Global Serial to Ethernet Device Servers Market Size, Share and Analysis Report By Form Factor (Standalone, Embedded), By Connectivity Type (Wired, Wireless), By Application (Industrial, Automation, Healthcare, Telecommunications, Transportation, Building Automation, Others), By End-Use (Manufacturing, Retail, Transportation and Logistics, Energy and Utilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177051

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Technical Performance Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Form Factor Analysis

- Connectivity Type Analysis

- Application Analysis

- End-Use Analysis

- Customer Impact: Trends and Disruptors

- Regional Perspective

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

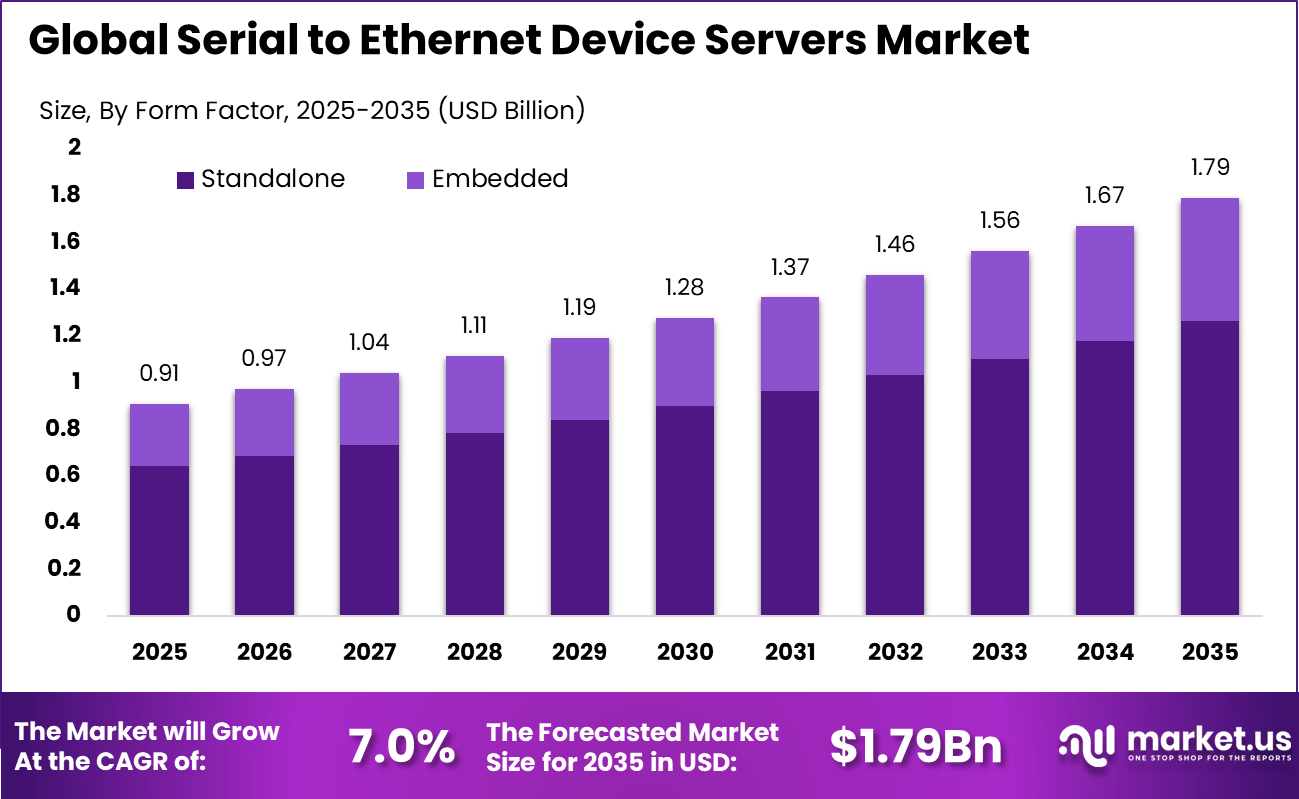

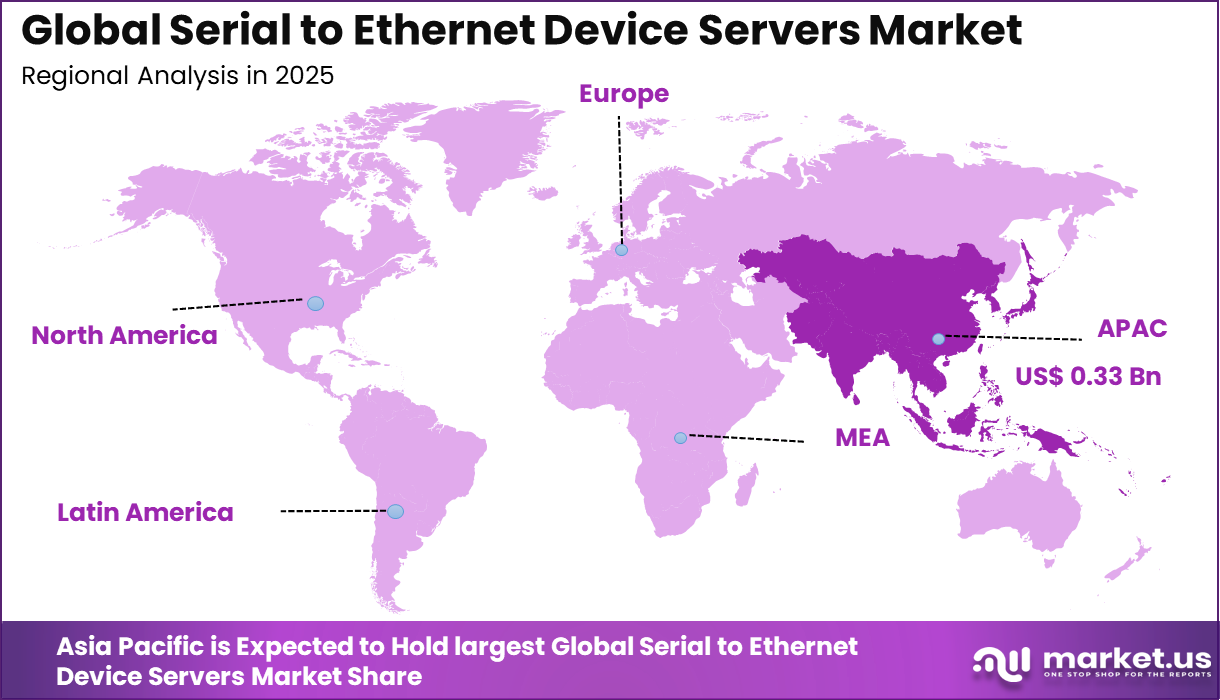

The Global Serial to Ethernet Device Servers Market size is expected to be worth around USD 1.79 billion by 2035, from USD 0.91 billion in 2025, growing at a CAGR of 7.0% during the forecast period from 2025 to 2035. Asia Pacific held a dominant market position, capturing more than a 36.8% share, holding USD 0.33 billion in revenue.

The Serial to Ethernet Device Servers Market refers to networking solutions that enable legacy serial devices to connect with modern Ethernet based networks. These devices act as communication bridges, allowing serial equipment such as sensors, controllers, meters, and industrial machines to transmit data over IP networks. This capability is critical in environments where older equipment remains operational but needs to be integrated with centralized monitoring or control systems.

