Global Phosphonate Market Size, Share Analysis Report By Types (ATMP, HEDP, DTPMP, Others), By End-user (Water Treatment, Detergent and Cleaning Agent, Oil field chemicals, Cosmetics, Building Materials, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162804

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

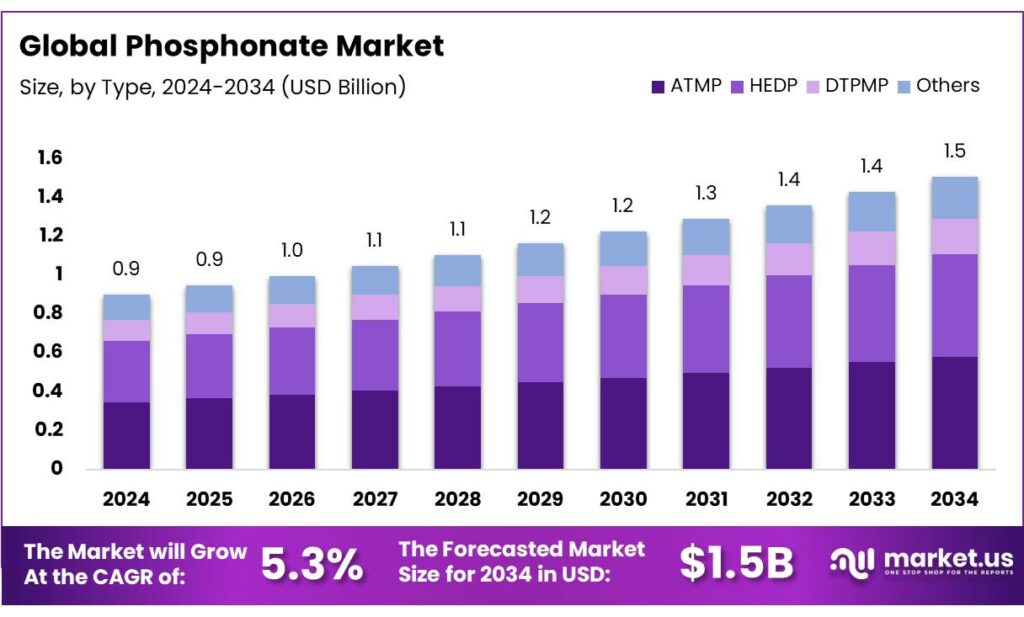

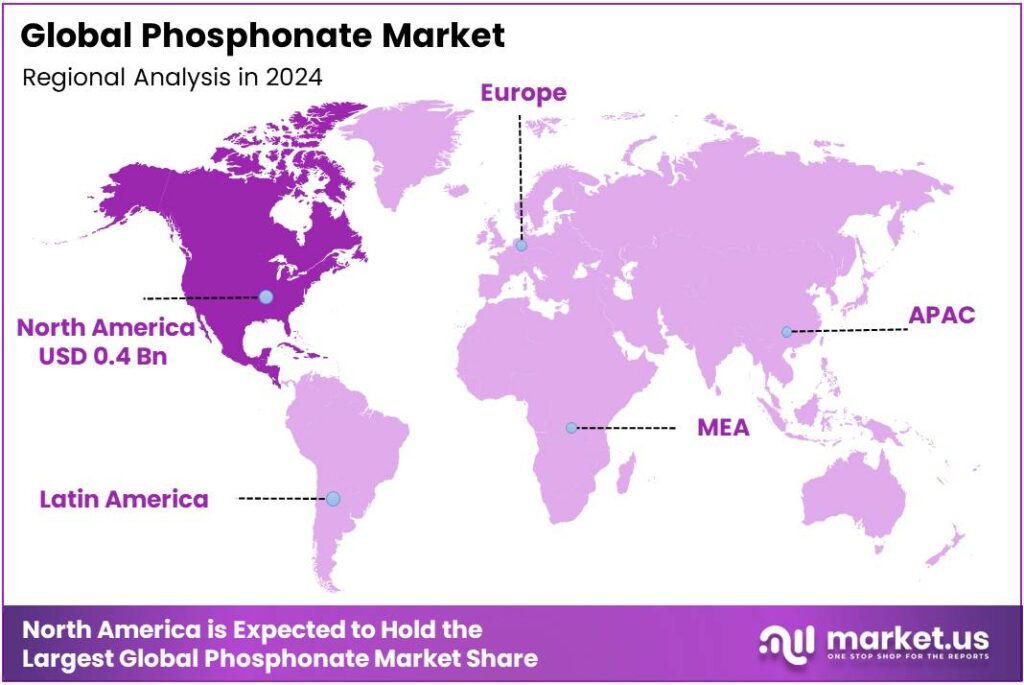

The Global Phosphonate Market size is expected to be worth around USD 1.5 Billion by 2034, from USD 0.9 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 45.9% share, holding USD 0.4 Billion in revenue.

