Global Polyacrylamide Market Size, Share, And Business Benefits By Product (Anionic, Cationic, Non-ionic), By Application (Water Treatment, Oil and Gas, Paper Making, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150046

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

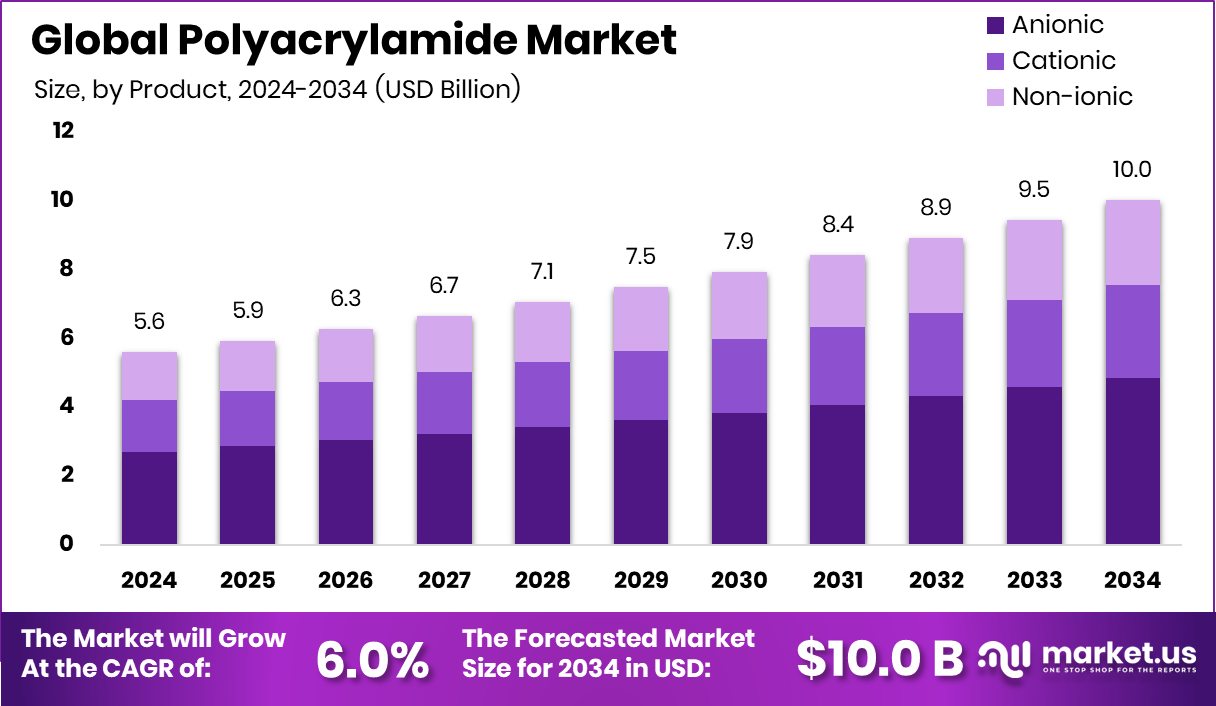

Global Polyacrylamide Market is expected to be worth around USD 10.0 billion by 2034, up from USD 5.6 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034. Strong demand from water treatment boosted North America’s 43.3% market share significantly.

Polyacrylamide (PAM) is a water-soluble polymer made from acrylamide subunits. It is widely used as a flocculant, thickener, and binder in various applications, including water treatment, paper manufacturing, oil recovery, and agriculture. Its ability to enhance the viscosity of water and bind particles makes it highly effective in separating solids from liquids, especially in industrial wastewater treatment processes.

The global demand for efficient water treatment solutions worldwide drives the polyacrylamide market. With growing concerns over water pollution and stricter regulations on industrial discharge, both municipal and industrial sectors are increasingly relying on PAM-based solutions for sludge dewatering and clarification. This push for cleaner water systems has significantly expanded the product’s market footprint.

Growing industrialization, particularly in developing economies, has further accelerated the demand for polyacrylamide. Industries such as textiles, mining, and pulp & paper use large volumes of PAM to improve production efficiency and reduce environmental impact. As these industries expand, the demand for effective process chemicals like polyacrylamide continues to rise.

An emerging opportunity lies in sustainable agriculture, where polyacrylamide is being explored for soil conditioning and erosion control. It helps improve soil structure and water retention, enhancing crop yield in arid regions. This application aligns with global efforts toward sustainable farming practices and food security.

Key Takeaways

- Global Polyacrylamide Market is expected to be worth around USD 10.0 billion by 2034, up from USD 5.6 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034.

- In 2024, Anionic Polyacrylamide held a 48.4% share in the global Polyacrylamide market.

