Global Reverse Osmosis (Ro) Membrane Market Size, Share, And Business Benefit By Material Type (Cellulose-Based Membranes (Cellulose Acetate (CA) Membranes, Nitrocellulose Membranes), Thin Film Composite Membranes (Polyamide (PA) Composite Membranes, GO-Based Polyacrylonitrile Membrane)), By Filter Module (Plate and Frame (PF) (Spiral, Pillow-Shaped), Tubular-Shaped, Spiral-Wound, Hollow-Fiber), By End-Use (Desalination Systems (Seawater, Brackish Water), Ro Purification Systems (Residential and Commercial, Municipal, Industrial), Medical Devices and Diagnostics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163724

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

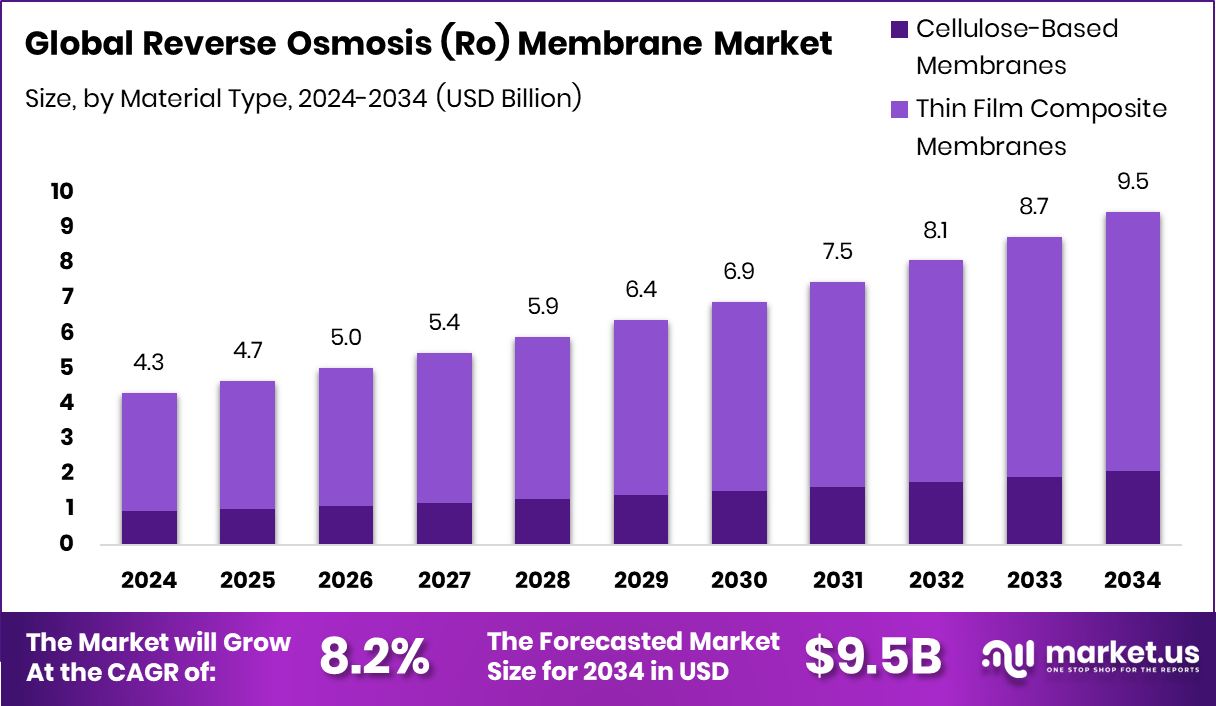

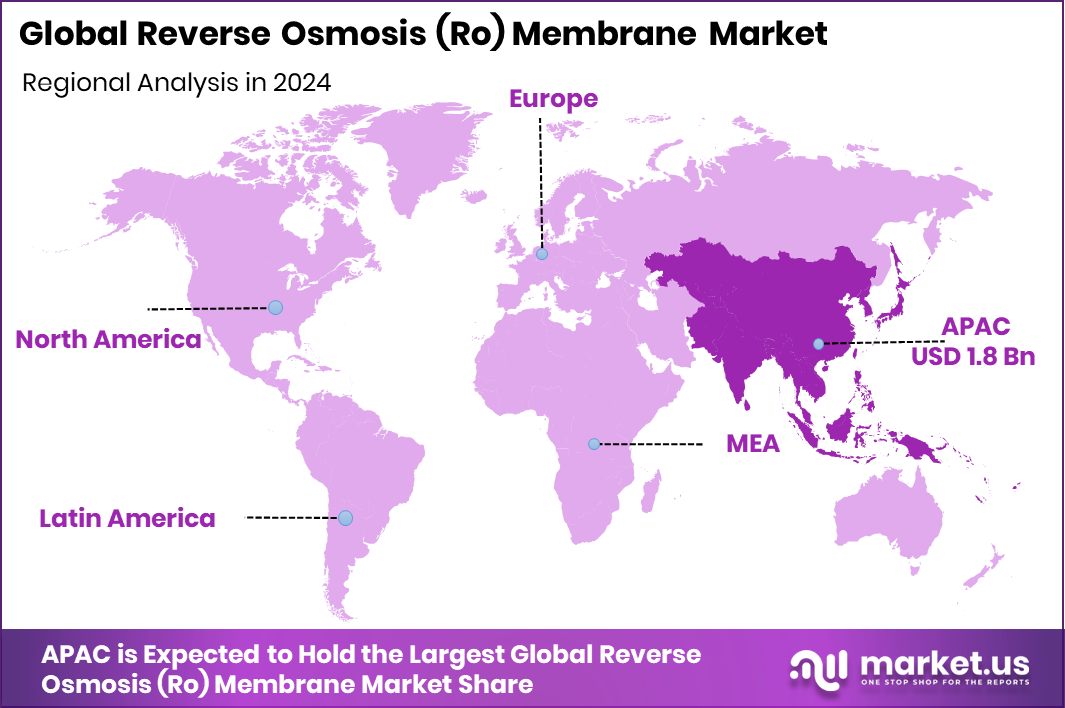

The Global Reverse Osmosis (Ro) Membrane Market is expected to be worth around USD 9.5 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. Growing desalination projects across the Asia-Pacific boosted the market value to USD 1.8 Bn.

A Reverse Osmosis (RO) membrane is a thin, semi-permeable layer that filters out impurities from water under high pressure. It allows only water molecules to pass through while blocking dissolved salts, heavy metals, bacteria, and organic compounds. These membranes are widely used in desalination plants, industrial wastewater treatment, and household purification systems to provide clean and safe water. Made mostly from thin-film composite materials, RO membranes are durable and designed to deliver high salt rejection with low energy consumption.

The RO membrane market includes companies, technologies, and services involved in producing and applying these membranes for water purification and desalination. It covers the manufacturing of membranes, module assembly, system integration, and maintenance services. The market is driven by rising water stress, industrial demand, and public and private investment in sustainable water infrastructure. Growing urbanization and government initiatives to enhance water security further boost market expansion globally.

