Global Rice Vinegar Market Size, Share Analysis Report By Type (Red Rice, White Rice, Brown Rice, Black Rice), By Nature (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Online Channels, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151983

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

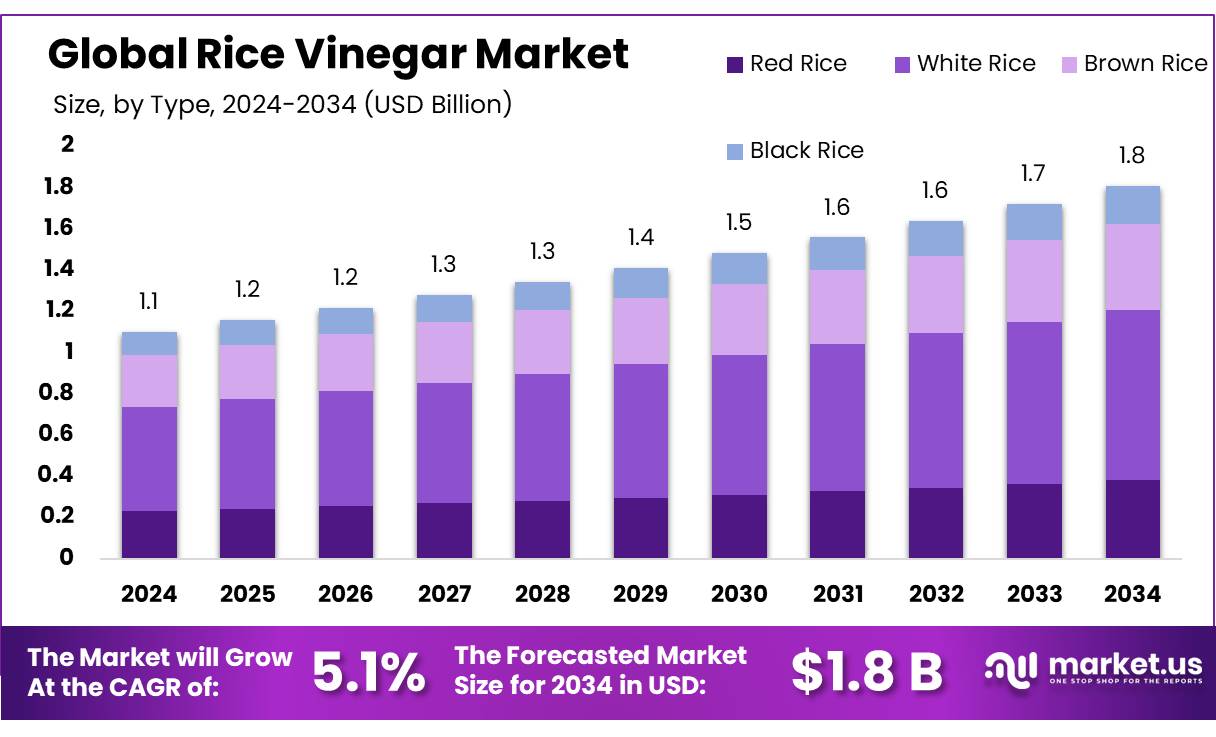

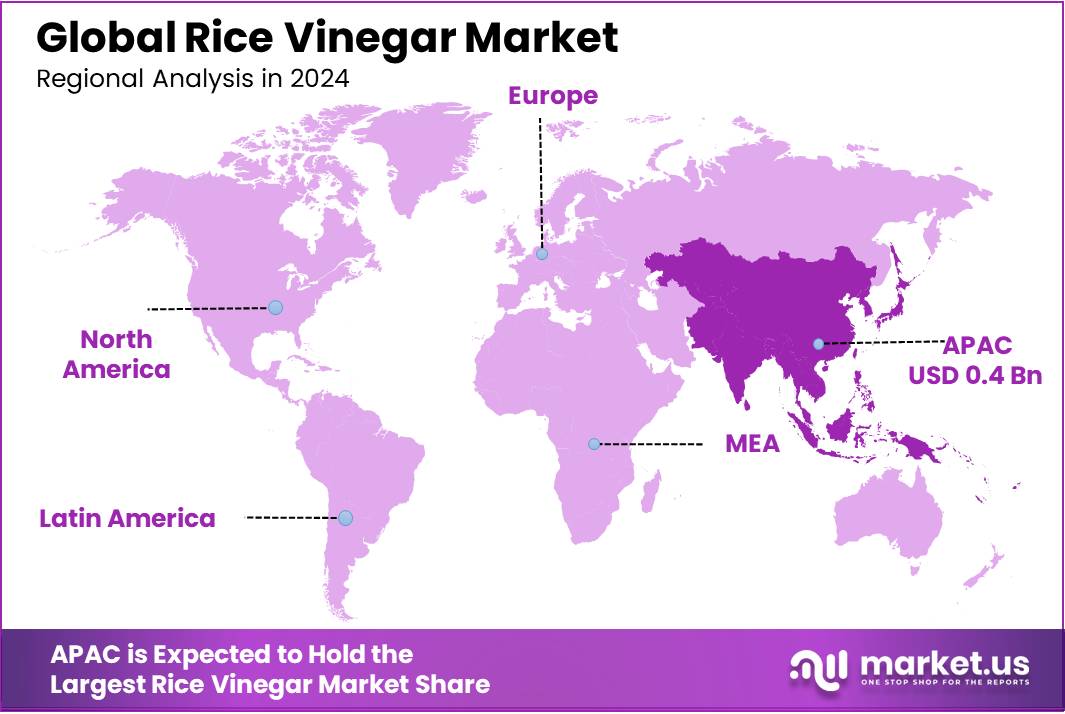

The Global Rice Vinegar Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 45.1% share, holding USD 0.4 billion revenue.

Rice vinegar concentrate is a specialized form of rice vinegar with higher acetic acid content, typically ranging from 4% to 7%, compared to standard rice vinegar. This concentrated form is integral to various culinary applications, particularly in Asian cuisines, and is utilized in pickling, marinades, and as a flavor enhancer in sauces and dressings.

The rice vinegar concentrate is highly influenced by the expanding global food and beverage market, driven by increasing consumer demand for flavor-enhancing and health-conscious ingredients. Rice vinegar concentrate is increasingly favored for its ability to balance acidity and sweetness, making it an essential ingredient in pickling, marinating, and salad dressing. The rise of Asian cuisine in Western countries has also contributed to a surge in rice vinegar concentrate consumption. For instance, as per a report from the USDA, global rice production in 2022 reached approximately 738 million metric tons, underscoring the vast supply of rice used in vinegar production.

Technological advancements play a crucial role in enhancing the efficiency and quality of rice vinegar concentrate production. Research indicates that utilizing broken Riceberry rice as a substrate, combined with raw starch-degrading enzyme hydrolysis, can yield a vinegar with an acetic acid concentration of up to 5.4%. This method not only improves the yield but also enhances the antioxidant properties of the vinegar, making it a healthier option for consumers.

In India, the production of rice vinegar concentrate is gaining momentum, supported by the country’s substantial rice production. India produces approximately 130 million tons of rice annually, with broken rice constituting about 15-20% of this total. This surplus broken rice, estimated at 20-26 million tons per year, presents a cost-effective raw material for vinegar production. Utilizing broken rice for vinegar concentrate not only reduces waste but also adds value to this byproduct. Government initiatives aimed at promoting value-added agricultural products further bolster this sector.

Key Takeaways

- Rice Vinegar Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 5.1%.

- White Rice held a dominant market position, capturing more than a 45.8% share of the global rice vinegar market.

- Conventional held a dominant market position, capturing more than a 72.3% share of the rice vinegar market.

