Global Polyethylene Terephthalate Glycol (Petg) Market Size, Share, And Business Benefit By Product Type (Extruded Grade, Injection Molding Grade, Blow Molding Grade), By Application (Prototypes, Containers and Packaging, Tools, Jigs, Fixtures, Equipment and Machinery, Others), By End-Use (Food and Beverage, Cosmetics, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167039

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

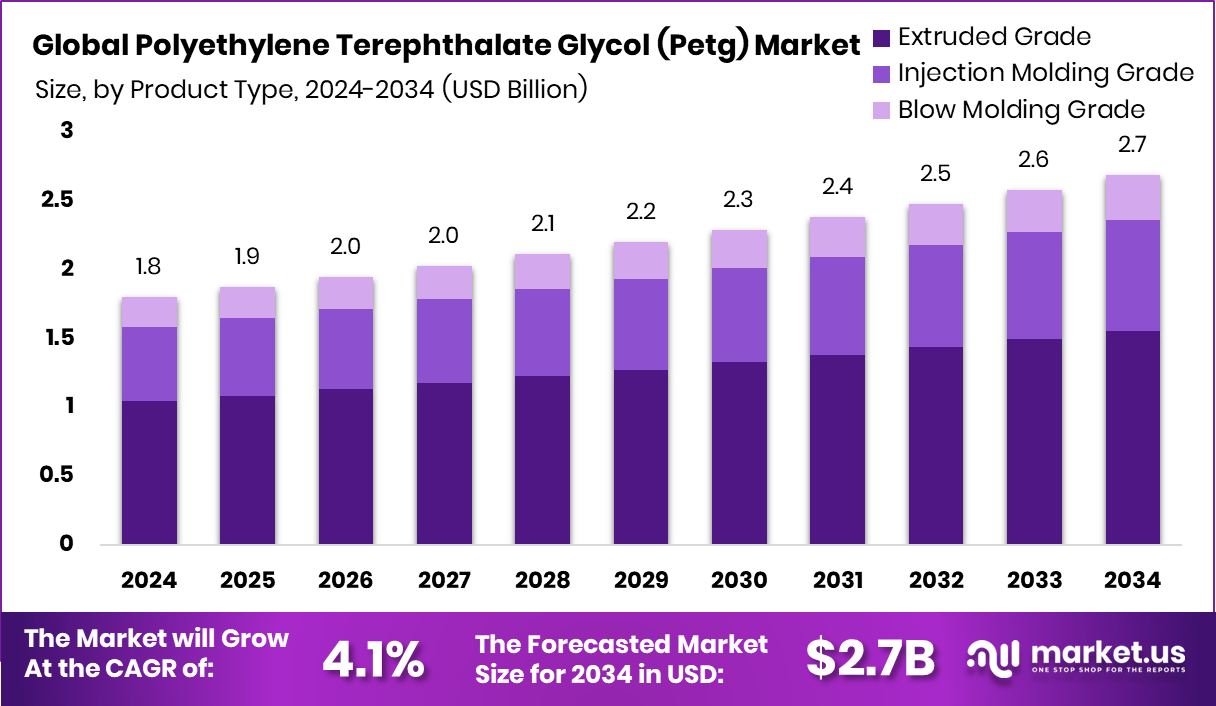

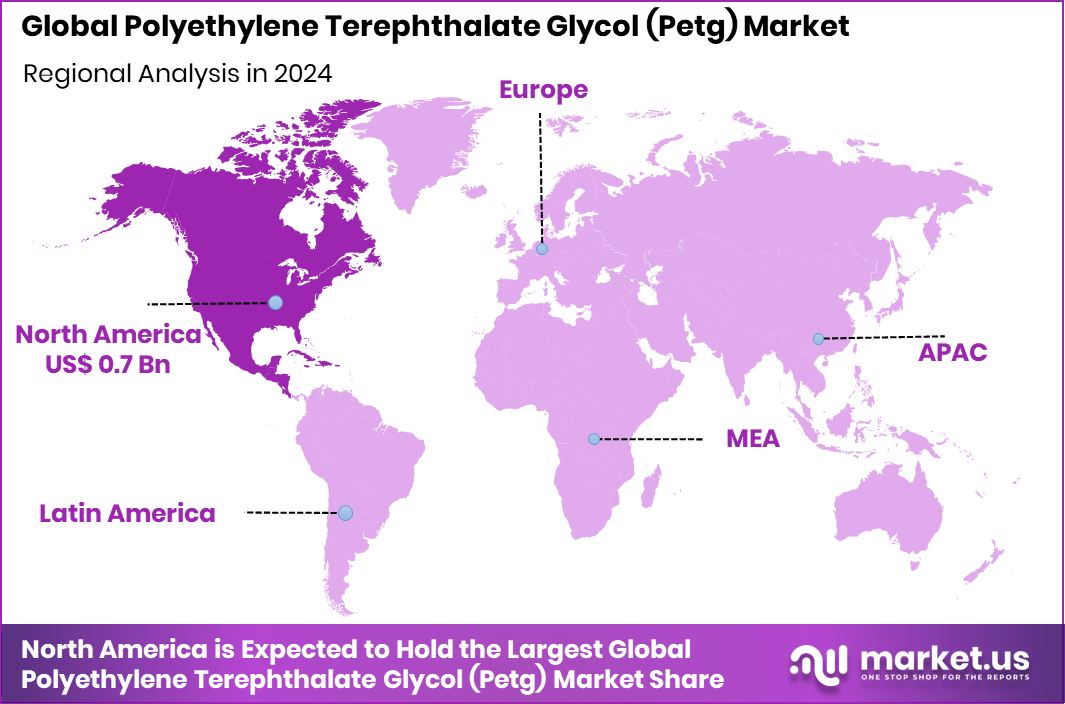

The global Polyethylene Terephthalate Glycol (Petg) Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Growing consumer goods applications helped North America maintain a 43.10% share at USD 0.7 Bn.

Polyethylene Terephthalate Glycol (PETG) is a modified version of PET that includes glycol to improve clarity, flexibility, and impact resistance. It is widely used in packaging, healthcare devices, 3D printing filaments, and consumer goods because it is easier to thermoform and maintains strong durability without becoming brittle. Its ability to offer crystal-clear transparency and strong chemical resistance makes it a preferred material for high-performance applications.

The Polyethylene Terephthalate Glycol (PETG) market represents the global demand, production, and adoption of PETG across packaging, medical, electronics, and industrial sectors. Rising interest in recyclable and lightweight materials is pushing more brands to shift toward PETG-based formats. Its balance of performance, processability, and sustainability keeps the market on a steady growth path as industries look for safer and more versatile plastics.

Growth factors are becoming stronger as beauty, personal care, and premium packaging expand. When brands secure new capital—such as Renee Cosmetics raising $30 million in fresh funding and another $30 million in a Series C round at a $200 million valuation—it increases demand for PETG containers, applicators, and display packaging. These investments encourage higher product launches, driving packaging material consumption.

Demand for PETG is also supported by the rise of indie and mid-size beauty labels. Funding rounds like SUGAR Cosmetics raising $5 million from Anicut Capital and K-Beauty startups securing $4.9 million in early 2025 fuel new packaging requirements, premium aesthetics, and customized formats. PETG fits these needs because it offers clarity and strength suitable for modern cosmetic lines.

A major opportunity comes from the expanding halal beauty market, projected to reach $118 billion by 2028. With GCC-backed funding and strong anti-counterfeit initiatives, brands prefer traceable, high-quality packaging materials. PETG provides tamper-resistant, clean-label-compatible solutions, positioning it well to benefit from this fast-growing global segment.

Key Takeaways

- The global Polyethylene Terephthalate Glycol (Petg) Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- Extruded grade dominated the PETG market with 57.9%, driven by strong clarity and easy processing qualities.

