Global Silicon Oil Market Size, Share Analysis Report By Product Types (Straight Silicon Oil, Modified Silicon Oil), By Application (Lubricants, Water Repellents, Working Media, Heat Carrier, Others), By End Use (Automotive, Healthcare, Personal Care and Cosmetics, Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160805

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

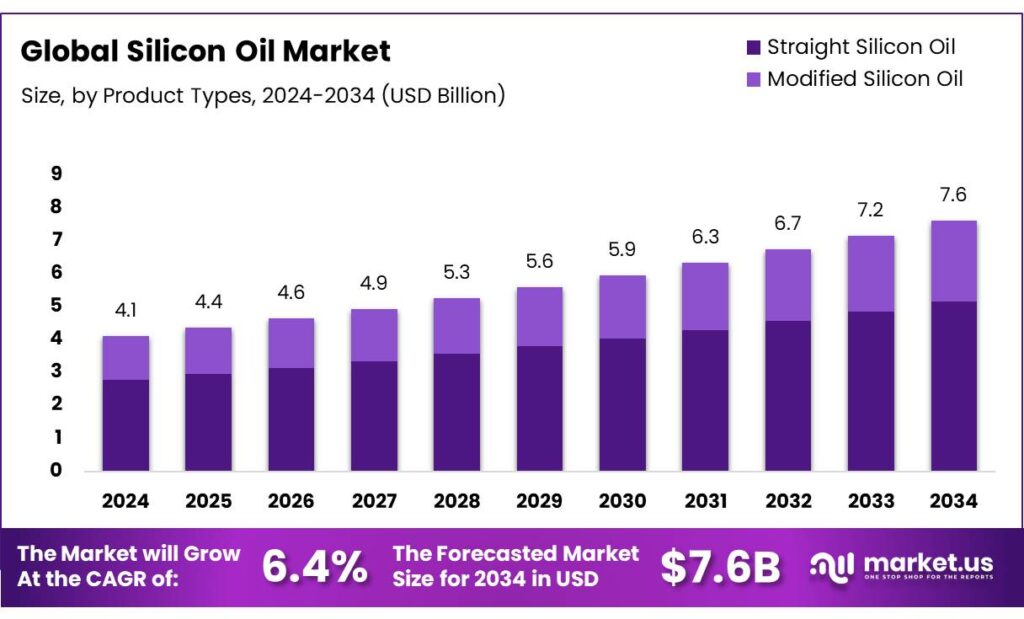

The Global Silicon Oil Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Silicone oil (also called polysiloxane fluids, e.g. polydimethylsiloxane) is a class of silicon-oxygen polymers with organic side chains that remain liquid at ambient temperatures. These fluids are prized for their high thermal stability, excellent dielectric properties, low surface tension, chemical inertness, and broad temperature operating window. They find applications as lubricants, hydraulic fluids, antifoam agents, heat transfer media, release agents, electrical insulators, and additives in personal care and coatings.

Key drivers underpinning growth in the silicone oil industry include strong end-use demand from personal care, automotive, electronics, construction, and renewable energy sectors. In personal care, silicones impart favorable sensorial properties and find use in hair care, skin care, and cosmetics. In automotive and electronics, silicone oils serve as high-performance lubricants, heat transfer fluids, dielectric fluids, and sealants. The rise of electric vehicles (EVs) and power electronics increases demand for reliable thermal fluids and insulating materials, which benefits silicone oil adoption.

The energy sector itself consumes large volumes of silicone-based materials: globally, ~962,000 tons of silicone products are used annually in energy applications, including as encapsulants, adhesives, and insulating fluids.

Silicone oils are synthetic polymers known for their unique properties, including high thermal stability, low toxicity, and excellent lubricity. These characteristics make them indispensable in applications such as lubricants, sealants, anti-foam agents, hydraulic fluids, and dielectric fluids. Industries including automotive, electronics, personal care, and construction significantly contribute to the demand for silicone oils. For instance, the automotive sector utilizes silicone oils for lubrication and damping applications, while the electronics industry employs them for thermal management and insulation purposes.

Key Takeaways

- Silicon Oil Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 6.4%.

- Straight Silicon Oil held a dominant market position, capturing more than a 67.8% share of the global silicone oil market.

- Lubricants held a dominant market position within the silicone oil industry, capturing more than a 38.3% share.

