Global Reactive Diluents Market Size, Share, And Business Benefits By Product (Aliphatic, Aromatic, Cycloaliphatic), By Application (Paints and Coatings, Composites, Adhesives and Sealants, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163005

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

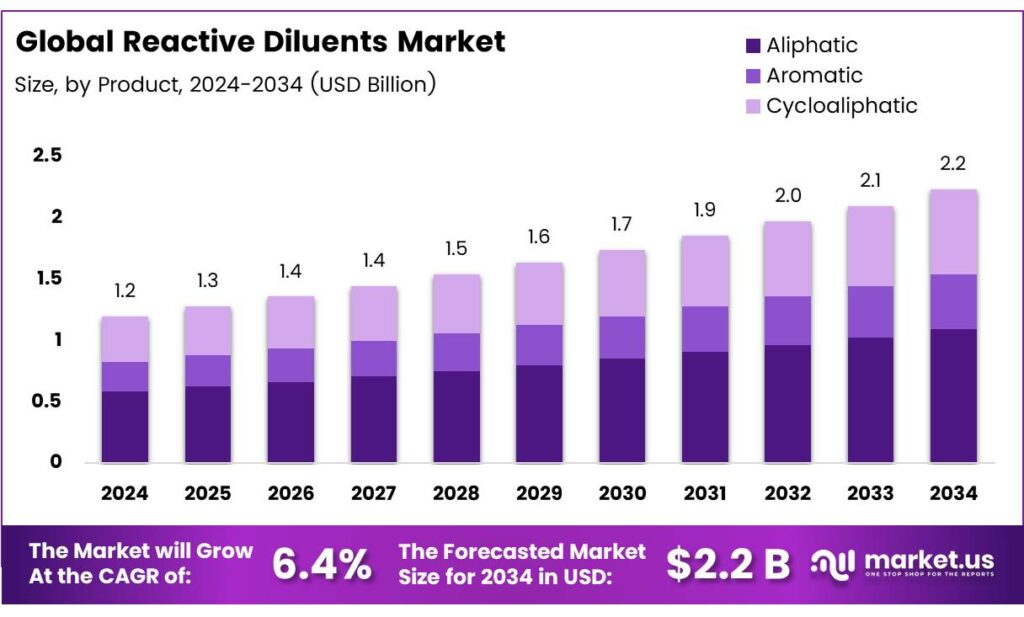

The Global Reactive Diluents Market size is expected to be worth around USD 2.2 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Reactive Diluent is an unsaturated ethylene monomer added to a composition to reduce its viscosity and adjust its rheology during curing. It is miscible with the principal oligomers and reacts with them to form a copolymer. The primary purpose of using a reactive diluent is to minimize outgassing that would typically occur if a solvent were used in the adhesive system. Reactive diluents are essential for developing epoxy resins that satisfy stringent requirements for viscosity and glass transition temperature in advanced processes and applications.

To create low-carbon-impact resins, three natural phenols, carvacrol, guaiacol, and thymol, were converted into monofunctional epoxies via glycidylation. These liquid epoxies showed viscosities of 16–55 cPs at 20°C without purification, dropping to 12 cPs with distillation. When added to DGEBA at 5–20 wt%, they reduced viscosity by a factor of ten while preserving glass transition temperatures above 90°C, outperforming some commercial analogues.

Typical reactive diluents are low-molecular-weight compounds with low room-temperature viscosity and at least one reactive group that integrates into the thermoset network. They enable low-viscosity processing and enhance mechanical properties like flexibility, elongation, and impact resistance. Growing demands for low-VOC and sustainable materials have driven the development of biobased diluents, CMGE from cashew nutshell liquid, and BDGE from fermented sugars.

