Global RFID Printers Market Size, Share Report By Type (Industrial printers, Desktop printers, & Mobile printers), By Printing Technology (Thermal transfer, Direct thermal, & Inkjet), by Frequency (Low frequency (LF), High frequency (HF), & Ultra-High Frequency (UHF)), By Industry Vertical (Manufacturing, Retail, Transportation & Logistics, Healthcare, Government, Entertainment, & Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153715

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

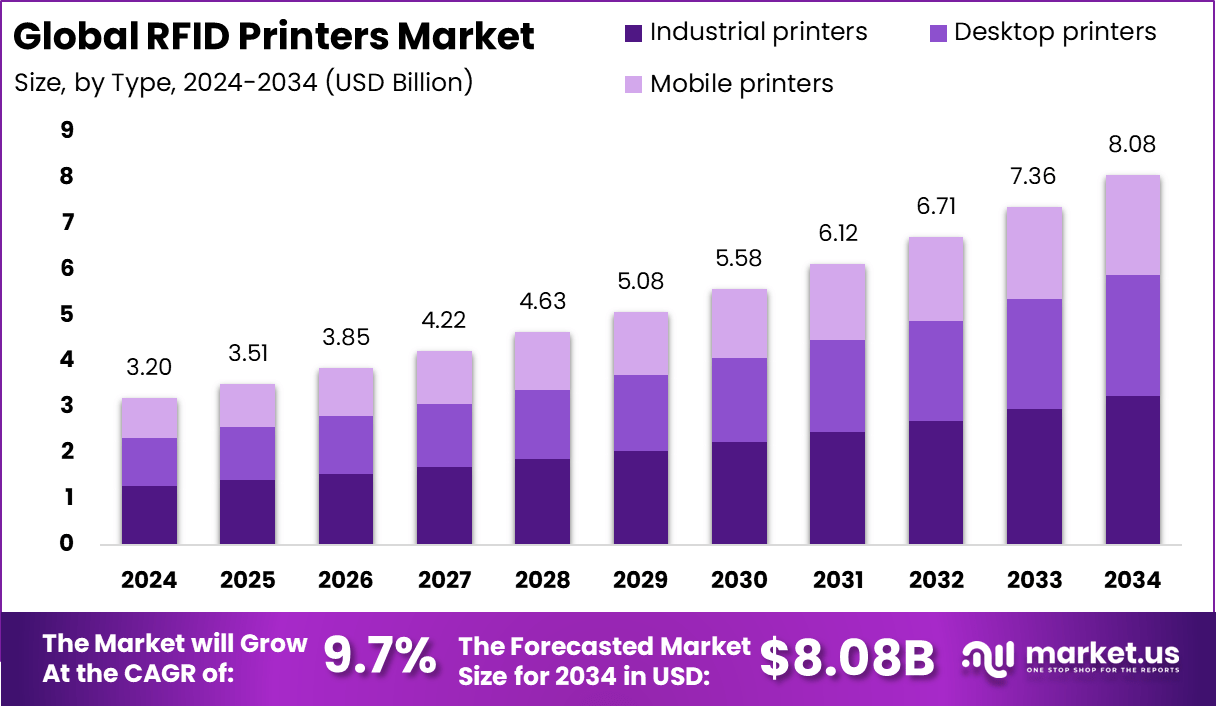

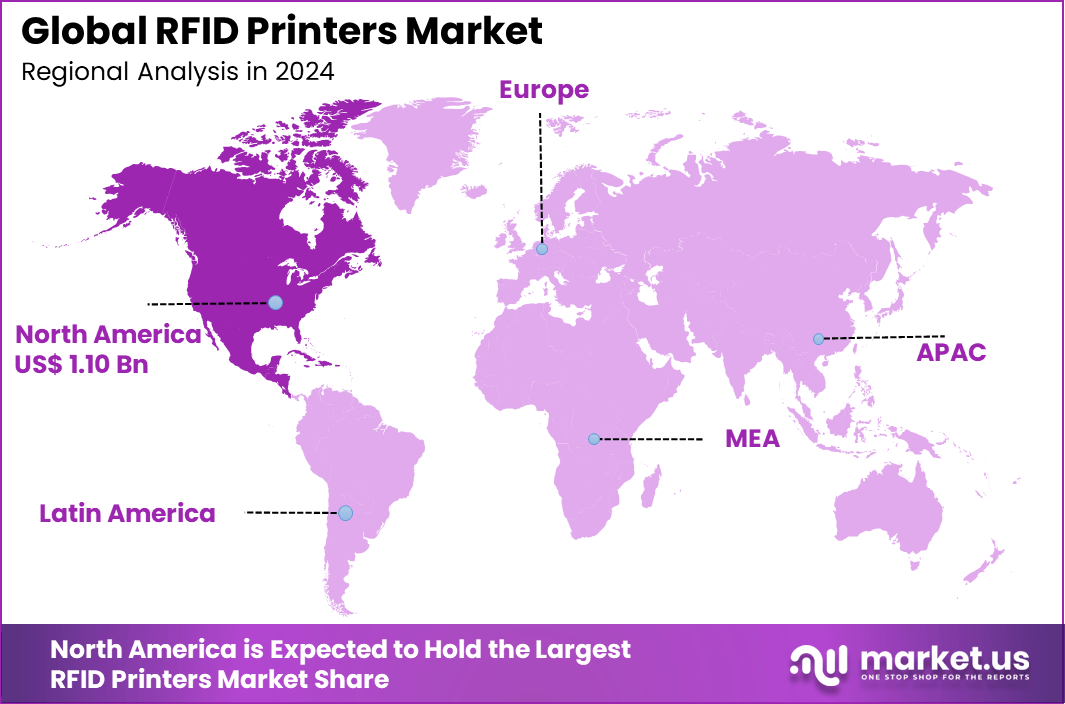

The global RFID Printers market size accounted for USD 3.2 0 billion in 2024 and is predicted to increase from USD 3.51 billion in 2025 to approximately USD 8.08 billion by 2034, expanding at a CAGR of 9.70% from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.4% share, holding USD 1.10 Billion revenue.

The RFID printers market is characterized by steady expansion and sustained commercial interest. This market refers to devices capable of both printing and encoding RFID labels, and their integration has become central in sectors requiring accurate tracking and identification. Market growth can be attributed to rising automation ambitions and the increasing need for immediate visibility of assets and inventory in real time.

The top driving factors include the escalating requirement for real‑time data in supply chains, where accuracy and speed are critical. Landscapes such as retail, logistics, healthcare and manufacturing are emphasizing improved traceability, reduced labor costs and enhanced data precision with RFID encoding capabilities built into printers.

Key Takeaways

- In 2024, the thermal transfer segment led by printing method. It captured 36.7% share, favored for its durability and high-quality print.

- By type, industrial printers held the top position. They accounted for 40.2% share due to their ability to handle high-volume and heavy-duty printing needs.

