Global Self-healing Materials Market Size, Share Analysis Report By Product (Concrete, Coatings, Polymers, Asphalt, Fiber-reinforced Composites, Ceramic, Metals), By Technology (Reversible Polymers, Microencapsulation, Shape Memory Materials, Biological Material Systems, Others), By Application (Energy Generation, Building And Construction, Automotive And Transportation, Electronics And Semiconductors, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173449

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

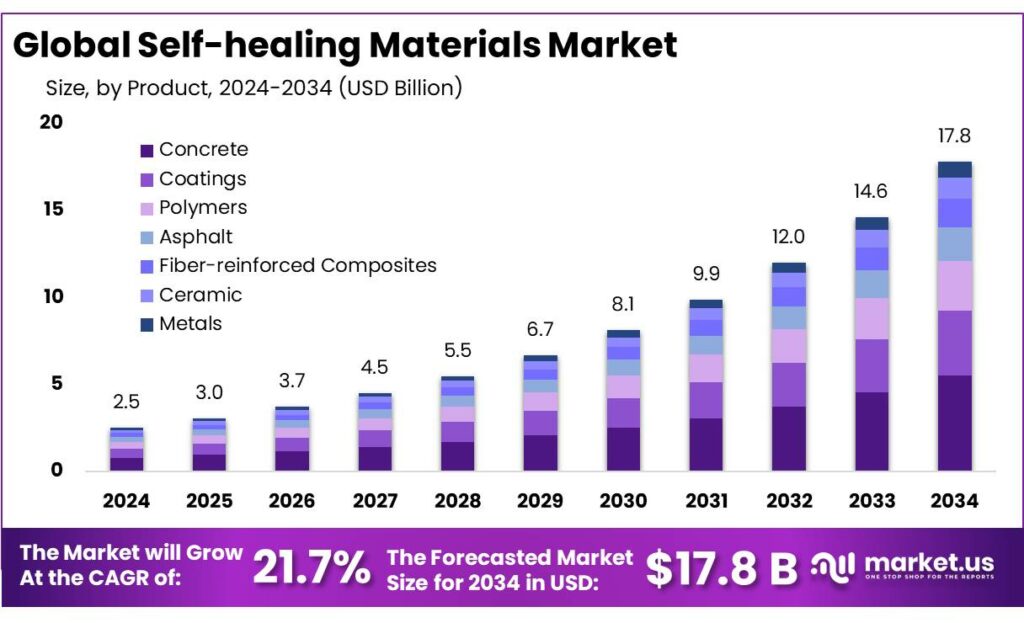

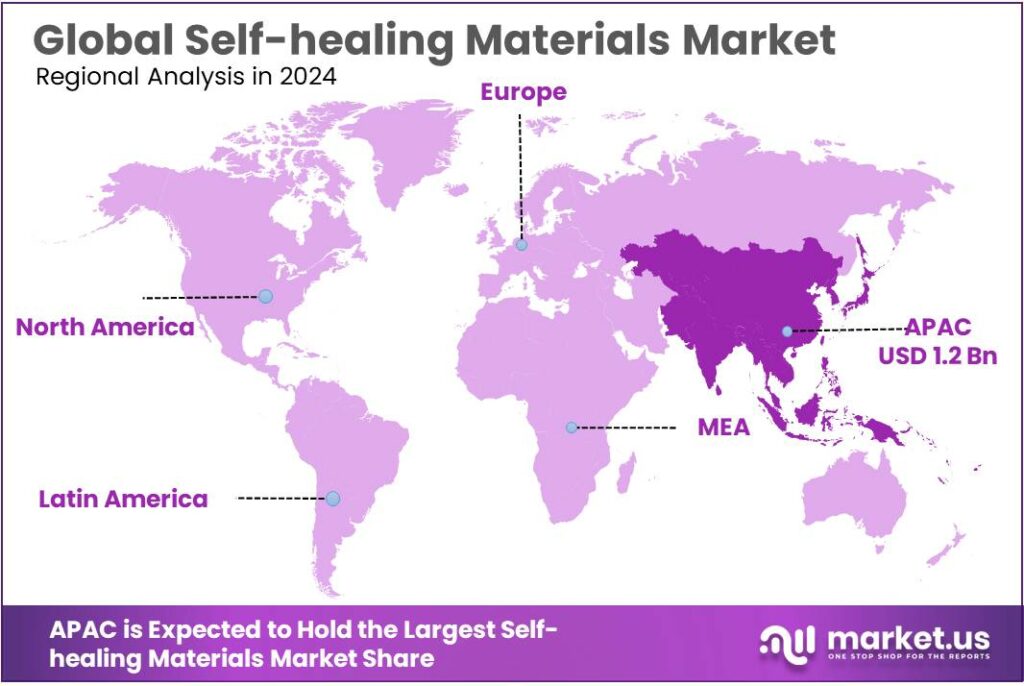

Global Self-healing Materials Market size is expected to be worth around USD 17.8 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 21.7% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 49.9% share, holding USD 1.2 Billion in revenue.

Self-healing materials are engineered systems that can autonomously repair micro-cracks, scratches, or internal damage, extending service life and reducing maintenance. Industrial interest is rising because asset owners increasingly evaluate materials on total lifecycle cost, not only upfront price. In practice, self-healing is being designed into polymers, cementitious systems, and functional composites used in transport, energy, and electronics.

From an industrial scenario standpoint, the strongest pull comes from infrastructure durability and corrosion protection. Corrosion is not a niche cost; global estimates put the economic impact at about US$2.5 trillion, around 3.4% of global GDP, creating a clear financial rationale for coatings and barrier materials that can recover performance after damage. In the United States, the Federal Highway Administration has cited a direct bridge-corrosion cost of about US$8.3 billion per year, reinforcing why departments and contractors keep looking for longer-life protective systems.

Demand also links to public infrastructure renewal and stricter performance expectations for long-lived assets. For bridges alone, the American Society of Civil Engineers highlighted a need to increase bridge rehabilitation spending from $14.4 billion annually to $22.7 billion annually to improve conditions—an environment where self-healing concretes, crack-sealing admixtures, and self-repairing protective layers are increasingly evaluated as “maintenance reducers,” not just material upgrades. In parallel, corrosion-focused industry guidance cites the U.S. Federal Highway Administration estimate of $20.5 billion annually for 16 years to properly update existing bridges—another signal that markets will pay for materials that reduce recurring repair cycles.

