Global Protective Relay Market Size, Share, And Enhanced Productivity By Voltage (Low Voltage, Medium Voltage, High Voltage), By Application (Feeder Protection, Generator Protection, Bus-Bar Protection, Capacitor Bank Protection, Breaker Protection, Transformer Protection, Others), By End Use (Infrastructure, Industrial, Government, Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174498

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

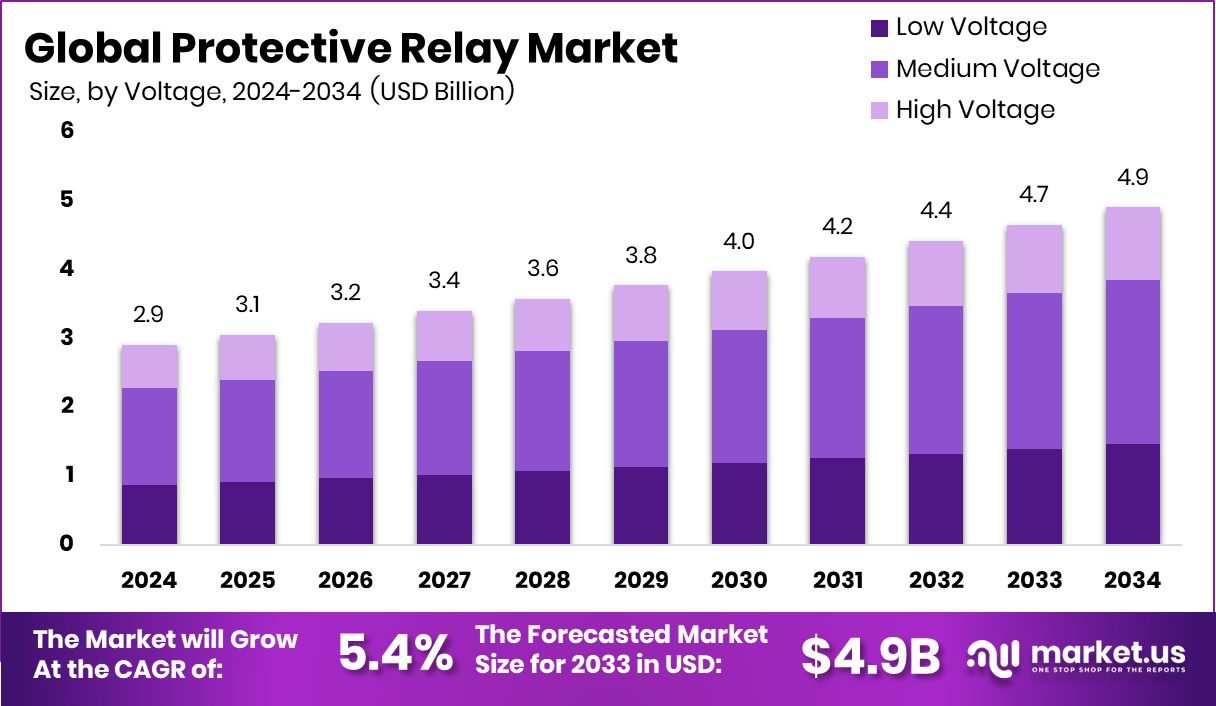

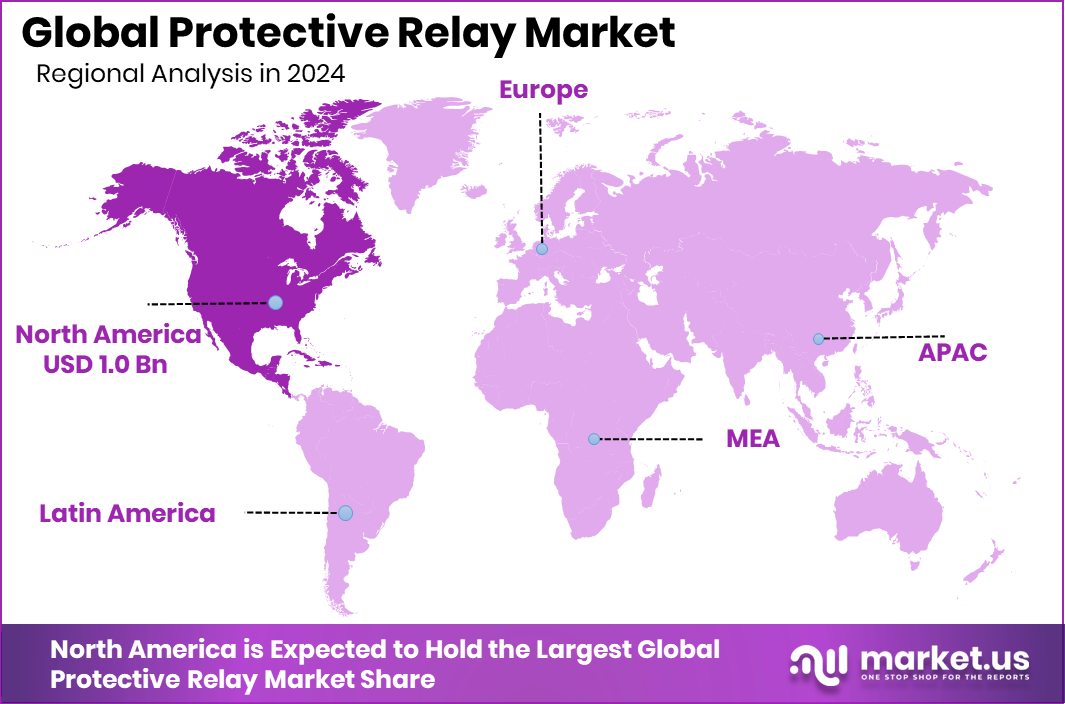

The Global Protective Relay Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.9 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. North America accounted for 37.8% of the Protective Relay Market, generating USD 1.0 Bn.

A protective relay is an automatic electrical device that detects abnormal conditions such as short circuits, overloads, or voltage faults in power systems. When a fault occurs, the relay sends a signal to isolate the affected section, preventing equipment damage, fires, and large-scale outages. Protective relays are essential for keeping electricity networks safe, stable, and reliable across generation, transmission, and distribution systems.

The Protective Relay Market covers the design, deployment, and replacement of these devices across power grids and industrial networks. Market activity is closely linked to grid reliability, system safety, and modernization needs. Financial pressure on utilities, highlighted by events like Power Finance Corporation’s stock falling to a 52-week low of Rs.330.55, is pushing operators to prioritize efficient protection systems that reduce losses and unplanned downtime.

Growth factors include rising investments in grid resilience and outage prevention. For example, the African Development Bank’s approval of over $68 million to safeguard Bamako’s power supply reflects the growing focus on protecting fragile power networks, where reliable relays play a key role in minimizing blackouts and equipment failures.

Demand is also rising due to rapid progress in low-power electronics and intelligent control systems. Funding rounds such as MythWorx’s $5M, Atmosic Technologies’ $40M, Innatera’s $21M, Ceremorphic’s $50M, and Dresden startup FMC’s €100M highlight how energy-efficient computing is influencing smarter, faster protection devices.

Opportunities are emerging from long-term energy transition and grid innovation funding. Initiatives like Ofgem’s £5.8 million SIF funding, Forbion’s $200m decarbonization fund, and Fortress-led $500m fintech investment support digital infrastructure, efficiency, and system monitoring, creating space for advanced protective relay solutions across modern power networks.

Key Takeaways

- The Global Protective Relay Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.9 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In the Protective Relay Market, medium voltage dominates with 48.6%, driven by widespread utility and industrial adoption.

- Feeder protection holds 28.1% share in the Protective Relay Market, supported by grid reliability requirements.

