Global Plastics Injection Molding Market Size, Share, And Business Benefit By Raw Material (Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polystyrene, Polyethylene, Polyvinyl Chloride (PVC), Polycarbonate, Others), By Application (Packaging, Building and Construction, Consumer Goods, Electronics, Automotive and Transportation, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166059

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

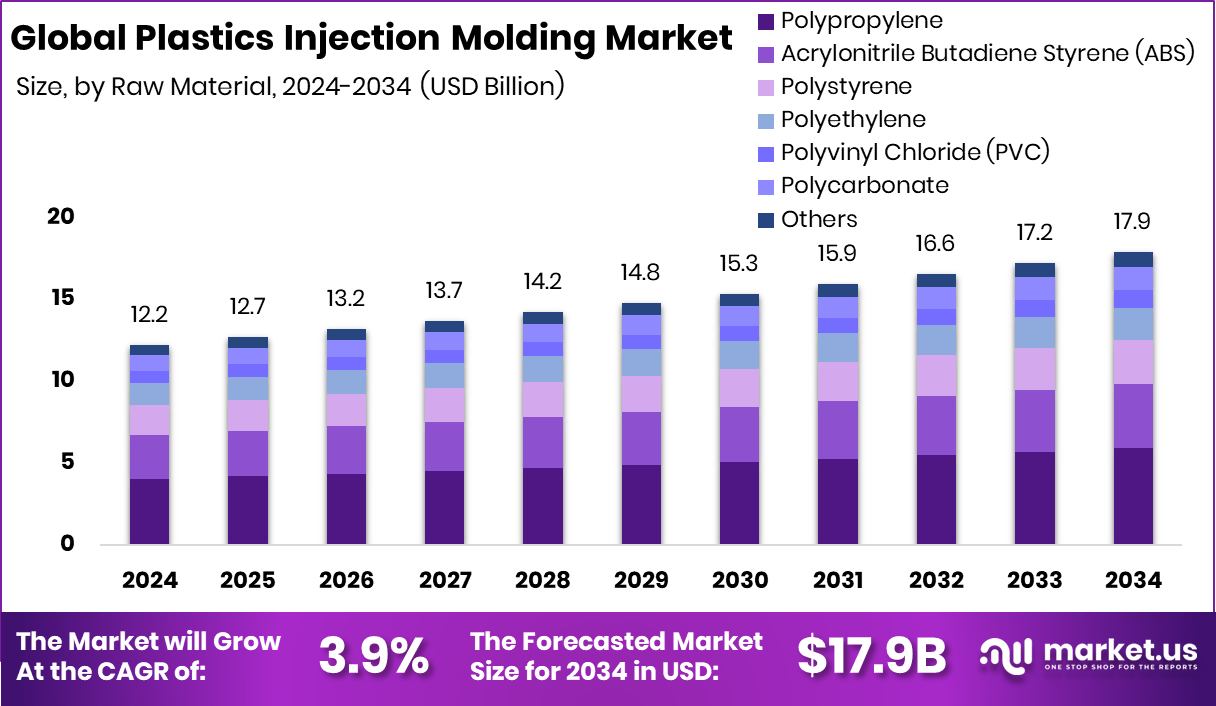

The Global Plastics Injection Molding Market is expected to be worth around USD 17.9 billion by 2034, up from USD 12.2 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. Asia-Pacific at 36.8% and USD 4.4 Bn shows sustained growth.

Plastics injection molding is a manufacturing process used to create precise plastic parts in large volumes. It works by melting plastic pellets and injecting the molten material into a closed metal mold under pressure. After cooling and solidification, the part is ejected, and the cycle repeats, making it suitable for everything from automotive and electronics components to medical and packaging products. It supports complex shapes, consistent quality, fast production speed, and compatibility with many plastic types, including polypropylene, ABS, nylon, and engineering-grade polymers.

