Global Protein Alternatives Market Size, Share, And Business Benefit By Source (Plant Proteins (Soy Protein, Wheat, Pea, Rice, Hemp, Others), Microbial Proteins (Mycoprotein, Algea Protein), Insect Proteins (Cricket, Black Soldier Fly Larvae (BSFL), Others)), By Form (Protein Isolates, Protein Concentrates, Textured Proteins and TVP, Hydrolysates and Peptides), By Production Technology (Dry and Wet Fractionation, Extrusion and Texturization, Precision Fermentation, Cellular Agriculture), By Application (Food and Beverage (Plant-Based Meat Analogues), Dairy and Dairy Alternative Alternatives (Bakery and Confectionery, Beverages, Others), Dietary Supplements and Sports Nutrition, Animal Feed and Pet Food, Personal Care and Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 163289

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

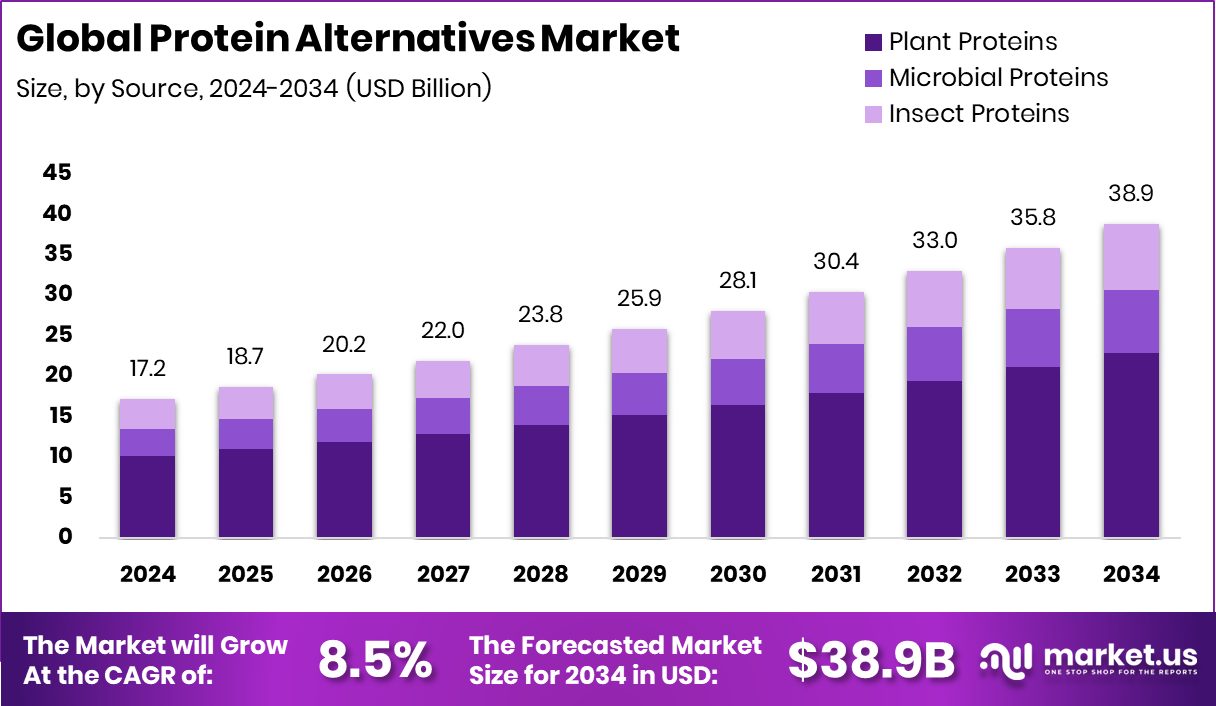

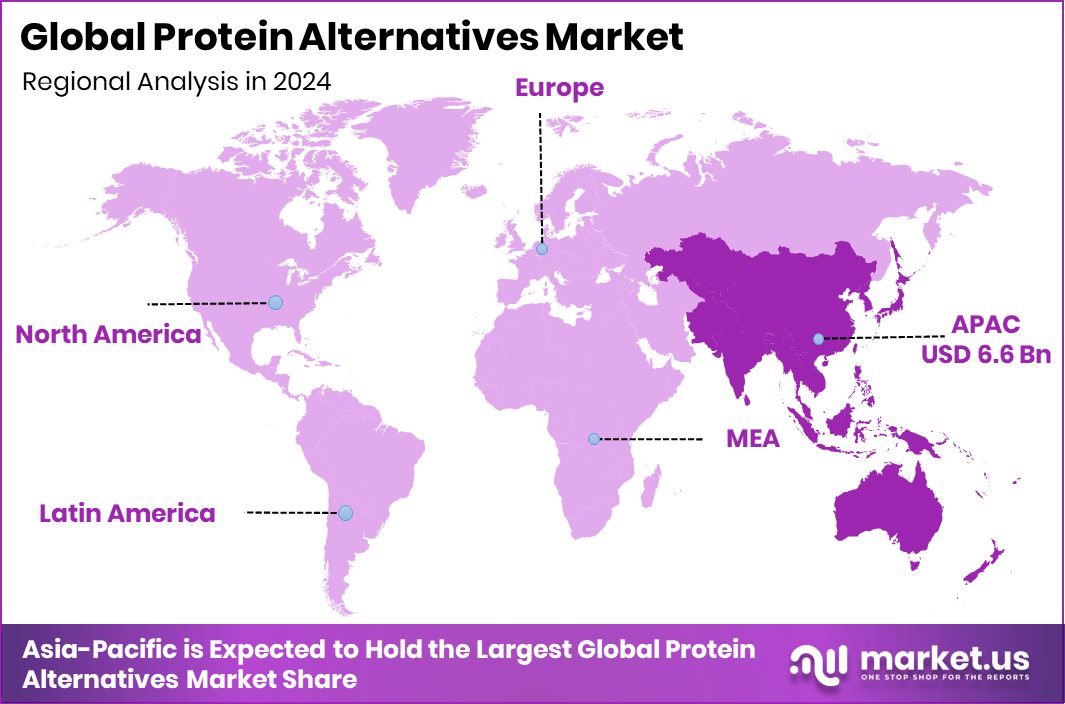

The Global Protein Alternatives Market is expected to be worth around USD 38.9 billion by 2034, up from USD 17.2 billion in 2024, and is projected to grow at a CAGR of 8.5% from 2025 to 2034. Asia-Pacific’s 38.90% strong demand for sustainable nutrition continues to boost growth in protein alternatives.

Protein alternatives refer to nondairy, non-animal-derived sources of dietary protein that mimic or replace traditional animal-based proteins in foods and beverages. These alternatives encompass a diverse range of sources, including plant-based proteins (such as from legumes, jackfruit, or microalgae), fermentation-derived proteins, and upcycled by-product proteins from wastes or co-streams. With consumers seeking sustainability, health, and ethical credentials, protein alternatives are positioned as a versatile ingredient class that can deliver nutrition while reducing environmental footprint.

One major growth factor for the protein alternatives market is the rising consumer interest in sustainability and ethical consumption. As awareness grows around greenhouse gas emissions, land use, and animal welfare associated with conventional animal-based proteins, food manufacturers are increasingly turning to novel protein sources. For example, microalgae protein start-up bags $25 m in funding, and fermentation-brewed proteins: Farmless raises €4.8M in seed funding for pilot plant & NPD. These investments underscore how capital is flowing into innovation, accelerating novel protein technologies that respond to both consumer values and regulatory pressures.