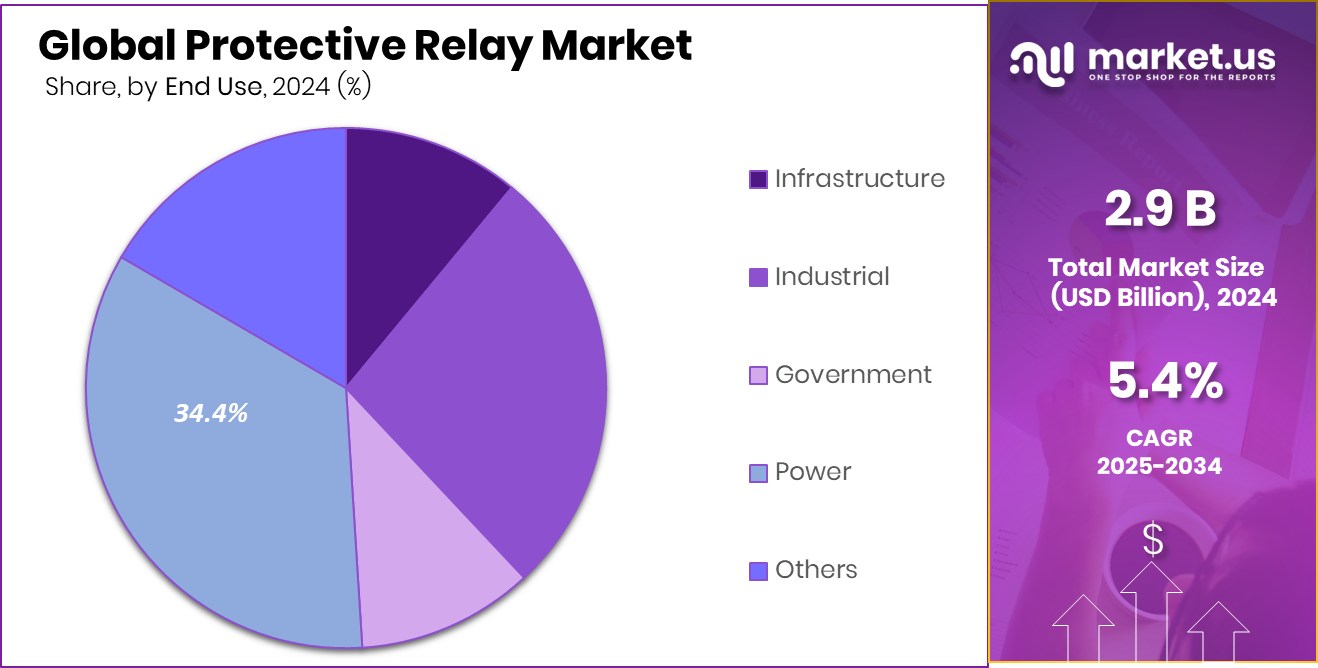

- The power sector accounts for 34.4% of the Protective Relay Market, driven by network expansion.

- Protective Relay Market in North America reached 37.8% share, totaling USD 1.0 Bn.

By Voltage Analysis

Medium voltage dominates the protective relay market with a 48.6% share across utilities.

In 2024, the Medium Voltage segment held a dominant 48.6% share in the Protective Relay Market, driven by its widespread use across substations, industrial feeders, and distribution networks. Medium-voltage systems form the backbone of power distribution, typically operating between 1 kV and 35 kV, where fault detection and selective isolation are critical.

Utilities increasingly deploy advanced digital protective relays at this voltage level to improve grid reliability, minimize outage duration, and reduce equipment damage. The integration of automation, remote monitoring, and communication protocols further strengthens demand, as medium-voltage networks are central to renewable energy integration and smart grid upgrades globally.

By Application Analysis

Feeder protection leads the protective relay market applications, holding 28.1% adoption globally.