The global demand for clean water continues to rise due to rapid industrialization and increasing water scarcity. Technological advancements have made RO systems more efficient and cost-effective, boosting adoption across sectors. Recently, Flocean secured US$9 million in funding to deliver subsea desalination projects, showcasing growing innovation and investment in next-generation membrane systems designed to address coastal and offshore water challenges.

Urban growth and industrial expansion are creating strong demand for efficient purification systems. Households and commercial users are turning to compact RO units for everyday use. The water supply startup DrinkPrime raised Rs 60 crore to expand its RO-based services, reflecting how consumer-driven models are pushing consistent market demand for portable and home-based purification systems across developing regions.

Future opportunities lie in low-energy desalination systems, recycling of used membranes, and adoption in emerging economies. The recent $19 million funding received by Blue Earth to enhance innovative water technologies highlights the investment potential in sustainable solutions. However, mismanagement, such as the demolition of multiple RO plants worth ₹15–20 lakh each in Bengaluru, indicates a pressing opportunity for smarter infrastructure planning and long-term, cost-efficient RO deployment worldwide.

Key Takeaways

- The Global Reverse Osmosis (Ro) Membrane Market is expected to be worth around USD 9.5 billion by 2034, up from USD 4.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- In 2024, Thin Film Composite Membranes captured 78.3% of the Reverse Osmosis (RO) Membrane Market.

- In 2024, Spiral-Wound Modules accounted for 67.2% of the Reverse Osmosis (RO) Membrane Market.

