Global Oxalic Acid Market Size, Share, And Business Benefits By Grade (Technical and Pharma Grade, Industrial Grade, Food Grade, Laboratory and Analytical Grade), By End Use (Pharmaceuticals, Rare-earth and Metal Processing, Textile and Leather, Electronics and Semiconductor, Chemical Synthesis, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161360

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

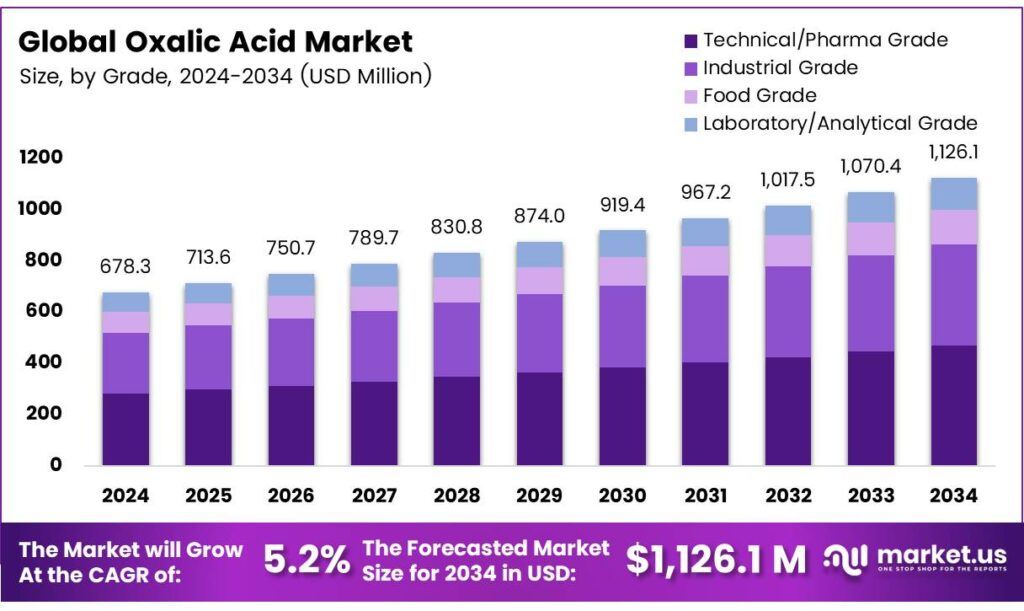

The Global Oxalic Acid Market size is expected to be worth around USD 1126.1 Million by 2034, from USD 678.3 Million in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Oxalic acid is a common organic compound produced by various living organisms, including fungi, bacteria, plants, animals, and humans. Oxalate forms when oxalic acid in plants binds to minerals, though the terms oxalic acid and oxalate are often used interchangeably. The body either generates oxalate as a waste product or acquires it from dietary sources. Oxalate can bind with minerals in the body, forming compounds like calcium oxalate or iron oxalate, which are then excreted through urine or stool.

Electrochemical methods like cyclic voltammetry (CV) and flow injection analysis (FIA) with amperometric detection have been used to study oxalic acid’s electrochemical behavior. An oxidation current was observed at 1.35 V (vs. Ag/AgCl), a high potential uncommon with standard electrodes. The system showed a linear response for concentrations from 50 nM to 10 μM, with a detection limit of 0.5 nM.

Gut bacteria like Oxalobacter formigenes metabolize dietary oxalate, reducing its harmful effects by using it as an energy source. Found in 60–80% of adults’ feces, this bacterium is often less abundant in those prone to calcium oxalate kidney stones. Dietary strategies, such as boiling vegetables to reduce oxalate content by up to 76% and consuming calcium-rich foods like milk, yogurt, or cheese, can help bind oxalate in the gut, lowering absorption and kidney stone risk.

