Global Sex Toys Market Size, Share, Growth Analysis By Product (Vibrators, Dildos, Penis Rings, Anal Toys, Masturbation Sleeves, Sex Dolls, Others), By Distribution Channel (E-commerce, Specialty Stores, Mass Merchandisers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165567

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

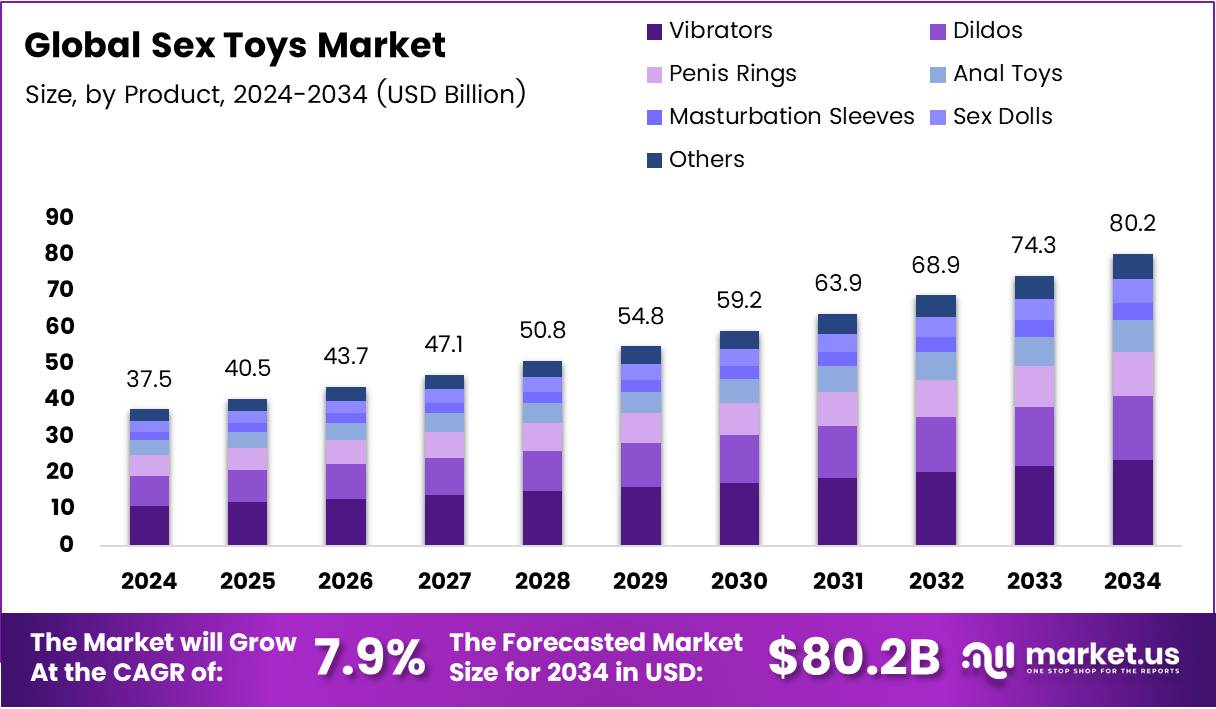

The Global Sex Toys Market size is expected to be worth around USD 80.2 Billion by 2034, from USD 37.5 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The sex toys market represents a growing segment within the global personal wellness industry, driven by rising awareness, lifestyle changes, and increasing acceptance of intimacy products. It includes vibrators, stimulators, lubricants, and smart devices designed to enhance personal pleasure and wellness. As cultural taboos decline, the industry continues shifting toward mainstream visibility.

Furthermore, the market benefits from rapid digital retail expansion and higher consumer openness toward self-care solutions. Manufacturers are focusing on ergonomic design, body-safe materials, and discreet technology that supports privacy. This evolution encourages consistent product innovation while strengthening consumer trust, ultimately transforming sex toys into essential personal wellness items rather than niche accessories.