- Containers and packaging led the market with 44.2%, supported by rising consumer product launches globally.

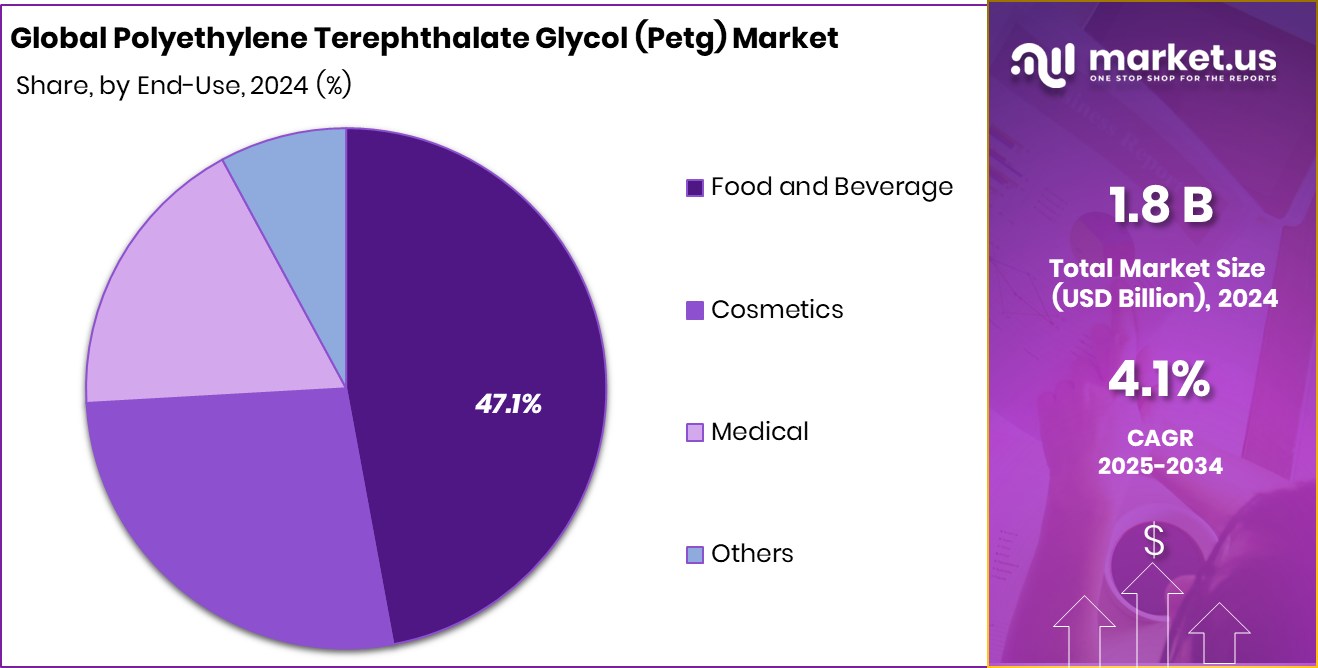

- The food and beverage segment held 47.1%, driven by rising demand for safe, transparent packaging.

- The North American strong packaging industry supported the 43.10% share and USD 0.7 Bn value.

By Product Type Analysis

Extruded grade PETG holds 57.9% due to easy processing advantages.

In 2024, Extruded Grade held a dominant market position in the By Product Type segment of the Polyethylene Terephthalate Glycol (PETG) Market, with a 57.9% share. This grade remained preferred because it delivers high clarity, strong impact resistance, and stable processing performance, which suits packaging, cosmetic containers, medical trays, and display components. Its ability to thermoform easily without losing transparency helped manufacturers maintain consistent quality across large production runs.

As brands in personal care, beauty, and consumer goods continued to introduce premium product lines, demand for reliable and visually appealing packaging rose steadily. The rising shift toward recyclable and durable materials further strengthened the adoption of Extruded Grade PETG, keeping it firmly in the leading position throughout the year.