The plastics injection molding market reflects a wide industrial adoption of lightweight, durable, and customizable plastic components. Its growth is tied to automotive lightweighting, medical disposables, electronics miniaturization, and packaging innovation. Advanced machinery, automation, and recyclable polymers are expanding capabilities, while new capacity investments and recycling initiatives are reshaping supply and sustainability. Rising focus on the circular economy is encouraging post-consumer scrap integration and material recovery.

Market growth factors include rapid industrial expansion and strong polymer availability supported by ongoing capacity additions. A major push comes from initiatives such as a $2 billion polypropylene production plant and terminal investment in Türkiye, expected to add $300 million annually to national trade, enabling more stable raw material access for molding industries. Financial support, such as REC extending ₹4,785 crore for a refinery project in Rajasthan, also indicates upstream infrastructure strength that supports polymer-based manufacturing growth.

The demand outlook remains positive due to expanding automotive interiors, electrical housings, medical consumables, household items, and precision components. Lightweight substitutes for metals, faster molding cycles, and growing customization needs are boosting preference. Packaging and consumer electronics remain significant contributors, driven by durability and cost efficiency.

Key opportunities include recycling, biopolymers, and circular material systems. Programs like The Recycling Partnership, targeting $35 million in funding for polypropylene recycling, along with $2 million in support to boost PP recovery facilities, highlight room for sustainable product lines, closed-loop manufacturing models, and investments in recycled-grade molding applications.

Key Takeaways

- The Global Plastics Injection Molding Market is expected to be worth around USD 17.9 billion by 2034, up from USD 12.2 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Polypropylene held 33.7% in the Plastics Injection Molding Market, driven by versatility and lightweight performance.