Additionally, several countries are gradually improving regulatory clarity for safety standards, materials testing, and responsible marketing practices. These regulations aim to protect consumers while supporting legitimate manufacturers. As frameworks strengthen, market investments increase, encouraging safer production environments and reducing the circulation of low-quality or unregulated products.

Moreover, the growing preference for online shopping significantly enhances market reach. Digital platforms provide privacy, wider product selections, and convenient delivery options. Combined with rising consumer education about sexual health, this shift creates strong opportunities for product diversification, new user adoption, and long-term market expansion across both emerging and developed regions.

As demand expands, the market increasingly aligns with broader wellness trends, where consumers prioritize personal comfort, mental health, and relationship enhancement. Younger buyers embrace these products as part of self-exploration, while older demographics seek discreet solutions for improved intimacy. These evolving behaviors continue shaping product development and category sophistication within the Sex Toys Market.

According to the report, most sex toy sales center on female-focused products, reflecting shifting empowerment and wellness priorities. The report also states that 69% of women aged 18-60 have a vibrator, while 82% of women own at least one sex toy, signaling strong and consistent female purchasing power within the category.

Finally, according to the report, 78% of Americans owned a sex toy in 2023, rising from 65% in 2017, showing steady market growth. The report further indicates that 70% of the US population purchases sex toys online, whereas only 31% buy them in physical stores, confirming strong digital-first consumer behavior and expanding market opportunities.

Key Takeaways

- Global Sex Toys Market valued at USD 37.5 Billion in 2024 and projected to reach USD 80.2 Billion by 2034 at a 7.9% CAGR.

- Vibrators lead the product segment with a 29.4% market share in 2024.

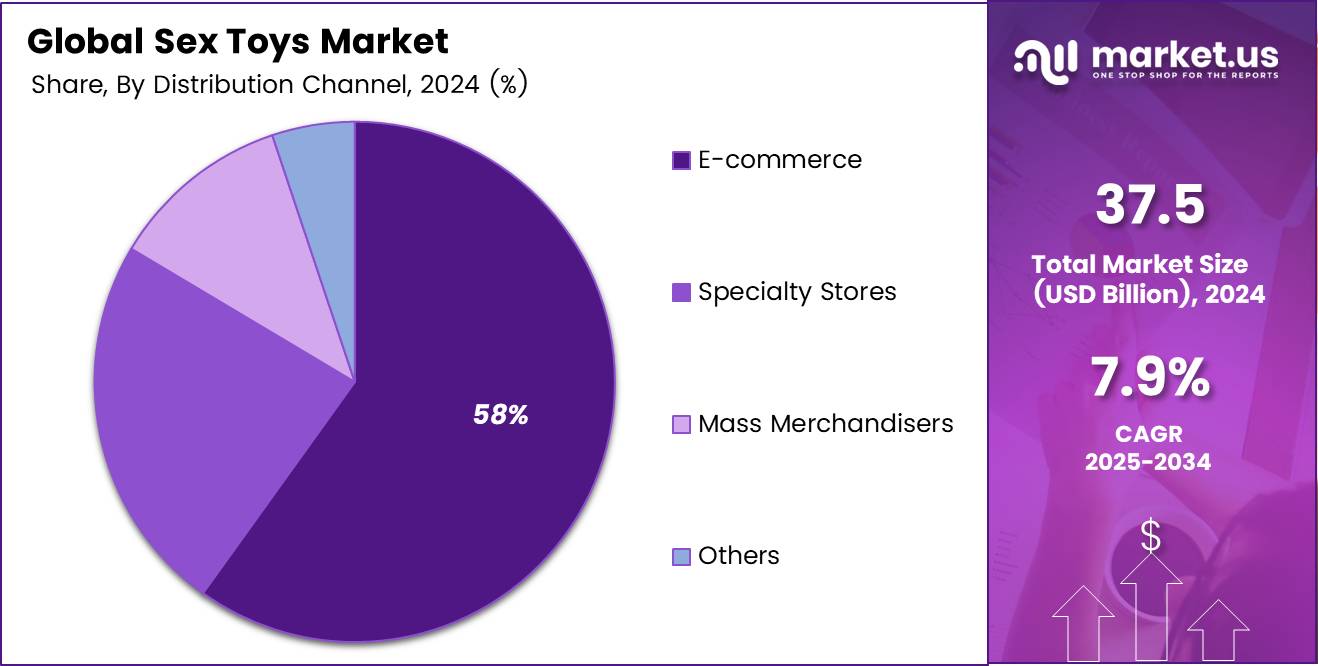

- E-commerce dominates distribution channels with a 58.3% share due to privacy and convenience.

