Global Propylene Carbonate Market Size, Share Analysis Report By Form (Aqueous, Pellets, Others), By Application (Solvent, Catalyst, Electrolyte, Additives, Cleaners, Others), By End-use (Cosmetics and Personal Care, Paints and Coatings, Pharmaceuticals, Agrochemicals, Energy and Power, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160745

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

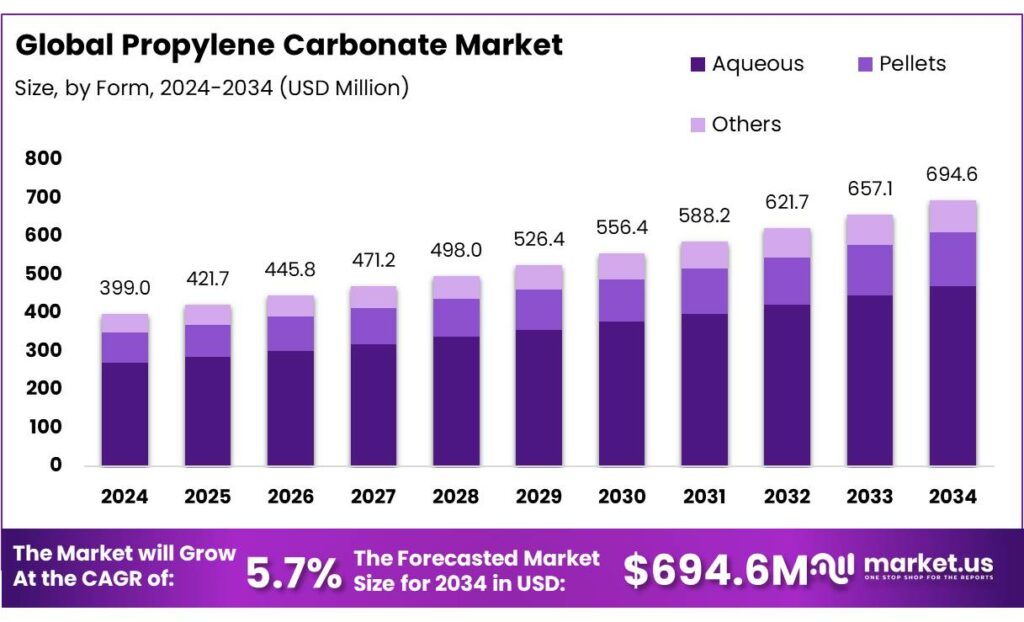

The Global Propylene Carbonate Market size is expected to be worth around USD 694.6 Million by 2034, from USD 399.0 Million in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Propylene carbonate (PC) is a versatile organic solvent and electrolyte additive with a growing presence in various industrial sectors. It is synthesized through the reaction of propylene oxide with carbon dioxide, resulting in a colorless, odorless liquid with high solvency power and low toxicity. These properties make it an attractive alternative to traditional solvents, aligning with increasing environmental and regulatory demands for safer and more sustainable chemical solutions.

The industrial scenario is characterised by moderate market concentration around mid-stream petrochemical producers and specialty chemical firms; reported global production was approximately 343,000 tonnes in 2024, with production growth varying by region as battery-grade and electronic-grade requirements increase. Capacity additions have been driven by Asia (notably China), where industrial policy and higher downstream battery manufacturing activity support upstream solvent production. Price observations indicate regional variability — for example, spot prices in China approached USD ~907/tonne in Q4 2023.

Key driving factors have been the rapid scale-up of lithium-ion battery manufacturing and expanding utility-scale and EV battery deployment. Global battery demand trends reported by the International Energy Agency indicate that EV battery demand is projected to multiply several times over the 2020s (battery demand growth of 4–7× by 2030–2035 across scenarios), supporting solvent demand used in electrolytes and related battery chemicals. Concurrently, growth in electronic-grade PC for capacitors and industrial applications has been reported in multiple market studies.

In India, the propylene carbonate market is witnessing developments that align with the country’s industrial growth. Balaji Amines has commissioned a 15,000 tonnes/year propylene carbonate unit as part of its greenfield project in Solapur, Maharashtra. This initiative positions the company as a sole supplier of propylene carbonate in India, catering to the domestic demand and potential export markets.

