Global Rubber Track Market Size, Share, Growth Analysis By Track Type (Continuous Wire Strand, Overlapping/Non-Continuous Wire Strand), By Equipment Type (Compact Track/Multi-Terrain Loaders, Agriculture Tractors, Mini-Excavators, Combine Harvesters, Others), By Tread Pattern (Block-Pattern, C-Pattern, Straight-Bar, Multi-Bar, Zig-Zag, Others), By Application (Construction & Mining, Agriculture & Harvesters), By Sales Channel (Aftermarket, OEM) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174188

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Rubber Track Market Overview

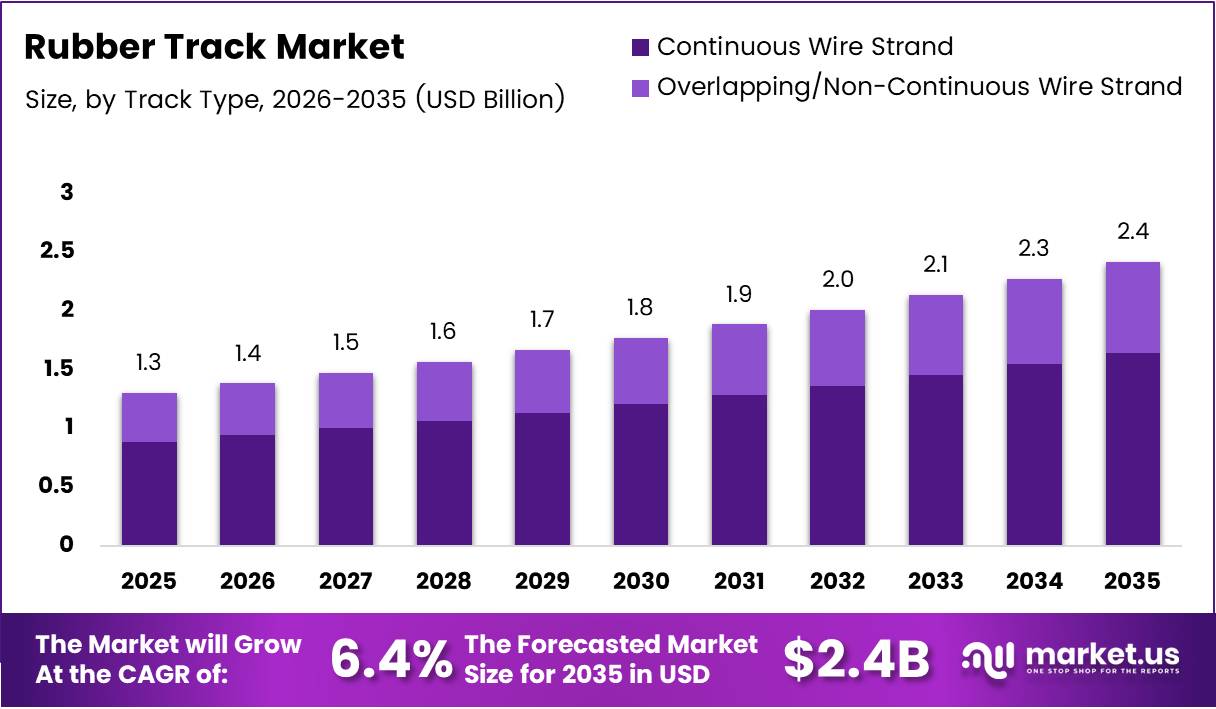

The Global Rubber Track Market size is expected to be worth around USD 2.4 Billion by 2035 from USD 1.3 Billion in 2025, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

Rubber tracks represent specialized traction systems designed for heavy equipment and machinery. These continuous belt-like structures utilize reinforced rubber compounds with embedded wire strands. Moreover, they provide superior mobility across challenging terrains while minimizing surface damage compared to traditional steel tracks.

The market demonstrates significant expansion driven by construction modernization and agricultural mechanization. Consequently, equipment manufacturers increasingly adopt rubber track technology for compact loaders, excavators, and harvesters. Additionally, infrastructure development projects worldwide fuel demand for low-ground-pressure machinery solutions.

Construction and landscaping sectors show accelerating adoption rates for compact track loaders. Therefore, fleet operators prioritize equipment that delivers enhanced maneuverability without damaging finished surfaces. Furthermore, urban infrastructure projects require machinery that reduces ground disturbance during operation.

