Global Processed Egg Market Size, Share, And Business Benefit By Product Type (Liquid Egg, Frozen Egg, Dried Egg, Others), By Application (Bakery, Dairy Products, Confectionery, Ready-to Eat, Nutritional Supplement, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162702

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

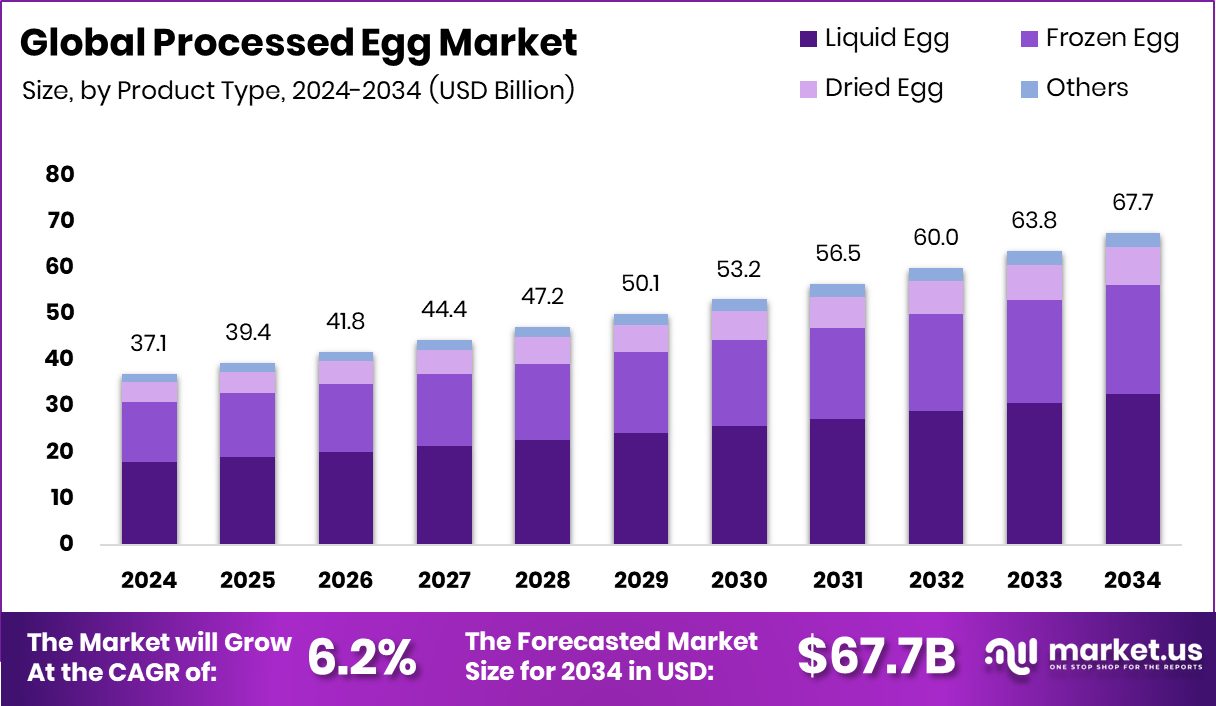

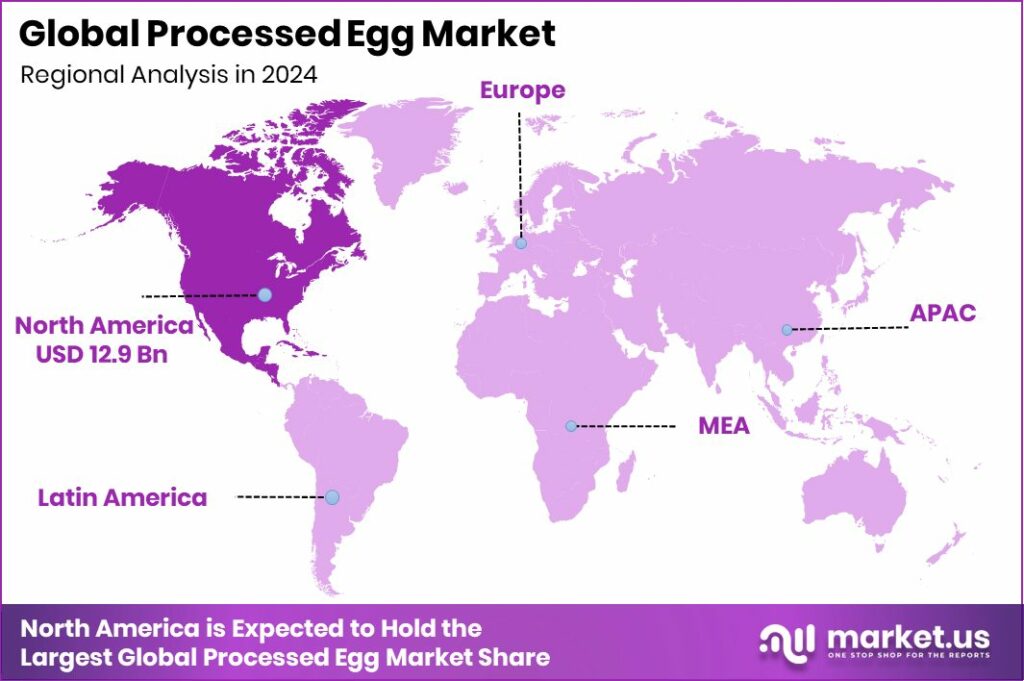

The Global Processed Egg Market is expected to be worth around USD 67.7 billion by 2034, up from USD 37.1 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Strong demand in North America, representing 34.80% share, achieved a USD 12.9 Bn valuation.

Processed egg refers to shell eggs that have been broken, pasteurized, and further treated to produce liquid, frozen, or dried egg products. These are used in food service, industrial food manufacturing, and retail convenience formats. The products carry benefits such as extended shelf life, convenience in handling, and consistent quality.

The processed egg market encompasses the supply, distribution, and consumption of these treated egg products (liquid, frozen, dried) across food processing, bakeries, ready meals, and other end-use segments. It involves global production, logistics, value-added processing, and consumption of eggs beyond the fresh shell form.

One key growth factor is the rising demand for convenience and quick-meal solutions, which encourages food manufacturers to use processed egg formats rather than shell eggs. Consumers increasingly prefer ready-to-eat or ready-to-cook meals, pushing the growth of processed egg forms that save labor and time.

