Global Plug Valve Market Size, Share, And Enhanced Productivity By Type (Non-Lubricated Plug Valve, Lubricated Plug Valve, Eccentric Plug Valve, Expanding Plug Valve), By Material (Cast Iron, Stainless Steel, Brass, Plastic), By Operation Type (Manual, Electric, Pneumatic, Hydraulic), By Design (Two-Way Plug Valves, Three-Way Plug Valves), By End-User (Oil and Gas, Chemical and Petrochemical, Water and Wastewater, Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168374

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

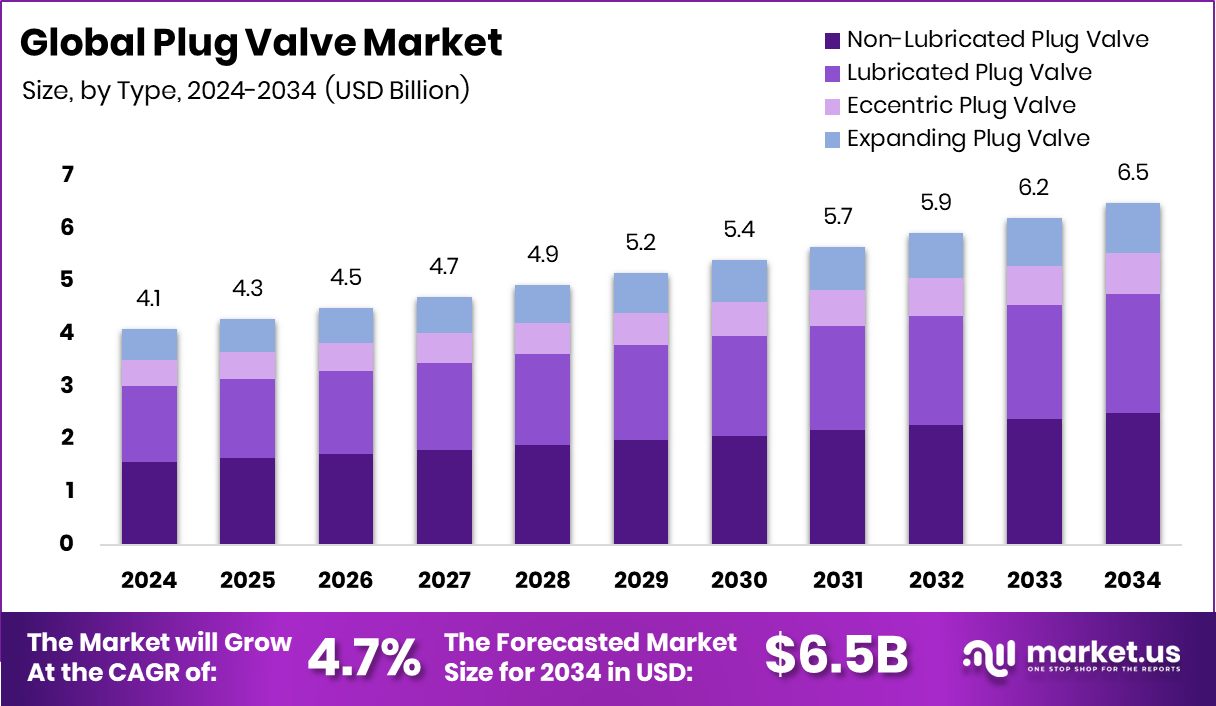

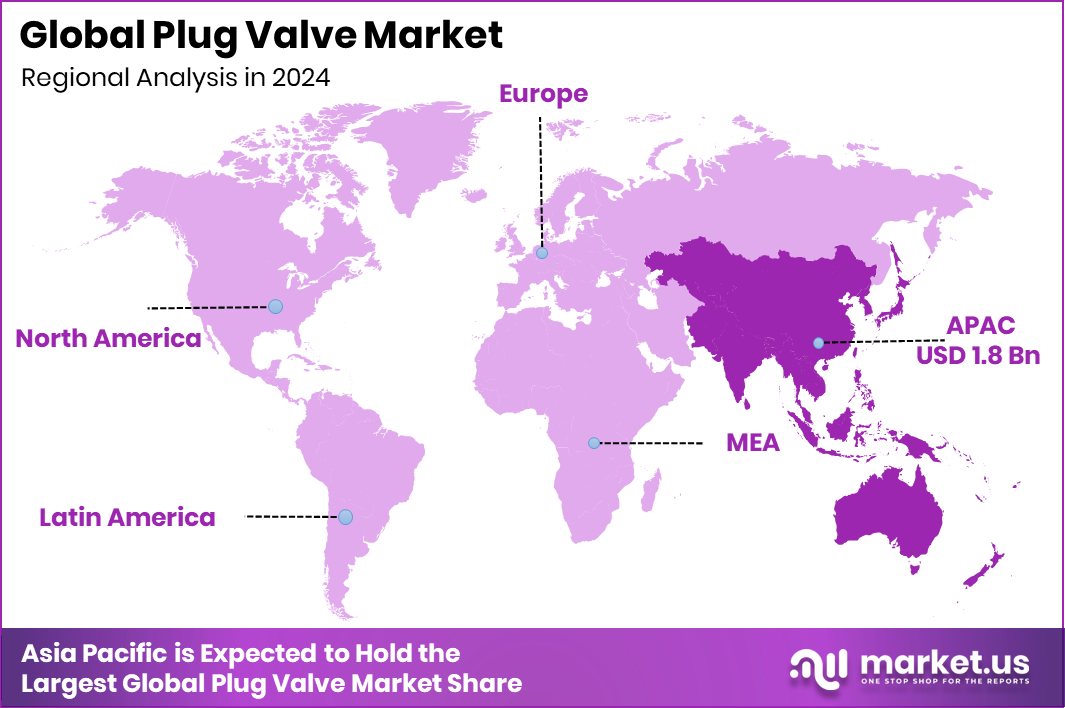

The Global Plug Valve Market is expected to be worth around USD 6.5 billion by 2034, up from USD 4.1 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The Asia-Pacific region leads Plug Valve Market growth at 45.80%, reaching USD 1.8 Bn.

A plug valve is a quarter-turn valve that uses a cylindrical or tapered plug with a hole through its center to control fluid flow. When the plug rotates, the hole aligns or blocks the pipeline, allowing quick on-off control. Plug valves are valued for their tight shut-off, simple design, and ability to handle high pressure, high temperature, and corrosive fluids in oil, gas, chemicals, and water systems.

The plug valve market covers manufacturing, supply, and use of these valves across industrial pipelines and process plants. Demand is closely linked to industrial fluid handling needs where reliability and low leakage are critical. Their compact structure and low maintenance make plug valves suitable for heavy-duty operations and long service cycles in demanding environments.

