Global Photovoltaic (PV) Battery Market Size, Share, Growth Analysis By Battery Type (Lithium-Ion, Lead-Acid, Nickel-Cadmium, Flow Batteries), By Chemistry (Lithium Cobalt Oxide, Lithium Iron Phosphate, Nickel Manganese Cobalt), By Storage Capacity (Below 5 kWh, 5-10 kWh, 10-15 kWh, Above 15 kWh), By Application (Residential, Commercial, Industrial, Utility Scale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168315

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

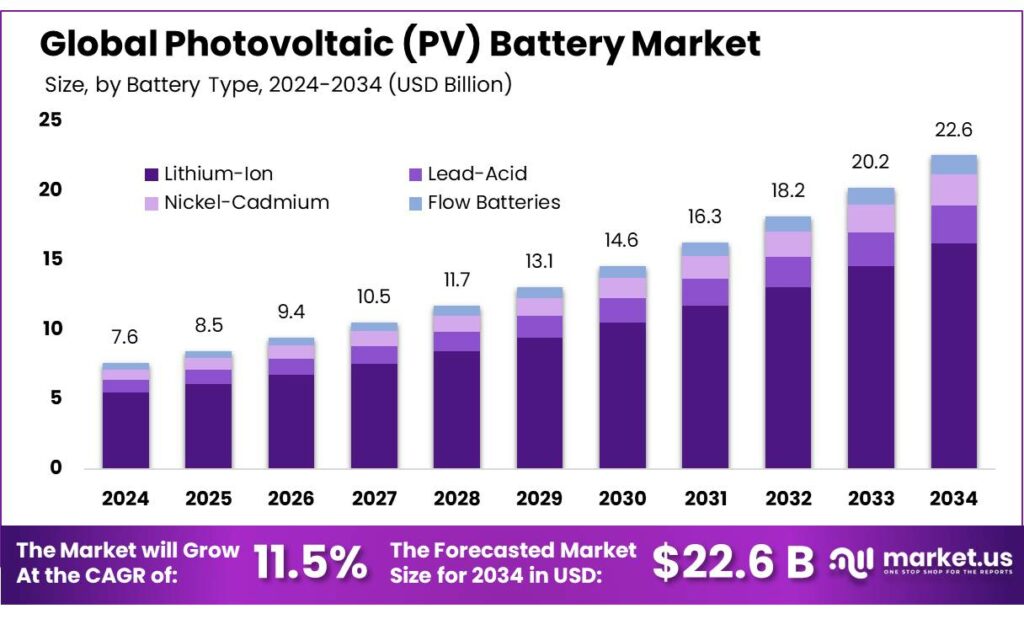

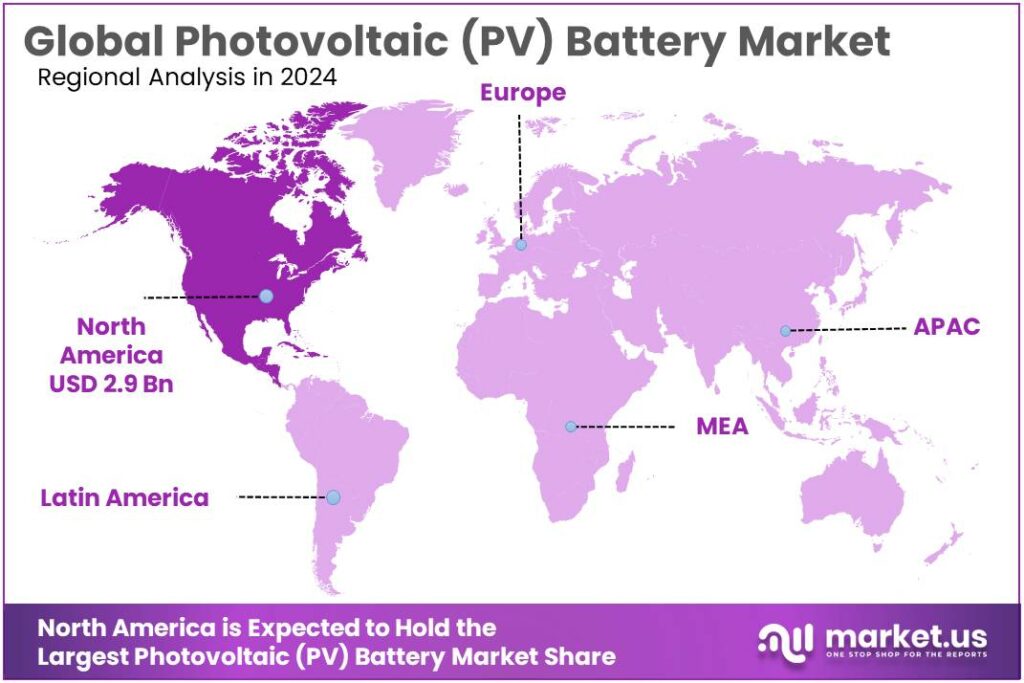

The Global Photovoltaic (PV) Battery Market size is expected to be worth around USD 22.6 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.9% share, holding USD 2.9 Billion revenue.

Photovoltaic (PV) batteries refer to energy-storage systems, mainly lithium-ion, that store electricity generated by solar PV panels and release it later to smooth output, shift energy to evening peaks, and provide backup power. They are deployed at residential rooftops, commercial and industrial sites, and large grid-scale solar farms. This segment sits at the heart of the broader solar-plus-storage value chain, linking PV module manufacturers, battery cell producers, power electronics suppliers, and project developers into integrated distributed and utility-scale solutions.

The industrial backdrop is expanding rapidly as PV deployment accelerates. REN21 reports that at least 407 GW of new solar PV capacity came online in 2023, taking global installed PV capacity to around 1.6 TW, a record increase driven by low module costs and supportive policies. In parallel, global battery storage capacity – much of it coupled to renewables – grew 120% in 2023 to reach 55.7 GW, with China alone jumping from 7.8 GW in 2022 to 27.1 GW in 2023, while the United States rose to 16.2 GW, underscoring how fast PV-battery infrastructure is scaling.

