Global Power Tools Market Size, Share, And Enhanced Productivity By Product (Drills, Saws, Wrenches, Grinders, Sanders, Others), By Mode of Operations (Electric, Pneumatic, Others), By Applications (Industrial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172898

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

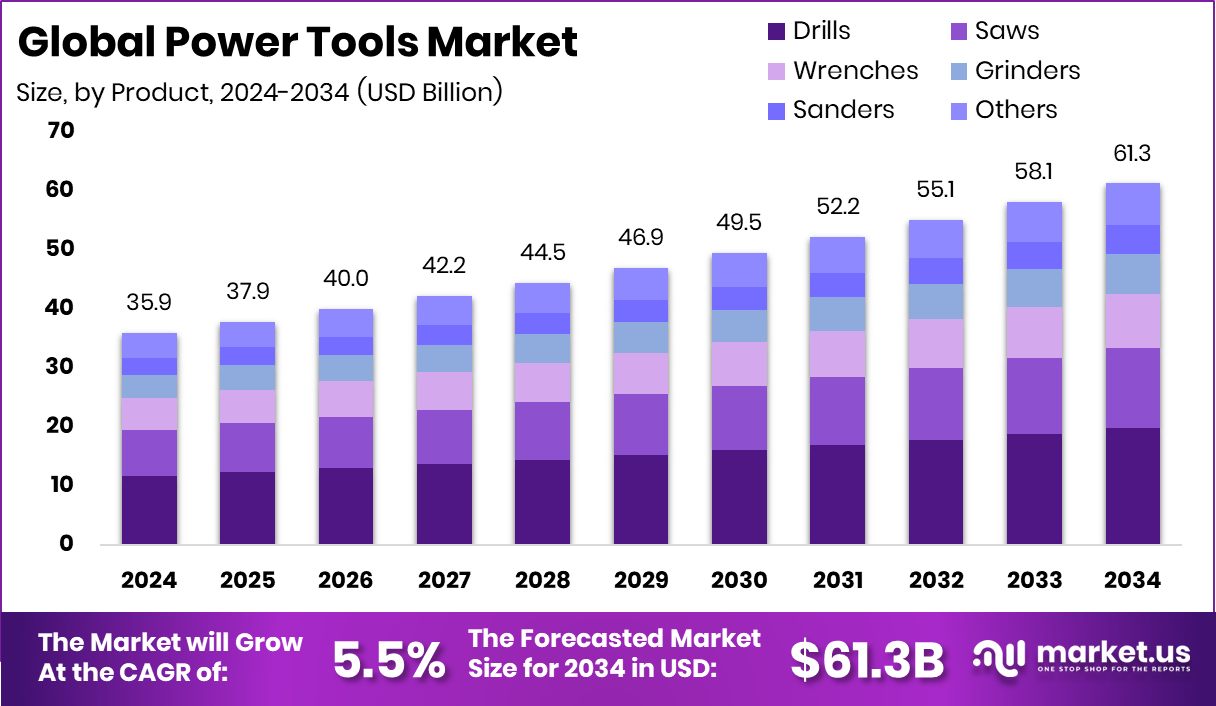

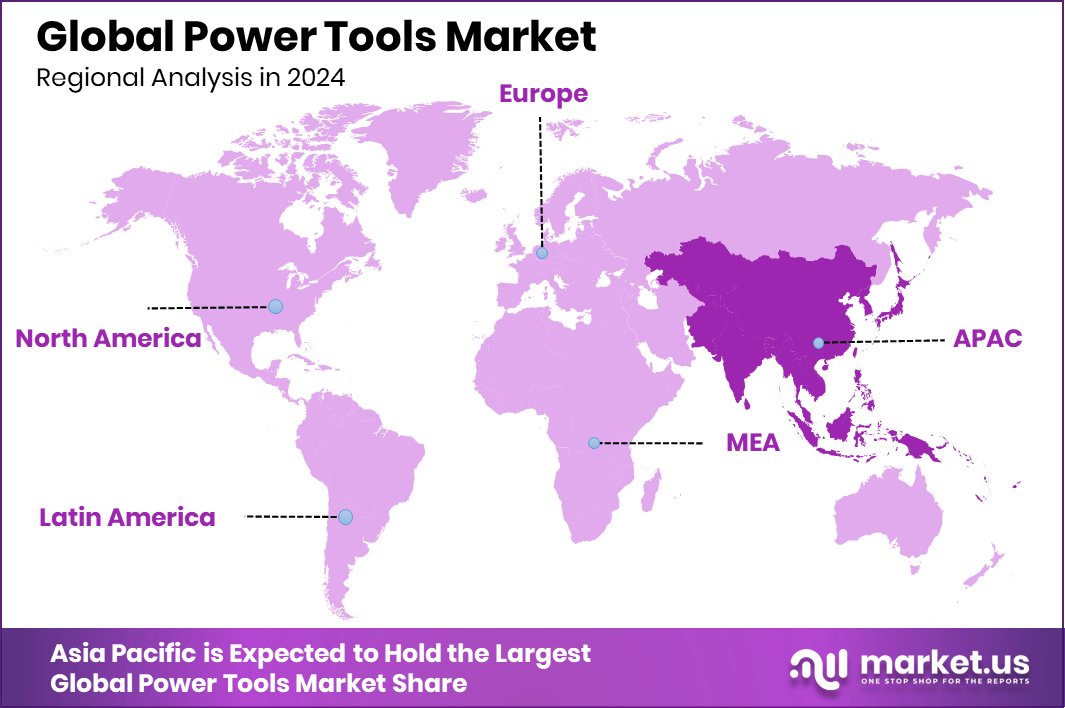

The Global Power Tools Market is expected to be worth around USD 61.3 billion by 2034, up from USD 35.9 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. In 2024, Asia Pacific remained dominant in the Power Tools Market at 37.20%, worth USD 13.3 Bn regionally.

Power tools are machines that use electricity, batteries, or other power sources to perform tasks like drilling, cutting, grinding, fastening, and polishing. They reduce manual effort, save time, and improve accuracy compared to hand tools. Power tools are widely used in construction, manufacturing, automotive repair, woodworking, and home improvement. Their ability to handle heavy workloads while maintaining consistency makes them essential for both professionals and skilled workers across industries.

The Power Tools Market refers to the global demand and supply of these powered machines across industrial, commercial, and residential uses. Market activity is shaped by construction growth, factory modernization, and the need for higher productivity. Digital tools and connected platforms are also influencing how power tools are selected and used. For example, Trunk Tools raised $40 million to improve how construction teams interact with project data, indirectly supporting smarter and more efficient tool usage on job sites.

One major growth factor is the rising investment in advanced technologies and skilled industries. In Texas, a $6 million grant was awarded to develop semiconductor power devices, supporting better performance, efficiency, and durability in electrically powered equipment, including tools used in industrial environments.

Demand for power tools continues to rise due to expanding construction, repair, and infrastructure activities. At the same time, growing digital adoption in adjacent sectors matters. Lightyear raised $23 million in Series B funding to strengthen retail investment platforms in the UK, reflecting broader confidence in technology-led productivity and equipment-driven work ecosystems.

The opportunity lies in innovation and specialization. Startups and technology-driven firms are improving how tools connect with data, safety systems, and workflows. Even outside construction, funding such as Loxa securing £1.69 million in seed funding shows how risk management and digital solutions support safer, more reliable operations—creating long-term opportunities for advanced power tool adoption.

Key Takeaways

- The Global Power Tools Market is expected to be worth around USD 61.3 billion by 2034, up from USD 35.9 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- Within the Power Tools Market, drills held 32.4% share due to versatility across construction applications.

- Electric tools dominated the Power Tools Market with 69.2% share through efficiency, portability, and safety acceptance.