Key Takeaways

- Propylene Carbonate Market size is expected to be worth around USD 694.6 Million by 2034, from USD 399.0 Million in 2024, growing at a CAGR of 5.7%.

- Aqueous form held a dominant market position, capturing more than a 67.9% share of the global propylene carbonate market.

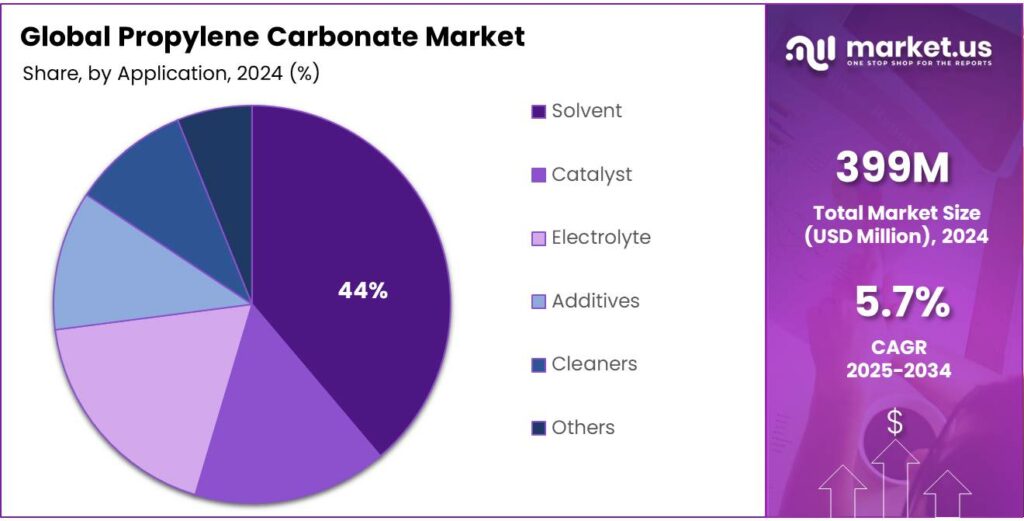

- Solvent held a dominant market position, capturing more than a 44.5% share of the global propylene carbonate market.

- Paints & Coatings held a dominant market position, capturing more than a 34.8% share of the global propylene carbonate market.

