Global Probiotic Dietary Supplement Market Size, Share Analysis Report By Form (Chewables And Gummies, Capsules, Powders, Tablets And Softgels, Others), By End-use (Adults, Infants, Children) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162572

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

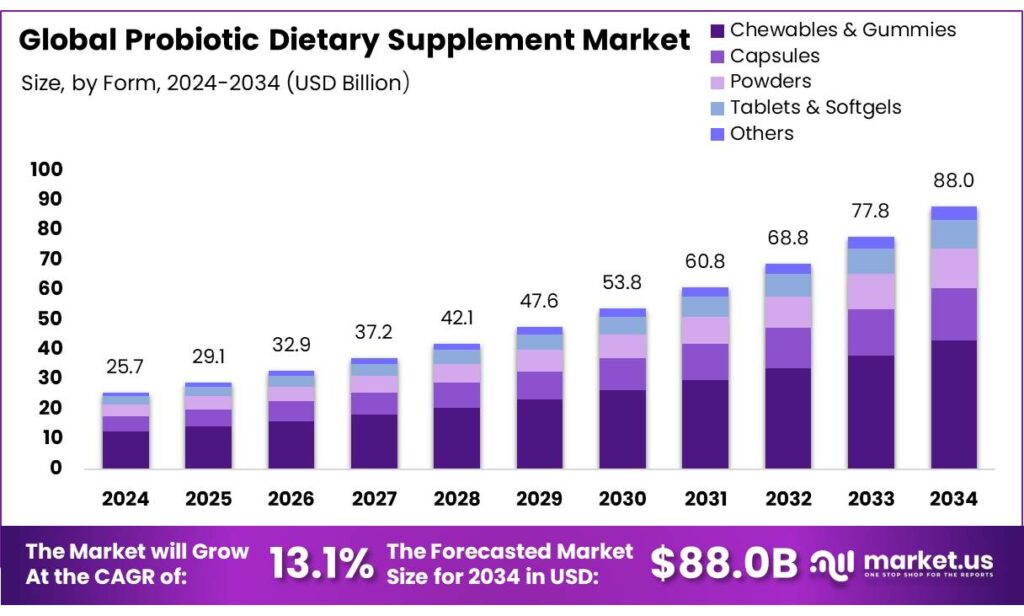

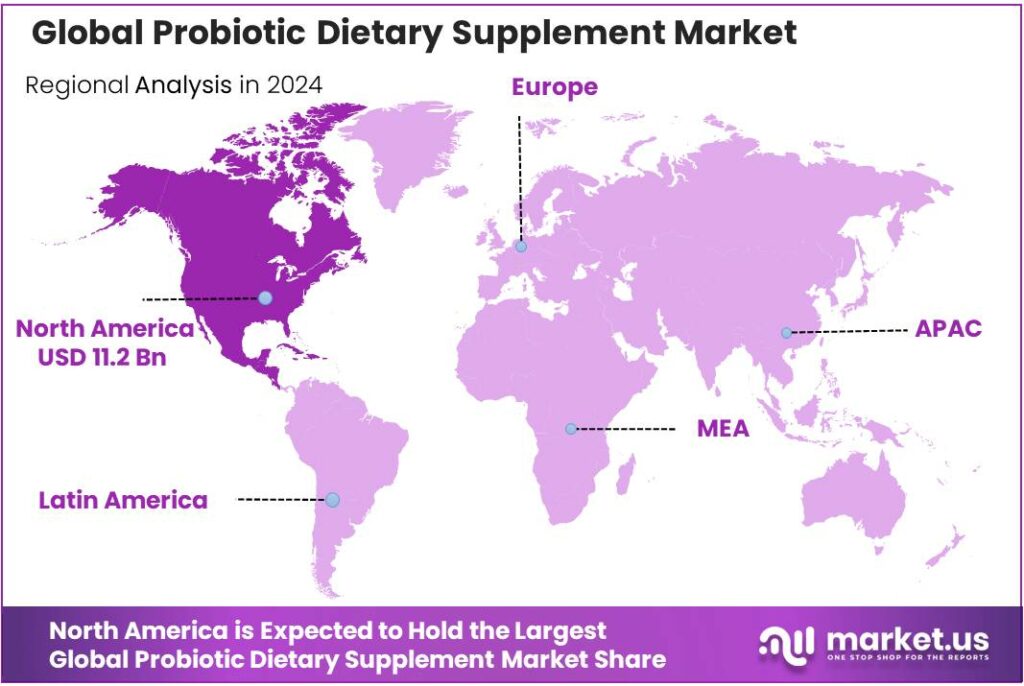

The Global Probiotic Dietary Supplement Market size is expected to be worth around USD 88.0 Billion by 2034, from USD 25.7 Billion in 2024, growing at a CAGR of 13.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.7% share, holding USD 11.2 Billion in revenue.

Probiotic dietary supplements are products containing “live microorganisms that, when administered in adequate amounts, confer a health benefit on the host,” per the joint FAO/WHO working definition that still anchors modern guidance. They are supplied chiefly as capsules, powders, and functional blends using Lactobacillus and Bifidobacterium strains, among others.

- In the U.S., probiotics ranked among the most commonly used non-vitamin/mineral supplements; the National Health Interview Survey reported about 4 million adults (1.6%) used probiotics or prebiotics in the prior 30 days in 2012, with usage quadrupling versus 2007—signaling durable consumer interest in microbiome-supporting formats.

The industrial scenario is shaped by converging public-health and regulatory priorities. Antimicrobial resistance (AMR) intensifies demand for non-antibiotic approaches to gut health and infection risk reduction: WHO estimates 1.27 million deaths were directly attributable to bacterial AMR