Global Rice Syrup Market Size, Share, Growth Analysis By Type (Organic, Conventional), By Form (Liquid, Powder), By Application (Food And Beverage, Infant Formula, Nutritional Supplements, Sauces And Dressings, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158537

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

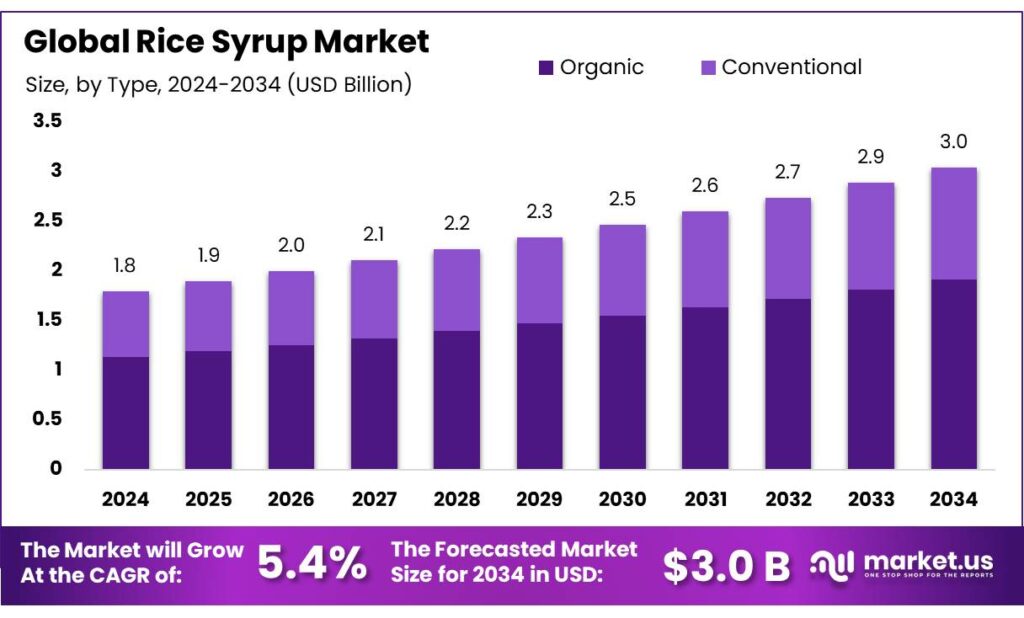

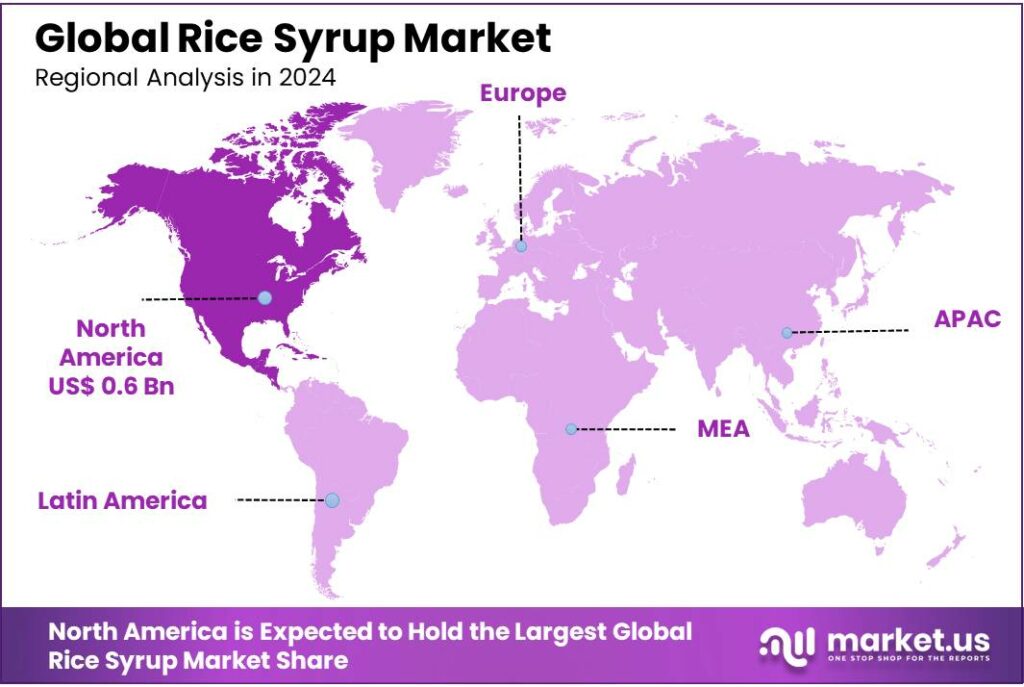

The Global Rice Syrup Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.9% share, holding USD 0.6 Billion in revenue.

The rice syrup industry is experiencing notable growth, driven by increasing consumer demand for natural sweeteners and supportive government initiatives. Rice syrup, derived from broken rice through enzymatic hydrolysis, offers a healthier alternative to traditional sweeteners like cane sugar and corn syrup. Its applications span various sectors, including food and beverages, pharmaceuticals, and cosmetics, owing to its mild sweetness and low glycemic index.

Government initiatives further bolster the industry’s growth. The National Bank for Agriculture and Rural Development (NABARD) offers subsidies and loans for agro-processing units, facilitating the establishment and modernization of rice syrup production facilities. Additionally, the Operation Greens Scheme provides a 50% subsidy on transportation and storage costs for top crops, including rice, enhancing the efficiency of the supply chain.

