Global Polyalphaolefin Market Size, Share, And Business Benefit By Product Type (Low Viscosity PAO, Medium Viscosity PAO, High Viscosity PAO), By Grade (Homopolymers, Copolymers, Terpolymers, Others), By End-use (Automotive Lubricants, Industrial Lubricants, Aerospace Lubricants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161322

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

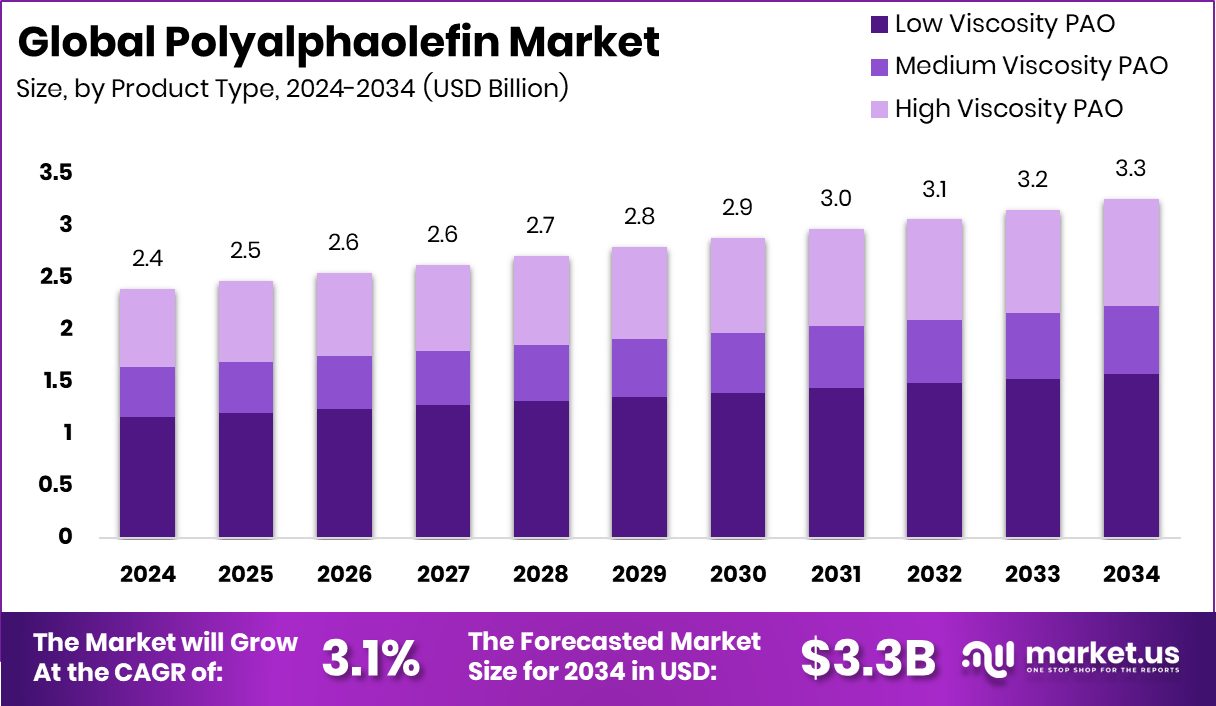

The Global Polyalphaolefin Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034. Strong automotive and industrial lubricant demand continues to drive Asia Pacific’s 48.90% market growth.

Polyalphaolefin (PAO) is a class of synthetic hydrocarbon fluids made by polymerizing alpha-olefin monomers. It serves as a premium base oil in lubricants thanks to its excellent viscosity stability, low volatility, and strong thermal and oxidative resistance. These attributes make it ideal for demanding environments in engines, gear systems, compressors, hydraulic systems, and other industrial applications.

The polyalphaolefin market refers to the global trade and manufacture of PAO base oils and their derived lubricant formulations. It spans upstream chemical synthesis, blending with additives, distribution to automotive, industrial, aerospace, and specialty end users, and aftermarket sales of synthetic lubricants and greases.

