Global Organic Pigments Market By Type (Azo, Phthalocyanine, Naphthol, Quinacridone, Dioxazine, Others), By Application (Printing Inks, Paints and Coatings, Plastics, Textile Dyeing, Art Supplies, Cosmetics and Personal Care, Electronic Displays, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151195

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

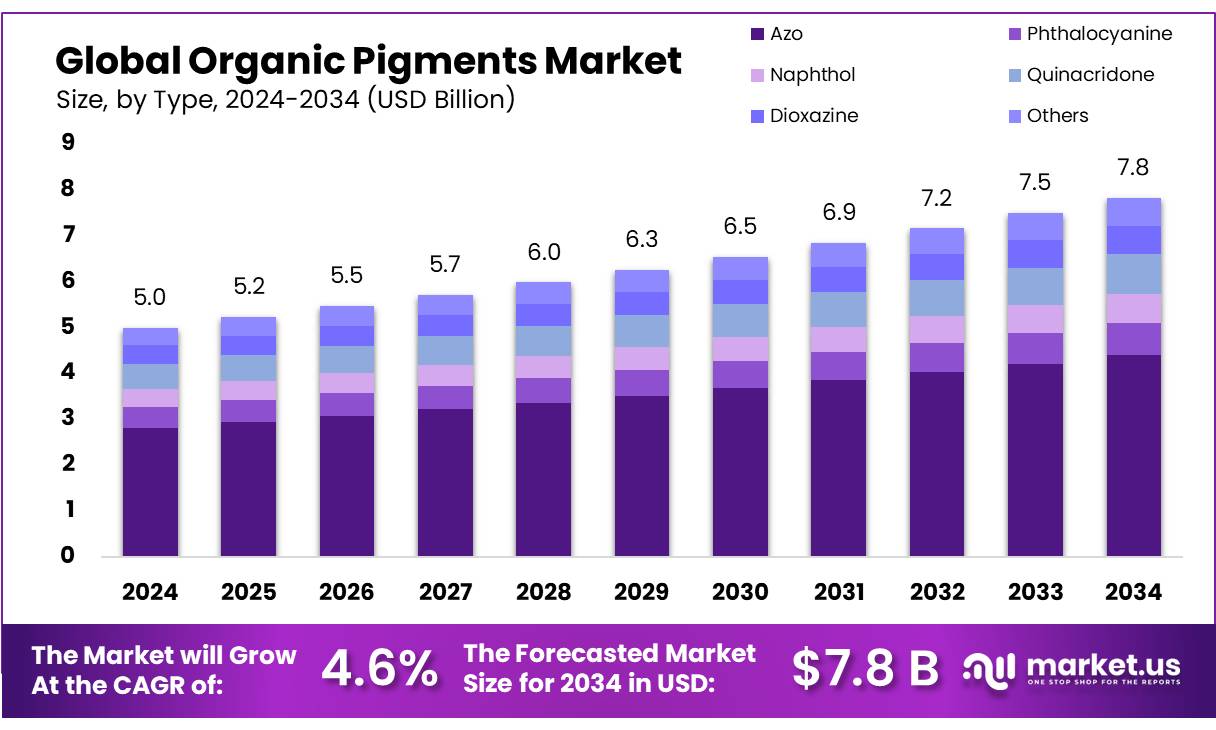

The Global Organic Pigments Market size is expected to be worth around USD 7.8 Bn by 2034, from USD 5.0 Bn in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Organic pigment concentrates comprise finely dispersed colorants—commonly azo, phthalocyanine, diarylide, and high performance pigment (HPP) types—used as masterbatches in formulations for paints, coatings, printing inks, plastics, textiles, and specialty applications. Production is anchored in fine chemical technologies and sophisticated dispersion processes.

For instance, copper phthalocyanine remains one of the highest volume organic pigments globally, with Japan alone generating around 10,000 t/year in the late 20th century.

Government initiatives are significantly reinforcing local production. India’s Make in India policy supports domestic pigment manufacturing; under the Production Linked Incentive (PLI) scheme, over INR 1.97 lakh crore (USD 28 billion) has been allocated to multiple chemical and specialty sectors, offering performance-based subsidies to encourage domestic incremental sales. This policy attracts investment in chemical intermediates and pigment production, promoting raw material integration and value addition. Additionally, organic agriculture initiatives—such as converting over 40% growth in certified organic farmland—fuel feedstock availability for natural organic pigments.