Another driver is the growing use of processed eggs in bakery, confectionery, and foodservice applications. These sectors favor standardized, easily handled egg products over fresh eggs due to better safety, handling, and consistency. As baked goods, pastries, and processed foods expand, so does demand for processed egg formats.

There is an opportunity in emerging markets where consumption of processed and convenience foods is still growing and egg processing infrastructure is under-penetrated. Also, innovations in longer-shelf-life, value-added formats, or plant-based egg-replacer options create new avenues for investment and product development.

Funding developments highlight the wider ecosystem: Revyve raises $28 m Series B for egg replacers from yeast; Cracking The Egg Code: How Eggoz Hatched An INR 130 Cr+ Empire; Fertility Startup Gameto Raises $44 Million to Test Egg-Freezing Therapy in US; Cofertility Secures $7.25 M Series A Funding to Expand Egg Freezing and Donation Platform; Cofertility: $7.25 Million (Series A) Raised To Make Egg Freezing More Accessible; B.C. opens applications for IVF funding, offering up to $19K per patient; Brazil’s Future Cow Raises R$4.85 M to Scale Up Animal-Free Dairy Proteins Via Fermentation; Milk and grocery startup Country Delight to secure $25 M from Temasek; Alec’s Ice Cream Secures $11 Million Series A Funding to Support the Explosion of Culture Cup And Transition to Regenerative Dairy Farms.