One key growth driver is the push for higher fuel efficiency and lower emissions in vehicles, which encourages the adoption of high-performance synthetic lubricants built on PAO. Industrialization in emerging economies also fuels demand for durable machinery lubricants. At the same time, costs and supply volatility of the raw materials (derived from petrochemicals) restrain growth.

Big oil interests are deeply entwined with the sector—big oil spent $445 m in the last election cycle to influence Trump and Congress, and HSBC helped the oil and gas industry raise $47 bn despite its net-zero pledges, showing how political and financial power can shift investment flows.

The transition toward electric vehicles and advanced industrial systems opens room for specialty PAO variants (e.g., with enhanced heat transfer or compatibility). Biodegradable and bio-based PAO research presents a chance to balance performance with sustainability. Also, given that only a quarter of Saudi Arabia’s $1 trillion capex plan will go into oil, capital might gradually pivot toward greener sectors, potentially opening more funding for sustainable lubricant innovation.

Moreover, the fact that oil interests gave more than $75 million to Trump PACs illustrates how fossil fuel capital can sway regulatory and infrastructure priorities, meaning players aligned with cleaner bases may find political cover or resistance, depending on alignment.

Key Takeaways

- The Global Polyalphaolefin Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034.

- In 2024, the polyalphaolefin market saw low-viscosity PAO dominate with a 48.6% share.

- The Homopolymers segment accounted for 42.9% of the Polyalphaolefin Market in 2024.

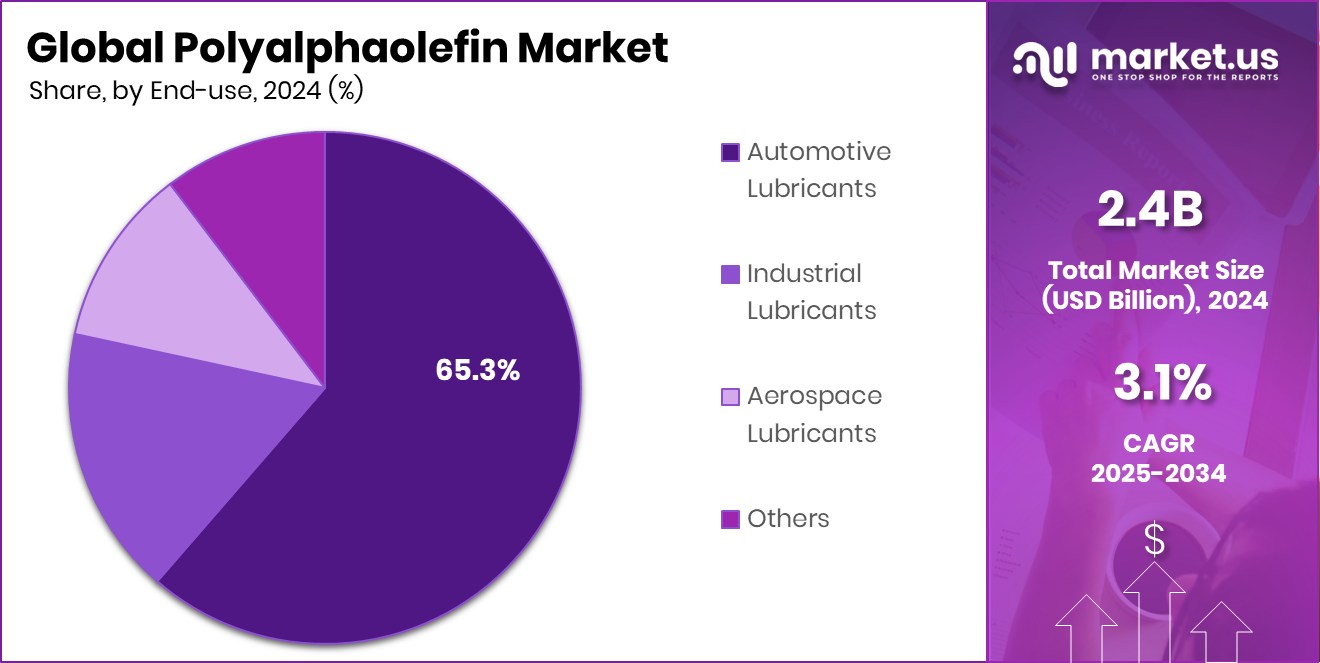

- Automotive lubricants held the largest 65.3% share of the polyalphaolefin market in 2024.

