Global Rice Milling Machinery Market Size, Share, And Enhanced Productivity By Machine (Fully Automatic, Semi-Automatic, Manual), By Technology (Conventional Milling, Smart/Lot-Enabled Milling, Energy-Efficient Milling Systems), By Operation (Pre-cleaning, Separating, Grading, Rice Whitening, Other), By Motor Power (3.5 HP, 5 HP, 7.5 HP, 10 HP), By Capacity (Small-Scale (Below 10 Tons/Day), Medium-Scale (10-50 Tons/Day), Large-Scale (Above 50 Tons/Day)), By End Use (Commercial Mills, Farmers/Small Millers), By Distribution Channel (Direct, Indirect), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178833

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Machine Analysis

- By Technology Analysis

- By Operation Analysis

- By Motor Power Analysis

- By Capacity Analysis

- By End Use Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

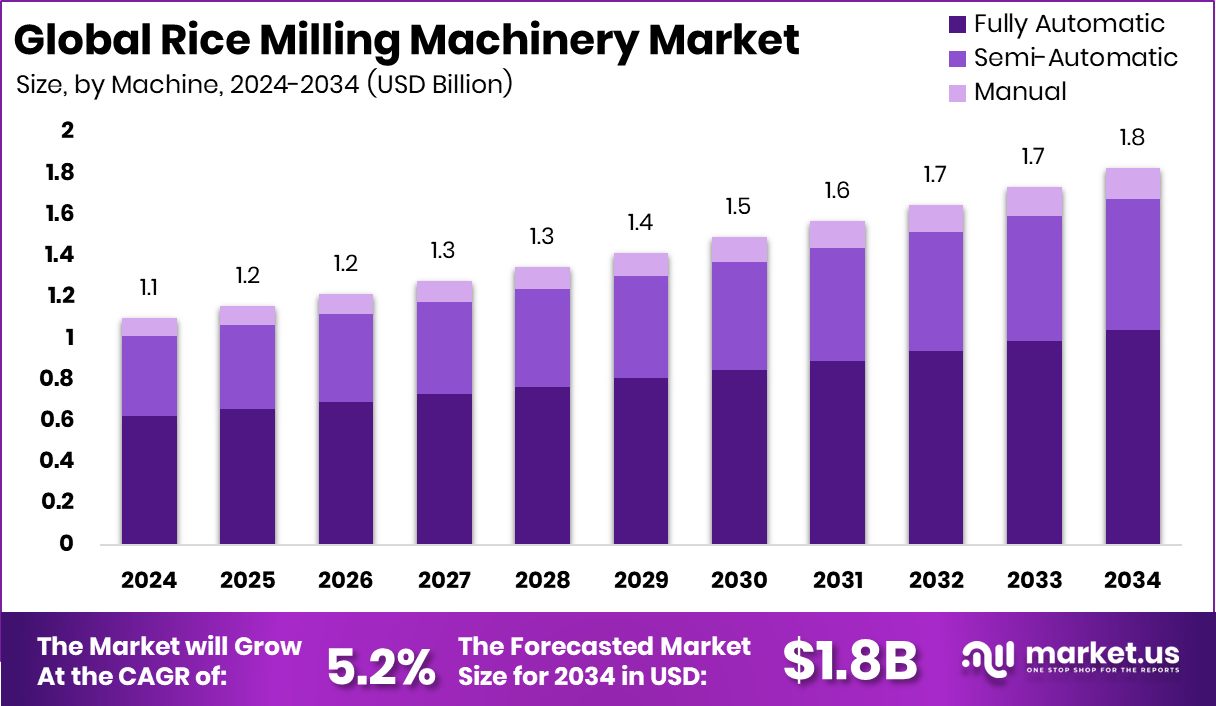

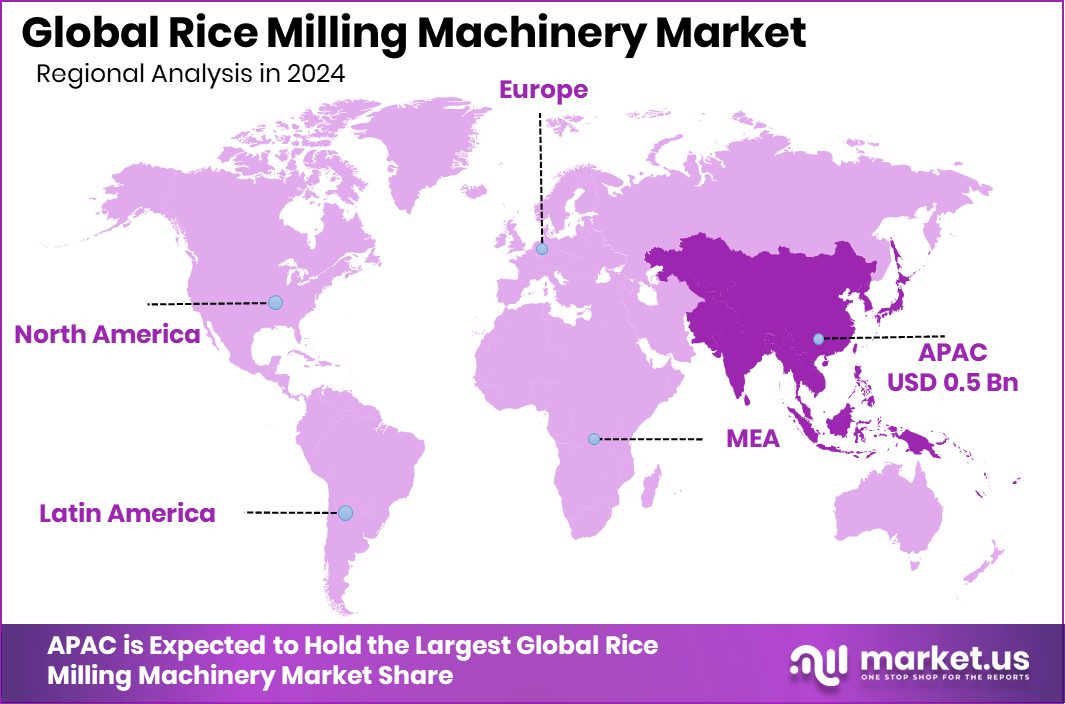

The Global Rice Milling Machinery Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. In the Asia Pacific, the Rice Milling Machinery Market recorded 48.2%, totaling USD 0.5 Bn.

The Global Rice Milling Machinery Market covers machines ranging from fully automatic systems to manual units, supported by technologies such as conventional milling, smart IoT-enabled setups, and energy-efficient systems. These machines carry out key operations, including pre-cleaning, separating, grading, and whitening, powered by motor categories from 3.5 HP to 10 HP. Capacity options span small units below 10 tons per day to large mills above 50 tons. The market serves commercial mills and small farmers through both direct and indirect distribution channels.

Rice milling machinery refers to equipment used to process paddy into polished rice through multiple mechanical stages that ensure clean, uniform, and market-ready grains. The Rice Milling Machinery Market represents the global demand, supply, and technological progress surrounding these machines across different-scale users.

Growth in this market is supported by modernization programs and funding actions such as governments lending revolving credit to over 30 rice mills and national agencies committing investments like the ₱3.3 billion plan to build 300 new mills by 2028. These initiatives directly raise demand for reliable machinery.

Market demand is also influenced by efforts to upgrade processing capacity, highlighted by the P643-million JICA grant for rice facility development and the Ksh20 million support program for select agri-businesses. These activities strengthen purchasing power among millers.

Opportunities continue to widen as digital farming ecosystems expand, seen in Indonesia’s Eratani securing $6.2 million in Series A funding, which encourages integrated rice value-chain improvements and drives adoption of smarter milling equipment.

Key Takeaways

- The Global Rice Milling Machinery Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- Rice Milling Machinery Market was dominated by fully automatic machines with 56.9% share.