Phosphonates are organophosphorus chelants and threshold antiscalants widely used to control calcium/iron scale and corrosion in power-plant cooling circuits, desalination pre-treatment, oilfield production systems, and industrial cleaning. Demand closely tracks energy and water-infrastructure activity. The International Energy Agency projects global electricity demand to grow ~3.4% annually through 2026, sustaining large volumes of recirculating and once-through cooling water that require sequestrants and inhibitors.

In 2024, global electricity generation rose by >1,200 TWh, with >80% of that increase from clean energy—expanding thermal, nuclear, and renewable balance-of-plant water treatment needs where phosphonate programs are standard. Renewables supplied a record 32% of world electricity in 2024, adding 858 TWh; grid-connected storage, data centers, and hybrid plants bring new cycles and chemistries that still depend on robust antiscalant control upstream of heat-exchange surfaces.

Policy tailwinds are material. In the United States, the Bipartisan Infrastructure Law directs >$50 billion to EPA water infrastructure over five years, while the Clean Water State Revolving Fund receives $11.7 billion plus $1 billion for emerging contaminants—funding that accelerates wastewater plant upgrades where phosphonate programs are commonly specified in clarification and membrane pretreatment. In India, the Jal Jeevan Mission reports 15.72 crore rural households with tap water as of 22 Oct 2025, expanding municipal treatment footprints where phosphonate control of carbonate/silicate scaling is routine.

Emerging markets’ infrastructure drives parallel growth. India’s Jal Jeevan Mission reports 15.72 crore rural households (≈ 157 million) with tap water, up from 3.23 crore in 2019, one of the fastest water-infrastructure expansions globally. Each new scheme adds kilometres of pipes, reservoirs, and treatment units that need scale/corrosion control to maintain hydraulic performance and reduce non-revenue water. Program implementation has also generated sizable local employment and skill, strengthening operational capacity for sustained chemical treatment programs.

Desalination remains a structural opportunity and a formulation-intensive application. A United Nations-cited assessment found ~16,000 desalination plants globally and warned that current operations generate ~1.5 litres of brine per litre of freshwater, underlining the need for efficient antiscalants to protect membranes and optimize recovery. Historically, there were about 19,000 plants worldwide with roughly 60% of capacity on seawater feeds and >20% on brackish water, with the Middle East holding the largest share—regions where high-salinity scaling risks make phosphonate packages particularly valuable. Recent utility-OEM partnerships to expand desalination in emerging markets further amplify long-term chemical demand.

Key Takeaways

- Phosphonate Market size is expected to be worth around USD 1.5 Billion by 2034, from USD 0.9 Billion in 2024, growing at a CAGR of 5.3%.

- Aminotris(methylenephosphonic acid) (ATMP) held a dominant position in the global phosphonate market, accounting for more than 38.6% Share.

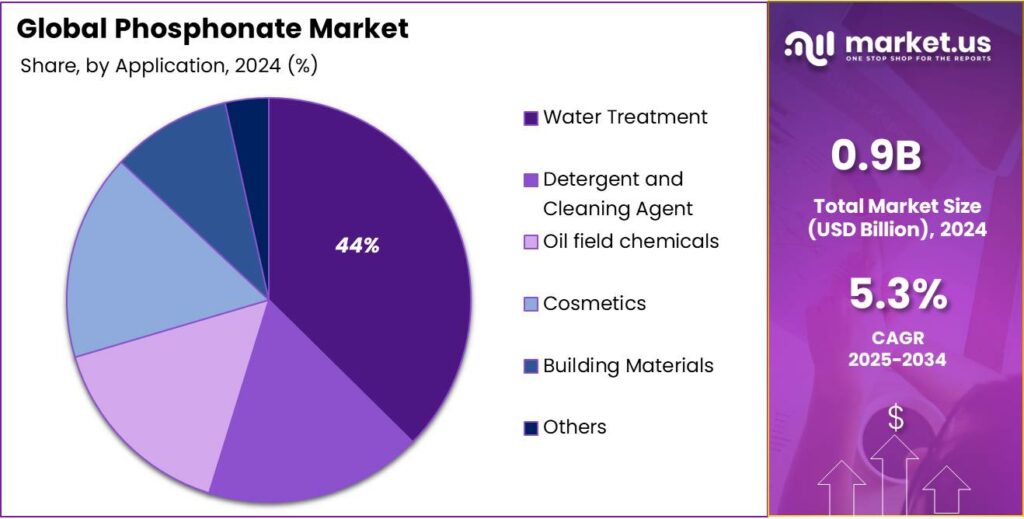

- Water Treatment held a dominant position in the global phosphonate market, capturing more than 44.3% of the total share.

