Global Polyester Fiber Market By Type (Polyester Staple Fiber (PSF), Polyester Filament Yarn (PFY)), By Source (Virgin, Recycled And Blended), By Grade (Polyethylene Terephthalate (PET) Polyester, PCDT Polyester), By Form ( Solid, Hollow), By Application (Apparel, Home textiles, Carpets And Rugs, Non-woven Fabrics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151033

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

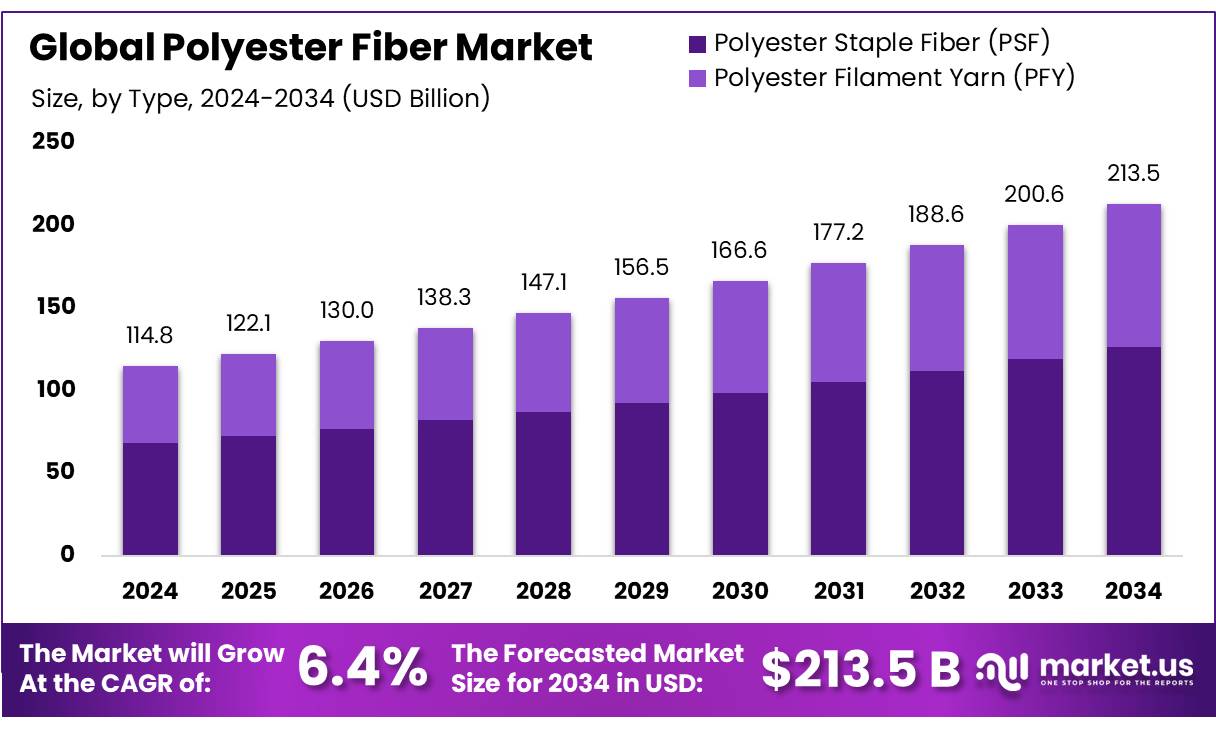

The Global Polyester Fiber Market size is expected to be worth around USD 213.5 Billion by 2034, from USD 114.8 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The polyester fiber industry is a cornerstone of the global textile sector, encompassing both virgin and recycled materials. In India, the market is experiencing significant growth, driven by domestic demand, export opportunities, and supportive government policies.

India’s polyester fiber industry is characterized by a robust production capacity and a diverse range of applications. According to the Ministry of Textiles, the country produces approximately 1,700 million kg of man-made fibers and 3,400 million kg of man-made filaments annually. Notably, Surat, Gujarat, stands out as a major hub, accounting for 60% of India’s polyester cloth production. The industry faces challenges such as rising demand, import dependency, and the need for technological upgrades to enhance competitiveness in the global market.