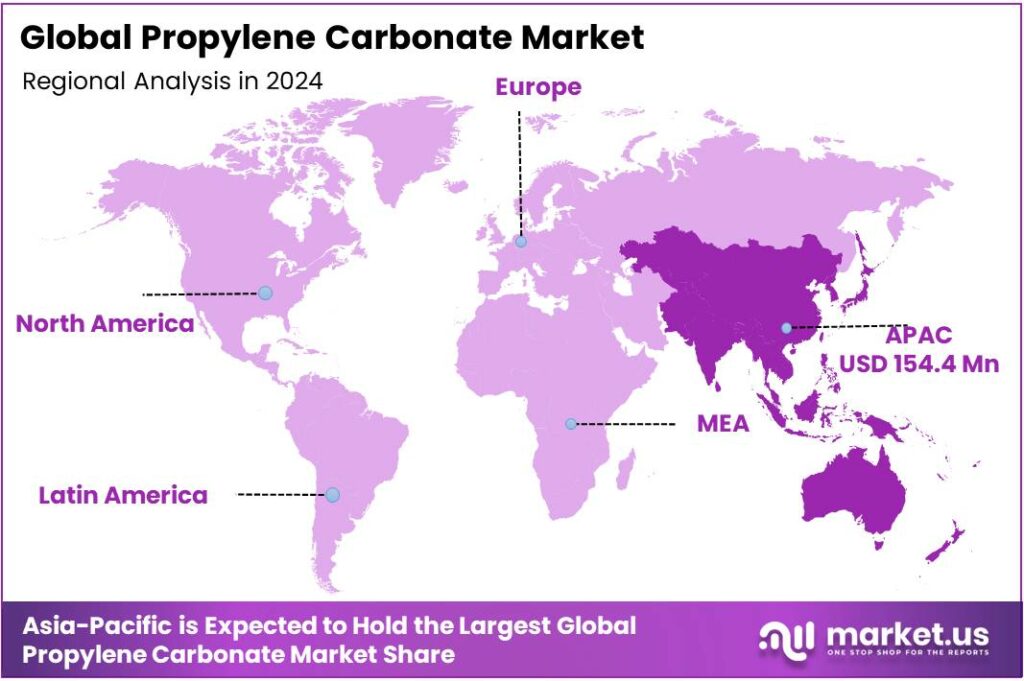

- Asia Pacific region asserted clear leadership in the propylene carbonate market, accounting for 38.7% of global demand equivalent to USD 154.4 million.

By Form Analysis

Aqueous Form Leads the Market with 67.9% Share in 2024

In 2024, Aqueous form held a dominant market position, capturing more than a 67.9% share of the global propylene carbonate market. This dominance can be attributed to its extensive use as a solvent and cleaning agent across industrial and laboratory applications, supported by its environmental compatibility and low toxicity profile. The aqueous form is increasingly preferred in formulations for paints, coatings, and personal care products, where water-based solutions are replacing traditional solvent-based systems to meet emission control norms and sustainability goals.

Industries such as electronics, automotive, and energy storage have shown rising consumption of aqueous propylene carbonate, particularly for applications in electrolytes and surface treatments. The product’s high dielectric constant and biodegradability have made it suitable for replacing petroleum-based solvents, aligning with global green chemistry initiatives. In 2025, demand for aqueous propylene carbonate is expected to continue its upward trend as manufacturers shift toward safer and more sustainable production processes, with growing adoption in lithium-ion battery electrolytes and semiconductor cleaning solutions.

By Application Analysis

Solvent Application Leads the Market with 44.5% Share in 2024

In 2024, Solvent held a dominant market position, capturing more than a 44.5% share of the global propylene carbonate market. This leading position is primarily due to its extensive use as a high-performance solvent in paints, coatings, adhesives, and cleaning formulations. Its excellent solvency power, high dielectric constant, and low vapor pressure make it an ideal choice for dissolving polymers, resins, and electrolytes in both industrial and consumer applications. As industries continue to move toward environmentally friendly formulations, propylene carbonate has gained preference over conventional petroleum-based solvents because of its low toxicity and biodegradability.

During 2025, the solvent segment is expected to witness steady growth driven by rising demand from the electronics and energy storage sectors, where propylene carbonate serves as a crucial solvent in lithium-ion battery electrolytes. The ongoing expansion of the electric vehicle industry and the push for high-performance energy storage systems are reinforcing the use of propylene carbonate-based solvents due to their thermal stability and electrochemical compatibility. Additionally, increasing use in the formulation of waterborne coatings and eco-friendly cleaning agents further strengthens its market position.

By End-use Analysis

Paints & Coatings Lead the Market with 34.8% Share in 2024

In 2024, Paints & Coatings held a dominant market position, capturing more than a 34.8% share of the global propylene carbonate market. This strong position is mainly due to its wide use as a high-performance solvent and coalescing agent in waterborne and solvent-based paint formulations. Propylene carbonate enhances pigment dispersion, improves viscosity control, and ensures uniform film formation, making it a preferred ingredient in premium coatings. The shift toward eco-friendly and low-VOC coatings in construction, automotive, and industrial applications has significantly boosted the demand for propylene carbonate as a safer alternative to traditional solvents.

The increasing adoption of waterborne paints, driven by strict environmental regulations and sustainable building trends, has further supported this growth. In 2025, the paints and coatings segment is expected to maintain its upward trajectory, driven by ongoing infrastructure development, urbanization, and renovation activities across emerging markets. Additionally, the automotive refinishing and protective coatings sectors are contributing to rising consumption due to the compound’s excellent solvency and compatibility with polymer systems such as polyurethane and epoxy.

