Global Polyethylene Glycol Market Size, Share, And Business Benefits By Grade (Pharmaceutical Grade, Industrial Grade, Cosmetic Grade, Food Grade), By Source (Ethylene Oxide, Ethylene Dichloride, Ethylene Glycol), By Application (Medical, Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149918

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

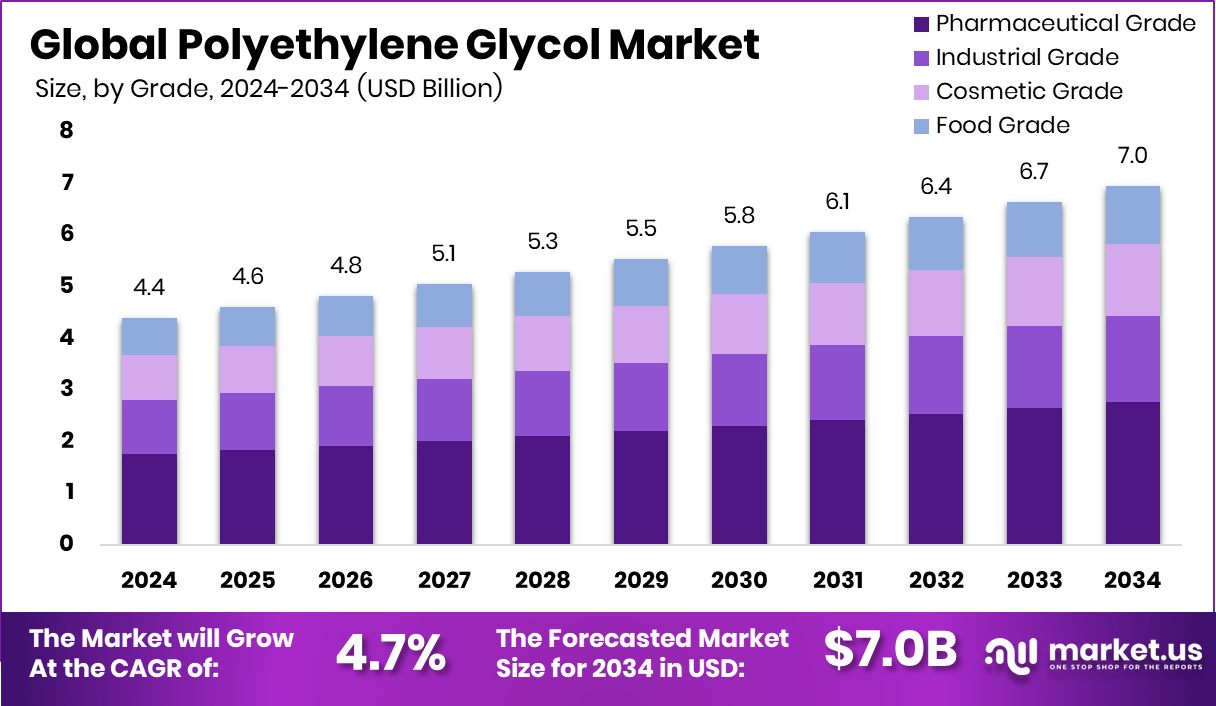

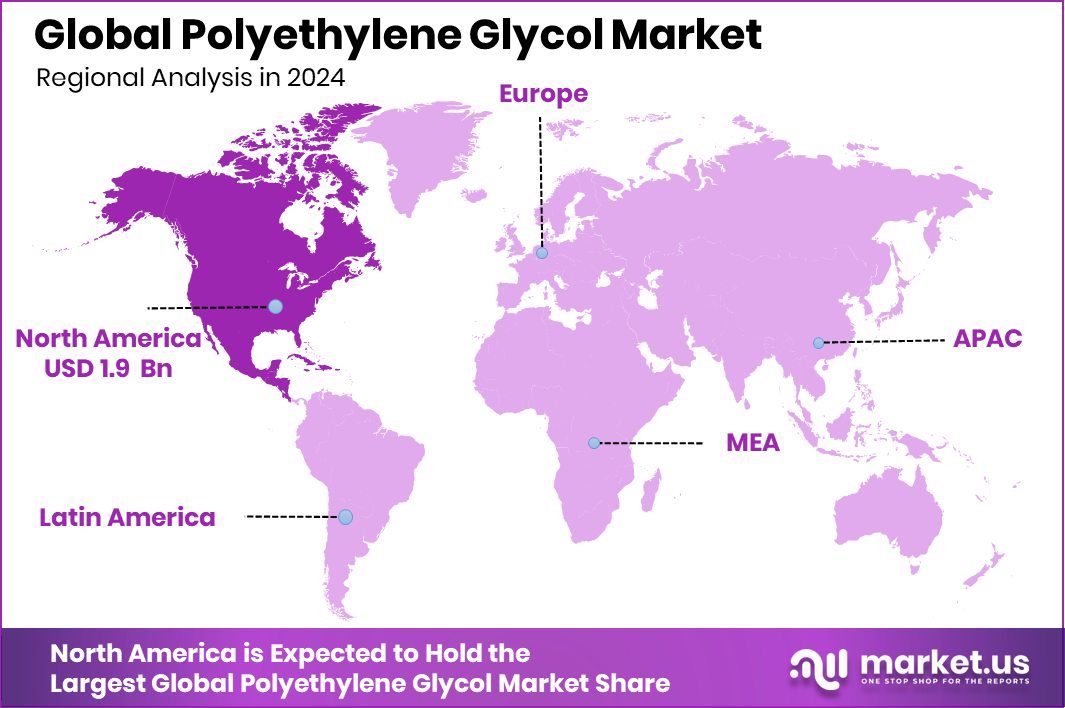

Global Polyethylene Glycol Market is expected to be worth around USD 7.0 billion by 2034, up from USD 4.4 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034. With USD 1.9 Bn revenue, North America dominated at 44.6% market share.

Polyethylene Glycol (PEG) is a synthetic, water-soluble polymer made by polymerizing ethylene oxide. It comes in various molecular weights, making it highly versatile across industries. PEG is odorless, non-toxic, and non-irritating, so it’s widely used in pharmaceuticals, cosmetics, industrial processing, and food products. Depending on the application, its solubility in water and many organic solvents allows it to act as a binding agent, dispersing agent, or stabilizer.

The polyethylene glycol market refers to the global demand, supply, and applications of PEG across different sectors. The market spans pharmaceuticals, personal care, chemical processing, and construction. It is shaped by industrial needs, regulatory approvals, and ongoing research into new applications of PEG. PEG’s multifunctionality has made it a staple in many formulations, whether for drug delivery systems or surface coatings.

One of the key growth factors is the rising need for PEG in drug formulation. With increasing chronic diseases and an aging population, pharmaceutical companies are relying on PEG for improved drug solubility and controlled release mechanisms. Demand is also increasing from the personal care and cosmetic industries, where PEGs are used in creams, lotions, shampoos, and cleansers due to their emulsifying and moisture-retention properties.

Key Takeaways

- Global Polyethylene Glycol Market is expected to be worth around USD 7.0 billion by 2034, up from USD 4.4 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034.

- In 2024, Pharmaceutical Grade dominated the Polyethylene Glycol Market with a strong 39.8% share.

- Ethylene Oxide-sourced Polyethylene Glycol accounted for 67.3%, leading the market by raw material preference.