In 2024, Feeder Protection accounted for 28.1% of the Protective Relay Market, reflecting its essential role in safeguarding distribution lines from faults such as overloads, short circuits, and ground faults. Feeders directly connect substations to end users, making their protection critical for service continuity and system stability.

Utilities prioritize feeder protection relays to ensure fast fault isolation while maintaining supply to unaffected sections of the network. Growing urbanization, expansion of distribution infrastructure, and increased penetration of distributed energy resources have intensified the need for precise, adaptive feeder protection, supporting steady adoption across both urban and semi-urban power networks.

By End Use Analysis

Power end-use drives protective relay market demand, accounting for 34.4% share.

In 2024, the Power end-use segment captured 34.4% of the Protective Relay Market, supported by continuous investments in power generation, transmission, and distribution infrastructure. Power utilities rely heavily on protective relays to prevent equipment failure, reduce blackout risks, and ensure safe grid operations under varying load conditions.

Aging grid assets, coupled with rising electricity demand, have accelerated relay replacement and modernization programs. Additionally, the transition toward renewable energy and grid digitalization has increased system complexity, reinforcing the need for reliable protection solutions across conventional power plants, substations, and modern energy networks.

Key Market Segments

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Feeder Protection

- Generator Protection

- Bus-Bar Protection

- Capacitor Bank Protection

- Breaker Protection

- Transformer Protection

- Others

By End Use

- Infrastructure

- Industrial

- Government

- Power

- Others

Driving Factors

Industrial Manufacturing Investments Strengthen Grid Protection Needs

Growing industrial activity is a major driving factor for the Protective Relay Market. Large manufacturing facilities depend on stable and safe power to avoid costly shutdowns, equipment damage, and safety risks. The $207 million investment welcomed by Ontario in the advanced manufacturing sector highlights how regions are expanding production capacity and upgrading industrial infrastructure.

As factories adopt automated systems and high-load machinery, electrical faults can cause serious disruptions. Protective relays become essential tools to quickly detect faults and isolate affected sections, keeping operations running smoothly. This push toward modern, high-value manufacturing increases the need for reliable electrical protection, making protective relays a core component of industrial power systems.

Restraining Factors

Emergency Power Priorities Limit Long-Term Grid Investments

A key restraining factor for the Protective Relay Market is the diversion of funds toward short-term emergency energy needs. The €40 million released by the EU to protect civilians in Ukraine from the winter cold shows how governments sometimes prioritize immediate heating and power access over long-term grid modernization.

In such situations, spending focuses on temporary power solutions rather than upgrading protection equipment. This can delay investments in advanced protective relays, especially in regions facing conflict or humanitarian pressure. As budgets tighten, utilities may postpone relay replacements, slowing market growth despite clear technical needs for better protection.

Growth Opportunity

Grid Security And Advanced Transformer Innovation Expands Opportunities

Growth opportunities are rising as power grids face both physical and digital security risks. The €17 million raised by Amsterdam-based Optics11 to protect Europe’s fiber-optic cables highlights growing concern around infrastructure sabotage and system resilience. At the same time, the U.S. DOE’s $18M funding for Flexible Innovative Transformer Technologies (FITT) supports smarter, more reliable grid equipment. These developments increase the complexity of power systems, creating a strong demand for advanced protective relays that can respond quickly, coordinate with new transformers, and support secure, resilient grid operations.

Latest Trends

Smart Medium Voltage Systems Shape Protection Technology Trends

One of the latest trends in the Protective Relay Market is the rise of intelligent, medium-voltage power systems linked to data-heavy applications. The $80m raised by Amperesand to deploy medium-voltage transformer systems at hyperscale AI facilities shows how power networks are evolving to support digital infrastructure.

In parallel, $42M in federal funding for next-generation grid control technologies reflects a broader move toward smarter, software-driven grids. These systems require protective relays that are faster, more adaptive, and capable of handling complex load patterns, making digital protection a central trend shaping the market.