Key Market Segments

By Form

- Aqueous

- Pellets

- Others

By Application

- Solvent

- Catalyst

- Electrolyte

- Additives

- Cleaners

- Others

By End-use

- Cosmetics & Personal Care

- Paints & Coatings

- Pharmaceuticals

- Agrochemicals

- Energy & Power

- Others

Emerging Trends

Integration of Propylene Carbonate in Lithium-Ion Batteries

A significant and growing trend in the propylene carbonate (PC) market is its increasing integration into lithium-ion batteries (LIBs), driven by the global shift towards electric vehicles (EVs) and renewable energy storage solutions. PC serves as a high-purity electrolyte solvent in LIBs, contributing to enhanced stability, improved conductivity, and overall battery performance.

The increasing adoption of electric vehicles and the growing need for efficient energy storage solutions present significant opportunities for propylene carbonate in the lithium-ion battery industry. As the demand for high-performance batteries continues to rise, propylene carbonate is poised to play a crucial role in meeting these needs.

This surge in demand for battery-grade propylene carbonate presents significant growth opportunities for manufacturers and suppliers in the chemical industry. Companies are investing in research and development to enhance the quality and efficiency of propylene carbonate production, aiming to meet the stringent requirements of the battery industry. Additionally, the focus on sustainable and eco-friendly materials aligns with global environmental goals, further driving the adoption of propylene carbonate in various applications.

Drivers

Government Initiatives and Regulatory Support

One of the primary drivers propelling the growth of the propylene carbonate market is the increasing implementation of government initiatives and stringent environmental regulations across various regions. These policies not only encourage the adoption of eco-friendly chemicals but also mandate industries to transition towards sustainable practices, thereby boosting the demand for biodegradable and low-toxicity solvents like propylene carbonate.

Similarly, in Europe, stringent environmental policies have accelerated the shift towards sustainable chemicals. The European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation and directives targeting the reduction of hazardous substances in industrial processes have created a favorable environment for the adoption of propylene carbonate.

These regulations encourage manufacturers to seek alternatives to traditional solvents that are less harmful to human health and the environment. As a result, industries in Europe are increasingly incorporating propylene carbonate into their formulations to meet regulatory requirements and consumer demand for green products.

In the Asia-Pacific region, countries like China and Japan are also implementing policies to promote the use of sustainable chemicals. China’s commitment to achieving carbon neutrality by 2060 has led to investments in green technologies and the development of eco-friendly materials. Propylene carbonate, with its low environmental impact, fits well within these national strategies, driving its demand in various applications. Japan, known for its stringent environmental standards, has seen an increase in the use of propylene carbonate in industries such as electronics and automotive, where compliance with environmental regulations is critical.

Restraints

Volatility in Raw Material Prices

One significant challenge facing the propylene carbonate (PC) industry is the volatility in the prices of its key raw materials, particularly propylene oxide and carbon dioxide. These fluctuations can lead to increased production costs, affecting the overall pricing and profitability of PC.

Propylene oxide, a primary feedstock for PC production, is derived from petroleum-based processes. As such, its price is closely tied to the global oil market. For instance, in August 2024, propylene prices in the U.S. saw a significant rise due to factors such as inflation, energy price fluctuations, and global market uncertainties. These increases in upstream propylene prices directly impacted the production costs of PC, leading to higher prices for end customers.

Similarly, carbon dioxide, another essential raw material for PC, is subject to market dynamics and regulatory influences. While CO₂ is abundant, its capture and utilization in PC production require specific technologies and infrastructure, which can be costly. Additionally, fluctuations in CO₂ availability and pricing can further contribute to the instability in PC production costs.

Opportunity

Increasing Demand in Lithium-Ion Batteries

One of the most promising growth opportunities for propylene carbonate (PC) lies in its expanding role in lithium-ion batteries (LIBs), particularly in the context of the global shift towards electric vehicles (EVs) and renewable energy storage solutions. PC serves as a high-purity electrolyte solvent in LIBs, contributing to enhanced stability, improved conductivity, and overall battery performance.

The increasing adoption of electric vehicles and the growing need for efficient energy storage solutions present significant opportunities for propylene carbonate in the lithium-ion battery industry. As the demand for high-performance batteries continues to rise, propylene carbonate is poised to play a crucial role in meeting these needs.

