Global Rice Transplanter Market Size, Share, And Business Benefits By Product Type (Ride-on Rice Transplanter, Walking Rice Transplanter), By Propulsion Type (Self-Propelled, Manually Operated), By Capacity (Less than 4 Rows, 4-8 Rows, 8-12 Rows, More than 12 Rows), By Transplanting Method (Single Row, Multiple Rows), By Application (Commercial, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159406

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Propulsion Type Analysis

- By Capacity Analysis

- By Transplanting Method Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

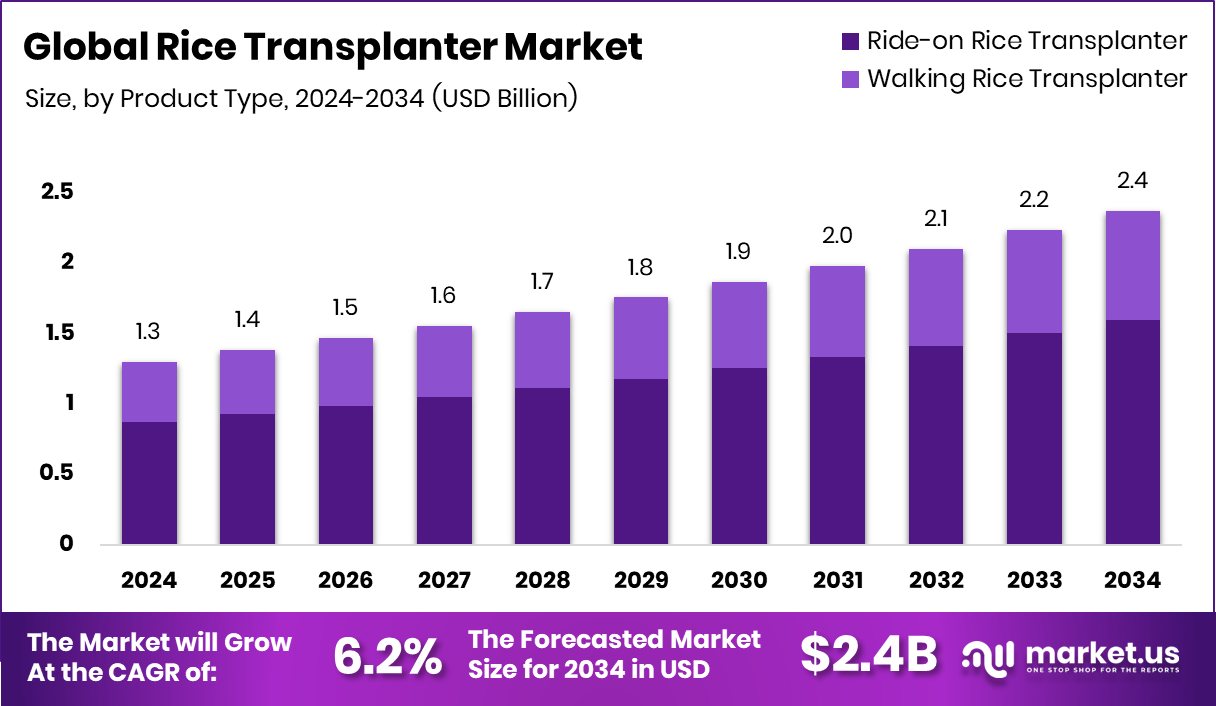

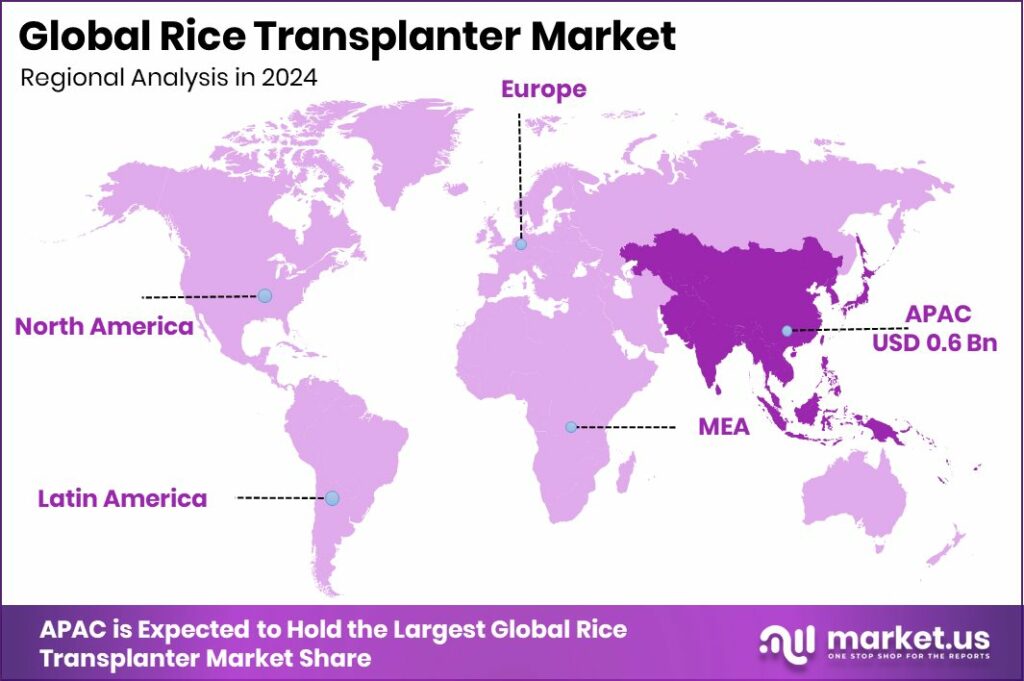

The Global Rice Transplanter Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Asia-Pacific’s 52.90% share. Leadership highlights rising mechanization and government support in rice cultivation.

A Rice Transplanter is a mechanized farming machine designed to transplant rice seedlings into paddy fields in uniform rows. It saves labor, reduces planting time, and ensures better crop management compared to manual transplantation. The machine improves seedling survival rates and supports higher productivity, especially in regions where rice cultivation is intensive and labor shortages are common.

The Rice Transplanter Market is expanding steadily as farmers look for modern solutions to boost efficiency and reduce costs. Growing adoption of mechanization in agriculture, supportive government schemes, and subsidies are accelerating demand. For instance, Government assistance up to 5 lakhs on paddy transplanting machine – Register immediately has encouraged many small and medium farmers to invest in these machines.