Cost deflation is a central industrial driver. IRENA estimates that total costs of fully installed battery storage projects fell by 93% between 2010 and 2024, from around USD 2,571/kWh to USD 192/kWh, transforming the economics of pairing batteries with PV. Separate IRENA analysis shows lithium-ion storage costs declining about 82% between 2013 and 2023, largely due to manufacturing scale-up and technology improvements, which makes PV-battery systems increasingly competitive with fossil-fuel peaker plants.

Policy support is another strong driving factor. In the United States, the Residential Clean Energy Credit allows households to claim 30% of the cost of qualified clean-energy property, including battery storage paired with solar, for systems installed from 2022 to 2032, significantly improving the payback of residential PV-battery systems. At the same time, global renewable expansion targets imply huge storage needs: the International Energy Agency estimates that around 1,300 GW of battery storage will be required worldwide by 2030 to support variable renewables such as solar and wind, highlighting the scale of the PV-battery opportunity.

Key Takeaways

- Photovoltaic (PV) Battery Market size is expected to be worth around USD 22.6 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 11.5%.

- Lithium-Ion held a dominant market position, capturing more than a 72.4% share.

- Lithium Cobalt Oxide held a dominant market position, capturing more than a 56.9% share.

- 5-10 kWh held a dominant market position, capturing more than a 39.5% share.