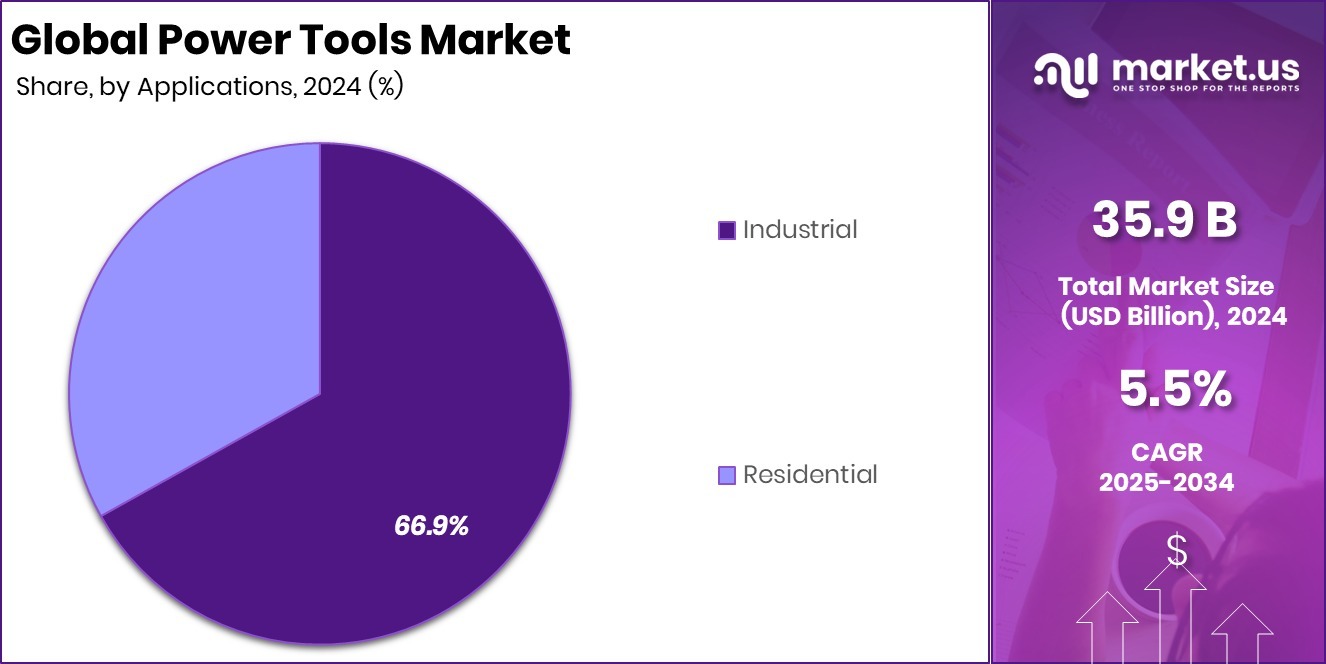

- Industrial applications led the Power Tools Market with 66.9% share, driven by automation and infrastructure expansion.

- In 2024, the Asia Pacific accounted for 37.20% of the Power Tools Market, reaching USD 13.3 Bn value.

By Product Analysis

Drills dominate the power tools market with 32.4% share, driven by applications.

In 2024, Drills held a dominant 32.4% share within the Power Tools Market, reflecting their wide use across construction, metalworking, woodworking, and maintenance tasks. Drills remain the most versatile tool category, supporting functions such as drilling, fastening, and light demolition with attachments. Strong demand from infrastructure upgrades, housing renovation, and factory maintenance continues to support drill sales.

Cordless drill models are increasingly preferred due to mobility, safety, and ease of use on job sites. Manufacturers are also focusing on ergonomic designs, higher torque efficiency, and longer tool life to meet professional expectations. As skilled labor productivity becomes critical, drills remain a first-choice investment for both industrial buyers and contractors.

By Mode of Operations Analysis

Electric mode leads the power tools market, holding 69.2% due to efficiency.

In 2024, Electric-powered tools accounted for a commanding 69.2% share of the Power Tools Market by mode of operation, driven by their reliability, consistent performance, and suitability for continuous workloads. Electric tools are widely used in factories, workshops, and large construction projects where a stable power supply is available. Compared to pneumatic or hydraulic tools, electric models offer lower operating complexity and easier maintenance.

