Global Paraquat Market Size, Share, And Business Benefits By Formulation (Soluble Concentrate, Liquid Concentrate, Granules), By Crop Type (Cereals, Oilseeds, Fruits, Vegetables), By Application (Agriculture, Horticulture, Industrial), By Herbicide Mechanism (Contact Herbicide, Non-Selective Herbicide), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156991

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

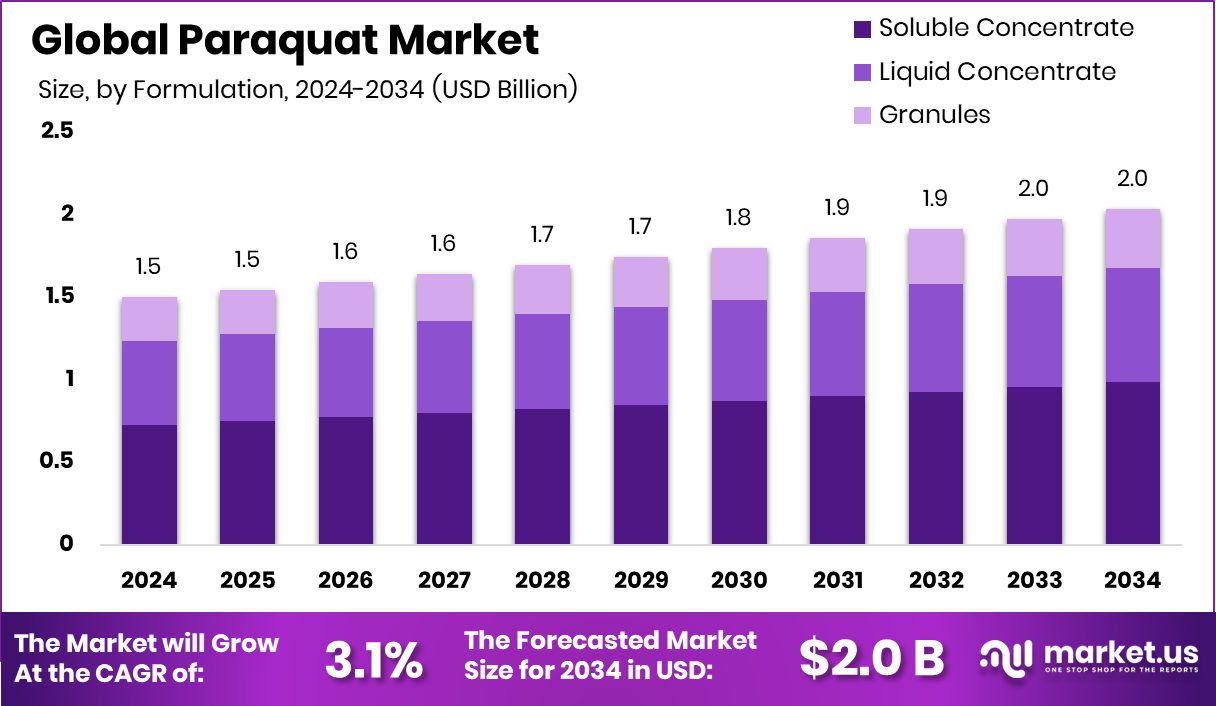

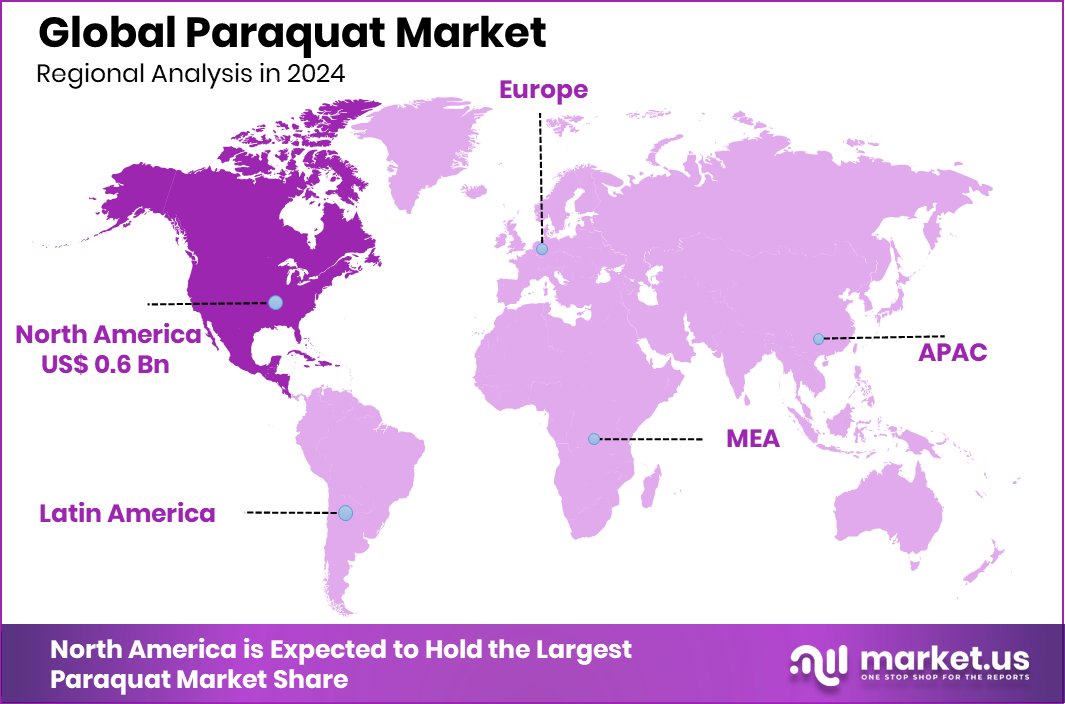

The Global Paraquat Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034. Growing reliance on effective herbicides sustains North America’s 43.90% Paraquat Market share, worth USD 0.6 Bn.

Paraquat is a fast-acting, non-selective herbicide widely used to control weeds and grasses in agriculture. It is known for its effectiveness in managing invasive plants and preparing land for new crops. However, paraquat is also highly toxic, requiring strict handling regulations to ensure safety for farmers and the environment.

The paraquat market refers to the global trade, production, and consumption of this herbicide across agricultural regions. It plays an important role in modern farming practices, especially in countries with large-scale crop production. The market is shaped by factors such as agricultural demand, government regulations, and the push for efficient weed control solutions. According to an industry report, UTIA scientists were awarded $800,000 grant to advance research on oilseed crops.

One of the major growth factors for the paraquat market is the increasing need for higher crop yields to support global food security. With the world’s population projected to surpass 9 billion by 2050, farmers are seeking reliable herbicides like paraquat to manage weeds quickly and effectively, allowing crops to thrive. According to an industry report, Cano-ela secures €1.6M funding to develop innovative plant-based ingredients from oilseeds.

The demand for paraquat is also fueled by its broad application in crops such as soybeans, maize, cotton, and rice. Its ability to deliver rapid results makes it a preferred choice in regions with high weed infestations, reducing labor costs and saving time for farmers. According to an industry report, Budget 2024: Agriculture and allied activities receive an allocation of Rs 1.52 lakh crore.

Key Takeaways

- The Global Paraquat Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034.

- In 2024, soluble concentrate formulations dominated the Paraquat market, capturing a strong 48.5% share.

- Cereals accounted for 44.8% of the Paraquat market, highlighting their essential role in staple crop production.