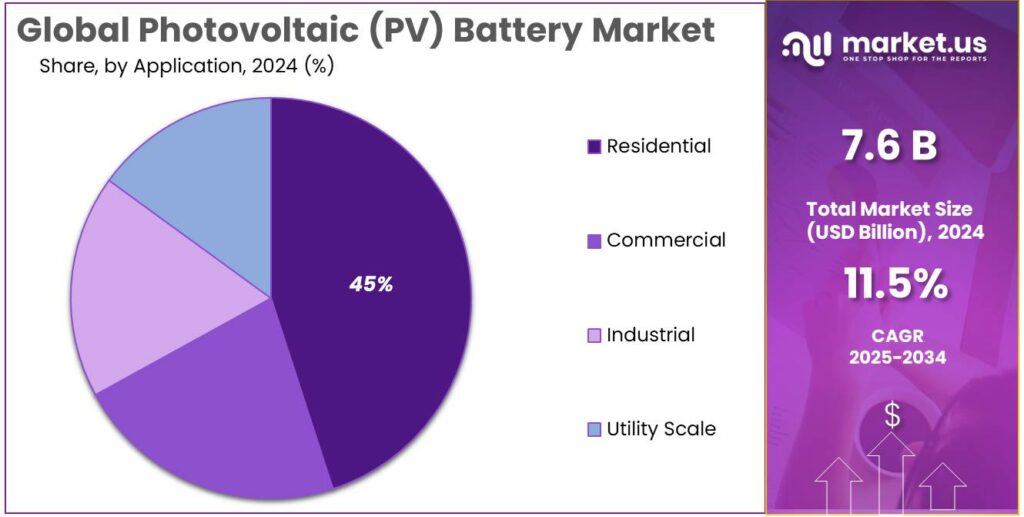

- Residential held a dominant market position, capturing more than a 44.8% share.

- North America accounted for a clear regional concentration of PV-battery demand, with a 38.90% share and an indicated market value of USD 2.9 billion.

By Battery Type Analysis

Lithium-Ion dominates PV battery market with 72.4% share due to its superior energy density and rapidly declining costs.

In 2024, Lithium-Ion held a dominant market position, capturing more than a 72.4% share of the Photovoltaic (PV) battery segment. This position was supported by technology characteristics that made Lithium-Ion the preferred choice across residential, commercial and utility-scale PV applications: high energy density enabled compact installations, favourable cycle life reduced levelized cost of storage, and established manufacturing scale delivered consistent price declines. The industrial scene was characterized by widespread deployment of Lithium-Ion systems for short- to multi-hour storage tasks, where dispatchability and efficiency were required to firm variable solar output.

Procurement and project planning were driven by predictable performance metrics and mature supply chains for cells and pack integration, while system designers and financiers favoured standardised Lithium-Ion specifications to simplify warranty and insurance arrangements. In year-on-year terms, 2024 marked the consolidation of market share around Lithium-Ion, and into 2025 the technology continued to be the principal choice for new PV+storage installations. Policy measures and tariff structures that rewarded time-shifted solar generation were instrumental in reinforcing uptake, and attention was increasingly directed toward lifecycle management, recycling and second-life applications to address end-of-life risks.

By Chemistry Analysis

Lithium Cobalt Oxide leads PV battery chemistry with 56.9% thanks to its high energy density and widespread use.

In 2024, Lithium Cobalt Oxide held a dominant market position, capturing more than a 56.9% share of the Photovoltaic (PV) battery chemistry segment. This dominance can be attributed to the chemistry’s high volumetric and gravimetric energy density, which enabled more compact and lightweight pack designs suitable for space-constrained residential and commercial installations. Procurement and project design choices were influenced by predictable discharge profiles and well-understood cycle behaviour, which reduced technical and financial uncertainty for developers and integrators.

During 2024 the technology was favoured for applications where energy density and footprint minimisation were priority requirements, and into 2025 it remained the preferred chemistry for many new PV+storage projects as system planners balanced cost, performance and warranty considerations. Lifecycle management practices, including concerted attention to safety, end-of-life recycling and second-use markets, were increasingly incorporated into procurement specifications to mitigate long-term risks.

By Storage Capacity Analysis

5–10 kWh systems dominate PV battery installations with 39.5% because they offer the best mix of capacity, cost and ease of installation.

In 2024, 5-10 kWh held a dominant market position, capturing more than a 39.5% share of the Photovoltaic (PV) battery storage capacity segment. This band was favoured across residential and small commercial projects because it provided sufficient daily energy shifting for bill management and backup without the higher capital outlay of larger systems. Procurement practices and project specifications were commonly aligned to this capacity range, which simplified stocking, financing and installation processes and reduced lead-time uncertainty for integrators.

System designers preferred 5–10 kWh packs for their straightforward sizing against typical household solar generation profiles, and lifecycle considerations such as warranty terms and expected degradation were easier to model at this scale. In 2025 the segment continued to be the primary choice for new behind-the-meter deployments as market actors prioritized rapid returns on investment and operational simplicity, reinforcing the 5–10 kWh band’s role as the backbone of near-term PV+storage growth.

By Application Analysis

Residential sector leads PV battery adoption with 44.8% as homeowners prioritize resilience and bill savings.

