Global Refinery Catalysts Market Size, Share, And Business Benefits By Product (Zeolite, Metallic, Chemical Compounds, Others), By Applicationn (FCC Catalysts, Alkylation Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Catalytic Reforming, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158868

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

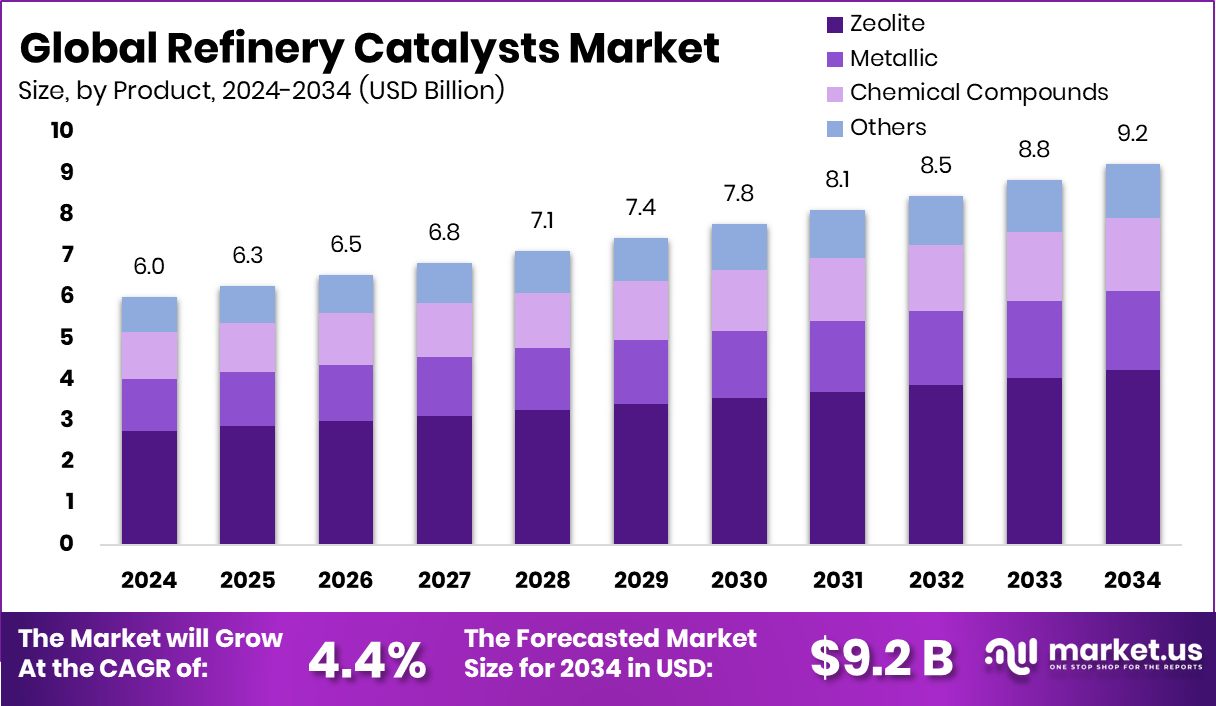

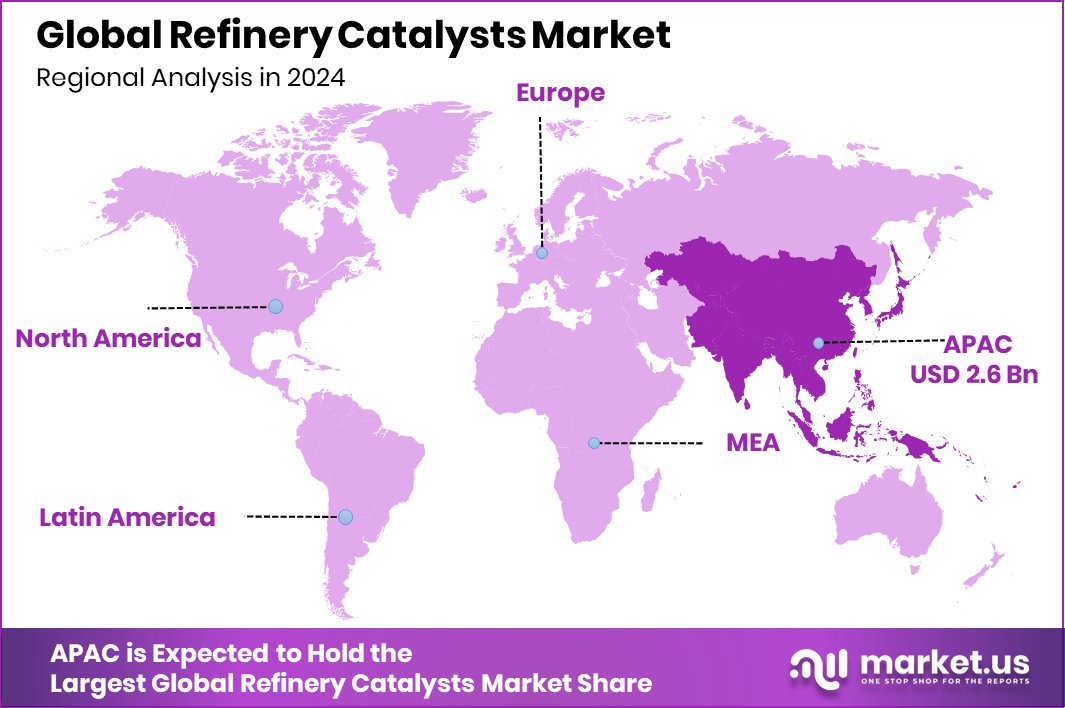

The Global Refinery Catalysts Market is expected to be worth around USD 9.2 billion by 2034, up from USD 6.0 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Asia Pacific, holding 44.80% market share and USD 2.6 Bn value, leads global refinery catalyst consumption.

Refinery catalysts are essential substances used in petroleum refining to accelerate chemical reactions, converting crude oil into products like gasoline, diesel, and jet fuel. They enhance processes such as fluid catalytic cracking (FCC), hydrocracking, and catalytic reforming, improving efficiency, selectivity, and reducing energy use and emissions. The global refinery catalysts market is growing due to rising demand for cleaner fuels, stricter environmental regulations, and advancements in refining technologies.

Refineries, particularly in the Asia-Pacific, are adopting catalysts to process heavier crude oils and renewable feedstocks, improving yield and fuel quality. The market is driven by the need for high-performance fuels and regulatory compliance, with governments enforcing emission standards that encourage the use of advanced catalysts to reduce sulfur content. Technological innovations are creating catalysts with higher activity, selectivity, and resistance to impurities, lowering operational costs and enhancing refining efficiency.

Investment in refinery modernization and capacity expansion further supports market growth. Recent developments include Kenya’s Octavia securing $3.9 million in seed funding for carbon removal technologies, the European Investment Bank and Eni signing a €500 million agreement to convert Livorno refinery into a biorefinery, and the U.S. Department of Energy awarding $118 million to accelerate domestic biofuel production, highlighting the industry’s shift toward sustainability and renewable energy integration.

Key Takeaways

- The Global Refinery Catalysts Market is expected to be worth around USD 9.2 billion by 2034, up from USD 6.0 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In the Refinery Catalysts Market, zeolite accounts for 45.8% of total product demand globally.