- Additionally, the impact of reactive diluent purity on viscosity was assessed using MGEC as the benchmark. Distillation was performed to separate the product from impurities, which mainly comprised oligomeric MGEC fractions. This yielded a purified MGEC grade (MGEC-P) with 77% recovery and 98% purity. Notably, MGEC-P exhibited a lower viscosity of 12 mPa s at 20°C (Fig. S2c†), surpassing that of commercial BDGE and C12–C14 MGE at temperatures exceeding 40°C.

Epoxy adhesives used for repairing concrete cracks often require reactive diluents to reduce viscosity. However, research on the effects of various reactive diluents on epoxy adhesive properties is still limited. This study compares three reactive diluents: monofunctional alkyl C12–C14 glycidyl ether (AGE), butyl glycidyl ether (BGE), and difunctional 1,4-butanediol diglycidyl ether (BDDE) to evaluate their impacts on viscosity, exothermic temperature, mechanical properties, and bond strength with cement mortar.

Key Takeaways

- The Global Reactive Diluents Market is projected to grow from USD 1.2 billion in 2024 to USD 2.2 billion by 2034, at a CAGR of 6.4% from 2025 to 2034.

- Aliphatic reactive diluents dominated the By Product Analysis segment in 2024 with 48.9% market share due to low volatility, excellent resin compatibility.

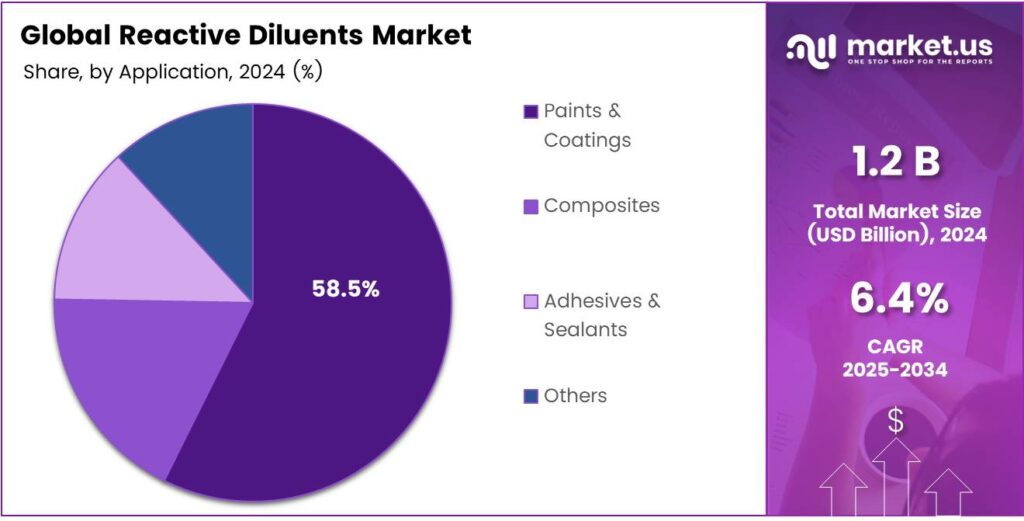

- Paints and Coatings led the By Application Analysis segment in 2024 with 58.5% share, driven by improved flow, finish quality, and demand from rapid urbanization.

- Asia-Pacific held the largest regional market share of 43.8% in 2024, valued at USD 0.5 billion.

By Product Analysis

Aliphatic dominates with 48.9% due to its versatile properties and eco-friendly profile.

In 2024, Aliphatic held a dominant market position in the By Product Analysis segment of the Reactive Diluents Market, with a 48.9% share. This sub-segment thrives because it offers low volatility and excellent compatibility with resins. Manufacturers increasingly prefer it for sustainable formulations. As a result, aliphatic diluents drive innovation in green chemistry applications.

Aromatic reactive diluents play a key role in high-performance sectors. They enhance viscosity reduction effectively in epoxy systems. However, their use faces scrutiny over toxicity concerns. Still, advancements in purification boost their adoption. Thus, aromatic variants continue supporting demanding industrial needs.