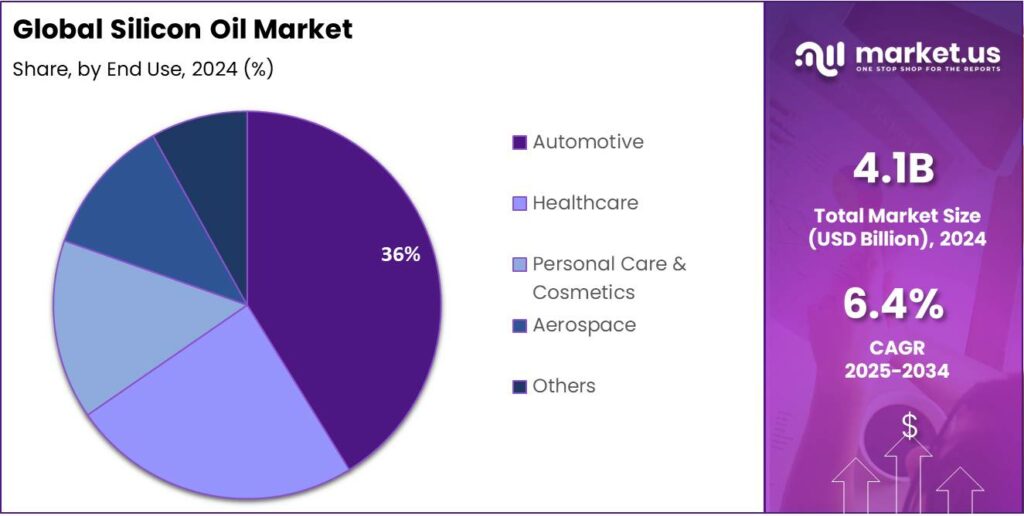

- Automotive segment held a dominant market position in the silicone oil industry, capturing more than a 35.7% share.

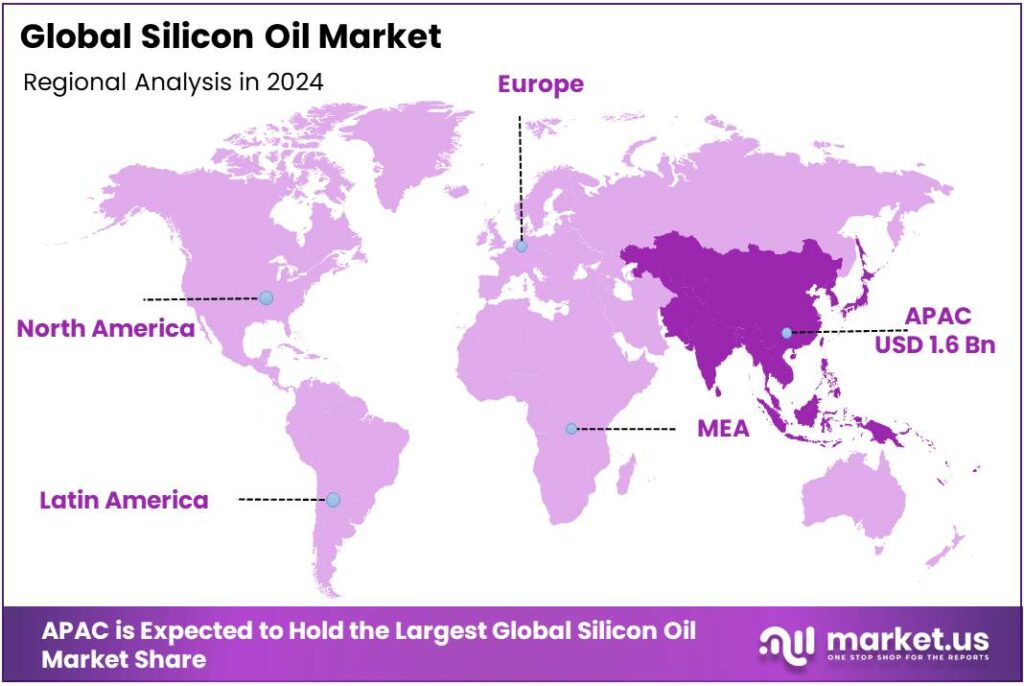

- Asia Pacific region emerged as the dominant market for silicone oils, capturing a substantial 39.7% share, equating to an estimated market value of USD 1.6 billion.