Market growth is mainly driven by rising industrial investments and expanding metal, petrochemical, and infrastructure activities. Increased stainless steel production strengthens availability of corrosion-resistant valve components. This is supported by AmBank granting RM1.06 billion to Worldwide Stainless for acquiring Bahru Stainless, restoring Malaysian ownership of the country’s sole stainless steel producer, which strengthens downstream industrial fabrication capacity.

Demand for plug valves is rising as industries upgrade pipelines for efficiency and safety. Jindal Stainless’s $150 million investment in a slag processing unit improves material efficiency and sustainable steel supply, indirectly supporting durable valve manufacturing needed for high-performance flow control systems in energy and process industries.

Future opportunities are tied to industrial financing and modernization of processing plants. Steel Dynamics Group receiving £17 million funding from Cynergy Business Finance highlights continued capital flow into advanced metal production, enabling innovation in valve design, longer service life, and expansion of plug valve use in new and replacement pipeline projects.

Key Takeaways

- The Global Plug Valve Market is expected to be worth around USD 6.5 billion by 2034, up from USD 4.1 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Plug Valve Market sees Non-Lubricated Plug Valves leading by type, holding 38.4% share globally today.

- Plug Valve Market prefers Stainless Steel materials, commanding 42.8% share due to durability and reliability.

- Plug Valve Market remains manual-operated dominant, with Manual operation capturing 49.1% share across industrial applications.

- Plug Valve Market favors Two-Way Plug Valve designs, accounting for a strong 72.6% share worldwide.

