Global Plastic Water Storage Systems Market Size, Share, And Enhanced Productivity By Type (Polyethylene Tanks, Polypropylene Tanks, Fiberglass Reinforced Plastic (FRP) Tanks, PVC Tanks, Composite Tanks), By Application (Residential Water Storage, Commercial Water Storage, Agricultural Water Storage, Industrial Water Storage, Emergency Water Storage), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171900

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

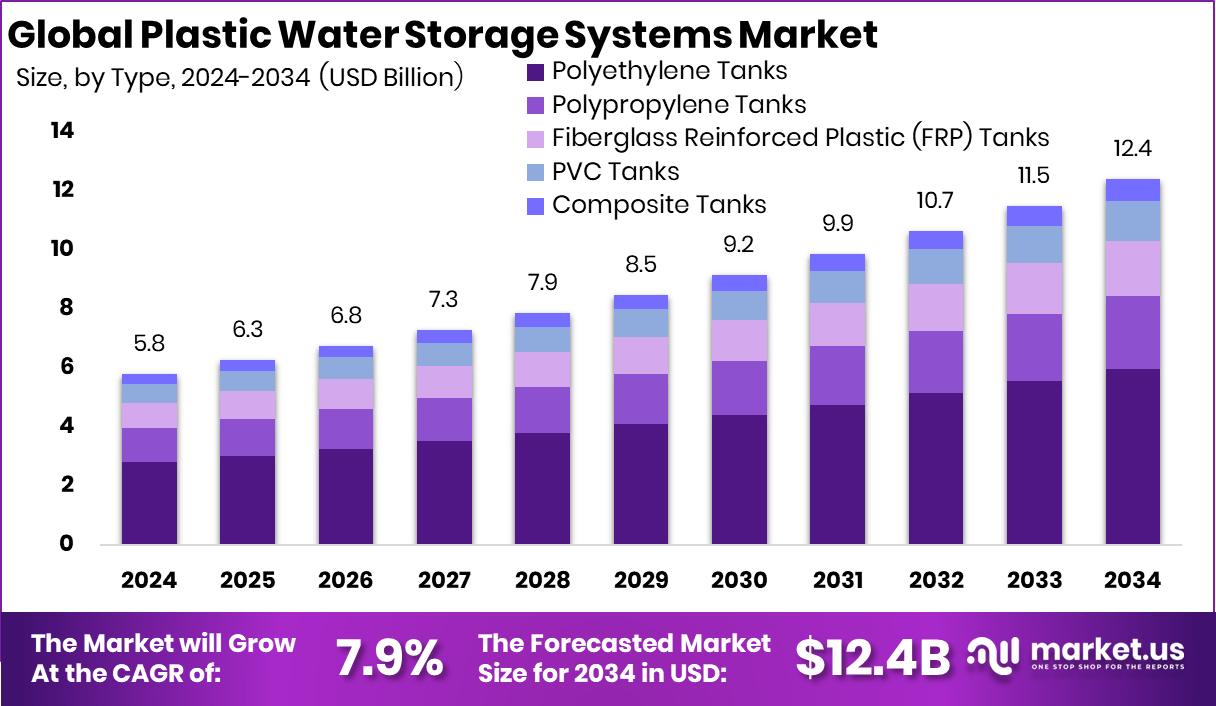

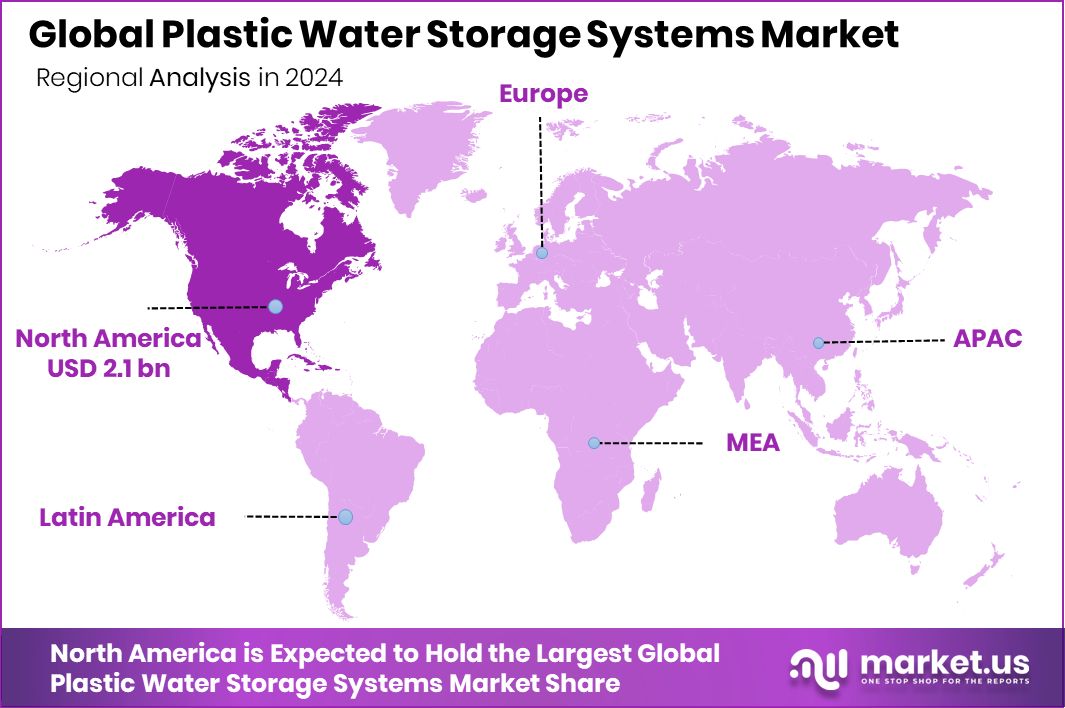

The Global Plastic Water Storage Systems Market is expected to be worth around USD 12.4 billion by 2034, up from USD 5.8 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034. North America maintained steady demand, supporting the 36.30% share in 2024.

Plastic water storage systems are containers made from durable plastics such as polyethylene, designed to safely store water for household, agricultural, commercial, and industrial use. They are widely preferred because they are lightweight, corrosion-resistant, easy to install, and suitable for long-term storage in varying climate conditions. These systems support daily needs like drinking, cleaning, irrigation, and emergency backup supply, making them an important part of water-management practices across both urban and rural regions.

The Plastic Water Storage Systems Market represents the industry that manufactures, distributes, and installs these tanks for different end-users. The market expands as communities seek safer and more reliable water-storage solutions in response to irregular supply patterns, rising construction activities, and increasing awareness about water security. Government-backed investments also strengthen demand for advanced and long-lasting storage options.

Growth in this sector is supported by steady infrastructure spending and rising household requirements. Programs such as DANR’s $172 million allocation for statewide environmental projects and $312 million awarded to communities for clean-water improvements stimulate large-scale adoption of plastic storage systems. These initiatives encourage more installations in public facilities and underserved regions.

Demand also rises as states strengthen water infrastructure. The TDEC’s nearly $300 million investment in water systems helps expand treatment, distribution, and storage capacity, creating direct opportunities for plastic tank suppliers. Growing urban expansion and construction further push consumers toward durable and cost-effective storage products.

Market opportunities continue to develop as economic-development spending increases. Gov. Reeves highlighted over $100 million in upcoming development programs, while JM Financial’s coverage predicting an upside in plastic-related sectors signals confidence in long-term industry potential.

Key Takeaways

- The Global Plastic Water Storage Systems Market is expected to be worth around USD 12.4 billion by 2034, up from USD 5.8 billion in 2024, and is projected to grow at a CAGR of 7.9% from 2025 to 2034.

- Polyethylene tanks hold a 48.2% share in the Plastic Water Storage Systems Market due to durability.