By Product Types Analysis

Straight Silicon Oil dominates with 67.8% share in 2024 due to its versatility and broad industrial applications.

In 2024, Straight Silicon Oil held a dominant market position, capturing more than a 67.8% share of the global silicone oil market. This prominence can be attributed to its unique properties, including excellent thermal stability, low surface tension, and superior lubricating performance, which make it suitable for a wide range of industrial applications. Key industries such as automotive, electronics, construction, and personal care heavily rely on Straight Silicon Oil for uses like lubricants, anti-foam agents, sealants, and dielectric fluids. Its effectiveness in enhancing product performance and extending equipment life has driven widespread adoption across these sectors.

The demand for Straight Silicon Oil has shown a consistent upward trend in 2024, supported by growing industrial automation, increasing production of electric vehicles, and the expanding electronics sector that requires reliable thermal management solutions. Additionally, regulatory encouragement for environmentally friendly and energy-efficient materials has indirectly bolstered its usage. Manufacturers favor Straight Silicon Oil for its inertness and compatibility with other materials, ensuring safety in applications ranging from medical devices to personal care products.

By Application Analysis

Lubricants dominate with 38.3% share in 2024 driven by high demand across automotive and industrial sectors.

In 2024, Lubricants held a dominant market position within the silicone oil industry, capturing more than a 38.3% share. The strong adoption of silicone-based lubricants can be attributed to their exceptional thermal stability, low friction, and long-lasting performance under extreme conditions. These properties make them highly suitable for automotive engines, industrial machinery, and precision equipment, where reliable lubrication is essential to reduce wear and enhance efficiency.

The segment’s growth in 2024 has been supported by increasing industrial automation and the rising production of electric and hybrid vehicles, which demand specialized lubricants for smooth operation and battery thermal management. Additionally, silicone lubricants are preferred in applications requiring chemical inertness, such as in food processing equipment and delicate electronic components, ensuring safety and durability.

By End Use Analysis

Automotive leads with 35.7% share in 2024 due to growing demand for high-performance materials in vehicles.

In 2024, the Automotive segment held a dominant market position in the silicone oil industry, capturing more than a 35.7% share. The growth of this segment is largely driven by the increasing use of silicone oils in vehicle lubrication, damping systems, and thermal management applications. Silicone oils are preferred in the automotive sector because of their high thermal stability, low volatility, and excellent resistance to oxidation, which enhance engine efficiency and prolong the life of automotive components.

The rising adoption of electric and hybrid vehicles has further fueled the demand for silicone oils in thermal management of batteries and electronic systems, where precise temperature control is critical. Moreover, automotive manufacturers are increasingly integrating silicone-based sealants and lubricants into engines, transmissions, and suspension systems to improve performance and reduce maintenance needs.

Key Market Segments

By Product Types

- Straight Silicon Oil

- Modified Silicon Oil

By Application

- Lubricants

- Water Repellents

- Working Media

- Heat Carrier

- Others

By End Use

- Automotive

- Healthcare

- Personal Care & Cosmetics

- Aerospace

- Others

Emerging Trends

Rise of Bio‑Based & Sustainable Silicone Oils in Food Applications

One of the most compelling trends shaping the silicone oil space is the growing shift toward bio‑based, greener, and more sustainable formulations, especially in food and food-contact applications. This development is not just technical evolution—it reflects changing consumer values, regulatory pressure, and the food industry’s drive to reduce environmental footprints.

The push toward sustainability in food systems is gaining real traction. Governments and regulatory bodies are tightening rules around chemicals migrating from materials into food, and consumers increasingly demand transparency and eco‑friendly ingredients. For example, studies on silicone molds used in baking found that some products showed measurable migration of siloxanes during heating (e.g. triple sequential migration assays at 100 °C for 8 h) in real‑world use scenarios. Such findings increase pressure on producers to use purer, safer, and more stable silicone formulations. The trend toward low‑migration, high‑stability silicone oils is therefore aligned with safer material demands.

In response, specialty chemical firms and silicone oil manufacturers are investing in “greener silicones” — formulations that incorporate bio‑derived feedstocks, reduce residual byproducts, or enable easier recycling. The idea is to maintain the high thermal and chemical stability that silicone oils are prized for, while improving life-cycle environmental performance. This trend is especially pertinent in food and packaging sectors, where regulators often push for safer, low-migration, and non-toxic materials.