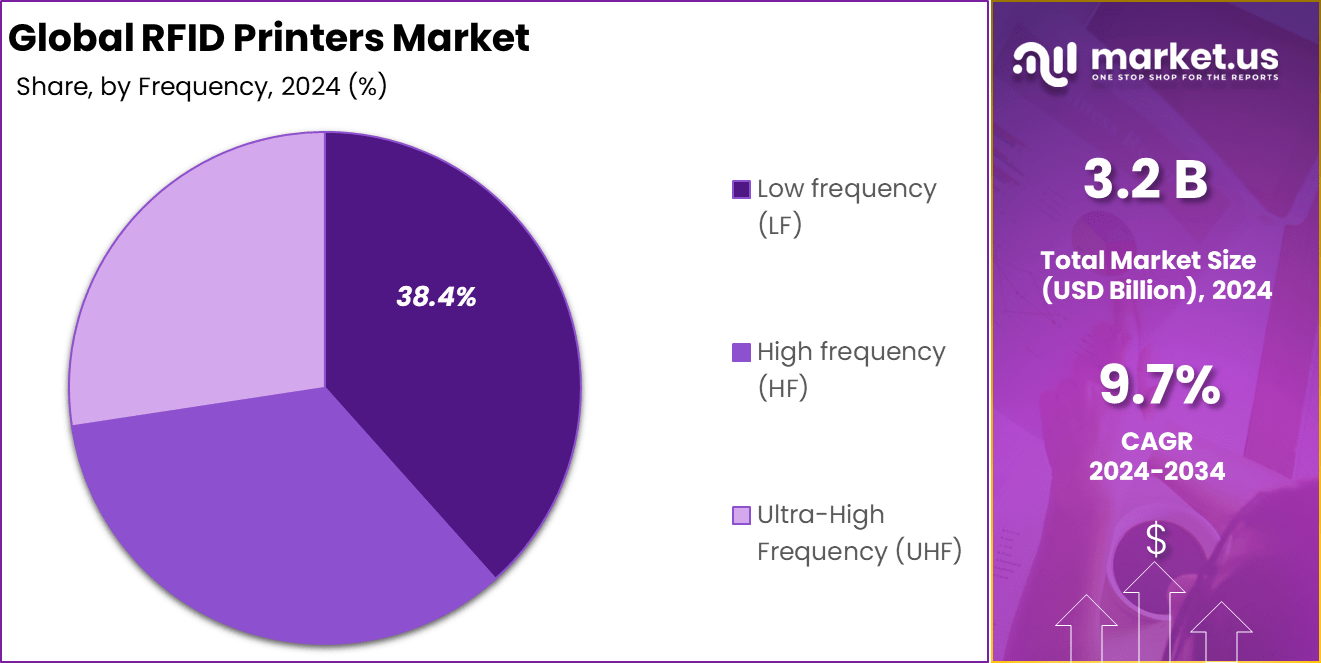

- The high frequency (HF) segment dominated by frequency. It captured 38.4% share, driven by applications in inventory and supply chain management.

- The manufacturing sector remained the leading end-use industry. It held 62.7% share, with growing use in asset tracking and production efficiency.