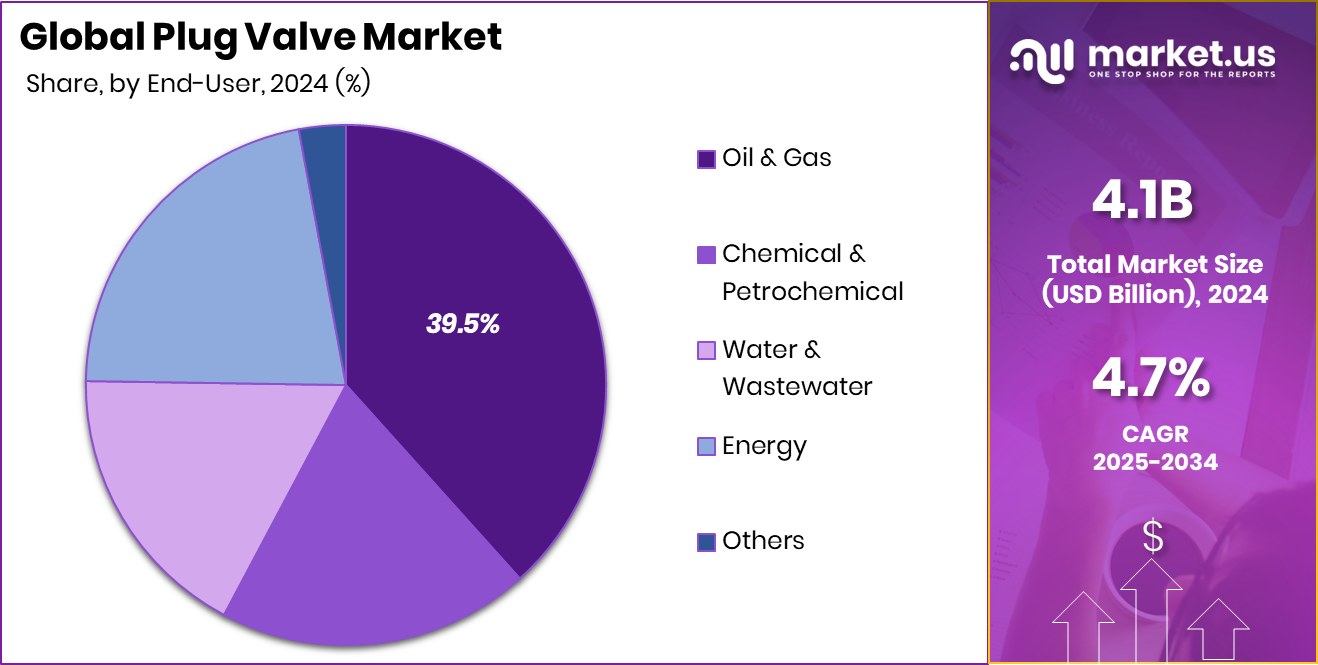

- Plug Valve Market demand is led by Oil and Gas end-users, holding 39.5% share overall.

- In Asia-Pacific, industrial pipeline expansion supports a 45.80% share of USD 1.8 Bn.

By Type Analysis

In Plug Valve Market, Non-Lubricated Plug Valves lead type with 38.4% share.

In 2024, Non-Lubricated Plug Valve held a dominant market position in the By Type segment of the Plug Valve Market, with a 38.4% share. This leadership reflects its strong acceptance across industries that prioritize clean operation and low maintenance.

Non-lubricated plug valves are designed to operate without grease injection, making them suitable for applications where product contamination must be avoided. Their simple construction supports reliable sealing while reducing operational downtime. End users value these valves for consistent performance in systems handling gases, water, and light process fluids.

The absence of lubricants also lowers long-term servicing needs, supporting cost control over extended operating cycles. As a result, the segment continues to attract sustained demand in both new installations and replacement projects, reinforcing its dominant position within the overall plug valve industry.

By Material Analysis

In Plug Valve Market, Stainless Steel dominates material usage with 42.8% share.

In 2024, Stainless Steel held a dominant market position in the By Material segment of the Plug Valve Market, with a 38.4% share. This dominance is driven by the material’s strong resistance to corrosion, pressure, and temperature variations in demanding operating conditions.

Stainless steel plug valves are widely preferred where durability and long service life are essential for continuous flow control. Their ability to maintain sealing performance over extended operating cycles supports stable process operations.

End users also favor stainless steel for its hygiene and structural integrity, especially in fluid systems requiring consistent reliability. These performance advantages reinforce its widespread adoption, allowing stainless steel to retain a leading position within the material-based segmentation of the plug valve market.

By Operation Type Analysis

In Plug Valve Market, manual operation dominates applications, accounting for 49.1% share.

In 2024, Manual held a dominant market position in the By Operation Type segment of the Plug Valve Market, with a 49.1% share. This dominance reflects strong user preference for straightforward and reliable valve control across routine industrial operations.

Manual plug valves are valued for their simple mechanism, which allows quick quarter-turn operation without dependence on external power sources. Their ease of use supports efficient flow control in systems where frequent adjustments are not required.

Maintenance is generally minimal, helping operators manage long-term operating costs. These practical advantages make manual operation suitable for stable process environments, supporting steady adoption across installations and sustaining its leading share within the operation type segmentation.

By Design Analysis

In Plug Valve Market, two-way plug valves dominate preference with 72.6% share.