By Application Analysis

Containers and packaging dominate with 44.2% because brands prefer transparent materials.

In 2024, Containers and Packaging held a dominant market position in the By Application segment of the Polyethylene Terephthalate Glycol (PETG) Market, with a 44.2% share. This leadership came from the growing use of PETG in cosmetic bottles, personal care packaging, food containers, and transparent display packs that require clarity and strength. Brands increasingly preferred PETG because it delivers premium shelf appeal and maintains durability during transport and handling.

The material’s ease of thermoforming and chemical resistance helped manufacturers produce lightweight yet sturdy packaging formats. As new product launches accelerated across beauty, personal care, and lifestyle categories, PETG-based packaging gained wider acceptance, reinforcing its position as the most relied-upon application category in 2024.

By End-Use Analysis

Food and beverage leads with 47.1% due to safe material performance.

In 2024, Food and Beverage held a dominant market position in the By End-Use segment of the Polyethylene Terephthalate Glycol (PETG) Market, with a 47.1% share. This leadership was supported by the rising demand for clear, durable, and contamination-resistant packaging used for bottles, trays, and protective covers. PETG’s strong impact resistance and ability to maintain product visibility made it a preferred choice for brands focused on premium presentation and safety.

Its compatibility with food-grade processing further encouraged manufacturers to shift toward PETG formats. As convenience foods, ready-to-drink beverages, and transparent packaging trends expanded, PETG remained essential for meeting evolving consumer expectations while offering a reliable balance of safety and aesthetics.

Key Market Segments

By Product Type

- Extruded Grade

- Injection Molding Grade

- Blow Molding Grade

By Application

- Prototypes

- Containers and Packaging

- Tools

- Jigs

- Fixtures

- Equipment and Machinery

- Others

By End-Use

- Food and Beverage

- Cosmetics

- Medical

- Others

Driving Factors

Rising Demand for Premium Packaging Solutions

A major driving factor for the Polyethylene Terephthalate Glycol (PETG) market is the strong rise in premium packaging needs across beauty, personal care, and lifestyle products. PETG’s clarity, strength, and easy shaping make it ideal for brands wanting high-quality, elegant packaging. This demand grows even faster when new beauty labels attract fresh capital and expand their product lines.

A recent example is Unilever Ventures backing ClayCo Cosmetics with $2 million in a Series A round, which directly boosts the need for PETG-based containers, bottles, and display packaging. As more startups move toward premium-looking and eco-friendly packaging, PETG remains one of the most preferred materials because it offers both safety and visual appeal.

Restraining Factors

Growing Environmental Concerns Limit PETG Expansion

A key restraining factor for the Polyethylene Terephthalate Glycol (PETG) market is the increasing pressure from environmental concerns and stricter rules around plastic usage. Even though PETG is recyclable, many regions still face limited collection and processing infrastructure, causing brands to think twice before expanding PETG-based packaging.

As sustainability goals tighten, companies look for materials with lower environmental impact, slowing PETG adoption in some sectors. At the same time, rapid digital shifts and beauty-tech growth—such as Kult raising $20 million in a funding round led by M3M Family Office—push brands toward tech-driven, minimal-packaging models. This shift encourages alternative packaging formats, indirectly reducing PETG’s growth potential despite its performance benefits.

Growth Opportunity

Expanding Beauty Packaging Needs Create Opportunity

A major growth opportunity for the Polyethylene Terephthalate Glycol (PETG) market comes from the fast-growing beauty and personal care industry, where brands are constantly seeking clearer, premium, and safer packaging options. PETG fits this shift perfectly because it offers strong transparency, durability, and an upscale look without being fragile. As beauty companies expand, their packaging needs rise sharply.

A recent boost came when SUGAR Cosmetics raised ₹41 crore ($5 million), enabling new product launches and wider retail presence. This naturally increases demand for PETG bottles, compacts, applicators, and display components. With more beauty labels investing in innovation and premium design, PETG stands to gain strong long-term opportunities.