With Swiss startup brews $10 M in funding to repurpose dairy factory for beer waste protein, and ‘World’s Most Abundant Protein’ cheap enough to replace soy: up-cycled Rubisco protein startup Day 8 nabs $750K pre-seed, the pipeline of novel ingredient options is rapidly expanding to meet that evolving demand.

The protein alternatives market offers significant opportunities in food innovation, ingredient diversification, and cost parity with traditional proteins. For instance, armed with $18.5 m in seed funding, Brevel scales neutral-tasting algae protein at cost parity with soy and pea. Another opportunity lies in leveraging underutilized raw materials and up-cycling waste streams; for example, Karana gets $1.7 m in seed funding for its ‘whole plant-based’ meat alternative made from jackfruit. Additionally, large-scale investments such as Bunge’s investment $550 M in a US soy protein concentrate facility signal industry confidence, while Benson Hill makes a $102 million acquisition to expand soy protein capabilities, showing how mainstream protein supply chains are evolving to integrate alternatives.

Looking ahead, the market for protein alternatives is expected to accelerate as technology advances, lower production costs, scaling becomes more efficient, and regulatory frameworks adapt to novel proteins. Investments are already flowing: microalgae, fermentation, upcycling, and plant-based technologies are all being backed. As formulation challenges are overcome and consumer acceptance rises, protein alternatives are moving from niche to mainstream—offering manufacturers and consumers alike a tangible path toward more sustainable, diverse, and resilient protein ecosystems.

Key Takeaways

- The Global Protein Alternatives Market is expected to be worth around USD 38.9 billion by 2034, up from USD 17.2 billion in 2024, and is projected to grow at a CAGR of 8.5% from 2025 to 2034.