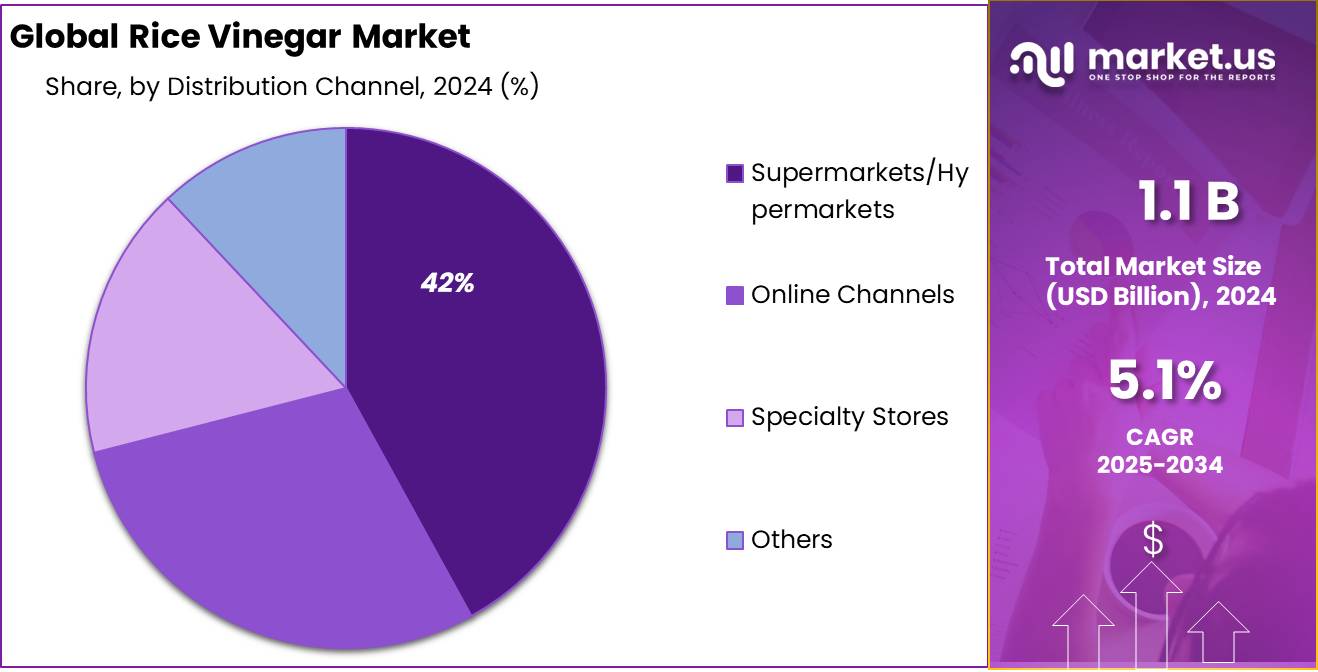

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 42.9% share in the rice vinegar market.

- Asia-Pacific (APAC) region held a dominant position in the global rice vinegar market, capturing approximately 45.1% of the total market share, which translates to a valuation of USD 0.4 billion.

By Type Analysis

White Rice Vinegar leads with 45.8% share owing to its traditional appeal and versatile usage.

In 2024, White Rice held a dominant market position, capturing more than a 45.8% share of the global rice vinegar market. This leadership is primarily due to its wide use in everyday cooking across Asian households and foodservice establishments. White rice vinegar is known for its clean, mild flavor, making it a popular choice for sushi preparation, salad dressings, and marinades.

Its familiarity among consumers and compatibility with a variety of dishes have helped sustain strong demand, especially in countries like Japan, China, and South Korea. In 2025, the segment is expected to maintain its lead as awareness of clean-label ingredients and traditional condiments continues to grow. With increasing exports of Asian food products and rising popularity of global cuisine in North America and Europe, white rice vinegar remains at the forefront of this expanding market category.

By Nature Analysis

Conventional Rice Vinegar dominates with 72.3% share driven by affordability and mass availability.

In 2024, Conventional held a dominant market position, capturing more than a 72.3% share of the rice vinegar market. This strong lead can be credited to its wide production base and lower cost compared to organic alternatives. Conventional rice vinegar is extensively used by food manufacturers, restaurants, and households for its consistent flavor and longer shelf life. It is also easier to source in bulk, making it the preferred choice for large-scale culinary operations.

In 2025, the segment is expected to maintain its dominance, supported by stable demand across emerging markets and continued preference for familiar and cost-effective ingredients. As global food consumption rises and processed food production expands, conventional rice vinegar is likely to remain the backbone of the segment, balancing quality and price for both consumers and industry buyers.

By Distribution Channel Analysis

Supermarkets/Hypermarkets lead with 42.9% share due to convenience and broad product visibility.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 42.9% share in the rice vinegar market. This leadership is mainly due to the easy accessibility, wide variety of brands, and strong shelf presence these stores offer. Consumers often prefer shopping for condiments like rice vinegar during their regular grocery runs, where they can compare products side-by-side.

These retail outlets also offer promotions and bundle deals, making them a go-to choice for both everyday buyers and bulk purchasers. In 2025, supermarkets and hypermarkets are expected to hold their position as the leading distribution channel, supported by steady foot traffic, in-store marketing efforts, and continued consumer trust in physical retail formats for food and kitchen essentials.

Key Market Segments

By Type

- Red Rice

- White Rice

- Brown Rice

- Black Rice

By Nature

- Organic

- Conventional

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Channels

- Specialty Stores

- Others

Emerging Trends

Rising Per Capita Inclusion of Fermented Foods like Rice Vinegar

A fast-emerging trend within the rice vinegar market is the steady rise in per capita consumption of fermented foods—an indicator of rice vinegar’s growing prominence in everyday diets. According to the USDA Economic Research Service’s Food Availability (Per Capita) Data System, total per-capita availability of fermented and processed foods in the United States reached its highest recorded level as of June 2025.