Several factors are driving the growth of the polyester fiber industry in India. The increasing demand for man-made fibers (MMFs) in the textile sector, driven by changing consumer preferences and the need for cost-effective materials, is a primary catalyst.

Additionally, the government’s strategic initiatives, such as the Production Linked Incentive (PLI) scheme, aim to bolster domestic manufacturing capabilities. The PLI scheme, with an approved outlay of ₹10,683 crore, incentivizes the production of MMF apparel, fabrics, and technical textiles, thereby enhancing the sector’s competitiveness.

Government Initiatives Indian government has implemented policies to support the synthetic fiber industry, including the Production-Linked Incentive (PLI) scheme. As of June 2024, 64 proposals worth ₹198 billion have been approved under the PLI scheme to promote the production of man-made fiber fabrics, garments, and technical textiles. Infrastructure Development PM Mega Integrated Textile Region and Apparel (PM MITRA) scheme aims to establish seven mega textile parks with an outlay of ₹4,445 crore. These parks are expected to reduce logistics costs, enhance competitiveness, and create employment opportunities.

Key Takeaways

- Polyester Fiber Market size is expected to be worth around USD 213.5 Billion by 2034, from USD 114.8 Billion in 2024, growing at a CAGR of 6.4%.

- Polyester Staple Fiber (PSF) held a dominant market position, capturing more than a 59.3% share of the global polyester fiber market.

- Virgin held a dominant market position, capturing more than a 68.1% share of the global polyester fiber market.

- Polyethylene Terephthalate (PET) Polyester held a dominant market position, capturing more than a 92.9% share in the global polyester fiber market.

- Solid held a dominant market position, capturing more than a 69.4% share in the global polyester fiber market.

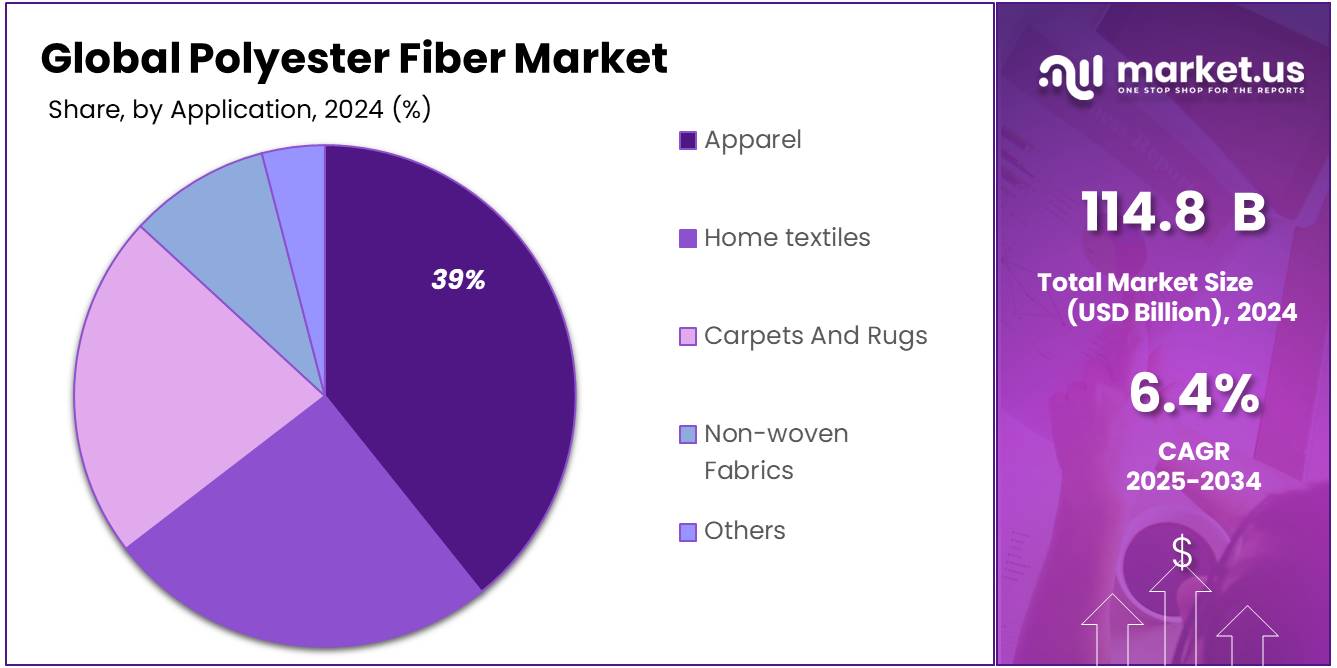

- Apparel held a dominant market position, capturing more than a 38.8% share in the global polyester fiber market.

