Global Polybutylene Terephthalate Market Size, Share, And Enhanced Productivity By Type (Industrial Grade, Commercial Grade), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By End Use Industry (Automotive, Extrusion Products, Electrical and Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167677

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

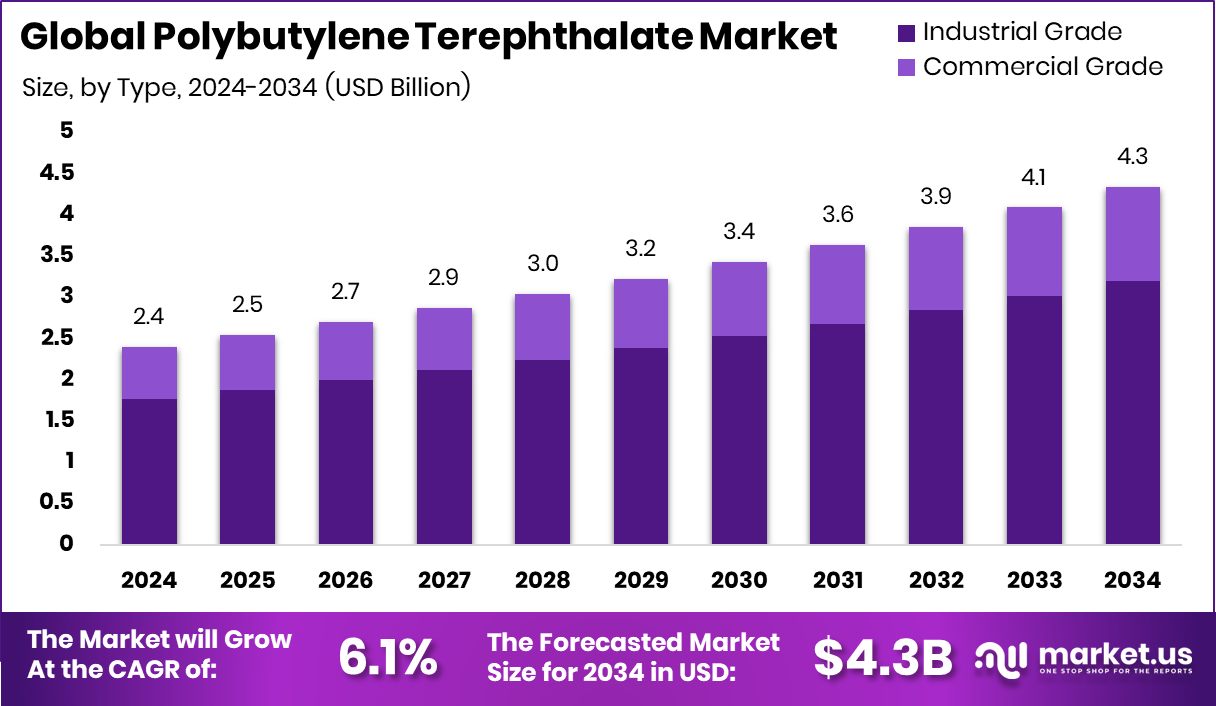

The Global Polybutylene Terephthalate Market is expected to be worth around USD 4.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. The growing automotive and electronics sectors continue supporting Asia Pacific’s 43.9% share leadership.

Polybutylene Terephthalate, often known as PBT, is an engineering thermoplastic used for electrical insulation, automotive parts, industrial machinery, and high-strength molded components. It offers strong dimensional stability, heat resistance, chemical resistance, and low moisture absorption, making it suitable for applications where durability and precision are important. Because of its processability and compatibility with fiber reinforcement, PBT continues to be used in connectors, switches, sensors, and molded housings.

The Polybutylene Terephthalate market reflects growing interest from industries looking for lightweight, high-performance materials that replace metals or heavier plastics. The push toward electric mobility and miniaturized electronics continues to influence its adoption, especially where flame resistance and mechanical stability are required. The market is also shaped by molding innovation, automation, and additive manufacturing, which help improve quality and reduce material waste.

Growth is influenced by stronger investment in manufacturing, reshoring, and modernization. Examples include Advanced Powder Products receiving $3 million in funding for expansion, two mold makers receiving $100K for additive technology, and $1.1 million in funding awarded in Broken Arrow for industrial expansion, showing confidence in advanced materials production.

Demand rises as automation and high-precision molding gain support. A recent highlight includes ATI Motors securing $10.85 million in Series A funding and $1.12 million awarded across nine companies for industrial modernization, encouraging faster scaling and advanced component design.

Opportunity builds as manufacturing investment continues, including a start-up receiving $20 million to restore injection molding capacity in the U.S. These funding activities open pathways for innovation in lightweight automotive parts, smart electronics, and customized industrial components, where PBT fits well due to its reliability and manufacturability.