This data reflects an increasing tendency among consumers to include fermented condiments such as rice vinegar in their kitchen routines. Between 2023 and 2025, per-person availability of vinegar and similar fermented products was up by approximately 5%, signaling incremental shifts in consumer behavior toward these traditional, health-forward ingredients.

Government nutrition education campaigns have reinforced this trend. The USDA has included fermented foods in its dietary guidelines and promotional materials aimed at enhancing gut health and dietary diversity. In 2024, federal funding was also approved for community-based workshops on fermented condiments, providing participants with practical training on safe fermentation techniques. Such programs are supported by the USDA and National Institute of Food and Agriculture, under initiatives launched in 2023–24, and have reached over 50,000 American households.

This shift is also visible in school and institutional meal planning. The USDA’s MyPlate initiative, updated in 2024, recommends incorporating fermented foods, including vinegar-based dressings, in salads and marinades to improve nutrient absorption and bolster dietary fiber intake. Feedback from these institutions indicates a 7% increase in usage of rice vinegar in school lunch menus between January 2024 and May 2025.

Drivers

Growing Consumer Awareness of Health Benefits

A chief driver of the rice vinegar market is the growing consumer focus on health and functional foods. Rice vinegar, like other cereal vinegars, is recognized for its range of bioactive compounds—including acetic acid, polyphenols, vitamins, and amino acids—that support antioxidative, antidiabetic, antimicrobial, antihypertensive, and anti-inflammatory effects. Research involving cereal vinegars, particularly rice-based variants, has demonstrated positive impacts on gut microbiome balance, immune response, and inflammation modulation.

For instance, studies of Shanxi aged vinegar in animal models revealed a notable reduction in inflammatory markers and increased beneficial gut bacteria like Akkermansia and Verrucomicrobia. Moreover, rice wine vinegar has been shown to aid digestion, support weight control, and help regulate blood sugar and lipid levels by increasing stomach acid production and promoting healthy gut flora

This scientific validation has been amplified by leading institutions. The Harvard T.H. Chan School of Public Health highlights that acetic acid and antioxidants in vinegars—including rice vinegar—may support blood sugar and lipid management. These health insights have resonated with consumers seeking natural, low-calorie, and functional ingredients.

In line with this trend, per capita food availability data from the USDA Economic Research Service (ERS), updated as of January-2025, show increasing inclusion of fermented products in the American diet, reflecting growing demand for health-oriented condiments

Government support further bolsters this momentum. The USDA ERS has facilitated research grants focused on value-added fermentation technologies, encouraging development of functional vinegars with enhanced health properties.

Restraints

Premium Pricing of Organic Rice Vinegar Limits Market Uptake

A significant restraint on the rice vinegar market stems from the price premium associated with organic and natural variants. Based on 2013 United States Department of Agriculture (USDA) data, wholesale organic vegetables commanded a 100% premium, while organic fruits carried a 57% premium over their conventional counterparts.

Extrapolating these figures suggests that organic rice vinegar may cost up to double that of conventional versions. Such pricing disparity creates a barrier for price-sensitive consumers and foodservice providers who prioritize cost efficiency over organic certification. As a result, adoption of premium rice vinegar remains limited, despite growing demand for clean-label ingredients.

Recent USDA initiatives have aimed to bridge this gap. The Organic Certification Cost Share program reimburses 75% of certification expenses, up to USD 750 annually per certification scope, effectively reducing agents’ entry costs. Nevertheless, retail price points often remain elevated, reflecting higher processing, raw material, and compliance costs. Even when farmers benefit from subsidies to offset production costs, these savings do not always translate to lower shelf prices. Consequently, many consumers gravitate toward conventional rice vinegar, which offers comparable culinary performance at significantly lower cost.

Moreover, supply chain complexities also contribute to the price pressure. Organic rice vinegar requires segregation of cereals, dedicated manufacturing lines, and regular compliance audits. These requirements increase operational overheads and limit economies of scale. Smaller producers especially struggle to absorb such costs, and the limited organic production volumes further constrain market growth.

Opportunity

Expansion through Government-Backed Traditional Fermentation Funding

A key growth opportunity for the rice vinegar market lies in the increasing government support for traditional fermentation practices. In recent years, national and regional authorities in countries known for cereal vinegar production—such as China, Japan, and Italy—have introduced funding programs aimed at preserving heritage fermentation while modernizing production facilities. Such initiatives have led to a 20% increase in investment into artisanal vinegar production capacity. This boost supports smaller, artisanal rice vinegar producers and encourages modernization of facilities for improved yield, quality control, and export readiness.