Advancements in motor efficiency, brushless technology, and energy management systems have further improved performance and reduced downtime. Growing electrification of industrial facilities and expansion of manufacturing hubs continue to favor electric power tools, making them the preferred choice for heavy-duty and precision-driven applications.

By Applications Analysis

Industrial applications command the power tools market with 66.9% share globally demand.

In 2024, Industrial applications dominated the Power Tools Market with a 66.9% share, highlighting the sector’s strong dependence on mechanized tools for productivity and safety. Industries such as automotive manufacturing, heavy engineering, metal fabrication, and shipbuilding rely heavily on power tools for assembly, cutting, grinding, and finishing operations.

Rising automation, stricter workplace safety standards, and demand for higher output per worker are accelerating tool adoption across industrial settings. Regular equipment upgrades and preventive maintenance practices further sustain demand. As industrial facilities modernize and expand capacity, power tools remain essential assets for ensuring efficiency, accuracy, and consistent operational performance.

Key Market Segments

By Product

- Drills

- Saws

- Wrenches

- Grinders

- Sanders

- Others

By Mode of Operations

- Electric

- Pneumatic

- Others

By Applications

- Industrial

- Residential

Driving Factors

Workforce Skills And Technology Adoption Drive Demand

A key driving factor for the Power Tools Market is the rising focus on skilled workforce development and technology adoption across industries. As more regions invest in training young workers, the need for efficient, easy-to-use tools increases. For example, the World Bank approved nearly $410 million in funding to support youth training programs in Türkiye, helping prepare workers for construction, manufacturing, and technical trades. Skilled workers rely heavily on power tools to improve speed, accuracy, and safety at work sites.

At the same time, innovation in advanced technologies is influencing how tools are designed and used. London-based CoMind raised €85 million to develop solutions that replace invasive brain monitoring, reflecting broader progress in human-machine interaction and safer technology use. These advances encourage smarter, safer working environments, indirectly boosting demand for modern power tools that align with skilled labor needs and technology-enabled workplaces.

Restraining Factors

High Skill Gaps And Financial Risks Limit Adoption

One major restraining factor in the Power Tools Market is the gap between tool advancement and worker readiness. Many modern power tools require proper training to operate safely and efficiently. Without skilled workers, companies hesitate to invest in advanced equipment. To address this challenge, the U.S. Department of Labor awarded $86 million to 14 states for skills training programs focused on critical and emerging industries. This highlights that skill shortages remain a real concern, slowing full-scale tool adoption.

Alongside workforce issues, financial uncertainty also affects buying decisions. Reports of an entrepreneur’s former firm facing claims of £8.4 million owed reflect broader risks related to cash flow and business stability. When companies face legal or financial pressure, spending on new power tools is often delayed, limiting market growth despite strong long-term demand.

Growth Opportunity

Digital Finance Expansion Enables Tool Access Growth

A strong growth opportunity for the Power Tools Market lies in improving access to finance and digital services for small businesses and workers. Many contractors and workshops delay buying power tools due to upfront costs, even when demand exists. The rise of digital-first financial companies is helping change this behavior.

For example, Marshmallow, valued at £1.5 billion, shows how new fintech models are scaling quickly by serving underserved users. This shift reflects a broader trend where flexible payments, embedded finance, and digital risk assessment make it easier for businesses to invest in equipment.

As financial access improves, more users can afford modern power tools, upgrade older equipment, and expand operations. This creates long-term market opportunity, especially among small contractors and independent professionals who form a large part of tool demand.

Latest Trends

Smart Digital Brands And Financial Caution Shape

A key latest trend in the Power Tools Market is the growing influence of digitally driven consumer brands alongside rising financial caution in large transactions. Digital-first companies are scaling faster by using data, design, and direct customer engagement, which also shapes expectations for connected and user-friendly power tools.

For example, Atomberg raised $86 million from Temasek and Steadview, showing strong investor confidence in smart, energy-efficient products built around technology and everyday use. This trend supports demand for power tools that are intelligent, efficient, and easy to monitor.