Key Takeaways

- The Global Processed Egg Market is expected to be worth around USD 67.7 billion by 2034, up from USD 37.1 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In the Processed Egg Market, liquid egg holds a 48.3% share due to its convenience and versatility.

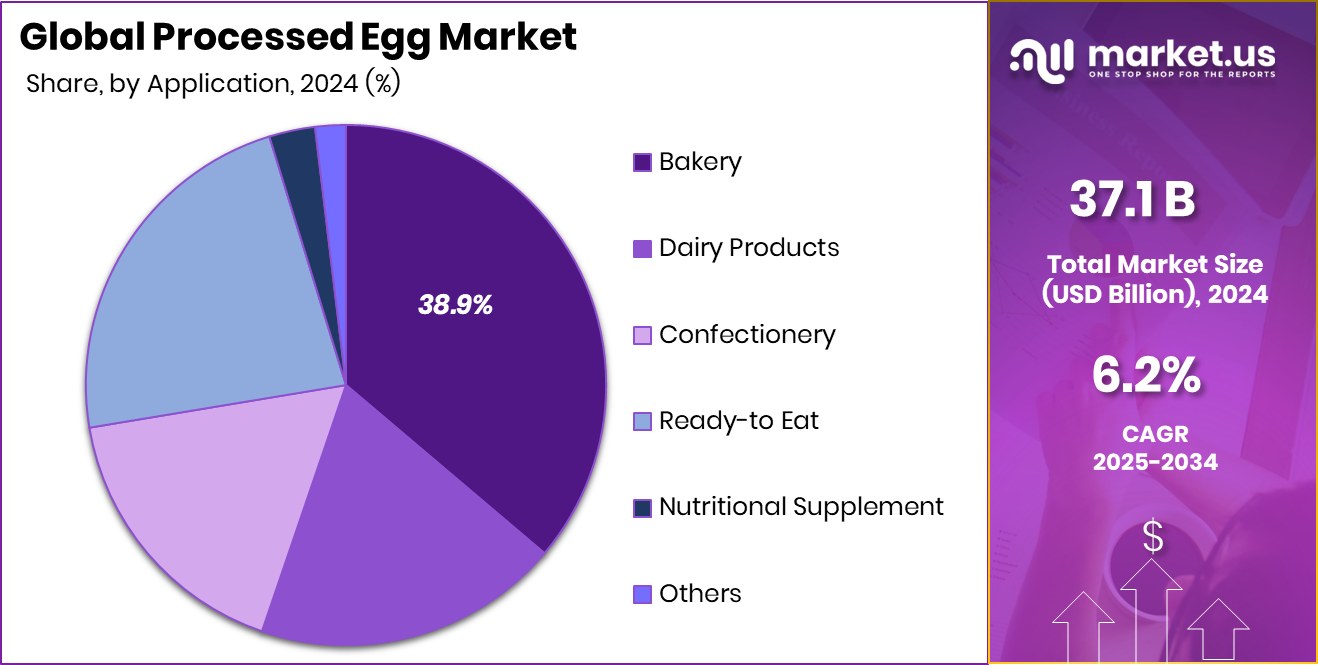

- The bakery segment accounts for a 38.9% share in the Processed Egg Market globally.

- The North America region dominated with a 34.80% share, generating USD 12.9 Bn market value.

By Product Type Analysis

Liquid egg held a 48.3% share in the Processed Egg Market.

In 2024, Liquid Egg held a dominant market position in By Product Type segment of the Processed Egg Market, with a 48.3% share. Liquid egg products are widely used by foodservice operators and industrial food processors due to their easy handling and high productivity. They reduce the time spent on cracking and mixing shell eggs and ensure better consistency in formulation. The segment benefits from growing demand in bakeries, confectionery, and ready-meal production lines.

