Global Servo Drives Market Size, Share, Industry Analysis Report By Type (AC Servo Drives, DC Servo Drives), By Voltage Range (Low Voltage ≤ 1 kV, Medium Voltage 1 kV – 6.6 kV, High Voltage > 6.6 kV), By End-Use Industry (Industrial Manufacturing, Automotive & Aerospace, Semiconductor & Electronics, Healthcare & Medical Devices, Food & Beverage, Oil & Gas, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156411

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

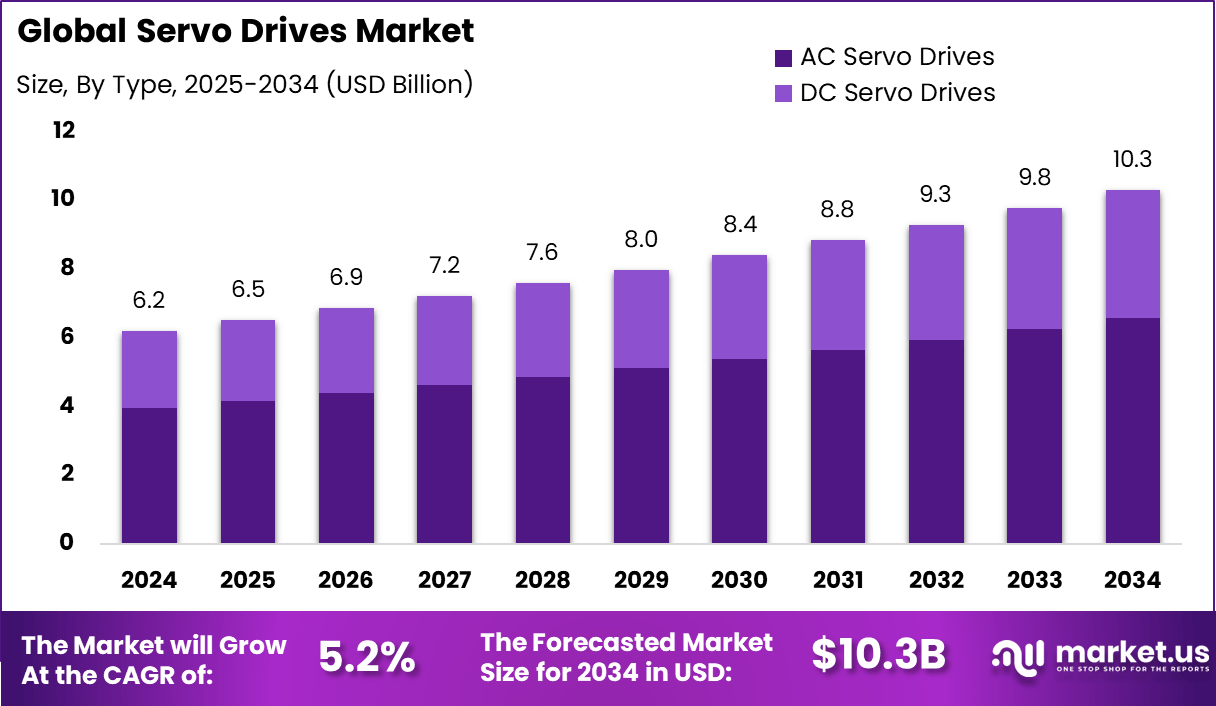

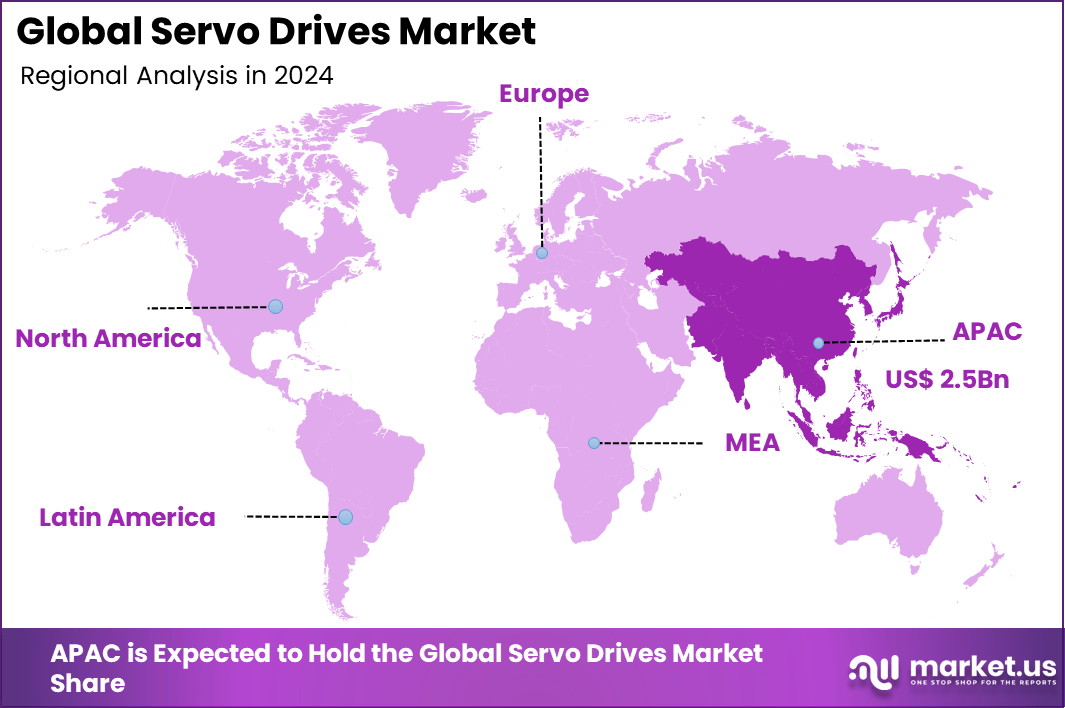

The Global Servo Drives Market size is expected to be worth around USD 10.3 Billion By 2034, from USD 6.2 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 41% share, holding USD 2.5 Billion revenue.

The servo drives market can be described as a critical component sector within automated system design, particularly in applications requiring precise motion control. Its expansion is supported by advancements in industrial automation and the broader trend toward energy-efficient systems. The market is characterized by incremental adoption across manufacturing, robotics, and related domains, each driven by evolving performance expectations and regulatory mandates.

Top driving factors for the servo drives market include the increasing adoption of industrial automation and robotics, rising demand for precision motion control, and growing emphasis on energy efficiency. The push towards Industry 4.0 and smart manufacturing practices fosters greater demand for servo drives that integrate with IoT and AI technologies for real-time monitoring and adaptive control.

Key Insight Summary

- By Type, AC Servo Drives dominated with a 64% share, supported by their efficiency and widespread industrial use.