The export potential of rice syrup is also expanding. India exported 139 shipments of rice syrup from May 2024 to April 2025, marking a significant growth compared to previous periods. This upward trend aligns with the global shift towards clean-label and organic products, positioning Indian rice syrup favorably in international markets.

India, as one of the world’s largest rice producers, has seen a substantial increase in its rice production, reaching an all-time high of 149 million metric tons in 2025, up from 137.8 million tons the previous year. This surplus has led to strategic initiatives by the Indian government to utilize excess rice stocks. In 2024, the government approved the sale of 5.2 million metric tons of rice from the Food Corporation of India (FCI) for ethanol production, aiming to manage surplus stocks and support the country’s ethanol blending targets

Key Takeaways

- Rice Syrup Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 5.4%.

- Organic rice syrup dominated the Indian market, capturing over 62.9% of the total share.

- Liquid rice syrup led the Indian market, capturing over 73.2% of the total share.

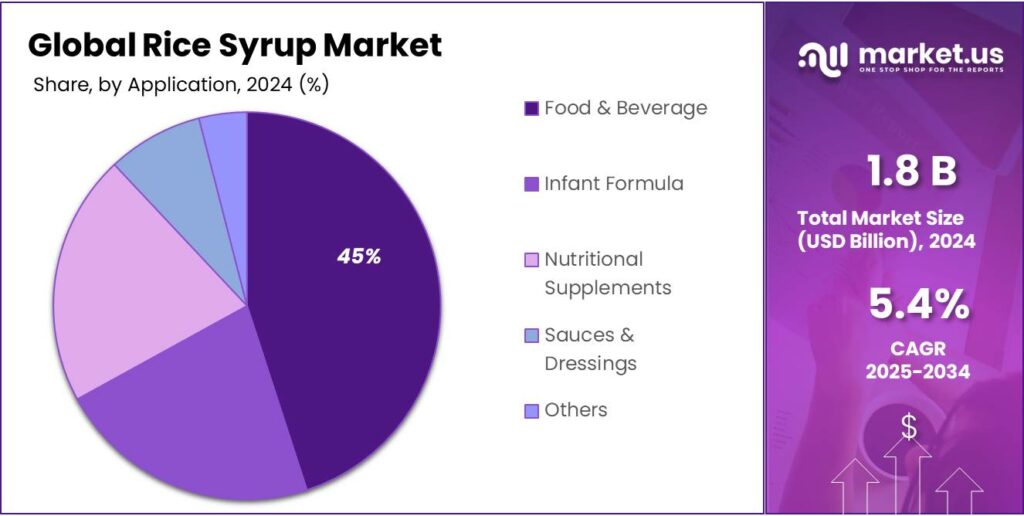

- Food & Beverage sector emerged as the dominant application for rice syrup in India, capturing over 45.8% of the total market share.