One of the biggest growth drivers is the rising demand for food security and efficient farming practices. Mechanization ensures timely sowing, leading to better yields. In India, farmers can avail up to 50% or 8 lakh subsidy on Rice Transplanter, which has significantly lowered barriers for adoption and strengthened overall market growth.

The demand for rice transplanters is increasing due to labor shortages in rural areas and rising wages for manual transplantation. Farmers now prefer machines that reduce time and labor costs while improving productivity. Additionally, private investments are boosting innovation, such as Tencent; others plow $15m+ into ag automator FJ Dynamics, which signals strong future demand for automated rice planting technologies.

The opportunity lies in expanding awareness and accessibility of subsidies, along with introducing affordable and easy-to-operate models for small farmers. With government backing and rising interest from agri-tech investors, the market is poised to reach more regions where rice is a staple crop, making mechanization more inclusive and sustainable.

Key Takeaways

- The Global Rice Transplanter Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- Ride-on Rice Transplanter held 67.2% share, showing farmers’ strong preference for mechanized planting solutions.

- Self-propelled rice transplanters dominated with a 69.1% share, driven by ease of use and higher efficiency.

- In capacity, the 4-8 row segment captured a 44.4% share, balancing affordability with effective field coverage.

- The multiple-row transplanting method led the market with a 77.6% share, ensuring faster and more uniform plantation.