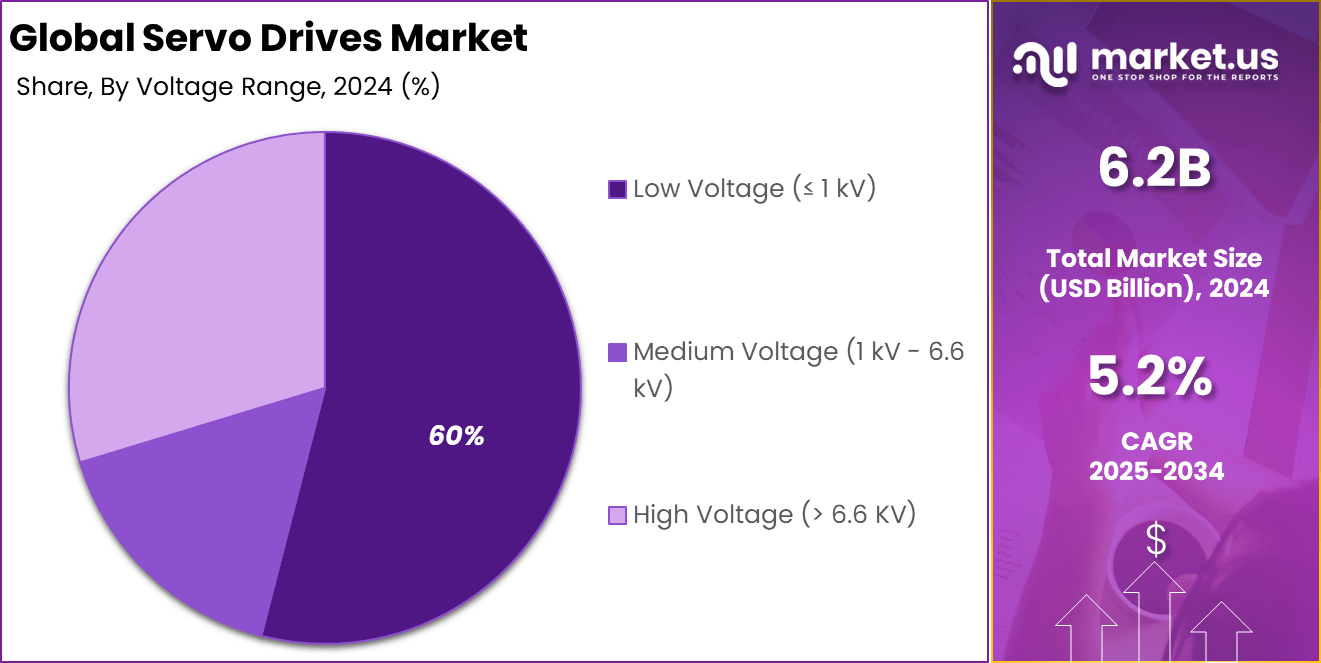

- By Voltage Range, Low Voltage (≤ 1 kV) held a 60% share, reflecting high adoption in compact and precision applications.

- By End-Use Industry, Industrial Machinery & Equipment led with a 32% share, driven by automation and manufacturing demand.

- By Region, Asia-Pacific captured 41% share, highlighting its role as the global hub for industrial production.