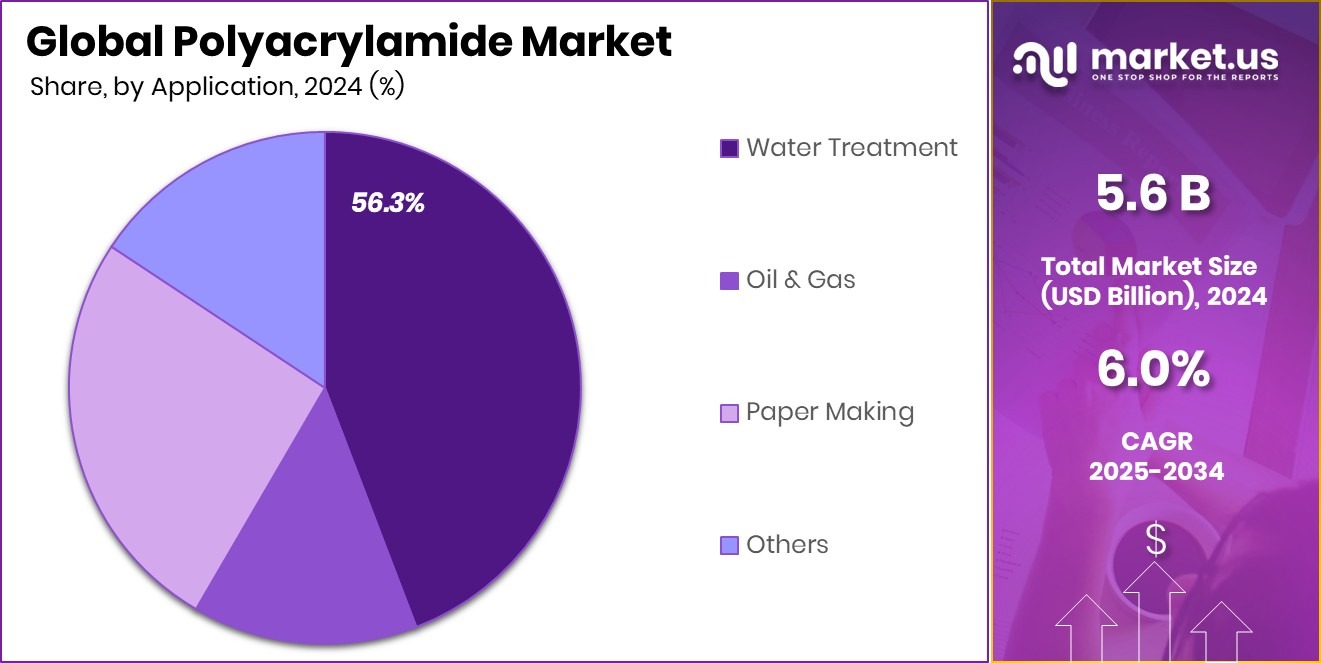

- Water Treatment application dominated the Polyacrylamide market in 2024, accounting for a 56.3% overall share.