in 2019 and 4.95 million deaths were associated with AMR globally. In the U.S., Clostridioides difficile remains a major burden, with CDC estimating 223,900 cases in hospitalized patients and 12,800 deaths in 2017, a key clinical context where microbiome strategies are studied.

Key demand drivers include persistent gastrointestinal disease burdens, high antibiotic use, and wider awareness of microbiome health. UNICEF reports that diarrhoea still accounted for about 9% of all under-5 deaths in 2021—roughly 1,200 deaths per day—highlighting a continuing global health need alongside oral rehydration and vaccination programs.

Within OECD/EU countries, community antibiotic consumption averaged 17.0 defined daily doses (DDD) per 1,000 inhabitants per day in 2022, while one in five bacterial infections in OECD countries are now resistant, contributing to ~79,000 deaths annually across OECD and EU/EEA—macro trends that sustain interest in microbiome-supportive strategies. U.S. survey data show probiotics/prebiotics were among the most commonly used non-vitamin/mineral supplements, reflecting mainstream adoption that industry must meet with quality and evidence.

Key Takeaways

- Probiotic Dietary Supplement Market size is expected to be worth around USD 88.0 Billion by 2034, from USD 25.7 Billion in 2024, growing at a CAGR of 13.1%.

- Capsules held a dominant market position, capturing more than a 33.80% share in the global probiotic dietary supplement market.

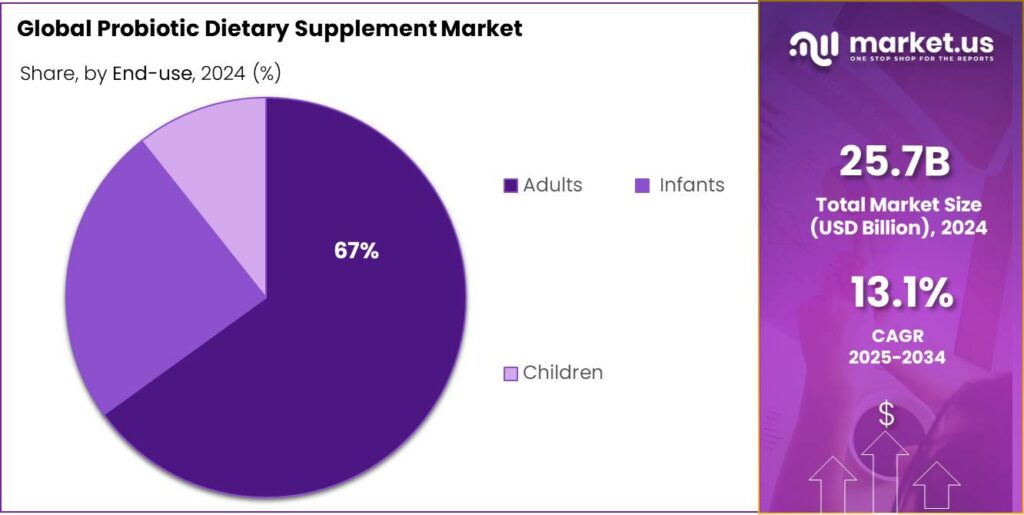

- Adults held a dominant market position, capturing more than a 67.30% share in the global probiotic dietary supplement market.