- In the protein alternatives market, plant proteins dominate with a 58.9% share, driven by sustainability and nutritional advantages.

- The protein alternatives market sees protein isolates at 38.5%, valued for purity, solubility, and formulation flexibility.

- Within the protein alternatives market, dry and wet fractionation technologies capture a 45.4% share, ensuring efficiency and high-quality extraction.

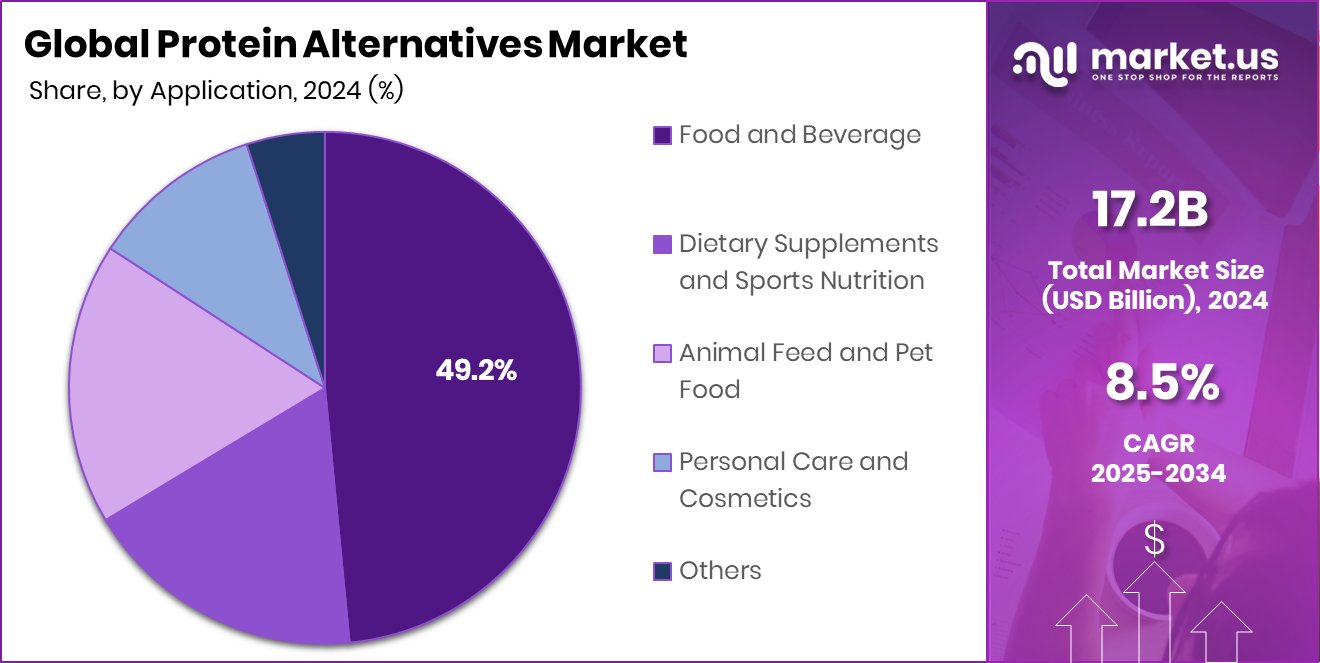

- The Protein Alternatives Market reports food and beverage applications at 49.2%, reflecting rising adoption in snacks, dairy, and beverages.

- The Asia-Pacific market value reached approximately USD 6.6 billion, driven by rising protein consumption.

By Source Analysis

In 2024, plant proteins held a 58.9% share in the Protein Alternatives Market.

In 2024, Plant Proteins held a dominant market position in the By Source segment of the Protein Alternatives Market, with a 58.9% share. This leadership is driven by their wide availability, cost-effectiveness, and nutritional profile comparable to animal proteins. Consumers increasingly prefer plant-based protein sources such as soy, peas, and grains for their sustainable and health-oriented benefits.

The segment’s dominance also reflects its versatility in food applications like beverages, meat substitutes, and bakery products. Favorable government initiatives promoting plant-based nutrition and growing vegan lifestyles further strengthen its demand, positioning plant proteins as the key foundation of the global protein alternatives landscape in 2024.

By Form Analysis

Protein Isolates accounted for a 38.5% share in the protein alternatives market.

In 2024, Protein Isolates held a dominant market position in the By Form segment of the Protein Alternatives Market, with a 38.5% share. This dominance is attributed to their high purity level, superior digestibility, and strong functionality in food formulations. Protein isolates are widely used in beverages, nutrition bars, and dietary supplements, offering concentrated protein content with minimal fats and carbohydrates.