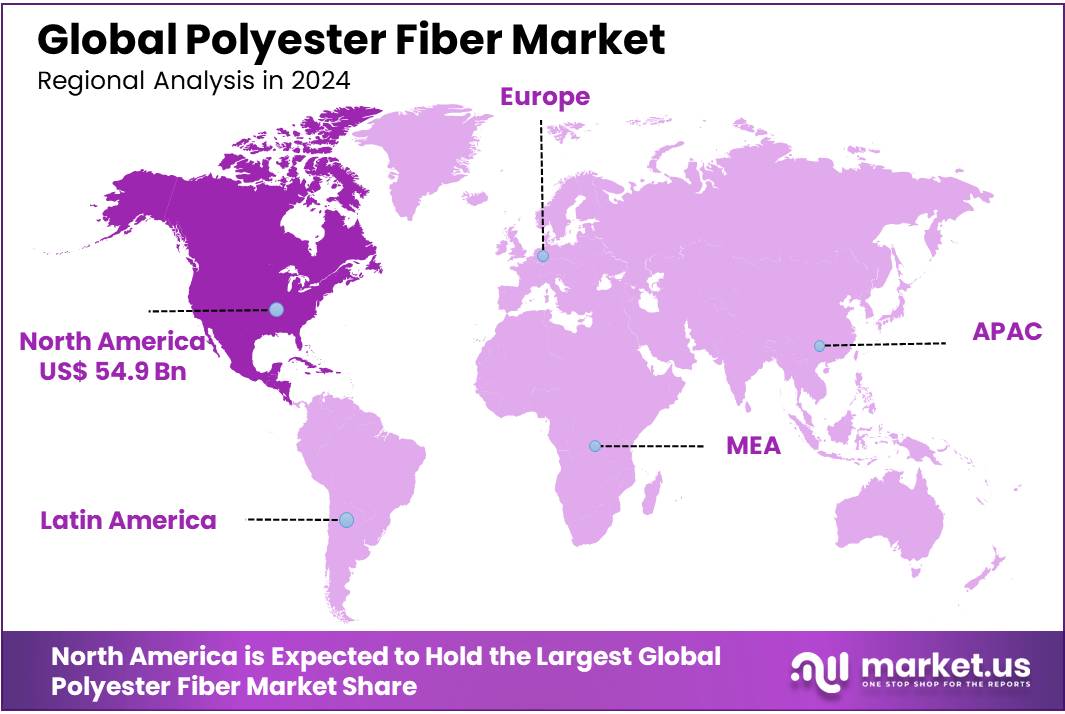

- North America emerged as the leading region in the global polyester fiber industry, contributing nearly half of the total market share at 47.9%, equivalent to roughly USD 54.9 billion.

By Type

Polyester Staple Fiber (PSF) leads with 59.3% share owing to its cost-efficiency and wide usage in textiles and fillings.

In 2024, Polyester Staple Fiber (PSF) held a dominant market position, capturing more than a 59.3% share of the global polyester fiber market. This segment continued to see strong demand due to its versatility, especially in textile manufacturing, non-woven fabrics, home furnishings, and stuffing applications such as pillows and cushions.

PSF is widely preferred because of its lower production cost and easier recyclability compared to other polyester types. Its lightweight properties, moisture resistance, and ease of blending with natural fibers further added to its popularity. In 2025, the PSF segment is expected to maintain its lead, driven by increasing adoption in emerging markets across Asia and continued focus on eco-friendly and recycled fiber production.

By Source

Virgin Polyester dominates with 68.1% share due to its consistent quality and high demand in primary textile production.

In 2024, Virgin held a dominant market position, capturing more than a 68.1% share of the global polyester fiber market by source. The dominance of virgin polyester is largely due to its stable physical properties, uniform quality, and wide availability, making it the preferred choice for large-scale textile manufacturing.

