Global Protein Shot Market Size, Share, And Business Benefit By Source (Animal-Base, Plant-Based), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Health and Wellness Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162350

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

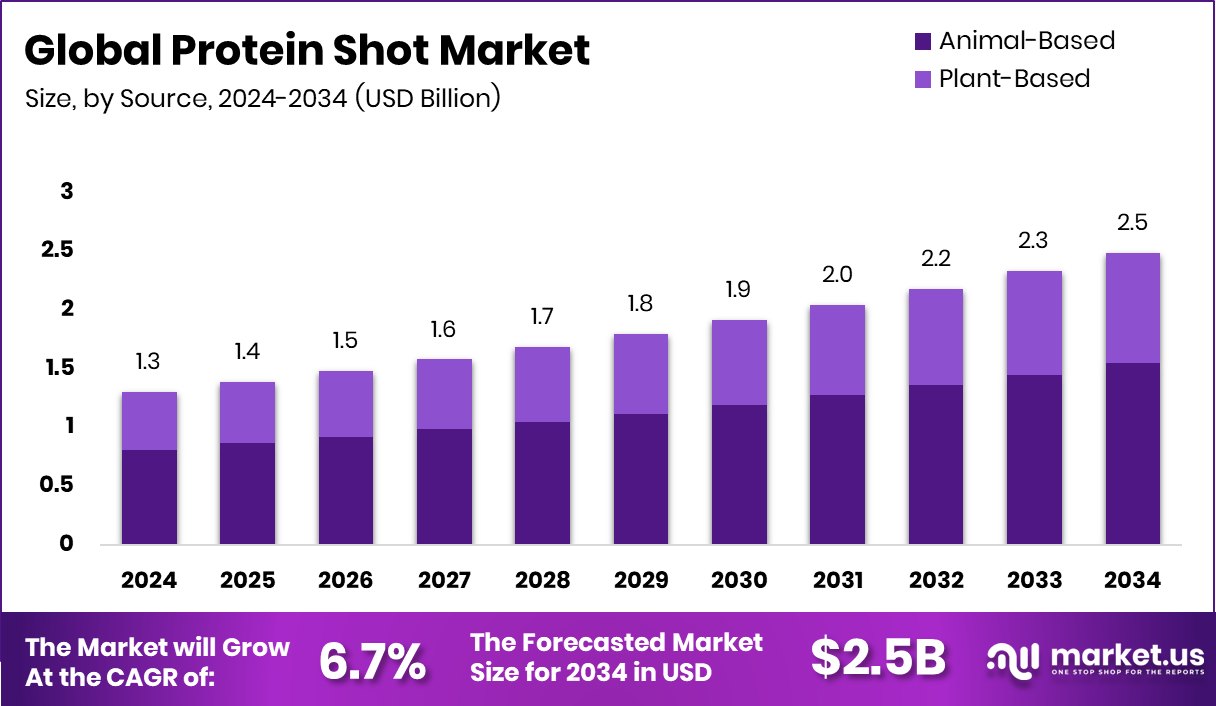

The Global Protein Shot Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. North America’s 43.80% growth reflects rising protein consumption trends and advanced nutritional product innovation.

A protein shot is essentially a compact, ready-to-drink, high-protein liquid designed for convenience. Instead of mixing powders or preparing a full shake, you just open the little bottle and consume a concentrated dose of protein—often with added amino acids, minerals, or collagen. These shots are popular with people who are on the go, need a quick muscle-repair boost after workouts, or want to top up protein intake without a full meal.

When we talk about the protein shot market, we mean the segment of nutrition/functional beverages where these small-volume, high-protein liquid products compete with traditional protein powders, shakes, bars, and meal-replacement items. The market includes athletes, fitness enthusiasts, busy professionals, older adults, and even medical nutrition applications. The market’s growth is driven by convenience, portable formats, and changing lifestyle behavior.

One big growth factor is the rising consumer demand for convenience and portability in nutrition — people are busy, eating on the run, and want quick solutions. Also, as awareness of daily protein needs increases (for muscle maintenance, ageing populations, and fitness) the protein-shot format fits well. Additionally, the innovation in formulation (for example, high-quality, low-volume shots delivering 10-20 g of protein in 80-125 ml) is making them more appealing.

Demand for protein shots is being fuelled by multiple trends: expanding fitness culture globally, more people doing strength training or functional workouts, ageing populations looking to maintain muscle mass, and even the weight-management segment, where protein helps with satiety. Moreover, health-conscious consumers seek products with clean labels, less sugar, and more functional benefits. The format of a quick shot means it can slot into busy schedules or be used post-workout or between meals.