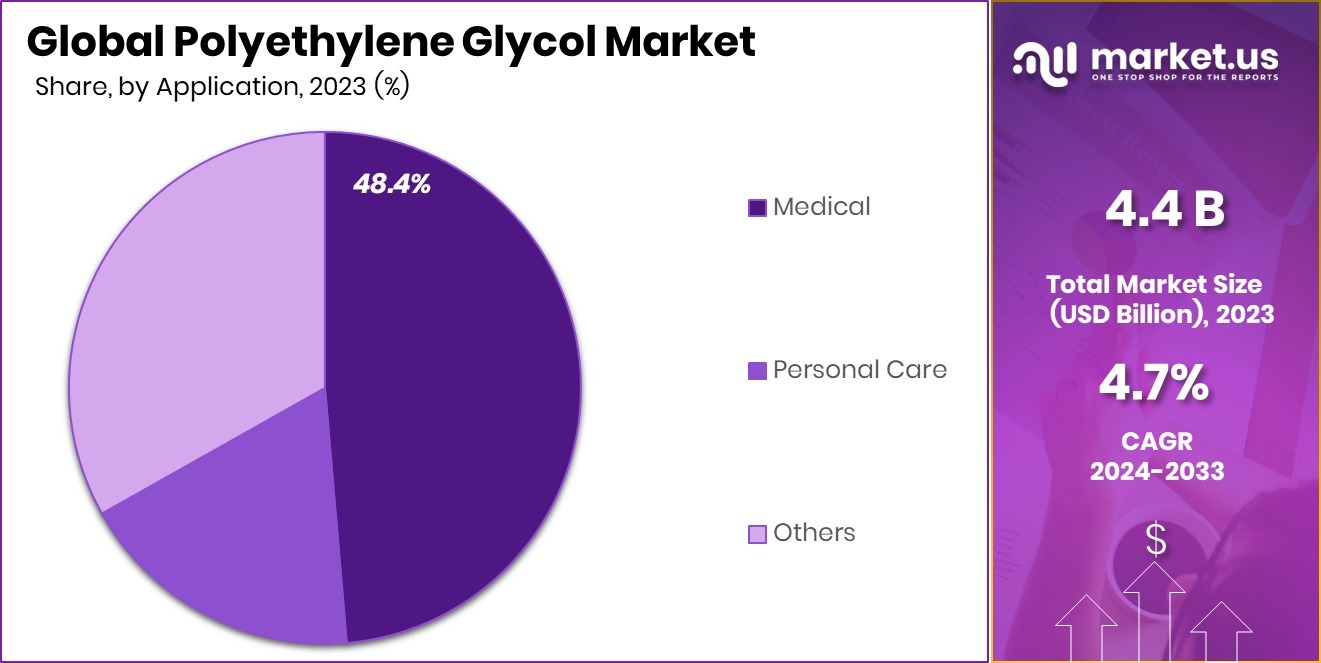

- Medical applications held a commanding 48.4% market share, highlighting healthcare’s heavy reliance on PEG products.

- North America’s Polyethylene Glycol Market reached USD 1.9 Bn, accounting for 44.6% share.

By Grade Analysis

Pharmaceutical grade held a 39.8% share in the polyethylene glycol market in 2024.

In 2024, Pharmaceutical Grade held a dominant market position in the By Grade segment of the Polyethylene Glycol Market, with a 39.8% share. This leadership can be attributed to the rising demand for PEG in drug formulations, particularly in oral, topical, and parenteral delivery systems.

Its ability to enhance the solubility and stability of active pharmaceutical ingredients (APIs) has made it an essential excipient in modern drug development. Moreover, the increasing prevalence of chronic diseases, coupled with an aging global population, has intensified the need for efficient drug delivery vehicles, further driving the consumption of pharmaceutical-grade PEG.

The regulatory acceptance of PEG in pharmaceutical applications across major markets such as the U.S., Europe, and Asia has also reinforced its position in the segment. PEG’s inertness, non-toxicity, and compatibility with other ingredients make it suitable for both over-the-counter and prescription medicines.

In addition, its use in manufacturing laxatives, ointments, and injectable formulations has expanded due to its favorable safety profile and consistency in performance. As innovation in biopharmaceuticals continues to grow, pharmaceutical-grade PEG is expected to maintain its leading role, especially with rising investment in PEGylated drug formulations and advanced delivery mechanisms across global healthcare systems.

By Source Analysis

Ethylene oxide sources dominated with a 67.3% share in the Polyethylene Glycol Market.

In 2024, Ethylene Oxide held a dominant market position in the By Source segment of the Polyethylene Glycol Market, with a 67.3% share. This dominance is primarily driven by its widespread industrial availability, cost-effectiveness, and well-established synthesis process.

Ethylene oxide acts as a fundamental raw material in the production of PEG, enabling a highly controlled polymerization process that delivers consistent molecular weights and product quality. The reliability of this feedstock continues to support large-scale manufacturing across pharmaceuticals, cosmetics, and industrial sectors.

The preference for ethylene oxide-based PEG is further strengthened by its compatibility with existing production infrastructure, allowing manufacturers to scale operations without major technological shifts. Additionally, the regulatory familiarity with ethylene oxide-based PEG products in pharmaceutical and personal care formulations has reinforced its use, especially in regions with strict quality standards such as North America and Europe.