- The Asia Pacific market was valued at around USD 1.1 billion during the same year.\

By Product Type Analysis

Low-viscosity PAO-dominated, accounting for a 48.6% share due to excellent flow performance.

In 2024, Low Viscosity PAO held a dominant market position in the By Product Type segment of the Polyalphaolefin Market, with a 48.6% share. This leadership reflects its widespread use in automotive and industrial lubricants, where smooth flow and stable performance at low temperatures are critical. The segment’s dominance is also attributed to its ability to enhance fuel efficiency and reduce wear under variable operating conditions.

Low viscosity PAOs are preferred for blending high-performance synthetic engine oils, transmission fluids, and greases that demand thermal stability and extended drain intervals. Their balanced performance and compatibility with advanced additive systems continue to sustain their strong market presence through 2025.

By Grade Analysis

Homopolymers led the polyalphaolefin market with a 42.9% share.

In 2024, Homopolymers held a dominant market position in the *By Grade* segment of the Polyalphaolefin Market, with a 42.9% share. This strong share highlights their extensive utilization in lubricant formulations that demand consistent molecular structure and superior oxidative stability. Homopolymer-based PAOs are valued for their predictable viscosity index, excellent film strength, and ability to perform efficiently under extreme operating temperatures.

Their uniform chain structure makes them suitable for high-performance automotive and industrial applications, ensuring smoother engine operations and longer lubricant life. The reliability and cost-effectiveness of homopolymers have maintained their preference among manufacturers, reinforcing their leadership position in the market through 2025.

By End-use Analysis

Automotive Lubricants held a 65.3% share in the polyalphaolefin market.

In 2024, Automotive Lubricants held a dominant market position in the *By End-use* segment of the Polyalphaolefin Market, with a 65.3% share. This dominance reflects the extensive use of PAO-based synthetic oils in modern vehicle engines that demand superior thermal stability, reduced friction, and enhanced fuel economy. The ability of PAO formulations to perform efficiently under both high and low temperatures has made them a preferred choice for automotive manufacturers and service providers.

Their long drain intervals and excellent oxidation resistance support reduced maintenance costs and improved engine durability. As automotive technologies advance toward higher efficiency standards, the use of PAO in premium engine and transmission lubricants continues to sustain strong demand.

Key Market Segments

By Product Type

- Low Viscosity PAO

- Medium Viscosity PAO

- High Viscosity PAO

By Grade

- Homopolymers

- Copolymers

- Terpolymers

- Others

By End-use

- Automotive Lubricants

- Industrial Lubricants

- Aerospace Lubricants

- Others

Driving Factors

Rising Demand for High-Performance Synthetic Lubricants

One of the major driving factors for the Polyalphaolefin Market is the increasing demand for high-performance synthetic lubricants across automotive and industrial sectors. Polyalphaolefins (PAOs) offer excellent viscosity control, heat resistance, and long-lasting lubrication, which make them ideal for engines, turbines, and gear systems. As more industries focus on energy efficiency and extended equipment life, the shift toward premium base oils like PAOs is accelerating.

Additionally, global sustainability programs and government actions are supporting cleaner production methods. For example, California will get $35 million in federal funding to plug orphaned oil and gas wells, reducing leakage and environmental risks. This move indirectly boosts demand for advanced synthetic lubricants as industries transition to more sustainable and efficient operations.