Agricultural mechanization drives substantial market growth, particularly in emerging economies. However, farmers demand equipment capable of operating across wet fields and sensitive soil conditions. Additionally, rubber tracks enable year-round farming operations by providing consistent traction performance regardless of weather conditions.

According to Fusable EDA equipment finance data, 54,269 new compact track loaders were financed from March 2024 to February 2025, versus 48,061 in the prior period. This represents notable year-over-year growth in equipment adoption. Moreover, the increasing financing activity indicates strong market confidence and expanding user base across construction sectors.

Technological advancements enhance product durability and performance characteristics substantially. Manufacturers develop multi-ply reinforced structures that extend operational lifespan significantly. Consequently, advanced tread pattern designs improve traction capabilities across diverse applications. Furthermore, integration of recyclable rubber compounds addresses environmental sustainability concerns effectively.

Key Takeaways

- Global Rubber Track Market valued at USD 1.3 Billion in 2025, projected to reach USD 2.4 Billion by 2035

- Market growing at CAGR of 6.4% during forecast period 2026-2035

- Continuous Wire Strand dominates Track Type segment with 67.9% market share

- Compact Track/Multi-Terrain Loaders lead Equipment Type segment at 37.8% share

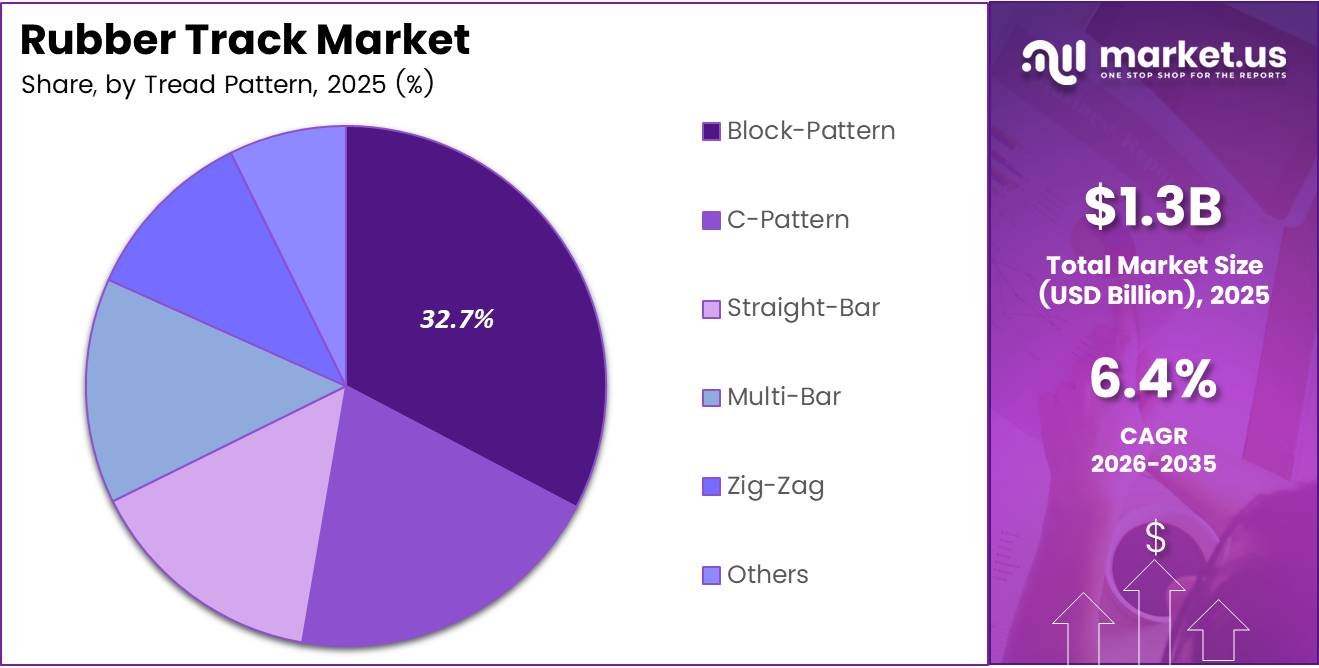

- Block-Pattern captures 32.7% of Tread Pattern segment

- Construction & Mining application holds dominant 59.5% market position

- Aftermarket Sales Channel accounts for 67.2% market share

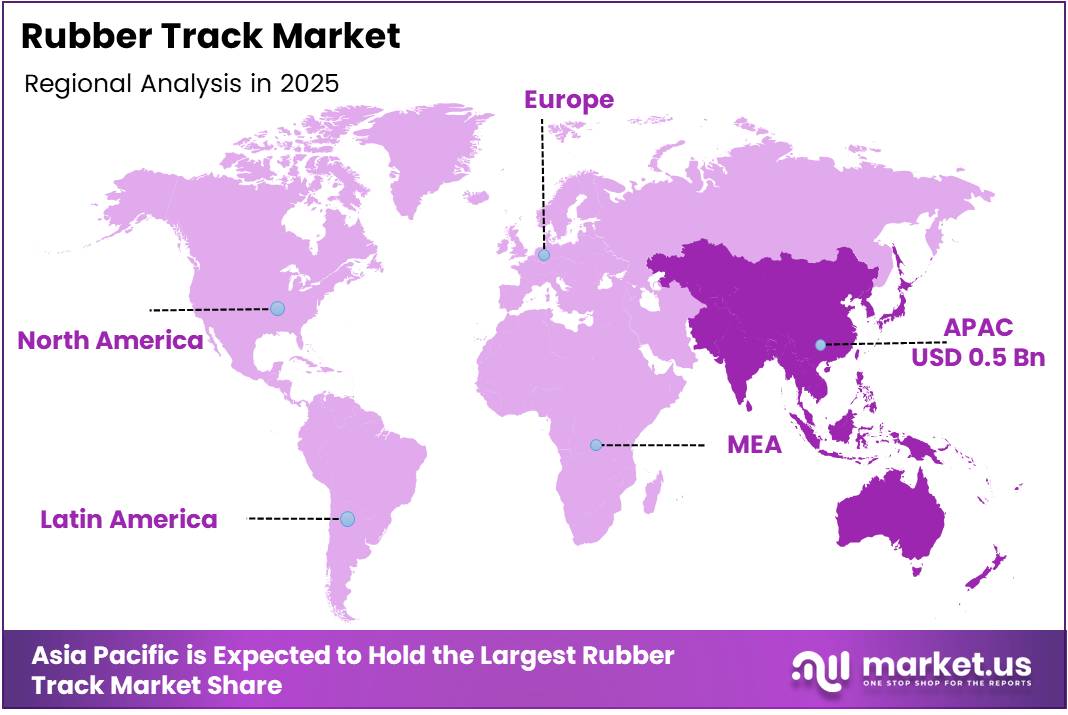

- Asia Pacific dominates regional market with 39.1% share, valued at USD 0.5 Billion

Track Type Analysis

Continuous Wire Strand dominates with 67.9% due to superior structural integrity and extended operational lifespan.