- North American region assumed a commanding position in 2024, capturing approximately 45.9% of the market share and an estimated market value of US$ 0.4 billion.

By Types Analysis

ATMP dominates the Phosphonate Market with 38.6% share in 2024

In 2024, Aminotris(methylenephosphonic acid) (ATMP) held a dominant position in the global phosphonate market, accounting for more than 38.6% of total revenue. ATMP’s strong performance can be attributed to its high efficiency as a chelating and scale-inhibiting agent, which makes it essential in water treatment, oilfield operations, and industrial cleaning applications. Its stability under high temperature and alkaline conditions continues to drive preference across power generation and petrochemical sectors. The compound’s long-lasting inhibitory effect on calcium carbonate and sulfate scales has made it a preferred choice in industrial cooling water systems and boiler treatments.

Increasing industrial water reuse and the expansion of urban water treatment infrastructure across Asia and Europe further strengthened ATMP demand. In addition, ongoing global initiatives to optimize water resource management—particularly in China and India—supported wider adoption in municipal treatment facilities. Moving into 2025, demand for ATMP is expected to sustain steady growth as industries prioritize chemical solutions that improve operational efficiency and reduce maintenance costs. The compound’s compatibility with biodegradable formulations and blend applications also opens new avenues for use in sustainable treatment chemicals.

By End-user Analysis

Water Treatment dominates the Phosphonate Market with 44.3% share in 2024

In 2024, Water Treatment held a dominant position in the global phosphonate market, capturing more than 44.3% of the total share. This leadership is driven by the extensive use of phosphonates as scale and corrosion inhibitors in industrial and municipal water treatment systems. Their strong chemical stability and ability to prevent mineral deposits in pipelines, boilers, and cooling systems make them indispensable in maintaining the efficiency of water-handling infrastructure. Rapid industrialization and the growing demand for clean water across manufacturing and energy sectors have significantly contributed to this segment’s prominence.

Rising water stress in developing economies and stricter environmental standards on industrial effluents encouraged higher adoption of phosphonate-based formulations for sustainable water management. The growing deployment of cooling towers, desalination plants, and wastewater recycling facilities has further strengthened the segment’s consumption base. Moving into 2025, the demand for phosphonates in water treatment is expected to continue its steady rise, supported by government initiatives promoting wastewater reuse and zero-liquid-discharge systems.

Key Market Segments

By Types

- ATMP

- HEDP

- DTPMP

- Others

By End-user

- Water Treatment

- Detergent and Cleaning Agent

- Oil field chemicals

- Cosmetics

- Building Materials

- Others

Emerging Trends

Risk-based water-reuse standards are reshaping phosphonate use in food & beverage plants

A clear trend in the food system is the mainstreaming of risk-based water-reuse, which is changing how processors design cleaning-in-place (CIP), cooling, and boiler programs—and, by extension, how they specify phosphonate antiscalants and corrosion inhibitors. In 2023 the Codex Alimentarius Commission adopted the Guidelines for the Safe Use and Reuse of Water in Food Production and Processing, a global reference that explicitly frames water reuse through “fit-for-purpose” risk assessment across ingredient water, direct contact, and non-product contact uses. This codified push for safe reuse moves food and beverage sites from one-pass water toward closed or semi-closed loops, where scaling, fouling, and corrosion risks intensify—conditions in which phosphonates have proven value.

The scale of the opportunity is anchored in the food system’s water footprint. Globally, about 70% of freshwater withdrawals are for agriculture, with industry just under 20% and domestic uses around 12%—a distribution that highlights why downstream food processing faces growing pressure to conserve and reuse water. As plants recycle more water through heat-exchangers and CIP circuits, cycles of concentration rise, elevating mineral scaling and corrosion risk; phosphonates help maintain heat-transfer efficiency and asset life at higher recovery ratios. These headline shares—70% / <20% / ~12%—come from the UN World Water Development Report statistical series, which compiles global withdrawals by sector.