In 2024, Residential held a dominant market position, capturing more than a 44.8% share of the Photovoltaic (PV) battery application segment. This prevalence was driven by widespread behind-the-meter adoption where homeowners sought energy independence, backup power and time-of-use bill reduction; system selection and deployment were routinely aligned to household load profiles and solar generation patterns. Procurement and financing models were adapted to favour rooftop-plus-storage packages, with installers and distributors standardising product bundles and warranty terms to reduce transaction friction.

The residential segment benefited from predictable sizing needs—facilitating faster permitting and installation—and from growing consumer awareness of resilience benefits after grid outages. Into 2025 the residential band remained the primary source of incremental demand for PV-coupled batteries as policy incentives, retail finance options and falling system costs continued to improve the payback case for household storage, reinforcing its role as the largest single application in the near-term PV battery market.

Key Market Segments

By Battery Type

- Lithium-Ion

- Lead-Acid

- Nickel-Cadmium

- Flow Batteries

By Chemistry

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Nickel Manganese Cobalt

By Storage Capacity

- Below 5 kWh

- 5-10 kWh

- 10-15 kWh

- Above 15 kWh

By Application

- Residential

- Commercial

- Industrial

- Utility Scale

Emerging Trends

Solar-Powered Cold Chains Are Redefining How PV Batteries Are Used

A clear latest trend in Photovoltaic (PV) batteries is their rapid move into food and agriculture cold chains. Instead of just backing up homes or offices, PV batteries now keep milk, fruit, fish and vegetables cold in places where the grid is weak or missing. This is not a niche idea; it responds to a massive food-loss problem that leading food agencies have been highlighting for years. The Food and Agriculture Organization (FAO) estimates that roughly one-third of all food produced for human consumption is lost or wasted globally, equal to about 1.3 billion tonnes every year.

More recent FAO SDG data show that 13.3% of food is lost globally after harvest at farm, storage, transport and processing stages in 2023, slightly up from 13.0% in 2015. FAO further notes that post-harvest losses can reach 20% for cereals, 30% for dairy and fish, and 40% for fruit and vegetables, especially in Africa where cooling and storage are weak.

A key part of this trend is the focus on “sustainable cold chains.” The “Chilling Prospects” analysis from Sustainable Energy for All reports that a lack of sustainable cold chain leads directly to around 526 million tonnes of food losses every year, and can cut smallholder farmer incomes by about 15%.

PV batteries are at the centre of new cold-room designs that can run reliably without diesel. For example, a ColdHubs solar-powered cold room in Nigeria uses 5.5 kWp of solar PV, a 2-tonne storage capacity and batteries that are replaced roughly every six years; the unit runs at about 94% utilisation and cost around USD 27,000 to build.

Policy and technical reports are now treating PV batteries as part of the food-system toolkit, not only the power-sector toolkit. A joint FAO–IRENA study notes that global food cold-chain activities already account for around 5% of total food-system emissions, and stresses that renewables-based cooling and storage can cut emissions while reaching remote farming and fishing communities.

Drivers

Rapid Growth of Solar Power and Falling Battery Costs Drive PV Battery Adoption

One of the strongest driving factors for the Photovoltaic (PV) Battery market is the fast global expansion of solar power combined with the steady fall in battery costs. Governments, utilities, and households are installing more solar systems every year, but solar power alone cannot meet electricity needs after sunset or during cloudy periods. PV batteries solve this gap by storing daytime solar energy and supplying it when demand is high, making solar power more reliable and valuable.

Global solar deployment is growing at an unprecedented pace. According to the International Energy Agency (IEA), the world added around 407 GW of new solar PV capacity in 2023, pushing total installed solar capacity beyond 1.6 TW. This was the largest single-year increase in renewable capacity ever recorded.

As more solar systems connect to power grids, the need for storage rises automatically. The IEA also estimates that to meet global clean-energy and net-zero targets, installed battery storage capacity must reach about 1,300 GW by 2030, compared with less than 60 GW in 2023. A major share of this storage will be paired directly with solar PV plants.

Another key force is the sharp drop in battery prices. The International Renewable Energy Agency (IRENA) reports that the average cost of utility-scale battery storage systems fell by about 93% between 2010 and 2024, declining from over USD 2,500 per kWh to below USD 200 per kWh. This dramatic reduction has transformed PV batteries from a premium add-on into a commercially viable solution.