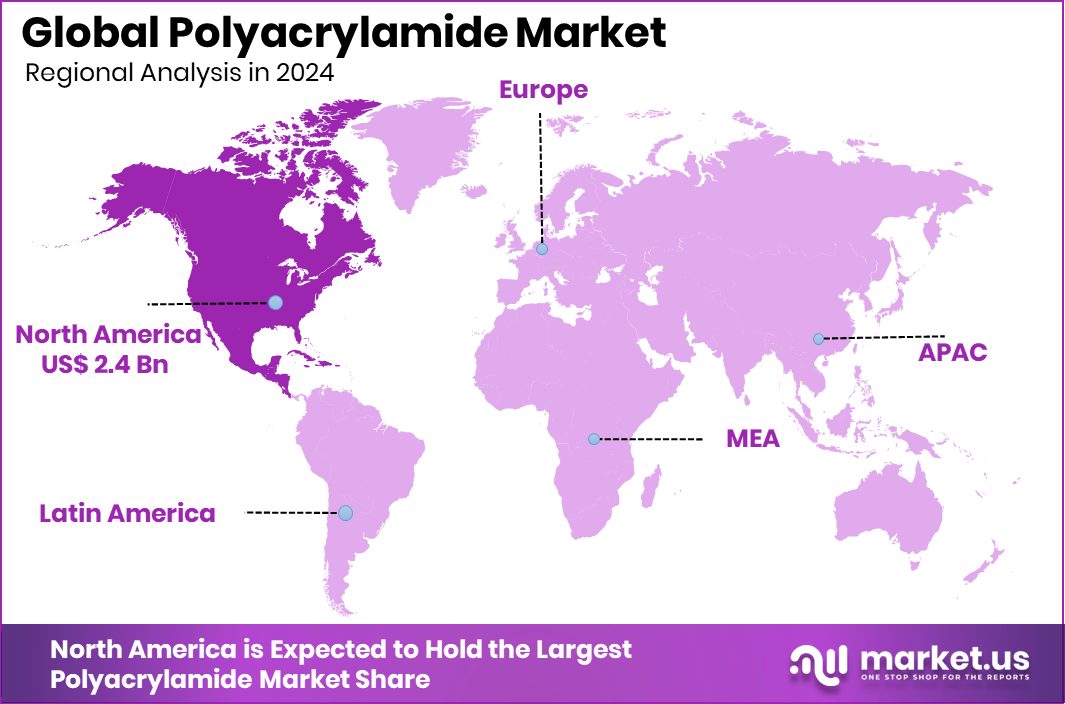

- The North American market value reached USD 2.4 billion during the same year.

By Product Analysis

In 2024, Anionic polyacrylamide dominated the market with a 48.4% share.

In 2024, Anionic held a dominant market position in By Product segment of the Polyacrylamide Market, with a 48.4% share. This dominance was primarily driven by its extensive use in wastewater treatment applications, particularly in municipal and industrial effluent systems.

Anionic polyacrylamide is highly effective in separating suspended solids from liquids, making it an ideal choice for sludge dewatering and clarification processes. Its wide compatibility with high pH levels and inorganic particles contributed to its strong preference in sectors like mining, textiles, and paper manufacturing.

Moreover, the growing global emphasis on water conservation and sustainable waste management practices supported the increased adoption of anionic variants. Governments and regulatory bodies across both developed and developing economies have been implementing stringent guidelines for wastewater discharge, which directly propelled the demand for anionic polyacrylamide in treatment plants.

Additionally, the cost-effectiveness of anionic polymers and their high molecular weight further enhanced their utility across large-scale water treatment facilities, cementing their leading market share in 2024. With continued infrastructure upgrades and industrial expansion, the segment is expected to maintain its prominence over the near term.

By Application Analysis

Water treatment led application in the Polyacrylamide Market, accounting for 56.3% of the overall share.

In 2024, Water Treatment held a dominant market position in the By Application segment of the Polyacrylamide Market, with a 56.3% share. This significant market share was largely attributed to the increasing global demand for clean and safe water, both for industrial and municipal usage.

Polyacrylamide plays a critical role in water treatment processes by enhancing flocculation and sedimentation, effectively removing contaminants from wastewater. The rising population, coupled with rapid urbanization, particularly in emerging economies, has pushed governments and private operators to invest in advanced water purification systems where polyacrylamide remains a core input.

Stricter environmental regulations on industrial wastewater discharge also boosted the product’s uptake in treatment facilities. Industries such as textiles, chemicals, and oil refining are deploying polyacrylamide-based solutions to comply with effluent quality norms. Furthermore, increased investments in wastewater infrastructure modernization across developed countries added to the segment’s growth.

The cost efficiency and high performance of polyacrylamide in removing suspended solids made it indispensable in large-scale water treatment setups. This strong alignment with regulatory goals and sustainability priorities helped the water treatment segment secure its dominant position in the global polyacrylamide market in 2024.

Key Market Segments

By Product

- Anionic

- Cationic

- Non-ionic

By Application

- Water Treatment

- Oil and Gas

- Paper Making

- Others

Driving Factors

Rising Need for Clean Water Worldwide

One of the main reasons behind the strong growth of the polyacrylamide market is the increasing global demand for clean water. Many cities and industries are facing serious water pollution issues due to urban growth, industrial waste, and a lack of proper treatment facilities. Polyacrylamide is widely used in water and wastewater treatment plants to help remove dirt, oil, and harmful particles from water.

It works by clumping together solids so they can be easily removed. As more countries enforce strict water treatment rules and focus on sustainability, the demand for polyacrylamide is going up. Its role in making water safer and cleaner for reuse or discharge is making it a key product in today’s water-focused world.

Restraining Factors

Health and Environmental Concerns Limit Product Use

One major factor slowing down the polyacrylamide market is the concern over its environmental and health impact. Polyacrylamide itself is safe when used properly, but it is made from acrylamide, which can be toxic if not handled correctly. There is worry that leftover acrylamide may remain in treated water or soil, which can harm people and animals over time.

Because of these concerns, many countries have strict rules on how much polyacrylamide can be used and how it must be disposed of. These regulations make it harder for companies to use or expand their use freely. This slows down growth, especially in areas where environmental safety is a top priority.

Growth Opportunity

Agriculture: Enhancing Soil and Water Efficiency

Polyacrylamide presents a significant growth opportunity in agriculture, particularly in improving soil quality and water retention. When applied to soil, polyacrylamide acts as a conditioner, enhancing soil structure and increasing its ability to retain water. This is especially beneficial in arid and semi-arid regions where water scarcity is a major challenge. By reducing water runoff and soil erosion, polyacrylamide helps maintain soil fertility and supports healthier plant growth.