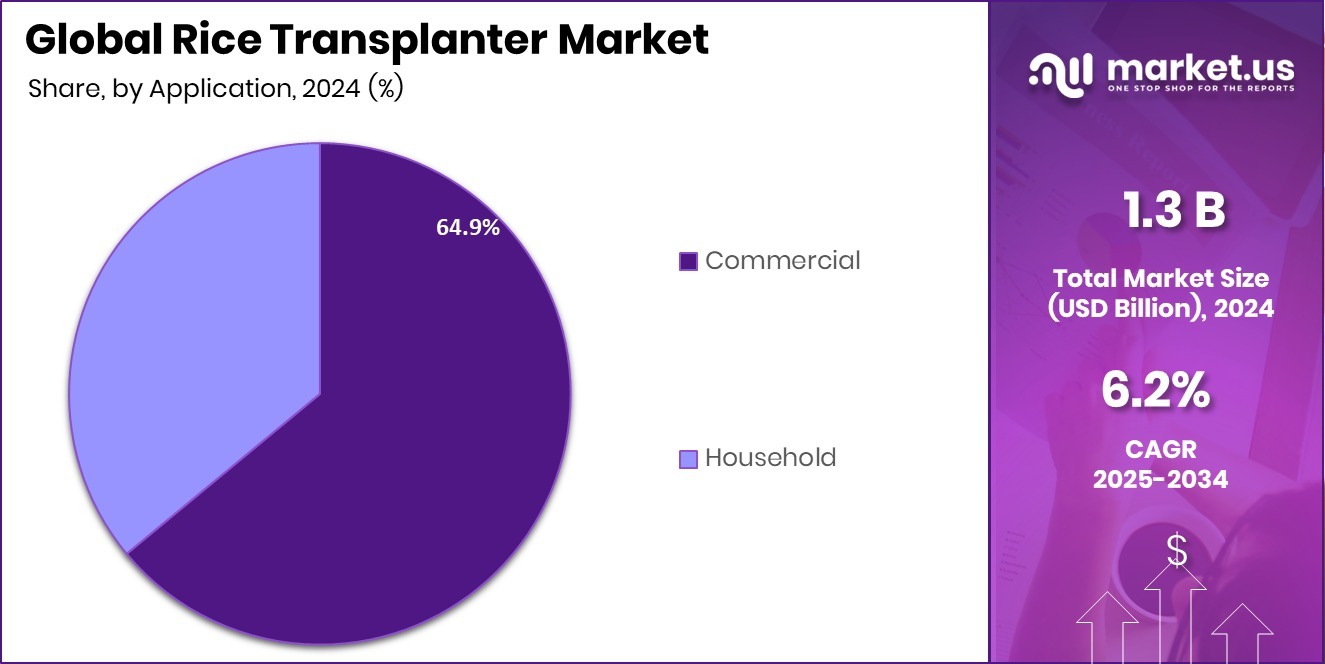

- Commercial application accounted for a 64.9% share, highlighting rising adoption among large-scale farming operations globally.

- The Asia-Pacific recorded strong market revenue, reaching USD 0.6 billion in 2024.

By Product Type Analysis

Ride-on Rice Transplanter dominates the Rice Transplanter Market with a 67.2% share.

In 2024, Ride-on Rice Transplanter held a dominant market position in the By Product Type segment of the Rice Transplanter Market, with a 67.2% share. This dominance reflects the increasing preference of farmers for mechanized solutions that offer efficiency and ease of operation in large paddy fields.

The ride-on models are particularly valued for their ability to cover wider areas in less time, thereby reducing labor dependency and operational costs. Their higher adoption also stems from supportive government initiatives that provide financial assistance and subsidies, making these machines more accessible to medium and large-scale farmers. As a result, ride-on rice transplanters continue to represent the leading choice in modern paddy cultivation.

By Propulsion Type Analysis

Self-Propelled models hold 69.1% in the Rice Transplanter Market globally.

In 2024, Self-Propelled held a dominant market position in the By Propulsion Type segment of Rice Transplanter Market, with a 69.1% share. The strong share highlights the growing reliance on advanced mechanization that reduces manual effort and enhances operational efficiency in paddy transplantation.

Self-propelled models are preferred for their ability to offer better control, precision in planting, and faster field coverage compared to other propulsion types. Their adoption is further supported by government-backed subsidies and financial assistance, which make these machines more affordable to farmers aiming for higher productivity. This combination of efficiency and accessibility has firmly positioned self-propelled transplanters as the leading choice in the propulsion segment.

By Capacity Analysis

4-8 Rows capacity leads with 44.4% in the Rice Transplanter Market.

In 2024, 4-8 Rows held a dominant market position in the capacity segment of the Rice Transplanter Market, with a 44.4% share. This capacity range is widely adopted as it provides an ideal balance between efficiency and affordability for farmers cultivating medium-sized paddy fields. Machines with 4-8 rows are preferred for their ability to handle transplantation at a faster pace while still being cost-effective and easy to operate.

Their popularity is also linked to government support programs and subsidies that make such equipment more accessible to farmers. As a result, this segment has become the leading choice for those seeking practical and efficient solutions in rice planting operations.