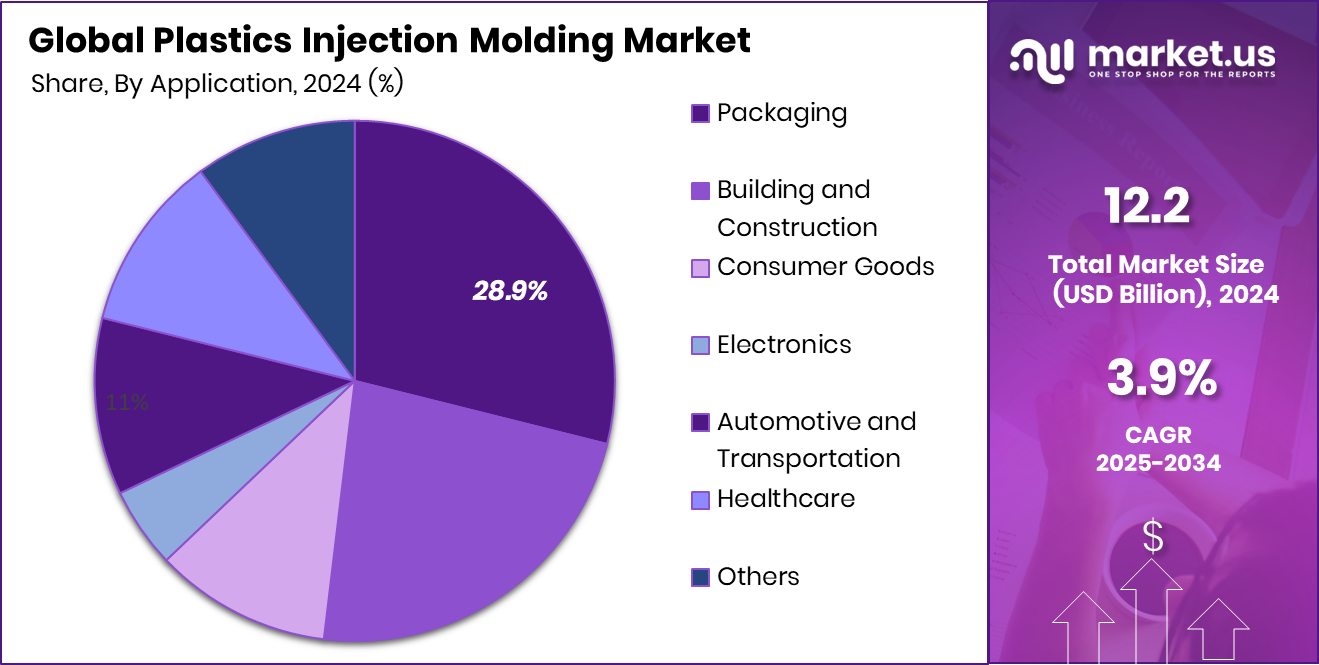

- Packaging accounted for 28.9% in the Plastics Injection Molding Market, supported by hygiene needs and global consumption growth.

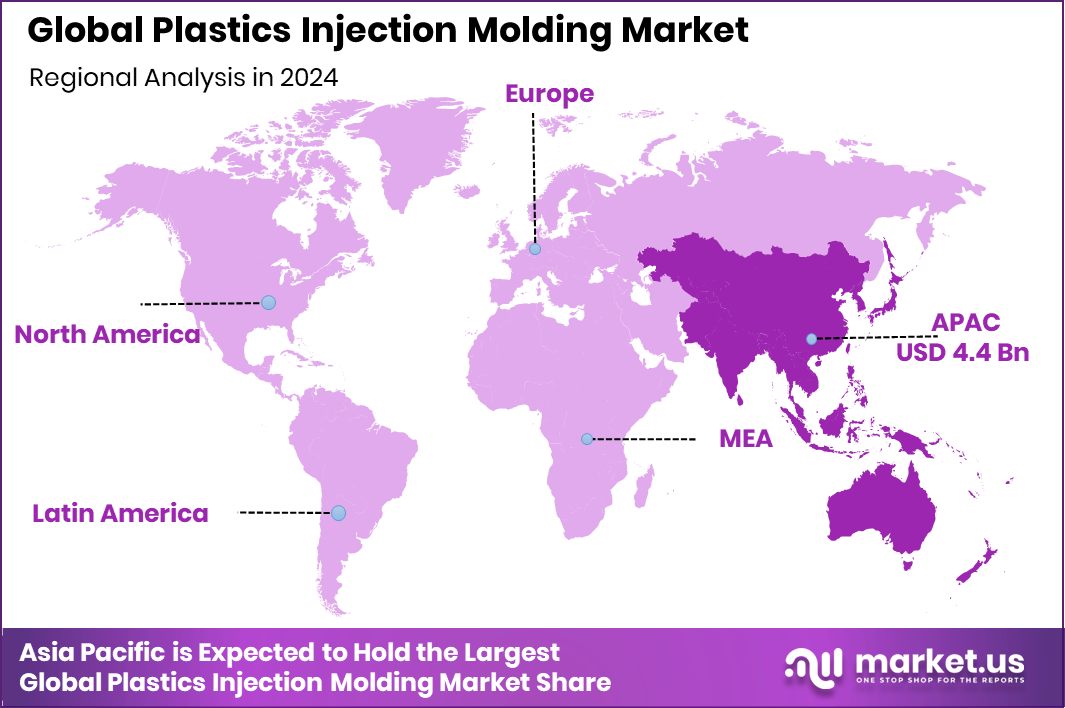

- The Asia-Pacific touched USD 4.4 Bn, showing strong manufacturing and industrial expansion.

By Raw Material Analysis

By Polypropylene 33.7% share, the Plastics Injection Molding Market prefers lightweight parts.

In 2024, Polypropylene held a dominant market position in By Raw Material segment of the Plastics Injection Molding Market, with a 33.7% share. This leadership reflects its wide adaptability, balanced mechanical strength, low cost profile, and suitability for both rigid and flexible applications.

It remains a preferred choice for automotive trims, daily-use consumer goods, storage products, caps and closures, appliance housings, thin-wall packaging, and medical-grade components. Its processing ease, recyclability, and moisture-resistant characteristics help maintain consistent demand in sectors where durability meets cost-efficiency expectations.