In 2025, Continuous Wire Strand held a dominant market position in the Track Type segment of Rubber Track Market, with a 67.9% share. This technology incorporates uninterrupted steel wire reinforcement throughout the track’s circumference. Moreover, continuous strand construction delivers exceptional tensile strength and resistance to elongation. Consequently, equipment operators prefer this design for heavy-duty applications requiring maximum durability and reliability across demanding operational environments.

Overlapping/Non-Continuous Wire Strand represents the alternative track construction methodology in this segment. This design features individually embedded wire strands arranged in overlapping patterns throughout the rubber matrix. Additionally, this configuration provides adequate strength for lighter equipment applications. However, the discontinuous reinforcement structure limits maximum load capacity compared to continuous wire alternatives in high-stress operational scenarios.

Equipment Type Analysis

Compact Track/Multi-Terrain Loaders dominate with 37.8% driven by versatile construction and landscaping applications.

In 2025, Compact Track/Multi-Terrain Loaders held a dominant market position in the Equipment Type segment of Rubber Track Market, with a 37.8% share. These machines deliver exceptional maneuverability across diverse terrain conditions while maintaining low ground pressure. Moreover, construction contractors favor these loaders for site preparation, material handling, and finished surface operations. Therefore, the segment benefits from increasing urbanization and infrastructure development projects globally.

Agriculture Tractors constitute a substantial equipment category adopting rubber track technology increasingly. These machines utilize tracks to minimize soil compaction while distributing weight across larger surface areas. Additionally, farmers employ tracked tractors for field operations during wet conditions when wheeled equipment cannot operate. Consequently, this segment grows steadily as agricultural mechanization accelerates worldwide.