The expanding applications of propylene carbonate in lithium-ion batteries, driven by the global shift towards clean energy and electric vehicles, represent a substantial growth opportunity for the chemical. With supportive government initiatives and increasing demand in key industries, propylene carbonate is well-positioned to capitalize on these trends and contribute to the advancement of sustainable energy solutions.

Regional Insights

Asia Pacific leads with 38.7% share (USD 154.4 Mn) in 2024

In 2024, the Asia Pacific region asserted clear leadership in the propylene carbonate market, accounting for 38.7% of global demand equivalent to USD 154.4 million, supported by a dense downstream ecosystem of battery manufacturing, electronics assembly, and coatings production.

The region’s scale is underpinned by large chemical and specialty-materials plants in China, Japan, South Korea and India, which supply both industrial-grade and battery-grade solvents to domestic and export markets; this manufacturing density has concentrated procurement and enabled supply-chain efficiencies that favour regional suppliers.

Policy support and industrial strategy in major markets have further stimulated regional demand: incentives for domestic battery value chains, local content and chemical sector modernization have encouraged investment in upstream solvent production and quality upgrade projects.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Shandong DePu Chemical (Xintai, Shandong, China) produces propylene carbonate, along with propylene glycol and dimethyl carbonate. Its capacity for propylene carbonate is about 20,000 tonnes/year. The company, established in 2004/2007, uses DCS (Distributed Control System) for process control and emphasizes quality assurance and modern management. It caters to both domestic and export markets, including Europe, America, Japan, Korea, and Southeast Asia.

BASF SE supplies propylene carbonate through its Intermediates division under brands like Propylene Carbonate S®. Its offerings target coatings, enamels, and wire insulation applications, thanks to the solvent’s strong polarity and compatibility with polyester, polyurethane, epoxy and phenol resins. The company emphasizes its broad range of intermediates and formulation ingredients that serve coating industries and industrial manufacturing globally. BASF’s portfolio advantage derives from its R&D strength, regulatory compliance, and global presence.

Empower Materials specializes in high-performance, CO₂-based polymers, notably the QPAC®40 poly(propylene carbonate) binder. Their product is used as a binder in ceramic, metal, glass powders, pastes, inks, coatings, and sacrificial/pore-forming applications. QPAC®40 decomposes cleanly leaving very low ash residue (<10 ppm), offering advantages in purity-sensitive processes. Empower supplies in forms such as pellets, films, aqueous emulsion or solutions, and focuses on sustainable, thermally decomposable materials.

Top Key Players Outlook

- Yondell Basell Industries

- Shandong Depu Chemical

- BASF SE

- Empower Materials

- Huntsman International LLC.

- Dhalop Chemicals

- Linyi Evergreen Chemical Co., Ltd.

- Central Drug House

Recent Industry Developments

BASF’s total group sales revenue was €65.26 billion, down about 5.29% from 2023, reflecting lower selling prices despite slightly higher volumes.

In 2024 LyondellBasell Industries, announced plans to expand its propylene production capacity at the Channelview Complex near Houston, Texas. The new unit, expected to start operations in late 2028, will have an annual propylene production capacity of approximately 400,000 metric tons, employing 750 people during peak construction and adding 25 permanent jobs upon completion.

Report Scope

Report Features Description Market Value (2024) USD 399.0 Mn Forecast Revenue (2034) USD 694.6 Mn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Aqueous, Pellets, Others), By Application (Solvent, Catalyst, Electrolyte, Additives, Cleaners, Others), By End-use (Cosmetics and Personal Care, Paints and Coatings, Pharmaceuticals, Agrochemicals, Energy and Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Yondell Basell Industries, Shandong Depu Chemical, BASF SE, Empower Materials, Huntsman International LLC., Dhalop Chemicals, Linyi Evergreen Chemical Co., Ltd., Central Drug House Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yondell Basell Industries

- Shandong Depu Chemical

- BASF SE

- Empower Materials

- Huntsman International LLC.

- Dhalop Chemicals

- Linyi Evergreen Chemical Co., Ltd.

- Central Drug House