Latest Trends

Shift Toward Premium Aesthetic Packaging Materials

One of the latest trends in the Polyethylene Terephthalate Glycol (PETG) market is the rapid shift toward premium, aesthetically appealing packaging across beauty and personal care categories. Brands want packaging that looks luxurious, feels sturdy, and remains clear even after repeated handling, and PETG fits these expectations perfectly.

Its ability to offer crystal visibility and smooth shaping has made it a preferred material for high-end product lines. This trend grows stronger as beauty brands scale with fresh investments. A recent example is Pilgrim securing Rs 200 crore funding at a Rs 3,000 crore pre-money valuation, enabling wider launches and upgraded packaging formats. Such expansions directly increase demand for PETG-based components in modern, premium beauty packaging.

Regional Analysis

North America held a 43.10% share, reaching USD 0.7 Bn in PETG demand.

In 2024, North America dominated the Polyethylene Terephthalate Glycol (PETG) Market with a 43.10% share, valued at USD 0.7 Bn, supported by strong demand for premium packaging, expanding personal care products, and growing use of PETG in food and beverage containers. The region’s advanced manufacturing base and high adoption of transparent, durable packaging formats further strengthened its leadership position.

Europe followed with steady usage across cosmetics, pharmaceuticals, and industrial applications, driven by strict quality standards and rising interest in recyclable materials. Asia Pacific showed increasing consumption of PETG due to expanding consumer goods markets and greater investment in modern packaging technologies across key economies.

The Middle East & Africa demonstrated gradual uptake as food, beverage, and retail sectors modernized packaging formats. Latin America continued to adopt PETG steadily, supported by rising demand for clear, impact-resistant packaging in growing personal care and household product categories.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Eastman continued to play a central role in shaping the Polyethylene Terephthalate Glycol (PETG) market, supported by its long-standing expertise in specialty polymers. The company’s focus on consistent product quality and reliable global supply helped brands in packaging, medical devices, and consumer goods maintain stable production. Eastman’s long-term emphasis on developing clear, durable, and easily processed PETG grades strengthened its position among manufacturers seeking premium material performance.

SK Chemicals maintained strong relevance in the PETG landscape by expanding its presence across high-value applications. Its commitment to advanced polymer technologies allowed the company to meet rising demand for transparent, impact-resistant materials in cosmetics, electronics, and lifestyle products. SK Chemicals continued to benefit from growing interest in recyclable and environmentally aligned plastics, positioning its PETG offerings as dependable solutions for modern packaging needs.

Henan Yinjinda New Materials reinforced its influence through competitive manufacturing capabilities and a sharper focus on quality improvements. The company supported a growing customer base across packaging and industrial sectors by offering PETG grades designed for consistent clarity and processing stability. Its role became more prominent as demand from regional converters increased, enabling it to contribute meaningfully to the overall supply balance of the global PETG market.

Top Key Players in the Market

- Eastman

- SK Chemicals

- Henan Yinjinda New Materials

- PolimexSrl

- Magical Film Enterprises

- Allen Plastic Industries

Recent Developments

- In January 2025, Eastman achieved a milestone: eight of its specialty PET resins — including grades compatible with PET and packaging applications — received approval from RecyClass for recyclability in Europe.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Extruded Grade, Injection Molding Grade, Blow Molding Grade), By Application (Prototypes, Containers and Packaging, Tools, Jigs, Fixtures, Equipment and Machinery, Others), By End-Use (Food and Beverage, Cosmetics, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eastman, SK Chemicals, Henan Yinjinda New Materials, PolimexSrl, Magical Film Enterprises, Allen Plastic Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyethylene Terephthalate Glycol (Petg) MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Polyethylene Terephthalate Glycol (Petg) MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eastman

- SK Chemicals

- Henan Yinjinda New Materials

- PolimexSrl

- Magical Film Enterprises

- Allen Plastic Industries