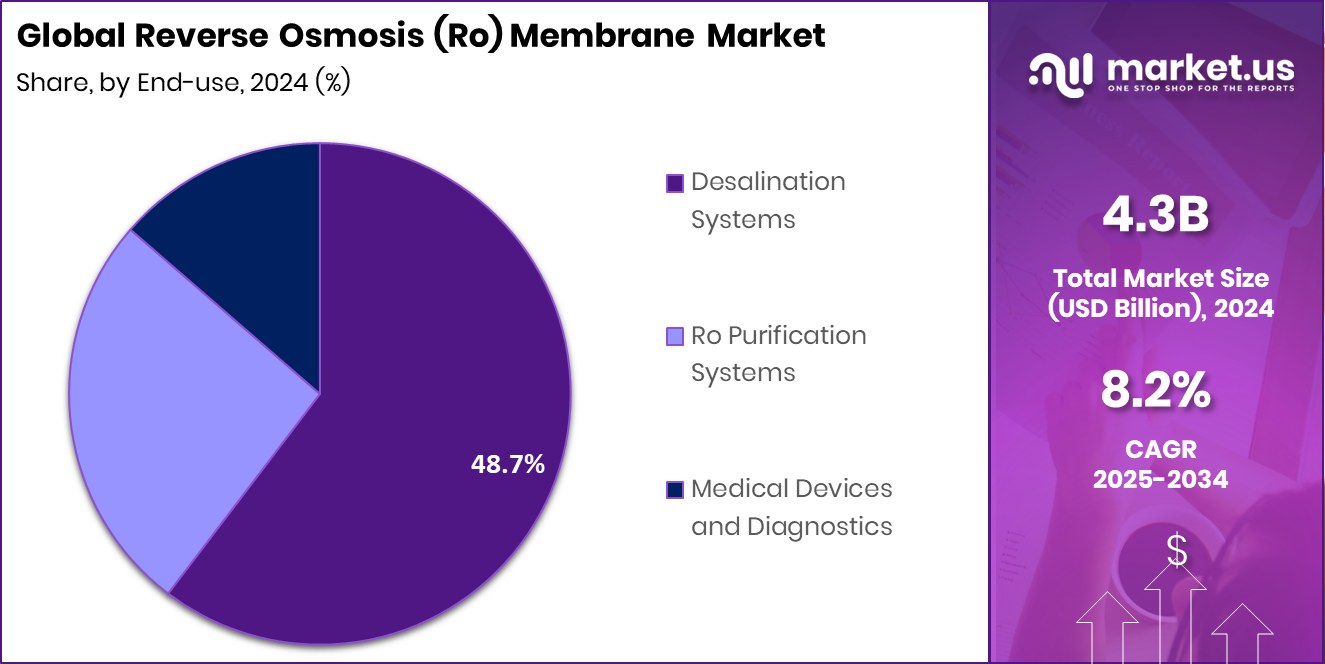

- In 2024, Desalination Systems held a 48.7% share in the Reverse Osmosis (RO) Membrane Market.

- The Asia-Pacific region recorded a strong market valuation of USD 1.8 billion.

By Material Type Analysis

In 2024, Thin Film Composite Membranes dominated the Reverse Osmosis (RO) Membrane Market with 78.3% share.

In 2024, Thin Film Composite Membranes held a dominant market position in the By Material Type segment of the Reverse Osmosis (RO) Membrane Market, accounting for a 78.3% share. Their dominance is attributed to superior filtration efficiency, high salt rejection rates, and excellent durability compared to other membrane materials. These membranes are widely used in desalination, industrial wastewater treatment, and residential purification due to their consistent performance under varying pressure and temperature conditions.

The increasing adoption of advanced thin-film composite technology supports cost-effective water purification solutions, making it the preferred choice among end users. Continuous innovation in material composition and energy-efficient designs further reinforces the segment’s strong presence and reliability in the global RO membrane market.

By Filter Module Analysis

Spiral-wound modules held a 67.2% share in the Reverse Osmosis (RO) Membrane Market.

In 2024, Spiral-Wound held a dominant market position in the By Filter Module segment of the Reverse Osmosis (RO) Membrane Market, with a 67.2% share. This dominance is mainly due to its compact design, high packing density, and superior filtration efficiency, which make it ideal for large-scale water treatment and desalination systems. The spiral-wound configuration offers excellent space utilization and lower energy consumption compared to other module types.

Its easy maintenance and cost-effectiveness have further strengthened its adoption in municipal, industrial, and residential applications. Continuous improvements in module construction and durability are also enhancing operational life and performance stability, keeping spiral-wound filters the preferred choice for both new installations and replacement demand in the RO membrane industry.