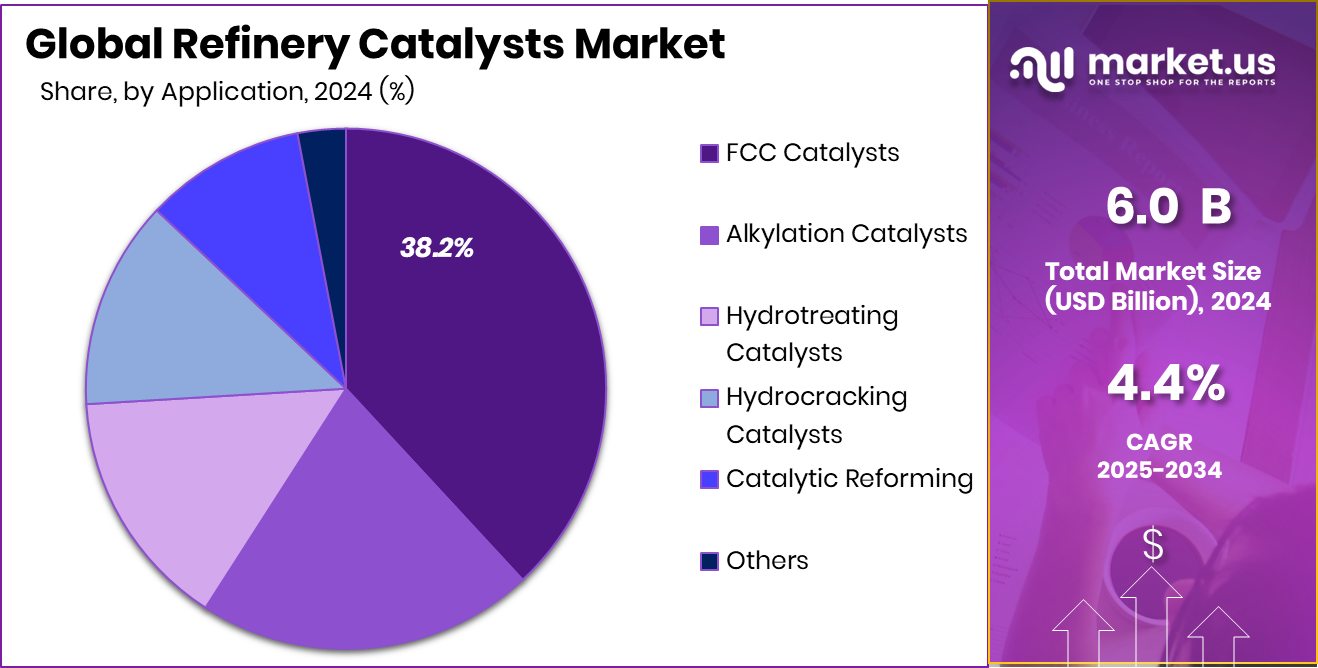

- FCC catalysts dominate applications in the Refinery Catalysts Market, representing 38.2% of overall usage worldwide.

- The market in the Asia Pacific, worth USD 2.6 Bn, continues growing due to rising refinery demand.

By Product Analysis

In the Refinery Catalysts Market, zeolite dominates with a 45.8% share.

In 2024, Zeolite held a dominant market position in the By Product segment of the Refinery Catalysts Market, with a 45.8% share. This strong performance is attributed to Zeolite’s high efficiency in processes such as fluid catalytic cracking (FCC), where it enhances conversion rates and improves product yields. Its ability to selectively target reactions while reducing energy consumption and emissions makes it a preferred choice for refineries worldwide.The segment’s growth is further supported by increasing demand for cleaner fuels and stricter environmental regulations, prompting refiners to adopt Zeolite-based catalysts for improved sulfur removal and fuel quality. Continued investments in advanced refining technologies are expected to sustain Zeolite’s leading position in this segment.

By Application Analysis

FCC catalysts lead applications, accounting for 38.2% of the market demand.

In 2024, FCC Catalysts held a dominant market position in the By Application segment of the Refinery Catalysts Market, with a 38.2% share. This leadership is driven by FCC catalysts’ critical role in fluid catalytic cracking, a key refining process that converts heavy crude oils into high-value products like gasoline and diesel. Their efficiency in enhancing conversion rates, improving selectivity, and reducing energy consumption has made them a preferred choice for refineries globally.

The segment’s growth is supported by increasing fuel demand, stringent environmental regulations, and the need for low-sulfur, high-quality fuels. Ongoing technological advancements in FCC catalysts further strengthen their performance, ensuring continued dominance in the application segment.