Key Takeaways

- The Global Polybutylene Terephthalate Market is expected to be worth around USD 4.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- In the Polybutylene Terephthalate Market, Industrial Grade holds 73.8% due to its strength and manufacturing suitability.

- The Polybutylene Terephthalate Market shows Injection Molding at 58.4%, driven by precision parts and scalable production.

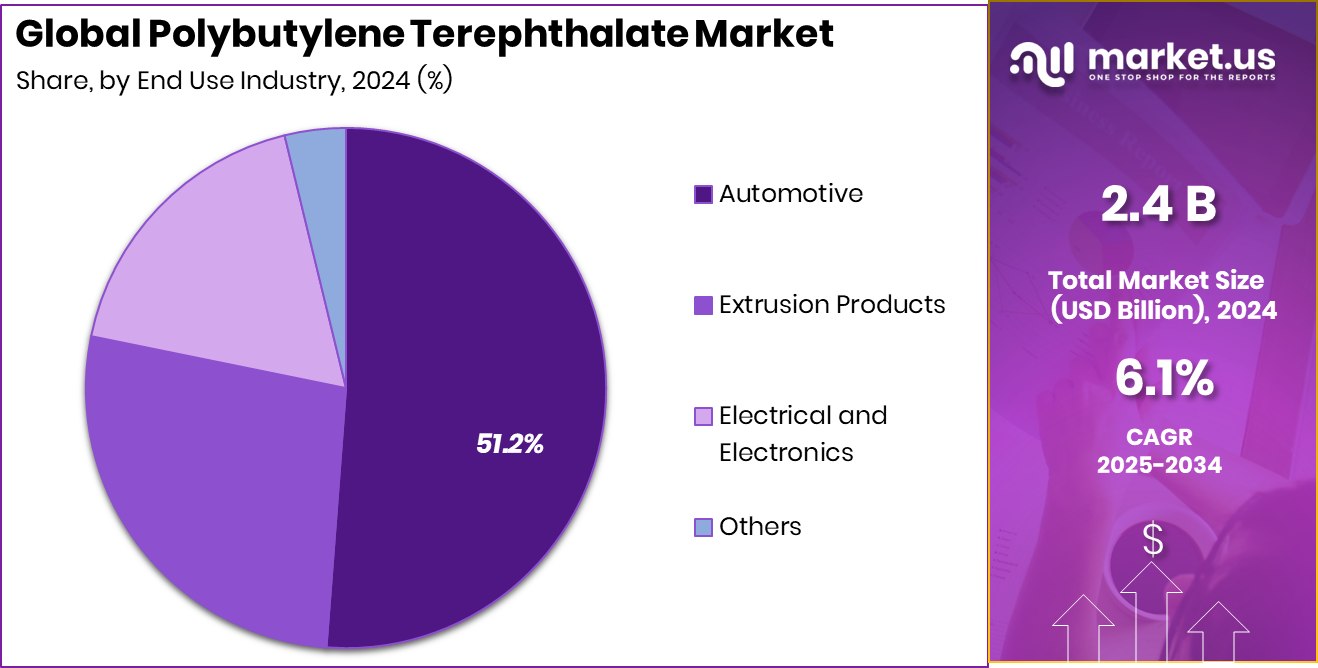

- In the Polybutylene Terephthalate Market, Automotive leads with 51.2%, supported by lightweight components and electric vehicle growth.