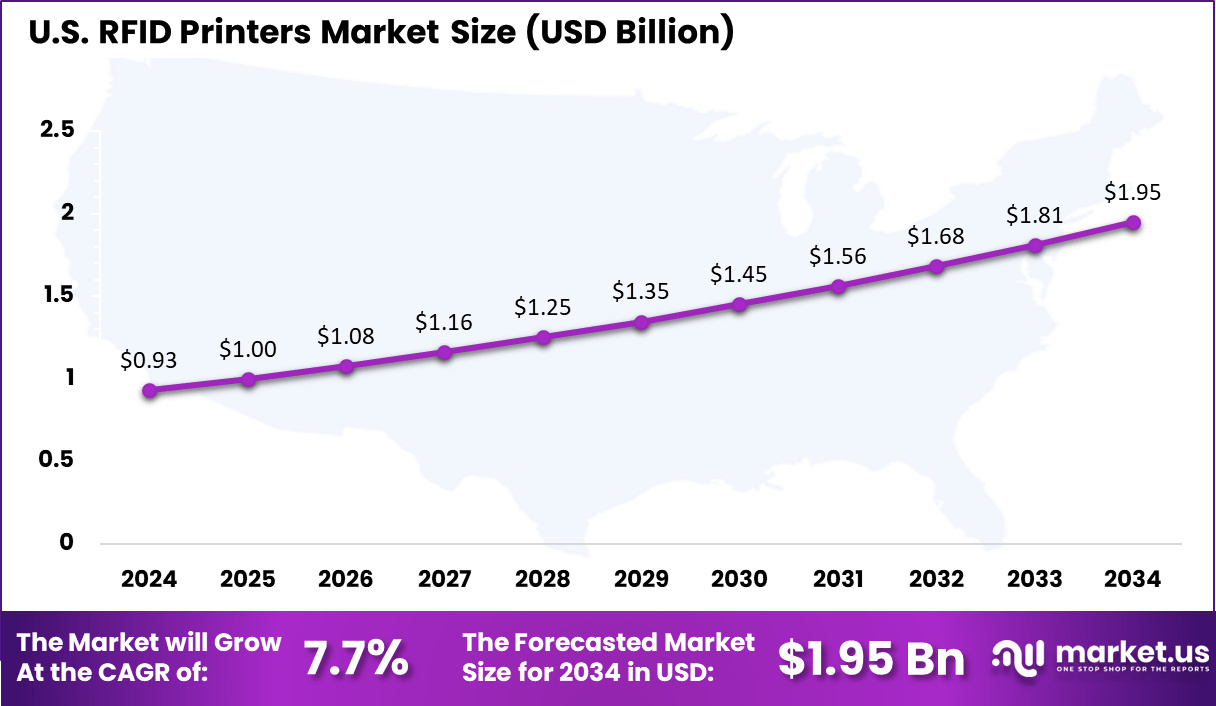

- The US RFID Printers Market reached USD 0.93 billion in 2024, expanding at a 7.7% CAGR due to increased automation.

- North America led globally, holding 33.7% share, supported by strong adoption in retail, healthcare, and industrial applications.

U.S. RFID Printers Market Size

The U.S. RFID Printers Market was valued at USD 0.93 Billion in 2024 and is anticipated to reach approximately USD 1.95 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.7% during the forecast period from 2025 to 2034.

In 2024, the U.S. held a dominant market position in the RFID printers industry, capturing a significant portion of the global share due to its advanced infrastructure in logistics, healthcare, and retail. The presence of highly automated warehouses, omnichannel retail operations, and regulatory requirements for traceability in pharmaceuticals and food safety has directly contributed to the high adoption of RFID printing technologies.

In 2024, North America held a dominant market position, capturing more than a 34.4% share and generating USD 1.1 Billion in revenue. This leadership is primarily driven by the widespread implementation of RFID-based inventory tracking systems in retail, healthcare, manufacturing, and logistics.

The region’s strong foundation in digital transformation and the presence of well-established logistics networks have significantly contributed to the rapid deployment of RFID printers. Retailers are especially prioritizing item-level tagging and omnichannel inventory control, which rely heavily on encoded RFID labels for real-time visibility.

The dominance of North America is also supported by strict regulatory frameworks and compliance requirements that promote the use of RFID for transparency and traceability. Mandates such as the FDA’s drug tracking regulations and the USDA’s animal identification rules are pushing organizations toward secure, automated labeling.

By Type Analysis

In 2024, industrial RFID printers dominate the market with a 40.2% share. These printers are designed to withstand demanding production environments, offering durability, high throughput, and precision in printing RFID tags. The growing demand for industrial automation and enhanced inventory management is driving the adoption of these robust printing solutions across sectors that require reliable and continuous operation.

Industrial printers support businesses in efficiently tracking assets, improving supply chain visibility, and reducing manual errors. Their ability to integrate with other manufacturing systems makes them essential for large-scale industrial deployments where performance, speed, and quality cannot be compromised.

Printing Technology Analysis

In 2024, Thermal transfer technology accounts for 36.7% of the RFID printers market in 2024, making it the leading printing method. This technology is favored for its high-quality, durable prints that resist smudging, abrasion, and fading under harsh conditions. The reliability of thermal transfer printers makes them ideal for printing barcodes alongside RFID tags, which is crucial for accurate tracking and identification.

Organizations prefer thermal transfer printing because it supports various label materials and delivers consistent results for long-term applications. Its ability to produce clear and scannable RFID tags enhances operational efficiency in logistics and asset management.

Frequency Analysis

In 2024, High frequency (HF) RFID technology leads the frequency segment with a 38.4% share in 2024. HF RFID offers balanced read range and data transfer speeds, making it suitable for applications where tags need to be read quickly at moderate distances. This frequency enables efficient tracking and inventory management in environments such as libraries, manufacturing floors, and retail operations.

HF’s versatility and affordability have made it a preferred choice for businesses looking to implement RFID solutions without the complexities of ultra-high frequency systems. Its widespread compatibility with existing RFID infrastructure further cements its leading position.

Industry Vertical Segment Analysis

In 2024, Manufacturing is the leading industry vertical for RFID printers in 2024, accounting for 30.2%. The sector is leveraging RFID printing technology to optimize asset tracking, improve quality control, and bolster supply chain transparency.