On the supply side, initiatives like the Mission Organic Value Chain Development in North East India (MOVCD-NER) support organic agriculture—an important source of bio-based pigment feedstock—engaging 50,000 farmers over 50,000 ha since 2015.

In parallel, the Paramparagat Krishi Vikas Yojana (PKVY) incentivizes up to INR 20,000/acre over three years, aiming to establish 500,000 acres of organic farming through 10,000 clusters. These programs, aligned with the National Programme for Organic Production (NPOP), strengthen the upstream raw material supply chain and align pigment production with “Make in India” and sustainability agendas .

Key Takeaways

- Organic Pigments Market size is expected to be worth around USD 7.8 Bn by 2034, from USD 5.0 Bn in 2024, growing at a CAGR of 4.6%.

- Azo held a dominant market position, capturing more than a 56.2% share of the global organic pigments market.

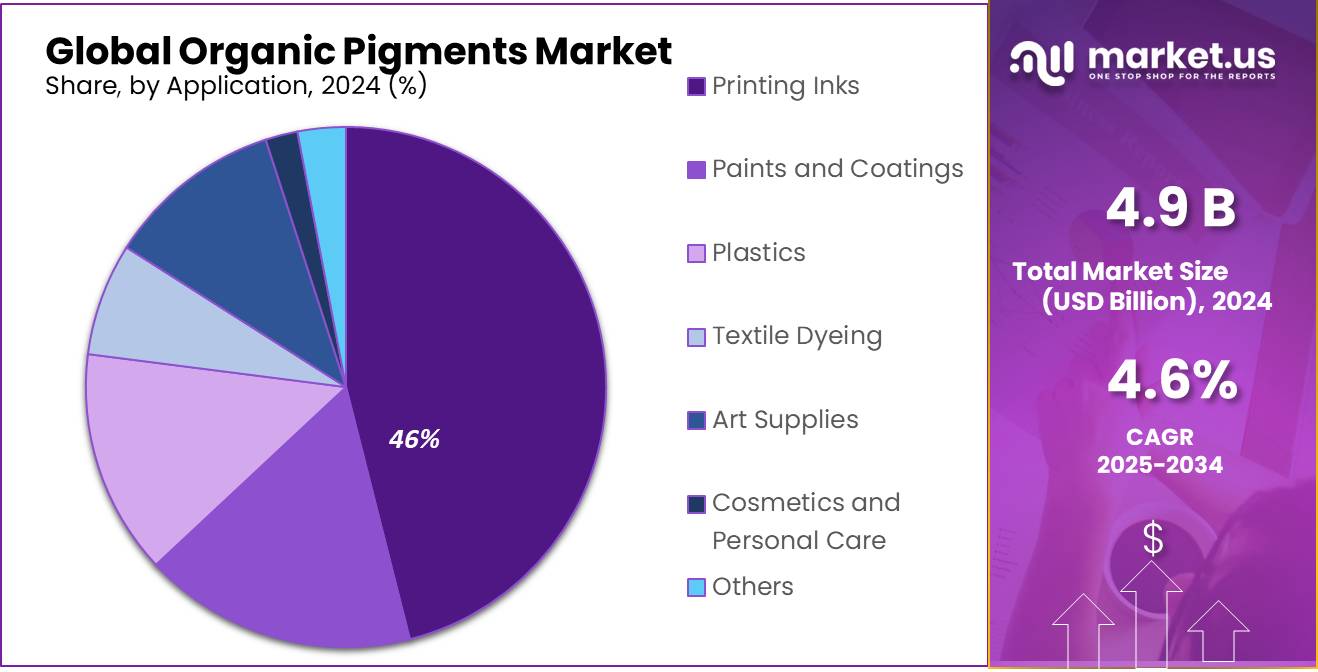

- Printing Inks held a dominant market position, capturing more than a 46.1% share of the global organic pigments market.