Mini-Excavators represent compact earthmoving equipment widely deployed across residential construction projects. These machines feature rubber tracks that enable operation on paved surfaces without causing damage. Furthermore, their compact footprint and reduced noise levels make them ideal for urban construction environments. Therefore, this segment experiences robust growth driven by expanding residential development activities.

Combine Harvesters utilize rubber tracks to enhance mobility during harvesting operations across challenging field conditions. These agricultural machines benefit from improved flotation and reduced soil compaction characteristics. Moreover, tracked harvesters operate effectively across wet fields where wheeled alternatives struggle. Additionally, the technology enables farmers to extend harvesting windows and improve operational efficiency significantly.

Tread Pattern Analysis

Block-Pattern dominates with 32.7% offering balanced traction and stability across mixed terrain applications.

In 2025, Block-Pattern held a dominant market position in the Tread Pattern segment of Rubber Track Market, with a 32.7% share. This design features distinct rubber blocks arranged strategically across the track surface. Moreover, block patterns deliver excellent traction on soft ground while maintaining stability on hard surfaces. Consequently, equipment operators select this configuration for applications requiring versatile performance across changing terrain conditions.

C-Pattern represents a specialized tread design featuring curved block arrangements optimized for specific applications. This configuration provides enhanced lateral stability during slope operations and turning maneuvers. Additionally, the pattern reduces track slippage while maintaining consistent ground contact. Therefore, contractors utilize C-pattern tracks for equipment operating on uneven terrain and hillside construction projects.

Straight-Bar patterns feature continuous bars running perpendicular to the track’s direction of travel. This design maximizes surface contact area and distributes load evenly across the track width. Furthermore, straight-bar configurations excel in applications requiring maximum flotation on soft ground. However, they provide limited directional control compared to block-pattern alternatives in mixed terrain scenarios.

Multi-Bar tread patterns incorporate multiple parallel bars with varying heights and spacing configurations. These designs balance traction capabilities with self-cleaning characteristics essential for muddy conditions. Moreover, multi-bar patterns prevent material buildup between tread elements during operation. Consequently, agricultural and forestry equipment operators favor this configuration for operations in organic debris environments.

Zig-Zag patterns feature angled tread elements arranged in alternating directions across the track surface. This configuration enhances self-cleaning capabilities while maintaining adequate traction performance. Additionally, zig-zag designs reduce vibration transmission to the operator platform. Therefore, this pattern suits applications requiring extended operational hours and operator comfort considerations.

Application Analysis

Construction & Mining dominates with 59.5% propelled by infrastructure expansion and urbanization projects globally.

In 2025, Construction & Mining held a dominant market position in the Application segment of Rubber Track Market, with a 59.5% share. This sector demands robust equipment capable of operating across challenging terrain while minimizing surface damage. Moreover, urban construction projects increasingly require machinery that preserves finished surfaces and reduces ground disturbance. Consequently, contractors adopt rubber-tracked equipment for site preparation, material handling, and precision grading operations extensively.

Agriculture & Harvesters represent a growing application segment driven by farming mechanization in emerging markets. These operations utilize rubber tracks to minimize soil compaction while maximizing operational efficiency. Additionally, tracked agricultural equipment enables farming activities during adverse weather conditions when soil moisture levels prohibit wheeled machinery. Therefore, this segment expands steadily as farmers seek technologies that enhance productivity and protect soil health.

Sales Channel Analysis

Aftermarket dominates with 67.2% driven by replacement demand and equipment maintenance requirements.

In 2025, Aftermarket held a dominant market position in the Sales Channel segment of Rubber Track Market, with a 67.2% share. Equipment owners require regular track replacement due to wear from normal operations and challenging terrain conditions. Moreover, aftermarket channels provide diverse product options catering to specific application requirements and budget constraints. Consequently, independent distributors and equipment dealers capture substantial revenue through replacement part sales and service operations.

OEM sales channel represents factory-direct equipment sales with pre-installed rubber track systems. Manufacturers increasingly offer rubber tracks as standard or optional equipment on new machinery. Additionally, OEM channels ensure proper track specification matching equipment capabilities and intended applications. Therefore, this segment benefits from growing equipment sales and expanding factory-fitted track system adoption rates.