- North America region held a dominant position in the global probiotic dietary supplement market, capturing approximately a 43.7% share, corresponding to an estimated value of USD 11.2 billion.

By Form Analysis

Capsules dominate with 33.80% share owing to their convenience and high consumer trust

In 2024, Capsules held a dominant market position, capturing more than a 33.80% share in the global probiotic dietary supplement market. The capsule form has remained the most preferred delivery format due to its ease of consumption, longer shelf stability, and effective protection of live probiotic strains from stomach acids. Consumers increasingly favor capsules for their accurate dosage, portability, and compatibility with daily supplement routines. This format also supports sustained release, ensuring probiotics reach the intestine effectively, which enhances their therapeutic benefits.

The demand for capsule-based probiotic supplements is expected to continue expanding, driven by the growing health-conscious population and rising adoption of preventive healthcare practices. Manufacturers are focusing on innovative capsule technologies such as delayed-release and enteric-coated forms to improve strain survivability and absorption rates. The rise of vegan capsules made from plant-derived cellulose further aligns with the global trend toward clean-label and natural products.

By End-use Analysis

Adults dominate with 67.30% share driven by rising awareness of digestive and immune health

In 2024, Adults held a dominant market position, capturing more than a 67.30% share in the global probiotic dietary supplement market. The strong demand among adults is primarily driven by the growing focus on gut health, immune system support, and overall wellness management. Increasing lifestyle-related digestive disorders and stress-induced health issues have encouraged adults to incorporate probiotic supplements as part of their daily routine. This segment has also benefited from higher disposable incomes and greater health awareness, particularly in urban populations.

The adoption of probiotic supplements among adults is expected to rise steadily, supported by expanding retail availability and product diversification across dosage forms. Many adults prefer capsules and tablets due to their convenience, while others opt for powders or functional beverages for easier integration into diets. Marketing efforts emphasizing natural wellness, preventive health, and scientifically backed probiotic strains have further strengthened consumer confidence in this segment.

Key Market Segments

By Form

- Chewables & Gummies

- Capsules

- Powders

- Tablets & Softgels

- Others

By End-use

- Adults

- Infants

- Children

Emerging Trends

Generic Probiotics” to Harmonized, Strain-Verified, Fiber-Paired Products

Across the category, one clear trend is a shift from broad “probiotic” messaging to rigorously defined, strain-verified supplements that align with emerging international guidance—and that increasingly pair with dietary fiber (synbiotics) to support efficacy. In the 2024 discussion, an electronic working group with 38 Member countries and 14 Observers participated—an unusually broad coalition for a technical topic—showing regulators’ and governments’ shared interest in clarity.

National rules are moving in the same direction. India’s regulator, FSSAI, already requires that probiotic foods/supplements deliver a minimum viable count of ≥10⁸ CFU per recommended daily serving. This numeric threshold pushes brands to validate manufacturing, stability, and label claims through a product’s shelf life—exactly the kind of discipline that Codex harmonization would encourage globally.

At the same time, product design is shifting toward synbiotics—pairing live microbes with fibers that help them thrive—because typical diets fall short on fiber. The World Health Organization recommends adults consume at least 25 g/day of naturally occurring dietary fiber as part of healthy carbohydrate patterns. Many populations undershoot this, making fiber-paired probiotic formats a logical step for real-world effectiveness.

Healthcare system realities are also shaping this trend. Community antibiotic exposure—often disruptive to the gut microbiome—remains substantial in high-income regions. The EU/EEA population-weighted mean antibiotic consumption in the community was 17.0 defined daily doses (DDD) per 1,000 inhabitants per day in 2022, underscoring demand for products that are positioned for use during or after necessary antibiotic courses.