The market is closely linked to industrial connectivity and infrastructure modernization initiatives. Serial to Ethernet device servers are widely used in manufacturing plants, utilities, transportation systems, and building automation environments. Many industries continue to rely on serial based equipment due to long asset lifecycles and high replacement costs. Industry estimates indicate that more than 65% of industrial field devices in operation globally still use serial communication protocols.

One of the main driving factors is the need to extend the life of existing industrial equipment. Replacing functional serial devices with Ethernet native alternatives often requires high capital investment and operational downtime. Serial to Ethernet device servers provide a cost effective way to modernize communication without changing core assets. This approach supports gradual digital transformation while preserving prior investments.

For instance, in December 2025, Moxa showcased its expanded Serial-to-Ethernet gateway portfolio at SPS 2025, highlighting secure device servers for EtherCAT and PROFINET integration. The NPort 6000-G2 series offers real-time traffic monitoring via web interface, solidifying Taiwan’s position as a global leader in robust industrial connectivity solutions for harsh environments.

Demand for serial to Ethernet device servers remains strong in sectors with large installed bases of legacy equipment. Manufacturing facilities, energy utilities, and transportation operators rely on these devices to connect serial controllers to supervisory systems. Operational studies suggest that networked monitoring can reduce unplanned downtime by more than 20% through faster fault detection. This operational benefit directly supports demand.