In 2024, Two-Way Plug Valves held a dominant market position in the By Design segment of the Plug Valve Market, with a 72.6% share. This strong position is supported by their simple flow path and effective on–off control in pipeline systems.

Two-way plug valves are widely used where direct shut-off or straight-through flow is required, making them suitable for routine isolation duties. Their design supports tight sealing and consistent performance under varying pressure conditions.

Operators favor these valves for their ease of operation and dependable service life. These functional strengths contribute to their broad acceptance, allowing two-way plug valves to maintain a commanding presence within the design-based segmentation of the plug valve market.

By End-User Analysis

In Plug Valve Market, oil and gas remains end-user with 39.5% share.

In 2024, Oil and Gas held a dominant market position in the By End-User segment of the Plug Valve Market, with a 39.5% share. This leadership reflects the sector’s consistent requirement for reliable flow isolation across upstream, midstream, and downstream operations.

Plug valves are widely used in oil and gas facilities due to their strong shut-off capability and dependable performance under high pressure and demanding operating conditions. Their compact design supports installation in tight pipeline layouts, while durable construction helps maintain operational safety.

The sector’s focus on minimizing leakage and ensuring uninterrupted flow control reinforces steady adoption, allowing oil and gas applications to retain the largest share within the end-user segmentation.

Key Market Segments

By Type

- Non-Lubricated Plug Valve

- Lubricated Plug Valve

- Eccentric Plug Valve

- Expanding Plug Valve

By Material

- Cast Iron

- Stainless Steel

- Brass

- Plastic

By Operation Type

- Manual

- Electric

- Pneumatic

- Hydraulic

By Design

- Two-Way Plug Valves

- Three-Way Plug Valves

By End-User

- Oil and Gas

- Chemical and Petrochemical

- Water and Wastewater

- Energy

- Others

Driving Factors

Rising Industrial Infrastructure Demands Drive Plug Valve Adoption

The main driving factor for the Plug Valve Market is the steady growth of industrial infrastructure that requires reliable and simple flow control solutions. Plug valves are widely chosen because they offer quick shut-off, low leakage, and stable operation in pipelines handling liquids and gases.

As industries expand processing plants, utilities, and distribution networks, the need for valves that can work under pressure and reduce maintenance becomes stronger. Investment activity across broader industrial ecosystems also supports this trend.

For example, Castiron secured a $6 million seed round to support food artisans, highlighting how capital is flowing into production and processing environments where dependable flow control is essential. Such funding indirectly strengthens demand for durable valves used in supporting infrastructure, logistics, and utility systems that enable industrial growth.

Restraining Factors

Strict Environmental Rules Increase Installation Complexity

One major restraining factor for the Plug Valve Market is the rise in strict environmental regulations that affect industrial operations and pipeline systems. Plug valves must now meet tighter leakage, emission, and material compliance standards, which can slow approval and installation timelines.

Industries are required to invest more time in testing, documentation, and system upgrades before valves can be put into service. Government-backed environmental programs also reflect this shift in regulatory focus.

For instance, the Department of Agriculture and Natural Resources announced more than $172 million for statewide environmental projects, signaling stronger oversight and sustainability requirements. While these initiatives support environmental protection, they can increase compliance efforts for industrial equipment users, limiting faster adoption of plug valves in certain regulated applications.

Growth Opportunity

Petrochemical Capacity Expansion Creates Long Term Demand

A key growth opportunity for the Plug Valve Market comes from ongoing expansion and restructuring within petrochemical and processing industries. As companies invest in new plants or optimize existing facilities, reliable flow-control equipment becomes essential to manage safety and efficiency.

Even when projects face short-term financial pressure, they often lead to long-term infrastructure upgrades. For example, SCG Chemicals reported a loss of $87 million from its Vietnam-based Long Son Petrochemicals business in the first quarter, highlighting operational challenges that can trigger system reviews and modernization efforts.

Such conditions encourage operators to replace aging flow systems with durable plug valves that ensure stable performance, supporting future demand as facilities move toward more efficient and resilient operations.

Latest Trends

Gas Chemical Expansion Drives Advanced Valve Demand

One of the latest trends in the Plug Valve Market is the rising demand from large-scale gas and chemical expansion projects. As gas processing and downstream chemical facilities grow, there is a stronger focus on valves that can deliver reliable shut-off, withstand pressure variations, and operate consistently over long periods.

Large funding-backed projects highlight this shift toward modernized infrastructure. For instance, Uzbekneftegaz received €1.1 billion funding for the expansion of the Shurtan gas chemical complex, reflecting renewed investment in gas-based production capacity.