Key Market Segments

By Track Type

- Continuous Wire Strand

- Overlapping/Non-Continuous Wire Strand

By Equipment Type

- Compact Track/Multi-Terrain Loaders

- Agriculture Tractors

- Mini-Excavators

- Combine Harvesters

- Others

By Tread Pattern

- Block-Pattern

- C-Pattern

- Straight-Bar

- Multi-Bar

- Zig-Zag

- Others

By Application

- Construction & Mining

- Agriculture & Harvesters

By Sales Channel

- Aftermarket

- OEM

Drivers

Rising Adoption of Compact Track Loaders in Construction and Landscaping Equipment Fleets

Construction contractors increasingly deploy compact track loaders for versatile site operations and material handling applications. These machines deliver superior maneuverability across finished surfaces without causing damage to paved areas or landscaping. Moreover, rubber tracks distribute equipment weight evenly, reducing ground pressure substantially compared to wheeled alternatives. Consequently, equipment rental companies expand their tracked loader inventories to meet growing customer demand.

Urban construction projects require machinery that minimizes surface disruption while maintaining productivity levels. Therefore, contractors prioritize equipment featuring rubber tracks for operations near existing structures and completed installations. Additionally, landscaping professionals utilize tracked loaders for turf installation, hardscape construction, and site grading operations. Furthermore, the technology enables year-round equipment utilization across diverse weather conditions and terrain types.

Restraints

Higher Replacement Cost of Rubber Tracks Compared to Traditional Steel Tracks

Rubber track replacement represents a substantial operational expense for equipment owners and fleet managers. These components typically cost significantly more than conventional steel track systems per replacement cycle. Moreover, rubber tracks experience accelerated wear when operating on abrasive surfaces or in high-temperature environments. Consequently, some operators hesitate to adopt tracked equipment due to elevated long-term maintenance costs.

Budget-conscious contractors evaluate total ownership costs when selecting equipment for their fleets. Therefore, higher replacement expenses influence purchasing decisions, particularly for applications involving extended abrasive surface operation. Additionally, equipment operating in demolition or mining environments experiences reduced track lifespan significantly. Furthermore, operators must balance performance advantages against increased maintenance expenditures throughout equipment service life.

Growth Factors

Increasing Penetration of Rubber Tracks in Autonomous and Remote-Controlled Machinery

Autonomous equipment development accelerates across construction, agriculture, and mining sectors substantially. These advanced machines require reliable undercarriage systems that deliver consistent performance across diverse terrain conditions. Moreover, rubber tracks provide smooth operation characteristics essential for precision control systems and sensor accuracy. Consequently, manufacturers increasingly specify rubber track undercarriages for autonomous machinery platforms.

Remote-controlled equipment adoption expands for hazardous environment operations and specialized applications. Therefore, operators demand reliable traction systems that enable precise machine control from safe distances. Additionally, rubber tracks reduce vibration transmission that could interfere with electronic control systems and communication equipment. Furthermore, the technology supports emerging automation trends by providing predictable performance characteristics essential for unmanned operations.

Emerging Trends

Development of Multi-Ply Reinforced Rubber Track Structures for Extended Lifespan

Manufacturers engineer advanced track constructions featuring multiple reinforcement layers for enhanced durability. These multi-ply designs incorporate varied rubber compounds optimized for specific performance characteristics and operational requirements. Moreover, layered construction distributes operational stresses more effectively throughout the track structure. Consequently, equipment owners achieve substantially extended service intervals and reduced replacement frequency.

Advanced tread pattern designs emerge featuring sophisticated geometries that enhance traction across diverse surface conditions. Therefore, engineers utilize computer modeling to optimize block configurations for maximum grip and self-cleaning capabilities. Additionally, manufacturers integrate recyclable rubber compounds addressing environmental sustainability concerns increasingly important to equipment buyers. Furthermore, OEM partnerships expand as factory-fitted track systems gain preference over aftermarket conversions substantially.

Regional Analysis

Asia Pacific Dominates the Rubber Track Market with a Market Share of 39.1%, Valued at USD 0.5 Billion

Asia Pacific maintains dominant market position driven by extensive infrastructure development and agricultural mechanization initiatives. The region holds 39.1% market share, valued at USD 0.5 Billion in 2025. Moreover, China, India, and Southeast Asian nations invest heavily in construction equipment modernization programs. Consequently, demand for rubber-tracked machinery accelerates across urban development projects and farming operations. Additionally, government infrastructure spending initiatives support sustained market expansion throughout the forecast period.