By Transplanting Method Analysis

Multiple Rows transplanting method captures 77.6% in the Rice Transplanter Market share.

In 2024, Multiple Rows held a dominant market position in the By Transplanting Method segment of the Rice Transplanter Market, with a 77.6% share. The preference for multiple row transplanters reflects farmers’ need for higher efficiency and productivity in paddy cultivation. These machines enable uniform planting across larger field areas, significantly reducing time and labor compared to single-row methods.

Their strong adoption is further supported by the ability to achieve consistent spacing, which contributes to better crop growth and improved yields. With government subsidies and financial assistance making such equipment more affordable, multiple row transplanting has emerged as the leading method, capturing the majority share in this segment.

By Application Analysis

Commercial application accounts for 64.9% of the Rice Transplanter Market.

In 2024, Commercial held a dominant market position in the By Application segment of the Rice Transplanter Market, with a 64.9% share. The dominance of this segment reflects the increasing adoption of rice transplanters by large-scale farming operations and organized agricultural practices.

Commercial farms often require efficient and high-capacity machines to manage extensive paddy fields, making mechanization essential to save time and labor costs. The higher share is also driven by supportive policies and financial incentives that encourage large farming groups to invest in advanced machinery. As a result, commercial applications have emerged as the leading segment, showcasing the critical role of mechanization in meeting large-scale rice cultivation demands.

Key Market Segments

By Product Type

- Ride-on Rice Transplanter

- Walking Rice Transplanter

By Propulsion Type

- Self-Propelled

- Manually Operated

By Capacity

- Less than 4 Rows

- 4-8 Rows

- 8-12 Rows

- More than 12 Rows

By Transplanting Method

- Single Row

- Multiple Rows

By Application

- Commercial

- Household

Driving Factors

Strong Government Subsidies Spur Mechanization Uptake

One of the top driving factors in the Rice Transplanter market is generous government financial support, which makes costly machinery more attainable for farmers. Under India’s Sub-Mission on Agricultural Mechanization (SMAM), eligible farmers can receive subsidies covering up to 50% of the transplanter’s cost.

Furthermore, certain state programs offer fixed grants, such as Government assistance up to ₹5 lakhs, for paddy transplanters to encourage adoption. By lowering the upfront investment burden, these subsidies accelerate mechanization among small and marginal growers, pushing the rice transplanter market forward.

Restraining Factors

High Initial Cost Limits Farmer Adoption

One of the key restraining factors for the Rice Transplanter market is the high upfront cost of machines, which many small and marginal farmers find hard to afford. Even with subsidies and financial aid, the residual expense after funding remains substantial, discouraging widespread purchase. Moreover, limited access to credit and formal financing in rural areas further compounds this barrier.

According to studies of subsidy distribution challenges in Bihar, the high initial cost and uncertainty of availability were identified as major constraints to farm mechanization and uptake of modern equipment. Because many farmers operate on tight margins and seasonal income, even subsidized pricing may be out of reach without flexible credit or installment options. Until lower-cost models or better financing structures become more common, the high purchase cost will continue to restrain the growth of rice transplanter adoption.

Growth Opportunity

Expansion into Custom-Hiring Services as an Opportunity

One major growth opportunity lies in leveraging custom-hiring service models for rice transplanters. Many small and marginal farmers cannot afford individual ownership, but they can rent machines through shared service centers. This model spreads cost, enables wider access, and drives utilization across regions. Government policy under the Sub-Mission on Agricultural Mechanization (SMAM) supports not only direct purchase subsidies, but also the development of village-level farm machinery banks and custom hiring centers to broaden mechanization reach.

By facilitating machinery availability without the need for full ownership, custom hiring can open untapped demand among farmers who otherwise remain excluded. Over time, this service network model can accelerate the adoption of rice transplanters across fragmented landholdings, pushing market expansion in underserved areas.

Latest Trends

Smart & Sensor-Driven Machines Lead the Way

A key recent trend in the Rice Transplanter market is the integration of smart technologies and automation into transplanting machines. Modern transplanters are now equipped with sensors, GPS, electronic controls, and automation features that improve planting accuracy, reduce human error, and optimize resource use.