It is extensively used in apparel, automotive textiles, industrial fabrics, and home furnishings, where durability and strength are critical. While recycled polyester is gaining attention, many manufacturers still rely on virgin fibers for performance-intensive applications. Looking ahead to 2025, virgin polyester is expected to retain its lead, although the gap may narrow slightly as sustainability goals and government-led recycling initiatives continue to gain ground.

By Grade

Polyethylene Terephthalate (PET) Polyester dominates with 92.9% share due to its strength, recyclability, and versatility across industries.

In 2024, Polyethylene Terephthalate (PET) Polyester held a dominant market position, capturing more than a 92.9% share in the global polyester fiber market by grade. PET continues to be the most widely used polyester grade because of its high tensile strength, dimensional stability, and resistance to chemicals and moisture. These properties make it ideal for both textile applications and industrial uses such as packaging, automotive fabrics, and geotextiles.

Its compatibility with recycling technologies has also made it a favored choice among manufacturers moving toward sustainability. In 2025, the PET polyester segment is expected to maintain its overwhelming lead, supported by increasing demand for durable, lightweight materials across sectors and growing infrastructure for PET recycling.

By Form

Solid Polyester dominates with 69.4% share due to its strong structure and wide use in apparel and industrial textiles.

In 2024, Solid held a dominant market position, capturing more than a 69.4% share in the global polyester fiber market by form. Solid polyester fibers are widely used in clothing, upholstery, carpets, and technical textiles because of their higher strength, firmness, and resistance to deformation. These fibers provide better durability and aesthetic appeal in finished products, making them the preferred choice for end-use industries.

Solid form also offers better dye absorption and fabric stability, which supports its large-scale adoption in textile mills. Moving into 2025, the solid segment is expected to maintain its dominance, especially with growing demand from fashion and home furnishing sectors in Asia-Pacific and North America.

By Application

Apparel segment leads with 38.8% share owing to high demand for lightweight, durable, and affordable fabrics.

In 2024, Apparel held a dominant market position, capturing more than a 38.8% share in the global polyester fiber market by application. Polyester fiber remains a top choice for clothing manufacturers due to its wrinkle resistance, ease of care, and cost efficiency. It is widely used in everyday wear, sportswear, outerwear, and fashion garments, offering versatility across all clothing categories.

As consumer preference shifts toward performance-based fabrics, polyester’s moisture-wicking and quick-drying features have boosted its presence, especially in activewear. By 2025, the apparel segment is expected to retain its leadership, supported by growing urban populations, rising disposable incomes, and the continuous expansion of fast fashion across Asia, Latin America, and Africa.

Key Market Segments

By Type

- Polyester Staple Fiber (PSF)

- Polyester Filament Yarn (PFY)

By Source

- Virgin

- Recycled And Blended

By Grade

- Polyethylene Terephthalate (PET) Polyester

- PCDT Polyester

By Form

- Solid

- Hollow

By Application

- Apparel

- Home textiles

- Carpets And Rugs

- Non-woven Fabrics

- Others

Drivers

Increasing Demand for Sustainable and Eco-friendly Products

One of the major driving factors for the polyester fiber market is the rising consumer demand for sustainable and eco-friendly products. Polyester, being a versatile and durable material, is increasingly being recognized for its potential to be recycled, making it an attractive choice in industries such as apparel, home furnishings, and automotive. This demand has been particularly influenced by the global push towards sustainability and reducing the environmental impact of textile production.

Governments around the world are playing a crucial role in promoting sustainability through various initiatives. For example, the European Union has been actively pushing for the recycling of textile fibers as part of its circular economy plan, which encourages the reduction of waste and the reuse of materials. According to the European Commission, textiles account for a significant portion of waste in the EU, and initiatives like the Circular Economy Action Plan are pushing for sustainable production practices. These regulations are driving textile manufacturers to invest in technologies that promote recycling and reduce reliance on virgin polyester fibers.

Additionally, many global brands are adopting sustainable practices by integrating recycled polyester into their supply chains. For instance, in 2020, Patagonia, a well-known outdoor clothing brand, reported that nearly 80% of its garments contained some form of recycled polyester. Such examples highlight how the shift toward sustainable materials is reshaping the polyester fiber market. This is not just a trend but an ongoing transformation in the textile and fashion industries, with governments and businesses aligning on the need for more eco-conscious choices.