The increasing focus on automation and real-time monitoring is encouraging manufacturers to adopt RFID printers that can produce reliable and durable tags in high volumes. By integrating RFID printing into production lines, manufacturers can reduce downtime, prevent losses, and enhance overall productivity.

Key Market Segments

By Type

- Industrial printers

- Desktop printers

- Mobile printers

By Printing Technology

- Thermal transfer

- Direct thermal

- Inkjet

By Frequency

- Low frequency (LF)

- High frequency (HF)

- Ultra-High Frequency (UHF)

By Industry Vertical

- Manufacturing retail

- Transportation & logistics

- Healthcare

- Government

- Entertainment

- Others

Drivers

Increasing Adoption of RFID Technology

RFID technology is a major driver of RFID printer market growth. RFID (Radio Frequency Identification) has become an important tool for technology industries that are demanding to improve efficiency, accuracy and real -time data visibility in their operations. Unlike Traditional Barcode Systems, RFID uses radio waves to automatically identify and track objects, which significantly enhances inventory management, and support chain Logistics.

One of the main factors adopting RFID has the ability to provide more accuracy and automation in tracking goods in complex supply chains. This reduced less errors, labor costs and improved operational efficiency. For example, in retail, RFID technology is used for inventory management, which allows rapid stocktakes and reduce the possibility of stockouts or overstocking.

In addition, with the progress in RFID technology, the RFID tags and the cost of readers have decreased, making it more accessible to small and medium -sized businesses. As industry wants to streamline operations, improve traceability, and meet regulatory requirements, accelerates RFID, which increases the demand for RFID printer.

Restraint

Complexity in Integration with Legacy Systems

Complication in integrating RFID technology with heritage systems is a significant restraint for the RFID printer market. Many businesses still rely on older or heritage software and hardware infrastructure which is not compatible with modern RFID technologies. These systems often require significant changes in existing architecture to integrate RFID printers, which can be both time consuming and expensive.

The challenge lies in the fact that heritage systems were not designed to handle RFID data, which is much more dynamic and complex than traditional barcode information. This requires a complete overhaul or middleware of the system to bridge the gap between old systems and new RFID technologies. Such integration efforts often demand technical expertise and can cause disruption in business operations, further prevent companies from adopting RFID solutions.

In addition, this integration process can result in unexpected costs for businesses, including training staff, adjusting workflows and customizing software. Many companies, especially for small and medium -sized enterprises, this cost overtakes the possible benefits of adopting RFID technology, obstructing comprehensive market growth.

Opportunities

Increasing Demand for Supply Chain Automation

The increasing demand for supply chain automation presents an important opportunity for the RFID printer market. As industry strives for more operational efficiency, accuracy and speed, automating the supply chain processes has become a priority. RFID technology plays an important role in this change by enabling real -time tracking, inventory management and spontaneous integration in the supply chain.

RFID printers are at the center of this automation, as they facilitate efficient printing of RFID labels that can easily be associated with products, shipments and assets. These label businesses help track goods because they through different stages of the supply chain, from manufacturing to distribution to retail. With RFID, companies can reduce human errors, improve stock visibility, and increase operating workflows, leading to decision making and better resource management.

The growth of e-commerce, increasing complexity of global supply chains, and rapid, more accurate inventory control requirement is increasing the demand for RFID-competent automation. This creates a major development opportunity for RFID printers, especially businesses invested in technologies to streamlined and optimize their supply chain operations.

What are the Major Trends in the RFID Printers Market?

- Integration of RFID with IoT: Integration of Internet of Things (IOT) with RFID technology is a major trend in the RFID printer market. Iot RFID enables real -time data capture and communication between tags, printers and other devices. This allows businesses to collect and analyze data from RFID tags, increase tracking and inventory management in supply chains.

- Adoption of Cloud-Based RFID Solutions: Cloud computing is becoming increasingly prevalent in RFID system. Business for better data storage, real-time analytics and remote access are transferred to cloud-based RFID solutions. Cloud integration allows companies to manage RFID printers and to track inventory from any place, increase flexibility and scalability.