Additionally, its use can lead to more efficient irrigation practices, conserving water resources, and reducing the need for frequent watering. Polyacrylamide’s role in enhancing soil health and water efficiency aligns with these sustainability goals, making it a valuable tool for farmers aiming to increase crop yields while conserving resources.

Latest Trends

Shift Toward Eco-Friendly and Safer Formulations

A key trend in the polyacrylamide market today is the growing shift toward eco-friendly and safer formulations. As awareness about environmental and health safety increases, companies are working to reduce the presence of residual acrylamide in their products. This includes developing low-toxicity or biodegradable versions of polyacrylamide that can perform well without harming the environment.

Many industries, especially in water treatment and agriculture, are now preferring products that meet stricter environmental guidelines. This trend is also being supported by new regulations that encourage sustainable chemical use. As a result, innovation in green chemistry is becoming a major focus, with researchers exploring new materials that offer the benefits of polyacrylamide while being safer for people and nature.

Regional Analysis

In 2024, North America led the Polyacrylamide Market with a 43.3% share.

In 2024, North America held a dominant position in the global Polyacrylamide Market, accounting for 43.3% of the total share, with a market value of USD 2.4 billion. The region’s leadership is primarily supported by the extensive adoption of polyacrylamide in municipal water treatment facilities and stringent regulations that promote advanced wastewater solutions. Additionally, strong industrial usage across sectors like oil recovery and paper processing has further fueled demand in the region.

Europe followed with moderate consumption levels, supported by established industrial infrastructures and environmental compliance across member nations. Meanwhile, Asia Pacific showed notable growth potential, driven by expanding urban centers and growing awareness around clean water management. In regions like the Middle East & Africa, and Latin America, adoption remained steady, with growing investments in water treatment infrastructure and agriculture applications gradually increasing the demand for polyacrylamide.

While these regions are still developing in terms of volume, they present long-term opportunities due to rising regulatory enforcement and environmental challenges. However, North America maintained its lead in both value and volume terms in 2024, setting the benchmark for industrial-scale usage and regulatory-driven growth in the global polyacrylamide landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Anhui Jucheng Fine Chemicals Co., Ltd, based in China, maintained a strong presence in the polyacrylamide sector. The company’s focus on producing high-quality polyacrylamide products caters to various applications such as water treatment, oil recovery, and paper manufacturing. Their commitment to innovation and adherence to environmental standards positioned them as a reliable supplier in the global market.

BASF SE, a German multinational chemical company, continued to be a leading player in the polyacrylamide market. With a diverse product portfolio and extensive research and development capabilities, BASF addressed the growing demand for polyacrylamide in water treatment and enhanced oil recovery applications. Their strategic initiatives aimed at sustainability and efficiency contributed to their strong market position.

Black Rose Industries Ltd, an India-based manufacturer, expanded its polyacrylamide production capacity to meet increasing domestic and international demand. The company’s focus on producing both liquid and solid forms of polyacrylamide enabled it to serve a broad range of industries, including agriculture, textiles, and wastewater treatment.

Top Key Players in the Market

- Anhui Jucheng Fine Chemicals Co., Ltd

- BASF SE

- Black Rose Industries Ltd.

- Kemira OYJ

- PetroChina Company Limited

- Shandong Polymer Bio-Chemicals Co., Ltd.

- SNF Group

- The Dow Chemical Company

- Xitao Polymer Co., Ltd

Recent Developments

- In March 2025, Kemira and IFF formed a €130 million joint venture, Alpha Bio, to produce 44,000 tons of renewable biobased materials annually in Kotka, Finland. Operations are set to begin by late 2027, focusing on high-performance biopolymers for personal care and industrial use.

- In 2024, PetroChina’s subsidiary, Daqing Oilfield Company Limited, acquired CNPC Electric Energy. This acquisition, categorized as a business combination under common control, was part of PetroChina’s broader strategy to enhance its capabilities in the energy and materials sectors.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Billion Forecast Revenue (2034) USD 10.0 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Anionic, Cationic, Non-ionic), By Application (Water Treatment, Oil and Gas, Paper Making, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anhui Jucheng Fine Chemicals Co., Ltd, BASF SE, Black Rose Industries Ltd., Kemira OYJ, PetroChina Company Limited, Shandong Polymer Bio-Chemicals Co., Ltd., SNF Group, The Dow Chemical Company, Xitao Polymer Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anhui Jucheng Fine Chemicals Co., Ltd

- BASF SE

- Black Rose Industries Ltd.

- Kemira OYJ

- PetroChina Company Limited

- Shandong Polymer Bio-Chemicals Co., Ltd.

- SNF Group

- The Dow Chemical Company

- Xitao Polymer Co., Ltd