Global Phosphoric Fertilizer Market Size, Share, And Business Benefits By Product (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), Others), By Application (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156324

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

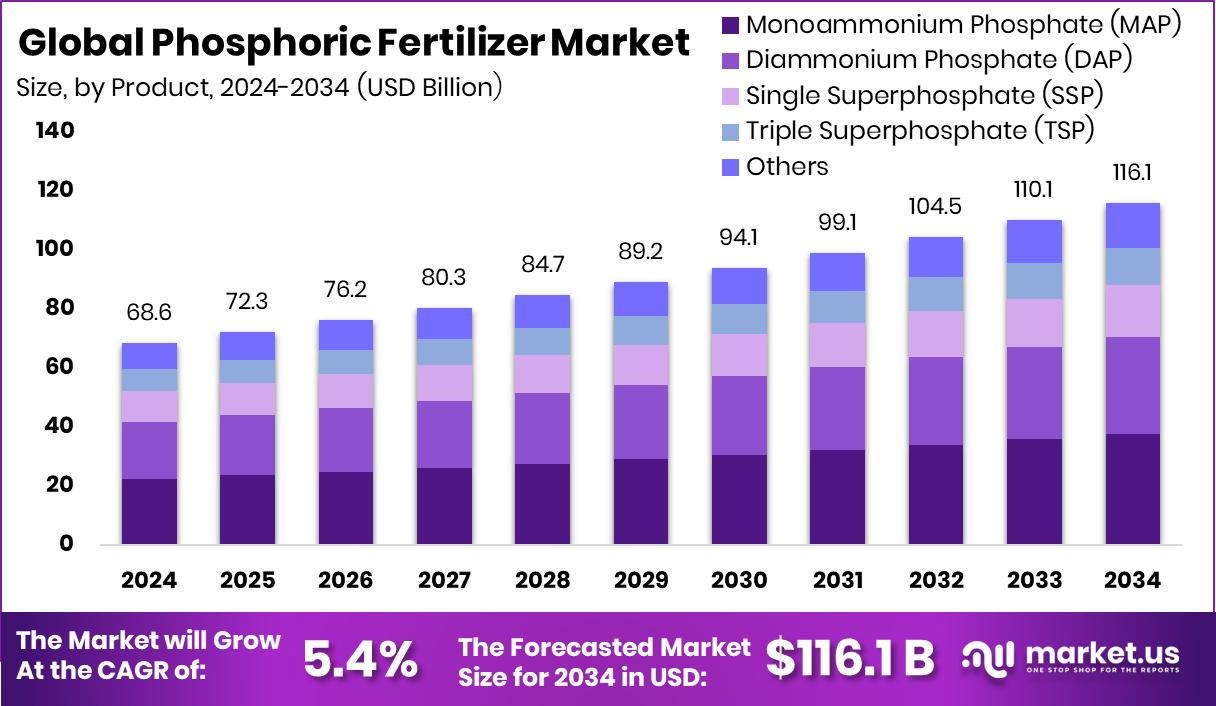

The Global Phosphoric Fertilizer Market is expected to be worth around USD 116.1 billion by 2034, up from USD 68.6 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. Asia-Pacific sustained leadership, holding 44.80%, generating USD 30.6 Bn.

Phosphoric fertilizer is a type of fertilizer made using phosphoric acid, which is rich in phosphorus. Phosphorus is one of the three essential macronutrients required for plant growth, alongside nitrogen and potassium. It plays a crucial role in root development, flowering, fruiting, and overall energy transfer within plants. These fertilizers are widely used in agriculture to boost crop productivity and improve soil fertility, especially in regions where soil phosphorus levels are naturally low. According to an industry report, Tesco commits £4 million worth of fruits and vegetables to supply 400 schools this year.