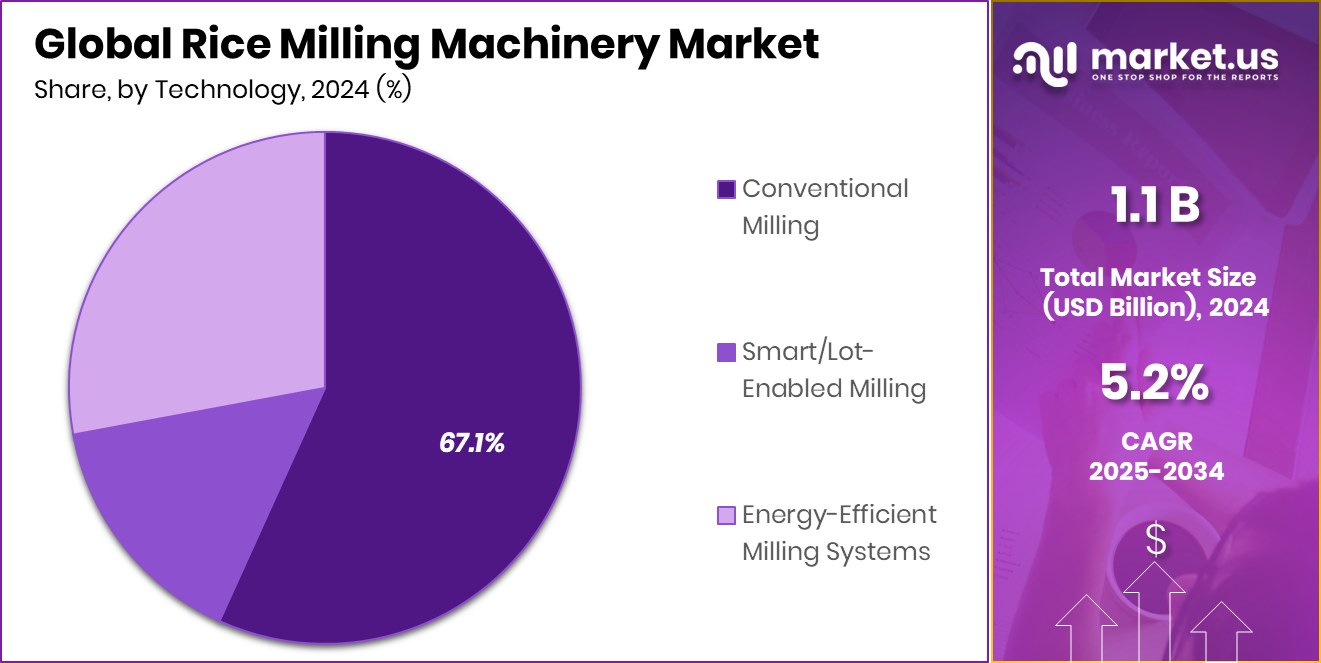

- Rice Milling Machinery Market segment for conventional milling dominated overall demand with 67.1% share.

- Rice Milling Machinery Market whitening operation category dominated usage patterns, holding a 33.6% share.

- Rice Milling Machinery Market was dominated by 5 HP motor systems, securing 37.5% share.

- Rice Milling Machinery Market, small-scale units below ten tons dominated with a 49.3% share.

- Rice Milling Machinery Market was dominated by commercial mills users, capturing a 72.7% share.

- Rice Milling Machinery Market direct distribution channel dominated sales volumes with a 67.4% share.

- The region Asia Pacific achieved 48.2% share, contributing significantly to USD 0.5 Bn.

By Machine Analysis

The Rice Milling Machinery Market shows 56.9% adoption of fully automatic machines across global processing operations.

In 2024, the Rice Milling Machinery Market saw fully automatic systems dominate with a strong 56.9% share, reflecting the industry’s rapid shift toward efficiency, reduced labor dependence, and higher processing consistency. This dominance is driven by mills seeking faster throughput, minimal downtime, and improved grain quality to stay competitive in both domestic and export-driven rice economies.

Fully automatic machines integrate cleaning, dehusking, polishing, and grading into seamless workflows, helping commercial operators manage large volumes with predictable output standards. The preference for automation has been further boosted by rising labor shortages and the rising need to meet quality certifications demanded by global buyers. As modernization programs expand across rice-producing nations, fully automated machinery continues to hold a decisive leadership position.

By Technology Analysis

Conventional milling dominates the Rice Milling Machinery Market with 67.1% preference among manufacturers and millers.