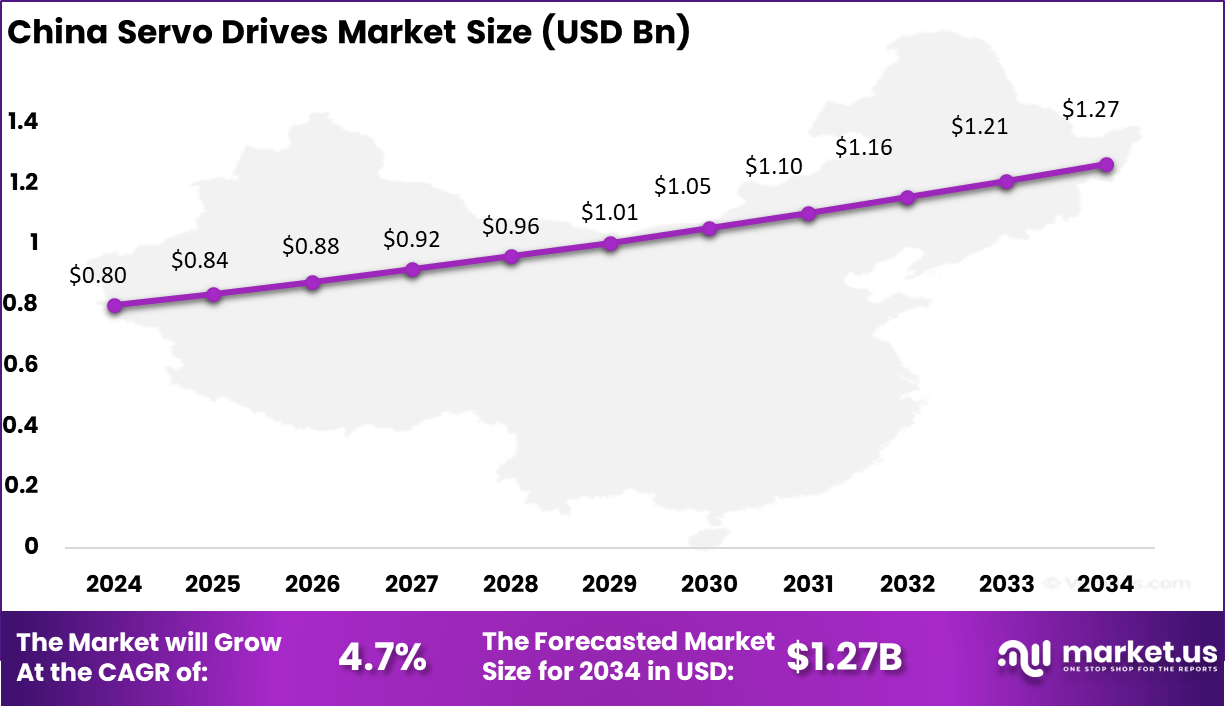

- China’s market was valued at USD 0.8 Billion in 2024, with a projected CAGR of 4.7%, showing consistent growth supported by its expanding manufacturing sector.

China Market Size

The China Servo Drives Market was valued at USD 0.8 Billion in 2024 and is anticipated to reach approximately USD 1.27 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 41% share and generating around USD 2.5 Billion in revenue. The region’s leadership is mainly driven by its strong manufacturing base, particularly in China, Japan, South Korea, and India, where automation has become central to industrial growth.

Rapid industrialization and expansion of sectors such as automotive, electronics, and consumer goods have created large-scale demand for servo drives to improve efficiency, precision, and productivity. The rise of smart factories across APAC has further accelerated the adoption of advanced motion control technologies.

The dominance of APAC is also supported by government initiatives that encourage automation and digital transformation. Countries such as China and India are heavily investing in robotics and industrial modernization to strengthen their global competitiveness. Additionally, the availability of cost-effective production capabilities and a skilled workforce has made the region a manufacturing hub, attracting global players to expand their operations.

Market Trends & Innovations

Trends Description Digital Twin & Simulation Use of digital twins for design, testing, and predicting servo system performance Edge Computing in Servo Drives Real-time data processing and predictive maintenance at device edge AI & Machine Learning Enhancing smart diagnostics, self-optimization, and adaptive control Compact & High-Power Designs Miniaturization combined with high power density to meet modern industrial needs Integration with Robotics Servo drives optimized for collaborative and autonomous robots By Type

AC Servo Drives hold a commanding share of the servo drives market, accounting for 64% of the total segment. This dominance is backed by their superior performance, reliability, and versatility across various industrial applications.

AC servo drives are preferred for their efficiency in controlling motor speed and torque with precision, enabling smooth and accurate automated processes. Their ability to operate under diverse conditions with robust control features makes them integral to industries where precision and dynamic response are critical.

The broad adoption of AC servo drives is further supported by technological advancements that enhance energy efficiency and system integration. These drives are widely used in robotics, CNC machinery, packaging, and manufacturing equipment, where the demand for high-performance automation continues to grow globally.

By Voltage Range

The low voltage servo drives segment, defined as drives operating at voltages of 1 kV or below, accounts for 60% of the market share. This segment’s growth stems from its widespread application across small to medium-sized industrial machinery and equipment due to advantages like cost-effectiveness, ease of installation, and compatibility with a variety of motor sizes.

Low voltage drives are crucial in sectors such as manufacturing, agriculture, and residential infrastructure, where energy efficiency and operational reliability are paramount. Expanding adoption of low voltage drives is also driven by global trends towards automation and energy conservation, with regulatory mandates emphasizing reduced power consumption in industrial operations.