Regional Analysis

North America leads the Protective Relay Market with 37.8% share, at USD 1.0 Bn.

In 2024, North America dominated the Protective Relay Market, accounting for 37.8% of total demand and valued at USD 1.0 Bn, reflecting its mature transmission and distribution infrastructure and strong focus on grid protection reliability. Utilities across the region emphasize relay upgrades to manage complex power flows, aging assets, and stricter reliability expectations, which sustains consistent adoption.

Europe represents a stable and technically advanced market, where protective relays support interconnected grids and cross-border power exchange, driving steady replacement of legacy systems with digital protection solutions. Asia Pacific shows robust momentum due to rapid grid expansion, rising electricity consumption, and ongoing transmission build-outs, positioning the region as a key growth contributor despite lower per-network maturity.

In the Middle East & Africa, demand is shaped by new power projects and grid reliability needs in developing networks, where protection systems are essential for minimizing outages in expanding transmission corridors. Latin America continues to adopt protective relays to strengthen grid stability and manage network modernization, supporting gradual market expansion through utility-driven upgrades and operational safety priorities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ABB continues to set benchmarks in the global Protective Relay Market through its deep expertise in power systems and grid automation. The company’s strength lies in delivering highly reliable, digitally enabled relay solutions that support complex transmission and distribution networks. ABB’s focus on interoperability, cybersecurity, and lifecycle service capabilities positions it strongly as utilities modernize aging grid infrastructure while maintaining high protection accuracy and operational continuity.

Doble Engineering Company plays a specialized and influential role by supporting utilities and asset owners with protection testing, diagnostics, and relay performance assurance. Its value in the market stems from deep technical knowledge rather than volume manufacturing. By helping utilities validate relay settings, improve fault analysis, and extend equipment life, Doble strengthens the effective deployment and long-term reliability of protective relay systems across critical power assets.

In 2024, Eaton maintains a strong market position by offering robust protective relays integrated with broader power management portfolios. Eaton’s solutions appeal to utilities and industrial users seeking dependable protection combined with ease of integration. Its emphasis on safety, grid resilience, and scalable protection architectures supports adoption across substations, feeders, and industrial power systems.

Fanox is recognized for its focused approach to protection relays, particularly in industrial and distribution applications. The company emphasizes practical, application-driven designs that balance performance and simplicity. Fanox’s agility and specialization enable it to address niche protection requirements, reinforcing its relevance in targeted segments of the global Protective Relay Market.

Top Key Players in the Market

- ABB

- Doble Engineering Company

- Eaton

- Fanox

- Mitsubishi Electric Corporation

- General Electric

- NR Electric Co., Ltd.

- Siemens

- Schweitzer Engineering Laboratories, Inc.

- TIEPCO

Recent Developments

- In September 2024, NR Electric highlighted its advanced manufacturing and testing facilities for high-voltage converter and protection systems, signaling continued investment in infrastructure supporting protective relay and grid automation technologies.

- In April 2024, GE held a seminar in Canada to present its Multilin 8 Series protection relay platform, designed for feeder, motor, transformer, and generator protection. This platform integrates advanced protection, control, monitoring, and metering in one family of devices.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage (Low Voltage, Medium Voltage, High Voltage), By Application (Feeder Protection, Generator Protection, Bus-Bar Protection, Capacitor Bank Protection, Breaker Protection, Transformer Protection, Others), By End Use (Infrastructure, Industrial, Government, Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Doble Engineering Company, Eaton, Fanox, Mitsubishi Electric Corporation, General Electric, NR Electric Co., Ltd., Siemens, Schweitzer Engineering Laboratories, Inc., TIEPCO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Protective Relay MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Protective Relay MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Doble Engineering Company

- Eaton

- Fanox

- Mitsubishi Electric Corporation

- General Electric

- NR Electric Co., Ltd.

- Siemens

- Schweitzer Engineering Laboratories, Inc.

- TIEPCO