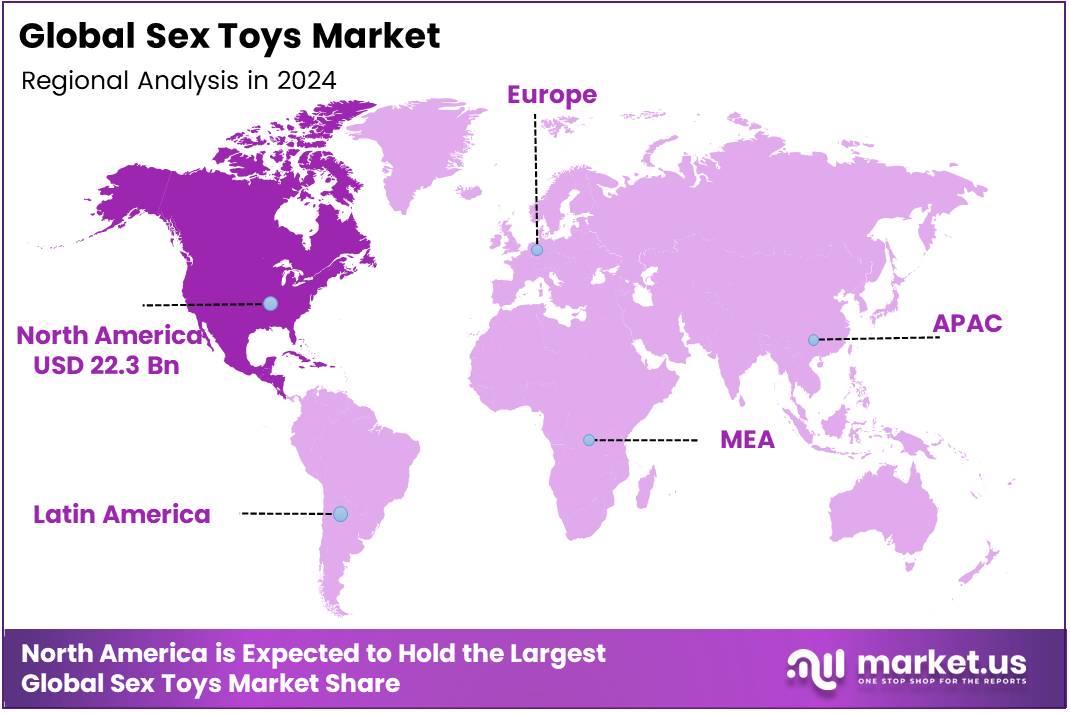

- North America holds the largest regional share at 59.7%, valued at USD 22.3 Billion.

By Product Analysis

Vibrators dominate with 29.4% due to their versatility, technological enhancements, and broad consumer acceptance.

In 2024, Vibrators held a dominant market position in the By Product segment of the Sex Toys Market, with a 29.4% share. This leadership stems from expanding product innovations, including app-controlled features and discreet designs. Additionally, rising female empowerment and growing sexual wellness awareness continue to boost demand across global markets.

Dildos maintained steady demand in the By Product Analysis segment. This category benefits from its simplicity, durability, and diverse material choices. Moreover, consumers increasingly pursue customizable textures and shapes, strengthening steady sales. As sexual openness progresses, the acceptance and adoption of dildos continue to rise.