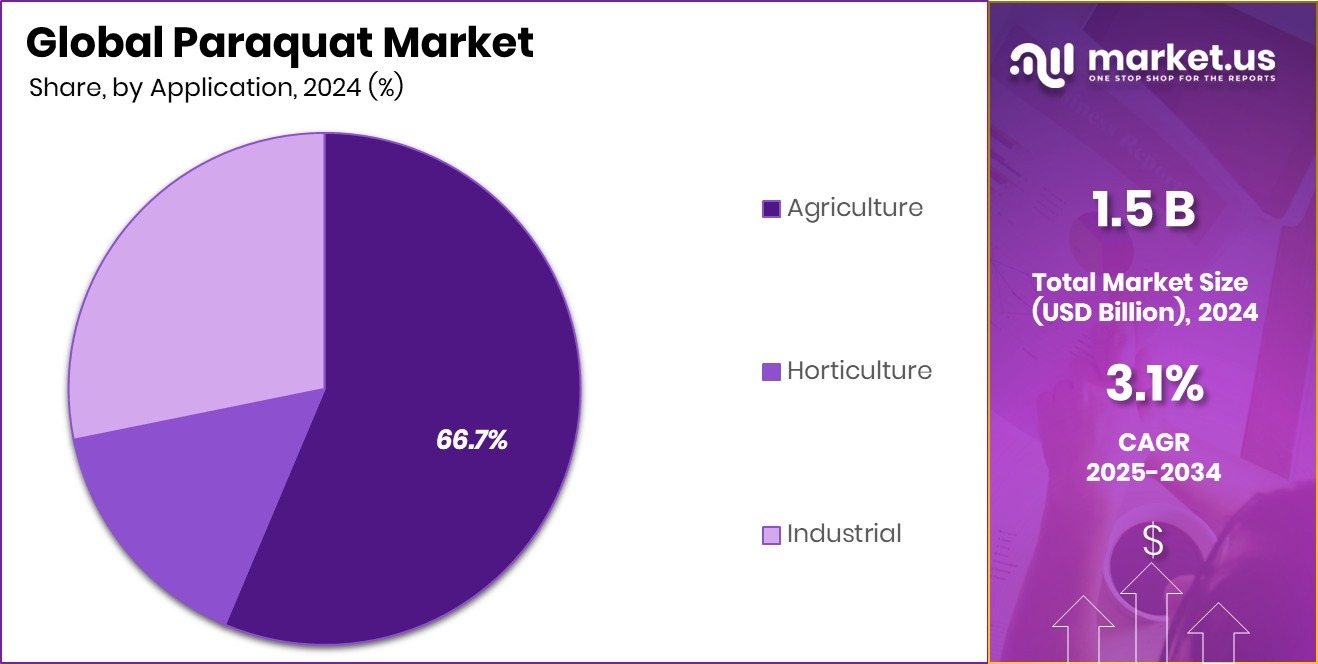

- Agriculture applications led the Paraquat market with 66.7% share, reflecting its widespread adoption in farming practices.

- Contact herbicides dominated the Paraquat market at 74.9%, showcasing paraquat’s effectiveness in quick weed control.

- The strong market position of North America, 43.90% share, USD 0.6 Bn, reflects advanced agricultural practices.

By Formulation Analysis

In 2024, soluble concentrate formulations dominated, capturing 48.5% of the paraquat market.

In 2024, Soluble Concentrate held a dominant market position in the By Formulation segment of the Paraquat Market, with a 48.5% share. This leadership reflects the widespread preference among farmers and agricultural professionals for formulations that are easy to apply, fast-acting, and highly effective in controlling a broad spectrum of weeds.

Soluble concentrate is particularly valued because it offers quick absorption and efficient weed control, which reduces the time and labor needed for land preparation and crop protection. Its compatibility with common spraying equipment further enhances its adoption across large-scale farming operations.

The high share of soluble concentrate also stems from its ability to provide consistent results in varied climatic and soil conditions. For crops such as rice, maize, soybeans, and cotton, where weed pressure is significant, farmers rely heavily on this formulation to secure healthy yields. In addition, the formulation’s ease of transport and storage adds to its practicality for both small and large farming systems.

By Crop Type Analysis

Cereals accounted for 44.8%, highlighting Paraquat’s strong role in staple crops.

In 2024, cereals held a dominant market position in the By Crop Type segment of the Paraquat Market, with a 44.8% share. This dominance highlights the essential role of paraquat in securing staple food production, particularly in crops like wheat, rice, maize, and barley, which form the backbone of global diets.

With an increasing global population and rising food demand, farmers have leaned heavily on effective herbicides such as paraquat to safeguard cereal yields from aggressive weed competition. The ability of paraquat to act quickly and control a wide range of weeds has made it a trusted solution for cereal farmers who require timely and efficient land management practices.

The significant market share also reflects the vast cultivation area occupied by cereals worldwide. As these crops are central to food security and are cultivated across diverse regions, from Asia-Pacific to Latin America, paraquat continues to be an indispensable tool in ensuring higher productivity.

Its rapid mode of action, ease of use, and cost-effectiveness make it particularly valuable in large-scale cereal farming, where delays in weed management can directly impact yields and profitability. Looking forward, the reliance on paraquat in cereal production is likely to remain steady, reinforcing its leadership in this crop type segment.