Another trend is custom, high-purity, application-specific grades of silicone oil. Food processors don’t always need a one-size-fits-all product—they want oils tailored for baking release, anti-foaming in beverages, or clean lubricants for machinery. Producers are responding by offering low‑viscosity, ultra‑low contaminant, food-grade H1/3H certified variants that minimize unwanted residues. This specialization trend is accelerating as food plants become more automated and precise.

Drivers

Exceptional Thermal and Chemical Stability

One of the strongest and most persuasive drivers for the growth and adoption of silicone oil is its outstanding thermal and chemical stability. In simple terms, silicone oil can withstand wide temperature ranges, resist breakdown under heat or chemical attack, and maintain performance under challenging conditions. That reliability makes it especially valuable in sectors where conditions are harsh and materials must remain safe, consistent, and durable.

Silicone oils are known to retain stability across temperatures from roughly –60 °C up to +230 °C, and even beyond in specialized grades. They are favored in industrial settings such as heating baths, transformer insulation, or as anti-foaming agents in food processing, where conventional hydrocarbons or mineral oils would degrade or oxidize. This durability means less need for frequent replacement or maintenance, which cuts down downtime and cost—this is a practical benefit users readily value.

In the food and beverage industry, where safety and purity are paramount, the inertness of silicone oil is a major virtue. Food-grade silicone oil must pass rigorous regulatory controls—like meeting FDA’s standards for food-contact materials (21 CFR 177.2600). Because the oil does not react with food ingredients and resists chemical migration, it is used as a release agent, anti-foam, or lubricant right in contact with food machinery and products. The assurance that silicone oil will not break down under normal operating conditions helps food manufacturers maintain product quality and regulatory compliance.

Government and regulatory frameworks also support usage of stable materials. For instance, agencies like the U.S. FDA require that food-contact substances demonstrate chemical stability, low migration, and safety under repeated use. These rules effectively favor substances like silicone oils over less stable alternatives. In many countries, national standards or food safety authorities mirror similar criteria, encouraging food processors to shift to more stable, inert components in their machinery and process fluids.

Restraints

High Cost And Price Volatility

One of the biggest restraints limiting the wider adoption of silicone oil—especially in cost‑sensitive sectors like food processing—is its high cost and associated price volatility. This isn’t just a technical quirk—it affects purchasing decisions, margins, and supply chain stability, which in turn can slow down uptake even when users like its performance.

Silicone oil, particularly high purity or food‑grade variants, tends to cost substantially more than conventional mineral oils, esters, or synthetic hydrocarbon fluids. In industrial form, standard silicone oils often trade at USD 5 to 20 per kilogram, while ultra‑high purity grades (for specialty uses) may command USD 50 or more per kilogram. Silicone oil, particularly high purity or food‑grade variants, tends to cost substantially more than conventional mineral oils, esters, or synthetic hydrocarbon fluids. In industrial form, standard silicone oils often trade at USD 5 to 20 per kilogram, while ultra‑high purity grades (for specialty uses) may command USD 50 or more per kilogram.

Beyond base cost, the price of silicone oil is subject to import tariffs, raw material fluctuations, and supply chain disruptions, which magnify risk for buyers. For example, in April 2025, the U.S. imposed a 125 % tariff on certain silicones imported from China, sharply increasing the landed cost of silicone oils in American markets. Such tariff shocks ripple through to global suppliers too, tightening margins or causing price surges that deter new contracts. In global markets where buyers see sudden swings, adopting silicone oil becomes a risk not just on performance but on cost certainty.

Opportunity

Expansion in Food‑Processing & Bakery Applications

One of the most promising growth opportunities for silicone oil lies in its increasing adoption within food processing, baking, and confectionery operations. In these settings, silicone oil serves as a release agent, anti‑foaming additive, lubricant for machinery, and in certain formulation aids. As the global food industry grows, the demand for reliable, inert, and safe process aids rises—and silicone oil is well placed to benefit.

In bakery and confectionery, silicone oils are widely used as baking release agents (on pans, molds), improving texture, surface finish, and reducing waste by ensuring cakes or candies do not stick. As urbanization accelerates and disposable incomes rise in many developing markets, consumption of baked goods, ready-to-eat snacks, and convenience foods is growing. The Food and Agriculture Organization (FAO) of the United Nations projects that global food production will need to increase by around 70 % by 2050 to meet demand from growing population and changing diets.