Government and trusted-industry initiatives are also shaping the pipeline from lab to factory. In polymer innovation, the U.S. National Science Foundation has supported industry-aligned programs, including US$7 million from NSF alongside US$2.5 million in partner contributions for sustainable polymer research—an R&D environment where self-healing chemistries can be a practical route to longer-lived plastics and coatings.

In Europe, battery-linked self-healing development is being funded through Horizon Europe pathways: the HEALING BAT project reports €5,791,347 in support from the European Commission and associated agencies, reflecting active public funding for “self-healing” concepts to improve battery lifetime and sustainability.

Key Takeaways

- Self-healing Materials Market size is expected to be worth around USD 17.8 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 21.7%.

- Concrete held a dominant market position, capturing more than a 31.7% share.

- Reversible Polymers held a dominant market position, capturing more than a 37.9% share.

- Building & Construction held a dominant market position, capturing more than a 39.1% share.

- Asia-Pacific (APAC) region emerged as the dominant market for self-healing materials, holding roughly 49.90% of the global share and generating approximately USD 1.2 billion.

By Product Analysis

Concrete leads the Self-healing Materials Market with a 31.7% share, supported by long-term durability benefits

In 2024, Concrete held a dominant market position, capturing more than a 31.7% share, mainly due to its wide use in infrastructure and building projects where maintenance costs are high. Self-healing concrete was increasingly adopted in bridges, tunnels, roads, and commercial buildings because it could automatically seal cracks and extend structural life.

This helped reduce repair frequency and long-term expenses. In 2025, demand continued to grow as governments and developers focused on durable and sustainable construction solutions. The ability of self-healing concrete to improve safety, reduce material waste, and support longer service life allowed it to maintain a leading role within the self-healing materials market.

By Technology Analysis

Reversible polymers dominate the Self-healing Materials Market with a 37.9% share, driven by repeatable healing performance

In 2024, Reversible Polymers held a dominant market position, capturing more than a 37.9% share, mainly because of their ability to repair damage multiple times without losing core material properties. These materials were widely used in coatings, electronics, automotive components, and protective surfaces, where small cracks and wear occur frequently.