Penis Rings advanced within the By Product segment by delivering enhanced pleasure and performance support. These products appeal to couples seeking intimacy improvement. Furthermore, their affordability and ease of use attract first-time buyers. Growing awareness through online platforms continues to support strong market visibility.

Anal Toys experienced growing adoption across diverse user groups. Enhanced safety materials, ergonomic designs, and improved hygiene standards strengthen consumer confidence. Additionally, shifting attitudes toward experimenting with intimacy have expanded the segment’s reach. Educational content and e-commerce promotion further accelerate acceptance.

Masturbation Sleeves gained traction as consumers sought realistic and immersive experiences. Advances in materials, suction technologies, and textural variety contribute to increased demand. Moreover, discreet packaging and online availability encourage broader adoption. As male sexual wellness becomes more openly discussed, this segment enjoys expanding interest.

Sex Dolls continued to evolve through lifelike designs and premium silicone innovations. These enhancements elevate realism and long-term durability. Additionally, rising consumer curiosity and advances in robotics stimulate niche but consistent growth. Wider availability and customization options support their expanding market presence.

Others in the By Product segment included a mix of emerging pleasure devices addressing diverse preferences. These offerings benefit from constant product experimentation and evolving consumer curiosity. As manufacturers introduce multifunctional designs, this category captures users seeking novelty, further enriching the broader sex toys market.

By Distribution Channel Analysis

E-commerce dominates with 58.3% due to convenience, privacy, and extensive product availability.

In 2024, E-commerce held a dominant market position in the By Distribution Channel segment of the Sex Toys Market, with a 58.3% share. Its growth is supported by discreet delivery, vast assortments, competitive pricing, and user-friendly digital interfaces that simplify product education and comparison.

Specialty Stores continued serving customers who prefer personalized guidance. These stores offer curated collections, knowledgeable staff, and hands-on product visibility. As consumers seek safe purchasing environments, specialty outlets maintain relevance by enhancing comfort and trust across diverse demographic groups.

Mass Merchandisers expanded accessibility by integrating sexual wellness products into mainstream retail spaces. Their wide reach, competitive pricing, and familiarity encourage new buyers. Additionally, discreet placement and increased normalization within retail environments strengthen category growth.

Others within the distribution segment captured customers through boutique outlets, independent sellers, and alternative retail platforms. These channels cater to niche preferences and localized buying behaviors. As consumer curiosity rises, these varied distribution points help broaden overall market penetration.

Key Market Segments

By Product

- Vibrators

- Dildos

- Penis Rings

- Anal Toys

- Masturbation Sleeves

- Sex Dolls

- Others

By Distribution Channel

- E-commerce

- Specialty Stores

- Mass Merchandisers

- Others

Drivers

Rising Mainstream Acceptance of Sexual Wellness Products Drives Market Expansion

Growing social acceptance of sexual wellness products is a major driver for the sex toys market. As conversations about sexual health become more open, consumers feel more comfortable exploring products that support personal well-being. This shift is also influenced by educational campaigns and lifestyle influencers who normalize intimate wellness as part of self-care.

The rapid rise of e-commerce is further accelerating market growth. Online platforms allow consumers to shop discreetly, compare products, and access a wider range of options. This convenience attracts new users who prefer privacy and anonymity in their purchasing decisions.

Another important driver is the industry’s increasing focus on women’s health and pleasure-centered innovations. Many brands now design products that address female anatomy more thoughtfully, supporting empowerment and improved sexual wellness. This shift has broadened the market’s appeal and encouraged greater product diversification.

Technological advancements also play a key role. Smart, app-connected devices allow users to customize experiences, track wellness data, and even interact remotely. These innovations attract tech-savvy consumers seeking personalized solutions. Together, these drivers strengthen market confidence and create a more inclusive, innovative environment that supports long-term demand.

Restraints

Persistent Social Stigma and Cultural Taboos Restrict Market Progress

Despite growing acceptance in some regions, the sex toys market continues to face major restraints due to cultural taboos. In many societies, discussions about sexual wellness remain sensitive, making consumers hesitant to purchase or even research such products. This limits market penetration and slows awareness efforts.

