Global Otoscope Market By Type (Halogen Otoscopes, LED Otoscopes, Fiber Optic Otoscopes and Video Otoscopes), By Portability (Handheld and Wall-Mounted), By Modality (Wired Digital and Wireless), By Application (Diagnostic and Surgical/Interventional Use), By End-User (Hospitals, ENT Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172212

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

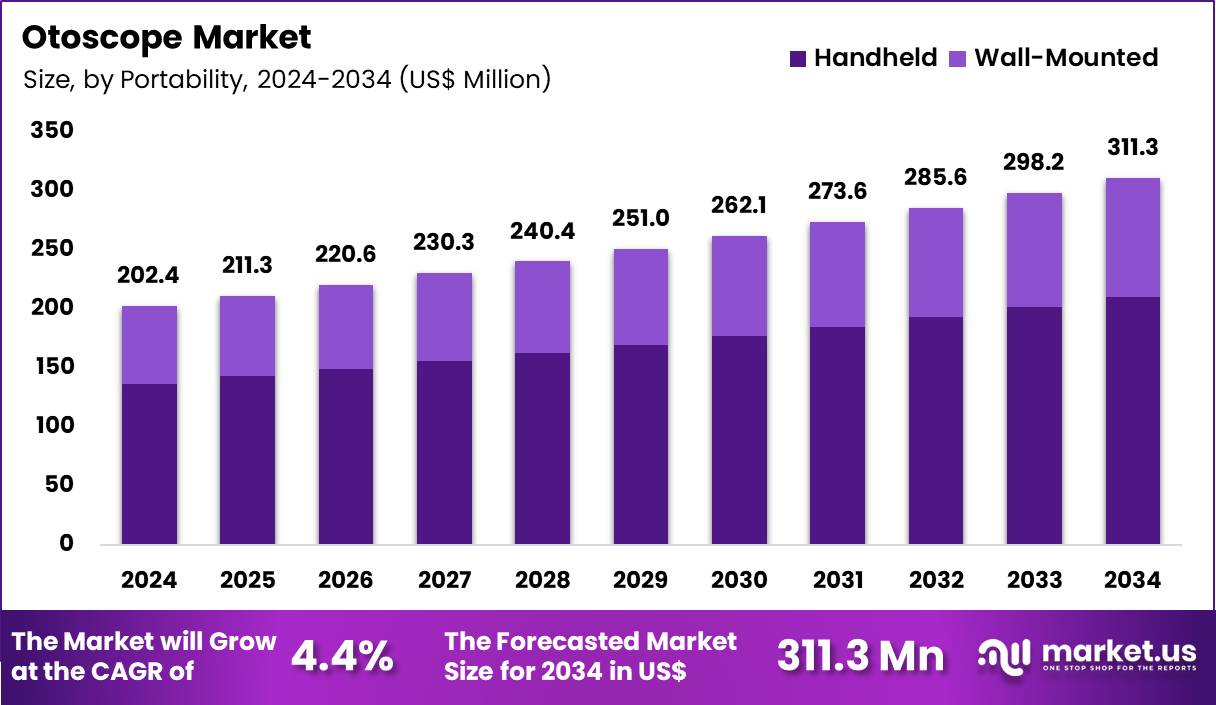

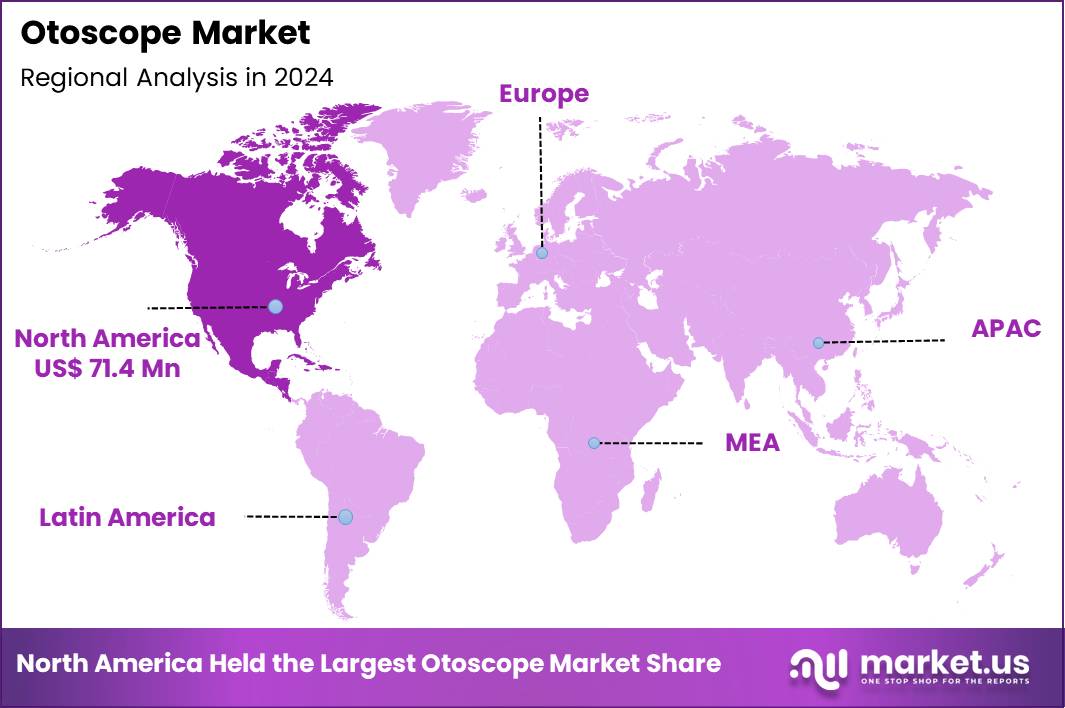

The Global Otoscope Market size is expected to be worth around US$ 311.3 Million by 2034 from US$ 202.4 Million in 2024, growing at a CAGR of 4.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 35.5% share with a revenue of US$ 71.4 Million.

Growing prevalence of ear-related disorders drives clinicians to adopt advanced otoscopes that deliver superior visualization of the tympanic membrane and external auditory canal for accurate diagnoses. Pediatricians frequently utilize these devices to examine young patients for otitis media, identifying effusion, perforation, or inflammation through magnified views. Otolaryngologists employ video otoscopes during comprehensive ear evaluations, documenting findings for cerumen impaction removal and foreign body extraction.

General practitioners apply pneumatic otoscopes to assess tympanic membrane mobility, distinguishing between acute and secretory otitis media effectively. These instruments support telehealth consultations by capturing high-resolution images for remote specialist review in chronic ear condition monitoring. On July 21, 2025, WiscMed released findings from a peer-reviewed clinical study published in the International Journal of Pediatric Otorhinolaryngology evaluating its Wispr Digital Otoscope.

The results showed that high-definition video imaging improved diagnostic confidence in cases of acute otitis media, supporting more appropriate antibiotic use in pediatric care. The device’s Version 95 software update includes a dedicated Pediatric Mode, which displays child-friendly visuals on the built-in screen to encourage cooperation during examinations.

Manufacturers target opportunities to integrate smartphone-compatible otoscopes, enabling primary care providers to perform detailed ear inspections in diverse clinical settings with portable convenience. Developers enhance fiber optic illumination in reusable models, improving clarity for cholesteatoma detection during follow-up examinations post-tympanostomy tube placement. These devices broaden applications in audiology clinics for pre-hearing test canal assessments, ensuring unobstructed pathways before audiometric evaluations.

Opportunities expand in veterinary medicine adaptations, allowing examination of animal ear canals for infections and parasites with specialized specula. Companies advance disposable specula designs to maintain hygiene standards during high-volume screenings for swimmer’s ear in sports medicine. Firms pursue wireless connectivity features that facilitate seamless image sharing in multidisciplinary tinnitus management teams.