Their reversible bonding mechanism allowed fast healing under heat or light, which improved product life and reduced maintenance needs. In 2025, adoption continued to rise as manufacturers focused on durable and lightweight materials with longer service cycles. This strong balance of performance, flexibility, and cost efficiency helped reversible polymers maintain their leading position in the self-healing materials market.

By Application Analysis

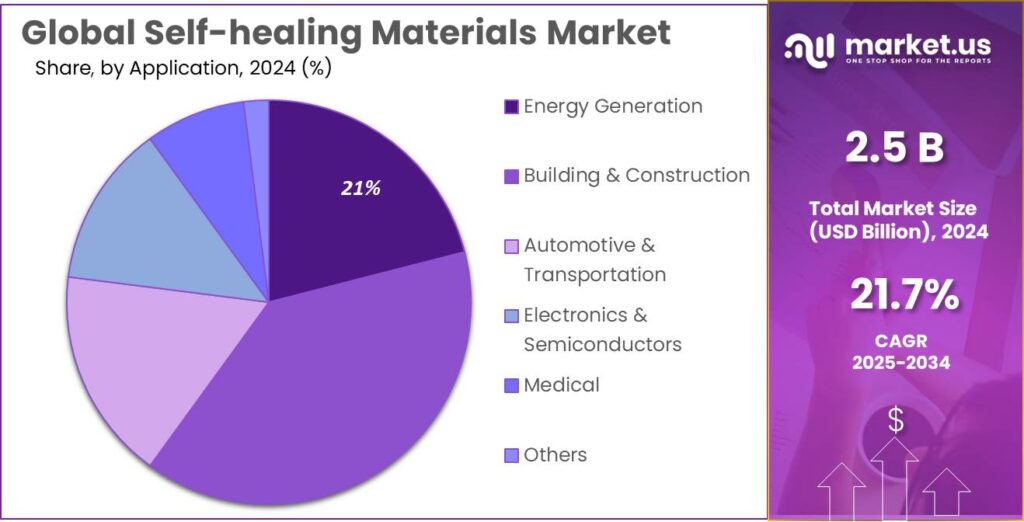

Building & Construction leads the Self-healing Materials Market with a strong 39.1% share, driven by durability needs

In 2024, Building & Construction held a dominant market position, capturing more than a 39.1% share, supported by rising demand for long-lasting and low-maintenance structures. Self-healing materials were increasingly used in concrete, coatings, and protective layers for bridges, tunnels, buildings, and infrastructure assets, where early crack repair helps prevent structural damage. This reduced repair costs and improved safety over the life of projects.

In 2025, continued investment in smart infrastructure and sustainable construction supported steady adoption, as developers looked for materials that extend service life and lower total ownership costs. These benefits allowed the building and construction segment to remain the leading application area in the self-healing materials market.

Key Market Segments

By Product

- Concrete

- Coatings

- Polymers

- Asphalt

- Fiber-reinforced Composites

- Ceramic

- Metals

By Technology

- Reversible Polymers

- Microencapsulation

- Shape Memory Materials

- Biological Material Systems

- Others

By Application

- Energy Generation

- Building & Construction

- Automotive & Transportation

- Electronics & Semiconductors

- Medical

- Others

Emerging Trends

Self-Healing Barrier Films Move Into Food Packaging

One clear trend in self-healing materials is the shift from “nice-to-have” lab demos into barrier layers, coatings, and flexible films that protect food. The reason is simple: packaging fails in boring ways—tiny scratches, pinholes, and micro-cracks that slowly let in oxygen or moisture. A self-healing layer can close those defects by itself, keeping the barrier performance steady for longer. That matters because global food waste is still enormous: in 2022, the world wasted about 1.05 billion tonnes of food across households, food service, and retail, which is roughly 19% of food available to consumers.

- Food brands and retailers are feeling pressure from both waste and packaging scrutiny, so they are chasing materials that can do “more” with “less.” For example, PepsiCo reports that in 2024 it used 2.1 million metric tons of plastic in its key packaging markets. Nestlé’s reporting also shows the scale: its total plastic packaging is listed at about 927 kilotonnes in 2023.