Restraining Factors

High Production Costs and Raw Material Dependence

A key restraining factor for the Polyalphaolefin Market is its high production cost and strong dependence on petroleum-based raw materials. The manufacturing process of PAOs involves complex chemical reactions and requires expensive catalysts, which significantly increase overall production expenses. Fluctuations in crude oil prices also affect the cost and availability of alpha-olefin feedstocks, making pricing less stable for producers.

These factors often lead to higher prices of finished lubricants compared to conventional mineral oils, limiting their use in cost-sensitive applications. Smaller manufacturers and end-users in developing regions find it difficult to adopt PAO-based products due to these higher costs. As a result, affordability and raw material volatility remain major challenges slowing down wider market penetration.

Growth Opportunity

Expanding Use in Electric Vehicle Lubrication Systems

A major growth opportunity for the polyalphaolefin market lies in its expanding use within electric vehicle (EV) lubrication systems. As EV production continues to rise globally, there is growing demand for specialized lubricants that can handle high temperatures, electrical conductivity, and energy efficiency requirements unique to electric powertrains.

Polyalphaolefins provide excellent thermal stability, oxidation resistance, and fluidity, making them ideal for EV cooling and gearbox applications. Their clean performance also supports longer service intervals and improved reliability. With automotive manufacturers focusing on sustainability and advanced driveline efficiency, PAO-based fluids are becoming vital in extending the lifespan of critical EV components. This shift opens new opportunities for innovation and product development in the coming decade.

Latest Trends

Shift Toward Bio-Based and Sustainable PAO Formulations

One of the latest trends in the Polyalphaolefin Market is the growing shift toward bio-based and sustainable PAO formulations. Manufacturers are focusing on reducing carbon emissions and environmental impact by developing renewable-source alpha-olefins derived from plant-based feedstocks. These bio-PAOs maintain similar performance characteristics to traditional petroleum-based PAOs, such as high oxidative stability and excellent viscosity control, while supporting eco-friendly manufacturing practices.

The trend is driven by stricter environmental regulations, rising consumer awareness, and the push from industries to achieve greener supply chains. This transition is also encouraging innovation in catalyst design and polymerization processes, allowing the production of high-quality lubricants that meet both performance and sustainability goals across automotive and industrial applications