- Miniaturization of RFID Printers: Manufacturers are focusing on making RFID printers more compact and portable. Small, more efficient printers can be used in a wide range of applications, including mobile retail environment, warehouse and logistics operations. This shortage tendency allows businesses to use RFID printers in space-developed areas, allowing more efficient tracking and labelling of products.

- Expanding the scope of applications: While industry equipment such as logistics and retail core sectors, healthcare, aviation, and even agriculture are searching for RFID printing to track equipment, monitor patients, manage livestock and provide RFID printing to streamline services.

- Sustainability and eco-friendly labelling: As the ESG target becomes a priority, the increasing demand for permanent RFID printing materials and energy-skilled printers. Recruitment tags, minimal ink use, and smart material management are trending between environment-conscious organizations.

- Customization and personalization capabilities: Modern RFID printers offer high-resolution printing and tag customization, meeting sector-specific needs such as anti-counterfeit features, temperature-sensitive labels and increased capabilities for safe asset tagging.

- Growth of UHF and NFC tag printing: Ultra-high-female (UHF) and near-field communication (NFC) The rise of applications is fuelling the demand for versatile printers that support a wide range of RFID tag types, which are capable of contactless payment, access control and intelligent packaging.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Zebra Technologies Corporation has maintained a leading position in the RFID printer market due to its extensive product range and continuous innovation in thermal printing solutions. Honeywell International Inc. and SATO Holdings Corporation are also prominent players, recognized for their high-performance printers tailored for industrial and retail applications.

Avery Dennison Corporation and Toshiba Tec Corporation have expanded their RFID printer offerings by integrating advanced software and RFID inlays. These players emphasize ease of integration and print quality, supporting high-volume applications. TSC Auto ID Technology Co., Ltd. and Wasp Barcode Technologies have also gained traction, particularly among small and mid-sized enterprises, by offering cost-effective and compact printer models.

Postek Electronics Co., Ltd., Godex International Co., Ltd., and BIXOLON Co., Ltd. are key contributors to market competitiveness, especially in Asia-Pacific. These companies have focused on enhancing durability, wireless connectivity, and compatibility with warehouse management systems. They continue to expand distribution networks globally while introducing models with lower energy consumption and user-friendly interfaces.

Top Key Players in the Market

- Zebra Technologies Corporation

- Honeywell International Inc.

- SATO Holdings Corporation

- Avery Dennison Corporation

- Toshiba Tec Corporation

- TSC Auto ID Technology Co., Ltd.

- Wasp Barcode Technologies

- Postek Electronics Co., Ltd.

- Godex International Co., Ltd.

- BIXOLON Co., Ltd.

- Others

Recent Developments

- In June 2025, Elegoo has introduced a new RFID Ecosystem for its FDM printers. The system is aimed at streamlining 3D printing workflows by enabling automatic recognition of tagged items and corresponding print parameters.

- In April 2022, TSC Printronix Auto ID strengthened its RFID Printer Range with Launch of its First Mobile. This compact, mobile powerhouse is further evidence of TSC Printronix Auto ID’s expertise in RFID and marks a resilient step forward in production and logistics processes.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 8.08 Bn CAGR (2024-2033) 9.7% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2033 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Industrial printers, Desktop printers, & Mobile printers), By Printing Technology (Thermal transfer, Direct thermal, & Inkjet), by Frequency (Low frequency (LF), High frequency (HF), & Ultra-High Frequency (UHF)), By Industry Vertical (Manufacturing, Retail, Transportation & Logistics, Healthcare, Government, Entertainment, & Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Zebra Technologies Corporation, Honeywell International Inc., SATO Holdings Corporation, Avery Dennison Corporation, ToshibaTec Corporation, TSC Auto ID Technology Co., Ltd., Wasp Barcode Technologies, Postek Electronics Co., Ltd., Godex International Co., Ltd., BIXOLON Co., Ltd., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zebra Technologies Corporation

- Honeywell International Inc.

- SATO Holdings Corporation

- Avery Dennison Corporation

- Toshiba Tec Corporation

- TSC Auto ID Technology Co., Ltd.

- Wasp Barcode Technologies

- Postek Electronics Co., Ltd.

- Godex International Co., Ltd.

- BIXOLON Co., Ltd.

- Others