In 2024, conventional milling technology continued to dominate the Rice Milling Machinery Market with a commanding 67.1% share, highlighting its widespread acceptance among small and medium millers who rely on familiar setups and proven operational reliability. Despite the emergence of advanced technologies, traditional milling systems remain preferred due to their lower capital cost, technical simplicity, and easy maintenance in regions where skilled technicians are limited.

Many established mills continue reinvesting in conventional equipment because it aligns with their long-standing process flows and regional grain varieties. This dominance also reflects the steady replacement demand from mills upgrading older machines while retaining conventional frameworks. As cost-conscious markets expand across Asia and Africa, conventional milling maintains its leading position.

By Operation Analysis

Rice Whitening accounts for 33.6% share in the Rice Milling Machinery Market’s operational workflow.

In 2024, rice whitening operations held a notable 33.6% share within the Rice Milling Machinery Market, showing how critical this stage is for final grain appearance, texture, and commercial value. The whitening segment remains essential because buyers, especially in premium markets, associate high whiteness levels with quality and uniformity. Mills continue prioritizing dedicated whitening machines to achieve consistent polish levels, low breakage, and minimal nutrient loss.

The dominance of this process is supported by export markets demanding visually refined rice, particularly in regions trading long-grain and aromatic varieties. As consumer preference trends favor premium packaged rice and stricter grading standards, the whitening category maintains a strong foothold, driving continuous investment in updated machinery.

By Motor Power Analysis

In the Rice Milling Machinery Market, 5 HP motor power systems hold a strong 37.5% share.

In 2024, machinery equipped with 5 HP motor dominated the Rice Milling Machinery Market with a 37.5% share, reflecting its suitability for small and medium operations needing reliable performance without excessive energy consumption. These machines strike the right balance between affordability, manageable installation requirements, and adequate operational capacity for semi-commercial milling.

Many rural and peri-urban mills prefer 5 HP configurations because they can operate efficiently even in areas with unstable power supply, often supported by compact generators or low-voltage setups. The segment’s dominance also stems from its accessibility for first-time millers transitioning from manual or small mechanical tools. As decentralized rice processing grows, 5 HP solutions remain a highly adopted choice.

By Capacity Analysis

Small-scale units below 10 tons daily capacity represent 49.3% of the Rice Milling Machinery Market.

In 2024, small-scale rice milling machinery with capacities below 10 tons per day captured a strong 49.3% share, making it the most widely adopted category in developing rice-producing regions. This dominance is fueled by the growing number of local entrepreneurs, village-level processing units, and micro-mills seeking affordable and flexible equipment.

Small-scale systems allow farmers to process paddy closer to cultivation areas, reducing transport costs and improving grain freshness. Their lower investment threshold and minimal infrastructure needs make them ideal for rural modernization programs. Governments supporting agri-mechanization also contribute to this segment’s leading position. As demand for localized processing and niche rice varieties increases, small-scale mills continue to thrive.

By End Use Analysis

Commercial mills capture a dominant 72.7% share within the expanding Rice Milling Machinery Market landscape.

In 2024, commercial mills remained the dominant end-use segment in the Rice Milling Machinery Market with an impressive 72.7% share, reflecting their critical role in large-scale rice processing and global supply chains. These mills prioritize machinery that enhances output speed, uniformity, and grain recovery rates, which drives continuous investment in both modern and conventional equipment. Their dominance is reinforced by their ability to meet export standards and supply bulk volumes to urban retail, foodservice, and industrial buyers.

Commercial millers also adopt multi-stage setups integrating cleaning, dehusking, whitening, grading, and sorting systems for maximum efficiency. With rising consumption in Asia, Africa, and the Middle East, commercial mills remain the backbone of the industry.

By Distribution Channel Analysis

Direct distribution channels lead the Rice Milling Machinery Market with a significant 67.4% share globally.

In 2024, direct distribution channels dominated the Rice Milling Machinery Market with a solid 67.4% share, indicating manufacturers’ growing reliance on direct sales networks, specialized agents, and technical support partnerships. Buyers prefer direct procurement because it ensures access to genuine machinery, installation guidance, after-sales service, and performance warranties—critical factors for mills investing in high-value equipment. This dominance also reflects the increasing customization needs of millers who want machines tailored to specific grain varieties and operational layouts.