By End-Use Analysis

Desalination systems captured a 48.7% share in the Reverse Osmosis (RO) Membrane Market.

In 2024, Desalination Systems held a dominant market position in the By End-Use segment of the Reverse Osmosis (RO) Membrane Market, with a 48.7% share. This leadership is driven by the growing global need for freshwater in regions facing acute water scarcity. Desalination systems using RO membranes are increasingly adopted in coastal and arid areas to convert seawater into potable water for municipal and industrial purposes.

The rising investments in large-scale desalination projects and government initiatives to ensure a sustainable water supply further supported this segment’s growth. The proven efficiency, low maintenance, and improved lifespan of RO membranes in desalination applications have strengthened their preference, ensuring continued market dominance for this end-use category.

Key Market Segments

By Material Type

- Cellulose-Based Membranes

- Cellulose Acetate (CA) Membranes

- Nitrocellulose Membranes

- Thin Film Composite Membranes

- Polyamide (PA) Composite Membranes

- GO-Based Polyacrylonitrile Membrane

By Filter Module

- Plate and Frame (PF)

- Spiral

- Pillow-Shaped

- Tubular-Shaped

- Spiral-Wound

- Hollow-Fiber

By End-Use

- Desalination Systems

- Seawater

- Brackish Water

- Ro Purification Systems

- Residential and Commercial

- Municipal

- Industrial

- Medical Devices and Diagnostics

Driving Factors

Rising Investments in Large-Scale Desalination Projects

One of the main driving factors for the Reverse Osmosis (RO) Membrane Market is the growing investment in large-scale desalination projects to meet the rising global demand for freshwater. Many regions facing severe water shortages are turning to RO technology as a reliable and cost-effective solution. Governments and private investors are funding new projects to enhance water security and reduce dependence on natural freshwater sources.

For instance, Spain has committed €340 million to the Casablanca Desalination Plant, showcasing how major economies are supporting sustainable water initiatives. Such funding boosts the adoption of advanced RO membranes, encouraging continuous research and innovation to improve efficiency, lower operational costs, and expand access to clean water globally.

Restraining Factors

High Operational Costs and Energy Consumption Challenges

A key restraining factor for the Reverse Osmosis (RO) Membrane Market is the high operational cost and energy consumption associated with desalination and water purification systems. Running RO plants requires substantial electricity to maintain high-pressure operations, which raises expenses and limits adoption in regions with poor energy infrastructure. Frequent membrane replacement and chemical cleaning also add to maintenance costs, making operations less affordable for smaller facilities.

However, ongoing innovations are helping address these challenges. For instance, Flocean secured US$9 million in funding to deliver subsea desalination, an approach aimed at reducing surface energy requirements and improving system efficiency. Such technological advancements may gradually lower energy costs and help overcome this major restraint in the coming years.

Growth Opportunity

Expanding Desalination Infrastructure in Emerging Regions

A major growth opportunity for the Reverse Osmosis (RO) Membrane Market lies in the rapid expansion of desalination infrastructure across emerging and water-stressed regions. Governments are increasingly investing in advanced RO systems to secure sustainable water resources for growing urban and industrial populations. The Saudi Water Authority’s plan to finance SAR 2.4 billion for the Jubail and Al Khobar desalination systems highlights this strong commitment to expanding water treatment capacity.

Such large-scale projects will significantly boost the demand for efficient and durable RO membranes. As nations in the Middle East, Africa, and Asia continue to prioritize water security, the integration of modern RO technologies presents a substantial opportunity for long-term growth and innovation in the global market.

Latest Trends

Rising Privatization and Shifting Investments in Desalination

One of the latest trends in the Reverse Osmosis (RO) Membrane Market is the growing shift toward privatization and dynamic investment movements within the desalination sector. Investors and private funds are increasingly engaging in large-scale water infrastructure projects, recognizing the long-term value of sustainable water supply systems. However, fluctuations in funding are also shaping the market’s direction.

For instance, Cape May lost $1.5 million in funding for its desalination plant, showing how financial constraints can delay smaller projects. At the same time, a stake in the $2.5 billion Sydney desalination plant is up for sale as a Canadian fund plans an exit. These developments highlight changing ownership patterns and evolving capital structures in global desalination initiatives.

Regional Analysis

In 2024, the Asia-Pacific dominated the RO Membrane Market with 43.80% growth.