These factors have led to increased deployment of low voltage servo drives in pump control, conveyor systems, and automated production lines, where precise motor management reduces downtime and improves productivity. Market forecasts predict a steady CAGR for this segment, confirming its integral role in the evolving servo drives ecosystem.

By End-Use Industry

The industrial machinery and equipment sector represents the largest end-use segment in the servo drives market, capturing approximately 32% of the total share. This industry relies heavily on servo drives to enhance automation, improve precision, and optimize operational efficiency in equipment such as CNC machines, packaging systems, conveyors, and robotic arms.

The expanding automation initiatives and smart factory deployments within this sector continue to fuel the demand for high-quality servo drives. Growth in industrial machinery is propelled by the increasing need for improved productivity and accuracy across manufacturing processes.

Adoption of servo drives in this domain is pivotal for enabling real-time motion control and reducing energy consumption, which aligns with the broader industry goal of achieving sustainable manufacturing. The sector remains a primary market driver as industries globally shift towards automation to meet cost and quality targets.

Key Market Segments

By Type

- AC Servo Drives

- DC Servo Drives

By Voltage Range

- Low Voltage (≤ 1 kV)

- Medium Voltage (1 kV – 6.6 kV)

- High Voltage (> 6.6 KV)

By End-Use Industry

- Industrial Manufacturing

- Automotive & Aerospace

- Semiconductor & Electronics

- Healthcare & Medical Devices

- Food & Beverage

- Oil & Gas

- Other End-Use Industries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Factor

Growing Industrial Automation Demand

One of the main drivers for the servo drives market is the rapid growth of industrial automation. As manufacturing and production processes increasingly adopt automated systems, the need for precise motion control and efficient motor operations rises. Servo drives are essential in controlling motors that power robotic arms, CNC machines, and automated assembly lines, providing accurate speed, torque, and position control.

This growing automation trend across automotive, electronics, aerospace, and packaging industries fuels the demand for more advanced and reliable servo drive solutions. Furthermore, the integration of Internet of Things (IoT) technologies in factories has accelerated smart manufacturing initiatives. With Industry 4.0 frameworks encouraging predictive maintenance and real-time process optimization, servo drives equipped with intelligent feedback systems become indispensable.

Restraint Factor

High Initial Investment Cost

A significant restraint hindering the broader adoption of servo drives is their high initial cost. Advanced servo systems involve sophisticated electronics, precise control algorithms, and integration with smart factory setups, which lead to substantial upfront investment.

For small and medium-sized enterprises (SMEs), this can be a financial barrier, as the capital expenditure to switch from traditional motor controls to servo drives is considerable, limiting market penetration among smaller players.

Additionally, the installation and commissioning processes for servo drives often require specialized technical expertise. This complexity adds to operational costs and may cause hesitation among companies unfamiliar with these technologies. As a result, despite the long-term operational savings and efficiency gains, the upfront cost and integration challenges act as a market brake, especially in price-sensitive regions

Opportunity Analysis

Expansion of Electric Vehicles and Aerospace Sectors

The rapid expansion of electric vehicles (EVs) and aerospace industries offers substantial opportunities for servo drive manufacturers. EV production requires high-precision manufacturing equipment that relies heavily on servo drives for controlling motors with exact torque and speed during battery assembly and motor manufacturing.

These sectors demand reliable, energy-efficient, and compact servo systems capable of supporting the precision needed in complex, high-tech applications. Moreover, the aerospace industry’s growing reliance on automation for component manufacturing, flight simulations, and testing environments increases servo drive procurement.