Key Takeaway

- By form factor, standalone serial to Ethernet device servers led the market with a 70.6% share, reflecting widespread use in fixed industrial installations.

- By connectivity type, wired solutions accounted for 86.2% of total demand, supported by reliability and stable data transmission needs.

- By application, industrial automation held a leading position with a 44.8% share, driven by factory networking and control system integration.

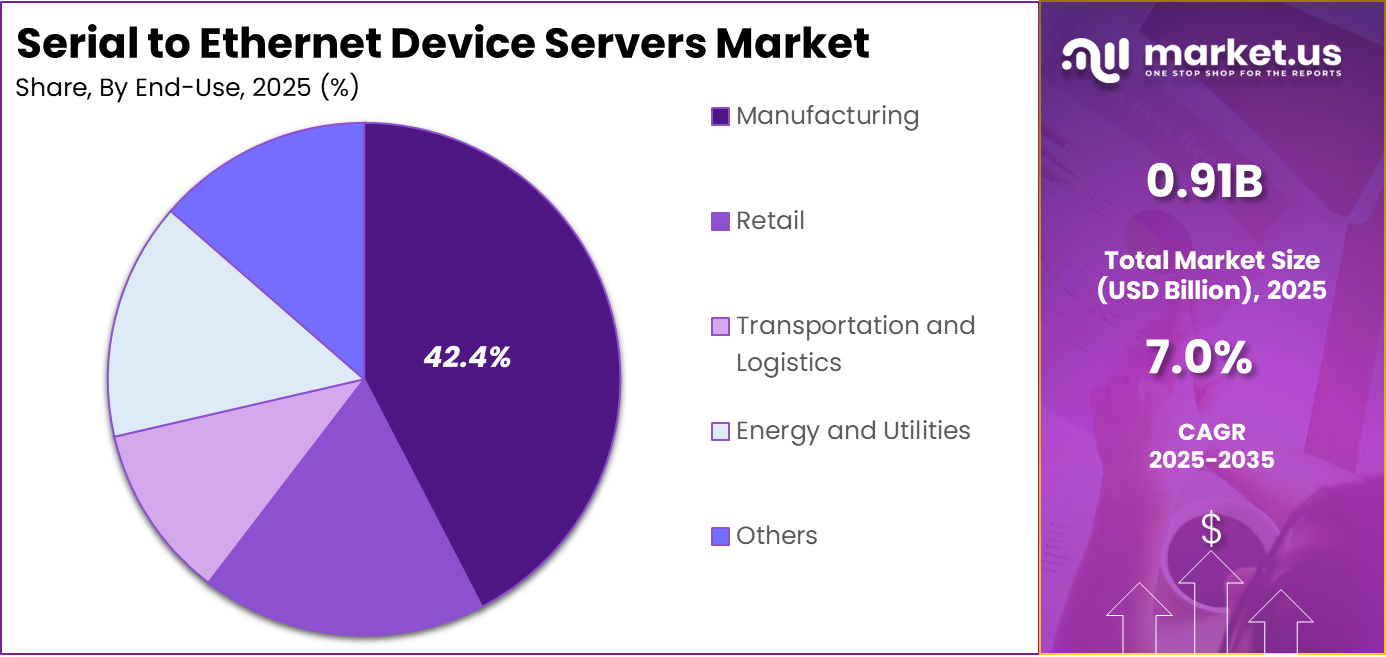

- By end use, the manufacturing sector represented 42.4% of market adoption, supported by continuous equipment monitoring requirements.

- Regionally, Asia Pacific dominated the market with a 36.8% share, supported by strong industrial expansion.