The phosphoric fertilizer market represents the global demand, supply, and trade of fertilizers that are based on phosphoric acid or its derivatives. It reflects the rising need for efficient crop nutrition as populations grow and farmland becomes more strained. This market is influenced by agricultural practices, government policies, technological advances in fertilizer production, and changing food demand worldwide. According to an industry report, the USDA’s $1 billion funding cut prompts food banks to brace for challenges.

Demand for phosphoric fertilizers remains strong due to their vital role in high-yield agriculture. Countries with nutrient-deficient soils rely heavily on these fertilizers to sustain food production and maintain soil health. According to an industry report, Origin launches operations in Bengaluru with plans to raise $10 million in funding.

Opportunities lie in sustainable and efficient fertilizer technologies. With growing concerns about overuse and environmental impact, innovations in controlled-release phosphoric fertilizers and eco-friendly application methods open new paths for long-term market expansion. According to an industry report, N.S. farmers are to benefit from $7 million Season Extension Enhancement Program funding to boost growing season and market reach.

Key Takeaways

- The Global Phosphoric Fertilizer Market is expected to be worth around USD 116.1 billion by 2034, up from USD 68.6 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In 2024, Monoammonium Phosphate (MAP) led the Phosphoric Fertilizer Market with a 32.5% share.

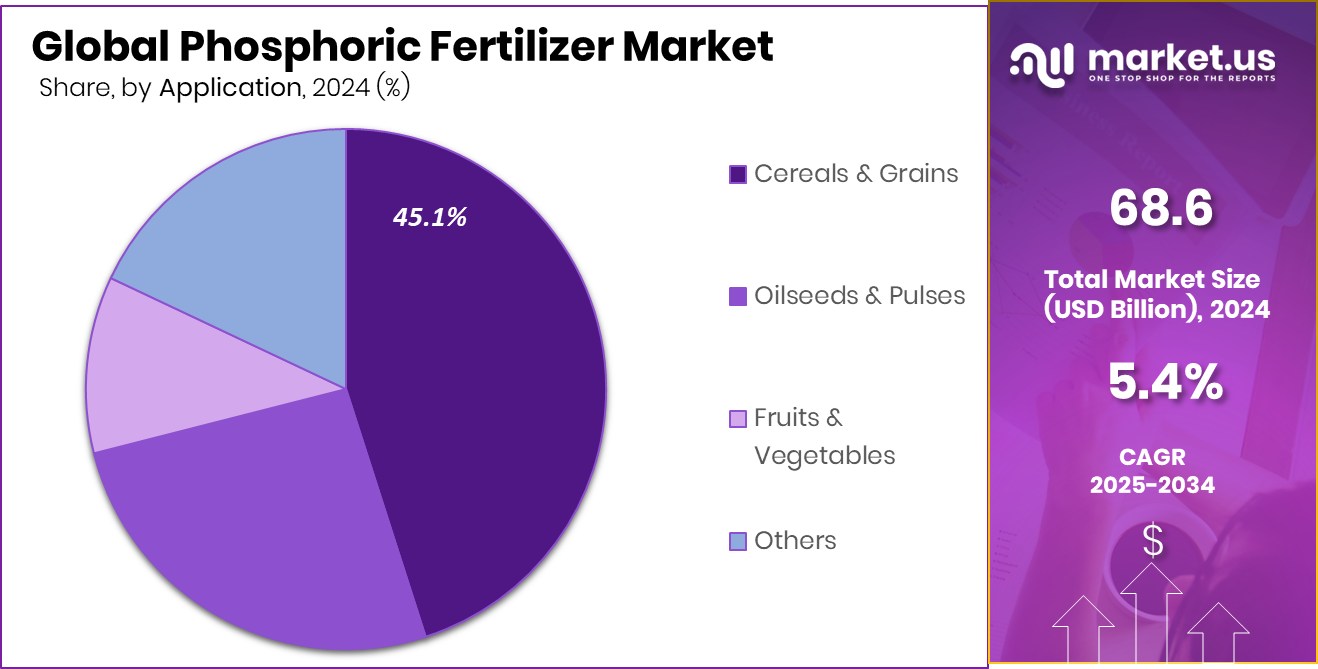

- Cereals and Grains dominated the phosphoric fertilizer market in 2024, securing 45.1% due to higher cultivation needs.