Drivers

Growing Need for Gut Health Support Amid High Infectious-Disease Burden

One major driving factor for the demand for probiotic dietary supplements is the persistent high burden of gastrointestinal infections—particularly diarrhoeal diseases—globally, which creates heightened consumer and healthcare interest in gut microbiome support. According to UNICEF data, diarrhoea accounted for approximately 9% of all deaths among children under five years of age in 2021. This translates to over 1,200 children dying per day, or about 444,000 children a year, despite effective and low-cost treatments being available.

Furthermore, high antibiotic usage and rising antimicrobial resistance (AMR) are linked with disruptions in the gut microbiome, increasing the interest in gut-health management. WHO estimates that bacterial antimicrobial resistance was directly responsible for 1.27 million deaths in 2019 and contributed to nearly 4.95 million deaths overall.

Government and global health initiatives further underscore this trend. UNICEF’s work on water, sanitation and hygiene (WASH) indicates that roughly 400,000 children under the age of five die annually due to inadequate WASH services, which increase susceptibility to diarrhoeal and gut-related diseases. The double burden of infectious disease and compromised gut health means that more families and healthcare systems are looking for preventive interventions—including dietary supplementation—to fill gaps that infrastructure alone cannot immediately address.

Restraints

Regulatory And Scientific Evidence Barriers

One of the major restraining factors in the growth of the probiotic dietary supplement category lies in the significant regulatory and scientific-evidence hurdles that accompany claims of health benefit. In the European Union, the European Food Safety Authority (EFSA) has consistently rejected health-claim applications for probiotics: for example, the terminology “probiotic” is itself treated as an implied health claim under Regulation (EC) 1924/2006, leading to a prohibition on products being marketed with that term unless the claim is authorised.

According to analysis of the EFSA claims database covering 2005-2013, although approximately 78% of analyzed claims related to gut-health or probiotic foods were judged by the EFSA panel to be “(possibly) beneficial,” they nevertheless failed to satisfy EFSA’s criteria for official approval.

A related issue is the quality and consistency of human evidence. EFSA and other regulators emphasise the need for well-conducted human trials in the relevant target population with clearly defined endpoints that reflect maintenance or improvement of normal physiological functions, rather than therapeutic claims of disease treatment. Many probiotic submissions have suffered from insufficient strain characterisation, inadequate human trial design, or poorly defined functional endpoints such as “supports immunity” without measurable outcome.

Another dimension is regulatory safety oversight. In the United States, the Food and Drug Administration (FDA) has issued formal warnings concerning probiotic products in vulnerable populations. For example, the FDA reported that a preterm infant administered a probiotic product developed invasive sepsis and died. The agency noted “more than two dozen other reported adverse events in the United States since 2018” linked to probiotic use in hospitalized infants.

Opportunity

Probiotics aligned to child-gut health and AMR strategies

A powerful growth opportunity for probiotic dietary supplements is to design, test, and position strain-specific products that sit alongside child-gut health and antimicrobial-resistance (AMR) strategies in primary care and maternal-child health programs. The public-health burden remains large. UNICEF estimates diarrhoea caused about 9% of all under-5 deaths in 2021—over 1,200 child deaths every day—despite low-cost treatments being available. That is roughly 444,000 deaths a year, highlighting persistent gut vulnerability and the need for supportive nutrition solutions families can actually access.

The World Health Organization (WHO) adds that diarrhoeal disease kills around 443,832 children under 5 each year and causes nearly 1.7 billion childhood cases annually, numbers that keep gut health on the policy agenda in low- and middle-income settings.

AMR intensifies this opportunity. Disrupted microbiomes after antibiotic courses are common, and the scale of AMR is sobering: WHO estimates 1.27 million deaths directly attributable to bacterial AMR in 2019, contributing to 4.95 million deaths overall. OECD reports that one in five bacterial infections in OECD countries are resistant, with about 79,000 deaths each year across OECD and EU/EEA; most AMR deaths are linked to healthcare-acquired resistant infections.

Antibiotic exposure in the community remains substantial too; in the EU/EEA the mean human antibiotic consumption was 16.4 defined daily doses (DDD) per 1,000 inhabitants per day (2020), and around 90% of use occurs in the community—right where consumer health products operate.