Regional Analysis

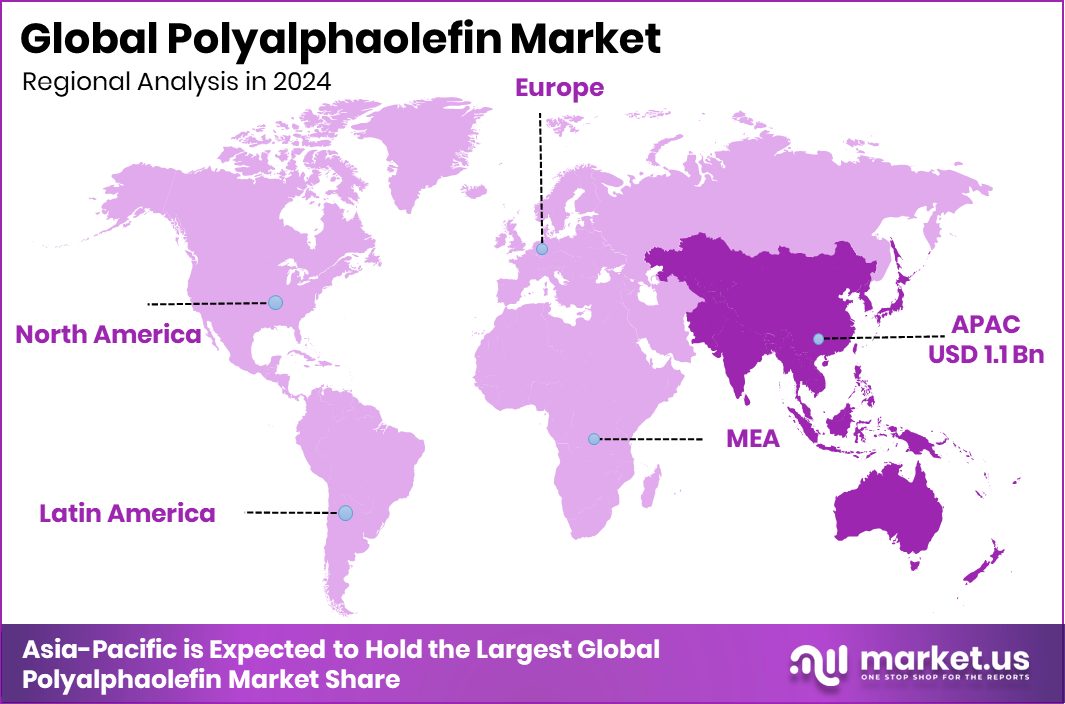

In 2024, the Asia Pacific dominated the Polyalphaolefin Market with a 48.90% share

In 2024, the Asia Pacific emerged as the dominant region in the global Polyalphaolefin Market, accounting for 48.90% of the total share, valued at approximately USD 1.1 billion. The region’s leadership is supported by rapid industrialization, expanding automotive manufacturing bases, and rising demand for high-performance synthetic lubricants in countries like China, Japan, India, and South Korea. The growing focus on fuel efficiency and extended engine life continues to boost PAO adoption across automotive and industrial sectors.

North America maintains a strong position driven by technological advancements and established industrial infrastructure, while Europe benefits from stringent emission regulations promoting the use of premium lubricants.

Meanwhile, the Middle East & Africa and Latin America represent emerging markets showing a gradual uptake of synthetic base oils, supported by expanding industrial and transportation activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Exxon Mobil Corporation maintained a strong market presence through its advanced PAO production technologies and well-integrated supply chain. The company’s expertise in synthetic base oil formulation and focus on high-performance lubricants supported its continued leadership across both automotive and industrial lubricant applications.

INEOS strengthened its position by expanding its alpha-olefin production capacity, ensuring consistent feedstock availability for PAO manufacturing. Its technical innovation and efficient downstream operations contributed to maintaining cost-effective production and stable product quality. INEOS’s diversified chemical operations also provided a steady balance between upstream and specialty product development, enhancing its resilience in a competitive market.

Chevron Phillips Chemical Company LLC continued leveraging its long-standing expertise in olefin and polyolefin chemistry to deliver high-purity PAO products. The company’s emphasis on product performance and operational sustainability supported its growing influence across global lubricant markets. Together, these three players emphasized process efficiency, advanced polymerization technology, and tailored solutions for evolving end-use needs, reinforcing the market’s steady growth trajectory and technological advancement in 2024.

Top Key Players in the Market

- Exxon Mobil Corporation

- INEOS

- Chevron Phillips Chemical Company LLC

- Dowpol Corporation

- LANXESS

- NACO Corporation

- Total Energies

Recent Developments

- In August 2024, at the Lubricant Expo, ExxonMobil spotlighted novel PAO technologies in developing high-performance fluids for electric vehicles (EVs), emphasizing lower viscosity fluids optimized for new powertrains.

- In June 2022, INEOS Oligomers started up a 120,000 tpy Low Viscosity (LV) PAO unit at its Chocolate Bayou, Texas site, which positioned it as a major merchant supplier of LV PAO globally.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Low Viscosity PAO, Medium Viscosity PAO, High Viscosity PAO), By Grade (Homopolymers, Copolymers, Terpolymers, Others), By End-use (Automotive Lubricants, Industrial Lubricants, Aerospace Lubricants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Exxon Mobil Corporation, INEOS, Chevron Phillips Chemical Company LLC, Dowpol Corporation, LANXESS, NACO Corporation, Total Energies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Exxon Mobil Corporation

- INEOS

- Chevron Phillips Chemical Company LLC

- Dowpol Corporation

- LANXESS

- NACO Corporation

- Total Energies