Rising consumer preference for convenient and safe protein sources also supports the use of pasteurized liquid eggs. Manufacturers favor this format for its reduced contamination risk and longer shelf life, helping them meet food safety standards and production efficiency goals in the global processed egg industry.

By Application Analysis

Bakery applications dominated the Processed Egg Market with a 38.9% share.

In 2024, Bakery held a dominant market position in the By Application segment of the Processed Egg Market, with a 38.9% share. The bakery sector relies heavily on processed eggs for their emulsifying, foaming, and binding properties, which enhance product texture and stability. Liquid and dried egg products are commonly used in breads, cakes, pastries, and cookies to achieve uniform quality and extend shelf life.

The segment’s growth is supported by increasing consumer demand for packaged and ready-to-eat baked goods. With industrial bakeries expanding globally, the use of processed eggs ensures production efficiency and food safety compliance. Their versatility in large-scale bakery formulations continues to make them an essential ingredient in the processed egg market.

Key Market Segments

By Product Type

- Liquid Egg

- Frozen Egg

- Dried Egg

- Others

By Application

- Bakery

- Dairy Products

- Confectionery

- Ready-to Eat

- Nutritional Supplement

- Others

Driving Factors

Rising Processed Food Demand Boosting Egg Utilization

A major driving factor for the processed egg market is the rising global demand for ready-to-eat and convenient food products. Food manufacturers increasingly use processed eggs for their ease of handling, safety, and consistent quality, especially in baked goods, confectionery, and instant meals. With consumers preferring hygienic and protein-rich products, liquid and dried egg formats have become essential in large-scale production.

Growing café culture and quick-service restaurants are also supporting this trend. Funding activities further reflect confidence in this space—FES Cafe raises Rs 3 crore in seed funding to expand its processed food offerings, and Doughlicious gains $5 million funding boost to enhance its product ranges, emphasizing the growing appeal of processed and value-added food ingredients worldwide.

Restraining Factors

High Processing Costs Limiting Market Accessibility

A key restraining factor for the processed egg market is the high cost involved in processing and maintaining quality standards. Pasteurization, packaging, and cold-chain logistics add significant expenses, making processed egg products costlier than conventional shell eggs. Small-scale food producers and local bakeries often avoid these products due to limited budgets, which restricts market expansion, especially in developing regions. Additionally, fluctuating raw egg prices and energy costs further impact production economics.

Despite these challenges, ongoing investments in food innovation continue to uplift the broader ecosystem. For instance, Candytoy Corporate Secures INR 110 Cr Series A Funding to Propel Growth, signaling growing investor interest in improving processing technologies and scaling sustainable, cost-efficient food manufacturing solutions.

Growth Opportunity

Expanding Processed Food Industry Creating New Opportunities

A major growth opportunity for the processed egg market lies in the rapid expansion of the global processed and packaged food industry. As consumers increasingly choose convenient, protein-rich, and ready-to-eat meals, demand for liquid and dried egg products is rising steadily. These products offer longer shelf life, high nutritional value, and safety benefits—making them ideal for large-scale food manufacturing. The opportunity also grows with investments in modern food processing and automation technologies.

Recent funding highlights this momentum—Canada’s Awake Chocolate celebrates attaining significant $8 million funding, and Candytoy Corporate raises Rs 110 cr in a funding round to expand manufacturing facilities. Such investments indicate a strong future for processed ingredients and value-added food applications worldwide.

Latest Trends

Growing Focus on Sustainable and Ethical Sourcing

One of the latest trends in the processed egg market is the growing focus on sustainability and ethical sourcing throughout the production chain. Consumers now prefer egg products that come from farms following humane animal welfare standards and environmentally friendly practices. Producers are shifting toward cage-free and low-carbon operations to reduce their environmental impact and appeal to conscious buyers. This shift aligns with global discussions about sustainable food systems and responsible sourcing.