On the policy side, international standard-setting is moving—another growth tailwind. Codex Alimentarius (FAO/WHO) has been considering harmonized probiotic guidelines for foods and dietary supplements, an effort discussed through the Codex Committee on Nutrition and Foods for Special Dietary Uses. Clearer, internationally referenced guidance on definitions, labeling, and evidence would lower regulatory ambiguity and facilitate cross-border trade for well-documented strains.

Regional Insights

North America dominates with 43.70% share (USD 11.2 billion) due to mature healthcare infrastructure and high consumer wellness focus

In 2024, the North America region held a dominant position in the global probiotic dietary supplement market, capturing approximately a 43.70% share, corresponding to an estimated value of USD 11.2 billion in that year. This strong regional performance is underpinned by high supplement usage among adults, advanced retail and omnichannel distribution networks, and a long-established culture of preventive healthcare. The region benefits from comprehensive regulatory frameworks that support dietary-supplement innovation, alongside a highly educated consumer base that readily adopts evidence-based functional health products.

The value captured reflects not only strong consumer demand but also premium pricing of probiotic supplements, development of technologically advanced strain formulations, and the significant presence of key market players headquartered in North America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Vitakem Nutraceuticals Inc: A U.S.-based contract manufacturer and private-label specialist in nutraceuticals, Vitakem offers full turnkey services under GMP certification. It lists a range of probiotic/gut-health products (for example, a “30 Billion-Biotic” delivering 30 billion CFU per serving) on its site. The company emphasizes speed, small-batch flexibility (minimums of ~144 bottles for some stock items) and supports export/fulfilment for e-commerce brands.

Lesaffre: A French-origin fermentation and yeast-science company with ~170 years of heritage, Lesaffre develops live yeast, yeast fractions and microbial ingredients for human health, nutrition and probiotics. Its offering includes patented yeast probiotic strain S. cerevisiae CNCM I-3856 (ibSium®) noted for gut resilience during antibiotic therapy. Lesaffre’s strength lies in microbial ingredient innovation rather than consumer-facing supplement branding.

H&H Group: A Hong Kong-listed nutrition & wellness company with a portfolio covering infant formulas, adult nutrition, probiotic and nutritional supplements, and pet nutrition. In its 2024 annual report it noted revenue from “paediatric probiotic & nutritional supplements” in mainland China of RMB 805.8 million, down 32.9 % year-on-year. The company is focusing on premiumisation, channel optimisation and consumer health trends in China and other Asia markets.

Top Key Players Outlook

- Vitakem Nutraceuticals Inc

- Lesaffre

- DuPont de Nemours, Inc.

- H&H Group

- Symrise

- ProbioFerm

- Dietary Pros, Inc.

- Dr. Joseph Mercola (Mercola Market)

- BASF SE

- ADM

Recent Industry Developments

In the 2024, Symrise achieved € 4 999 million in total revenues, with organic growth of 8.7%, and a segment-level performance of over € 3 091 million in the Taste, Nutrition & Health arm. Its EBITDA reached € 1 033 million, marking a margin of 20.7%.

In 2024 DuPont de Nemours, Inc. recorded USD 12.39 billion in net sales, representing an approximate 2.6 % increase over the previous year.

Report Scope

Report Features Description Market Value (2024) USD 25.7 Bn Forecast Revenue (2034) USD 88.0 Bn CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Chewables And Gummies, Capsules, Powders, Tablets And Softgels, Others), By End-use (Adults, Infants, Children) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Vitakem Nutraceuticals Inc, Lesaffre, DuPont de Nemours, Inc., H&H Group, Symrise, ProbioFerm, Dietary Pros, Inc., Dr. Joseph Mercola (Mercola Market), BASF SE, ADM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Probiotic Dietary Supplement MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Probiotic Dietary Supplement MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vitakem Nutraceuticals Inc

- Lesaffre

- DuPont de Nemours, Inc.

- H&H Group

- Symrise

- ProbioFerm

- Dietary Pros, Inc.

- Dr. Joseph Mercola (Mercola Market)

- BASF SE

- ADM