Industry innovators embed artificial intelligence algorithms into digital otoscopes, automating classification of common pathologies like otitis externa for faster preliminary assessments. Developers refine wide-angle lenses to capture comprehensive views of the ear canal, aiding precise localization of exostoses in surfers’ ear evaluations. Market participants launch compact, battery-powered models with integrated screens for standalone use in school health screenings.

Companies prioritize high-definition recording capabilities to build longitudinal patient records for recurrent ear infection tracking. Innovators incorporate spectral analysis tools to differentiate tissue types during myringotomy candidate selections. Ongoing developments emphasize user-friendly interfaces with touchscreen controls, streamlining workflows in busy urgent care facilities for ear pain consultations.

Key Takeaways

- In 2024, the market generated a revenue of US$ 202.4 million, with a CAGR of 4.4%, and is expected to reach US$ 311.3 million by the year 2034.

- The type segment is divided into halogen otoscopes, LED otoscopes, fiber optic otoscopes and video otoscopes, with led otoscopes taking the lead in 2024 with a market share of 41.5%.

- Considering portability, the market is divided into handheld and wall-mounted. Among these, handheld held a significant share of 67.6%.

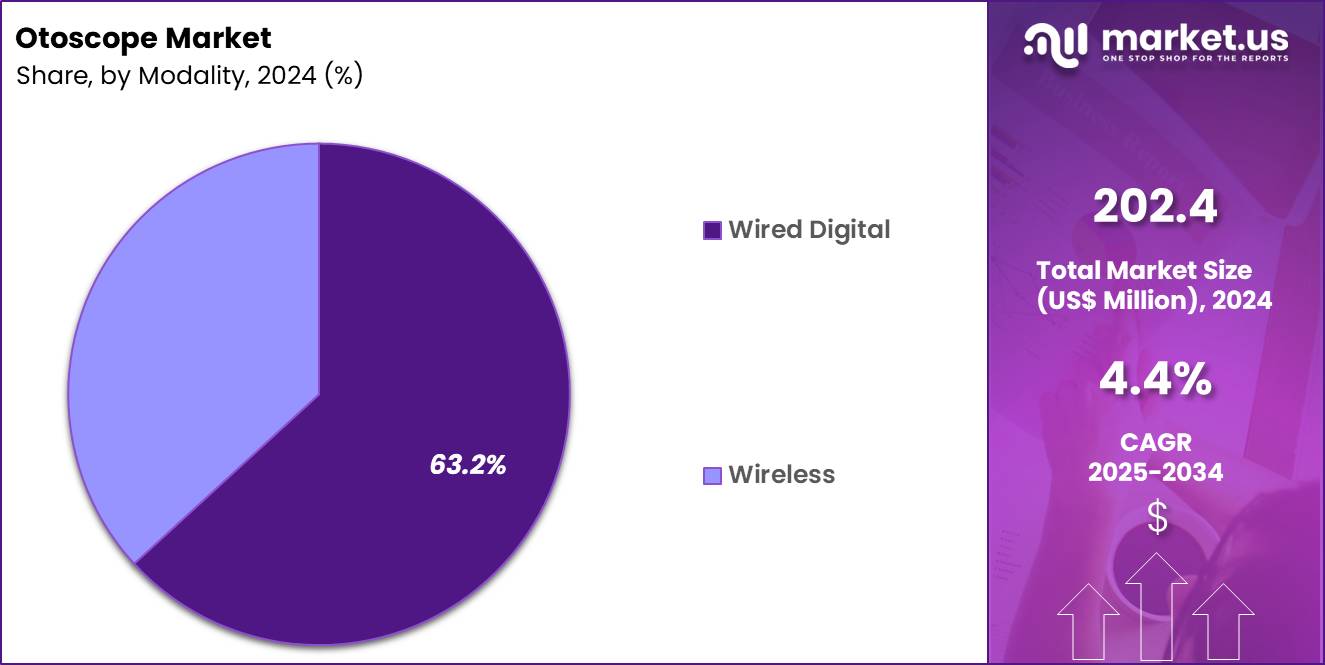

- Furthermore, concerning the modality segment, the market is segregated into wired digital and wireless. The wired digital sector stands out as the dominant player, holding the largest revenue share of 63.2% in the market.