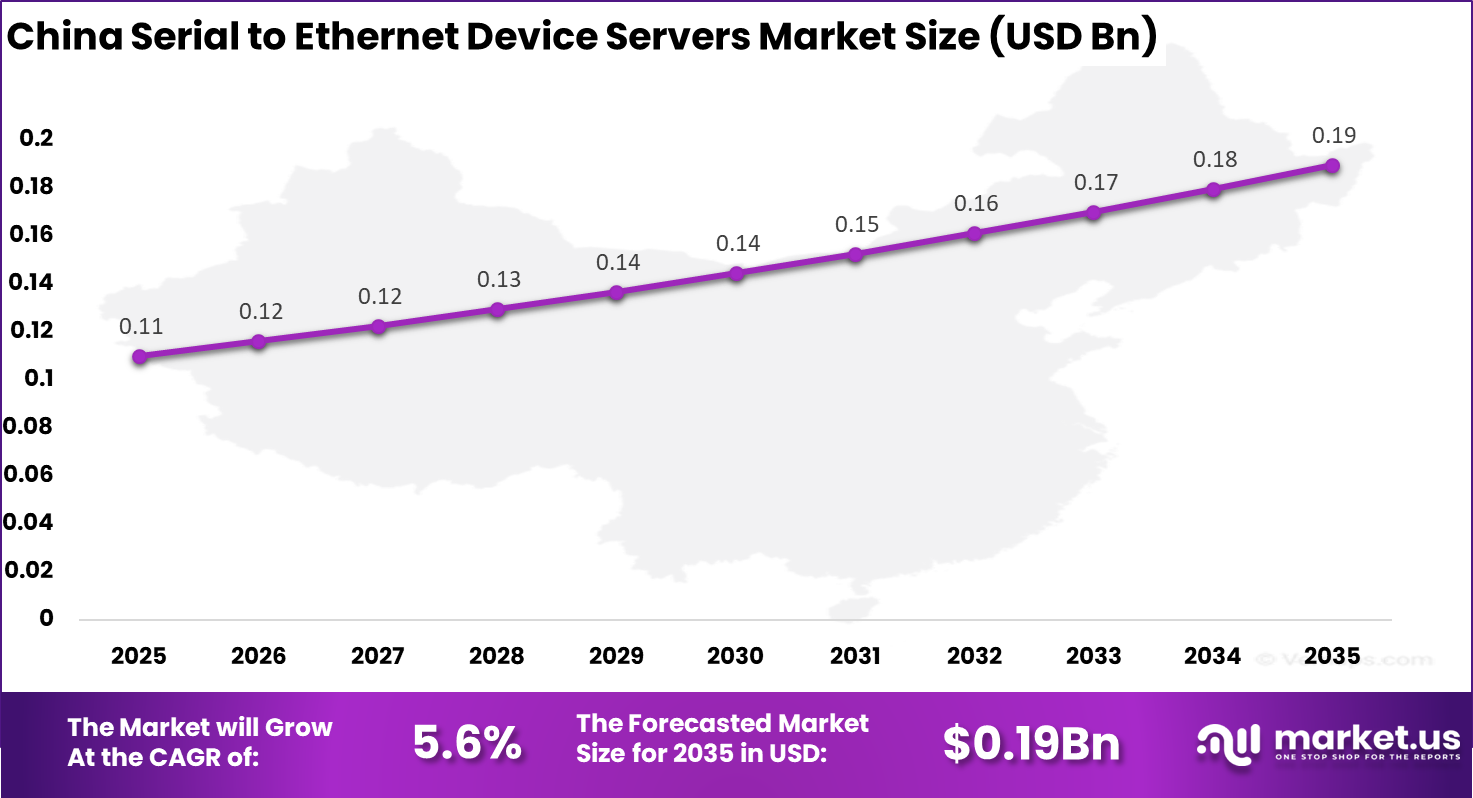

- China recorded a market value of USD 0.11 billion and showed a steady CAGR of 5.6%, driven by automation investments.

Technical Performance Statistics

- Baud rate performance typically ranges from 300 bps to 115,200 bps, while advanced models can support speeds of up to 1 Mbps.

- Network speed is commonly supported through 10/100 Mbps adaptive Ethernet ports, with selected industrial models offering 1000 Mbps capability.

- Data integrity is measured by throughput efficiency, with high quality devices achieving at least 95% of theoretical bandwidth under full duplex operation.

- Connection capacity in industrial gateways supports up to 16 simultaneous master connections and 32 slave connections.

- Physical transmission range for standard RS 485 is limited to approximately 1,200 meters, while Ethernet connectivity enables virtually unlimited distance over LAN or internet networks.