By Application Analysis

Agriculture applications led with 66.7%, reinforcing Paraquat’s importance in farming practices.

In 2024, Agriculture held a dominant market position in the By Application segment of the Paraquat Market, with a 66.7% share. This clear dominance underscores the crucial role paraquat plays in modern farming practices, particularly in managing weed pressure across large cultivation areas.

Farmers increasingly rely on paraquat due to its fast-acting and broad-spectrum weed control, which helps protect yields in crops such as rice, maize, soybeans, and cotton. The formulation’s effectiveness in clearing fields before planting and in maintaining crop health during the growing season has made it a vital input for agricultural productivity.

The large share also reflects the ongoing demand for efficient crop protection tools in regions with intensive farming activities. With global food demand rising, paraquat’s role in helping farmers achieve higher yields and reduce labor-intensive practices has become even more critical. Its adaptability to different climates and soil conditions further strengthens its use in agriculture, where timely weed control can directly influence profitability.

By Herbicide Mechanism Analysis

Contact herbicides held 74.9%, showcasing Paraquat’s rapid weed-control market dominance.

In 2024, Contact Herbicide held a dominant market position in the By Herbicide Mechanism segment of the Paraquat Market, with a 74.9% share. This leading position highlights the strong reliance of farmers on contact herbicides like paraquat for rapid and effective weed control. Contact herbicides act directly on plant tissues upon application, ensuring visible results in a short time.

This quick action is especially important in agricultural systems where weed growth can compete aggressively with crops for nutrients, water, and sunlight. The ability to manage weeds efficiently without waiting for systemic absorption makes paraquat a preferred solution across diverse farming practices.

The high market share of contact herbicides also reflects its suitability for pre-planting field preparation, where farmers need fast land clearing to begin sowing.

Additionally, its effectiveness against a wide variety of annual weeds has positioned it as a reliable choice for staple crops like cereals and oilseeds. The simplicity of use, coupled with reduced labor requirements, has further encouraged its adoption in both small and large farming operations.

Key Market Segments

By Formulation

- Soluble Concentrate

- Liquid Concentrate

- Granules

By Crop Type

- Cereals

- Oilseeds

- Fruits

- Vegetables

By Application

- Agriculture

- Horticulture

- Industrial

By Herbicide Mechanism

- Contact Herbicide

- Non-Selective Herbicide

Driving Factors

Rising Need for Effective Weed Management Solutions

One of the top driving factors for the paraquat market is the rising need for effective weed management solutions. Farmers across the world face challenges from weeds that reduce crop yields and lower farm productivity.

Paraquat, being a fast-acting contact herbicide, provides quick control of a wide variety of weeds, helping farmers save both time and labor. This is especially important in staple crops like rice, maize, and wheat, which are grown on a massive scale.

As global food demand continues to increase, efficient weed management becomes essential to secure high yields. Paraquat’s proven reliability and cost-effectiveness make it a preferred choice, reinforcing its strong role in supporting agricultural growth worldwide.

Restraining Factors

Health and Environmental Risks Limit Paraquat Usage

A major restraining factor for the paraquat market is the serious health and environmental risks linked to its use. Paraquat is highly toxic, and even small accidental exposure can cause severe health problems, leading many countries to restrict or ban its usage.

Farmers and agricultural workers face risks during mixing, spraying, and handling, which increases the need for protective measures and training. On the environmental side, paraquat can harm soil health, contaminate water sources, and affect biodiversity if not used properly.

These concerns have led to stricter government regulations and rising awareness about safer alternatives. As a result, despite its effectiveness in weed control, the use of paraquat faces significant challenges that restrict market expansion.

Growth Opportunity

Expanding Agricultural Activities in Emerging Global Markets

One of the key growth opportunities for the paraquat market lies in the expanding agricultural activities of emerging economies. Countries in Asia, Africa, and Latin America are increasing their cultivated land and modernizing farming practices to meet the rising demand for food.

In these regions, paraquat offers farmers an affordable and efficient solution for controlling weeds, especially in crops like rice, maize, and soybeans. Its quick action and ease of use help small and large farms manage weed pressure effectively, reducing manual labor and costs.