The market offers opportunities for innovation in flavors, ingredient sources (for instance,plant-based, insect, or fungal-based proteins), premium formats, and new distribution channels (online, gyms, convenience stores). Funding news shows strong interest: a Polish startup raised €9.5 million for an autonomous insect-protein factory; another secured €26 million for insect protein production; a kids-nutrition specialist raised ₹8 Crore to scale protein-rich offerings; a fungal-protein startup got €3 million; and a micro-algae tech startup in Paris raised €2 million. These reflect investor appetite and the opportunity to extend protein solutions beyond traditional forms.

Key Takeaways

- The Global Protein Shot Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In 2024, animal-based protein shots dominated the Protein Shot Market with a 62.2% share.

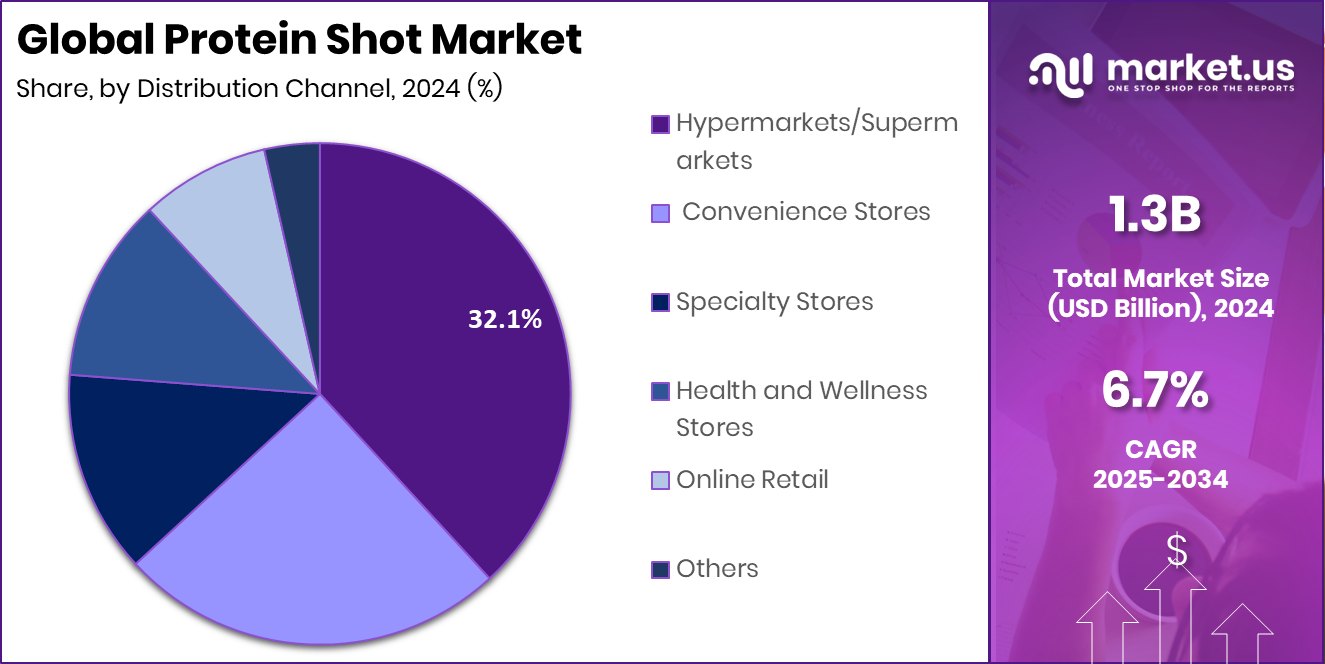

- Hypermarkets and supermarkets led the Protein Shot Market with a 32.1% share in 2024.

- The North American market value reached around USD 0.5 billion, driven by strong fitness demand.

By Source Analysis

In 2024, Animal-Based products dominated the Protein Shot Market with a 62.2% share.

In 2024, Animal-Based held a dominant market position in the By Source segment of the Protein Shot Market, with a 62.2% share. This dominance is largely due to its high protein bioavailability, superior amino acid profile, and growing adoption among fitness enthusiasts seeking quick muscle recovery.

Animal-based protein shots, derived from whey, collagen, or milk proteins, are widely preferred for their effectiveness in supporting muscle repair and strength building. The segment also benefits from advanced formulation technologies that enhance taste and absorption.

As consumers increasingly focus on efficient nutrition and convenience, animal-based protein shots continue to lead, supported by established manufacturing processes and strong consumer trust in traditional protein sources.

By Distribution Channel Analysis

Hypermarkets/Supermarkets led the Protein Shot Market with 32.1% share in 2024.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Protein Shot Market, with a 32.1% share. The strong presence of these retail formats is driven by their wide product assortments, attractive discounts, and easy accessibility for consumers. Shoppers prefer purchasing protein shots from hypermarkets and supermarkets due to the availability of multiple brands, instant product comparisons, and the assurance of quality.