Such projects require robust flow control solutions to support safe operations, driving adoption of plug valves designed for long service life and stable performance in complex processing networks.

Regional Analysis

Asia-Pacific dominates the Plug Valve Market with 45.80% share, valued at USD 1.8 Bn.

Asia-Pacific dominates the Plug Valve Market, holding a 45.80% share and valued at USD 1.8 Bn. This leadership reflects strong industrial activity across energy, chemicals, and infrastructure projects in the region. Rapid expansion of pipeline networks and continuous upgrades of processing facilities support steady demand for reliable flow control solutions. The region’s focus on durability and long service life in valves reinforces sustained adoption, allowing Asia-Pacific to maintain its leading position by both market share and value.

North America represents a mature market for plug valves, supported by established pipeline infrastructure and regular maintenance cycles. Demand here is driven by the need to replace aging flow control systems and improve operational reliability in process industries. Emphasis on safety standards and efficient shut-off functions continues to support stable demand across industrial applications.

Europe shows consistent adoption of plug valves due to ongoing industrial modernization and environmental compliance requirements. Industries focus on dependable valve performance to meet operational efficiency targets. This results in steady usage across industrial flow systems, particularly in regulated operating environments.

Middle East & Africa benefits from energy and processing investments that require durable and compact valve solutions. Plug valves are preferred for their simple design and effective flow isolation in demanding environments.

Latin America sees gradual growth, supported by infrastructure development and industrial upgrades. Increasing focus on system reliability and maintenance efficiency supports plug valve adoption across regional facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Emerson Electric Company plays a significant role in the global Plug Valve Market through its strong focus on industrial automation and flow-control solutions. In 2024, the company’s plug valve offerings align closely with its broader portfolio for process industries, supporting reliable shut-off and operational safety. Its emphasis on engineering precision and long service life helps customers maintain efficient plant operations while reducing downtime. Emerson’s global manufacturing and service presence allows it to support complex valve requirements across varied industrial environments.

Flowserve Corporation continues to strengthen its position in the Plug Valve Market by leveraging deep expertise in valves, pumps, and sealing technologies. In 2024, the company remains focused on delivering durable plug valve solutions designed for demanding pressure and temperature conditions. Its integrated approach to flow management enables operators to optimize system performance while maintaining consistent control. Flowserve’s experience across energy and industrial applications supports steady demand for its plug valve portfolio.

Schlumberger Limited contributes to the Plug Valve Market through its strong linkage with oilfield and energy-related operations. In 2024, plug valves remain important within Schlumberger’s equipment ecosystem to support flow isolation and system reliability. The company’s operational knowledge of challenging environments helps reinforce dependable valve usage across critical applications.

Top Key Players in the Market

- Emerson Electric Company

- Flowserve Corporation

- Schlumberger Limited

- Val-Matic Valve & Mfg. Corporation

- Henry Pratt Company

- Norgas Controls Inc.

- Galli & Cassina Spa

- NTGD Valve (China) Co. LTD

- AZ Armaturen

- FluoroSeal Group

Recent Developments

- In November 2024, Emerson announced a proposal to acquire all outstanding shares of AspenTech, further consolidating its automation- and software-oriented business verticals.

- In August 2024, Flowserve signed an agreement to acquire MOGAS Industries, a specialist in severe-service valves and associated aftermarket services.

- In April 2024, SLB announced a definitive all-stock agreement to acquire ChampionX, a company known for production chemicals, artificial-lift technologies and related oilfield services.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 6.5 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non-Lubricated Plug Valve, Lubricated Plug Valve, Eccentric Plug Valve, Expanding Plug Valve), By Material (Cast Iron, Stainless Steel, Brass, Plastic), By Operation Type (Manual, Electric, Pneumatic, Hydraulic), By Design (Two-Way Plug Valves, Three-Way Plug Valves), By End-User (Oil and Gas, Chemical and Petrochemical, Water and Wastewater, Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Emerson Electric Company, Flowserve Corporation, Schlumberger Limited, Val-Matic Valve & Mfg. Corporation, Henry Pratt Company, Norgas Controls Inc., Galli & Cassina Spa, NTGD Valve (China) Co. LTD, AZ Armaturen, FluoroSeal Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Emerson Electric Company

- Flowserve Corporation

- Schlumberger Limited

- Val-Matic Valve & Mfg. Corporation

- Henry Pratt Company

- Norgas Controls Inc.

- Galli & Cassina Spa

- NTGD Valve (China) Co. LTD

- AZ Armaturen

- FluoroSeal Group