Their ability to blend seamlessly in various food products enhances texture and taste while maintaining nutritional integrity. The growing preference for clean-label and fortified foods further supports the demand for protein isolates, solidifying their leading position in the global protein alternatives landscape during 2024.

By Production Technology Analysis

Dry and wet fractionation held a 45.4% share in the protein alternatives market.

In 2024, Dry and Wet Fractionation held a dominant market position in the by-production technology segment of the protein alternatives market, with a 45.4% share. This leading position is attributed to the efficiency and scalability of these techniques in separating and refining plant-based and microbial proteins. Dry and wet fractionation technologies enable high-quality protein extraction while preserving essential nutrients and minimizing waste.

Their adaptability across various raw materials ensures consistent output and functional versatility for use in food, beverage, and nutrition products. The method’s cost-effectiveness and ability to produce clean-label protein ingredients have strengthened its preference among manufacturers, securing its dominance in the protein alternatives production landscape during 2024.

By Application Analysis

Food and Beverage dominated with a 49.2% share in the protein alternatives market.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Protein Alternatives Market, with a 49.2% share. This dominance is driven by the growing incorporation of alternative proteins into everyday food products such as snacks, bakery items, and beverages. Consumers are increasingly adopting protein-enriched diets focused on wellness and sustainability, boosting demand for such applications.

Food and beverage manufacturers are utilizing protein alternatives to enhance texture, flavor, and nutritional value while meeting clean-label expectations. The segment’s growth also reflects rising awareness of plant-forward diets and protein fortification trends, establishing food and beverage applications as the primary driver of global protein alternative consumption in 2024.

Key Market Segments

By Source

- Plant Proteins

- Soy Protein

- Wheat

- Pea

- Rice

- Hemp

- Others

- Microbial Proteins

- Mycoprotein

- Algae Protein

- Insect Proteins

- Cricket

- Black Soldier Fly Larvae (BSFL)

- Others

By Form

- Protein Isolates

- Protein Concentrates

- Textured Proteins and TVP

- Hydrolysates and Peptides

By Production Technology

- Dry and Wet Fractionation

- Extrusion and Texturization

- Precision Fermentation

- Cellular Agriculture

By Application

- Food and Beverage

- Plant-Based Meat Analogues

- Dairy and Dairy Alternative Alternatives

- Bakery and Confectionery

- Beverages

- Others

- Dietary Supplements and Sports Nutrition

- Animal Feed and Pet Food

- Personal Care and Cosmetics

- Others

Driving Factors

Health Awareness and Functional Nutrition Boost Market Growth

One key driving factor for the Protein Alternatives Market is the growing awareness of health and nutrition among consumers worldwide. People are shifting from high-sugar and processed foods toward protein-rich, functional alternatives that support fitness and overall well-being. This change is further influenced by government measures like the proposed 20% health tax on bakery and confectionery items, encouraging people to choose healthier protein-based products.

Additionally, rising investments are fueling innovation in protein-enriched foods—such as Awake Chocolate, nabbing $5.8 million investment to develop protein-rich energy snacks. These efforts reflect a global move toward nutritious, sustainable, and performance-enhancing food options, which continues to drive strong growth in the protein alternatives market.

Restraining Factors

High Production Costs and Limited Consumer Familiarity

A major restraining factor for the Protein Alternatives Market is the high production cost of novel protein sources, especially those derived from fermentation, microalgae, or upcycled ingredients. Developing these alternatives requires advanced technology and strict quality control, which increases prices compared to traditional proteins. Additionally, many consumers are still unfamiliar with alternative proteins, leading to slower adoption in everyday diets.

While bakery and snack sectors are receiving investments—such as The Baker’s Dozen raising $5 million and Bakery Mazowsze securing a £20,000 funding boost—these funds mainly support conventional product lines, not protein innovations. This limited funding flow toward alternative proteins, combined with higher costs, continues to restrain the market’s broader expansion.

Growth Opportunity

Innovation in Sustainable and Clean-Label Protein Foods

A key growth opportunity in the Protein Alternatives Market lies in the innovation of sustainable and clean-label protein foods. Consumers are increasingly seeking products that are ethical, environmentally friendly, and nutritionally balanced. This shift is creating space for new protein formulations and food technologies. For example, Win-Win raises $4 million for cocoa-free chocolate and collaborates with Martin Braun-Gruppe, highlighting how alternative ingredients can replicate traditional flavors sustainably.

Similarly, a deep-tech start-up securing €4.2 million for replacing oils and fats with water shows how technology is redefining food production. Such advancements open doors for protein alternatives to integrate into a wider range of foods, offering manufacturers fresh opportunities for product diversification and global market expansion.