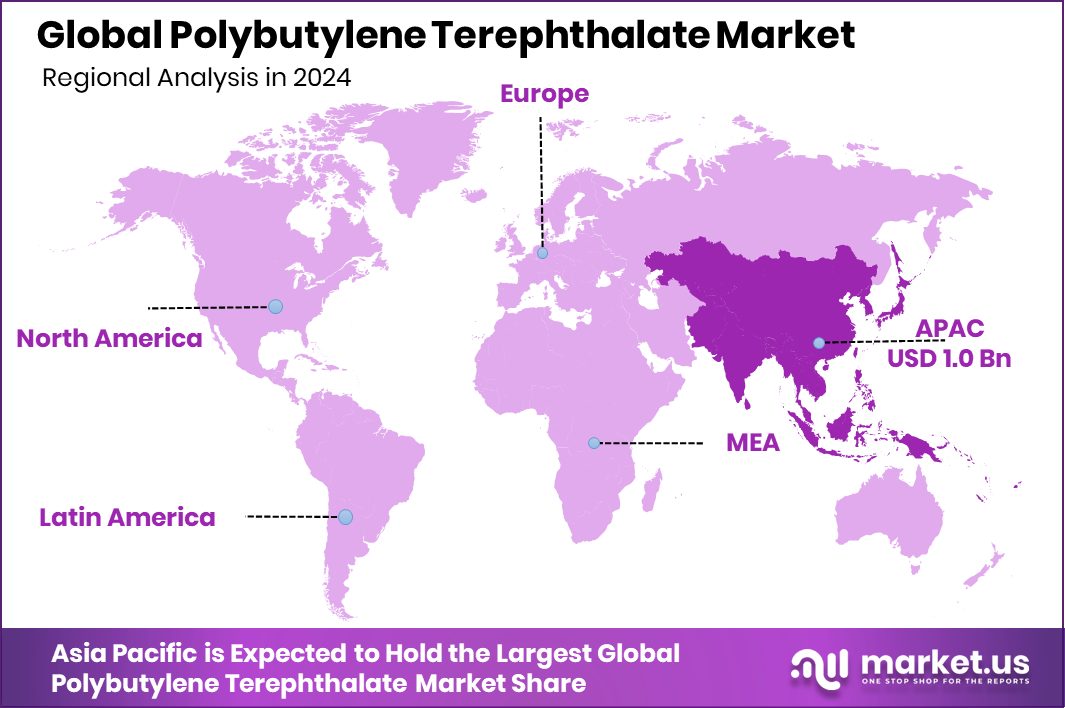

- The Asia Pacific reached a market value of USD 1.0 billion in 2024.

By Type Analysis

The polybutylene terephthalate market is dominated by industrial grade, with 73.8% share globally.

In 2024, Industrial Grade held a dominant market position in the By Type segment of the Polybutylene Terephthalate Market, with a 73.8% share. This strong position reflects its wide use in automotive components, consumer appliances, electronic housings, and industrial machinery, where durability, thermal resistance, and consistent molding performance matter.

The shift toward lightweight materials and the need for components that withstand heat and mechanical stress support this preference. Industrial Grade PBT is also valued for its stability in wiring systems, connectors, and safety-critical parts, making it suitable for high-volume and precision-manufacturing environments. With ongoing modernization in manufacturing and greater demand for reliable polymers, this segment continues to lead adoption across multiple industries.

By Processing Method Analysis

Polybutylene Terephthalate Market dominated by Injection Molding at 58.4% processing share.

In 2024, Injection Molding held a dominant market position in the By Processing Method segment of the Polybutylene Terephthalate Market, with a 58.4% share. This dominance reflects the material’s compatibility with high-speed, precision manufacturing used in electrical components, automotive parts, and appliance housings.

The method supports consistent part geometry, smooth surfaces, and reliable repeatability, making it suitable for large-volume production. Injection molding also enables the use of reinforced grades and functional additives without compromising dimensional stability.

As industries continue focusing on lightweight components, reduced cycle times, and integrated functionality, this processing method remains the preferred approach for manufacturing PBT parts with strong mechanical strength and reliable performance in demanding applications.

By End-Use Industry Analysis

Polybutylene Terephthalate Market dominated by the Automotive sector, holding 51.2% end-use demand.

In 2024, Automotive held a dominant market position in the By End Use Industry segment of the Polybutylene Terephthalate Market, with a 51.2% share. This leadership reflects the material’s suitability for high-performance vehicle components that require strength, heat resistance, and long-term reliability. Its use in connectors, sensors, under-the-hood parts, and lightweight structural parts supports ongoing shifts toward efficiency and compact engineering.

The growing adoption of electric and hybrid vehicles further strengthens the role of polybutylene terephthalate, as it performs well in environments exposed to vibration, temperature variation, and electrical load. With continuous automotive innovation and the need for durable engineered plastics, this segment maintains a strong and influential position.

Key Market Segments

By Type

- Industrial Grade

- Commercial Grade

By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- Others

By End Use Industry

- Automotive

- Extrusion Products

- Electrical and Electronics

- Others

Driving Factors

Rising Use in Automotive and Electronics

A key driving factor for the Polybutylene Terephthalate market is the growing use of durable and lightweight materials in automotive and electronic components. Industries are moving toward parts that can handle heat, stress, and electrical load without losing strength. PBT fits well in wiring systems, connectors, sensor housings, and molded mechanical parts because it is stable and easy to process.

The shift toward electric vehicles and compact electronic devices makes materials like PBT more important. Investments in manufacturing capacity also support this growth. A recent example includes an Oro-Medonte company securing $2.9 million in funding to expand operations, which reflects confidence in advanced materials production and long-term demand for high-performance polymers.

Restraining Factors

High Material Cost Limits Wider Adoption

One key restraining factor for the Polybutylene Terephthalate market is the relatively higher cost of the material compared to some standard plastics. While PBT offers strong performance, its price can limit use in cost-sensitive products where durability is not the main need. Manufacturers in consumer goods and general-purpose applications sometimes shift to lower-priced alternatives, which slows the broader replacement of existing materials.