Oxalic acid, a metabolite in the TCA cycle, is crucial for diagnosing urolithiasis and intestinal disorders through urine and blood oxalate levels. Traditional analytical methods are bulky, slow, and less sensitive, requiring extensive sample preparation. The biosensor showed a linear response range of 8.4 mM to 272 mM, a correlation coefficient of 0.93, a sensitivity of 0.0113 A/M, a detection limit of 3.0 mM, and a 5-second response time at 0.4 V (vs Ag/AgCl). It effectively measured oxalate in human urine samples.

Key Takeaways

- The Global Oxalic Acid Market is projected to grow from USD 678.3 million in 2024 to USD 1126.1 million by 2034, at a CAGR of 5.2%.

- Technical and Pharma Grade oxalic acid held a 41.7% market share in 2024, driven by metal cleaning, textile dyeing, and leather processing.

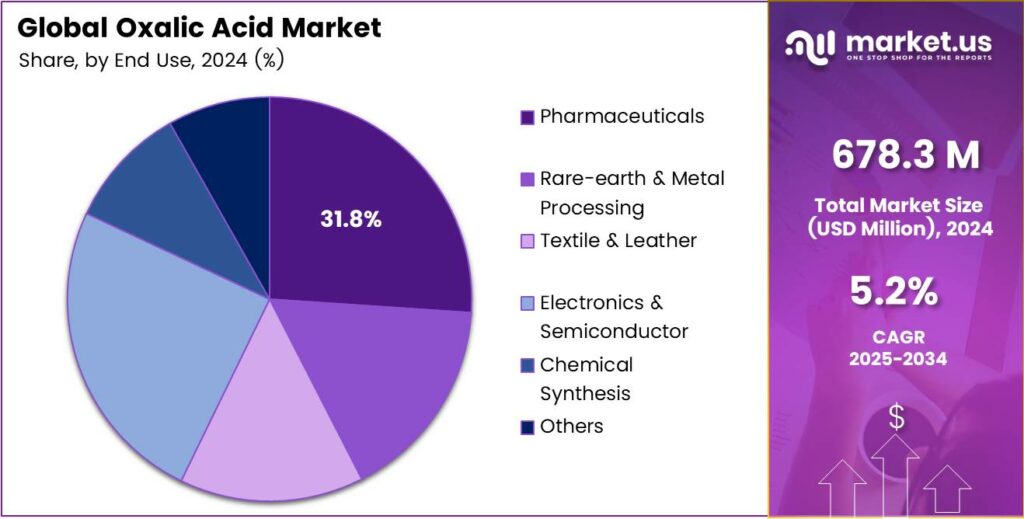

- Pharmaceuticals captured a 31.8% market share in 2024, fueled by drug synthesis and API purification.