Crucially, the water-reuse trend is measurable. Global water-use efficiency improved by about 23% between 2015 and 2022, indicating that economies are extracting more value per cubic metre. Higher efficiency typically coincides with higher reuse and more concentrated process streams, which require robust scale/corrosion control to avoid unplanned downtime or energy penalties. For chemical suppliers, this efficiency gain translates into a technical brief: formulate phosphonates that keep performance at elevated cycles while meeting food-hygiene expectations on residuals and documentation. The SDG methodology also clarifies how improvements are computed—important for benchmarking water-program outcomes at plant level and justifying treatment investments.

Drivers

Water-Intensity of Food Processing and Its Impact on Phosphonate Demand

One major driving factor for the demand for phosphonates lies in the water-intensive nature of food production—particularly the processing and cleaning operations that require robust scale, corrosion and bio-fouling control. According to Food and Agriculture Organization of the United Nations (FAO), agriculture accounts for about 70% of global freshwater withdrawals. While this figure refers primarily to crop production, the downstream food-processing sector also uses substantial volumes of clean, treated water for operations such as washing, blanching, sterilisation, cooling, clean-in-place (CIP) loops and boiler/feed-water systems.

Within a typical food-processing facility, water is used not only as an ingredient or for sanitation, but also as a heat-exchange medium, steam generation resource and cleaning agent. Research captured by PubMed-Central notes that water use in food production covers four major categories: primary production, cleaning and sanitation, processing operations, and ingredient water. When large volumes of water flow through heat-exchangers, evaporators, boilers or cooling loops, the risk of scaling, corrosion and fouling rises. That is precisely where phosphonates—effective antiscalants and metal surface protective agents—step in.

The sheer scale of water usage in food systems—70% of global freshwater withdrawals driving upstream demand, and intensive water use in processing driving downstream demand for treatment chemicals—creates a strong impetus for phosphonates. Given the trend toward water reuse, tighter hygiene standards and higher temperatures or concentrations in food-processing loops, the role of phosphonates is likely to become even more critical. As food production continues to expand to meet global demand, and as processors push for greater water-efficiency and reuse, the demand-side for phosphonates is sustainably reinforced.

Restraints

Regulatory & Environmental Hurdles in Food-Processing Water Systems

One significant restraining factor for the use of phosphonates in industrial water treatment stems from tightening regulations and environmental concerns around chemical additives in food-processing water systems. Modern food and beverage production plants are under growing pressure to minimise chemical residues, reuse water streams and comply with stringent hygiene standards. For instance, the Food and Agriculture Organization of the United Nations (FAO) published the “Guidelines for the safe use and reuse of water in food production and processing,” which emphasize a risk-based approach to treating and reusing water in direct or indirect contact with food products.

In many food-processing facilities, the goal is to recycle or reuse as much process water as possible to reduce freshwater withdrawal, lower cost, and conform to sustainability targets. But that trend also leads to more aggressive scaling or fouling conditions, which increases the complexity of scale/corrosion control. At the same time, the initial cost and lifecycle of chemical treatments—including phosphonate-based antiscalants or corrosion inhibitors—become a larger part of the investment decision. The fact sheet from Oklahoma State University states that food-processing plants must evaluate the full cost of water use, reuse and treatment: “it is essential to know the actual cost of water being saved, so that recovery options cost savings or return on investment will be understood.”

Finally, environmental and sustainability pressures can work against the unrestricted use of phosphonates. As food & beverage companies push for minimal chemical inputs, lower residuals and greener credentials, they may prefer more “bio-based” or ultra-low residue antiscalants/corrosion-inhibitors even if performance is slightly lower or cost slightly higher. This means that formulators of phosphonate-based systems must demonstrate not only technical efficacy but also minimise environmental impact, photodegradation by-products, and end-of-life disposal footprints. Until phosphonate systems evolve to meet the lowest-residue benchmarks and sustainability expectations, some food-processors may defer or reduce their use of traditional phosphonate chemistries.

Opportunity

Water-Reuse Expansion in Food & Beverage Processing

One major growth opportunity for phosphonates lies in their role within the expanding water-reuse and recycling frameworks in food and beverage processing plants. Globally, agriculture uses approximately 70 % of freshwater withdrawals, highlighting just how large-scale water demand is in food systems. While this statistic refers primarily to primary agriculture, the downstream food-processing and beverage-manufacturing sectors are increasingly under pressure to reduce freshwater withdrawals and recycle process-water loops—and that creates a need for advanced water-treatment chemicals such as phosphonates, which mitigate scaling, corrosion, and fouling in reuse systems.