Supporting this transformation, confectionery startup Go Desi raises $5 million in funding led by Aavishkaar Capital, highlighting investor interest in ethical and traceable food brands. Meanwhile, farmers building climate resilience face a $151 billion financing gap, emphasizing the urgent need for financial support to promote sustainable farming and supply chains.

Regional Analysis

In 2024, North America held a 34.80% share, valued at USD 12.9 Bn in processed eggs.

In 2024, North America held a dominant position in the Processed Egg Market, accounting for 34.80% of the global share, valued at USD 12.9 billion. The region’s leadership is driven by the strong presence of food processing industries and the growing preference for convenient, ready-to-eat, and protein-rich food products.

Advanced technologies in egg pasteurization, packaging, and cold-chain logistics support large-scale production and distribution of liquid, frozen, and dried egg products. Europe shows steady growth due to rising demand for bakery and confectionery applications, while Asia Pacific witnesses increasing consumption driven by expanding urban populations and foodservice sectors.

Meanwhile, the Middle East & Africa and Latin America present emerging potential, supported by gradual industrialization and increasing awareness of processed food benefits across diverse consumer bases.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cal-Maine Foods Inc. continued to strengthen its presence through large-scale egg production and investments in advanced processing systems. The company’s focus on improving pasteurization technology and ensuring product consistency supports the growing demand for liquid and dried egg products used in bakeries, confectionery, and foodservice applications. Their emphasis on sustainable farming and cage-free production also aligns with the rising preference for ethically sourced ingredients.

Rose Acre Farms Inc. has maintained a strong foothold through its vertically integrated operations, ensuring high-quality control from farm to finished egg product. The company’s efficiency in handling large-scale production and logistics allows it to meet the needs of food manufacturers seeking reliability and safety.

Wabash Valley plays a significant role in regional supply by offering processed egg solutions tailored for commercial and industrial use. Its operational flexibility and adherence to food safety standards help maintain competitiveness in both domestic and export markets. Collectively, these players drive innovation, sustainability, and supply stability in the processed egg industry, ensuring the segment remains responsive to changing consumer preferences and evolving global food safety expectations.

Top Key Players in the Market

- Cal-Maine Foods Inc.

- Rose Acre Farms Inc.

- Wabash Valley

- Rembrandt Enterprises Inc.

- Daybreak Foods

- Pulviver

- Honeyville Inc.

- Dr. Oetker

- Interovo Egg Group BV

- Gruppo Eurovo

Recent Developments

- In March 2025, Rose Acre Farms purchased a property in Bullhead City, Arizona to expand its operations in the western U.S., planning a new egg-breaking and liquid-egg processing facility.

- In September 2024, Cal-Maine completed a strategic investment with Crepini LLC, forming a new joint venture called Crepini Foods LLC (New York). Cal-Maine contributed about US$6.75 million in cash for a 51% stake, while Crepini LLC provided its existing assets in exchange for 49%. This move expands Cal-Maine’s egg-product portfolio into value-added wraps, crepes, and ready-to-eat items and supports its shift into prepared foods.

Report Scope

Report Features Description Market Value (2024) USD 37.1 Billion Forecast Revenue (2034) USD 67.7 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid Egg, Frozen Egg, Dried Egg, Others), By Application (Bakery, Dairy Products, Confectionery, Ready-to Eat, Nutritional Supplement, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cal-Maine Foods Inc., Rose Acre Farms Inc., Wabash Valley, Rembrandt Enterprises Inc., Daybreak Foods, Pulviver, Honeyville Inc., Dr. Oetker, Interovo Egg Group BV, Gruppo Eurovo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cal-Maine Foods Inc.

- Rose Acre Farms Inc.

- Wabash Valley

- Rembrandt Enterprises Inc.

- Daybreak Foods

- Pulviver

- Honeyville Inc.

- Dr. Oetker

- Interovo Egg Group BV

- Gruppo Eurovo