Governments and industry regulators in some markets are also promoting modernization of food processing and incentives for safer, higher efficiency technologies. For instance, in India, broader industrial schemes like “Make in India” and pushes for upgrading food processing infrastructure can indirectly support adoption of higher‑quality process aids (though I did not find a direct scheme specific to silicone oil in food). In the U.S., clean energy and sustainable manufacturing incentives are being leveraged, such as the Investment Tax Credit (ITC) which supports capital investment in clean technologies.

Regional Insights

Asia Pacific leads with 39.7% share in 2024, valued at USD 1.6 billion, driven by industrial demand and economic growth.

In 2024, the Asia Pacific region emerged as the dominant market for silicone oils, capturing a substantial 39.7% share, equating to an estimated market value of USD 1.6 billion. This leadership position is primarily attributed to the region’s robust industrial base, rapid urbanization, and increasing demand across various end-use sectors.

China stands out as a key contributor, accounting for approximately 44% of the region’s silicone consumption and 62% of its production. The nation’s significant manufacturing capabilities and expansive industrial activities bolster its position as a central hub for silicone oil utilization. Additionally, China’s role as a net exporter, responsible for 71% of the region’s silicone exports, underscores its pivotal role in the global supply chain.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wacker Chemie AG, headquartered in Munich, Germany, is a leading global supplier of specialty chemicals, including silicone products. In 2024, the company reported sales of €5.72 billion, a decline from €6.44 billion in 2023, primarily due to lower prices and reduced demand in sectors like automotive and construction. Despite these challenges, Wacker anticipates a 10% growth in its silicones division in 2025, driven by strong demand in specialty products and semiconductor-grade polysilicon.

BCD Chemie GmbH, based in Germany, specializes in distributing a wide range of chemicals, including silicone oils and emulsions. The company offers products under the Xiameter™ and Dowsil™ brands, in partnership with Dow Silicones. BCD Chemie provides various silicone oils with different viscosities, modified silicone oils, and corresponding silicone oil emulsions, catering to diverse industrial applications.

AL.CHI.MI.A. Srl, based in Italy, is renowned for producing ultra-purified polydimethylsiloxane silicone oils, particularly for ophthalmic surgeries. Their RS-OIL product line, available in viscosities ranging from 1,000 to 5,700 cSt, ensures long-term stable tamponade in retinal detachment management. With over 250,000 packages sold globally over the past decade, AL.CHI.MI.A. has established itself as a trusted supplier in the medical field.

Top Key Players Outlook

- Wacker Chemie AG

- BCD Chemie GmbH

- Clearco Products Co, Inc.

- AL.CHI.MI.A. srl

- Elkem ASA

- Silitex S.r.l.

- LHCHEM

- ARIHANT SOLVENTS AND CHEMICALS

- ALSTONE INDUSTRIES PVT. LTD

- SILIBASE SILICONE

Recent Industry Developments

In 2024, Wacker Chemie AG, a global specialty chemicals company headquartered in Munich, Germany, reported total sales of €5.72 billion, a decrease of 11% compared to the previous year.

In trade activity, BCD Chemie also is active internationally: in 2024 it featured in 62 U.S. shipments per Panjiva trade records.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 7.6 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Types (Straight Silicon Oil, Modified Silicon Oil), By Application (Lubricants, Water Repellents, Working Media, Heat Carrier, Others), By End Use (Automotive, Healthcare, Personal Care and Cosmetics, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wacker Chemie AG, BCD Chemie GmbH, Clearco Products Co, Inc., AL.CHI.MI.A. srl, Elkem ASA, Silitex S.r.l., LHCHEM, ARIHANT SOLVENTS AND CHEMICALS, ALSTONE INDUSTRIES PVT. LTD, SILIBASE SILICONE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wacker Chemie AG

- BCD Chemie GmbH

- Clearco Products Co, Inc.

- AL.CHI.MI.A. srl

- Elkem ASA

- Silitex S.r.l.

- LHCHEM

- ARIHANT SOLVENTS AND CHEMICALS

- ALSTONE INDUSTRIES PVT. LTD

- SILIBASE SILICONE