Direct distribution further minimizes delays, reduces procurement costs, and strengthens long-term supplier relationships. As modernization accelerates across emerging economies, manufacturers continue expanding direct outreach to maintain market leadership.

Key Market Segments

By Machine

- Fully Automatic

- Semi-Automatic

- Manual

By Technology

- Conventional Milling

- Smart/Lot-Enabled Milling

- Energy-Efficient Milling Systems

By Operation

- Pre-cleaning

- Separating

- Grading

- Rice Whitening

- Other

By Motor Power

- 3.5 HP

- 5 HP

- 7.5 HP

- 10 HP

By Capacity

- Small-Scale (Below 10 Tons/Day)

- Medium-Scale (10-50 Tons/Day)

- Large-Scale (Above 50 Tons/Day)

By End Use

- Commercial Mills

- Farmers/Small Millers

By Distribution Channel

- Direct

- Indirect

Driving Factors

Rising modernization accelerates rice milling adoption

In 2024, the Rice Milling Machinery Market is propelled by rising modernization across milling operations, where mills increasingly adopt automated and reliable processing equipment to improve grain output and consistency. This shift is supported by digital and mechanical upgrades that help millers reduce losses and enhance polishing quality.

Additional momentum comes from broader innovation activity in the manufacturing ecosystem, illustrated by funding such as TracXon raising €4.75 million, showing how technology-led solutions continue to influence equipment development and automation culture across industrial sectors. As rice-producing regions push for better post-harvest efficiency and modern infrastructure, the need for advanced milling machinery grows steadily.

Restraining Factors

High machinery costs limit small farmers

In 2024, high machinery costs remain a strong barrier for many small farmers and rural mills, slowing the replacement of outdated equipment and delaying modernization plans. Operational expenses, installation requirements, and maintenance commitments often force smaller operators to postpone upgrades despite growing quality expectations in the rice value chain. This challenge is echoed across the broader equipment ecosystem, demonstrated by LimitlessCNC securing $4.1 million to advance precision manufacturing technologies—showing how innovation often requires substantial financial backing that smaller users struggle to access. These cost-related constraints continue to restrict widespread uptake of high-performance rice milling systems.

Growth Opportunity

Smart IoT-enabled milling systems gain traction

In 2024, growth opportunities emerge strongly from the increasing adoption of smart, IoT-enabled milling systems that allow mills to monitor performance, energy use, and grain quality in real time. Such systems support better operational decisions and help reduce wastage, making them attractive for both commercial mills and village-level units.

Broader industry momentum toward digital manufacturing is also visible in funding like 3D Spark, raising €2 million to enhance manufacturing workflow optimization, underscoring how software-driven ecosystems are shaping equipment selection and operational planning. As rice processors seek predictable performance and traceability, IoT-enabled machinery opens new pathways for market expansion.

Latest Trends

Shift toward energy-efficient milling technologies

In 2024, the market sees a clear shift toward energy-efficient milling technologies, driven by the rising need to lower operational costs and meet sustainability goals. Manufacturers are increasingly focusing on machines that consume less power while delivering high throughput and better grain recovery. This trend aligns with wider industrial transitions toward cleaner and optimized manufacturing systems, supported by developments such as Bosch investing €6 million in Nuremberg 3D printing, highlighting the push toward advanced production technologies that emphasize efficiency. As energy prices fluctuate and mills aim for long-term cost control, energy-efficient rice milling machinery gains stronger market preference.

Regional Analysis

Asia Pacific dominated the Rice Milling Machinery Market with 48.2%, reaching USD 0.5 Bn.

The Rice Milling Machinery Market shows varied performance across global regions, shaped by production intensity and milling modernization levels. Asia Pacific remains the dominating region, holding 48.2% of the total market and reaching USD 0.5 Bn, supported by its large rice-producing economies and ongoing upgrades in both small and commercial mills. In contrast,

North America demonstrates steady adoption driven by precision milling needs and expanding packaged rice processing, though overall demand remains moderate due to limited cultivation. Europe records stable uptake, supported by investments in quality-focused whitening and polishing technologies for premium rice varieties.