Restraints

Environmental Concerns Regarding Polyester Fiber Production

A significant restraining factor for the polyester fiber market is the environmental concerns associated with its production. While polyester is a popular choice for its durability and versatility, the process of manufacturing it has raised alarms due to its significant environmental impact. Polyester is derived from petroleum-based products, and its production releases a large amount of carbon dioxide and other greenhouse gases into the atmosphere. According to the United Nations Environment Programme (UNEP), the textile industry is one of the largest polluting industries globally, contributing approximately 10% of global carbon emissions. This makes polyester production a focal point of environmental scrutiny.

Additionally, the polyester fiber manufacturing process consumes large amounts of water and energy, which exacerbates its environmental footprint. In the fashion industry, where polyester is heavily used, concerns over microplastic pollution also arise. During washing, polyester garments shed microfibers that can enter oceans and water systems, posing a threat to marine life. The UNEP has reported that plastic microfibers are now one of the most common types of ocean pollution, with textile fibers being a key contributor.

Governments and environmental organizations are increasingly pushing for more sustainable practices in the textile sector. For example, the United Nations’ Sustainable Development Goals (SDGs) advocate for responsible consumption and production patterns, which include reducing the environmental impact of textile manufacturing. As a result, some countries have implemented stricter environmental regulations, requiring brands and manufacturers to adopt cleaner and more sustainable alternatives.

Opportunity

Growth in Demand for Recycled Polyester

A major growth opportunity for the polyester fiber market lies in the rising demand for recycled polyester. As sustainability becomes a priority for both consumers and businesses, the adoption of recycled polyester is gaining momentum. The increasing awareness of environmental issues, such as plastic pollution and resource depletion, is pushing industries to seek out more eco-friendly alternatives. Recycled polyester, made from post-consumer plastic bottles and textile waste, offers a sustainable solution by reducing the need for virgin polyester and lowering the carbon footprint of polyester production.

Global brands, including food packaging industries, are also beginning to integrate recycled polyester into their supply chains. Major food and beverage companies, such as Coca-Cola and PepsiCo, have committed to using recycled materials in their packaging. Coca-Cola, for instance, announced plans to make its bottles from 50% recycled PET by 2030. These companies are not only reducing their environmental impact but also responding to the increasing consumer demand for sustainable packaging options. The food industry’s commitment to using recycled polyester aligns with the broader movement towards a circular economy and offers a lucrative growth opportunity for the polyester fiber market.

Trends

Adoption of Recycled Polyester in Sustainable Food Packaging

A notable trend in the polyester fiber market is the increasing incorporation of recycled polyester (rPET) into sustainable food packaging solutions. This shift is driven by growing consumer demand for eco-friendly products and stringent government regulations aimed at reducing plastic waste.

In 2023, over 60 billion PET bottles were diverted from landfills globally and repurposed into polyester fibers through mechanical and chemical recycling methods. This initiative not only addresses plastic waste but also supports the circular economy by reusing materials that would otherwise contribute to environmental pollution .

Governments worldwide are implementing policies to encourage the use of recycled materials in packaging. For instance, the European Union’s Circular Economy Action Plan promotes the recycling of textile fibers, including polyester, as part of its strategy to reduce waste and promote sustainable production practices.

Similarly, Canada’s investment of over $3.3 million in 2024 supports organizations developing innovative solutions to address plastic waste and pollution, further emphasizing the importance of recycling in achieving sustainability goals .

The food industry is responding to these trends by adopting rPET in packaging. Major companies are setting ambitious targets to increase the use of recycled materials in their products. For example, Coca-Cola aims to make its bottles from 50% recycled PET by 2030, aligning with global efforts to reduce plastic waste and promote sustainability.

Regional Analysis

North America dominates with a 47.9% share, representing approximately a USD 54.9 billion market in 2024.

In 2024, North America emerged as the leading region in the global polyester fiber industry, contributing nearly half of the total market share at 47.9%, equivalent to roughly USD 54.9 billion. This leadership is supported by a well-established textile infrastructure, combined with high consumption of polyester-based products in apparel, home furnishings, and technical textiles.