- Power consumption for standard units generally falls between 0.76 W and 2.9 W, supporting energy efficient operation.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising need to connect legacy serial devices to IP networks +2.1% Global Short to medium term Expansion of industrial automation and IIoT deployments +1.8% Asia Pacific, North America Medium term Increasing adoption of remote monitoring and control systems +1.5% Global Medium term Growth in smart infrastructure and utility networks +1.0% North America, Europe Medium to long term Demand for cost-effective modernization of legacy equipment +0.6% Global Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Gradual phase-out of serial-based legacy systems -1.6% North America, Europe Medium to long term Limited awareness outside industrial environments -1.3% Emerging Markets Medium term Security concerns related to exposed network endpoints -1.2% Global Medium term Competition from fully IP-native industrial devices -1.0% Global Medium term Price sensitivity in cost-driven industrial sectors -0.8% Emerging Markets Short to medium term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Industrial networking equipment manufacturers Medium Low to Medium Global Stable hardware-driven demand Automation and control system vendors Medium Medium North America, Asia Pacific Integration-led growth Industrial IoT solution providers Medium Medium Global Supporting connectivity layer Private equity firms Low to Medium Medium North America, Europe Niche industrial consolidation Venture capital investors Low High North America Limited innovation upside Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Secure serial-to-IP protocol conversion +2.0% Legacy device networking Global Short term Industrial-grade Ethernet and ruggedized hardware +1.7% Harsh environment reliability Asia Pacific, North America Medium term Embedded security and encryption features +1.4% Network protection Global Medium term Centralized device management software +1.1% Remote configuration and monitoring Global Medium to long term Integration with IIoT and SCADA platforms +0.8% Operational visibility North America, Europe Long term Form Factor Analysis

In 2025, Standalone devices account for 70.6% of overall adoption in the Serial to Ethernet Device Servers Market. This dominance reflects their ease of deployment and flexibility across different industrial environments. Standalone units can be installed close to legacy equipment, reducing integration complexity.

The preference for standalone form factors is also driven by reliability requirements. These devices operate independently without dependence on modular racks or centralized systems. This improves uptime in critical operations.

Standalone solutions further support scalability in industrial networks. Organizations can add or replace devices without disrupting existing infrastructure. These advantages continue to sustain strong demand for standalone form factors.

For Instance, in October 2025, Lantronix launched the XPress DR+ standalone industrial server for DIN-rail mounting, connecting serial gear like PLCs over Ethernet. Its rugged design fits harsh floors without extra housing, helping users control barcode scanners remotely.

Connectivity Type Analysis

In 2025, the Wired segment held a dominant market position, capturing a 86.2% share of the Global Serial to Ethernet Device Servers Market. Ethernet based wired networks deliver consistent performance, low latency, and strong resistance to interference, which is essential for mission critical operations. Industrial environments depend on predictable communication to avoid downtime and data loss.

The dominance of wired solutions is further supported by existing Ethernet infrastructure in factories and utilities. Many facilities already rely on structured cabling, making wired device servers easier to integrate. Security concerns also favor wired connections, especially where sensitive operational data is transmitted.

For instance, in September 2025, Digi International introduced the Connect EZ 4 WS serial server with dual wired Ethernet ports for reliable RS-232 links. Focused on steady data in noisy plants, it uses RealPort for transparent connections, avoiding wireless drops. Factories choose it for mission-critical uptime in machine monitoring.

Application Analysis

In 2025, The Industrial Automation segment held a dominant market position, capturing a 44.8% share of the Global Serial to Ethernet Device Servers Market. This dominance is due to the continued use of serial based equipment such as controllers, meters, and sensors.

Serial to Ethernet device servers allow these systems to connect with modern network architectures without replacing installed assets. This approach helps industries maintain continuity while adopting digital monitoring and control systems.

Automation focused industries increasingly require real time data access and centralized management. Device servers enable remote diagnostics and system visibility, improving operational efficiency. Their role in bridging legacy systems with Ethernet networks keeps industrial automation as the leading application area.

For Instance, in December 2024, Advantech unveiled serial-to-Ethernet Modbus gateways with dual Ethernet for LAN backup in automation. They bridge RTU/ASCII to TCP seamlessly, aiding PLC control and sensor nets. This cuts integration time in plants, fueling automation’s lead with real-time data access.

End-Use Analysis

In 2025, The Manufacturing segment held a dominant market position, capturing a 42.4% share of the Global Serial to Ethernet Device Servers Market, as factories seek to improve productivity and system integration. Device servers support the networking of production equipment, allowing better coordination between machines and control systems. This connectivity helps manufacturers optimize workflows and reduce operational inefficiencies.

The manufacturing sector also values device servers for extending equipment lifespan. Rather than replacing costly machinery, manufacturers integrate existing serial devices into Ethernet networks. This practical approach supports gradual digital transformation while controlling costs.