Cycloaliphatic diluents excel in UV-curable formulations. They provide superior weathering resistance and clarity. Industries favor them for outdoor coatings. Moreover, their stability under harsh conditions accelerates growth. Consequently, cycloaliphatic options expand market opportunities in specialized fields.

By Application Analysis

Paints and Coatings dominate with 58.5% due to booming construction and automotive demands.

In 2024, Paints and Coatings held a dominant market position in the By Application Analysis segment of the Reactive Diluents Market, with a 58.5% share. This area benefits from diluents, improving flow and finish quality. Rapid urbanization fuels demand. Therefore, reactive diluents ensure durable, high-gloss surfaces in vast projects.

Composites leverage reactive diluents for lightweight structures. They reduce viscosity without compromising strength. Aerospace and wind energy sectors rely on this. Innovations in resin infusion further propel usage. Hence, composites witness steady expansion through efficient processing.

Adhesives and Sealants utilize diluents for better bonding performance. They enable flexible, fast-curing products. Construction and automotive repairs drive this segment. Enhanced adhesion properties meet rigorous standards. As such, adhesives and sealants gain traction in dynamic markets.

Key Market Segments

By Product

- Aliphatic

- Aromatic

- Cycloaliphatic

By Application

- Paints and Coatings

- Composites

- Adhesives and Sealants

- Others

Emerging Trends

Bio-based, low-VOC reactive diluents go mainstream

A clear trend in reactive diluents is the move to bio-based, low-VOC chemistry to meet stricter air-quality rules without sacrificing performance. Regulatory pressure is real on both sides of the Atlantic. In the U.S., EPA’s Architectural Coatings rule is designed to cut 103,000 megagrams (113,500 tons) of VOCs per year, pushing formulators to swap conventional solvents for reactive components that cure into the film instead of evaporating.

In Europe, Directive 2004/42/EC caps VOC content across many paint and varnish categories, which keeps nudging resin systems toward higher solids and reactive diluent routes. At the same time, large suppliers are scaling bio-sourced reactive diluents so sustainability gains are tangible, not just on paper. Arkema’s Sartomer unit reports its SARBIO range of (meth)acrylate monomers and oligomers with bio-sourced carbon content between 28% and 88%, giving formulators lower-viscosity, UV/EB-curable options for coatings, inks, adhesives, and 3D printing.

- A current technical data sheet shows SARBIO 5102 (isobornyl acrylate) with 75% total bio content and 10 mPa·s viscosity at 25°C, illustrating how bio-based diluents can deliver both sustainability and easy processing. On the epoxy side, Evonik’s Epodil family of mono- and difunctional glycidyl-ether diluents targets viscosity reduction while maintaining cured performance, another sign that reactive, not solvent, is becoming standard practice in industrial epoxy systems.

Drivers

Regulatory Pressure on VOC Emissions

- One of the most powerful drivers behind the rising use of reactive diluents is the tightening of regulations on volatile organic compounds (VOCs) in coatings and related industries. For example, in the United States, the U.S. Environmental Protection Agency (EPA) – under its Architectural Coatings regulation – estimated that limiting VOC content in architectural coatings could reduce emissions by 103,000 megagrams/year (which equates to 113,500 tons/year).

Because reactive diluents become part of the cured system (rather than evaporating out as solvent), they help formulators meet stringent VOC limits while retaining performance. That direct link between regulation and formulation choice makes the regulatory push not just a compliance cost, but a clear commercial impetus for change.

In human terms, formulators feel the squeeze of tighter air-quality rules, and reactive diluents offer a pathway to both transform the chemistry and stay on safe regulatory ground. The coatings industry has seen measures such as the reduction of VOCs from architectural coatings in California’s Los Angeles basin by over 50% between 2008 and 2014.