These features help farmers maintain uniform spacing, control planting depth, and even adjust performance depending on field conditions. Such capabilities also reduce operator fatigue and increase efficiency over longer hours. As demand grows for precision agriculture, transplanters adopting these smart systems are increasingly favored, especially in regions aiming to modernize farming. Governments supporting mechanization schemes indirectly encourage this shift by making advanced machines more accessible.

Regional Analysis

In 2024, Asia-Pacific dominated the Rice Transplanter Market with a 52.90% share.

The Rice Transplanter Market shows varied adoption across global regions, shaped by agricultural practices and mechanization levels. Asia-Pacific emerged as the dominating region in 2024, capturing 52.90% of the market share with a value of USD 0.6 billion. This leadership is supported by the region’s large rice cultivation base and rising mechanization, especially in countries where government subsidies and schemes encourage adoption.

North America and Europe represent smaller yet steady markets, where technological advancements and efficiency-driven practices shape demand, though the rice cultivation area is comparatively limited. In contrast, the Middle East & Africa region demonstrates gradual uptake, mainly in specific rice-growing zones, with adoption tied to improved food security initiatives.

Latin America also contributes modestly, supported by mechanization programs in rice-producing countries, though the scale remains smaller than Asia-Pacific. The regional dominance of Asia-Pacific reflects both the scale of cultivation and the push for mechanization, making it the core growth driver for the global rice transplanter market. Other regions, while important, remain secondary markets, focusing more on efficiency improvements than large-scale adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Yanmar Agritech Co., Ltd. continues to demonstrate strength through its deep expertise in agricultural machinery and strong presence in rice-growing regions. Its transplanters are widely recognized for efficiency, durability, and operator-friendly designs, aligning with farmers’ demand for precision and reliability in large-scale paddy fields. Yanmar’s ability to innovate in automated and semi-automated models positions it as a leader in mechanized planting solutions.

AGCO Corporation, with its global agricultural equipment portfolio, has focused on integrating advanced mechanization into rice cultivation. Although more diversified across agricultural machinery, AGCO’s entry into rice transplanters reflects its strategy of leveraging global expertise to expand mechanization in specialized crops. Its emphasis on productivity-driven solutions resonates well with regions where rice is a staple and labor shortages are a challenge, adding depth to the competitive landscape.

Mahindra & Mahindra Ltd., with its strong foothold in the Indian market and broader Asia-Pacific presence, continues to advance rice transplanter adoption through affordability and accessibility. By aligning with government subsidy programs and focusing on farmer-friendly designs, Mahindra has expanded its relevance to small and medium-sized farmers who form a significant part of the market base.

Top Key Players in the Market

- Yanmar Agritech Co., Ltd.

- AGCO Corporation

- Mahindra Mahindra Ltd.

- Kubota Agricultural Machinery

- Mitsubishi Agricultural Machinery Co., Ltd.

- Case New Holland Industrial S.p.A.

- Massey Ferguson Ltd.

- Deere Company

- Iseki Co., Ltd.

Recent Developments

- In June 2024, Mahindra introduced the Mahindra 6RO Paddy Walker, a compact, manually operated transplanter capable of transplanting six rows at once. It is designed for precision planting even in tighter field conditions.

- In April 2024, AGCO announced the launch of a new brand, PTx, combining its Precision Planting technology with its JV with Trimble (called PTx Trimble). This move is meant to unify and accelerate AGCO’s precision ag solutions, enabling better integration of tech in its machines, which can influence future rice transplanter innovations.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.4 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ride-on Rice Transplanter, Walking Rice Transplanter), By Propulsion Type (Self-Propelled, Manually Operated), By Capacity (Less than 4 Rows, 4-8 Rows, 8-12 Rows, More than 12 Rows), By Transplanting Method (Single Row, Multiple Rows), By Application (Commercial, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Yanmar Agritech Co., Ltd., AGCO Corporation, Mahindra Mahindra Ltd., Kubota Agricultural Machinery, Mitsubishi Agricultural Machinery Co., Ltd., Case New Holland Industrial S.p.A., Massey Ferguson Ltd., Deere Company, Iseki Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rice Transplanter MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Rice Transplanter MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Yanmar Agritech Co., Ltd.

- AGCO Corporation

- Mahindra Mahindra Ltd.

- Kubota Agricultural Machinery

- Mitsubishi Agricultural Machinery Co., Ltd.

- Case New Holland Industrial S.p.A.

- Massey Ferguson Ltd.

- Deere Company

- Iseki Co., Ltd.