Polypropylene also benefits indirectly from supportive investments, including capacity expansions and recycling initiatives launched to strengthen availability and circular use. This allows manufacturers to keep production stable while maintaining competitive cost advantages.

By Application Analysis

By Packaging a 28.9% share, the Plastics Injection Molding Market supports durable mass production.

In 2024, Packaging held a dominant market position in By Application segment of the Plastics Injection Molding Market, with a 28.9% share. Its strong position is supported by large-scale consumption across food, beverages, personal care, household products, and pharmaceutical containers.

Injection molding enables lightweight, durable, leak-proof, and cost-effective packaging formats such as caps, closures, containers, tubs, lids, and protective housings. The segment benefits from high-volume production capability, faster cycle times, and design flexibility needed for branding and usability.

Consumer preference for safe, convenient, and tamper-resistant packaging continues to reinforce the use of molded plastic formats. Alongside this, ongoing polypropylene recycling and funding-driven improvements in recovery infrastructure align with the long-term sustainability needs of packaging manufacturers.

Key Market Segments

By Raw Material

- Polypropylene

- Acrylonitrile Butadiene Styrene (ABS)

- Polystyrene

- Polyethylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Others

By Application

- Packaging

- Building and Construction

- Consumer Goods

- Electronics

- Automotive and Transportation

- Healthcare

- Others

Driving Factors

Growing Polymer Capacity and Industrial Expansion Boosting Growth

A major driving factor for the plastics injection molding market is the expansion of polymer production and new investment in large-scale material manufacturing facilities. When raw material supply becomes more stable, pricing and availability improve for molding units, helping them maintain continuous production.

A key example is the Adani Group resuming its $4 billion PVC plant project, planned for 2026 completion, which signals strong confidence in long-term polymer demand and domestic value creation.

Such large investments support the availability of PVC-based molding applications in pipes, fittings, packaging, consumer goods, and electrical parts. These capacity projects also help reduce import dependence, improve logistics, and offer better cost benefits for manufacturers aiming to scale.

Restraining Factors

High Environmental Pressure and Disposal Challenges Rising

One major restraining factor for the plastics injection molding market is the growing environmental pressure surrounding plastic waste, landfill accumulation, and the slow degradation rate of molded parts.

Many regions are tightening rules on single-use plastic products, packaging formats, and resin selection, which creates compliance costs for manufacturers. Waste-management capacity, sorting systems, and recycling quality are still not uniform across many countries, making it difficult to ensure consistent circular use.

At the same time, developing alternatives such as bio-based and compostable materials can require new machinery settings, trials, and re-certification, which slows adoption. These environmental expectations influence design, material sourcing, labeling, and disposal responsibility, creating operational challenges for both producers and product-using industries.

Growth Opportunity

Rising Scope in Recycled and Circular Plastics Manufacturing

A key growth opportunity in the plastics injection molding market is the shift toward recycled and circular materials for everyday and industrial products. Brands, manufacturers, and policy bodies are focusing on sustainable packaging, reusable components, and recycled polymer reprocessing to reduce plastic waste. This trend creates opportunities for molding companies to upgrade machinery, adopt recycled granules, and develop eco-focused product lines.

Financial support and partnerships encourage this transition, such as Engro Polymer signing a $35 million Ijarah-based financing facility with IFC, which reflects confidence in long-term polymer and value-added material growth. Such investments can accelerate recycled resin production, improve quality and stability, and boost availability, allowing molding manufacturers to innovate responsibly while expanding new-age product portfolios.

Latest Trends

Shift Toward Smart, Automated, and Digital Molding

One of the latest trends in the plastics injection molding market is the move toward automation, digital monitoring, and smart manufacturing systems. Many facilities are integrating robotic part handling, real-time production data tracking, AI-assisted quality inspection, and automatic material feeding systems to reduce errors and improve cycle times.