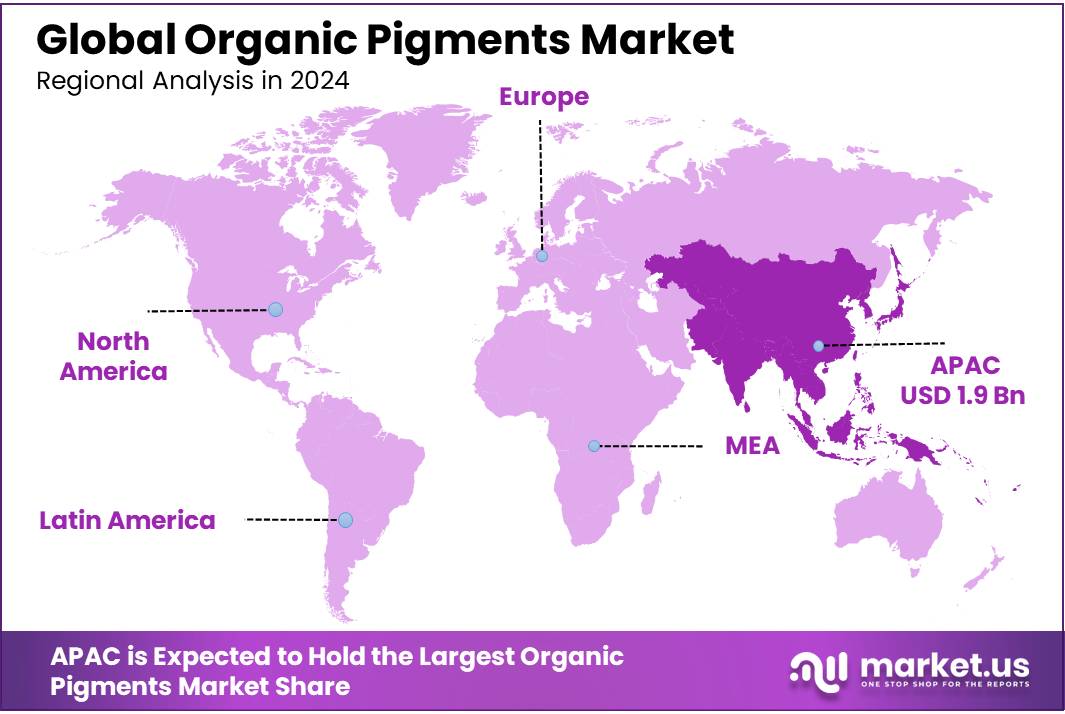

- Asia-Pacific (APAC) region holds a dominant position in the global organic pigments market, capturing a significant share of 38.9%, which equates to approximately USD 1.9 billion.

By Type

Azo Pigments Lead the Market with 56.2% Share in 2024, Driven by Versatility and Cost-Efficiency

In 2024, Azo held a dominant market position, capturing more than a 56.2% share of the global organic pigments market. This strong lead was primarily due to its widespread use across industries such as plastics, coatings, textiles, and printing inks. Azo pigments are favored for their bright color range, good dispersibility, and relatively low production costs, which make them suitable for high-volume applications.

Their adaptability in both solvent- and water-based systems further strengthens their industrial appeal. The year 2025 is expected to continue this trend, with Azo pigments maintaining their leadership in volume consumption and remaining a preferred choice for manufacturers seeking affordable and performance-based coloring solutions.

By Application

Printing Inks dominate with 46.1% share in 2024, driven by high demand from packaging and publishing sectors

In 2024, Printing Inks held a dominant market position, capturing more than a 46.1% share of the global organic pigments market. This leading share was supported by the growing use of organic pigments in flexographic, gravure, and digital printing applications, especially in packaging materials, labels, and commercial publishing.

The shift toward environmentally friendly inks and rising demand for vibrant, long-lasting colors in sustainable packaging have further boosted the use of organic pigments in ink formulations. Looking into 2025, this segment is expected to retain its lead as the packaging and labeling industry continues to expand globally, particularly across food, beverage, and consumer goods sectors.

Key Market Segments

By Type

- Azo

- Phthalocyanine

- Naphthol

- Quinacridone

- Dioxazine

- Others

By Application

- Printing Inks

- Paints and Coatings

- Plastics

- Textile Dyeing

- Art Supplies

- Cosmetics and Personal Care

- Electronic Displays

- Others

Drivers

Increasing Demand in Food and Beverage Industry

The growth of the organic pigments market is largely driven by the increasing demand for natural and sustainable colorants in the food and beverage sector. Consumers are becoming more health-conscious and are leaning towards products that are free from synthetic additives. This shift in consumer preference has led to a rising demand for organic pigments derived from natural sources such as fruits, vegetables, and plants.

According to the European Food Safety Authority (EFSA), the demand for natural food colorants is projected to grow significantly, as they are considered safer and more eco-friendly compared to synthetic alternatives. This trend is expected to propel the use of organic pigments in the food and beverage industry.