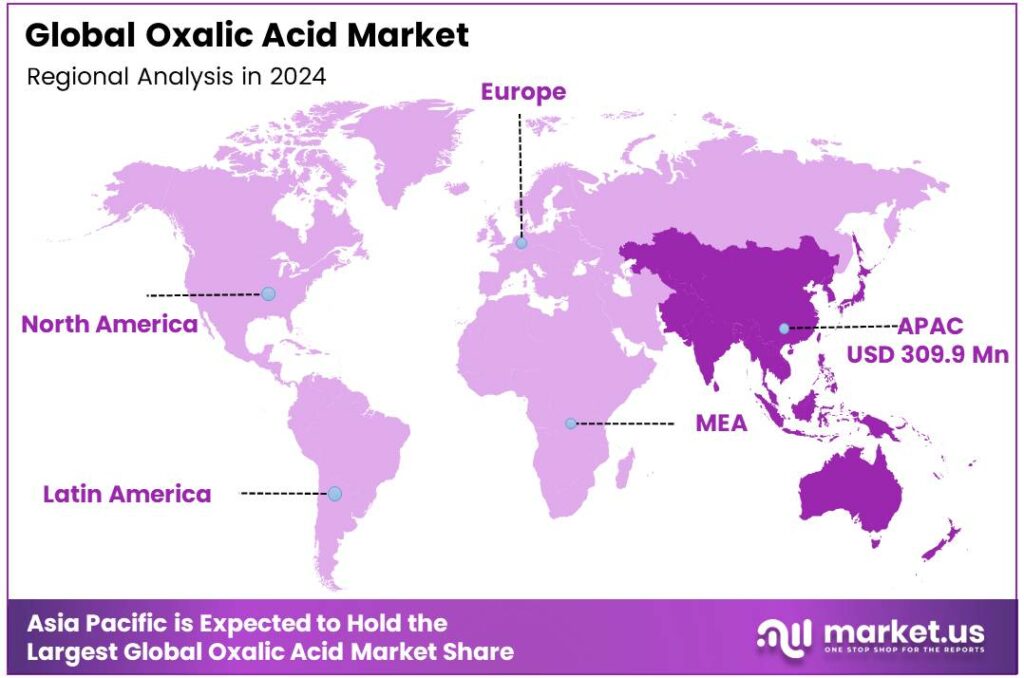

- Asia-Pacific led with a 45.7% share in 2024, valued at USD 309.9 million, due to its robust industrial base.

By Grade

Technical and Pharma Grade Captured 41.7% Market Share in 2024

In 2024, Technical and Pharma Grade held a dominant market position, capturing more than a 41.7% share of the global oxalic acid market. The technical grade segment was widely used in metal cleaning, textile dyeing, and leather processing due to its strong reducing properties and cost-effectiveness. Industrial users preferred it for high-volume applications where purity demands are moderate but performance consistency is essential.

Increasing demand from surface treatment industries and the metal finishing sector supported its dominance during the year. The pharma grade of oxalic acid gained traction in 2024 owing to its controlled purity, meeting strict pharmaceutical and laboratory standards. It was primarily used in drug formulation, reagent preparation, and purification processes.

As healthcare infrastructure expanded globally, the need for high-purity chemical intermediates grew significantly. Both grades are projected to see stable growth, supported by chemical, textile, and medical industry expansion, with rising investments in cleaner and higher-purity production technologies enhancing the overall market competitiveness.

By End Use

Pharmaceuticals Captured 31.8% Market Share in 2024

In 2024, Pharmaceuticals held a dominant market position, capturing more than a 31.8% share of the global oxalic acid market. The segment’s leadership was driven by the chemical’s extensive use in drug synthesis, laboratory reagents, and purification processes for active pharmaceutical ingredients (APIs).

Oxalic acid’s ability to act as a reducing and purifying agent made it vital in the production of antibiotics, vitamins, and intermediates for fine chemicals. The growing emphasis on precision manufacturing and purity standards in the pharmaceutical industry continued to strengthen its utilization.

The demand for oxalic acid in pharmaceuticals is expected to rise further as developing countries expand their local drug production capacity. Increased research in new drug formulations and the global shift toward cleaner synthesis routes are reinforcing its role. The segment also benefits from regulatory encouragement for local pharmaceutical manufacturing under healthcare resilience programs in Asia and Europe.

Key Market Segments

By Grade

- Technical and Pharma Grade

- 99.0-99.5% Purity

- 99.5-99.9%

- Anhydrous and Low-water Specialty

- Industrial Grade

- Food Grade

- Laboratory and Analytical Grade

By End Use

- Pharmaceuticals

- Rare-earth and Metal Processing

- Textile and Leather

- Electronics and Semiconductors

- Chemical Synthesis

- Others

Drivers

Surge in Food Processing Industry Demand for Chemical Additives

One of the major growth drivers for the oxalic acid market is its rising use in the food and agricultural chemicals space, especially through the fast-expanding food processing industry. As food processing scales up globally and in countries like India, there is a greater need for clean-up agents, bleaching, and pH control compounds, where oxalic acid can find roles in cleaning food processing equipment or in the extraction and purification of ingredients.