Cost pressure becomes more noticeable during periods of raw material volatility, making long-term planning difficult for some industries. Large financial movements in the industrial sector, such as Lone Star acquiring Hillenbrand for $3.8 billion, show consolidation in the supply chain, which may influence pricing structures, availability, and future competitive dynamics for engineered polymers.

Growth Opportunity

Expansion in Electric Vehicle Component Production

A major growth opportunity for the Polybutylene Terephthalate market comes from the increasing use of the material in electric vehicle components and battery-related systems. As more vehicles rely on electronics, sensors, and lightweight engineered plastics, PBT becomes an ideal material because it can handle heat, electrical load, and long-term mechanical stress.

Its use in connectors, high-voltage insulation parts, and charging components continues to rise with EV adoption. The push for smarter and compact electronics in vehicles further supports the demand.

Recent funding activity, such as DataBeyond Technology raising almost $100 million in Series B funding, shows the growing investment in electric and digital technologies, which creates additional opportunities for PBT in next-generation automotive platforms and electronic architectures.

Latest Trends

Shift Toward Sustainable and Modified Formulations

A key recent trend in the Polybutylene Terephthalate market is the movement toward more sustainable and advanced material formulations. Manufacturers are exploring recycled inputs, bio-based blends, and improved grades that reduce environmental impact while maintaining strength and durability. This shift is influenced by growing sustainability expectations from the automotive and electronics industries.

Companies are also improving processing efficiency and developing PBT materials that support circular manufacturing and lower carbon footprints. Interest in environmentally friendly materials is rising globally, and investments reflect this direction.

A recent example includes Eco-Friendly Sulapac receiving €15 million in new funding, showing increasing financial support for greener material innovation. This momentum encourages further development of eco-conscious engineered plastics, including PBT.

Regional Analysis

Asia Pacific led the Polybutylene Terephthalate Market with 43.9% share, reflecting strong demand.

In 2024, Asia Pacific remained the leading region in the Polybutylene Terephthalate Market with a 43.9% share, valued at around USD 1.0 billion. The dominance reflects the region’s strong base in electronics manufacturing, automotive production, and large-scale industrial activity.

North America continued to show steady demand, supported by growth in high-performance components used in automotive and electrical systems. Europe also maintained adoption driven by engineered materials and application in regulatory-driven innovation, especially in manufacturing and advanced industrial use.

Latin America recorded a gradual improvement in usage as industrial production and manufacturing activities progressed at a moderate pace. Meanwhile, the Middle East & Africa showed slow but emerging potential as industries expand toward engineered polymers and durable material applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE remains focused on advancing engineered polymer performance, especially where thermal stability and electrical insulation are essential. The company’s involvement in developing new formulations aligns with the increasing use of lightweight materials in automotive and precision electronics. Its ongoing work in improving processing consistency also supports wider industrial use.

Celanese Corporation plays a strategic role through its strong material innovation and emphasis on performance-driven polymer solutions. The company’s positioning within engineered plastics allows it to target applications requiring durability, chemical resistance, and stable processing. Celanese continues to align its products with industrial needs for reliable, high-strength molded components.

Chang Chun Group contributes significantly to the market with production capabilities and material supply across key manufacturing clusters. Its presence supports large-volume applications where stable quality and supply reliability matter. With electronics and automotive sectors expanding globally, these companies collectively support the ongoing shift toward engineered polymers that balance performance, efficiency, and manufacturability in complex, high-use environments.

Top Key Players in the Market

- BASF SE

- Celanese Corporation

- Chang Chun Group

- Evonik Industries AG

- Lanxess

- LG Chem

- Mitsubishi Chemical Group Corporation

- NAN YA Plastics Industrial Co., Ltd

- RTP Company

- SABIC

Recent Developments

- In May 2024, BASF announced it would increase the production capacity of its Ultramid® (PA) and Ultradur® (PBT) compounding plants in Panoli (Gujarat) and Thane (Maharashtra), India, with an increase of over 40% planned for PBT in these locations. The expanded capacity is expected to be available in the second half of 2025.

- In April 2024, Celanese introduced new engineered material solutions at CHINAPLAS 2024 for the electronics & automotive industries, showcasing enhancements in PBT and related polymers to meet demands for higher performance and sustainability.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 4.3 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Grade, Commercial Grade), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By End Use Industry (Automotive, Extrusion Products, Electrical and Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Celanese Corporation, Chang Chun Group, Evonik Industries AG, Lanxess, LG Chem, Mitsubishi Chemical Group Corporation, NAN YA Plastics Industrial Co., Ltd, RTP Company, SABIC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polybutylene Terephthalate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Polybutylene Terephthalate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Celanese Corporation

- Chang Chun Group

- Evonik Industries AG

- Lanxess

- LG Chem

- Mitsubishi Chemical Group Corporation

- NAN YA Plastics Industrial Co., Ltd

- RTP Company

- SABIC