In 2023, the food industry accounted for nearly 40% of the global market for organic pigments, with key segments including beverages, snacks, and dairy products. The adoption of organic pigments in beverages alone is expected to rise by 10% annually, as companies seek to align with consumer demands for clean-label and health-conscious products. The U.S. Department of Agriculture (USDA) has also backed this transition, introducing guidelines to support the use of natural colors in food products, especially those targeting children and sensitive populations.

The use of organic pigments is not just about color; it’s also a way for companies to signal their commitment to sustainability and consumer health. These pigments are biodegradable and safer for both humans and the environment, which is increasingly important in the face of global environmental concerns. For example, the global beverage giant, PepsiCo, has pledged to remove artificial colorants from its products and replace them with organic options, underscoring the market’s growth potential.

Restraints

High Production Costs of Organic Pigments

One of the main challenges hindering the growth of the organic pigments market is the high production cost associated with these natural colorants. Organic pigments are often derived from raw materials like plants and minerals, which are more expensive to cultivate and process compared to synthetic alternatives. This higher production cost leads to an overall increase in the price of end products, which can discourage manufacturers from adopting organic pigments, especially in cost-sensitive industries like food and cosmetics.

According to the Food and Drug Administration (FDA), the cost of organic pigments is roughly 25-30% higher than that of synthetic counterparts. For example, natural pigments derived from sources like beetroot or spinach require more complex extraction processes, which increase the cost of production. As a result, many companies in the food industry are hesitant to switch from synthetic dyes, despite the growing demand for more natural products. The U.S. food and beverage industry alone has seen a 15% increase in the cost of using natural colorants compared to synthetic ones.

Furthermore, the scalability of organic pigment production is limited by the availability of raw materials and the environmental factors that affect plant cultivation. This constraint can lead to supply chain disruptions and make it difficult for manufacturers to meet market demand. The USDA has provided funding to encourage more sustainable farming practices, but the infrastructure for large-scale production of organic pigments is still in its infancy.

Opportunity

Expansion of Clean Label Trends in the Food Industry

One of the most promising growth opportunities for the organic pigments market lies in the expansion of the clean label trend in the food industry. Clean label products are those that use natural ingredients, minimal processing, and no artificial additives. As consumers increasingly seek transparency and healthier options, food manufacturers are under pressure to replace synthetic additives, including artificial colorants, with more natural alternatives. Organic pigments, which are derived from fruits, vegetables, and plants, perfectly fit this demand for natural and cleaner ingredients.

The clean label market has been growing rapidly, with a report by the U.S. Department of Agriculture (USDA) estimating that 54% of all new food products launched in 2022 carried a clean label claim. This trend has driven food companies to explore organic pigments as viable substitutes for synthetic dyes.

In fact, over 30% of new beverages launched in North America in 2022 featured natural colorants, a number that is expected to increase by 12% annually in the coming years. Major players in the food industry, such as Nestlé and Coca-Cola, have committed to reducing the use of artificial ingredients in their products, further fueling the demand for organic pigments.

Government initiatives are also supporting this shift. The U.S. Food and Drug Administration (FDA) has endorsed the use of natural colorants in food products, helping to validate the growing consumer preference for organic pigments. Additionally, the USDA’s National Organic Program (NOP) has set specific guidelines that encourage the use of certified organic ingredients, including colorants, which further strengthens the case for organic pigments in the food and beverage sector.

Trends

FDA’s Approval of New Natural Colorants

A significant trend in the organic pigments market is the recent approval by the U.S. Food and Drug Administration (FDA) of three new natural colorants butterfly pea flower extract, galdieria extract blue, and calcium phosphate. These colorants are derived from natural sources such as flowers, algae, and minerals, offering food manufacturers safer and more sustainable alternatives to synthetic dyes. This move aligns with the growing consumer demand for clean label products and the FDA’s initiative to phase out petroleum-based synthetic dyes by the end of 2026.

The approval of these natural colorants expands the palette of available colors for food products, including beverages, cereals, candies, and dairy items. For instance, butterfly pea flower extract can produce a range of hues from blue to purple, while galdieria extract blue offers a vibrant blue color. Calcium phosphate provides a white coloring agent suitable for various applications. These natural alternatives not only meet consumer preferences for transparency and health-conscious choices but also support the industry’s shift towards more sustainable and eco-friendly practices.

