conditions. Thin film solutions fit regional needs due to reliable performance under high temperatures and varied sunlight levels.

Latin America reflects gradual market development, with increasing acceptance of thin-film solar cells for decentralised energy generation. The region’s focus on expanding solar access supports continued adoption across selected applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

First Solar plays a significant role in the silicon thin film solar cell landscape by focusing on large-scale solar solutions and long-term technology development. In 2024, the company’s strong emphasis on thin-film manufacturing efficiency and lifecycle performance supports its position in delivering dependable solar systems. Its approach is centered on consistent output, durability, and meeting large deployment requirements, making it relevant for long-duration energy generation needs.

Sharp Corporation brings long-standing expertise in electronics and solar technologies into the silicon thin-film solar cell space. In 2024, Sharp continues to apply its engineering strength to improve thin film module reliability and practical integration. The company’s solar activities benefit from its broader experience in precision manufacturing and system design, supporting applications that require stable performance and structured product quality.

Solar Frontier K.K. remains closely associated with thin-film solar advancement, particularly through refining silicon-based thin-film solutions. In 2024, the company’s focus on improving conversion efficiency and real-world performance strengthens its relevance in markets seeking dependable output under varied conditions. Its sustained commitment to thin film technology development reinforces its role within the global silicon thin film solar cell ecosystem.

Top Key Players in the Market

- First Solar

- Sharp Corporation

- Solar Frontier K.K.

- Kaneka Corporation

- Mitsubishi Electric Corporation

- Trony Solar Holdings Co., Ltd.

- Hanergy Thin Film Power Group Limited

- Ascent Solar Technologies, Inc.

- Global Solar Energy, Inc.

- Heliatek GmbH

- Solopower Systems, Inc.

Recent Developments

- In February 2025, Sharp announced that its subsidiary’s European solar arm (Sharp Energy Solutions Europe, SESE) would exit the European solar market, with business to cease. All existing warranties and support will be provided by its parent entity.

- In February 2024, the company secured a contract supply agreement: SolAmerica Energy, LLC agreed to procure 205 MW DC of First Solar’s Series 6 Plus / Series 7 thin-film modules, scheduled for delivery in 2024–2025.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 9.1 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Amorphous Silicon, Microcrystalline Silicon, Others), By Application (Residential, Commercial, Industrial, Utility-Scale), By Installation (Rooftop, Ground-Mounted), By End-User (Energy, Electronics, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape First Solar, Sharp Corporation, Solar Frontier K.K., Kaneka Corporation, Mitsubishi Electric Corporation, Trony Solar Holdings Co., Ltd., Hanergy Thin Film Power Group Limited, Ascent Solar Technologies, Inc., Global Solar Energy, Inc., Heliatek GmbH, Solopower Systems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silicon Thin Film Solar Cell MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Silicon Thin Film Solar Cell MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- First Solar

- Sharp Corporation

- Solar Frontier K.K.

- Kaneka Corporation

- Mitsubishi Electric Corporation

- Trony Solar Holdings Co., Ltd.

- Hanergy Thin Film Power Group Limited

- Ascent Solar Technologies, Inc.

- Global Solar Energy, Inc.

- Heliatek GmbH

- Solopower Systems, Inc.