- The application segment is segregated into diagnostic and surgical/interventional use, with the diagnostic segment leading the market, holding a revenue share of 76.5%.

- Concerning the end-user segment, the market is segregated into hospitals, ENT clinics and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 54.8% in the market.

- North America led the market by securing a market share of 35.3% in 2024.

Type Analysis

LED otoscopes, accounting for 41.5%, are expected to dominate the type segment because they offer superior illumination quality and longer operational life compared to halogen based alternatives. Clinicians increasingly prefer LED lighting due to its consistent brightness and true color rendering, which improves visualization of the ear canal and tympanic membrane. Lower heat generation enhances patient comfort during examinations. Reduced power consumption supports longer usage in busy clinical settings.

Maintenance costs remain lower because LEDs require fewer replacements. Technological advances continue to improve light intensity and durability. Manufacturers focus on compact and ergonomic LED designs to support routine diagnostics. Growing demand for reliable primary care diagnostic tools strengthens adoption. These factors keep LED otoscopes anticipated to sustain leadership.

Portability Analysis

Handheld otoscopes, holding 67.6%, are projected to lead portability demand as clinicians prioritize flexibility and ease of use across multiple care settings. Handheld devices support rapid examinations in outpatient clinics, emergency rooms, and bedside care. Their lightweight design reduces user fatigue during repeated use. Primary care physicians and pediatricians favor handheld formats for routine ear assessments.

Expanding home healthcare and mobile medical services further increase demand. Battery powered operation supports uninterrupted workflows. Cost effectiveness compared to wall mounted systems strengthens purchasing decisions. Compatibility with digital attachments expands functionality. These drivers keep handheld otoscopes likely to remain dominant.

Modality Analysis

Wired digital otoscopes, representing 63.2%, are expected to dominate modality adoption because they deliver stable data transmission and consistent image quality. Wired connectivity ensures uninterrupted visualization during diagnostic procedures. Hospitals and clinics value reliability in high volume settings. Digital imaging supports documentation and integration with electronic medical records.

Clinicians use captured images to explain conditions to patients and caregivers. Wired systems reduce concerns related to battery life and signal interference. Training environments benefit from real time image sharing. Cost efficiency compared to advanced wireless systems supports wider adoption. These factors keep wired digital otoscopes anticipated to maintain strong demand.

Application Analysis

Diagnostic applications, accounting for 76.5%, are projected to remain the leading use case as otoscopy represents a fundamental step in ear related clinical evaluation. Routine diagnosis of ear infections, wax buildup, and tympanic membrane abnormalities drives frequent usage. Pediatric populations contribute significantly to diagnostic demand.

Preventive healthcare visits increase routine ear examinations. Clinicians rely on otoscopes for early detection of conditions that prevent complications. Primary care settings generate high examination volumes. Public awareness of ear health supports regular screenings. Technological improvements enhance diagnostic accuracy. These dynamics keep diagnostic applications likely to dominate.

End-User Analysis

Hospitals, holding 54.8%, are expected to lead end user demand because they manage large patient volumes requiring routine and emergency ear examinations. Emergency departments frequently use otoscopes for rapid assessments. Teaching hospitals utilize digital otoscopes for training and supervision. Centralized procurement supports standardization across departments.

Hospitals invest in durable and high performance diagnostic equipment. Integration with hospital information systems enhances clinical documentation. Specialized ENT departments drive additional usage. Continuous patient inflow ensures consistent device utilization. These factors keep hospitals anticipated to remain the primary end users.