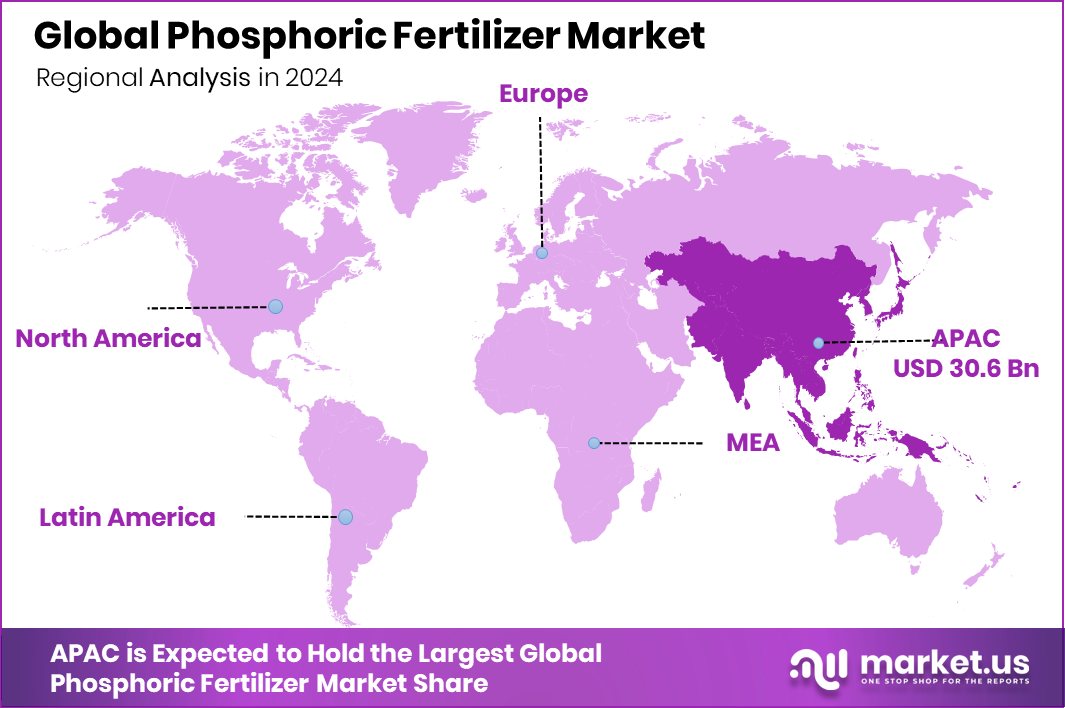

- Strong agricultural dependency drove Asia-Pacific’s 44.80%, valued at USD 30.6 Bn.

By-Product Analysis

Monoammonium Phosphate (MAP) holds 32.5% in the phosphoric fertilizer market.

In 2024, Monoammonium Phosphate (MAP) held a dominant market position in the By Product segment of the Phosphoric Fertilizer Market, with a 32.5% share. MAP has gained wide acceptance among farmers due to its balanced nutrient profile, offering both nitrogen and phosphorus in a readily available form.

This dual benefit makes it a preferred choice for enhancing root establishment, boosting early plant growth, and improving crop yields across cereals, fruits, and vegetables. Its water-soluble nature and high nutrient content also ensure efficient absorption by plants, which further strengthens its adoption in modern farming practices.

The dominance of MAP can also be linked to its cost-effectiveness and versatility in various soil conditions. Farmers increasingly prefer MAP as it not only improves soil fertility but also supports sustainable agricultural practices by reducing nutrient losses. The demand has been particularly strong in regions with phosphorus-deficient soils, where MAP serves as a reliable solution to address nutrient gaps.