Latest Trends

Social Media Influence and Novel Product Launches

A key latest trend in the Protein Alternatives Market is the rising influence of social media-driven food innovation and consumer engagement. Platforms like TikTok are reshaping how alternative protein products reach younger, trend-focused audiences. Viral marketing has become a strong tool for awareness and adoption of new protein-based foods.

For instance, Final Boss Sour secures $3 million in seed funding, followed by another $4 million investment round, reflecting the growing interest in protein-rich, functional, and creative food products. These developments show how digital-first food brands leverage online communities to accelerate growth. The blending of entertainment, taste, and wellness through social channels continues to drive visibility and consumer excitement in the protein alternatives landscape.

Regional Analysis

In 2024, the Asia-Pacific dominated the Protein Alternatives Market with a 38.90% share.

In 2024, Asia-Pacific held a dominant position in the Protein Alternatives Market, accounting for 38.90% share valued at USD 6.6 billion. The region’s leadership is driven by increasing consumer preference for plant-based nutrition, rapid urbanization, and government initiatives promoting sustainable food production. Countries such as China, Japan, and India are witnessing strong demand for protein-enriched foods, driven by growing awareness of health and fitness.

North America follows closely, supported by high consumption of protein-based snacks and the growing adoption of clean-label ingredients. Europe shows steady growth owing to its strong focus on sustainability, vegan diets, and regulatory support for alternative protein development.

Meanwhile, Latin America and the Middle East & Africa are emerging markets, gradually adopting plant and microbial protein sources to meet dietary diversification and rising health consciousness.

Collectively, these regions contribute to the global expansion of the protein alternatives market, led prominently by Asia-Pacific’s strong production capabilities and shifting consumer lifestyles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM continued to strengthen its position by expanding its plant-based protein portfolio through advanced processing technologies and sustainable sourcing. The company’s focus on soy, pea, and other plant proteins positioned it as a key enabler of food innovation and clean-label nutrition.

Cargill Inc. demonstrated strong progress by integrating sustainability and innovation into its alternative protein operations, emphasizing scalable production and ingredient diversification to meet rising global demand. Its continuous investments in fermentation and plant protein facilities highlight a long-term strategy toward sustainable protein supply chains.

International Flavors & Fragrances Inc. focused on enhancing taste, texture, and sensory appeal in protein-based products through its expertise in food science and biotechnology. By combining flavor solutions with nutritional innovation, IFF has contributed to improving consumer acceptance of alternative proteins. Together, these companies are driving advancements in product quality, sustainability, and functional performance, establishing a strong foundation for the protein alternatives industry’s continued evolution and global expansion in 2024.

Top Key Players in the Market

- ADM

- Cargill Inc.

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Ingredion Inc.

- The Scoular Company

- Avebe

- Roquette Frères

- Mycotechnology Inc.

- Bühler Group

Recent Developments

- In November 2024, ADM completed the acquisition of Revela Foods, LLC, a Wisconsin-based developer and manufacturer of innovative dairy-flavour ingredients and solutions. This move expands ADM’s Nutrition business and strengthens its portfolio in flavours that support protein alternative applications.

- In February 2024, Cargill expanded its partnership with ENOUGH to use and market their proprietary ABUNDA mycoprotein. To support this, Cargill also invested in ENOUGH’s recent growth funding round.

Report Scope

Report Features Description Market Value (2024) USD 17.2 Billion Forecast Revenue (2034) USD 38.9 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant Proteins (Soy Protein, Wheat, Pea, Rice, Hemp, Others), Microbial Proteins (Mycoprotein, Algea Protein), Insect Proteins (Cricket, Black Soldier Fly Larvae (BSFL), Others)), By Form (Protein Isolates, Protein Concentrates, Textured Proteins and TVP, Hydrolysates and Peptides), By Production Technology (Dry and Wet Fractionation, Extrusion and Texturization, Precision Fermentation, Cellular Agriculture), By Application (Food and Beverage (Plant-Based Meat Analogues), Dairy and Dairy Alternative Alternatives (Bakery and Confectionery, Beverages, Others), Dietary Supplements and Sports Nutrition, Animal Feed and Pet Food, Personal Care and Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Cargill Inc., International Flavors & Fragrances Inc., Kerry Group plc, Ingredion Inc., The Scoular Company, Avebe, Roquette Frères, Mycotechnology Inc., Bühler Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Protein Alternatives MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Protein Alternatives MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Cargill Inc.

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Ingredion Inc.

- The Scoular Company

- Avebe

- Roquette Frères

- Mycotechnology Inc.

- Bühler Group