These stores also provide enhanced visibility through dedicated health and nutrition aisles, influencing consumer purchasing decisions. The growing health awareness and impulse buying behavior in organized retail environments have further strengthened the segment’s dominance, making hypermarkets and supermarkets the leading distribution hubs for protein shot sales.

Key Market Segments

By Source

- Animal-Based

- Plant-Based

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Health and Wellness Stores

- Online Retail

- Others

Driving Factors

Rising Health Awareness Boosts Protein Shot Demand

One major driving factor for the Protein Shot Market is the growing awareness about health, fitness, and balanced nutrition. People are more conscious about their protein intake as it supports muscle recovery, boosts metabolism, and enhances overall wellness. Busy lifestyles have increased the demand for convenient, ready-to-drink protein formats. The market is also witnessing strong investor confidence that reflects this health-driven momentum.

For example, Gladful, a protein foods brand, raised ₹8 crore in fresh funding to expand its protein-rich offerings for families and children. Similarly, Lo! Foods is nearing ₹100 crore annual recurring revenue (ARR) through its low-carb and high-protein product range, highlighting how consumer interest in protein-based nutrition continues to rise steadily across markets.

Restraining Factors

High Cost of Raw Materials Increases Price Pressure

One key restraining factor for the Protein Shot Market is the escalating cost of quality ingredients and production processes. As brands attempt to deliver convenient, high-protein liquid shots, they face rising expenses in sourcing premium proteins, stabilisers, packaging, and maintaining shelf-life. These cost pressures can force higher retail pricing that turns off more price-sensitive consumers.

Even as considerable funding flows into the sector—such as a firm securing $75 million in Series A funding to scale protein-rich bars and another raising $6.5 million to expand protein innovation—these investments signal that achieving economies of scale remains challenging. Until ingredient costs and production efficiency improve, pricing constraints may limit wider adoption of these convenient protein-shot formats.

Growth Opportunity

Expanding Alternative Protein Sources Creates New Opportunity

A major growth opportunity in the Protein Shot Market lies in the rise of alternative protein sources such as mycoprotein, plant-based, and fermentation-derived ingredients. As consumers shift toward sustainable and ethical nutrition, companies are investing in innovative protein formats that reduce environmental impact while maintaining high nutritional value. This shift opens doors for protein shot producers to diversify formulations beyond animal-based proteins. A recent example includes

The Protein Brewery raised €30 million to advance its mycoprotein ingredient innovation, which reflects growing investor trust in sustainable protein technologies. From an analyst’s view, integrating these next-generation proteins can help brands tap into eco-conscious consumers, reduce production dependency on traditional sources, and strengthen long-term market resilience through sustainability-focused growth.

Latest Trends

Functional Protein Shots Gain Lifestyle Popularity

A leading trend in the Protein Shot Market is the rise of functional protein shots that combine nutrition with lifestyle benefits. Consumers are now looking beyond basic protein intake — they seek added advantages such as energy enhancement, immunity support, and digestive health. This has encouraged brands to infuse their products with vitamins, minerals, probiotics, and natural extracts for a holistic wellness appeal. The movement also aligns with rapid product innovation and startup funding.

Recently, Protein Chef secured $3.5 million in funding to fuel its next phase of development, focusing on premium, function-oriented protein beverages. This trend highlights how protein shots are evolving from fitness supplements into everyday wellness drinks, appealing to a broader, health-conscious audience.