Government policies also support this growth. In India, schemes such as Mega Food Parks aim to enhance linkages from farms to processing and to markets, pushing up processed food output. The government provides grants and encourages the setting up of multiple processing units, which indirectly stimulates demand for auxiliary chemicals.

Food processing growth fed into increased chemical consumption, including oxalic acid. As processing plants become more sophisticated, usage of higher-grade oxalic acid (for cleaner operations and purity needs) is expected to rise. The push to improve sanitation, meet food safety regulations, and reduce contamination in processed foods means more stringent chemical usage, thereby boosting demand.

Restraints

The Hidden Toxicity in Healthy Food: A Natural Danger We Must Manage

One of the most significant restraints on the wider use of oxalic acid, despite its industrial value, is its inherent toxicity to humans. This isn’t a synthetic danger; it’s a natural one found in some of the healthiest foods we eat. When consumed in high amounts, oxalic acid can crystallize within our bodies, binding with calcium to form calcium oxalate stones, the most common type of painful kidney stones.

The Food and Agriculture Organization (FAO) of the United Nations, in conjunction with the World Health Organization (WHO), operates the Joint FAO/WHO Expert Committee on Food Additives (JECFA). Their rigorous evaluation concludes that the Acceptable Daily Intake (ADI) for oxalic acid is 0-2 mg per kilogram of body weight. For an average adult weighing 70 kg (approximately 154 pounds), this translates to a maximum of about 140 mg of oxalic acid per day that can be consumed without significant health risk.

According to the US Department of Agriculture (USDA) food composition database, a standard 100-gram serving of raw spinach contains approximately 970 mg of oxalic acid. A single, modest bowl of fresh spinach can contain nearly seven times the recommended daily limit for our average adult. This stark numerical reality, from the world’s most trusted food and health organizations, highlights the core restraint: nature itself can be a potent source of overconsumption.

Opportunity

Expansion of Global Food Consumption and Processing

One significant growth factor for the oxalic acid market is the steady expansion of global food consumption and food processing. As more food is produced, processed, packaged, and distributed, the need for chemicals that support purification, cleaning, and ingredient extraction grows.

Oxalic acid often finds indirect use in the food value chain through maintenance of equipment, removal of stains or residues, and extraction of natural compounds. Global food consumption is projected to grow at about 1.3% per year over the coming decade. That sustained growth means that food processing capacity must increase, and with it the chemical inputs required by processing plants.

The food and beverage processing sector is substantial — in 2021, it employed around 1.7 million workers, representing about 15.4% of all U.S. manufacturing employment. That scale of processing implies a high volume of auxiliary chemical usage in cleaning, purification, and material treatment. As processors modernize and enforce stricter hygiene standards, chemicals like oxalic acid become more valuable.

Trends

Oxalic Acid’s New Role in Sustainable Farming

A powerful and encouraging shift is happening with oxalic acid, moving it from a role purely in industry into the hands of farmers as a guardian of their crops. The most significant emerging factor is its growing recognition as a natural, effective, and bee-friendly pesticide in agriculture.

In a world increasingly worried about the toxic legacy of synthetic chemicals on our soil and pollinators, oxalic acid offers a ray of hope. It represents a return to simpler, more natural solutions that work with the environment, not against it. For beekeepers, in particular, it has become a vital tool in a quiet, desperate fight to save their hives, allowing them to protect their livelihoods without poisoning the very insects they cherish.

The Environmental Protection Agency (EPA) in the United States, which rigorously regulates pesticides, has granted registrations for oxalic acid-based formulations for use in agriculture. The data supporting this is compelling. A review published by the agency highlights its efficacy, noting that in approved uses, oxalic acid can achieve a very high level of pest control.

Regional Analysis

Asia-Pacific leads with a 45.7% share and a USD 309.9 Million market value.

In 2024, Asia-Pacific held a dominant position in the global oxalic acid market, capturing more than a 45.7% share valued at USD 309.9 million. The region’s leadership is strongly supported by its large-scale industrial base, encompassing pharmaceuticals, textiles, agrochemicals, and metal processing sectors.