A lack of standardized product safety regulations across different regions is another challenge. Without consistent guidelines, product quality can vary widely, lowering customer trust and discouraging purchases. Companies must navigate complex regulatory environments, which can increase compliance costs and delay product launches.

Legal restrictions in conservative markets further restrict growth. Some countries impose strict rules on the sale, import, or marketing of adult products, limiting access and reducing international expansion opportunities for manufacturers.

Concerns over data privacy also influence consumer behavior, especially with the rise of app-connected and digital sex devices. Users worry about how intimate data is stored or shared, creating hesitation toward adopting smart products. These restraints collectively shape how quickly the market can expand and highlight the need for stronger consumer protection, clearer regulations, and improved educational initiatives.

Growth Factors

Emerging Demand in Developing Economies Creates New Growth Pathways

Rising disposable income and shifting attitudes in developing economies present strong growth opportunities for the sex toys market. As urbanization and digital access increase, more consumers are exploring sexual wellness products for the first time. This opens the door for brands to expand globally through localized marketing and affordable product lines.

There is also growing demand for gender-inclusive and body-safe product ranges. Consumers increasingly seek items that accommodate diverse identities and prioritize non-toxic, medical-grade materials. Brands that innovate in this direction can attract broader audiences and build long-term loyalty.

Partnerships with healthcare providers offer another promising avenue. Sex therapists, gynecologists, and wellness clinics are beginning to recommend certain products for therapeutic purposes, such as pain relief or pelvic health support. These collaborations can help destigmatize the market and position products as part of overall well-being.

The integration of AI-driven personalization presents additional opportunity. Smart algorithms can adapt device settings based on user preferences or wellness data, creating more tailored experiences. This technological advancement appeals to consumers seeking enhanced personalization and positions the market for premium product growth.

Emerging Trends

Surge in Sustainable and Eco-Friendly Materials Shapes Market Trends

Sustainable and eco-friendly product materials are becoming a major trend in the sex toys market. Consumers are increasingly aware of environmental impact and prefer items made from recyclable, biodegradable, or ethically sourced materials. This shift encourages brands to innovate with greener production methods and transparent supply chains.

Compact and travel-friendly products are also gaining popularity. Busy lifestyles and frequent travel create demand for portable, discreet devices that offer convenience without compromising functionality. This trend supports product miniaturization and sleek design innovations.

Social media educators and influencers play a significant role in shaping brand awareness. Through open discussions about sexual wellness, they help normalize product use and guide consumers toward trusted brands. Their educational content reduces stigma and drives engagement among younger audiences.

The adoption of subscription models adds another layer of growth. Sexual wellness kits delivered monthly or quarterly offer curated experiences, boosting customer loyalty and recurring revenue for brands. These kits often include accessories, hygiene items, or new device upgrades, catering to consumers seeking convenience and ongoing product discovery.

Regional Analysis

North America Sex Toys Market Leads the Global Landscape with a Market Share of 59.7%, Valued at USD 22.3 Billion

The North America sex toys market holds a commanding position globally, driven by strong consumer awareness, increasing acceptance of sexual wellness products, and advanced product availability. The region accounts for 59.7% of the global share, valued at USD 22.3 Billion, reflecting robust demand across both online and offline channels. Continued innovation and a supportive regulatory environment further strengthen its dominance in the international market.

Europe Sex Toys Market Trends

Europe represents a well-established market characterized by strong cultural openness toward sexual wellness and high spending capacity. The region sees steady adoption of premium and technologically advanced products, supported by evolving lifestyle preferences. Growing e-commerce penetration and rising emphasis on personal wellness continue to fuel consistent market expansion.

Asia Pacific Sex Toys Market Trends

The Asia Pacific region is emerging as one of the fastest growing markets, driven by increasing urbanization, rising disposable incomes, and shifting societal attitudes toward sexual health. Expanding online distribution networks and greater exposure to global lifestyle trends contribute significantly to demand growth. Countries within the region are witnessing notable increases in first-time buyers, reflecting the market’s long-term potential.