Government policies strongly reinforce this trend. In the United States, the Inflation Reduction Act allows a 30% federal tax credit for standalone battery storage and solar-plus-storage systems installed from 2023 to 2032. This policy has significantly improved project returns for residential and commercial PV battery systems.

Similar initiatives exist elsewhere. The European Union has committed to cutting greenhouse-gas emissions by 55% by 2030 under the “Fit for 55” package. To support this goal, many EU member states provide direct incentives for home batteries linked with rooftop solar, especially in Germany, Italy, and Spain.

Restraints

Raw Material Supply Constraints and Recycling Gaps Limit PV Battery Expansion

A major restraining factor for the Photovoltaic (PV) Battery market is the dependence on critical raw materials and the slow development of large-scale recycling systems. PV batteries, especially lithium-ion types, rely heavily on materials such as lithium, cobalt, nickel, and graphite. While solar installations are accelerating worldwide, the supply chains for these materials are struggling to keep pace, creating cost pressure and long-term availability concerns.

The International Energy Agency (IEA) highlights this challenge clearly. According to its Critical Minerals report, global demand for lithium is expected to increase by more than 3.5 times by 2030 compared with 2023 levels, mainly driven by batteries for energy storage and electric vehicles. However, new lithium mining projects typically take 10–16 years from discovery to production, making rapid supply expansion difficult.

Cost volatility is another concern. The IEA notes that lithium prices increased by nearly 8 times between 2020 and 2022 due to supply shortages, before correcting in 2023. Such price swings directly affect PV battery system costs and make long-term project planning harder for utilities and solar developers.

Recycling could ease this pressure, but current capacity remains limited. The International Renewable Energy Agency (IRENA) estimates that while 90–95% of lithium-ion battery materials are technically recyclable, less than 20% of end-of-life lithium batteries were actually recycled globally as of 2023. Most recycling infrastructure today is designed for lead-acid batteries, not modern energy-storage systems.

Grid-scale PV batteries also face regulatory and safety hurdles linked to materials. Fire risks related to thermal runaway have led several governments to impose stricter permitting rules for battery installations. In 2022, incidents at grid-connected lithium-ion storage facilities in the United States prompted updated fire safety guidance from authorities and local regulators, increasing compliance and insurance costs for new projects. The U.S. Department of Energy (DOE) acknowledges that safety-related standards and testing can add 5–10% to project development costs.

Governments are responding, but solutions will take time. The European Union’s Critical Raw Materials Act targets sourcing at least 10% of critical minerals domestically and recycling 15% by 2030, yet most of these measures are still in early stages. Until these policies translate into operational mines and recycling plants, raw material bottlenecks will continue to restrain PV battery growth.

Opportunity

Rural Electrification and Food Systems Create a Big Opening for PV Batteries

One of the biggest growth opportunities for Photovoltaic (PV) batteries sits where energy and food systems meet: off-grid and weak-grid rural areas that need power for irrigation, cold storage and food processing. Global energy access is still far from universal. A joint SDG7 report led by WHO shows about 685 million people were living without electricity in 2022, and 2.1 billion still lacked clean cooking, with most of them in rural regions.

International initiatives now explicitly link electrification with resilient food systems, creating a clear demand pull for PV battery projects. Under “Mission 300,” the World Bank Group and African Development Bank plan to connect 300 million people in Africa to electricity by 2030, using both grid and distributed renewable solutions such as solar mini-grids and stand-alone systems. Many of these mini-grids are being designed around batteries so that clinics, irrigation pumps and agro-processing equipment can run reliably after sunset and during cloudy days.

There is also a strong climate and emissions angle. FAO has pointed out that solar irrigation can substantially cut greenhouse-gas emissions from water pumping—up to around 95% compared with diesel-powered alternatives—while reducing local pollution and soil contamination from fuel spills. When PV pumps are combined with batteries, farmers can pump during off-peak hours, operate more efficiently, and power cold rooms or milk chillers overnight, which directly reduces food loss.