- Supermarkets and hypermarkets held a dominant position in India’s rice syrup market, capturing more than 46.1% of the total share.

- North America emerged as the dominant region in the global rice syrup market, capturing a substantial 36.9% share, translating to approximately USD 0.6 billion.

By Type Analysis

Organic Rice Syrup Leads with 62.9% Market Share in 2024

In 2024, organic rice syrup dominated the Indian market, capturing over 62.9% of the total share. This significant presence is attributed to the growing consumer preference for natural and healthier sweeteners. As health consciousness rises, more consumers are opting for organic products, steering demand towards organic rice syrup.

The surge in demand for organic rice syrup is further supported by government initiatives promoting organic farming. This expansion in organic farming areas ensures a steady supply of raw materials for organic rice syrup production, bolstering its market position.

By Form Analysis

Liquid Rice Syrup Dominates with 73.2% Market Share in 2024

In 2024, liquid rice syrup led the Indian market, capturing over 73.2% of the total share. This dominance is attributed to its versatility and ease of use across various applications. The liquid form’s ability to blend seamlessly into products like beverages, sauces, and dressings makes it a preferred choice for manufacturers aiming for consistency and quality.

The growing consumer preference for natural and minimally processed ingredients further bolsters the demand for liquid rice syrup. As health-conscious consumers seek alternatives to refined sugars, liquid rice syrup’s mild sweetness and natural origin position it as an attractive option in the market.

By Application Analysis

Food & Beverage Sector Leads Rice Syrup Market with 45.8% Share in 2024

In 2024, the Food & Beverage sector emerged as the dominant application for rice syrup in India, capturing over 45.8% of the total market share. This significant share is attributed to the growing consumer preference for natural and minimally processed ingredients in food and beverage products. Rice syrup, known for its mild sweetness and clean label appeal, aligns with the increasing demand for healthier alternatives to refined sugars.

The versatility of rice syrup further contributes to its widespread use across various food and beverage applications. In bakery products, rice syrup serves as a natural sweetener and moisture-retaining agent, enhancing the texture and shelf life of items like cakes, cookies, and bread. In beverages, particularly health drinks and smoothies, rice syrup provides a smooth sweetness without overpowering other flavors, making it a preferred choice among manufacturers aiming for balanced taste profiles. Additionally, its use in sauces, dressings, and snacks is on the rise, driven by the clean label trend and consumer demand for transparency in ingredient sourcing.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Lead Rice Syrup Distribution with 46.1% Market Share in 2024

In 2024, supermarkets and hypermarkets held a dominant position in India’s rice syrup market, capturing more than 46.1% of the total share. This significant market presence is attributed to the extensive reach and convenience offered by these retail formats. Major chains like Reliance Retail, DMart, and Big Bazaar provide consumers with easy access to a variety of rice syrup products, enhancing product visibility and consumer trust.

This growth reflects increasing urbanization, rising disposable incomes, and changing consumer preferences, all contributing to the greater availability and demand for rice syrup products in these retail outlets.

Key Market Segments

By Type

- Organic

- Conventional

By Form

- Liquid

- Powder

By Application

- Food & Beverage

- Baked Goods

- Confection

- Frozen Desserts

- Meats & Seafood

- Others

- Infant Formula

- Nutritional Supplements

- Sauces & Dressings

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience stores

- Online

- Others

Emerging Trends

Emerging Trends in Rice Syrup Production and Consumption in India

India’s rice syrup industry is experiencing a notable transformation, driven by evolving consumer preferences and strategic government initiatives. As health-conscious choices gain prominence, rice syrup is increasingly favored as a natural sweetener over traditional sugars. This shift is particularly evident among younger demographics, such as millennials and Gen Z, who are actively seeking cleaner, plant-based alternatives to refined sugars.