By Application Analysis

Cereals and grains dominate with 45.1% in the phosphoric fertilizer market.

In 2024, Cereals and Grains held a dominant market position in the By Application segment of the Phosphoric Fertilizer Market, with a 45.1% share. The dominance of this segment is largely driven by the central role cereals and grains play in global food security, as they form the staple diet for a majority of the world’s population.

Crops such as wheat, rice, maize, and barley require significant amounts of phosphorus for root development, grain formation, and overall yield enhancement. The use of phosphoric fertilizers has therefore become essential to meet the increasing demand for these crops, especially in regions where soil nutrients are heavily depleted due to intensive farming.

The strong adoption of phosphoric fertilizers in cereal and grain cultivation is also linked to rising consumption trends. With growing populations and expanding food processing industries, demand for cereals continues to rise sharply, particularly in Asia and Africa. Phosphoric fertilizers ensure not only higher yields but also better crop quality, making them indispensable in modern large-scale agriculture.

Key Market Segments

By Product

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Others

By Application

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Driving Factors

Rising Global Food Demand Boosts Fertilizer Usage

One of the top driving factors for the phosphoric fertilizer market is the rising global demand for food. As the world population is expected to reach nearly 9.7 billion by 2050 (United Nations), farmers are under constant pressure to produce more food from limited farmland. Cereals, grains, and staple crops require high levels of phosphorus for strong root growth and better yields, making phosphoric fertilizers essential.

With shrinking arable land and soil degradation, the role of fertilizers becomes even more critical to maintain productivity. Governments in many regions are also supporting fertilizer adoption through subsidies and agricultural programs, which further fuels market growth. Thus, increasing food demand stands as the strongest driver for phosphoric fertilizer expansion.

Restraining Factors

Environmental Concerns and Soil Degradation Limit Growth

A key restraining factor for the phosphoric fertilizer market is the growing concern over environmental impact and soil health. Excessive and unbalanced use of phosphoric fertilizers can lead to soil degradation, reduced fertility, and water pollution caused by runoff into rivers and lakes. This runoff contributes to eutrophication, which harms aquatic ecosystems and raises sustainability issues.

Farmers are also facing stricter regulations in many countries regarding the controlled use of chemical fertilizers to protect the environment. Additionally, overuse of phosphates can reduce the soil’s natural balance, making crops increasingly dependent on external inputs. These challenges create barriers for widespread adoption and push the industry to innovate towards more eco-friendly and efficient fertilizer solutions.

Growth Opportunity

Sustainable Fertilizer Innovations Open New Market Avenues

A major growth opportunity for the phosphoric fertilizer market lies in the development of sustainable and advanced fertilizer technologies. Farmers and governments worldwide are increasingly focusing on eco-friendly solutions that balance productivity with environmental care. Controlled-release phosphoric fertilizers, water-soluble formulations, and bio-based alternatives are gaining attention as they reduce nutrient losses, minimize runoff, and enhance soil health.

With rising awareness about sustainable farming, these innovative fertilizers are expected to see strong demand, particularly in regions facing soil degradation and climate change pressures. Supportive policies and investments in green agriculture further create space for companies to expand. This shift toward sustainable fertilizer solutions presents a clear growth pathway for the phosphoric fertilizer market in the coming years.

Latest Trends

Precision Farming Practices Drive Phosphoric Fertilizer Adoption

One of the latest trends shaping the phosphoric fertilizer market is the rapid adoption of precision farming practices. Farmers are increasingly using technologies such as GPS-based soil mapping, drones, and smart irrigation systems to apply fertilizers more accurately and efficiently. This trend reduces wastage, lowers costs, and ensures that phosphorus is delivered exactly where and when crops need it most.

Precision farming also addresses environmental concerns by minimizing runoff and improving nutrient use efficiency. With rising global pressure for sustainable agriculture and higher yields, phosphoric fertilizers are becoming an integral part of these modern farming systems. The integration of digital tools with fertilizer application is expected to grow, marking a strong trend in the market.