Key Market Segments

By Type

- Halogen otoscopes

- LED Otoscopes

- Fiber optic otoscopes

- Video otoscopes

By Portability

- Handheld

- Wall-Mounted

By Modality

- Wired Digital

- Wireless

By Application

- Diagnostic

- Surgical/Interventional Use

By End-User

- Hospitals

- ENT Clinics

- Others

Drivers

High prevalence of ear infections in children is driving the market

The otoscope market is significantly driven by the high prevalence of ear infections, particularly acute otitis media, in young children, necessitating frequent diagnostic examinations of the ear canal and tympanic membrane. Otoscopes serve as essential tools for primary care providers and pediatricians to visualize inflammation, fluid buildup, or perforations associated with these infections. Early and accurate diagnosis facilitates appropriate management, reducing complications such as hearing impairment or recurrent episodes.

Parental awareness of symptoms like ear pain and fever prompts timely medical consultations, increasing device utilization. Vaccination programs, while mitigating some bacterial causes, have not eliminated viral contributions or all vaccine-preventable strains. Healthcare guidelines emphasize otoscopic evaluation in suspected cases to guide antibiotic stewardship.

Global pediatric populations sustain demand in both developed and emerging healthcare systems. Telemedicine integrations extend otoscope applications for remote assessments. According to the National Institute on Deafness and Other Communication Disorders, five out of six children experience an ear infection by the time they are three years old. This enduring epidemiological pattern ensures consistent need for reliable otoscopic equipment across clinical settings.

Preventive care initiatives further incorporate routine ear checks in well-child visits. Professional training emphasizes proficiency in otoscopy for effective pediatric care. Overall, this driver maintains robust market momentum aligned with child health priorities.

Restraints

Limited access to specialized training and equipment in rural areas is restraining the market

The otoscope market faces restraints from limited access to specialized training and advanced equipment in rural and underserved areas, where healthcare infrastructure often lacks resources for comprehensive ear diagnostics. Primary providers in these regions may rely on basic models, potentially compromising diagnostic accuracy for complex cases. Geographic isolation hinders participation in continuing education programs focused on otoscopic techniques.

Budget constraints prioritize general supplies over premium video or digital otoscopes. Maintenance challenges for sophisticated devices deter investment in remote facilities. Referral delays to urban specialists extend patient discomfort and risk progression. Workforce shortages exacerbate inconsistencies in examination proficiency. Regulatory compliance for device calibration adds logistical burdens in low-volume practices.

Community health centers encounter funding gaps for technology upgrades. These barriers collectively restrict market growth and equitable distribution of advanced otoscopic tools. Outreach programs attempt mitigation through mobile clinics, yet systemic issues persist. Cultural factors in certain populations influence help-seeking behaviors for ear conditions. Such restraints underscore the need for targeted interventions to enhance diagnostic capabilities broadly.

Opportunities

Emergence of AI-enabled diagnostic features is creating growth opportunities

The otoscope market harbors growth opportunities through the emergence of artificial intelligence-enabled diagnostic features that augment image analysis and decision support in ear examinations. These innovations assist clinicians in identifying subtle pathologies, such as effusion or tympanic membrane abnormalities, with greater consistency. Integration with mobile applications enables real-time guidance for less experienced users. Developers leverage machine learning to differentiate infection types, supporting antibiotic stewardship.

Partnerships between device manufacturers and technology firms accelerate feature deployment. Clinical validation studies build evidence for broader adoption in primary care. Regulatory pathways accommodate software updates as medical device data systems. Telehealth compatibility expands utility for virtual consultations. Pediatric applications benefit from reduced examination variability.

In February 2025, JEDMED Corporation partnered with Otologic Technologies to launch an AI-enabled digital otoscope in the United States. This collaboration exemplifies pathways for enhanced precision and accessibility in routine diagnostics. Educational modules incorporate AI tools for training future providers. Cost-effective implementations favor resource-limited settings. These opportunities diversify product offerings and elevate standard of care in otology.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends energize the otoscope market as rising healthcare investments and growing ear disorder prevalence worldwide push primary care clinics and ENT specialists to adopt digital and video otoscopes for accurate diagnostics. Leading manufacturers strategically introduce portable, smartphone-compatible models, capitalizing on telemedicine growth and aging populations to drive steady adoption in developed and emerging healthcare systems.