Meanwhile, Middle East & Africa show rising interest as consumption grows and new mills target improved grain output for domestic markets. Latin America reflects gradual modernization, driven by increasing local production in select countries and replacement demand for older equipment. Across all regions, Asia Pacific’s strong dominance highlights its central role in global rice processing, supported by high milling volumes and continuous machinery upgrades that keep the region at the forefront of market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The presence of AG Growth International in the global Rice Milling Machinery Market in 2024 reflects its continued focus on integrated grain handling and post-harvest solutions. The company’s portfolio supports milling operators seeking reliability, controlled grain movement, and reduced losses, making it a preferred choice for facilities emphasizing operational consistency. AG Growth International benefits from strong adoption in regions where modern grain management infrastructure is expanding, aligning well with millers looking to strengthen upstream handling before rice enters the milling cycle. Its steady technological refinements and emphasis on durability position the company as a dependable partner for mills scaling throughput.

Alvan Blanch maintains a notable position due to its established engineering capabilities and versatile processing equipment that fits both small-scale and developing-market requirements. In 2024, the company’s machinery is valued for dependable performance in diverse climatic and crop conditions, making it suitable for rice-producing regions upgrading traditional systems. Its solutions resonate particularly well with markets seeking compact, energy-efficient equipment to modernize without a heavy capital burden. Alvan Blanch’s long-standing reputation for adaptable designs continues to support its relevance in emerging rice-processing environments.

Bühler remains one of the most influential names in rice milling technology in 2024, driven by its focus on precision engineering, process automation, and grain quality optimization. Bühler’s equipment is widely recognized for enhancing yield, ensuring uniform whitening, and lowering breakage levels—attributes that appeal strongly to commercial mills handling export-grade rice. Its ongoing improvements in digital monitoring and process control keep the company aligned with mills prioritizing efficiency and consistent output. Bühler’s strong global footprint reinforces its standing among mills targeting premium quality standards.

Top Key Players in the Market

- AG Growth International

- Alvan Blanch

- Buhler

- Fowler Westrup

- G.G. Dandekar

- Hubei Bishan.

- Hubei Fotma

- Koolmill Systems

- Lushan Win Tone

- Mill Master

- PETKUS Technologie

- Satake

Recent Developments

- In October 2024, Bühler inaugurated its new Grain Innovation Center (GIC) in Uzwil, Switzerland. This centre gives customers a place to test and improve grain processing methods, including milling systems, and provides training and collaboration space for food and milling professionals. It is meant to help customers stay competitive with modern milling technologies.

- In June 2024, AG Growth International added a pre-cleaner and vertical fuel tank to its product lineup, showcased at the Ag in Motion (AIM) event, helping farmers improve grain handling efficiency. These additions enhance the company’s Milltec portfolio, which includes equipment that can be used in rice milling operations and broader grain processing.

- In January 2024, the company highlighted new grain and rice processing equipment, including the DF6000 grain dryer, a 3-screen rotary cleaner, and improved intake conveyor systems. These machines support faster and cleaner processing of rice and other grains.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine (Fully Automatic, Semi-Automatic, Manual), By Technology (Conventional Milling, Smart/Lot-Enabled Milling, Energy-Efficient Milling Systems), By Operation (Pre-cleaning, Separating, Grading, Rice Whitening, Other), By Motor Power (3.5 HP, 5 HP, 7.5 HP, 10 HP), By Capacity (Small-Scale (Below 10 Tons/Day), Medium-Scale (10-50 Tons/Day), Large-Scale (Above 50 Tons/Day)), By End Use (Commercial Mills, Farmers/Small Millers), By Distribution Channel (Direct, Indirect) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AG Growth International, Alvan Blanch, Buhler, Fowler Westrup, G.G. Dandekar, Hubei Bishan., Hubei Fotma, Koolmill Systems, Lushan Win Tone, Mill Master, PETKUS Technologie, Satake Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rice Milling Machinery MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Rice Milling Machinery MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AG Growth International

- Alvan Blanch

- Buhler

- Fowler Westrup

- G.G. Dandekar

- Hubei Bishan.

- Hubei Fotma

- Koolmill Systems

- Lushan Win Tone

- Mill Master

- PETKUS Technologie

- Satake