Despite increasing conversations around greener alternatives, ethylene oxide remains the backbone of commercial PEG production due to its efficiency and versatility in creating PEGs with varied viscosities and applications.

By Application Analysis

Medical applications accounted for 48.4% of the total Polyethylene Glycol Market share.

In 2024, Medical held a dominant market position in the By Application segment of the Polyethylene Glycol Market, with a 48.4% share. The segment’s strong performance is mainly driven by the widespread use of PEG in pharmaceutical formulations, including laxatives, drug delivery systems, and injectable solutions.

Its chemical stability, water solubility, and low toxicity make it a preferred excipient in tablets, capsules, creams, and intravenous products. The medical industry continues to rely on PEG for its role in improving bioavailability and modifying drug release profiles, especially in chronic therapies.

The rising prevalence of lifestyle-related and age-related conditions such as constipation, arthritis, and cardiovascular diseases has boosted the demand for PEG-based medications. In particular, PEG’s use in bowel preparation solutions and as a component in PEGylated drugs has gained further traction in hospitals and clinics.

Additionally, PEG’s approval by global health authorities for various medical uses has increased its adoption across developed and developing regions. With continued advancements in pharmaceutical and biopharmaceutical research, the medical application of polyethylene glycol is expected to remain at the forefront, reinforcing its leading share in this segment.

Key Market Segments

By Grade

- Pharmaceutical Grade

- Industrial Grade

- Cosmetic Grade

- Food Grade

By Source

- Ethylene Oxide

- Ethylene Dichloride

- Ethylene Glycol

By Application

- Medical

- Personal Care

- Others

Driving Factors

Growing Use of PEG in Drug Formulations

One of the biggest driving factors for the polyethylene glycol (PEG) market is its increasing use in making medicines. PEG is used by pharmaceutical companies to help drugs dissolve better, last longer in the body, and work more effectively. It is commonly used in tablets, capsules, ointments, and even injections.

Doctors also prefer PEG-based products for treating constipation and for preparing patients before medical procedures like colonoscopies. As more people need long-term treatments for chronic diseases like diabetes, cancer, and heart problems, the demand for PEG in medicines is rising. The global rise in aging population and healthcare spending also adds to this demand, making the medical field a strong and steady driver for PEG market growth.

Restraining Factors

Health and Environmental Concerns Limit PEG Usage

A key restraining factor for the polyethylene glycol (PEG) market is the growing concern about its health and environmental impact. Although PEG is widely considered safe, some studies have raised questions about its use in certain personal care or cosmetic products, especially when used over long periods or on sensitive skin. In rare cases, allergic reactions have been reported.

On the environmental side, PEG is derived from petroleum-based ethylene oxide, which is not biodegradable and may contribute to pollution. These concerns have led to stricter regulations in some countries and a growing demand for natural or eco-friendly alternatives. As awareness increases, companies may face pressure to reformulate products, slowing down PEG market expansion in some regions.

Growth Opportunity

Rising Demand for Bio-Based PEG Solutions

A major growth opportunity for the polyethylene glycol (PEG) market lies in the development of bio-based PEG. As people and companies become more environmentally conscious, there is a clear shift toward sustainable and eco-friendly materials.

Traditional PEG is made using petroleum-based chemicals, but bio-based PEG is produced from renewable plant sources, making it safer for the environment. This shift is especially important in cosmetics, food, and healthcare sectors, where customers prefer natural ingredients.

With governments encouraging green manufacturing and companies investing in clean technologies, the market for bio-based PEG is expected to grow steadily. Adopting these greener alternatives not only reduces carbon footprints but also helps businesses stand out in a competitive and eco-aware global market.

Latest Trends

PEGylation Enhances Drug Delivery Efficiency

A notable trend in the polyethylene glycol (PEG) market is the increasing adoption of PEGylation in drug development. PEGylation involves attaching PEG molecules to therapeutic agents, enhancing their stability, solubility, and circulation time in the body.

This modification reduces immunogenicity and improves the pharmacokinetics of drugs, making treatments more effective and patient-friendly. The technique is particularly beneficial for protein-based drugs and has been instrumental in developing long-acting formulations, reducing dosing frequency, and improving patient compliance.