Restraints

Regulatory and Safety Challenges (Hazardous Classification & VOC Compliance)

One major restraint for the reactive diluents market is increasingly stringent chemical regulations and safety re-classification. Reactive diluents, used to reduce viscosity in coatings, adhesives, and composites, often fall under epoxy chemistry and can contain low-molecular-weight glycidyl ethers or oxirane functional compounds.

- This reclassification has direct consequences: manufacturers must relabel products with hazard phrase H360F, adapt safety data sheets, invest in additional workplace protections, and possibly reformulate to avoid those hazard classes, each of which raises cost and delays time-to-market. The United States Environmental Protection Agency (EPA) under 40 CFR Part 59 mandates strict VOC content limits for coatings.

The dual burden of hazard classification + VOC regulation means that suppliers of reactive diluents must keep ahead of chemical-safety trends, adopt safer raw materials, and control emissions while keeping formulations efficient and economically viable. Furthermore, each regulatory jurisdiction has its own thresholds and testing regimes, meaning global producers face regulatory fragmentation and associated compliance cost burdens.

Opportunity

Surge in Sustainable Building Activity

One of the key growth drivers for reactive diluents is the rising wave of sustainable building renovations and construction activity. In the European Union, buildings alone account for about 40% of total energy consumption, and roughly 36% of CO₂ emissions stem from the built-environment sector.

- Recognising this, the European Commission launched the Renovation Wave for Europe strategy to renovate 35 million existing buildings and, in doing so, double the current annual rate of energy-efficient renovations. Furthermore, government support in the form of policy and funding enhances this trend. The European Commission has estimated that an additional €275 billion per year is needed to hit the renovation target.

This kind of investment signals to material suppliers and resin houses that the building-materials sector is entering a high-growth phase driven by regulatory and sustainability imperatives. The building materials ecosystem marches toward sustainability; the reactive diluent sector stands to benefit from the wave of activity and reformulation.

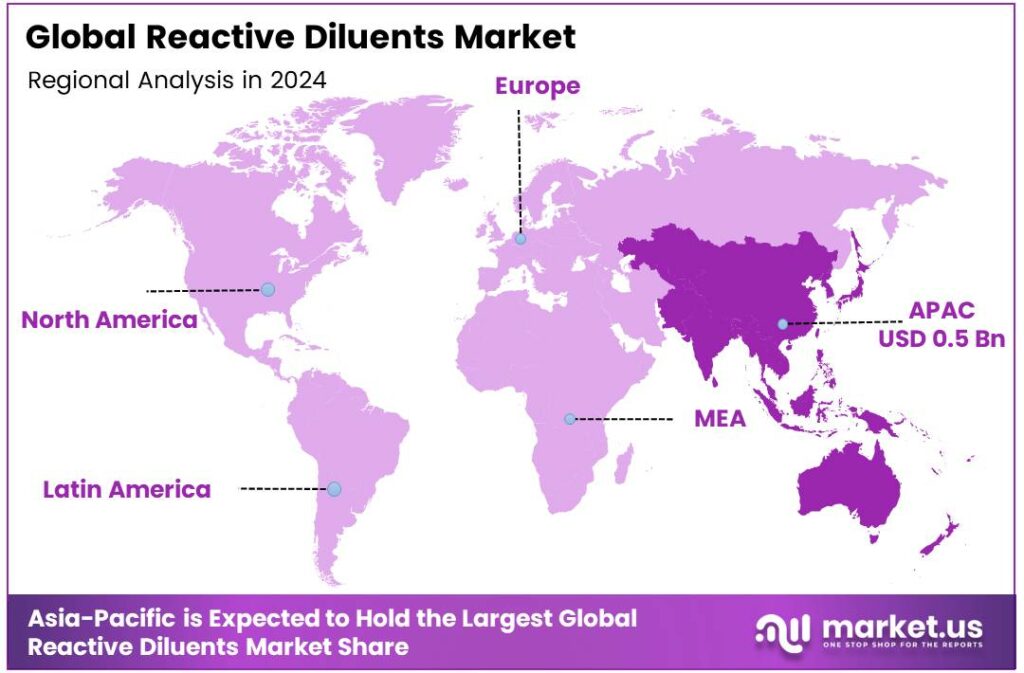

Regional Analysis

Asia-Pacific leads with a 43.8% share and a USD 0.5 Billion market value.