At the same time, the market is seeing caution around large financial deals. Grindr ended talks on a $3.46 billion take-private bid due to financing uncertainty. This highlights tighter capital discipline, encouraging tool makers and buyers to focus on practical innovation, cost control, and real productivity gains rather than aggressive expansion.

Regional Analysis

In 2024, Asia Pacific led the Power Tools Market with 37.20% share, valued at USD 13.3 Bn.

The Power Tools Market shows clear regional performance differences shaped by industrial maturity, construction activity, and manufacturing intensity. Asia Pacific stands as the dominating region, holding a 37.20% share of the global market and valued at USD 13.3 Bn. This leadership is supported by strong industrial production, large-scale infrastructure development, and expanding manufacturing bases across key economies in the region. Continuous demand from automotive, electronics, metal fabrication, and construction activities sustains high tool consumption, particularly for electric and industrial-grade equipment.

North America represents a stable and technologically advanced market, driven by consistent demand from professional contractors, industrial maintenance, and renovation activities. The region benefits from high tool replacement rates and strong adoption of advanced power tool features focused on safety and productivity.

Europe maintains steady market participation due to its well-established industrial sector and strict workplace efficiency standards. Emphasis on precision engineering and manufacturing quality supports sustained power tool usage.

The Middle East & Africa market is supported by ongoing construction and industrial development activities, while Latin America continues to see gradual growth aligned with improving industrial operations and infrastructure upgrades.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Makita Corporation continues to strengthen its position in the global Power Tools Market through a clear focus on professional users and long-term product reliability. The company’s emphasis on cordless innovation, battery platform consistency, and durable tool design aligns well with industrial and construction needs. Makita’s vertically integrated manufacturing approach allows better control over quality and performance, which supports strong brand trust among contractors and industrial users worldwide.

Robert Bosch Group remains a technology-driven leader, leveraging its deep engineering expertise to deliver precision, safety, and digital integration across power tools. Bosch’s strength lies in combining industrial-grade performance with smart features such as connected tools and advanced motor systems. Its broad presence across professional, industrial, and consumer segments enables balanced growth while reinforcing its reputation for engineering excellence and operational efficiency.

Stanley Black & Decker holds a strong competitive position due to its diversified product portfolio and global brand recognition. The company benefits from scale, wide distribution networks, and a strong presence in professional and industrial tools. Continuous focus on ergonomics, productivity, and job-site efficiency supports its relevance across construction, maintenance, and manufacturing environments, making it a resilient and influential player in the global power tools landscape.

Top Key Players in the Market

- Makita Corporation

- Robert Bosch Group

- Stanley Black & Decker

- Techtronic Industries Co., Ltd.

- Emerson Electric Co.

- Atlas Copco

- Hilti Corporation

- Ingersoll Rand, Inc.

- Hitachi Koki Co., Ltd.

Recent Developments

- In March 2025, Emerson Electric Co. finished buying all the remaining shares of Aspen Technology, Inc. (AspenTech) that it did not already own. With this move, AspenTech became a wholly owned subsidiary of Emerson, helping strengthen Emerson’s automation and industrial software capabilities.

- In August 2024, TTI announced solid first-half 2024 results with sales of US$7.3 billion and significant growth in its Milwaukee brand tools. This reflects ongoing product expansions within its core power tools portfolio.

Report Scope

Report Features Description Market Value (2024) USD 35.9 Billion Forecast Revenue (2034) USD 61.3 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Drills, Saws, Wrenches, Grinders, Sanders, Others), By Mode of Operations (Electric, Pneumatic, Others), By Applications (Industrial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Makita Corporation, Robert Bosch Group, Stanley Black & Decker, Techtronic Industries Co., Ltd., Emerson Electric Co., Atlas Copco, Hilti Corporation, Ingersoll Rand, Inc., Hitachi Koki Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Makita Corporation

- Robert Bosch Group

- Stanley Black & Decker

- Techtronic Industries Co., Ltd.

- Emerson Electric Co.

- Atlas Copco

- Hilti Corporation

- Ingersoll Rand, Inc.

- Hitachi Koki Co., Ltd.