For Instance, in October 2025, Moxa highlighted NPort solutions for manufacturing energy insights, converting serial switchgear data to Ethernet. With serial repeaters and redundancy, it enables real-time monitoring on lines. Manufacturers grab it to optimize output and cut faults in high-volume runs.

Customer Impact: Trends and Disruptors

Customer Impact Trends

Customers using serial to Ethernet device servers are increasingly focused on extending the usable life of legacy equipment while meeting modern connectivity expectations. Industrial operators, utilities, and infrastructure managers prefer solutions that avoid costly equipment replacement and production downtime.

Serial to Ethernet device servers enable remote access, centralized monitoring, and integration with supervisory systems, which improves operational visibility and reduces manual intervention. This trend reflects a broader customer preference for incremental digital transformation rather than disruptive system overhauls. Another important customer impact trend is growing emphasis on secure remote operations.

Customers now expect device servers to support encrypted communication, access control, and network segmentation. As industrial environments become more connected, security requirements influence purchasing decisions as strongly as connectivity features. Customers are prioritizing solutions that combine legacy compatibility with modern security assurance.

Key Disruptors

One major disruptor affecting customers is the rapid expansion of industrial Ethernet and IP based architectures. As Ethernet becomes the default networking standard, expectations for interoperability and performance continue to rise. This disruptor pushes customers to adopt device servers that can seamlessly bridge serial devices into Ethernet environments without compromising reliability.

Solutions that fail to meet evolving network standards risk obsolescence. Another disruptor is the increasing adoption of edge computing and smart gateways. Customers are beginning to favor devices that offer additional intelligence such as data filtering, buffering, or protocol translation at the edge.

This shift changes customer expectations from simple connectivity tools to multifunctional network components. Device servers that adapt to this demand can deliver higher value by supporting resilience and real time decision making closer to the data source.

Regional Perspective

China Market Size

The market for Serial to Ethernet Device Servers within China is growing tremendously and is currently valued at USD 0.11 billion, the market has a projected CAGR of 5.6%. The market is driven by rapid industrial automation, smart manufacturing adoption, and large-scale investments in Industry 4.0 initiatives.

Growing deployment of industrial IoT networks across factories, power utilities, transportation systems, and smart cities is accelerating demand for reliable serial device connectivity. Modernization of legacy equipment, rising use of Ethernet based control systems, and strong government support for digital infrastructure upgrades are further contributing to sustained market growth across industrial and commercial sectors.

Asia Pacific Market Overview

In 2025, Asia Pacific held a dominant market position in the Global Serial to Ethernet Device Servers Market, capturing more than a 36.8% share, holding USD 0.33 billion in revenue. This dominance is due to its strong manufacturing base, rapid industrial digitalization, and large scale deployment of automation systems across China, Japan, South Korea, and Southeast Asia.

High adoption of industrial IoT, expansion of smart factories, and continuous upgrades of legacy serial based equipment are driving demand. Supportive government initiatives for smart manufacturing, rising investments in data centers and infrastructure, and cost efficient electronics production further reinforce the region’s leadership in this market.

For instance, in March 2025, PLANET Technology demonstrated comprehensive Serial Device Servers alongside TSN 10G switches and Modbus TCP solutions at Hannover Messe 2025. These offerings support advanced industrial networking, reinforcing Asia Pacific’s manufacturing prowess in Serial to Ethernet technology for smart factories.

Emerging Trends Analysis

An emerging trend in the serial to Ethernet device servers market is the integration of edge processing capabilities. Some device servers now support basic data filtering, buffering, and protocol handling at the network edge. This reduces network load and improves resilience during connectivity interruptions. Edge enabled functionality enhances overall system performance.

Another trend is increased use in critical infrastructure modernization. Utilities, transportation systems, and public facilities are connecting legacy assets for monitoring and compliance purposes. Serial to Ethernet device servers play a key role in these upgrades by extending the life of existing equipment.

Growth Factors Analysis

One of the key growth factors for the serial to Ethernet device servers market is the long replacement cycle of industrial equipment. Organizations prefer incremental upgrades over full system replacement. Device servers align well with this approach by protecting prior investments. This structural factor supports long term demand.

Another growth factor is expansion of industrial Ethernet networks. As Ethernet becomes the standard backbone for industrial communication, connectivity solutions for non Ethernet devices remain essential. Serial to Ethernet device servers ensure inclusivity of legacy systems within modern network architectures. This ongoing network expansion supports market growth.