Government policy is also nudging the market toward higher-performance, lower-waste packaging—exactly the space where self-healing films can fit. The European Commission notes that the EU’s Packaging and Packaging Waste Regulation (PPWR) entered into force on 11 February 2025, with a general application date 18 months later, aiming to reduce packaging waste and primary raw-material use. In parallel, waste systems are being upgraded too. In England, the UK government announced up to £295 million to help councils introduce weekly food waste collections by 31 March 2026—a practical move that keeps food scraps out of landfill and increases pressure to prevent avoidable food waste upstream.

Drivers

High Maintenance Costs Push Industries Toward Self-Repairing Materials

A major driver for self-healing materials is the simple cost of keeping assets working. Across heavy industry, transport, and public infrastructure, small cracks and surface damage quietly turn into expensive failures when they are not stopped early. Self-healing coatings, polymers, and cement systems are attractive because they can seal micro-damage on their own, helping operators avoid repeat repairs and unexpected shutdowns.

The corrosion burden shows why the business case is getting stronger. A widely referenced industry assessment estimates the global cost of corrosion at US$2.5 trillion, equal to about 3.4% of global GDP (based on 2013 data). That scale of loss keeps plant owners, ports, pipelines, and bridge agencies focused on prevention technologies—not just better inspection routines. Self-healing protective layers sit directly in that “prevention” bucket because they aim to slow damage growth before it becomes a visible defect.

- Public infrastructure spending needs underline the same pressure. In the U.S., ASCE reported that bridge rehabilitation spending needs to rise by 58%, from $14.4 billion per year to $22.7 billion per year, to improve bridge conditions. When budgets have to stretch this far, agencies become more open to materials that extend intervals between repairs, even if the upfront material cost is higher.

Industry references also point to the scale of the bridge backlog challenge. AMPP’s corrosion reference library cites a Federal Highway Administration estimate that it would cost $20.5 billion annually for the next 16 years to properly update existing bridges, which it notes is more than 60% above what is currently being spent. Numbers like these explain why asset owners care about solutions that reduce repeat maintenance events: when the baseline need is that large, even modest lifecycle savings become meaningful.

Restraints

Regulatory and Qualification Barriers Hinder Adoption of Self-Healing Materials

In the United States, the Food and Drug Administration (FDA) sets strict standards for any food contact material, which includes polymers and coatings used in packaging or machinery that touch food products. The FDA’s regulatory framework requires manufacturers to clearly demonstrate that each component of a material is safe and that it won’t contaminate food with harmful chemicals.

According to FDA documentation, food contact substances must meet regulatory definitions under Title 21 of the Code of Federal Regulations, or be covered by generally recognized as safe (GRAS) status, a prior sanction letter, a Threshold of Regulation exemption, or an effective Food Contact Substance Notification before use. These requirements mean extensive testing, documentation, and often prolonged review times before a material can enter the food supply chain.

- These regulatory challenges are reinforced by the workload of the FDA and similar food safety bodies. For example, from fiscal years 2018 to 2023, the FDA conducted an average of 8,353 inspections per year at domestic facilities and only 917 inspections per year of foreign facilities, which was about 5% of its target for foreign inspections. These figures indicate ongoing resourcing and capacity challenges within the very agencies that would review and approve new contact materials in food settings.

Opportunity

Food Waste Targets Create a Strong Pull for Self-Healing Packaging

A major growth opportunity for self-healing materials is food packaging and food-handling surfaces, where tiny scratches, pinholes, and flex-cracks can quietly ruin barrier performance. When a film or coating loses its barrier, oxygen and moisture move faster, aromas leak, and shelf life drops. Self-healing layers (for example, coatings that “close” microcracks after bending) are being explored as a practical way to keep barrier performance stable during transport, retail handling, and repeated opening and closing.

- The size of the waste problem makes this opportunity real, not theoretical. UNEP’s Food Waste Index Report 2024 estimates that the world wasted about 1.05 billion tonnes of food in 2022 across retail, food service, and households, and that roughly 19% of food available to consumers goes to waste. The report also breaks this down to 631 million tonnes wasted at household level, 290 million tonnes in food service, and 131 million tonnes in retail.

Policy pressure is tightening, which further supports adoption. In the European Union, the European Commission describes binding food waste reduction targets to be achieved by 2030: 10% reduction in processing and manufacturing, and 30% reduction jointly at retail and consumption. Targets like these push companies to invest in prevention, because cutting waste after it happens is expensive and often reputationally risky.