The Indian government has recognized this trend and is actively supporting the growth of the organic sector, including rice-based products. The “Indian Organic Sector: Vision 2025” document highlights rice as a key category for development and promotion in the organic food product export sector. This initiative aims to enhance the quality and marketability of organic rice, thereby benefiting related products like rice syrup.

The government’s support for the agriculture sector, including initiatives like the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), has further bolstered the rice industry. These measures have enhanced the economic viability of rice cultivation, indirectly benefiting the rice syrup market by ensuring a steady supply of raw material. Additionally, the establishment of the Basmati Export Development Foundation (BEDF) center in Uttar Pradesh aims to improve the quality and export capacity of premium rice varieties, potentially increasing the availability of high-quality rice for syrup production.

Drivers

Government Support and Policy Initiatives Driving the Growth of Rice Syrup in India

The rice syrup industry in India is experiencing significant growth, propelled by a combination of consumer demand for healthier alternatives and robust government initiatives aimed at enhancing agricultural productivity and promoting sustainable practices.

- India’s rice production reached a record high of 149 million metric tons in 2025, up from 137.8 million tons the previous year. This surplus has led to strategic initiatives by the Indian government to utilize excess rice stocks. In 2024, the government approved the sale of 5.2 million metric tons of rice from the Food Corporation of India (FCI) for ethanol production, aiming to manage surplus stocks and support the country’s ethanol blending targets.

The Indian government’s support for the agriculture sector, including initiatives like the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), has further bolstered the rice industry. These measures have enhanced the economic viability of rice cultivation, indirectly benefiting the rice syrup market by ensuring a steady supply of raw material. Additionally, the establishment of the Basmati Export Development Foundation (BEDF) center in Uttar Pradesh aims to improve the quality and export capacity of premium rice varieties, potentially increasing the availability of high-quality rice for syrup production

Restraints

High Production Costs and Economic Viability Challenges

One significant challenge facing the rice syrup industry in India is the high production costs associated with its manufacturing process. The production of rice syrup involves several steps, including the enzymatic breakdown of rice starch, filtration, and concentration. These processes require specialized equipment and energy inputs, leading to substantial capital and operational expenditures.

- For instance, establishing a rice syrup processing plant with a capacity of 280 metric tons per day entails an investment of approximately ₹78.9 crore (₹789 lakhs) for plant and machinery alone. Additionally, the total capital investment (TCI) for such a facility is estimated at ₹62.9 crore (₹6290 lakhs), with a break-even point (BEP) of 28% and a rate of return (ROR) of 47%

These high capital requirements can be a deterrent for potential investors and entrepreneurs looking to enter the rice syrup market. The substantial initial investment, coupled with ongoing operational costs, necessitates a steady and substantial demand for rice syrup to achieve profitability. Without consistent demand, producers may struggle to cover their costs, leading to financial instability.

Furthermore, the economic viability of rice syrup production is influenced by the fluctuating prices of raw materials. The price of rice, a primary input in syrup production, is subject to variations due to factors such as monsoon patterns, government policies, and global market trends.

For example, in May 2025, the Indian government raised the minimum support price (MSP) for common rice paddy by 3% to ₹2,369 per 100 kg, the smallest increase in five years. This decision aimed to manage surplus rice stocks following a record harvest, which resulted in government warehouses holding 59.5 million tons of rice—over four times the official stockpile target

Opportunity

Government Support for Rice Syrup: A Growing Opportunity

India, the world’s largest rice producer and exporter, is experiencing a significant shift in its agricultural landscape. With a record rice harvest of 146.1 million tons in the 2024/25 season, the country faces the challenge of managing surplus stocks. To address this, the government has allocated a substantial portion—5.2 million metric tons—of this surplus rice for ethanol production. This strategic move not only supports India’s ambitious ethanol blending target of 20% by 2025/26 but also opens up new avenues for industries utilizing rice-based products, such as rice syrup.