In 2024, Asia-Pacific held a dominant market share of 43.8%, valued at USD 0.5 billion in the global reactive diluents market. The region’s leadership stems from its rapid industrial growth, infrastructure modernization, and increasing consumption of advanced materials across automotive, electronics, marine coatings, and construction industries.

Countries like China, Japan, South Korea, and India have emerged as major manufacturing hubs for epoxy and unsaturated polyester resins, core segments that heavily depend on reactive diluents for viscosity reduction and mechanical performance. China alone contributes over one-third of global epoxy resin capacity, supported by a strong downstream network of coatings and composite manufacturers.

Government-driven programs promoting energy-efficient and low-VOC materials have further enhanced demand. Additionally, construction activity in emerging economies, fueled by rapid urbanization and smart-city projects, has led to higher adoption of epoxy-based flooring and protective coatings, both reliant on reactive diluents for improved adhesion and curing performance.

The strong presence of regional resin producers, availability of cost-effective raw materials, and growing export capacity for formulated products are also supporting Asia-Pacific’s dominance. Japan and South Korea are investing in bio-based reactive diluents to align with sustainability goals, while Southeast Asian nations are developing new production facilities to meet local demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADEKA is a significant player renowned for its high-performance epoxy-based reactive diluents. The company focuses on developing innovative, low-viscosity solutions that enhance the workability and properties of epoxy resins without compromising performance. With a strong commitment to research and development, ADEKA targets advanced applications in electronics, composites, and industrial coatings.

Aditya Birla Chemicals is a division that holds a formidable position in the reactive diluents market, particularly with its epoxy modifiers and diluents. Leveraging extensive manufacturing capabilities and a wide distribution network, the company serves diverse industries like paints, coatings, adhesives, and construction chemicals. Their strength lies in providing cost-effective, large-volume solutions and leveraging vertical integration.

Arkema brings a distinct focus to the market through its expertise in bio-based and specialty reactive diluents. A leader in sustainable chemistry, the company develops innovative products, such as those derived from vegetable oils, which reduce the volatile organic compound (VOC) content of formulations. This aligns with global environmental regulations and the demand for greener alternatives.

Top Key Players in the Market

- ADEKA CORPORATION

- Aditya Birla Chemicals

- Arkema

- Atul Ltd

- BASF SE

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Cargill, Incorporated

- DIC CORPORATION

- Evonik Industries AG

Recent Developments

- In 2024, ADEKA’s current product/technology pages and featured materials highlight photo(light) curing resins used in optical films, coatings, and electronics; the lab describes cationic curing resins that harden under UV/heat, reducing energy vs. thermal cure, another area where reactive diluents are formulation levers.

- In 2024, Aditya Birla’s Advanced Materials site and technical datasheets list multiple Epotec RD grades, covering mono/di/tri-functional glycidyl ether reactive diluents used to cut epoxy viscosity and tailor properties, confirming active commercial participation in this space.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Aliphatic, Aromatic, Cycloaliphatic), By Application (Paints and Coatings, Composites, Adhesives and Sealants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADEKA CORPORATION, Aditya Birla Chemicals, Arkema, Atul Ltd, BASF SE, Bodo Moller Chemie GmbH, Cardolite Corporation, Cargill, Incorporated, DIC CORPORATION, Evonik Industries AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Reactive Diluents MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Reactive Diluents MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADEKA CORPORATION

- Aditya Birla Chemicals

- Arkema

- Atul Ltd

- BASF SE

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Cargill, Incorporated

- DIC CORPORATION

- Evonik Industries AG