The same direction shows up in the United States. The EPA explains a national goal to reduce food waste by 50% by 2030, aiming to bring food waste down to 164 pounds per person. A goal framed this clearly tends to move procurement conversations: retailers, foodservice groups, and consumer brands start looking for measurable waste-prevention levers, including better packaging performance under real handling stress. Self-healing materials fit here because they target a common failure mode—damage during shipping and use—without asking consumers to behave differently.

Regional Insights

APAC leads the Self-healing Materials Market with a strong 49.90% share and about USD 1.2 Bn revenue by 2025, driven by rapid industrial and construction growth

In 2024-2025, the Asia-Pacific (APAC) region emerged as the dominant market for self-healing materials, holding roughly 49.90% of the global share and generating approximately USD 1.2 billion in revenue by 2025. This leadership reflected robust demand from large and expanding sectors such as building & construction, automotive, electronics, and infrastructure development, particularly in countries like China, India, Japan, and South Korea, where rapid urbanisation and industrialisation accelerated material adoption.

APAC’s growth was underpinned by extensive infrastructure projects aimed at enhancing durability and reducing long-term maintenance costs, which made self-healing concrete, coatings, and polymers particularly attractive for public works and commercial buildings. Consumer electronics manufacturers in the region also increased use of self-healing polymers and coatings to enhance product resilience and reduce warranty claims. Government initiatives promoting advanced materials and sustainability further supported market expansion, contributing to evolving application landscapes in construction and industrial equipment.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Michelin Group, traditionally known for tyre manufacturing, has innovated self-healing rubber compounds for tire applications. In 2025, the company confirmed successful testing of second-generation self-healing tyre materials with elastic polymer chains that independently seal punctures, extending tyre life for commercial fleets and reducing maintenance requirements in transportation sectors.

High Impact Technology, LLC specialises in protective and self-repairing composite solutions for infrastructure and defence markets. In 2024–25, the company advanced self-healing composites designed for blast protection and fuel cell systems, supporting extended service life and reduced lifecycle costs in high-stress environments. Its technologies contribute to enhanced durability in critical applications where material resilience is essential.

Covestro AG, a key developer of specialty polymers and self-healing materials, continued to invest in self-repairing coatings and elastomers tailored for automotive and industrial sectors. In 2024–25, Covestro strengthened its self-healing portfolio through targeted R&D partnerships and emerging product launches for flexible displays and protective films, aligning with rising demand for longer-lasting and resilient material solutions in electronics and mobility applications.

Top Key Players Outlook

- The Dow Chemical Company

- Covestro AG

- High Impact Technology, LLC

- Huntsman International LLC

- Michelin Group

- MacDermid Autotype Ltd.

- Akzo Nobel N.V.

- Evonik Industries Corporation

- BASF SE

- NEI Corporation

Recent Industry Developments

In 2024, Dow achieved notable innovation milestones, winning 12 Edison Awards for technologies that improved sustainability and material performance, with several linked to advanced materials that enhance durability and recyclability in infrastructure and product applications.

In 2024, Covestro invested significantly in innovation, with total R&D spending at €392 million, directed toward developing new applications and improving material properties for sectors such as coatings, adhesives, and elastomers that can exhibit autonomous repair features in future product lines.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 17.8 Bn CAGR (2025-2034) 21.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Concrete, Coatings, Polymers, Asphalt, Fiber-reinforced Composites, Ceramic, Metals), By Technology (Reversible Polymers, Microencapsulation, Shape Memory Materials, Biological Material Systems, Others), By Application (Energy Generation, Building And Construction, Automotive And Transportation, Electronics And Semiconductors, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Dow Chemical Company, Covestro AG, High Impact Technology, LLC, Huntsman International LLC, Michelin Group, MacDermid Autotype Ltd., Akzo Nobel N.V., Evonik Industries Corporation, BASF SE, NEI Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Self-healing Materials MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Self-healing Materials MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- The Dow Chemical Company

- Covestro AG

- High Impact Technology, LLC

- Huntsman International LLC

- Michelin Group

- MacDermid Autotype Ltd.

- Akzo Nobel N.V.

- Evonik Industries Corporation

- BASF SE

- NEI Corporation