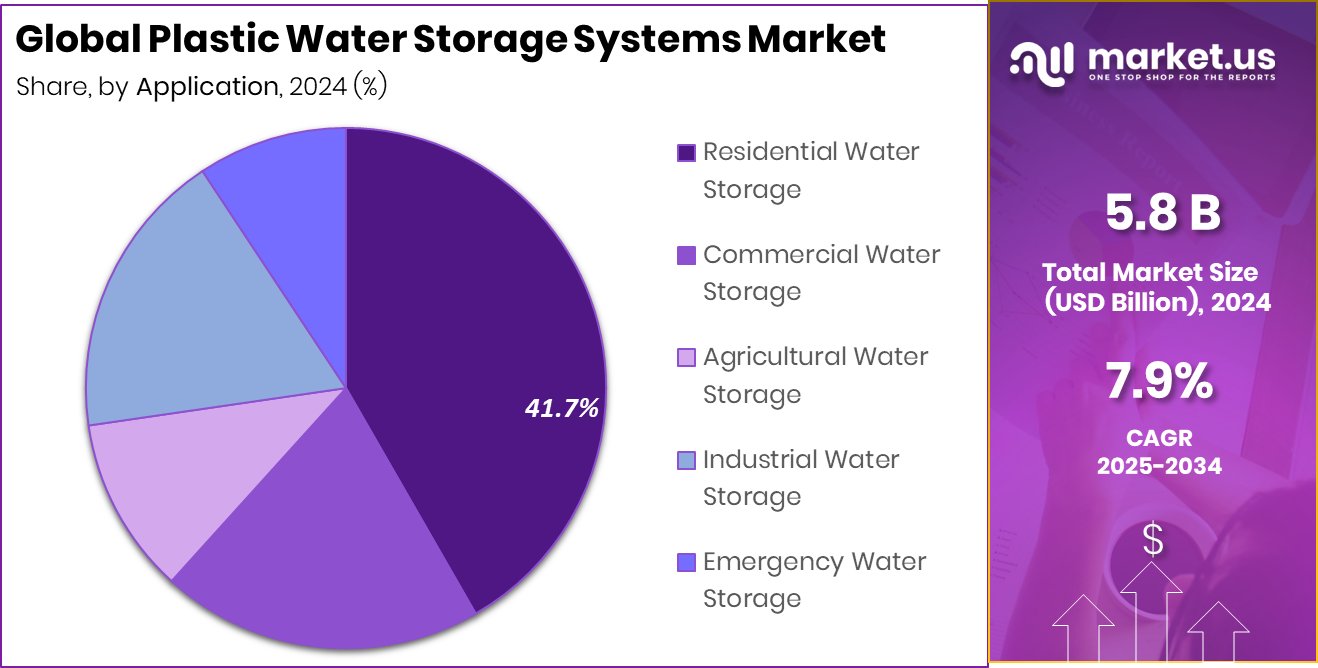

- Residential water storage accounts for 41.7% of the Plastic Water Storage Systems Market, driven by urban demand.

- North America recorded a strong market valuation of USD 2.1 billion.

By Type Analysis

Polyethylene tanks dominate the Plastic Water Storage Systems Market with 48.2% share.

In 2024, Polyethylene Tanks held a dominant market position in the By Type segment of the Plastic Water Storage Systems Market, with a 48.2% share. This leadership reflects their strong acceptance across households and commercial spaces due to their lightweight design, durability, and ease of installation. Many buyers prefer polyethylene because it resists corrosion and environmental wear, making it suitable for long-term water storage needs.

Additionally, the segment benefits from consistent demand for affordable and low-maintenance storage solutions. Polyethylene Tanks continue to strengthen their presence as consumers prioritize reliable and hygienic storage materials. Their large share highlights how this category remains the first choice for users seeking practical and cost-effective water storage options in 2024.

By Application Analysis

Residential water storage leads the Plastic Water Storage Systems Market with 41.7% share.

In 2024, Residential Water Storage held a dominant market position in the By Application segment of the Plastic Water Storage Systems Market, with a 41.7% share. This strong lead comes from growing household needs for dependable water storage, driven by urban expansion and inconsistent municipal supply in many regions. Families increasingly choose plastic tanks as they offer easier installation, better hygiene management, and long service life.

The segment’s large share also reflects rising adoption of compact and rooftop-friendly tanks that meet daily household usage patterns. Residential Water Storage remains the most influential application area, as homes continue to prioritize accessible and convenient water storage solutions. Its 2024 dominance shows how essential plastic tanks have become in everyday residential planning.

Key Market Segments

By Type

- Polyethylene Tanks

- Polypropylene Tanks

- Fiberglass Reinforced Plastic (FRP) Tanks

- PVC Tanks

- Composite Tanks

By Application

- Residential Water Storage

- Commercial Water Storage

- Agricultural Water Storage

- Industrial Water Storage

- Emergency Water Storage

Driving Factors

Growing Investments Strengthen Water Storage Demand

The Plastic Water Storage Systems Market is expanding steadily as governments increase their focus on long-term water security. A major boost comes from the UK water watchdog’s plan to attract £50 billion in investments, supported by guaranteed revenues that encourage large-scale upgrades in water systems. Such strong commitments naturally increase the need for durable water-storage structures, especially in regions planning future-focused infrastructure.

Another important contribution comes from California’s programs to support drought-prone communities. The state recently awarded $10 million to help small communities prepare for long-term dry conditions, creating clear demand for reliable storage solutions. As more households and public facilities adopt plastic tanks to manage future water shortages, the market benefits from a stable and growing customer base.

Restraining Factors

High Costs And Infrastructure Delays Slow Adoption

Despite strong demand, the Plastic Water Storage Systems Market faces challenges linked to infrastructure strain and rising replacement needs. Michigan’s environmental agency, EGLE, announced $267 million in Clean Water grants to rebuild water systems, showing how often aging infrastructure requires costly upgrades. These delays can slow the installation of new storage solutions, especially in regions facing budget pressure.

Florida also highlighted concerns by flagging more than $410 million in water projects, underscoring the financial burden associated with repairing pipelines, treatment units, and distribution systems. When funds are directed toward large repairs, smaller communities often postpone investment in storage systems. This slows market adoption and limits the speed at which plastic storage solutions can expand across affected areas.

Growth Opportunity

Agricultural Water Projects Create New Market Openings

A major growth opportunity for the Plastic Water Storage Systems Market comes from rising investments in agricultural water protection and resource management. In the U.S., Governor Hochul awarded $15.8 million to help dairy farmers protect water quality, encouraging farms to adopt better storage and handling systems. This support naturally increases demand for durable plastic tanks designed for water conservation and runoff control.