Key Market Segments

By Product

- Zeolite

- Metallic

- Chemical Compounds

- Others

By Application

- FCC Catalysts

- Alkylation Catalysts

- Hydrotreating Catalysts

- Hydrocracking Catalysts

- Catalytic Reforming

- Others

Driving Factors

Government Support Boosts Zeolite Production in India

The Indian government has been instrumental in advancing zeolite production through various initiatives. For instance, the Science and Engineering Research Board (SERB), a statutory body under the Department of Science and Technology, has historically provided financial assistance to research and development in science and engineering, including zeolite-related projects. While specific funding details for zeolite projects are not always publicly disclosed, SERB’s role in promoting basic research has indirectly supported such initiatives.

Additionally, the National Aluminium Company Limited (NALCO) has developed indigenous technology for producing detergent-grade Zeolite-A, licensed through the National Research Development Corporation (NRDC), showcasing the application of government-supported research in industrial production.

Restraining Factors

Government Funding for Metallic Catalysts in Refineries

The development of metallic catalysts is crucial for enhancing the efficiency and sustainability of refinery operations. In India, the government plays a significant role in funding research and development in this area. For instance, the Science and Engineering Research Board (SERB), under the Department of Science and Technology (DST), has supported projects focusing on low-cost, nano-intermetallic/alloy catalysts as alternatives to expensive platinum catalysts used in fuel cells. One such project was conducted by the National Environmental Engineering Research Institute (NEERI) in Nagpur, Maharashtra, with a funding of ₹51,14,780. These initiatives aim to reduce reliance on costly precious metals and promote the use of more affordable materials in catalytic processes.

Additionally, the Department of Science and Technology (DST) has funded research on multi-component alloy-based catalysts designed for the efficient production of green hydrogen. This research, conducted by scientists at the International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI), focuses on developing catalysts that can facilitate sustainable hydrogen production, which is essential for cleaner energy solutions in refineries.

Growth Opportunity

Government Funding Drives FCC Catalyst Innovation

The Indian government plays a pivotal role in advancing Fluid Catalytic Cracking (FCC) catalyst technology, which is essential for refining processes. Institutions like the Centre for High Technology (CHT) and the Oil Industry Development Board (OIDB) have been instrumental in funding research and development in this area. For instance, the development of catalysts to reduce sulfur content in FCC gasoline without compromising octane levels was supported by CHT/OIDB, under the guidance of the Standing Advisory Committee (SAC). Such initiatives aim to enhance the efficiency and environmental performance of refining processes.

Additionally, the government’s support extends to the procurement of FCC catalysts. For example, Bharat Petroleum Corporation Limited (BPCL) issued a tender for the supply of 900 MT of fresh catalyst for their FCC unit, indicating the government’s role in facilitating the adoption of advanced catalytic technologies in the refining sector. These efforts underscore the government’s commitment to fostering innovation and sustainability in the refining industry.

Latest Trends

Government Funding Accelerates Hydrocracking Catalyst Development

The Indian government has been actively supporting the advancement of hydrocracking catalysts, which are essential for refining heavy crude oil into valuable products like diesel and jet fuel. Institutions such as the Centre for High Technology (CHT) and the Oil Industry Development Board (OIDB) have been pivotal in this initiative.

For example, CHT/OIDB funded a project at the Indian Institute of Petroleum (IIP) to develop hydrocracking catalysts. The project received a contribution of ₹13.66 crore, with ₹1.36 crore already disbursed. This funding has facilitated research into improving catalyst performance and longevity, which is crucial for enhancing refinery efficiency and reducing operational costs.

Additionally, the government’s support extends to the development of ebullated bed hydrocracking technologies. HPCL, a public sector refinery, has been involved in procuring pilot plants for such technologies, indicating the government’s role in facilitating the adoption of advanced catalytic processes in the refining sector

Regional Analysis

Asia Pacific dominated the Refinery Catalysts Market with a 44.80% share, valued at USD 2.6 Bn.