North America Rubber Track Market Trends

North America demonstrates mature market characteristics with established equipment replacement cycles and strong aftermarket presence. Construction activity remains robust across residential and commercial development sectors. Moreover, agricultural mechanization continues advancing with tracked equipment adoption in precision farming applications. Therefore, the region maintains steady growth supported by equipment fleet modernization and technology upgrades.

Europe Rubber Track Market Trends

Europe exhibits strong demand driven by stringent environmental regulations and surface protection requirements. Urban construction projects prioritize low-impact machinery that preserves infrastructure and minimizes disruption. Additionally, agricultural operators adopt tracked equipment to address soil compaction concerns and environmental sustainability mandates. Furthermore, the region emphasizes equipment efficiency and emission reduction technologies.

Middle East and Africa Rubber Track Market Trends

Middle East and Africa show emerging growth potential fueled by infrastructure development and construction sector expansion. Regional governments invest substantially in transportation networks, urban development, and agricultural modernization programs. Moreover, challenging terrain conditions across many markets favor rubber track equipment adoption. Therefore, the region presents significant long-term growth opportunities.

Latin America Rubber Track Market Trends

Latin America experiences moderate growth driven by agricultural sector mechanization and mining industry activity. Brazil and Mexico lead regional equipment adoption with expanding construction and farming operations. Additionally, infrastructure investment initiatives support steady demand for tracked machinery. Furthermore, improving economic conditions enable equipment fleet modernization across various industries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Rubber Track Company Insights

Bridgestone Industrial maintains a leading global position through extensive manufacturing capabilities and diversified product portfolios serving multiple equipment segments. The company leverages advanced rubber compound technology developed through decades of tire manufacturing expertise. Moreover, Bridgestone’s global distribution network ensures consistent product availability across major markets worldwide.

Mclaren Industries Inc. specializes in aftermarket rubber track manufacturing with strong North American market presence and customer service capabilities. The company offers competitively priced alternatives to OEM products while maintaining quality standards acceptable for demanding applications. Additionally, Mclaren focuses on rapid delivery and responsive technical support that differentiates its market positioning.

Global Track Warehouse operates as a major distribution and manufacturing entity serving international markets with diverse product offerings. The company maintains extensive inventory positions enabling quick fulfillment of customer orders across multiple equipment brands and models. Moreover, Global Track Warehouse develops proprietary track designs optimized for specific equipment applications and operational requirements.

Camso represents a prominent manufacturer delivering innovative track systems for construction, agriculture, and powersports applications globally. The company invests substantially in research and development activities focused on performance enhancement and durability improvements. Additionally, Camso maintains strategic OEM partnerships with leading equipment manufacturers worldwide.

Key Players

- Bridgestone Industrial

- Mclaren Industries Inc.

- Global Track Warehouse

- Camso

- Soucy

- Yokohama TWS

- Grizzly Rubber Tracks

- Astrak

- Mattracks Inc.

- Jiaxing Taite Rubber

Recent Developments

- In March 2024, CAMSO launched the ICE° ARROWHEAD 130 snowmobile rubber track, introducing advanced tread technology for enhanced performance. This product delivers improved traction characteristics across varied snow conditions while maintaining durability standards.

- In August 2025, Mattracks launched the RT60 and RT80 track systems for compact equipment, expanding application versatility significantly. These systems enable wheeled equipment conversion to tracked configuration, providing enhanced mobility across challenging terrain conditions.

Report Scope

Report Features Description Market Value (2025) USD 1.3 Billion Forecast Revenue (2035) USD 2.4 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Track Type (Continuous Wire Strand, Overlapping/Non-Continuous Wire Strand), By Equipment Type (Compact Track/Multi-Terrain Loaders, Agriculture Tractors, Mini-Excavators, Combine Harvesters, Others), By Tread Pattern (Block-Pattern, C-Pattern, Straight-Bar, Multi-Bar, Zig-Zag, Others), By Application (Construction & Mining, Agriculture & Harvesters), By Sales Channel (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bridgestone Industrial, Mclaren Industries Inc., Global Track Warehouse, Camso, Soucy, Yokohama TWS, Grizzly Rubber Tracks, Astrak, Mattracks Inc., Jiaxing Taite Rubber Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bridgestone Industrial

- Mclaren Industries Inc.

- Global Track Warehouse

- Camso

- Soucy

- Yokohama TWS

- Grizzly Rubber Tracks

- Astrak

- Mattracks Inc.

- Jiaxing Taite Rubber