Opportunity grows further as states expand funding for agricultural water resource upgrades. Commissioner Wilton Simpson announced a $25 million funding opportunity to support projects that improve how farms capture, store, and manage water. These programs motivate farmers to invest in dependable storage solutions, making plastic tanks an essential part of long-term agricultural water planning.

Latest Trends

Shift Toward Resilient And Drought-Ready Storage Designs

A key trend shaping the Plastic Water Storage Systems Market is the move toward more resilient, drought-prepared storage solutions. Farmers and rural communities increasingly seek systems that help them withstand longer dry seasons. Supporting this shift, B.C. pledged $80 million to help farmers cope with prolonged drought, accelerating the adoption of plastic tanks that store emergency and irrigation water.

Innovation also supports this trend as material enhancements gain traction. For example, Graphmatech secured a €2.5 million EU grant to expand its pilot facility, enabling progress in advanced materials that can influence future tank durability and lifespan. Together, these efforts push the market toward stronger, longer-lasting, and climate-ready storage technologies.

Regional Analysis

North America led the Plastic Water Storage Systems Market with 36.30% share.

In the Plastic Water Storage Systems Market, North America emerged as the dominant regional segment with a 36.30% share valued at USD 2.1 billion. This leadership reflects the region’s strong adoption of durable storage solutions driven by residential, commercial, and institutional usage patterns. Demand remains steady as consumers prioritize reliable systems for managing water security across both urban and semi-urban settings.

Europe follows as a stable market, supported by consistent consumption in households and industrial facilities, where plastic tanks are preferred for their ease of handling and long service life. Asia Pacific shows growing uptake, supported by rapid urban growth and rising needs for household-level water storage.

Meanwhile, the Middle East & Africa region continues to integrate plastic storage systems as water availability fluctuations increase dependency on efficient storage infrastructure. Latin America also adopts these solutions, reflecting expanding residential requirements and a preference for cost-effective systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, A. O. Smith maintained a strong presence in the global Plastic Water Storage Systems Market by leveraging its long-standing focus on durable and user-centric water solutions. The company’s wide portfolio in water heating and storage equipment supports its reputation for consistent quality, allowing it to capture steady demand across residential and commercial applications. Its engineering strength and product reliability keep the brand relevant in regions where consumers prioritize long-term performance and efficient storage designs.

Roto Tank remained influential in 2024 by serving diverse application needs through its broad range of plastic tanks designed for residential, agricultural, and industrial use. The company’s emphasis on robust construction, weather resistance, and ease of installation enables it to retain strong customer loyalty in markets requiring reliable day-to-day water access. Its flexible product configurations help address varying capacity demands, strengthening its competitive position.

Chem-Tainer maintained its role as a notable player through its specialization in high-quality plastic tanks tailored for commercial and industrial environments. Its focus on material strength and chemical resistance ensures relevance in sectors where storage safety and compliance remain essential, allowing the company to uphold its credibility in 2024.

Top Key Players in the Market

- A. O. Smith

- Roto Tank

- Chem-Tainer

- Poly Processing

- Snyder Industries

- Plasson

- Sintex Industries

- Rainwater Harvesting

- Pentair

Recent Developments

- In April 2025, Poly Processing Company began offering its complete line of storage tanks in all specific gravities with the OR-1000 system. This expansion means customers can choose tanks with different wall thicknesses to better match their storage needs, improving tank performance and safety

- In October 2024, Snyder Industries announced via social media that its CageBuster intermediate bulk containers (IBCs) are now in stock and available for next-day shipping. CageBuster IBCs are heavy-duty containers used to transport and store liquids safely.

- In July 2024, A. O. Smith announced the planned acquisition of Pureit, a well-known water purification brand. This move expands A. O. Smith’s presence in water treatment and purification solutions, complementing its existing water heater and storage offerings. The company expected to complete the deal by year-end.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Billion Forecast Revenue (2034) USD 12.4 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyethylene Tanks, Polypropylene Tanks, Fiberglass Reinforced Plastic (FRP) Tanks, PVC Tanks, Composite Tanks), By Application (Residential Water Storage, Commercial Water Storage, Agricultural Water Storage, Industrial Water Storage, Emergency Water Storage) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape A. O. Smith, Roto Tank, Chem-Tainer, Poly Processing, Snyder Industries, Plasson, Sintex Industries, Rainwater Harvesting, Pentair Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plastic Water Storage Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Plastic Water Storage Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- A. O. Smith

- Roto Tank

- Chem-Tainer

- Poly Processing

- Snyder Industries

- Plasson

- Sintex Industries

- Rainwater Harvesting

- Pentair