Technological innovation and sustainability initiatives are further boosting regional performance. North American manufacturers are rapidly integrating recycled and specialty polyester fibers—such as moisture-wicking and flame-resistant grades—to meet evolving standards and consumer preferences. Government programmes and private investments in recycling infrastructure are also contributing to the scaling of recycled polyester (rPET) production, reinforcing the region’s competitive edge.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Reliance is one of the world’s top polyester fiber and yarn producers, with an integrated annual capacity of approximately 2.5million tonnes. Operating across multiple sites—including Hazira, Dahej, and Jamnagar in India—the company spans the entire polyester value chain, from PTA and MEG production to PSF and PFY manufacturing. Strong in R&D via its fibre application centers, Reliance supplies global textile, apparel, home furnishing, and industrial markets. The focus on vertically integrated operations ensures cost advantage and stable quality.

Sarla is a specialized manufacturer and exporter of a wide range of polyester and nylon yarns. An ISO 9001:2015 certified exporter, the company delivers textured, twisted, dyed, high-tenacity, covered yarns and sewing threads to global apparel and industrial markets. Its product portfolio includes high-bulk textured yarns and specialty threads used in sportswear, hosiery, seat belts, and technical applications. With manufacturing in India and Europe (Sarla Europe), it balances export-focused growth with technical yarn innovation.

Rashni Poly Fiber is Bangladesh’s leading recycled polyester (rPET) PSF producer, offering solid and hollow conjugated fibres in various deniers and lengths. Positioned to support the country’s garment industry, the company utilizes mechanical PET recycling to offer GRS-certified, high-tenacity fibers—e.g., 1.4D/38 mm—with 6.8 GPD tenacity. Located in Srimangal, Dhaka, it reflects a purpose-driven approach toward sustainability and backward integration in the regional textile ecosystem.

Top Key Players in the Market

- Reliance Industries Limited

- Sarla Performance Fibers Limited

- Märkische Faser GmbH

- Rashni Poly Fiber Industries Ltd.

- Toray Industries Inc.

- Nirmal Fibers (P) Ltd

- Indorama Ventures Public Company Limited

- Stein Fibers LTD.

- Green Group S.A.

- Kayavlon

- Diyou Fiber (M) Sdn Bhd

- Swicofil AG

- Sinopec Yizheng Chemical Fiber Limited Liability Company

- Alpek S.A.B. de C.V.

Recent Developments

In 2024 Reliance Industries Limited, held a 45% market share in India’s polyester production and a 4% share worldwide, underscoring its significant influence.

In 2024 Märkische Faser GmbH, company maintained a production capacity of approximately 55,000 tonnes per year, positioning itself as a leading producer in Europe.

Report Scope

Report Features Description Market Value (2024) USD 114.8 Bn Forecast Revenue (2034) USD 213.5 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyester Staple Fiber (PSF), Polyester Filament Yarn (PFY)), By Source (Virgin, Recycled And Blended), By Grade (Polyethylene Terephthalate (PET) Polyester, PCDT Polyester), By Form ( Solid, Hollow), By Application (Apparel, Home textiles, Carpets And Rugs, Non-woven Fabrics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Reliance Industries Limited, Sarla Performance Fibers Limited, Märkische Faser GmbH, Rashni Poly Fiber Industries Ltd., Toray Industries Inc., Nirmal Fibers (P) Ltd, Indorama Ventures Public Company Limited, Stein Fibers LTD., Green Group S.A., Kayavlon, Diyou Fiber (M) Sdn Bhd, Swicofil AG, Sinopec Yizheng Chemical Fiber Limited Liability Company, Alpek S.A.B. de C.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Reliance Industries Limited

- Sarla Performance Fibers Limited

- Märkische Faser GmbH

- Rashni Poly Fiber Industries Ltd.

- Toray Industries Inc.

- Nirmal Fibers (P) Ltd

- Indorama Ventures Public Company Limited

- Stein Fibers LTD.

- Green Group S.A.

- Kayavlon

- Diyou Fiber (M) Sdn Bhd

- Swicofil AG

- Sinopec Yizheng Chemical Fiber Limited Liability Company

- Alpek S.A.B. de C.V.