Countries such as China, India, and Japan serve as major producers and consumers, leveraging abundant raw material availability and cost-efficient manufacturing capabilities. China alone accounted for a major portion of regional production, driven by its advanced chemical infrastructure and strong export capacity to North America and Europe.

The demand for oxalic acid in the Asia-Pacific is also stimulated by growing applications in pharmaceuticals and food processing industries. India’s rapid expansion in drug formulation and dye manufacturing industries has reinforced oxalic acid as a reagent and cleaning agent. Increasing investments in the textile dyeing and metal treatment industries have further propelled regional growth.

Asia-Pacific is expected to maintain its dominance due to ongoing infrastructure expansion, rapid urbanization, and rising consumer demand for processed goods. The region’s strong integration of supply chains, coupled with the presence of numerous small and medium-sized chemical producers, ensures stable growth momentum.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mudanjiang Fengda leverages the country’s strong chemical manufacturing infrastructure to be a significant volume player in the global oxalic acid market. The company’s competitive position is built on cost-effective production and extensive supply chain capabilities, serving diverse industrial sectors. Its scale allows it to influence global pricing and availability, particularly in regions like Asia and Europe, where demand for industrial acids remains consistently high.

Oxaquim is a key South American supplier, holding a dominant position in the regional market, particularly within Chile. The company specializes in serving the mining industry, where oxalic acid is critical for metal purification and extraction processes. This strategic focus on a core local industry provides a stable demand base. Oxaquim’s strength lies in its regional expertise and deep understanding of the specific application needs of its primary industrial customers in the mining sector.

UBE Industries brings a reputation for high-quality chemical products and advanced manufacturing technologies to the oxalic acid market. The company focuses on producing high-purity grades suitable for demanding applications in pharmaceuticals, electronics, and specialty chemicals. UBE’s strength is its commitment to research, innovation, and stringent quality control, positioning it as a premium supplier.

Top Key Players in the Market

- Mudanjiang Fengda Chemical Co., Ltd.

- Oxaquim

- UBE Industries Ltd.

- Indian Oxalate Limited

- Shijiazhuang Taihe Chemical Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Penta s.r.o

- Connect Chemical GmbH

- Radiant Indus Chem Pvt. Ltd.

- Spectrum Chemical Mfg. Corp.

Recent Developments

- In 2024, the company faced extended anti-dumping duties imposed by the European Union on oxalic acid imports from Chinese suppliers, including Mudanjiang Fengda, aimed at protecting EU producers amid ongoing trade tensions. The firm maintains its position as China’s leading oxalic acid exporter.

- In 2024, Oxaquim S.A. initiated scaling of a bio-based oxalic acid production process at its Alcaniz facility in Spain, targeting significant reductions in carbon emissions to align with EU sustainability goals. Incorporating low-carbon technologies to enhance oxalic acid output while minimizing environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 678.3 Million Forecast Revenue (2034) USD 1126.1 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Technical and Pharma Grade, Industrial Grade, Food Grade, Laboratory and Analytical Grade), By End Use (Pharmaceuticals, Rare-earth and Metal Processing, Textile and Leather, Electronics and Semiconductor, Chemical Synthesis, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mudanjiang Fengda Chemical Co., Ltd., Oxaquim, UBE Industries Ltd., Indian Oxalate Limited, Shijiazhuang Taihe Chemical Co., Ltd., Spectrum Chemical Manufacturing Corp., Penta s.r.o, Connect Chemical GmbH, Radiant Indus Chem Pvt. Ltd., Spectrum Chemical Mfg. Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Mudanjiang Fengda Chemical Co., Ltd.

- Oxaquim

- UBE Industries Ltd.

- Indian Oxalate Limited

- Shijiazhuang Taihe Chemical Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Penta s.r.o

- Connect Chemical GmbH

- Radiant Indus Chem Pvt. Ltd.

- Spectrum Chemical Mfg. Corp.