In 2024, the Asia-Pacific region held a dominant position in the Reverse Osmosis (RO) Membrane Market, accounting for a 43.80% growth rate and reaching a market value of USD 1.8 billion. The dominance of this region is supported by the growing demand for clean water, rapid industrialization, and large-scale desalination projects across countries like China, India, Japan, and South Korea. Government initiatives focusing on water reuse and infrastructure development have further strengthened regional growth.

North America showed steady expansion driven by advancements in membrane technology and increased adoption of residential purification systems. Europe witnessed consistent growth supported by environmental regulations promoting sustainable water treatment solutions.

Meanwhile, the Middle East & Africa region continued to rely heavily on desalination projects to tackle water scarcity challenges. Latin America displayed moderate growth with investments in municipal water treatment infrastructure. Overall, Asia-Pacific remains the largest and fastest-growing regional market for RO membranes due to rising water stress, rapid urbanization, and continuous investment in desalination and wastewater management facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Alfa Laval AB continued to strengthen its presence in the global Reverse Osmosis (RO) Membrane Market through its advanced separation and filtration technologies. The company’s expertise in heat transfer and fluid handling complements its RO solutions, allowing it to serve industries such as food processing, pharmaceuticals, and water treatment efficiently. Alfa Laval’s focus on energy-efficient systems and sustainable operations reflects its long-term commitment to environmental performance and operational reliability.

AXEON Water maintained steady progress in 2024 by offering customized RO systems and membranes catering to both residential and commercial applications. Its emphasis on innovation, compact system design, and user-friendly operation has made it a preferred choice for small- to medium-scale water purification needs. AXEON’s continuous improvements in system durability and water recovery efficiency contribute significantly to its market reputation.

DuPont de Nemours, Inc. remained a leading name in 2024 with its wide portfolio of advanced membrane technologies. The company’s focus on high-performance thin-film composite membranes has enabled it to meet global desalination and industrial water treatment demands effectively. DuPont’s ongoing innovation in sustainable water solutions and its strong manufacturing capabilities underline its strategic position as a key driver of technology and performance within the RO membrane industry.

Top Key Players in the Market

- Alfa Laval AB

- AXEON Water

- DuPont de Nemours, Inc.

- Hunan Keensen Technology Co., Ltd

- Hydranautics (A Nitto Denko Group Company)

- Kovalus Separation Solutions

- LG Chem

- MANN+HUMMEL Water & Fluid Solutions GmbH

- Pentair

- Toray Industries Inc.

- TOYOBO MC Corporation

- Vontron Technology Co., Ltd.

Recent Developments

- In August 2025, Alfa Laval & AquaGreen signed a Memorandum of Understanding to advance water and waste solutions, combining Alfa Laval’s membrane/dewatering expertise with AquaGreen’s biomass and thermal technology. This signals a push into sustainable water-and-waste applications of membrane filtration.

- In July 2025, AXEON published its updated corporate brochure emphasising that its RO systems are now designed for “high efficiencies, minimal energy consumption, and offer greater savings with low operation and maintenance costs.”

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 9.5 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Cellulose-Based Membranes (Cellulose Acetate (CA) Membranes, Nitrocellulose Membranes), Thin Film Composite Membranes (Polyamide (PA) Composite Membranes, GO-Based Polyacrylonitrile Membrane)), By Filter Module (Plate and Frame (PF) (Spiral, Pillow-Shaped), Tubular-Shaped, Spiral-Wound, Hollow-Fiber), By End-Use (Desalination Systems (Seawater, Brackish Water), Ro Purification Systems (Residential and Commercial, Municipal, Industrial), Medical Devices and Diagnostics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Laval AB, AXEON Water, DuPont de Nemours, Inc., Hunan Keensen Technology Co., Ltd, Hydranautics (A Nitto Denko Group Company), Kovalus Separation Solutions, LG Chem, MANN+HUMMEL Water & Fluid Solutions GmbH, Pentair, Toray Industries Inc., TOYOBO MC Corporation, Vontron Technology Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Reverse Osmosis (Ro) Membrane MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Reverse Osmosis (Ro) Membrane MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Laval AB

- AXEON Water

- DuPont de Nemours, Inc.

- Hunan Keensen Technology Co., Ltd

- Hydranautics (A Nitto Denko Group Company)

- Kovalus Separation Solutions

- LG Chem

- MANN+HUMMEL Water & Fluid Solutions GmbH

- Pentair

- Toray Industries Inc.

- TOYOBO MC Corporation

- Vontron Technology Co., Ltd.