Persistent inflation and economic uncertainties, however, raise costs for precision optics and electronic components, leading providers to delay fleet replacements and constrain purchases in budget-limited settings. Geopolitical tensions, particularly U.S.-China trade disputes and regional supply disruptions, frequently interrupt deliveries of key sensors and assembly materials, creating production delays and sourcing challenges for globally oriented suppliers.

Current U.S. tariffs impose elevated duties on imported medical diagnostic devices, amplifying procurement expenses for American distributors and limiting affordability for smaller practices reliant on overseas production. These measures also trigger reciprocal barriers overseas that hinder U.S. exports of advanced otoscope technologies and slow multinational development partnerships.

Still, the tariff environment galvanizes meaningful investments in North American manufacturing facilities and diversified supply networks, forging resilient foundations that promise enhanced innovation and sustained market leadership ahead.

Latest Trends

Launch of AI-integrated digital otoscopes is a recent trend

In 2025, the otoscope market has witnessed a prominent trend toward the launch of AI-integrated digital models designed to improve diagnostic accuracy and workflow efficiency in ear examinations. These devices employ algorithms to analyze captured images for signs of infection, effusion, or structural anomalies. Smartphone connectivity facilitates image sharing and remote specialist review. Manufacturers prioritize user-friendly interfaces to support general practitioners in point-of-care decisions.

Clinical feedback drives refinements in sensitivity for pediatric cases. Regulatory approvals validate performance claims through comparative studies. Professional endorsements highlight reductions in diagnostic uncertainty. Market entrants focus on portable designs for home or field use. In February 2025, the world’s first AI-enabled digital otoscope was launched in the United States through a partnership between JEDMED and Otologic Technologies. This introduction signals accelerating adoption of intelligent features in everyday otoscopy.

Training resources accompany releases to ensure competent utilization. Data privacy measures address connected device concerns. Sustainability aspects influence material choices in new iterations. Overall, this trend advances otoscope capabilities toward proactive and precise ear health management.

Regional Analysis

North America is leading the Otoscope Market

In 2024, North America possessed a 35.3% share of the global otoscope market, augmented by escalating pediatric consultations and refinements in diagnostic precision for middle ear pathologies. Primary care physicians increasingly deploy digital video otoscopes to facilitate accurate tympanic membrane assessments, supporting timely interventions for recurrent acute otitis media in daycare-attending preschoolers.

Telemedicine integrations enable remote consultations with high-resolution imaging, expanding access in suburban and rural practices where seasonal respiratory infections predominate. Otolaryngology specialists incorporate wide-angle lenses for comprehensive canal inspections, addressing cerumen impaction and foreign body removals amid heightened parental vigilance. Regulatory clearances accelerate adoption of wireless, smartphone-compatible models, streamlining workflows in urgent care settings with high patient turnover.

Demographic factors, including expanded early childhood enrollment, intensify screening demands for effusion-related conductive impairments. Professional development programs emphasize pneumatic functionality for mobility testing, elevating diagnostic confidence among general practitioners. These advancements reinforce foundational ear health evaluations, mitigating progression to chronic sequelae.

The National Institute on Deafness and Other Communication Disorders notes that five out of six children experience an ear infection by age three, as detailed in its updated statistics page last reviewed in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Clinicians forecast substantial advancement in otoscopic instrumentation across Asia Pacific over the forecast period, as nations enhance primary ear care amid shifting infectious disease landscapes. Pediatric networks procure illuminated magnifiers to detect suppurative complications in overcrowded urban slums, optimizing antibiotic stewardship for viral-predominant episodes.

Governments subsidize portable LED variants for community health workers, enabling field-based screenings in remote island provinces vulnerable to humidity-exacerbated infections. Medtech enterprises tailor compact designs for neonatal units, facilitating gentle examinations in low-birth-weight cohorts prone to effusion persistence. Regional academies integrate training on spectral imaging add-ons, sharpening delineation of vascular patterns in allergic otitis cases.