For instance, a guideline issued by the Food and Agriculture Organization of the United Nations (FAO) and World Health Organization in 2023 emphasises that “water is used as an ingredient, in direct and indirect contact … in food processing through to consumption of the final food.” This underscores the fact that when processors reuse water, the quality of that water—and the chemical treatments required—must meet hygiene, safety, and operational uptime targets simultaneously. Phosphonates, as established antiscalant/corrosion-control agents in industrial water loops, are well positioned to serve those dual needs: technical asset-reliability and food-safe water return.

Moreover, because many food and beverage plants are in regions facing water scarcity, processing and reuse become strategic rather than optional. For example, the push toward more water-efficient agri-food systems is being tracked via SDG indicator 6.4.1: a global report shows water-use efficiency improved from USD 17.4 / m³ in 2015 to USD 20.8 / m³ in 2021—a 19.3% improvement. That drives investment in water-reuse technologies and chemicals. Phosphonates are part of that toolkit, helping enable higher recovery ratios, reduced fresh intake, and longer asset life.

Regional Insights

North America dominates the Phosphonate Market with a 45.90% share (~US$ 0.4 billion) in 2024

In the regional analysis of the global phosphonate market, the North American region assumed a commanding position in 2024, capturing approximately 45.90% of the market share and an estimated market value of US$ 0.4 billion. The dominance of this region is underpinned by a well-established industrial infrastructure, mature water-treatment systems, and vigorous regulatory frameworks that heighten demand for phosphonate-based scale and corrosion inhibitors. Industrial end-users such as power generation, oil & gas operations and municipal utilities in the United States and Canada drive sustained consumption of these specialty chemicals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Excel Industries participates in specialty and performance chemicals with capabilities that support phosphonate value chains for water-treatment and cleaning applications. Its manufacturing discipline, process safety, and quality systems enable consistent intermediates and finished products that fit into antiscalant and chelant programs. Excel’s customer proposition emphasizes dependable delivery, regulatory documentation, and collaborative development for cost-optimized formulations. By aligning with sustainability and waste-minimization practices, Excel helps users meet plant KPIs—longer asset life, reduced unplanned downtime, and improved water reuse—across food-adjacent and general industrial sites.

Bozzetto provides specialty chemicals for water treatment, textiles, detergent, and paper, pairing phosphonates with dispersants, sequestrants, and low-zinc corrosion inhibitors. The group’s application engineering helps customers balance performance with sustainability goals—optimizing scale control at higher cycles, lower phosphate footprints, and improved biodegradability profiles where feasible. Its integrated offering supports CIP, RO pretreatment, evaporators, and heat-exchange assets. Bozzetto’s strengths include formulation design, pilot testing, and field support that link chemistry choices to measurable KPIs: heat-transfer efficiency, downtime reduction, dosing economy, and residue management.

Top Key Players Outlook

- Aquapharm Chemical Pvt. Ltd

- Biesterfeld AG

- Bozzetto Group

- Changzhou Kewei Fine Chemicals Co. Ltd

- Excel Industries

- Italmatch Chemicals

- Jiangsu Yuanquan Hongguang Environmental Protection Technology Co. Lt

- Jiyuan Qingyuan Water Treatment Co. Ltd

- Mks DevO Chemical

- Shandong IRO Water Treatment Co. Ltd

Recent Industry Developments

In 2024 Aquapharm Chemicals Pvt. Ltd, reported a global manufacturing capacity of approximately 130,000 metric tonnes per annum (MTPA) across its Indian, USA and Saudi Arabia facilities, with plans to expand by a further 38,000 MTPA.

In 2024, Italmatch reported group revenues of €686 million, with a sales volume increase from 249 kt in 2023 to 269 kt in 2024.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Bn Forecast Revenue (2034) USD 1.5 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (ATMP, HEDP, DTPMP, Others), By End-user (Water Treatment, Detergent and Cleaning Agent, Oil field chemicals, Cosmetics, Building Materials, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aquapharm Chemical Pvt. Ltd, Biesterfeld AG, Bozzetto Group, Changzhou Kewei Fine Chemicals Co. Ltd, Excel Industries, Italmatch Chemicals, Jiangsu Yuanquan Hongguang Environmental Protection Technology Co. Lt, Jiyuan Qingyuan Water Treatment Co. Ltd, Mks DevO Chemical, Shandong IRO Water Treatment Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aquapharm Chemical Pvt. Ltd

- Biesterfeld AG

- Bozzetto Group

- Changzhou Kewei Fine Chemicals Co. Ltd

- Excel Industries

- Italmatch Chemicals

- Jiangsu Yuanquan Hongguang Environmental Protection Technology Co. Lt

- Jiyuan Qingyuan Water Treatment Co. Ltd

- Mks DevO Chemical

- Shandong IRO Water Treatment Co. Ltd