As the demand for advanced drug delivery systems grows, PEGylation stands out as a key innovation driving the pharmaceutical sector. This trend underscores PEG’s critical role in modern medicine, offering opportunities for growth in the PEG market.

Regional Analysis

In 2024, North America held a 44.6% share in the Polyethylene Glycol Market, USD 1.9 Bn.

In 2024, North America dominated the global Polyethylene Glycol Market, accounting for 44.6% of the total market share and generating USD 1.9 billion in revenue. The region’s leadership is supported by its strong pharmaceutical manufacturing base, growing demand for PEG-based medical products, and widespread application in personal care formulations.

High healthcare spending in the U.S. and Canada continues to boost PEG adoption in drug formulations and over-the-counter medications. Europe followed with steady demand due to the region’s well-established cosmetic and pharmaceutical industries, along with regulatory approvals supporting PEG usage in multiple applications.

Asia Pacific showed rising consumption, particularly in countries like China and India, where rapid industrialization and expanding healthcare sectors are driving PEG integration in formulations. The Middle East & Africa and Latin America regions represented smaller market shares, with demand mainly concentrated in pharmaceutical imports and localized cosmetic production.

However, these regions show potential for future growth as infrastructure and healthcare investments rise. While North America leads in revenue and percentage share, ongoing industrial growth in Asia Pacific is expected to challenge this dominance in the long term. Overall, regional demand for polyethylene glycol is shaped by economic maturity, industry structure, and regulatory acceptance across end-use sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF maintains a strong position in the PEG market through its diversified chemical portfolio and strategic investments. In 2024, BASF reported sales of €65.3 billion. The company’s focus on high-growth markets is evident in its establishment of a new Verbund site in Zhanjiang, China, designed as a pilot project for sustainability. This site is set to operate using 100% renewable electricity starting in 2025, aligning with BASF’s commitment to green transformation.

LOTTE Chemical has expanded its global footprint, with operations in the US, China, Japan, and Turkey, distributing products to over 120 countries. In 2024, the company reported consolidated sales of KRW 20.43 trillion. LOTTE’s diverse petrochemical product line, including polyethylene glycol, supports its presence in the global market.

Croda International Plc focused on its Consumer Care segment, which remained stable with reported sales of £237 million in Q1 2024, matching the previous year’s performance. The company emphasized its commitment to sustainability and innovation in specialty chemicals, aligning with the growing demand for eco-friendly PEG applications in personal care products.

Top Key Players in the Market

- BASF

- Dow Chemical Company

- LOTTE CHEMICAL

- Ineos

- Croda

- Liaoning Oxiranchem

- Liaoning Kelong

- Jiangsu Haian Petrochemical Plant

- Shanghai Bronkow Chemical

- Taijie Chemical

- Huangma Chemical

- India Glycols

Recent Developments

- In May 2025, LOTTE Chemical announced plans to commence operations at its new cracker facility in Cilegon, Indonesia, during the second half of the year. This facility, with a production capacity of 1 million metric tons of ethylene annually, is a significant component of LOTTE’s $3.95 billion investment in the region.

- In March 2025, BASF signed an agreement with Braven Environmental to use recycled materials in its production process. Braven will supply BASF with PyChem®, a product made from recycled plastic waste.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 7.0 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Pharmaceutical Grade, Industrial Grade, Cosmetic Grade, Food Grade), By Source (Ethylene Oxide, Ethylene Dichloride, Ethylene Glycol), By Application (Medical, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Dow Chemical Company, LOTTE CHEMICAL, Ineos, Croda, Liaoning Oxiranchem, Liaoning Kelong, Jiangsu Haian Petrochemical Plant, Shanghai Bronkow Chemical, Taijie Chemical, Huangma Chemical, India Glycols Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyethylene Glycol MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Polyethylene Glycol MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Dow Chemical Company

- LOTTE CHEMICAL

- Ineos

- Croda

- Liaoning Oxiranchem

- Liaoning Kelong

- Jiangsu Haian Petrochemical Plant

- Shanghai Bronkow Chemical

- Taijie Chemical

- Huangma Chemical

- India Glycols