The Food Corporation of India (FCI) is central to this initiative, managing the distribution of rice for various purposes, including ethanol production. By diverting surplus rice to ethanol production, the government aims to stabilize rice prices, reduce food waste, and promote sustainable energy practices. This policy shift is expected to have a ripple effect across related industries, including the rice syrup sector.

In India, the government’s focus on utilizing surplus rice for ethanol production indirectly benefits the rice syrup industry. The availability of rice as a feedstock for syrup production is crucial for manufacturers. With the government’s initiatives ensuring a steady supply of rice, producers can plan and scale their operations more effectively. Moreover, the emphasis on sustainable practices aligns with the growing consumer preference for clean-label and eco-friendly products, further boosting the demand for rice syrup.

Regional Insights

North America Leads Global Rice Syrup Market with 36.9% Share in 2024

In 2024, North America emerged as the dominant region in the global rice syrup market, capturing a substantial 36.9% share, translating to approximately USD 0.6 billion in revenue. This robust market presence is primarily driven by the increasing consumer demand for natural and clean-label sweeteners, aligning with the broader health and wellness trends prevalent in the region.

The United States, in particular, plays a pivotal role in this market, accounting for a significant portion of North America’s rice syrup consumption. Factors contributing to this dominance include a growing preference for gluten-free and allergen-free products, as well as the rising popularity of plant-based diets. Rice syrup’s mild sweetness and hypoallergenic properties make it an attractive alternative to traditional sweeteners like high-fructose corn syrup, especially among health-conscious consumers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Axiom Foods Inc. is a leading producer of plant-based ingredients, including rice syrup. Known for its innovation, the company offers rice syrup made from organic and non-GMO rice. Axiom focuses on sustainable practices, providing high-quality products to food and beverage manufacturers. Their rice syrup is widely used as a natural sweetener, catering to the growing demand for clean-label and plant-based ingredients in health-conscious consumer segments.

Habib-ADM Limited is a joint venture between Habib Group and Archer Daniels Midland Company, focusing on the production of rice syrup and other food ingredients. The company combines local expertise with ADM’s global capabilities to deliver high-quality rice syrups to markets across Asia. Habib-ADM offers rice syrups with a focus on sustainability, non-GMO products, and meeting the clean-label requirements of the food and beverage industry, positioning itself as a reliable supplier of natural sweeteners in the region.

Cargill, Incorporated is one of the largest global food and agriculture companies, offering rice syrup as part of its diverse portfolio of natural sweeteners. Cargill provides high-quality rice syrup for various applications, including beverages, snacks, and baked goods. The company focuses on sustainable sourcing, non-GMO products, and clean-label solutions, addressing the rising consumer demand for healthier and more transparent ingredients. Cargill’s global reach and innovation make it a key player in the rice syrup market.

Top Key Players Outlook

- Axiom Foods Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Wuhu Deli Foods Co., Ltd.

- Habib-ADM Limited

- ABF Ingredients (ABFI)

- Nature Bio-Foods Ltd.

- Navitalo

- Khatoon Industries

- Gehl Foods, LLC

Recent Industry Developments

In 2024, Axiom Foods Inc., a leading supplier of plant-based ingredients, made significant strides in the rice syrup sector.

In 2024, Cargill made notable advancements in the rice syrup sector, aligning with the growing consumer demand for natural and plant-based ingredients.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Organic, Conventional), By Form (Liquid, Powder), By Application (Food And Beverage, Infant Formula, Nutritional Supplements, Sauces And Dressings, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Axiom Foods Inc., Archer Daniels Midland Company (ADM), Cargill, Incorporated, Wuhu Deli Foods Co., Ltd., Habib-ADM Limited, ABF Ingredients (ABFI), Nature Bio-Foods Ltd., Navitalo, Khatoon Industries, Gehl Foods, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Axiom Foods Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Wuhu Deli Foods Co., Ltd.

- Habib-ADM Limited

- ABF Ingredients (ABFI)

- Nature Bio-Foods Ltd.

- Navitalo

- Khatoon Industries

- Gehl Foods, LLC