In 2024, the global Refinery Catalysts Market is witnessing significant regional variations, driven by differences in refinery capacities, technological adoption, and industrial growth. Asia Pacific emerges as the dominating region, accounting for 44.80% of the market share with a valuation of USD 2.6 Bn. This leadership is largely attributed to the region’s expanding refining infrastructure, high consumption of petroleum products, and rapid industrialization across countries such as China and India.

North America, Europe, the Middle East & Africa, and Latin America are also notable contributors, supporting the market through ongoing refinery upgrades and adoption of advanced catalytic technologies, although their specific market values are not detailed here.

The dominance of Asia Pacific underscores the strategic importance of the region in global refinery operations, as companies increasingly focus on capacity expansion and efficiency improvement to meet growing energy demands. Investments in modern refining technologies and government-backed initiatives for catalyst development further reinforce the region’s strong market position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Albemarle Corporation has strategically retained its Catalysts business under a separate, wholly owned subsidiary, emphasizing its commitment to the refining sector. This move allows Albemarle to focus on delivering advanced catalyst solutions, such as the PULSAR™ family, which includes KF 787 and KF 774, designed for clean fuels applications. Additionally, the launch of Ketjen Corporation, a provider of advanced catalyst solutions, underscores Albemarle’s dedication to enhancing performance and business value in the petrochemical and refining industries

BASF SE continues to lead in innovative catalyst technologies, offering tailored Fluid Catalytic Cracking (FCC) catalysts that cater to specific refinery feedstocks and desired outputs. Their focus on customer-driven research and development has led to the creation of new technologies that enhance operational efficiency and profitability in the refining industry. BASF’s commitment to sustainability is evident in its continuous innovation in FCC refining catalysts, providing solutions that offer feed flexibility and sustainable options for all FCC units

Johnson Matthey Plc has been a significant player in the global refinery catalysts market, offering a range of high-quality hydroprocessing catalysts. These catalysts are essential for processes such as hydrodesulfurization, hydrodenitrogenation, and hydrocracking, which are critical for producing cleaner fuels and meeting stringent environmental regulations. The company’s expertise in catalyst technology supports refiners in enhancing product quality and operational efficiency.

Top Key Players in the Market

- Albemarle Corporation

- BASF SE

- Johnson Matthey Plc

- W. R. Grace

- Clariant International Ltd.

- Arkema

- Zeolyst International

- Chevron Corporation

- Exxon Mobil Corporation

- Evonik Industries AG

- DuPont

- Haldor Topsoe A/S

Recent Developments

- In August 2024, BASF introduced Fourtiva™, a new Fluid Catalytic Cracking (FCC) catalyst designed for gasoil to mild resid feedstock. This catalyst incorporates BASF’s Advanced Innovative Matrix (AIM) and Multiple Frameworks Topology (MFT) technologies, aiming to maximize butylene yields, improve naphtha octane, increase LPG olefinicity, and minimize coke and dry gas formation. These enhancements support refiners in producing more valuable products and increasing profitability while reducing the carbon footprint of the FCC unit.

- In March 2024, Johnson Matthey announced a multi-million-dollar investment aimed at enhancing its innovation capabilities in the Fluid Catalytic Cracking (FCC) additives space. This investment underscores the company’s commitment to advancing catalyst technologies and improving the efficiency of refining processes.

Report Scope

Report Features Description Market Value (2024) USD 6.0 Billion Forecast Revenue (2034) USD 9.2 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Zeolite, Metallic, Chemical Compounds, Others), By Applicationn (FCC Catalysts, Alkylation Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Catalytic Reforming, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Albemarle Corporation, BASF SE, Johnson Matthey Plc, W. R. Grace, Clariant International Ltd., Arkema, Zeolyst International, Chevron Corporation, Exxon Mobil Corporation, Evonik Industries AG, DuPont, Haldor Topsoe A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refinery Catalysts MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Refinery Catalysts MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Albemarle Corporation

- BASF SE

- Johnson Matthey Plc

- W. R. Grace

- Clariant International Ltd.

- Arkema

- Zeolyst International

- Chevron Corporation

- Exxon Mobil Corporation

- Evonik Industries AG

- DuPont

- Haldor Topsoe A/S