Opportunity Analysis

A significant opportunity in the serial to Ethernet device servers market lies in industrial digital transformation initiatives. As factories and utilities adopt connected systems, the need to bring legacy devices online increases. Device servers provide a transitional solution that supports modernization without major capital expenditure. This role positions them as enablers of gradual digital upgrades.

Another opportunity is rising demand for secure remote access. Device servers equipped with encryption and authentication features support secure data transmission over IP networks. As cybersecurity awareness grows, demand increases for solutions that combine legacy connectivity with modern security controls.

Challenge Analysis

A major challenge for the serial to Ethernet device servers market is ensuring robust cybersecurity. Connecting legacy devices to IP networks increases exposure to cyber threats. Many serial devices were not designed with security in mind. Device server vendors must compensate with strong network level protections.

Another challenge is maintaining compatibility across diverse serial protocols and device types. Industrial environments often use multiple communication standards. Supporting broad interoperability while maintaining reliability requires ongoing firmware development and testing. This complexity increases development and support effort.

Key Market Segments

By Form Factor

- Standalone

- Embedded

By Connectivity Type

- Wired

- Wireless

By Application

- Industrial

- Automation

- Healthcare

- Telecommunications

- Transportation

- Building Automation

- Others

By End-Use

- Manufacturing

- Retail

- Transportation and Logistics

- Energy and Utilities

- Others

Key Regions and Countries

Asia Pacific

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Industrial connectivity specialists such as Moxa, Lantronix, and Digi International lead the serial to Ethernet device servers market through rugged and secure products. Their solutions enable legacy serial devices to connect with modern IP networks. High reliability, long lifecycle support, and industrial certifications strengthen adoption. These vendors are widely used in manufacturing, transportation, and utilities. Demand is driven by industrial digitalization and the need to modernize legacy equipment without full replacement.

Automation and industrial hardware providers such as Siemens, Advantech, and ICP DAS integrate device servers into broader automation platforms. ATEN International and Sealevel Systems focus on flexible port density and protocol support. These players emphasize interoperability, cybersecurity, and ease of deployment. Adoption is strong in smart factories and process automation environments.

Semiconductor and networking-focused companies such as Texas Instruments and Marvell Technology support the ecosystem at the chipset level. Device server specialists including Comtrol, Perle Systems, and Planet Technology address niche and regional requirements. Other vendors add competitive depth and customization. This landscape supports reliable industrial networking and gradual migration to Ethernet-based infrastructures.

Top Key Players in the Market

- ICP DAS

- Sealevel Systems

- ATEN International

- Moxa

- NetBurner

- Texas Instruments

- GigaSys

- Lantronix

- Marvell Technology

- Digi International

- Comtrol

- Siemens

- Planet Technology

- B&B Electronics

- Advantech

- Perle Systems

- Others

Recent Developments

- In August 2025, ICP DAS highlighted its serial-to-Ethernet device servers, like DS-2225i and programmable PDS-734D models for industrial daisy-chaining and Modbus gateways. These compact units bridge RS-232/485 to Ethernet in automation, supporting PoE and edge computing. ICP DAS continues dominating rugged connectivity for factory floors worldwide.

- In December 2025, Moxa showcased its expanded Serial-to-Ethernet gateway portfolio at SPS 2025 in Nuremberg, featuring EtherCAT junctions and gateways for real-time protocol conversion. These solutions enable seamless integration of legacy serial devices into modern OT networks.

Report Scope

Report Features Description Market Value (2025) USD 0.9 Billion Forecast Revenue (2035) USD 1.7 Billion CAGR(2025-2035) 7% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Form Factor (Standalone, Embedded), By Connectivity Type (Wired, Wireless), By Application (Industrial, Automation, Healthcare, Telecommunications, Transportation, Building Automation, Others), By End-Use (Manufacturing, Retail, Transportation and Logistics, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ICP DAS, Sealevel Systems, ATEN International, Moxa, NetBurner, Texas Instruments, GigaSys, Lantronix, Marvell Technology, Digi International, Comtrol, Siemens, Planet Technology, B&B Electronics, Advantech, Perle Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Serial to Ethernet Device Servers MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Serial to Ethernet Device Servers MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ICP DAS

- Sealevel Systems

- ATEN International

- Moxa

- NetBurner

- Texas Instruments

- GigaSys

- Lantronix

- Marvell Technology

- Digi International

- Comtrol

- Siemens

- Planet Technology

- B&B Electronics

- Advantech

- Perle Systems

- Others