Food-sector agencies are also pushing solar-plus-storage as part of climate-smart agriculture. The Food and Agriculture Organization (FAO) highlights solar-powered irrigation as a “reliable and affordable” tool that can help small family farmers increase income and strengthen food security in water-stressed regions such as Egypt’s Nile Delta.

Regional Insights

North America leads the PV battery regional market with a 38.90% share and an estimated market value of USD 2.9 billion, driven by mature solar-plus-storage deployment and supportive policy frameworks.

In 2024, North America accounted for a clear regional concentration of PV-battery demand, with a 38.90% share and an indicated market value of USD 2.9 billion. This position was supported by large-scale utility procurements, fast-growing behind-the-meter installations and expanding virtual power plant activity. The regional industrial scene was characterised by a wide mix of applications — residential time-shift and resilience, commercial demand-charge management, and utility-scale PV+storage for capacity firming — which together sustained steady order books and higher average system sizes.

North America’s BESS revenue trajectory underpins this picture: reported regional battery energy storage system revenues were in the low-single-billion USD range in 2024, reflecting rapid year-on-year growth in deployments. Policy and finance mechanisms contributed materially; federal and state incentives, expanded eligibility for storage under tax credit regimes and active grid modernization programmes reduced project risk and supported capital flows. Supply-chain dynamics were shaped by pronounced EV-sector scale-up and ongoing sourcing efforts for critical minerals, prompting heightened attention to recycling and second-life strategies in procurement specifications.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Q CELLS has been positioned as an integrated solar and storage solutions provider, with product lines spanning modules, behind-the-meter batteries and system software. Market adoption was supported by standardised product families that simplify procurement and installation for installers and distributors. Emphasis was placed on residential and small commercial packages where compactness and warranty terms mattered. Into 2024–2025 Q CELLS maintained a visible pipeline of combined PV+battery offerings as project developers sought turnkey solutions.

SolarEdge was described as a technology-led player that combined inverters, power optimizers and an energy management platform with modular battery options. A 2024 product introduction formalised an all-in-one residential solar plus scalable battery offering, reinforcing its route to market through channel partners and installers. System-level intelligence and monitoring were emphasised to improve yield and enable whole-home backup, which influenced procurement specifications for rooftop PV projects and behind-the-meter storage in 2024–2025.

JinkoSolar’s core strength in high-volume PV manufacturing was complemented by growing energy storage system (ESS) integration and project delivery capabilities. Vertical integration across wafer, cell and module production supported competitive pricing and supply reliability for bundled PV+storage solutions. The company’s international reach and product breadth made it a frequent choice for utility and commercial projects where supply certainty and integrated warranties were requested. This positioning continued into 2024–2025 as Jinko actively promoted combined PV and storage offerings.

Top Key Players Outlook

- Q CELLS

- SolarEdge Technologies

- JinkoSolar

- SunPower

- CATL

- Longi Green Energy

- Enphase Energy

- Panasonic

- Trina Solar

- BYD

Recent Industry Developments

In 2024 SunPower, reported a full-year net loss of US$247 million under GAAP, but by Q1 2025 — after reorganization — it posted US$80.2 million in quarterly revenue and a modest US$1.3 million operating profit**, marking its first profitable quarter in about four years.

In December 2024 SolarEdge Technologies it introduced its “USA Edition” home battery offering with 9.7 kWh capacity, aiming to serve residential markets under domestic-content incentives.

Report Scope

Report Features Description Market Value (2024) USD 7.6 Bn Forecast Revenue (2034) USD 22.6 Bn CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-Ion, Lead-Acid, Nickel-Cadmium, Flow Batteries), By Chemistry (Lithium Cobalt Oxide, Lithium Iron Phosphate, Nickel Manganese Cobalt), By Storage Capacity (Below 5 kWh, 5-10 kWh, 10-15 kWh, Above 15 kWh), By Application (Residential, Commercial, Industrial, Utility Scale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Q CELLS, SolarEdge Technologies, JinkoSolar, SunPower, CATL, Longi Green Energy, Enphase Energy, Panasonic, Trina Solar, BYD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Photovoltaic (PV) Battery MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Photovoltaic (PV) Battery MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Q CELLS

- SolarEdge Technologies

- JinkoSolar

- SunPower

- CATL

- Longi Green Energy

- Enphase Energy

- Panasonic

- Trina Solar

- BYD