Regional Analysis

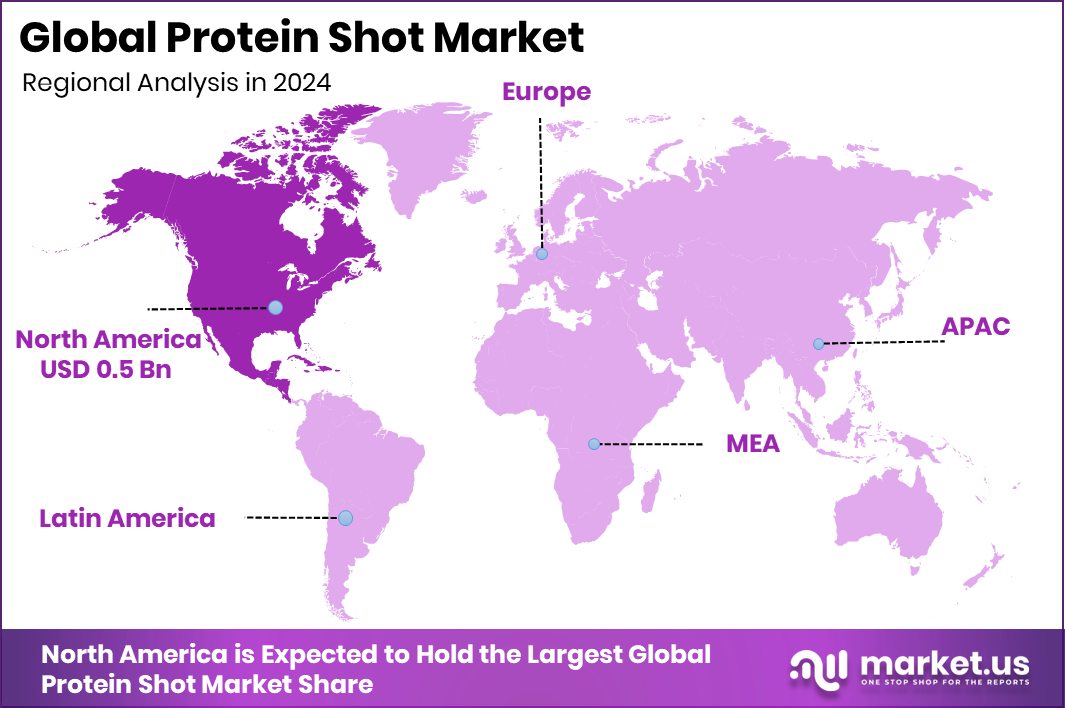

In 2024, North America dominated the Protein Shot Market with a 43.80% share.

In 2024, North America dominated the global Protein Shot Market with a 43.80% share, valued at USD 0.5 billion. The region’s growth is supported by high consumer awareness, established fitness culture, and increasing preference for convenient nutrition formats. The presence of a strong retail network and expanding functional beverage demand also drives market penetration.

Europe follows with the rising adoption of health-focused beverages and growing interest in protein-rich diets among urban populations. Asia Pacific is emerging rapidly, supported by expanding middle-class income and fitness awareness in countries like India, China, and Japan.

Meanwhile, Latin America and the Middle East & Africa are experiencing gradual growth, led by improving distribution channels and increased consumer focus on energy and wellness-based nutrition.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BariatricPal has carved a niche by focusing on individuals with specialised nutritional needs, particularly those recovering from bariatric surgery or seeking high-protein yet low-calorie solutions. Their strong online presence and tailored product offering—including protein-rich shakes and ready-to-drink formats—position them well within the convenience-oriented segment of the protein shots market. From an analyst’s perspective, their strength lies in addressing a defined consumer segment with higher nutritional demands and lower competition. That means they have an opportunity to expand beyond post-surgical users into broader health-and-wellness audiences.

AriZona Beverages brings strong brand recognition, extensive retail distribution, and experience in ready-to-drink beverages. For the protein shot market, their asset is the ability to leverage shelf space, purchasing power, and consumer familiarity to incorporate a protein shot offering. From an analyst’s lens, their advantage is built in: they can position protein shots as a natural extension of their drink portfolio, tapping impulse buyers in convenience stores and supermarkets. The risk, however, lies in credibility: moving into functional nutrition means competing with specialist brands, so AriZona will need to ensure product efficacy and clear value messaging rather than relying solely on brand extension.

OP2 Labs, through products like Frog Fuel and ProT GOLD, targets performance-driven users—athletes, fitness-oriented individuals, and those seeking rapid recovery. From an analyst viewpoint, they represent a focused, high-end segment of the protein shot market where formulation quality, clinical claims, and rapid assimilation matter. Their strength is product differentiation and functional positioning. The potential downside is limited scale and higher price sensitivity among mass consumers.

Top Key Players in the Market

- Bariatric Pal

- AriZona Beverages

- OP2 Labs Inc.

- Danone

- Aloha

- Hormel Foods Corporation

- Glanbia

- Others

Recent Developments

- In January 2025, BariatricPal’s online store introduced a “Best of 2025” curated collection, featuring expanded offerings in the protein category (including the brand’s own protein-brand items) under the “BariatricPal Store” menu. This shows the company broadening its product range focus and curating niche high-protein products.

- In August 2024, AriZona Beverages launched a limited-edition flavor “Frost ChillZicle,” available exclusively at 7-Eleven, Speedway, and Stripes stores across the U.S.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Animal-Base, Plant-Based), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Health and Wellness Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bariatric Pal, AriZona Beverages, OP2 Labs Inc., Danone, Aloha, Hormel Foods Corporation, Glanbia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bariatric Pal

- AriZona Beverages

- OP2 Labs Inc.

- Danone

- Aloha

- Hormel Foods Corporation

- Glanbia

- Others