Innovations in miniaturization and lightweight servo motors further cater to aerospace needs. With governments and corporations investing aggressively in clean transportation and advanced aerospace technologies, the servo drive market stands to benefit from heightened demand in these cutting-edge industries

Challenge Analysis

Rapid Technological Evolution and Skilled Labor Shortage

One of the critical challenges in the servo drives market is the rapid pace of technological change. To remain competitive, manufacturers must constantly innovate, updating products with new features such as IoT compatibility, higher energy efficiency, and enhanced control algorithms. However, this fast evolution can strain resources, making it difficult for some companies to keep up with market leaders, leading to potential obsolescence or loss of market share.

Another pressing challenge is the shortage of skilled professionals capable of designing, installing, and maintaining advanced servo systems. As servo drives become increasingly complex, the demand for trained engineers and technicians rises. This skills gap drives up operational costs and can delay deployment timelines, especially in emerging markets or smaller enterprises with limited access to specialized talent.

Competitive Analysis

In the servo drives market, global leaders such as Danfoss, Rockwell Automation, Schneider Electric, and Siemens have maintained strong positions by focusing on innovation and automation integration. Their strength lies in offering energy-efficient drive systems that support industries like manufacturing, automotive, and process control. With advanced product portfolios, these players continue to expand global footprints through strategic investments and partnerships.

ABB Ltd, Emerson Electric Co., Hitachi Ltd., Mitsubishi Electric Corporation, and Yaskawa Electric Corporation are also important contributors in this space. These companies are known for providing high-performance servo drive systems with precision control and adaptability for modern industrial needs. Their technologies are widely used in robotics, packaging, and motion control applications.

Other recognized participants include WEG, Advanced Motion Controls, Beckhoff Automation, Delta Electronics, Nidec Motor, Omron, and Panasonic. These firms continue to strengthen their presence through customized solutions, regional expansions, and competitive pricing strategies. Their contributions are notable in small and medium-sized enterprise automation where flexibility and affordability are key. Along with major global brands, these companies ensure a balanced competitive environment.

Top Key Players in the Market

- Danfoss

- Rockwell Automation

- Schneider Electric

- Siemens

- ABB Ltd

- Emerson Electric Co.

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- WEG

- Advanced Motion Controls

- Beckhoff Automation

- Delta Electronics

- Nidec Motor

- Omron

- Panasonic

- Other Key Players

Recent Developments

- Danfoss, Launched integrated servo drive ISD 520 in April 2025 targeting modular machine architectures for high-performance motion control.

- In April 2024, Applied Motion Products launched the MDX+ series, a compact line of integrated servo systems designed for space-efficient motion control. These systems combine drive, motor, and encoder components into a single unit, supporting power ranges from 100 to 550 W and operating on 24 to 60 VDC.

- In March 2024, Kollmorgen expanded the communication capabilities of its AKD2G servo drive. The updated version now supports Ethernet/IP and PROFINET IRT with CIP Sync, alongside its existing protocols, enabling motion synchronization across multiple drives and diverse control architectures.

Report Scope

Report Features Description Market Value (2024) USD 6.2 Bn Forecast Revenue (2034) USD 10.3 Bn CAGR(2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (AC Servo Drives, DC Servo Drives), By Voltage Range (Low Voltage ≤ 1 kV, Medium Voltage 1 kV – 6.6 kV, High Voltage > 6.6 kV), By End-Use Industry (Industrial Manufacturing, Automotive & Aerospace, Semiconductor & Electronics, Healthcare & Medical Devices, Food & Beverage, Oil & Gas, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Danfoss, Rockwell Automation, Schneider Electric, Siemens, ABB Ltd, Emerson Electric Co., Hitachi Ltd., Mitsubishi Electric Corporation, Yaskawa Electric Corporation, WEG, Advanced Motion Controls, Beckhoff Automation, Delta Electronics, Nidec Motor, Omron, Panasonic, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danfoss

- Rockwell Automation

- Schneider Electric

- Siemens

- ABB Ltd

- Emerson Electric Co.

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- WEG

- Advanced Motion Controls

- Beckhoff Automation

- Delta Electronics

- Nidec Motor

- Omron

- Panasonic

- Other Key Players