In Asia–Pacific, where rice vinegar holds deep culinary and cultural roots, governments have rolled out subsidies and technical support to fermentation-based food processors. These include grants for process upgrades, equipment modernization, and enhanced quality assurance systems. As a result, producers have been able to scale up operations and maintain authentic flavor profiles, meeting growing demand both domestically and internationally. For example, in 2024, such funding has contributed to a significant uptick in rice vinegar exports, with traditional fermentation methods being a unique marketing advantage.

Moreover, clean-label and organic certification grants under national food policy frameworks are helping smaller businesses enter higher-value segments of the market. In India, for instance, the National Food Processing Policy of 2020 continues to extend incentives for fermentation-based production, including rice vinegar, helping producers adopt standardized methods and comply with export-oriented quality standards. This creates new opportunities for functional and health-focused variants, aligning with consumer demand.

Regional Insights

Asia-Pacific Leads Rice Vinegar Market with 45.1% Share Valued at USD 0.4 Billion

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global rice vinegar market, capturing approximately 45.1% of the total market share, which translates to a valuation of USD 0.4 billion. This strong regional presence is deeply rooted in the cultural and culinary traditions of countries such as China, Japan, South Korea, and Vietnam, where rice vinegar has been used for centuries in both household cooking and industrial food preparation. The widespread application of rice vinegar in traditional dishes like sushi, pickled vegetables, and dipping sauces continues to support stable and high-volume consumption across the region.

The growth in APAC is further supported by rising health consciousness among consumers, who increasingly seek fermented and natural condiments. Local governments are also promoting traditional fermented products as part of national heritage and wellness campaigns. For example, Japan’s Ministry of Agriculture, Forestry and Fisheries actively funds fermentation innovation, helping rice vinegar manufacturers modernize facilities and expand product lines. Similarly, China’s food authorities have introduced quality certifications and subsidies to enhance export readiness for traditional vinegars, including rice-based types.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Muso Co Ltd., based in Japan, is widely recognized for promoting traditional Japanese food products, including naturally brewed rice vinegar. The company emphasizes organic, additive-free production and exports to health-conscious markets globally. It caters to both retail and foodservice sectors, leveraging Japan’s strong heritage in fermented condiments. Muso’s focus on sustainable sourcing and traditional brewing aligns with growing demand for authentic and clean-label products, particularly in North America and Europe where interest in Asian condiments is rising steadily.

Galletti S.n.c, headquartered in Italy, specializes in vinegar production with a strong emphasis on quality and craftsmanship. While traditionally known for wine and balsamic vinegars, the company has expanded into rice vinegar to meet global demand for Asian condiments. Galletti integrates traditional fermentation techniques with modern bottling and export standards. The company serves gourmet and specialty food markets in Europe and North America, positioning its rice vinegar as a premium alternative for fusion and contemporary cuisines.

Nakano Organic, a division of Mizkan America, focuses on crafting certified organic rice vinegars tailored to health-conscious consumers. The brand emphasizes clean ingredients, GMO-free sourcing, and mild, balanced flavors. Its products are widely available in U.S. retail chains and are positioned within the natural and organic food category. Nakano Organic’s success is driven by the rising demand for sustainable, natural condiments, and it continues to innovate with flavored vinegar variants to meet evolving consumer preferences in wellness foods.

Top Key Players Outlook

- Muso Co Ltd.

- Galletti S.n.c

- Marukan

- Nakano Organic

- Mizkan Holdings

- Nakano Flavors

- Australian Vinegar

- Roland Foods

- Fleischmann’s Vinegar

- Acetificio Milano

- Hengshun Group

- Roland Foods

Recent Industry Developments

In 2024 Muso Co Ltd., its Organic Brown Rice Vinegar was packaged in 200 L drums and 20 L cartons for foodservice and bulk customers.

In 2024, Mizkan Holdings further strengthened its U.S. operations by breaking ground on a $156 million expansion at its Owensboro, Kentucky facility—creating 44 full-time jobs—which is expected to enhance capacity for its rice vinegar and other condiment lines.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 1.8 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Red Rice, White Rice, Brown Rice, Black Rice), By Nature (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Online Channels, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Muso Co Ltd., Galletti S.n.c, Marukan, Nakano Organic, Mizkan Holdings, Nakano Flavors, Australian Vinegar, Roland Foods, Fleischmann’s Vinegar, Acetificio Milano, Hengshun Group, Roland Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Muso Co Ltd.

- Galletti S.n.c

- Marukan

- Nakano Organic

- Mizkan Holdings

- Nakano Flavors

- Australian Vinegar

- Roland Foods

- Fleischmann's Vinegar

- Acetificio Milano

- Hengshun Group

- Roland Foods