Economic expansions fuel private pediatric chain growth, stocking multifunctional devices for integrated audiometric pairings. Policy directives promote school-based programs, identifying conductive losses early to avert educational delays. These measures harness infrastructural progress, equipping providers to manage proliferative aural morbidities effectively. Analysis from the Global Burden of Disease study indicates that the age-standardized incidence rate of otitis media in the high-income Asia Pacific region rose to 4095.3 per 100,000 population by 2019.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the otoscope market drive growth by advancing digital and video-enabled platforms that improve diagnostic accuracy, documentation, and patient engagement in primary care and ENT settings. Companies expand demand through ergonomic designs, disposable specula options, and wireless connectivity that support infection control and workflow efficiency.

Commercial strategies emphasize bundling diagnostic tools with training, software, and service plans to secure long-term relationships with clinics and health systems. Innovation teams focus on image quality, portability, and smartphone integration to meet rising demand for telemedicine and remote examination capabilities.

Geographic expansion targets emerging healthcare markets where investment in primary diagnostics and pediatric care continues to increase. Welch Allyn, part of Hillrom under Baxter, anchors its position through a strong portfolio of diagnostic instruments, global distribution reach, and deep relationships with clinicians that reinforce its leadership in frontline examination solutions.

Top Key Players

- 3M

- Baxter

- Prestige Medical

- HEINE Optotechnik GmbH

- Olympus Corporation

- CellScope, Inc.

- Orlvision GmbH

- Mindmark Corporation

- American Diagnostic Corporation

- Inventis SRL

- SyncVision Technology Corporation

- GF Health Products, Inc.

- Rudolf Riester GmbH

- Riester GmbH & Co. KG

- Kirchner & Wilhelm

- Luxamed GmbH & Co. KG

- Firefly Global

Recent Developments

- In October 2024, Baxter, through its Welch Allyn brand, broadened the functionality of the MacroView Plus Wide-View Otoscope by rolling out the iExaminer Pro System worldwide. The solution enables clinicians to attach a smartphone to the otoscope using the iExaminer SmartBracket, converting a conventional visual examination into a digital workflow with image and video capture. This capability supports real-time patient engagement and allows clinical images to be securely shared for remote ENT review and teleconsultation.

- On April 4, 2025, HEINE Optotechnik introduced the BETA X Otoscope, bringing a modular design approach to the high-end diagnostic device segment. The new HEINE X CHANGE System allows users to interchange magnification optics and smartphone adapters on a single platform. An integrated examination light, HEINE inSPECT, enables quick assessment of areas such as the throat or pupillary response without switching instruments, improving examination efficiency.

Report Scope

Report Features Description Market Value (2024) US$ 202.4 Million Forecast Revenue (2034) US$ 311.3 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Halogen Otoscopes, LED Otoscopes, Fiber Optic Otoscopes and Video Otoscopes), By Portability (Handheld and Wall-Mounted), By Modality (Wired Digital and Wireless), By Application (Diagnostic and Surgical/Interventional Use), By End-User (Hospitals, ENT Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Baxter, Prestige Medical, HEINE Optotechnik GmbH, Olympus Corporation, CellScope, Inc., Orlvision GmbH, Mindmark Corporation, American Diagnostic Corporation, Inventis SRL, SyncVision Technology Corporation, GF Health Products, Inc., Rudolf Riester GmbH, Riester GmbH & Co. KG, Kirchner & Wilhelm, Luxamed GmbH & Co. KG, Firefly Global Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Baxter

- Prestige Medical

- HEINE Optotechnik GmbH

- Olympus Corporation

- CellScope, Inc.

- Orlvision GmbH

- Mindmark Corporation

- American Diagnostic Corporation

- Inventis SRL

- SyncVision Technology Corporation

- GF Health Products, Inc.

- Rudolf Riester GmbH

- Riester GmbH & Co. KG

- Kirchner & Wilhelm

- Luxamed GmbH & Co. KG

- Firefly Global