Middle East and Africa Sex Toys Market Trends

In the Middle East and Africa, the sex toys market is gradually gaining traction as awareness of sexual wellness improves and stigmas begin to ease in select urban centers. Growth is primarily supported by discreet online sales channels and rising influence of global consumer trends. Although the market is still developing, increasing acceptance and young demographic profiles are expected to drive future adoption.

Latin America Sex Toys Market Trends

Latin America showcases a steadily expanding market influenced by improving social acceptance and a growing focus on personal wellness. The region benefits from a youthful population, rising digital commerce, and increasing availability of affordable products. Economic modernization and evolving lifestyle preferences further contribute to consistent growth momentum across major countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Sex Toys Company Insights

Church & Dwight Co., Inc. – This established consumer-goods giant leverages its strong legacy in intimate-care and sexual-wellness products to maintain a solid foothold in the expanding adult-toy category. Its extensive retail network and brand recognition position it well for continued growth as consumer openness toward sexual-wellness products increases. The strategic challenge lies in driving innovation that complements its traditional product lines while meeting evolving consumer expectations.

Reckitt Benckiser Group plc – As the parent company of globally recognized sexual-wellness brands, Reckitt benefits from strong marketing capabilities and a wide distribution footprint. Its entry deeper into the pleasure-product space is supported by rising global demand and the normalization of sexual-wellness conversations. The company’s ability to position itself authentically in the adult-toy market will be crucial, especially in regions with stricter cultural norms.

LELO – A premium, design-driven leader in the sex-toys market, LELO continues to differentiate through high-end aesthetics, advanced technology and strong brand identity. The brand effectively captures consumers seeking luxury and performance within the sexual-wellness space. Its main challenge in 2024 is balancing exclusivity with broader market expansion while contending with rising competition from mid-priced innovators.

LifeStyles Healthcare Pte Ltd – With deep roots in sexual-wellness products, LifeStyles is well-positioned to extend further into intimate-pleasure devices as market acceptance grows globally. Its established brand credibility supports consumer trust as it diversifies into adjacent categories. Continued innovation and strategic distribution expansion will be key factors influencing its competitive strength in 2024.

Top Key Players in the Market

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- LELO

- LifeStyles Healthcare Pte Ltd

- Doc Johnson Enterprises

- Lovehoney Group Ltd

- BMS Factory

- PinkCherry

- Tenga Co., Ltd.

- Fun Factory

- We-Vibe

Recent Developments

- In March 2024 – MYHIXEL, a Spanish sexual-wellness startup, secured €1.4 million in a funding round. The investment helped accelerate product innovation and expand its global market presence.

- In February 2024 – Dame Products acquired Emojibator to expand its connected-toy portfolio. The acquisition strengthened Dame’s tech-focused offerings and broadened its brand ecosystem.

- In December 2024 – We-Vibe launched the “Moxie+” wearable panty vibrator product. The release introduced enhanced connectivity features and a more ergonomic wearable design.

- In April 2025 – Dame Products acquired Chakrubs, a luxury designer intimate-accessory brand. This move bolstered Dame’s premium product segment and expanded its artisan-crafted offerings.

Report Scope

Report Features Description Market Value (2024) USD 37.5 Billion Forecast Revenue (2034) USD 80.2 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vibrators, Dildos, Penis Rings, Anal Toys, Masturbation Sleeves, Sex Dolls, Others), By Distribution Channel (E-commerce, Specialty Stores, Mass Merchandisers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Church & Dwight Co., Inc., Reckitt Benckiser Group plc, LELO, LifeStyles Healthcare Pte Ltd, Doc Johnson Enterprises, Lovehoney Group Ltd, BMS Factory, PinkCherry, Tenga Co., Ltd., Fun Factory, We-Vibe Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- LELO

- LifeStyles Healthcare Pte Ltd

- Doc Johnson Enterprises

- Lovehoney Group Ltd

- BMS Factory

- PinkCherry

- Tenga Co., Ltd.

- Fun Factory

- We-Vibe