As governments support agricultural development and food security programs, the demand for reliable herbicides is set to rise. This creates a strong opportunity for paraquat to strengthen its presence in global agriculture.

Latest Trends

Stricter Regulations Shaping Paraquat Market Dynamics

A key trend in the paraquat market is the growing influence of stricter regulations on its use. Due to paraquat’s high toxicity, many governments have imposed tighter safety rules, with some countries banning it completely while others limit its usage under controlled guidelines.

This shift is pushing farmers and distributors to adopt safer handling practices, invest in protective equipment, and follow strict application standards. At the same time, regulatory pressure is encouraging research into safer formulations and alternatives that can balance effectiveness with sustainability.

While these rules present challenges, they also create a more responsible market environment, where paraquat is used with greater care to protect human health, the environment, and long-term agricultural productivity.

Regional Analysis

In 2024, North America dominated the Paraquat Market with a 43.90% share, valued at USD 0.6 Bn.

The Paraquat Market shows a varied regional presence, shaped by differences in farming practices, regulations, and crop demand across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2024, North America emerged as the dominant region, accounting for 43.90% of the market share, valued at USD 0.6 billion.

This leadership is driven by the region’s large-scale cultivation of cereals, maize, and soybeans, where effective weed management is critical for maintaining yields and profitability. Farmers in the United States and Canada continue to adopt paraquat due to its quick action, broad-spectrum control, and compatibility with modern mechanized farming methods.

While other regions are expanding steadily, North America’s dominance is reinforced by advanced agricultural infrastructure and the widespread use of herbicides in both commercial and subsistence farming. Regulatory oversight ensures safer usage, while strong demand for efficient weed control sustains the adoption of paraquat.

The region’s share also reflects its ability to balance productivity with growing environmental concerns through structured guidelines. Looking forward, North America is expected to maintain its lead, supported by continuous advancements in farming practices and the growing need to meet food supply demands efficiently.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adama has consistently maintained its reputation for offering crop protection products tailored to farmers’ needs. In the paraquat space, its focus on reliability and accessibility has strengthened its presence in both developed and emerging markets. The company’s strategy revolves around providing formulations that combine efficiency with ease of use, making paraquat a practical solution for a wide range of crops.

Corteva Agriscience brings a strong research-driven approach to the herbicide sector, aligning paraquat offerings with sustainable farming objectives. By leveraging its deep expertise in crop science, Corteva ensures that paraquat applications are integrated into broader farm management systems, helping farmers maximize yield while adhering to evolving regulatory standards.

FMC continues to play a significant role through its extensive distribution network and customer-centric solutions. The company’s ability to provide dependable herbicide options, including paraquat, allows it to cater to high-demand regions where weed pressure is intense. FMC’s operational strength lies in ensuring product availability and technical guidance, which reinforces its credibility among growers.

Top Key Players in the Market

- Adama

- Corteva Agriscience

- FMC

- UPL

- Jiangsu Taibai Agriculture

- Syngenta

- BASF

- Shandong Luba Chemical

Recent Developments

- In March 2025, UPL finalized the purchase of the remaining 20% stake in PT Excel, gaining full ownership of this Indonesian agribusiness company. PT Excel brings a well-established distribution network for agrochemicals, seeds, fumigants, and fertilizers. This acquisition strengthens UPL’s operational control and expands its reach across Southeast Asia.

- In June 2024, Corteva introduced Resicore Rev, a next-generation version of its popular Resicore herbicide. This upgraded formula offers better weed control for corn — even weeds like waterhemp and Palmer amaranth — thanks to its encapsulated formulation, improved tank-mix mixability, and extended residual action.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation (Soluble Concentrate, Liquid Concentrate, Granules), By Crop Type (Cereals, Oilseeds, Fruits, Vegetables), By Application (Agriculture, Horticulture, Industrial), By Herbicide Mechanism (Contact Herbicide, Non-Selective Herbicide) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adama, Corteva Agriscience, FMC, UPL, Jiangsu Taibai Agriculture, Syngenta, BASF, Shandong Luba Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adama

- Corteva Agriscience

- FMC

- UPL

- Jiangsu Taibai Agriculture

- Syngenta

- BASF

- Shandong Luba Chemical