However, the transition to natural colorants presents challenges. Natural pigments can be more expensive than synthetic dyes, potentially leading to higher production costs. Additionally, sourcing natural ingredients may involve complexities related to availability and consistency. Despite these challenges, the FDA’s approval signals a commitment to enhancing food safety and promoting healthier dietary choices, paving the way for broader adoption of organic pigments in the food industry.

Regional Analysis

The Asia-Pacific (APAC) region holds a dominant position in the global organic pigments market, capturing a significant share of 38.9%, which equates to approximately USD 1.9 billion in market value. This growth is primarily driven by the rising demand for natural colorants in key industries such as food and beverages, cosmetics, and textiles. The region’s strong manufacturing base, particularly in countries like China, India, and Japan, further supports this market dominance. APAC is also home to a large consumer base that is increasingly shifting towards clean-label and organic products, driving the demand for natural ingredients, including organic pigments.

In recent years, the APAC region has seen considerable growth in its food and beverage sector, particularly in countries like China and India, where the market for organic food products is expanding. According to the Food and Agriculture Organization (FAO), China is one of the largest producers and consumers of organic food, with a 20% increase in the demand for natural colorants in the food industry alone. The rising awareness of health and wellness, particularly among the middle-class populations in urban centers, is contributing to the shift toward organic pigments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DIC Corporation is a global leader in organic pigments, operating through its Sun Chemical subsidiary across over 60 countries. Its expertise spans printing inks and colorants, supported by annual revenues approximating ¥1,054 billion (USD 7.4 billion) in 2022. A substantial portion of its pigment output is funneled into packaging and publication printing markets. Continuous expansion is enabled by sophisticated R&D infrastructure in Japan, the U.S., and Europe, underscoring its innovation-driven approach and extensive operational capabilities.

Ferro Corporation specializes in performance pigments, supplying solutions for coatings, ceramics, glass, and plastics. The company operates across 23 facilities worldwide and delivers technology-based colorants tailored to industrial customers. Ferro’s strategic investments—such as acquiring Cappelle Pigments and expanding through subsidiaries—have bolstered its portfolio of organic and inorganic pigments. Its pigment offerings combine functional performance and aesthetic appeal, positioning it as a reliable supplier across diverse manufacturing industries.

Huntsman Corporation is a diversified chemical company with a segment focus on specialty and performance pigments, among other advanced materials. The firm reported approximately USD 6 billion in revenue during 2023, with pigments contributing through specialty product lines like titanium dioxide and niche organic variants. Sustainability initiatives reported in its 2024 report emphasize energy efficiency and safe production, enhancing its position in environmentally sensitive markets.

Top Key Players in the Market

- Anshan Hifichem Co., Ltd.

- Atul Ltd

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- Ferro Corporation

- Heubach GmbH

- Huntsman Corporation

- Kemira

- Lanxess

- Lily Group Co. Ltd.

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Ltd

- Sun Chemical

- Sunlour Pigment Co., Ltd.

- Artience Co., Ltd.

Recent Developments

In 2024, Huntsman reported revenues of approximately $6.03 billion, a slight decline from $6.11 billion in 2023.

In October 2024, Sudarshan Chemical Industries Limited (SCIL) announced the acquisition of Heubach GmbH’s global pigment operations for approximately €127.5 million, aiming to consolidate SCIL’s position in the global pigments market.

Report Scope

Report Features Description Market Value (2024) USD 5.0 Bn Forecast Revenue (2034) USD 7.8 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Azo, Phthalocyanine, Naphthol, Quinacridone, Dioxazine, Others), By Application (Printing Inks, Paints and Coatings, Plastics, Textile Dyeing, Art Supplies, Cosmetics and Personal Care, Electronic Displays, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anshan Hifichem Co., Ltd., Atul Ltd, Dainichiseika Color & Chemicals Mfg. Co., Ltd., DIC Corporation, Ferro Corporation, Heubach GmbH, Huntsman Corporation, Kemira, Lanxess, Lily Group Co. Ltd., Meghmani Organics Ltd., Sudarshan Chemical Industries Ltd, Sun Chemical, Sunlour Pigment Co., Ltd., Artience Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anshan Hifichem Co., Ltd.

- Atul Ltd

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- Ferro Corporation

- Heubach GmbH

- Huntsman Corporation

- Kemira

- Lanxess

- Lily Group Co. Ltd.

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Ltd

- Sun Chemical

- Sunlour Pigment Co., Ltd.

- Artience Co., Ltd.