Digital technologies also help measure mold temperature, injection pressure, energy use, and material flow to predict defects and lower rejection rates. This trend supports stable quality, reduces labor dependence, and enables round-the-clock manufacturing.

In addition, automated machines ensure consistent part geometry even for highly complex designs, helping manufacturers produce medical, automotive, electronics, and packaging components with better efficiency and standardized repeatability.

Regional Analysis

Asia-Pacific leads the Plastics Injection Molding Market with 36.8% dominant value.

The Plastics Injection Molding Market shows varied regional progress across North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America, influenced by industrial growth, product application expansion, and evolving material use.

Among these regions, Asia-Pacific stands as the dominating market with a 36.8% share, valued at USD 4.4 Bn, supported by large-scale manufacturing, packaging consumption, consumer goods demand, and strong polymer processing presence. Continuous investment in machinery, molds, and plastic components positions the region as an operational hub for multiple downstream sectors.

North America maintains a stable demand for precision-molded products used in medical, electronics, and industrial applications, supported by strong standards and a material testing culture. Europe records steady development driven by engineered plastics, safety-focused product applications, and regulatory-driven molding innovations.

The Middle East & Africa show gradual adoption linked with packaging, automotive components, and basic consumer product requirements, while Latin America benefits from moderate industrial and commodity-linked manufacturing activities. Across all regions, cost-effective plastic part production, custom design capability, durability, and compatibility with multiple material grades continue to drive usage in molded applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ALPLA is recognized for its long-standing focus on molded packaging and customized plastic solutions used across food, beverage, household, and personal care applications. The company’s consistent work in lightweight packaging, reusable formats, and functional product design keeps it aligned with evolving brand requirements and sustainability-driven product preferences.

Amcor PLC remains known for its capabilities in delivering packaging solutions with high precision and molded technical performance. Its positioning in the market is supported by multi-industry demand, where customers require durable, safe, and high-quality packaging parts formed through injection molding systems. The company maintains a focus on functionality, product protection, and usability, aligning its portfolio with changing consumer and regulatory expectations.

AptarGroup Inc. (CSP Technologies) plays a notable role in molded dispensing systems, closures, and protective packaging components, often linked to healthcare, food safety, and consumer goods. Their molding capabilities support controlled delivery, moisture-barrier performance, and extended product protection.

Top Key Players in the Market

- ALPLA

- Amcor PLC

- AptarGroup Inc. (CSP Technologies)

- BERICAP

- Berry Global Inc.

- EVCO Plastics

- HTI Plastics

- IAC Group

- Magna International

- Quantum Plastics

- Silgan Holdings Inc

Recent Developments

- In April 2025, Amcor completed the combination with Berry Global Group Inc., strengthening its offering in rigid plastics and injection-moulded packaging.

- In May 2024, ALPLA launched a dedicated injection-moulding division called ALPLAinject, reinforcing its capability to deliver high-quality injection-moulded parts such as closures, caps, jars, and multi-part packaging components.

Report Scope

Report Features Description Market Value (2024) USD 12.2 Billion Forecast Revenue (2034) USD 17.9 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polystyrene, Polyethylene, Polyvinyl Chloride (PVC), Polycarbonate, Others), By Application (Packaging, Building and Construction, Consumer Goods, Electronics, Automotive and Transportation, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ALPLA, Amcor PLC, AptarGroup Inc. (CSP Technologies), BERICAP, Berry Global Inc., EVCO Plastics, HTI Plastics, IAC Group, Magna International, Quantum Plastics, Silgan Holdings Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plastics Injection Molding MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Plastics Injection Molding MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ALPLA

- Amcor PLC

- AptarGroup Inc. (CSP Technologies)

- BERICAP

- Berry Global Inc.

- EVCO Plastics

- HTI Plastics

- IAC Group

- Magna International

- Quantum Plastics

- Silgan Holdings Inc