Regional Analysis

In 2024, Asia-Pacific dominated with 44.80%, reaching USD 30.6 Bn.

The Phosphoric Fertilizer Market demonstrates strong regional variations, with Asia-Pacific emerging as the leading region. In 2024, Asia-Pacific accounted for 44.80% of the market share, valued at USD 30.6 billion, making it the dominant region in global consumption. The region’s leadership is primarily attributed to its large agricultural base, rapid population growth, and rising food demand, particularly in countries such as China, India, and Southeast Asian nations.

With agriculture contributing significantly to GDP and employment in these economies, the demand for high-yield fertilizers like phosphoric fertilizers continues to rise. Government initiatives promoting fertilizer subsidies and sustainable farming further drive adoption.

In contrast, North America and Europe are witnessing stable demand due to advanced farming practices and strong awareness of soil management, while Latin America is experiencing steady growth led by the increasing cultivation of cash crops.

Meanwhile, the Middle East & Africa are gradually expanding their fertilizer usage owing to growing food security concerns and efforts to improve agricultural productivity. Overall, Asia-Pacific remains the undisputed leader, supported by large-scale farming activities and the urgent need to ensure food security for a vast population, solidifying its dominant position in the phosphoric fertilizer market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

EuroChem Group AG has maintained a strong presence with its vertically integrated operations, from mining phosphate rock to producing finished fertilizers. Its investments in modern production technologies and logistics networks have helped the company strengthen supply chains, making phosphoric fertilizers more accessible in both developed and emerging markets.

Agrium Inc. continues to play a key role by leveraging its strong distribution network and focus on agronomic services. The company emphasizes delivering balanced nutrient solutions to farmers, making it an important contributor to efficient phosphoric fertilizer usage worldwide. Its emphasis on research-driven farming solutions helps farmers maximize productivity while addressing soil health.

Potash Corp. of Saskatchewan Inc., with its extensive resource base, has also remained a significant contributor to the phosphoric fertilizer segment. By ensuring large-scale production and consistent supply, the company helps stabilize market availability and supports global agriculture in meeting food demand.

Top Key Players in the Market

- Eurochem Group AG

- Agrium Inc.

- Potash Corp. of Saskatchewan Inc.

- Yara International ASA

- CF Industries Holdings Inc.

- Israel Chemicals Ltd.

- Coromandel International Ltd.

- The Mosaic Co.

- OCP

- PJSC PhosAgro

Recent Developments

- In December 2024, Yara introduced YaraSuna, a line of organic- and organo-mineral fertilizers geared toward regenerative agriculture. These products—such as Rinnova, Ritmo, and Riserva—are made from naturally fermented animal manures, formed into micropellets containing about 30% organic carbon. The process avoids oven drying and is aimed at boosting soil health and crop resilience.

- In April 2024, the company launched a new R&D program under its EuroChem Phosphate University initiative. The objective is to boost the recovery of valuable components from phosphate rock by 10 percent by developing better processing technologies for complex ores.

Report Scope

Report Features Description Market Value (2024) USD 68.6 Billion Forecast Revenue (2034) USD 116.1 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), Others), By Application (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eurochem Group AG, Agrium Inc., Potash Corp. of Saskatchewan Inc., Yara International ASA, CF Industries Holdings Inc., Israel Chemicals Ltd., Coromandel International Ltd., The Mosaic Co., OCP, PJSC PhosAgro Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Phosphoric Fertilizer MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Phosphoric Fertilizer MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurochem Group AG

- Agrium Inc.

- Potash Corp. of Saskatchewan Inc.

- Yara International ASA

- CF Industries Holdings Inc.

- Israel Chemicals Ltd.

- Coromandel International Ltd.

- The Mosaic Co.

- OCP

- PJSC PhosAgro